Legal encyclopedia of MIP online - » Tax law » Payment of taxes and duties » Responsibilities of banks for the execution of orders for the transfer of taxes and duties

Get an expert’s opinion on the execution of orders for the transfer of taxes and fees in two clicks

There are various circumstances for the execution of orders given by banks.

What is a payment order

Important! A payment order is a payment document containing an instruction to transfer funds between commercial entities or other persons. The document is issued by the owner of the current account to the bank.

Any relationship between the bank and its client is subject to mandatory documentation. If it is necessary to transfer funds from his account, the client sends a special order to the servicing bank. The order is filled out in accordance with the current instructions.

Activities for transferring funds on the basis of a payment order are carried out in the following types:

- in the form of settlement transactions for goods and services;

- as full or partial prepayment;

- in the form of compensation for the resulting accounts payable.

In addition, the calculations may also not be related to the product type. These include the following types:

- transfers to the budget and extra-budgetary funds;

- settlements on bank loans;

- payment of penalties and fines.

Article 864 of the Civil Code of the Russian Federation. Acceptance of a payment order for execution by the bank (current version)

1. A payment order is executed by the bank provided that the content of the payment order and the settlement documents submitted along with it and their form comply with the established requirements. Regulations on the rules for transferring funds, approved. Bank of Russia 06/19/2012 N 383-P, established details, payment order form on paper. As mandatory details, the payment order must include the payment amount (in numbers and in words), the payer (name, TIN), the payer's account number, the recipient of the funds, the account number and bank of the recipient of the funds, the term and purpose of the payment, etc.

The payment order is drawn up, accepted for execution and executed electronically, on paper.

The order for the transfer of funds without opening a bank account of the payer - an individual on paper must indicate the details of the payer, recipient of funds, banks, transfer amount, purpose of payment, and may also indicate other information established by the credit institution or recipient of funds as agreed with the bank. An order to transfer funds without opening a bank account for the payer, an individual, can be drawn up in the form of an application. The form of the order for the transfer of funds without opening a bank account of the payer - an individual on paper is established by the credit institution or the recipients of funds in agreement with the bank. Based on the order to transfer funds without opening a bank account for the payer - an individual, the credit institution draws up a payment order. An order for the transfer of funds without opening a bank account of the payer - an individual, transmitted using an electronic means of payment, must contain information that allows you to identify the payer, recipient of funds, the transfer amount, and the purpose of the payment.

In order to avoid the transfer of funds to third parties if the payer fails to comply with the requirements for filling out a payment order, the bank sends the payer a request to clarify the contents of the order. Such a request must be made to the payer immediately upon receipt of the order.

2. The bank may leave the order without execution and return it to the payer if clarification on the contents of the payment order has not been received from the payer. In this case, the payment order may be left without execution within the established period, and if such a period has not been established, within a reasonable time. In this case, when determining a reasonable period, it is necessary to proceed from how much time it will take the payer to receive a request from the bank, prepare and send a payment order with clarifications.

It should be noted that if the requirements for the payment order are met, the court is not obliged to check the details of the recipient of the funds and send requests for their clarification, since responsibility for the correct completion of such details lies with the payer who filled out the payment order.

Thus, by Resolution of the Federal Antimonopoly Service of the Moscow District dated November 27, 2006 N KG-A40/11276-06, the court refused to satisfy the request for the recovery of erroneously transferred funds, since the defendant did not need to clarify the contents of the payment document of the recipient of the funds, since the details on the payment orders directly identified their recipient.

3. The conditions for the bank to execute the payer’s payment order are also the availability of funds in the payer’s account (unless otherwise provided by the agreement between the payer and the bank) and compliance with the order of debiting funds from the account. If there are funds on the account, the amount of which is sufficient to satisfy all the requirements presented to the account, these funds are written off from the account in the order in which the client’s orders and other documents for write-off are received (calendar priority).

If there are insufficient funds in the account to satisfy all demands placed on it, funds are written off in the following order:

- first of all, according to executive documents providing for the transfer or issuance of funds from the account to satisfy claims for compensation for harm caused to life and health, as well as claims for the collection of alimony;

- secondly, according to executive documents providing for the transfer or issuance of funds for settlements for the payment of severance pay and wages with persons working or who worked under an employment agreement (contract), for the payment of remuneration to the authors of the results of intellectual activity;

- thirdly, according to payment documents providing for the transfer or issuance of funds for settlements of wages with persons working under an employment agreement (contract), orders from tax authorities for the write-off and transfer of debts for the payment of taxes and fees to the budgets of the budget system of the Russian Federation, as well as instructions from the authorities monitoring the payment of insurance premiums to write off and transfer the amounts of insurance contributions to the budgets of state extra-budgetary funds;

- fourthly, according to executive documents providing for the satisfaction of other monetary claims;

- in fifth place for other payment documents in calendar order.

Debiting funds from the account for claims related to one queue is carried out in the calendar order of receipt of documents.

4. Applicable law:

— Regulation of the Bank of Russia dated June 19, 2012 N 383-P.

