Home / Services and prices / Accounting services / Preparation and submission of reports /

ATTENTION!

According to the territorial division, the service operates in the following mode: Moscow and Moscow region

- all types of reporting, except for “VAT” and “Profit”;

All of Russia (except Moscow and the Moscow region)

- all types of reporting.

If you already HAVE a declaration - 800 RUR If you are served by us - free*

INSTRUCTIONS

for submitting declarations online

QUESTIONNAIRE

for submitting declarations electronically

According to Federal Law No. 134-FZ of June 28, 2013, which came into force, all VAT payers are required to submit VAT returns only in electronic form. At the same time, Article 80 of the Tax Code of the Russian Federation, which underwent changes after the adoption of the law, states that tax returns (calculations) for VAT must be submitted to the tax authority (IFTS) at the place of registration of the taxpayer in established formats in electronic form via telecommunication channels (TCS). ) through an electronic document management operator.

Are you served by us*

If we carry out the accounting of your company, then we also prepare and submit reports.

The cost of the service is free!

Connect

* — By “service” we mean with connection to the electronic reporting system “Kontur.Extern”. At the same time, the cost of service includes reporting to all regulatory government bodies.

Draw your attention to:

on the last day for submitting VAT reports, the cost

of delivery

increases by 50%.

How to submit a VAT return through a representative: nuances

The main condition for using the considered option of sending a VAT return to the tax office is the execution of a power of attorney for the representative. For an individual entrepreneur, it must be notarized; legal entities draw up a power of attorney without the participation of a notary.

The power of attorney must be in the tax office before submitting the declaration (clause 1.11 of the Methodological Recommendations approved by Order of the Federal Tax Service of the Russian Federation dated July 31, 2014 No. ММВ-7-6/398). Otherwise, there is a risk that the declaration will be refused. This was indicated by the Federal Tax Service in a letter dated November 9, 2015 No. ED-4-15/ [email protected]

Read more here.

Note! From the report for the 4th quarter of 2021, it is necessary to use the updated form, as amended by the Federal Tax Service order No. ED-7-3 dated August 19, 2020 / [email protected]

You can find out what has changed in the report in the Review material from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Technically, this can be done in 2 ways:

- Take or mail a paper copy of the executed power of attorney to the Federal Tax Service in advance.

- Also send a copy of the power of attorney via TKS in advance. The scanned image must be signed by the principal's UKEP. The representative cannot do this. There is no need to provide an additional paper copy of the power of attorney to the tax authorities.

Instructions for submitting VAT online

In order for us to file a declaration for you, you need to:

- Independently fill out the power of attorney

from the Principal, sign it, affix a stamp and,

at the request of the tax authority, independently provide its original to the tax authority

in paper form (this requirement, as well as additional information to be indicated in the power of attorney, must be clarified with your Federal Tax Service): - Remit payment

under the Public Offer Agreement (PDF file, 343.7 KB) for submitting reports electronically through the reporting information system dated August 5, 2014.Important!

The purpose of the payment must include information about the company or individual entrepreneur (Grantor) for whom the payment was made.

Payment: non-cash payment is made without VAT

according to the details specified in the Public Offer Agreement (PDF file, 343.7 KB). - Fill out the online application form for the Principal yourself

(see below).

When filling out the form in the “Required Attachments” section, you must attach the following files to it (all files at once and without archiving)

:

Sample

powers of attorney for submitting reports under TKS (DOC file, 30.5 KB)

- a color scanned copy

of the completed power of attorney

in JPG format

; - your existing declaration in XML format

; If you do not have a declaration, you can use the “VAT Refund: Taxpayer” software from the official website of the Federal Tax Service of the Russian Federation, designed to generate a database of VAT refund declarations and generate text files for transmitting information on declarations to the Federal Tax Service of Russia. - a scanned copy of the payment order or payment receipt;

To select multiple files, press and hold the Ctrl button on your keyboard and select files with your mouse cursor.

A copy of the completed application form will be sent to you by email.

- Expect

a Notification of Entry or Notification of Refusal from us to your email.

Technical risks

1. Declaration on paper.

Since 2015, the VAT return can be submitted only in electronic form via telecommunication channels (TCS) through the EDI operator (new edition of clause 5 of Article 174 of the Tax Code of the Russian Federation, approved by Federal Law of November 4, 2014 No. 347-FZ). Otherwise, the company will be considered to have failed to submit the report. This will entail a fine of 5% of the amount of tax not paid on time for each month of delay, but not more than 30% of the specified amount and not less than 1,000 rubles. (Article 119 of the Tax Code of the Russian Federation). Moreover, after 10 days after the deadline for submitting the declaration (that is, 10 working days after the 25th day of the month following the end of the tax period), the tax authority has the right to decide to suspend transactions on the company’s accounts (clause 3 of Article 76 of the Tax Code of the Russian Federation ).

