Refused dividends

Should personal income tax be withheld from the amount of dividends if an individual refuses to receive them? At first glance, the answer seems obvious: if an individual did not receive income, then the subject of personal income tax did not arise.

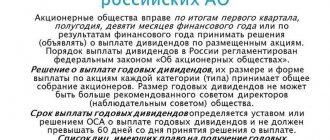

However, the letter of the Ministry of Finance of Russia dated October 4, 2010 N 03-04-06/2-233 states that personal income tax must be withheld. In this case, the day of refusal to receive dividends will be considered the day of actual receipt of income. How so? To understand what the Russian Ministry of Finance wanted to say, it is necessary to understand the situation itself. In accordance with Art. 42 of the Federal Law of December 26, 1995 N 208-FZ “On Joint-Stock Companies,” the general meeting of shareholders may decide to pay dividends on outstanding shares. At the same time, at the same meeting, a list of persons entitled to receive dividends is formed

in the manner and within the time limits established by the charter of the company or determined at the meeting. If the company's charter does not specify the period for payment of dividends, the period for their payment should not exceed 60 days from the date of the decision to pay dividends. Let us explain that the specified period - 60 days - is established for the company itself, that is, it is reserved for resolving issues related to the preparation of the necessary documents.

The company is obliged to pay dividends declared on shares of each category (type). Thus, in the accounting records on the date the general meeting of shareholders made a decision on the payment of dividends, an entry is made regarding the accrual of dividends for payment. At the same time, for the purpose of calculating personal income tax, the date of actual receipt of income in cash is defined as the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation) . That is, the Tax Code distinguishes between the concepts “accrued for payment” and “paid.”

Further options are possible. If it is assumed that each of the shareholders must independently apply to the company to receive the dividends due to them, then personal income tax on the specified amounts can only be calculated on the day of actual payment. This, in particular, is indicated in the letter of the Ministry of Finance of Russia dated January 11, 2006 N 03-05-01-04/1: withholding personal income tax when preparing a statement for the payment of dividends, that is, until the date the taxpayer actually receives income, does not comply with the law.

What happens to the accrued amounts if the shareholder never applies for dividends? The amounts of declared but not actually paid dividends form the organization's accounts payable. After the expiration of the limitation period, which in the case under consideration is determined in accordance with Art. 196 of the Civil Code of the Russian Federation and lasts for three years, the amounts of unclaimed dividends are subject to inclusion in the non-operating income of the company.

So, in the case considered, the shareholder did not officially refuse to receive dividends, he simply ignored them. There was no need to calculate personal income tax and, accordingly, withhold it and transfer it to the budget. If the general meeting of shareholders determines a different procedure for paying dividends, for example by transferring them by mail, the day of sending the postal order will be considered the date of actual receipt of income. On this date, it is required to calculate personal income tax, which is withheld from the amount due to the shareholder and transferred to the budget. That is, the dividend recipient receives not the entire accrued amount, but minus the withheld tax. If the postal order is not received by the addressee, the funds will be returned to the organization and will be included in non-operating income. However, the amount of personal income tax transferred to the budget cannot be qualified as excessively withheld and is not subject to return. The Russian Ministry of Finance explained this in its letter dated November 2, 2007 N 03-04-06-01/375.

Indeed, from the point of view of the Tax Code, in the case when an individual has a real opportunity to take advantage of the amounts due to him (no one is stopping him from going to the post office and receiving dividends), the income is considered received by him. Let us note that taxation issues are also resolved in the case when an employee does not apply to receive the accrued wages that are on deposit.

And finally, the situation with which we started. The key point is that the shareholder has refused to receive dividends. To refuse means to officially notify the company that, knowing about his right to receive the amounts due to him, the shareholder is not going to exercise this right and invites the company to dispose of the corresponding amounts at its own discretion or to direct them to the purposes specified by the shareholder. In order to avoid any further claims from the shareholder, the company must receive a corresponding statement from him in writing.

Can an individual give up something that does not originally belong to him? No. Moreover, he cannot give any orders regarding amounts that do not belong to him. That is why the Russian Ministry of Finance indicates that the day of refusal (the day of filing the corresponding application) of an individual to receive dividends should be considered the day of his actual receipt of income and, therefore, the date on which the amount of personal income tax is calculated, withheld and transferred to the budget. In other words, an individual has the right to dispose only of the income that belongs to him, on which personal income tax has been paid.

Note that an essentially similar answer was given earlier, only the question was formulated differently. At what rate is the amount of accrued dividends subject to personal income tax if the general meeting of shareholders decided that part of the dividends will be used to purchase preferred shares? The letter of the Ministry of Finance of Russia dated November 13, 2007 N 03-04-06-01/381 explained that income received in the form of dividends is subject to taxation on personal income tax at the rate provided for in paragraph 4 of Art. 224 of the Tax Code of the Russian Federation, regardless of the procedure for using dividends, including when they are used to purchase preferred shares.