5. Judicial practice:

— Determination of the Supreme Arbitration Court of the Russian Federation dated March 4, 2013 No. VAS-1709/13 in case No. A32-2925/2012;

— Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated 02/07/2012 in case No. A43-2176/2011.

— Resolution of the Federal Antimonopoly Service of the West Siberian District dated October 22, 2010 in case No. A45-13807/2009.

Comment source:

“COMMENTARY ON THE CIVIL CODE OF THE RUSSIAN FEDERATION. PART TWO OF JANUARY 26, 1996 No. 14-FZ"

ON THE. Barinov, S.A. Baryshev, E.A. Bevzyuk, M.A. Belyaev, T.A. Biryukova, Yu.N. Vakhrusheva, R.R. Dolotina, N.V. Elizarova, R.Yu. Zakirov, N.A. Zakharova, P.Z. Ivanishin, S.Yu. Morozov, T.N. Mikhaleva, 2014

Details for generating a payment order

When generating a payment document, it is mandatory to fill in the following details:

- date and payment number;

- document urgency status;

- the amount of money to be transferred;

- currency unit of payment;

- information about the payer;

- balance number;

- payer's company name, code;

- name of the receiving bank, code;

- beneficiary information;

- information about the purpose of payment;

- account number of the payer, payee;

- order of payment transactions;

- signature of the official.

If necessary, you may additionally need to provide information about the correspondent bank, the specifics of paying commissions and other expenses . The bank, for its part, also puts a mark confirming the fact of the payment. Corrections, erasures and blank fields in a payment order are not acceptable; the bank will not accept such a document.

What happens if the payment is late?

The bank simply will not accept it, and you will need to either change the date of the order or draw up a new document.

The first option is ideal if there were no others after the late payment. Then the chronology will not go astray. If a document whose submission deadline to the bank has passed has already been executed by the bank, we recommend leaving this document unexecuted and drawing up a new one. If necessary, the presence of an unrecorded document can easily be explained by the expiration of its validity period.

We also recommend that you read our article “Where can I fill out a payment order online?” .

Procedure for filling out a payment order

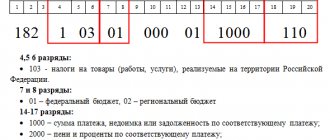

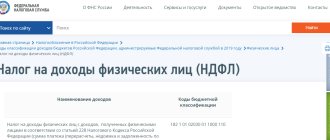

The payment order is filled out in accordance with the norms of Regulation 383-P and Order of the Ministry of Finance of Russia 107-N.

| Stages of filling out the P/P | How to fill |

| P/P number and date | The payment order is assigned a serial number and the date is entered in the format DD.MM.YYYY |

| Payment type | If the payment type is not filled in, then the payment order is classified as non-urgent. When specifying “Urgent”, the transfer of funds is carried out using urgent funds. |

| Status | Indicated only in case of transfer of funds to the budget. In this case, the status code is entered in accordance with Order No. 107-N. |

| Amount of payment | The payment amount is indicated in capital letters. The words “rubles” and “kopecks” are indicated in full, but the numerical value of kopecks is indicated in numbers. When indicating the payment amount digitally between rubles and kopecks, put a “-”; in the case of an amount without kopecks, put a “=” sign. Example: “Twenty-five thousand two hundred fifteen rubles 18 kopecks (25215-18).” |

| Payer | For the payer, indicate the TIN, KPP, name of the company or individual financial information of the entrepreneur, bank details (payer account, name, BIC, correspondent account) |

| Recipient | For the recipient, indicate the TIN, KPP, name of the company or individual financial information of the entrepreneur, bank details (recipient's account, name, BIC, correspondent account) |

| Type of operation | Always number "1" |

| Payment order | “1” – for payments under writs of execution, payment of alimony; “2” – for transfer of severance pay upon dismissal and salary debts according to writs of execution, payment of royalties; “3” – for transferring debts on taxes (contributions, fees), payment of salaries to employees; “4” – payments under other executive acts; “5” – the remaining P/P in the calendar order of receipt |

| Purpose of payment | Indicate the number of the agreement with the counterparty, invoice details for payment, etc. If the payment is transferred to the tax office, then the cells above “Purpose of payment” are filled in as follows: KBK, OKTMO, payment basis code, tax period, etc. |

Innovation in the modern banking world

Working in Sberbank’s “business online” software in real time is not difficult, since the clear and convenient interface developed by the bank’s specialists will allow you to carry out a lot of operations without wasting time on traveling and signing copious amounts of paperwork. There are many advantages to working with an electronic system, but the urgent payment option is especially beneficial, thanks to which clients can make transactions on their account around the clock. This form of exchanging financial documents with the bank is absolutely free. This function is used as follows:

- The client sends a request to perform a particular operation.

- Confirms the need for carrying out.

- The bank sends a response to the request along with the accompanying details.

- The transaction is confirmed by the client via SMS notification.

At the present stage of development, Sberbank of Russia can offer the most innovative services to its clients throughout the entire working week, 24 hours a day, thanks to the wide range of banking services provided. And the introduction of online services allows you to be “online” for as long as possible, making the necessary transactions, running a business, etc.