The VAT+ service reduces risks at every stage of working with VAT

Send a request

2. Form of purchase books and sales books.

The VAT return undergoes several format controls. To successfully pass them, it must fully comply with the format established by Federal Tax Service Order No. ММВ-7-3/558. To do this, purchase books and sales books must be kept strictly in the form approved by Decree of the Government of the Russian Federation of July 30, 2014 No. 735, which entered into force on October 1, 2014. Otherwise, the data simply cannot be uploaded for the declaration later.

3. Converting data into xml format.

Information about invoices from purchase books and sales books is generated in the form of separate attachment files in xml format to the main part of the declaration (sections 1 to 7). If the company's accounting system does not support the function of converting data into xml format, then you will need a special converter program, which must be purchased in advance. Or you can go the other way: choose an online reporting system that can convert data.

4. Internet channel bandwidth.

Since 2015, the size of the VAT return has increased: previously it was one small file, now it is an archive that includes several files, some of which (data from purchase books and sales books) can be very voluminous. Therefore, it is better for the taxpayer to assess in advance whether the Internet channel through which he is going to transmit the report allows him to do this quickly. To get an idea of the file size, you can multiply the number of lines in a book per quarter by 300 bytes (that’s about how much one line weighs). The result obtained must be compared with the width of the Internet channel and, if necessary, increase the speed of the Internet connection.

Programs and prices

The leader in terms of price-quality-convenience ratio in the electronic reporting market is 1C-Reporting. Comparison with other special operators is presented in table form. As an example, we took the service of a legal entity during the year.

| "1C-Reporting" | "Astral Report" | "Sky" | "Bukhsoft Online" | "Circuit. Extern" | "My Business" | VLSI | Otchet.Ru | |

| Price per year | From 3,900 to 5,900 rubles. | from 2,900 rub. | From 100 to 170 rubles. for the report | Single price RUB 2,938. | From 2,900 rub. | From 9,996 rub. | 3,300 rub. | From 1,300 to 4,300 rubles. |

| Technology | Offline | Offline | Online | Online | Online | Online | Offline | Offline |

| Technical support | around the clock | around the clock | around the clock | daily from 07:00 to 19:00 | around the clock | around the clock | around the clock | around the clock |

| Checking the report | Yes | No | No | Yes | Yes | No | Yes | Yes |

Obviously, when choosing the optimal program, consider how it works:

- offline — the system is installed on the computer (copy on an external hard drive or flash drive);

- online - cloud technologies, work from any computer on the Internet.

From the table above it can be seen that the first group includes such software products as VLSI++ and Astral Report. The second group is a little more difficult. Not all online programs allow access from any device. For example, “Kontur.Extern” allows you to generate and send a VAT return directly on its portal in cloud mode, but you can only access the information from the computer on which the cryptographic information protection tool (CIPF) is installed. “Contour” is considered an online program only conditionally. Completely cloud-based programs are Bukhsoft, Moe Delo, Otchet.ru and Nebo.

To select a special operator, it is important to evaluate the ratio of the functions and options offered to their price among similar operators. More expensive options usually include additional services, such as checking the declaration before sending. In addition, users receive a regulatory framework for accounting and reporting and advice from experienced accountants. Ease of connection and configuration, as well as feedback from the Federal Tax Service of Russia, play an important role. In addition to sending the VAT return itself, you must receive from the Federal Tax Service a receipt of its receipt, as well as other requirements and notifications.

Sanctions for violators

If the procedure for filing a VAT return was not followed (this also includes the case of filing a document in paper form, which was discussed above), the organization will be held accountable. In case of failure to comply with the deadlines for filing a VAT return, according to Article 119 of the Tax Code of the Russian Federation, the taxpayer will be fined. It is 5% of the total amount of tax that has not been paid until the 25th of the current month.

The fine is imposed for each month from the date established by law as the deadline for submitting a document on payment of VAT. It should be borne in mind that the minimum fine cannot be less than 1000 rubles, as well as exceed the 30% limit of the total amount. Since the submission of a VAT return is legitimate only in electronic form, violation of this rule is also subject to penalties, similar to the case when the declaration was not submitted at all.

If the deadlines for filing a VAT reporting document were violated, then, on the basis of Article 15.5 of the Code of Administrative Offenses of the Russian Federation, officials of the organization are subject to liability. Punishment includes both a warning and a fine of up to 500 rubles.

A delay in filing a VAT return (this includes attempting to submit it in paper form) for a period exceeding ten working days may also result in sanctions. Tax service employees have the right to suspend any financial transactions with taxpayer accounts, including the circulation of electronic funds. This measure is regulated by Article 76 of the Tax Code of the Russian Federation.

