The circle of taxpayers who can submit reports the old-fashioned way, on paper, is gradually narrowing. As a rule, depriving another group of taxpayers of such a “paper opportunity”, the authorities justify their decision by the fact that in practice, the majority still submit reports on the TKS. We want to remind you what reports, to whom and where you need to submit them electronically, and we will tell you what changes in this regard are coming in 2021.

In general, the criterion obliging tax reports to be submitted only electronically is the number of people: 100 or more people. This norm is laid down in paragraph 3 of Art. 80 NK. However, individual reports have their own rules.

VAT

The VAT return is submitted electronically, regardless of the volume of the taxpayer’s business.

However, there are some exceptions. The following can submit a declaration on paper:

- tax agents who are not VAT payers and do not conduct intermediary activities with the issuance of invoices on their own behalf. At the same time, tax agents who purchase recyclable materials do not fall under this exception and submit declarations electronically;

- legal successors of organizations applying the special regime.

The rules for filing a VAT return in 2021 do not change.

Question

Hello, please tell me, there have been changes in tax reporting form 920, a line has appeared - income from sales. To which BCC is the tax paid and is this tax not subject to exemption in accordance with clause 21 of Art. 1 of the Law of the Republic of Kazakhstan dated December 27, 2019? Because farms are exempt from paying the unified land tax until 2022. Just pay by November 10th, I’m wondering whether to pay 0.5% of the sales income or not. Thank you.

Illustrative collage: AgroInfo / Photo: pixabay.com

Answer

In accordance with paragraph 1 of Article 706 of the Tax Code of the Republic of Kazakhstan (hereinafter referred to as the Tax Code of the Republic of Kazakhstan), payment of the unified land tax and fees for the use of surface water resources are made in the following order:

1) amounts calculated from January 1 to October 1 of the tax period - no later than November 10 of the current tax period;

2) amounts calculated from October 1 to December 31 of the tax period - no later than April 10 of the tax period following the reporting tax period.

Thus, one of these days (November 10, 2021) for peasant and farm enterprises applying a special tax regime for peasant and farm enterprises, the deadline for paying taxes calculated for the period from January 1 to October 1, 2021 will come.

But, according to paragraph 21 of Article 1 of the Law of the Republic of Kazakhstan dated December 27, 2021 No. 290-VI “On introducing amendments and additions to certain legislative acts of the Republic of Kazakhstan on improving rehabilitation and bankruptcy procedures, budget, tax legislation and legislation on railway transport” taxpayers applying a special tax regime for peasant and farm enterprises, reduce by 100% the payable amount of the unified land tax, calculated in accordance with Article 704 of the Tax Code of the Republic of Kazakhstan. Consequently, these taxpayers do not need to pay the amount of the single land tax calculated for 9 months of 2021. There will be no need to pay the amount of EZN calculated for the 4th quarter of the current year and payable until April 10, 2021. The same should be done in 2021 and 2022 in accordance with the above law.

All other taxes (fees for the use of water resources, social payments for the head and members of the farm, individual income tax withheld at the source of payment - wages of hired workers of the farm and social payments for hired workers) are paid, as usual, for 9 months of 2021 - until November 10, 2020, for the 4th quarter of 2021 - until April 10, 2021. Tax holidays apply only to the payment of the unified land tax.

TNF 920.00 “Declaration for payers of the single land tax” for 2021 should be submitted to the tax authorities by March 31, 2021. The new lines of this TNF - “Income from the sale of agricultural products” (920.00.001-920.00.003) should reflect the amount of income received for the current year. But, in the lines “Amount of calculated unified land tax” (920.00.005) and “Amount of unified land tax payable” (920.00.006) you need to put “0”. The budget classification code (BCC) for payment and transfer of the EZN amount has not changed and remains the same - 104501.

Zhanna Batabaeva answered the question

In order to submit to the editorial office, you need:

Click on the “Ask a Question” section, fill out the specified field and leave your contact information.

You can also send us an email. Address

Share material

4-FSS, SZV-M, SZV-STAZH, SZV-TD

When the number of employees is 25 or more people, reporting to the Pension Fund of Russia and the Social Insurance Fund is submitted electronically.

However, starting next year the situation may change. The Ministry of Labor has developed a corresponding bill.

It is proposed to reduce the number of employees, in which insurers are required to submit in the form of an electronic document information on the insured persons working for them (including persons who have entered into GPC agreements, the remuneration for which insurance premiums are calculated) to the Pension Fund of the Russian Federation, as well as calculations of insurance premiums to the Social Insurance Fund to 10 Human.

That is, you will have to take 4-FSS, SZV-M, SSV-STAZH and SZV-TD electronically if you have more than 10 people.