Summarize. If the shareholder has not informed the company that he will not receive dividends, then it cannot be argued that he has refused to receive them. The amount of dividends is considered unclaimed and forms the organization's accounts payable. In this case, the organization will be able to use the corresponding amount at its discretion no earlier than three years later, that is, after the expiration of the statute of limitations. In this case, personal income tax is not withheld from the unclaimed amount.

If the shareholder officially declared that the company has the right to dispose of the dividends due to the shareholder at its own discretion, then the corresponding amounts are subject to taxation. At the same time, the company can use the remaining funds, although reduced by the amount of personal income tax, immediately, and not after three years.

It remains only to express regret that the answers given by official bodies often require additional clarification.

www.palata-nk.ru

What will happen to the company if it violates the deadline for paying dividends?

For one reason or another, a company may not pay dividends to its members or shareholders.

In this case, we are not talking about situations where the company does not have the right to make a decision on the distribution of its profits.

Let's assume that the company has completed all documents for payment of dividends. But the company did not transfer dividends to the participant or shareholder within the prescribed period. In the event that dividends are not paid due to the fault of the company itself, the participant or shareholder must apply to his company to pay the due dividends.

The deadline for filing a claim with the court is three years from the day following the last day of payment of dividends (clause 1 of Article 196 of the Civil Code of the Russian Federation).

A participant or shareholder should not delay going to court, since the financial position of the company may change during this time. And no one can guarantee that the company will not be liquidated before the statute of limitations for filing a lawsuit expires.

Therefore, if the company voluntarily refuses to pay dividends, a participant must immediately go to court and attach a certain package of documents . Among them:

- minutes of the general meeting of participants on the distribution of dividends;

- LLC charter;

- a participant’s claim sent to the LLC;

- calculation of amounts collected, including calculated interest;

- documents confirming the submission of the claim to the LLC - the source of payment of dividends;

- document confirming payment of the state fee for consideration of the claim in court.

In the statement of claim, the participant can also make a demand for payment of interest (Article 395 of the Civil Code of the Russian Federation).

If dividends are not paid due to the fault of the company, then it can be fined in the amount of 500 thousand rubles to 700 thousand rubles (Article 15.20 of the Code of Administrative Offenses of the Russian Federation).

If dividends are not paid because the company did not have the necessary bank details of a member or shareholder, then the company is not responsible for non-payment of dividends. For example, a participant’s bank details have changed, but he did not inform the LLC about this in a timely manner.

Menu

Attention!

The Registrar and the Company paying dividends are not authorized to inform shareholders about the impossibility of paying/sending dividends due to incorrect bank/postal details. In accordance with the requirements of paragraph 5 of Article 44 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies” and paragraph 1 of Article 7 of the Federal Law of August 7, 2001 No. 115-FZ “On Combating the Legalization (Laundering) of Income obtained by criminal means, and the financing of terrorism”, a person registered in the register of shareholders of the Company must promptly, but at least once a year, update information about himself, his representatives, as well as beneficial owners and beneficiaries (for individuals: F.I. O., passport details, address of the place of registration according to the passport details).

Also, according to the Federal Law of December 28, 2002 N 185-FZ “On the Securities Market”

Section ll. Chapter 2. Types of professional activities in the securities market.

“…..p.16. If the person for whom the personal account (custody account) was opened has not provided information about changes in his data, the issuer (the person obligated under the securities), the Registrar and the depositary are not liable for losses caused to such person due to failure to provide information. »

The main reason for non-payment of dividends is the lack of correct data in the register of shareholders, including:

- about the address of residence when receiving dividends by postal order;

- about bank account details when receiving dividends by bank transfer.

If dividends were not received on time due to outdated or incorrect details contained in the register, the shareholder must provide a Registered Person Questionnaire, indicating the correct details for transferring dividends, and an Application for repayment. The shareholder signs the Registered Person's Questionnaire in person in the presence of an authorized representative of the Registrar or certifies the authenticity of his signature by a notary. The shareholder signs the application personally.

Dividends will be paid within the month following the month in which the Questionnaire and application were executed by the Registrar (the period for making changes to personal data is three business days). Making changes in one register for individuals is paid by the shareholder according to the Registrar's Tariff.

You can pay for the Registrar's services at a bank branch. Receipt form - New Registrar JSC > Shareholders > Payment methods

When applying in person, payment can be made on site at the Registrar's office.

Attention!

If the shareholder was absent and did not have time to receive funds at the post office when paying dividends by postal order and, at the same time, the personal data contained in the register of shareholders is current, the shareholder must send an Application for repeated payment of dividends to JSC “New Registrar” . The shareholder signs the application personally. The application should be sent to the address: 107023, Moscow, st. Buzheninova, 30, building 1, JSC “New Registrar”, or a scan of the Application with the signature of the shareholder by e-mail to the following address:

with the note “For the department of calculation and payment of income on securities.”

Dividends will be paid within the month following the month in which the application was executed by the Registrar.

Attention!