Important! Since the law makes no difference between filing a value added tax return in paper form and not filing it at all, you should carefully study the rules for filling out the document via the Internet.

Electronic reporting tools

Any accountant understands that it is most convenient to submit VAT via the Internet using the program in which it was created. Transferring reporting from an accounting program to another resource is not immune to additional errors. We need a program that will allow you to submit VAT online and, if possible, free of charge. The first thing that comes to mind is the website of the Federal Tax Service of Russia. There is a “Taxpayer” program available there, which is absolutely free.

In addition, there are many offers on the market for accounting and reporting programs. Some of them are shareware, but most will still require some financial investment.

Free program from the Federal Tax Service

The Federal Tax Service is conducting a pilot project to operate software that ensures the submission of tax and accounting reports in electronic form via a website on the Internet. Taxpayers are given the opportunity to submit reports electronically completely free of charge. Although the “Help” button in each section provides instructions for filling out the corresponding section of the VAT return, this program does not provide support. You will have to track all software updates yourself. The user deals with all errors and malfunctions independently. It will not be possible to test the declaration before sending it.

In addition, in accordance with paragraph 3 of Article 80 of the Tax Code of the Russian Federation and paragraph 5 of Article 174 of the Tax Code of the Russian Federation, submit tax returns for value added tax using the Federal Tax Service service only if you have an electronic digital signature (EDS). You will have to buy it from any accredited certification center. That is, there will still be certain costs for sending reports in this way. In this regard, today it is not possible to submit a VAT return absolutely free of charge. It’s still worth taking a closer look at paid services.

Electronic reporting market

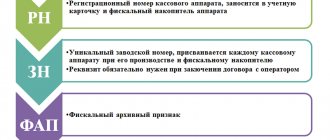

There are two ways to generate a VAT return and explanations in electronic form and send them to the tax office:

- straight;

- representative.

In the first case, the taxpayer organization must independently enter into an agreement with an electronic document management (EDF) operator. In addition, there are intermediary firms or special operators. The taxpayer becomes a subscriber under the agreement, he is provided with a program for sending reports, and an electronic digital signature is issued for the manager or other authorized person. In this case, the organization will need a special programmer who can configure the program, integrate it into the accounting program and update it regularly. For services, you will have to transfer money annually to the EDF operator.

In addition, there are so-called cloud services. In this case, the software is provided by the operator directly on the Internet and the user has the right not to install anything on their computers, and access to such a program is possible from any computer or laptop. The user receives full control over the submission of their reports and the ability to directly receive notifications and requests from the tax service.

The representative method is much simpler, but it does not guarantee control over the delivery of reports. In this case, the VAT return is sent through an organization that already has a software package installed that allows you to send reports to other organizations or entrepreneurs. Typically, such services are much cheaper than working directly with an operator. The tax authorities themselves do not welcome them; in this case, they have no feedback from the VAT payer.

Operator and program selection

In total, today there are 119 electronic document management operators registered and operating in Russia (see the full list on the Federal Tax Service website). An operator is a Russian organization that meets the requirements approved by the Federal Tax Service of Russia (clause 3 of Article 80 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated September 30, 2013 N PA-4-6/17542). Work only with those operators that are registered with the Federal Tax Service of Russia. Although the leaders in the EDI market are constantly changing, today the leaders in terms of the number of clients are:

- "Tensor" (product - VLSI);

- "Kaluga Astral" (product - "Astral Report" and many other projects where "Kaluga Astral" appears only as a special communications operator: "1C-Reporting", "Bukhsoft Online", "Moe Delo", "Sky" and others);

- "SKB Kontur" (products: "Kontur.Extern", "Elba" and "Accounting.Kontur");

- "Taxcom" (products: "Dockliner" and "1C-Sprinter").

Products for sending reports include:

- "Accounting.Kontur" (https://www.b-kontur.ru);

- “Astral Report” (https://astral.ppt.ru/);

- "Kontur.Extern" (https://kontur.ru/extern);

- “My Business” (https://www.moedelo.org/);

- “Sky” (https://nebopro.ru/).

All of these companies do not provide the opportunity to submit VAT for free via the Internet, but they all hold promotions during which they offer temporarily free reporting preparation. In addition, when establishing long-term cooperation, they almost always offer good discounts and the opportunity to submit VAT returns for a very reasonable fee.

This might also be useful:

- Inspection of individual entrepreneurs by the tax inspectorate

- What reporting must an individual entrepreneur submit?

- Individual entrepreneur reporting on the simplified tax system without employees

- How much taxes does an individual entrepreneur pay in 2021?

- Fixed payments for individual entrepreneurs in 2021 for themselves

- General taxation system for individual entrepreneurs

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!