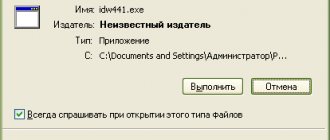

OPTION 1: KND 1166108 – via “Kontur.Extern”

Step one:

- Log in to the Kontur Extern website.

If you do not have Kontur Extern, then use the free “Test Drive” version: 3 months.

- On the main screen of Contour Extern, go to the “FTS” tab, then click on the “Request reconciliation” button.

Step Two:

- On the “Request Reconciliation” tab, select the required document.

Step Three:

- On the request screen for the provision of information services, fill in all the required fields: (Type of request according to the Federal Tax Service, Inspectorate Code, Requested tax according to KBK and OKTMO.)

- In the “Response format” field, enter: “XML”.

- Next we move on to sending.

Step Four:

- Wait for the results of document processing by the tax authority (usually this operation takes a few minutes, but delays may occur.)

- Go to the “Documents”, “ION Requests” section and download the finished act.

Accounting

If in 2021 some organizations could still submit their financial statements for 2021 on paper, then next year the situation will change.

A transition period was provided for small businesses. But from 2021, they, too, will submit their balance to the Federal Tax Service for posting it in the State Register of BOs only in electronic form through an electronic document management operator.

Does everyone remember that now we do not duplicate accounting into statistics? And, by the way, about her.

What forms are required for submission?

All enterprises submit a full package of the specified reports with the completion of all forms, with the exception of small organizations, which are allowed to provide a simplified version of the balance sheet and statement of financial results. Information in the documentation must be relevant, truthful, and complement each other.

For other companies, in addition to the mandatory forms of balance sheet and income statement, a statement of changes in capital or cash flow may be generated. As explanatory documentation, an enterprise can provide an explanatory note and an audit report:

The responsible person - an accountant or manager - must begin generating reports after the end of the reporting period, when all the results of the company’s work have been summed up. The reporting period in this case is set to the calendar year. In this regard, the reporting date in the documentation will be indicated as December 31 of the year for which the report is being prepared. Only after this date can you begin to fill out financial statements and generate a complete package of documents.

Statistical reporting

Now statistical reporting can be submitted to Rosstat both in paper and electronic form (clause 7 of article 8 of Federal Law No. 282-FZ of November 29, 2007.

However, already in 2021, organizations and individual entrepreneurs will be required to submit reports to Rosstat only in electronic form.

This norm is laid down in bill No. 1024255-7, which is now in the State Duma.

Sending statistical data electronically will require an electronic digital signature. The draft states that the signature can be anything the respondent chooses.

At the same time, small businesses in 2021 will still be able to submit reports to Statistics on paper. This category of taxpayers will be required to submit statistical reports electronically only from 2022.

Don’t forget that in 2021, small businesses are subject to continuous statistical surveillance. These new reports will also be available in paper form.

OPTION 2: Request List of KND 1166108 on the tax website

Step one:

This method will require registering in the “Personal Account of a Legal Entity” on the website of the Federal Tax Service. And receive an Electronic Signature (KSKPEP) of a Legal Entity.

- Log in to the website nalog.ru in your personal account of a legal entity.

Step Two:

- Select the “document request” tab in your personal account.

Step Three:

- Select “List of tax returns (calculations) and financial statements” and set the desired response method.

Let's sum it up

Let's summarize all of the above in a summary table.

Who submits reports exclusively electronically?

How many of you continue to report on paper? Why don't you switch to electronic reporting? We are interested in your opinion - tell us in the comments what makes you remain committed to paper reports.

We offer our clients to submit reports only electronically, and we also generate them ourselves. And accountants with us are not only freed from routine, but also earn money. Do you want to visit us?

BASIC

VAT Declaration Income Tax Declaration Information on the average number of employees Form 4-FSS Confirmation of the main type of activity Calculation of insurance premiums SZV-M Declaration on property tax of organizations Declaration on transport tax Declaration on land tax Reporting on income of individuals Accounting statements

An accountant working with OSN needs to have a good understanding of various taxes, because he will have to submit a wide range of reports, including:

1. Tax returns for:

- VAT;

- arrived;

- property;

- transport;

- earth.

2. Reporting to extra-budgetary funds:

- 4-FSS;

- confirmation of the main type of activity;

- SZV-M;

- SZV-experience.

3. Other reporting to the Federal Tax Service:

- calculation of insurance premiums;

- information on the average number of employees;

- 2-NDFL;

- 3-NDFL;

- 6-NDFL;

- financial statements.

