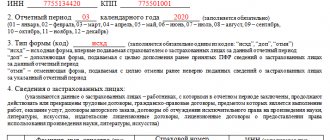

How and on what form is the SZV-M submitted?

Form SZV-M is the most frequently filled out report because it is submitted monthly (by the 15th day of the month following the reporting month). Individual entrepreneurs report using this form only if they have hired employees, but organizations are required to submit this report to the Pension Fund in any case, since they cannot exist without employees. Even if the company has a single founder with whom an employment contract has not been concluded (it is safer and as legal as possible to conclude an employment contract), then it is still required to provide information on him in the SZV-M form.

I wonder what the abbreviation SZV-M means? Read about this in the article .

The form on which the information should be submitted was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p.

You can view and download a sample of the SZV-M form in ConsultantPlus, having received a free trial access:

Clause 2 art. 8 of Law No. 27-FZ states that this information is submitted exclusively in electronic form if the number of people on the list is 25 or more. For SZV-M containing less than 25 people, a paper version of the submission is acceptable.

if you can send a report by mail from the article .

How to use

Where to start using services designed for PF reports? The first online check begins with registration, that is, you indicate your email address, personal password and type of organization (institution).

After filling out all the fields, a letter is sent to your e-mail. In order to log in, you must first follow the link provided in the letter. After this, the new user account is immediately activated.

In some services, in order to receive a code to remove the restrictions of the “free version”, you must leave your mobile phone number. If the organization has no more than three employees, then a fully functioning service will be available automatically.

If the preparation of the report to the Pension Fund of the Russian Federation was carried out in a program other than that provided by the online service, before sending it is necessary to check the files by selecting the desired verification mode: type “Package” - for checking reports (SZV-6+RSV-1) or “Reports” type – separate check of reports.

Every year, all individual entrepreneurs who have their own business are required to submit a report on time, which includes: a declaration to the tax service, declarations on payment of agricultural tax and land tax, and income tax declaration.The only quarterly reporting for individual entrepreneurs under the general taxation system is the VAT return. Find out more about quarterly reports for individual entrepreneurs here.

Next, you need to specify the verification files, which are then uploaded to the server. Each report is analyzed by the Pension Fund's verification program.

The test results can be seen in the protocol; it can be downloaded as a separate file. In particular, on the “Kontur-ru” service, when transferring files to “Kontur-Report PF” to correct errors, you do not need to re-enter information, since it will automatically be loaded from verified files.

As can be seen from the instructions given, checking reporting documentation is not so difficult. To do this, special websites provide all the necessary tools.

The main and mandatory condition is only free access to the Internet, and everything else has already been taken care of by specialists and developers of online services for checking and submitting reports to the Pension Fund of the Russian Federation, which have greatly simplified the work of accountants.

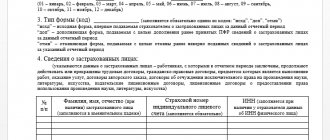

Do-it-yourself check

You must first clarify the data yourself, paying attention mainly to who you are submitting information about. According to Art. 7 Federal Law No. 167-FZ “On Compulsory Pension Insurance” the insured are:

- employees working under an employment contract;

- contractors working under a contract;

- authors, other representatives of the creative intelligentsia with whom copyright or licensing agreements were concluded.

An important condition is that all of the listed contracts must “fall” into the reporting period in one way or another:

- be valid;

- or be imprisoned;

- or be terminated within the specified period.

There is no need to include individual entrepreneurs in the report, as well as those with whom they have entered into some other civil law agreements rather than construction contracts.

After “working on the mistakes” yourself, you can use ready-made free software - on the Pension Fund website you can check SZV-M online without registration.

Check algorithm on the website of the Pension Fund of the Russian Federation

- Go to the website of the Pension Fund of the Russian Federation www.pfrf.ru.

- In the block under the logo, select “For Policyholders”, then (in the line below) click “For Employers”: a menu will open (perhaps not all options will be visible in it - use the scroll bar).

- Find and click “Free programs, forms and protocols” - this is where the SZV-M PF RF check is located.

- Select CheckPfr. This will be the SZV-M 2021 verification program: you can download it to your computer (for successful installation you need to have at least 1 GB of free memory on your computer).

The installed program will check the prepared document. If she finds any shortcomings, she will report this by issuing an o or “Warning”.

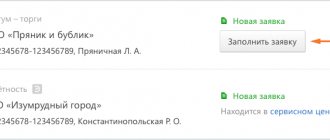

Taxnet.ru - online checking of reports

Taxnet specializes in everything “electronic”: signatures, tenders, document flow, including reporting. If you connect to the “Declaration.Online” service, you will be able to submit reports to the Pension Fund, Social Insurance Fund, Rosstat and the Federal Tax Service. The price of the issue depends on the timing and number of users. For example, an individual tariff for 12 months will cost 1,500 rubles per year. Full price list here.