Number of copies of payment order

To submit documents to the bank, the payment order is drawn up in four copies:

- One of them remains in the bank and serves as the basis for transferring funds from the client’s account.

- The second copy of the order is the basis for crediting funds to the recipient's bank account.

- The third remains with the beneficiary as confirmation of the receipt of funds to his current account.

- The fourth is returned to the sender with a confirmation that the payment has been completed.

Important! The bank accepts payment orders regardless of whether the client has funds in his current account or not.

Payment order validity period

In order to understand how a banking organization fulfills client requirements, it is necessary to distinguish the execution period from the period of time during which the document is considered valid. The term for execution of a payment order is understood as the period of time during which funds are transferred . This period is determined by Law 395-1-FZ “On Banks and Banking Activities”. The bank must execute the payment order no later than 1 business day from the date of receipt of the document, and the duration of the business day is determined independently. In case of late execution of a payment order, the bank will have to pay interest. It should also be remembered that this period has nothing to do with the period during which the payment is considered valid. This period of time is determined in accordance with legal regulations. It should also be taken into account that the period of time for the execution of orders for taxes and fees is regulated by separate rules. For example, according to Art. 60 of the Tax Code of the Russian Federation, this payment is carried out within one business day. In the event that payment is not made on time, other clauses will come into effect. For example, Art. 133 of the Tax Code of the Russian Federation and 15.8 of the Code of Administrative Offenses of the Russian Federation. Liability measures under these standards will differ from the usual payment of interest. After the bank receives an order from a client, it acts as follows:

- approves the sender's right to use financial resources;

- analyzes the integrity of orders for payment of funds;

- evaluates the correctness of filling in payment details;

- determines the availability and degree of sufficiency of funds in the current account to make a payment on behalf of the client.

If the transfer to the account has not yet arrived, the payer has the right to cancel it. This can be done in a few steps, by personally contacting a bank branch.

Responsibility of banks for improper performance or failure to fulfill their duties

Responsibility for violation of obligations assumed by the bank is provided for in Chapter 25 of the Civil Code of the Russian Federation. Having accepted a payment order from its client, the bank actually acts as a debtor for the obligation that arises from this order, and the law obliges it to compensate the client for all losses caused by failure to fulfill the obligation in a timely manner. Losses are determined according to the rules of Art. 15, 393 Civil Code of the Russian Federation.

If non-fulfillment (improper execution) occurred through the fault of the bank servicing the recipient of funds, as a result of their untimely crediting to the client’s bank account, it will also be held liable and will be required to repay the resulting losses (Article 866 of the Civil Code of the Russian Federation).

In this case, the liability of the bank that accepted the payment order will be limited to the moment the money arrives in the account of the servicing bank (Article 302 of the Civil Code of the Russian Federation).

Regarding the responsibility of banks that are involved in conducting bank transfers, if they violate the procedure for carrying out settlement transactions, which leads to the unlawful withholding of money, they have obligations to pay interest for the use of other people's money, which they are obliged to pay to the payer of the funds (Article 395 of the Civil Code RF).

Thus, the law clearly separates the moment of liability for each bank participating in the settlement chain.

Speaking about the responsibility of the bank, it is necessary to mention Art. 404 of the Civil Code of the Russian Federation, which provides for the possibility of reducing the amount of liability of the bank taking into account the degree of guilt of its client. This legal position is expressed in the FAS Resolution in case No. A09-5514/99-10.

The financial responsibility of the bank (fine) in this case is also established by the tax legislation of Art. 133, 135 Tax Code of the Russian Federation. In addition, officials of the guilty bank should also be brought to administrative responsibility in accordance with Art. 15.8, 15.10 Code of Administrative Offenses of the Russian Federation.

Repeated violation of its obligations by a bank during a calendar year may become the basis for the tax authority to send a petition to the Central Bank demanding that the license of the violating bank be revoked.

Author of the article

An example of determining the validity period of a payment order

In order to determine the period of time during which a payment order is considered valid, let’s consider a specific example. In accordance with clause 5.5 of the Rules for the transfer of funds, approved. Central Bank, the validity period of the payment order is 10 calendar days . However, calendar days and working days should not be confused.

Now let's move on to a specific example. LLC "Company" generated a payment order on February 11, 2021. In order to determine the validity period of this order, it is necessary to count 10 calendar days. We will start doing this on February 12th. That is, this deadline begins on February 21, 2021. Based on this, we can conclude that it is necessary to submit a payment order to the bank of LLC "Company" no later than February 21, 2021. If you do this later than the specified period, the banking organization will have the right to refuse to execute the order due to the expiration of the validity period.

Knowing that the payment period is valid for 10 days, the payer can easily make payments and submit payment documents to the bank in a timely manner. This allows companies and entrepreneurs to intelligently plan their working hours and visit the bank at any convenient time, and not immediately after drawing up an order. In this case, the user of banking services has additional convenience and comfort when making payment transactions.