3 months free use all the features of Kontur.Externa

Try it

VAT declaration

VAT is reported quarterly (Article 174 of the Tax Code of the Russian Federation). This type of declaration must be treated very carefully, because the Federal Tax Service will easily detect any inaccuracy. You should be especially vigilant in entering data on all invoices so that you do not have to submit clarifications in the future.

In 2021, the taxpayer will comply with the requirements of the law if he submits a VAT return within the deadlines prescribed by the legislator:

for the fourth quarter of 2021 - until January 25;

for the first quarter of 2021 - until April 25;

for the second quarter of 2021 - until July 25;

for the third quarter of 2021 - until October 25.

In 2021, VAT reporting always falls on working days, so the deadlines will not shift anywhere.

Most Russian businesses report VAT electronically. Only certain categories of VAT payers can submit a printed declaration (clause 5 of Article 174 of the Tax Code of the Russian Federation).

Not everyone knows that quarterly VAT can be transferred to the budget in equal amounts over the three months following the reporting quarter. The tax must be transferred to the Federal Tax Service account before the 25th day of each month. Thus, the tax for the second quarter of 2021 will have to be paid by 07/25/2017, 08/25/2017, 09/25/2017.

There are companies that, in addition to the declaration, also send to the inspection a log of received and issued invoices. The shipment must be made before the 20th day of the month following the expired tax period (clause 5.2 of Article 174 of the Tax Code of the Russian Federation). The magazine is submitted exclusively in electronic form.

Income tax return

Unlike VAT, income tax is considered an accrual total; accordingly, the declaration is submitted for the first quarter, six months, 9 months and a year (Article 285 of the Tax Code of the Russian Federation). During reporting periods, advance payments are made, and at the end of the year, the Federal Tax Service budget replenishes the tax minus the transferred advances (Article 287 of the Tax Code of the Russian Federation). If the company makes a loss, you will not have to pay tax.

In 2021, the deadlines for filing a declaration have not changed:

- for 2021 - until March 28;

- for the first quarter of 2021 - until April 29 (the deadline is shifted due to the weekend);

- for the first half of 2021 - until July 29;

- for 9 months of 2021 - until October 28.

If the taxpayer’s average quarterly income is more than 15 million rubles, he will have to report and pay advances every month (Clause 3 of Article 286, Article 287 of the Tax Code of the Russian Federation).

Some companies submit income tax returns in paper form, but they will lose this right as soon as the average number of workers exceeds 100 people (Clause 3 of Article 80 of the Tax Code of the Russian Federation).

Individual entrepreneurs submit 3-NDFL instead of an income tax return. You must report for 2018 by April 30, 2019.

Information on the average number of employees

At the end of the year, companies and individual entrepreneurs report their average headcount to the Federal Tax Service. The form is very easy to fill out and consists of one sheet.

The deadline for submitting information is January 21, 2019 (Clause 3, Article 80 of the Tax Code of the Russian Federation).

Companies that will begin their activities (register) in 2019 will also have to submit information about their headcount by the 20th day of the month following the month of registration. For example, if the company is created on 04/09/2019, information will need to be submitted no later than 05/20/2019.

Form 4-FSS

From 2021, the form is submitted only for accident insurance premiums. All companies and individual entrepreneurs with employees rent them out.

Due dates:

- for 2021 - until January 21 (on paper) and until January 25 (electronically);

- for the first quarter of 2021 - until April 22 (on paper) and until April 25 (electronically);

- for the first half of 2021 - until July 22 (on paper) and until July 25 (electronically);

- for 9 months of 2021 - until October 21 (on paper) and until October 25 (electronically).

Confirmation of main activity

Policyholders can work in different areas of activity. Every year, companies determine the type of activity that has the greatest share. This data is collected in a special table and submitted to the Social Insurance Fund (Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55). IP data is not provided.

By 04/15/2019, all companies must submit a set of three components: an application indicating one leading type of activity and a certificate confirming the main type of economic activity (with detailed calculations), as well as a copy of the explanatory note to the balance sheet for 2021 (the note is not submitted by small entities business).

Calculation of insurance premiums

Reporting deadlines:

- for 2021 - until January 30

- for the first quarter of 2021 - until April 30);

- for the first half of 2021 - until July 30;

- for 9 months of 2021 - until October 30.

SZV-M and SZV-STAZH

The form must be submitted by the 15th day of the month following the reporting month (Article 2 of Federal Law No. 250-FZ dated July 3, 2016). That is, the January SZV-M must be submitted by 02/15/2019, etc.

Learn the nuances of filling out the form

SZV-STAGE for 2021 must be submitted by 03/01/2019.

Declaration on property tax of organizations

All companies that own property are recognized as payers of the corresponding tax. As of 2021, the movable property tax has been abolished.