You can work with “Declaration.Online” from any computer. All data is stored in the cloud. For those who do not want to upload their data to the Internet, there is a computer program called Taxnet-Referent.

The program automatically checks all reports. She checks the control ratios and, if a problem is detected, asks to correct them.

The developers even took care of those who did not buy a subscription to the service. On the website you can check any report for free in three simple steps:

- upload the report file in .xml or .txt format;

- we select the type of document flow, but in practice the system determines it itself;

- send for verification.

The verification takes place in just a minute.

Checking RSV and SZV-M online and through the program

With a protocol indicating errors, the document can be corrected. But if the check fails and a negative report is received, the problem is most likely a file structure violation. In this case, you need to correct the structure and resubmit it for verification.

- calculation of accrued and paid contributions to compulsory health insurance in the Pension Fund of the Russian Federation and compulsory medical insurance in relation to individuals - RSV-1;

- calculation of accrued and paid contributions to compulsory health insurance in the Pension Fund of the Russian Federation and to territorial compulsory medical insurance funds by payers of insurance premiums who do not make payments to individuals - DAM-2;

- calculation of accrued and paid contributions to compulsory pension insurance while monitoring the payment of contributions at a given rate for employers who have civil aviation crew members on their staff - RV-3;

- information on accrued and paid contributions to compulsory health insurance and insurance experience - SZV-6.1;

- register SZV-6.2 and others.

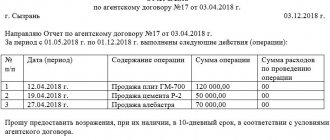

How to submit a PPED

Before submitting the SZV-TD, you need to send an application to the Pension Fund to connect the policyholder to the electronic document flow (PDED). To do this, in Externa, on the side menu, find the Pension Fund icon and select “Registration with the Pension Fund.” Two links will appear on the main screen - click “Application for connecting the policyholder to the electronic document flow of the Pension Fund of Russia (ZPED)”:

After clicking on the application, a form will open - enter the required details. Or you can scroll down the form and immediately select the certificate with which the document will be signed. If all the data in the payer's details is filled in, they will be entered in the form automatically. When everything is ready, click “Sign and Submit.” If anything is unclear, watch the video:

Contour verification of PFR reporting

This technique involves an executive system that allows residents to take advantage of the opportunity to obtain the required package of papers from one company, bypassing negotiations with one professional, filling out the given position and providing the smallest set of required papers.

A study of the implementation of the “one window” order in different areas of the Russian Federation demonstrates that the used form of informative actions contains a series of significant restrictions that do not allow us to effectively and at the proper level obtain conclusions, improve information and economic flows when coordinating papers in the course of interdepartmental interactions.

Error codes when checking SZV-M

What errors the verification program detects and how it encodes them is indicated in the mentioned resolution of the Pension Fund Board of December 7, 2016 No. 1077p.

Gross errors prevent the submission of a report to the Pension Fund. Warnings may also be issued. For example, if an individual does not have a TIN, the program will pay attention to this and issue a warning, but will accept the report.

The following error and warning codes exist:

- 20 - warning in connection with the completion and correctness of the individual’s TIN;

- 30 - error in information about an individual: inconsistency or incomplete filling of full name, SNILS;

- 50 — the error is related to general flaws when filling out the form: incorrect format; inconsistency of full name or policyholder registration number; non-existent electronic signature; a period is indicated that goes beyond the scope of the SZV-M representation; a repeated form with the “original” type was submitted.

What will the program check in SZV-M?

- Correct calculation and payment of insurance premiums for compulsory types of insurance.

- Correct provision of information on insured persons. Reporting in this format is submitted once a month.

When sending a file for verification, errors appear that can be corrected online in a timely manner. The program will immediately detect a discrepancy, and the following system message will be issued:

- Error.

- Warning.

Now policyholders will be able to check their documents before sending. This will help prevent sanctions from being imposed on an organization that has submitted a report with errors. Any error made in the employee’s data, for example:

- an error in the numbers when indicating the employee’s SNILS;

- error in TIN;

- error in the employee's name,

may result in a fine of 500 rubles for each employee.

CheckXML and CheckPFR 2021 programs - testing PFR files

CheckXML and CheckPFR software products allow you to check completed reports for the Pension Fund of the Russian Federation before sending them via the Internet or submitting them on a storage medium. After checking, you can be sure that the reporting is drawn up correctly, does not contain errors and will be accepted by the Pension Fund inspectors without any complaints.

- Personal data

- Individual information about length of service and earnings SZV-6-1, SZV-6-2, SZV-6-3, ADV-6-3, SZV-4-1, SZV-4-2

- Statements of payment of insurance premiums

- Applications for exchange of insurance certificates

- Applications for the issuance of a duplicate insurance certificate

- Death certificates

- Forms for DSV (voluntary insurance contributions)