To receive accrued but unpaid dividends for past periods due to outdated or incorrect details contained in the register, persons who sold shares of the Company must submit a Registered Person's Questionnaire, indicating the correct details for transferring dividends, a Receipt for payment for the Registrar's services and an Application for repayment of dividends. The shareholder signs the Registered Person's Questionnaire in person in the presence of an authorized representative of the Registrar or certifies the authenticity of his signature by a notary. Dividends will be paid within the month following the month in which the Questionnaire and application were executed by the Registrar.

Due to the preparation of tax reporting, repeat payments are not made to shareholders of PJSC Rostelecom in the period from January 1 to March 1 of each year.

Attention!

Dividends unpaid to the testator are paid to the heir within the month following the month in which the Registrar made an entry in the register about the transfer of ownership rights to securities as a result of inheritance (the period for carrying out the operation for the transfer of ownership rights to securities as a result of inheritance is three business days day).

You can familiarize yourself with the rules for filling out details in the Registered Person's Questionnaire - Recommendations for filling out details for transferring dividends

You can familiarize yourself with the general rules for paying dividends - General rules for paying dividends.

Share on Facebook Share

Share on TwitterTweet

Send email Mail

Print Print

Receiving dividends - how the process works

The process of receiving dividends today is well automated, so becoming a shareholder of a company that pays dividends, a broker’s client will not encounter any difficulties.

Everything related to dividends, their amount, payment terms, persons entitled to receive dividends, etc., is regulated by Federal Law No. 208-FZ of December 26, 1995.

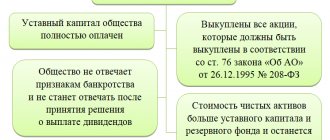

The amount and timing of dividend payments are determined by the general meeting of shareholders of the company based on the recommendations of the board of directors. Moreover, the amount of dividends depends on how economically successful the company is, since dividend payments are made only from its net profit. Naturally, if at the end of the year it was not possible to make a profit, then, in fact, there will be nothing to pay.

However, even if a profit was made, but not too much, or if the company is planning in the near future significant financial expenses to expand its business, pay off debt, or acquire assets important to it, the meeting of shareholders may also decide not to pay dividends.

By the way, for Russian state-owned companies there is a recommendation from the Ministry of Finance to allocate up to 50% of net profit to pay dividends.

Typically, dividends are paid once a year, but some issuers also pay interim dividends throughout the year. It is worth considering that only those persons (individuals or legal entities) who were the owners of these securities at the time of the so-called closure of the register can apply to receive dividends on shares, i.e. the date on which the registrar records all owners of shares in a given company.

Taking into account the fact that on the Moscow Exchange settlements for trades are carried out in the T+2 mode, i.e. the actual crediting of shares to the buyer's account occurs only on the second day from the date of purchase; in order to receive dividends, it is necessary to take care of purchasing shares in advance, without leaving everything to the last moment. Moreover, if good dividends are expected on the shares of a particular company, the prices for these shares begin to rise in advance, sometimes rising quite rapidly precisely by the time the register is closed (by the so-called cut-off date).

For beginners, we note this point: you should not hope that the next day after the closure of the register you will be able to sell shares as expensive as they cost before the closure of the register - immediately after determining the circle of persons entitled to receive dividends, the share price of this company sharply falls. Approximately the amount of expected dividends. This fall in financial circles is usually called the post-dividend gap.

Dividends on ordinary and preferred shares

We would also like to mention that dividends may differ significantly depending on whether you own ordinary or preferred shares. Preferred shares are not voting, i.e. their owner cannot take part in the meeting of shareholders, vote or generally influence the work of the company in any way. But he receives guaranteed dividends of a fixed amount.

The owner of ordinary shares can vote and participate in making important decisions for the company. But dividends on ordinary shares depend entirely on what decision on them will be made at the general meeting of shareholders. As a result, dividends on common shares may be very significant, or they may be zero. If the company has not paid dividends on preferred shares, these shares automatically become ordinary shares, i.e. voting, which gives the holders of these shares the opportunity to influence the company's policies. Including dividend payments.

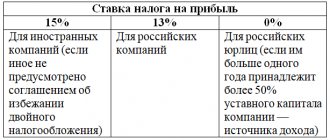

Taxation of dividends

Dividends are taxed at the standard rate of 9%. At the same time, what is important, the tax is withheld by the issuer of shares and immediately transferred to the budget. The holder of the securities receives dividends already “cleared” of taxes. Those. he will not have to pay taxes on dividends on his own or generally communicate with the tax office on this topic. Now dividends come only to a brokerage account (there were times when some companies, for example, Lukoil a couple of times and Gazprom for several years) credited dividends to the client’s personal bank account. And if the client did not provide his details on time, the money was credited to the registrar. But this practice has not been used for a long time.

Dividend calendar for Russian shares for 2021

Top dividend stocks from Otkritie Broker

Follow Financial One on social networks:

Facebook

|| VKontakte || Twitter || Youtube