Subjects of the Russian Federation determine the procedure and timing for the transfer of taxes and advance payments (Article 383 of the Tax Code of the Russian Federation). Also, by decision of a constituent entity of the Russian Federation, companies may be exempt from submitting interim tax calculations. However, everyone, without exception, should report for the year.

Tax calculations are submitted for January - March, January - June and January - September, and a declaration is submitted at the end of the year. Keep in mind that constituent entities of the Russian Federation can cancel interim settlements; in the meantime, all enterprises that have fixed assets on their balance sheet will have to submit an annual declaration (Article 379 of the Tax Code of the Russian Federation).

The property declaration for 2021 must be submitted before 04/01/2019 (Article 386 of the Tax Code of the Russian Federation).

Deadlines for tax calculations:

- for the first quarter of 2021 - until April 30;

- for the first half of 20197 - until July 30;

- for 9 months of 2021 - until October 30.

An electronic declaration is sent to the Federal Tax Service of companies with more than 100 employees (clause 3 of Article 80 of the Tax Code of the Russian Federation).

Individual entrepreneurs pay property tax, but do not submit declarations on it.

Transport tax declaration

The transport tax affects companies that have vehicles registered with the State Traffic Safety Inspectorate (Article 357 of the Tax Code of the Russian Federation). Accordingly, these same organizations submit a declaration once a year.

You must report for 2021 by 02/01/2019 (Article 363.1 of the Tax Code of the Russian Federation).

Despite the fact that the declaration is submitted once a year, regions, by their decision, have the right to additionally introduce quarterly advance payments (Article 363 of the Tax Code of the Russian Federation).

Small companies of up to 100 people can take advantage of the legal right and submit a paper declaration; larger enterprises submit it only electronically (clause 3 of Article 80 of the Tax Code of the Russian Federation).

Individual entrepreneurs do not submit transport tax returns.

Land tax declaration

If the company owns land, which, according to all the rules, is subject to taxation, it is necessary to report on land tax (Article 388 of the Tax Code of the Russian Federation).

The declaration for 2021 must be submitted before 02/01/2019 (Article 398 of the Tax Code of the Russian Federation).

If the company employs more than 100 people, you will have to report via the Internet (Clause 3 of Article 80 of the Tax Code of the Russian Federation).

Reporting income of individuals

Once a quarter, form 6-NDFL is submitted to the Federal Tax Service (Clause 2 of Article 230 of the Tax Code of the Russian Federation):

- for 2021 - until April 1;

- for the first quarter of 2021 - until April 30;

- for the first half of 2021 - until July 31;

- for 9 months of 2021 - until October 31.

When preparing the 6-NDFL report, you should be guided by the norms of Chapter 23 of the Tax Code of the Russian Federation and correctly indicate the deadlines.

In addition, for 2021, do not forget to submit the 2-NDFL certificate before 04/01/2019.

Both personal income tax reports can be submitted in paper form only if the number limit is observed - no more than 25 people. When there are more than 25 persons who received income, reporting is sent exclusively electronically.

Financial statements

Companies disclose information about their financial condition, debt, reserves, and capital in their annual financial statements. The Federal Tax Service and Rosstat are waiting for a copy of such reporting from payers.

As part of the reporting, you can find a balance sheet, a statement of financial results and separate appendices to them (clause 1 of article 14 of the Federal Law of December 6, 2011 No. 402-FZ). For small businesses, there are simplified reporting forms that allow you not to detail the presented indicators.

For 2021, reports must be submitted by 04/01/2019 (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation, clause 2, article 18 of the Federal Law of December 6, 2011 No. 402-FZ).

UTII

It is easier for companies and individual entrepreneurs to maintain tax records in this special regime, because the legislation allows them not to pay a number of taxes: on profit, on property and VAT (clause 4 of Article 346.26 of the Tax Code of the Russian Federation). Other taxes are paid on a general basis.

In addition to standard reports (see the list in the example about OSNO), impostors fill out a UTII declaration and send it to the Federal Tax Service:

- for the fourth quarter of 2021 - until January 20;

- for the first quarter of 2021 - until April 22;

- for the second quarter of 2021 - until July 22;

- for the third quarter of 2021 - until October 21.

Advance payments are made quarterly by the 25th day of the month following the reporting period.

The company will lose the right to UTII if the number of employees exceeds 100 people (clause 1, clause 2.2, article 346.26 of the Tax Code of the Russian Federation).

Companies with employees are forced to submit a significant portion of reports. To avoid missing set dates, use our calendar. Timely submission of reports and payment of taxes on time will help you avoid not only penalties and fines, but also unwanted blocking of your bank account.