Mergers of enterprises and their consequences

One of the forms aimed at consolidation and reorganization of a legal entity is the merger of enterprises.

This form is a process as a result of which several existing enterprises cease their activities, and a completely new legal entity is created on their basis.

The consequences of the merger will be the following events:

- Two (or more) enterprises will officially cease their activities and will be deregistered.

- A record of the registration of a new legal entity will appear in the Unified State Register of Legal Entities.

- All rights and obligations, as well as property and debts of liquidated enterprises will transfer to the newly created one.

In some cases, the merger requires the consent of the antimonopoly committee, since as a result of this procedure a large monopoly enterprise may be formed.

Also often, mergers of companies act as an alternative to liquidation, since with its help it is possible to quickly stop the activities of unprofitable companies.

Submitting documents to the Federal Tax Service Inspectorate

When registering a limited liability company created in the process of reorganization of an enterprise in the form of a merger, the Inspectorate of the Federal Tax Service, on the basis of decisions on state registration of the company created through reorganization in the form of a merger, and state registration of termination of the activities of reorganized limited liability companies:

- makes an entry in the Unified State Register (USRLE) about the creation of a new organization and the termination of the activities of previous companies;

- reports the termination of the activities of reorganized limited liability companies to the tax authorities at their location;

- sends copies of the decision on state registration of termination of the activities of reorganized limited liability companies, an application for registration of a new organization and an extract from the Unified State Register of Legal Entities;

- issues to the applicant documents indicating that an entry has been made in the Unified State Register of Organizations;

- reports registration by reorganization of a legal entity to the tax authority at the location of the newly created limited liability company and sends the registration file of the enterprise there.

Which form should I choose?

Two similar forms of reorganization are affiliation and merger, however, despite many common features, they also have significant differences.

Therefore, the choice between them largely depends on the characteristics and characteristics of specific enterprises.

Merger is the only form of reorganization, as a result of which information about the new enterprise is not entered into the Unified State Register of Legal Entities.

On the contrary, one or more legal entities are deregistered.

In this case, all property and debts as a result of the closure of the LLC through a merger of enterprises are transferred to the legal successor, whose organizational and legal form does not change.

Another feature of the merger is the fact that to carry it out you do not need to obtain a certificate of absence of debts from the Pension Fund.

Often, it is the absence of this document that is the basis for refusal of reorganization.

As for the merger of two companies into one, as a result of this procedure all participants are liquidated, and on their basis a new enterprise arises, with completely different registration data.

It brings together all the assets of predecessors and allows you to start a new activity more efficiently, with more opportunities.

In general, the merger procedure is easier than merging an LLC. However, the first form may violate the rights of participants, while the second provides the most equal opportunities for all reorganized enterprises.

Reorganization of an enterprise by merger

Sometimes the reorganization of an enterprise, for example a municipal one, must be carried out in the form of a merger. In this case, the rights of each of the merged entities are transferred to the merged legal entity. The transfer process is regulated by a special transfer deed.

This form of reorganization has its advantages. Merger allows you to solve the problem of business consolidation, and also, in some cases, liquidate the organization in an absolutely legal way. After all, as you know, the acquired legal entity completes its activities with the official registration of liquidation.

Reorganization of an enterprise - merger does not have strict regulations in the legislation, but it is still worth paying attention to some important points.

- The name of the company being formed can be changed, even to the name of the one being merged.

- There is no need to change the composition of owners. If necessary, this process is started before or after this kind of reorganization.

- If the total assets of companies exceed the norms established by law, additional permission from the FAS is required.

The process of reorganizing an enterprise by merger is possible only if there is a single legal form of organization. Otherwise, status changes are required before the reorganization process can begin.

Conversion by merging, step by step instructions

Since at least two business entities take part in the merger of organizations by accession, the algorithm of actions will be slightly different from all other forms:

Stage 1. At this stage, all participants in the reorganization hold general meetings of owners and, by voting, make a decision on the reorganization. The results are documented in a protocol (if there are several owners) or in the form of a decision on reorganization (if there is only one owner). Also, each company must conduct an inventory of assets, draw up a transfer deed and take care of paying off its debts.

An example of a completed decision on the reorganization of an LLC in the form of a merger.

Stage 2. Holding a joint meeting of the reorganization participants, which is attended by representatives of each company. At this stage, it is necessary to sign the final decision on the reorganization (in the form of a merger agreement), develop and approve the draft charter of the created enterprise, and also, based on the data submitted by the companies, formulate a general transfer act.

And about the transfer act during reorganization by merger, transformation of a closed joint stock company into an LLC and division, read here.

An example of a joint protocol for a company being created as a result of a merger. Stage 3. Notifying the registration authority of the decision to pursue a merger. Participants in the procedure are given three days from the moment of signing the merger agreement (agreement) to do this.

Sample agreement on the merger of companies participating in the reorganization.

Stage 4. Notification of all known creditors. These actions must be taken by all participants in the reorganization when merging a company with debts. Notification occurs in two ways:

- by sending relevant notices by mail;

- by publishing a message in the media (in the Bulletin, at least twice).

It is also necessary to take care of repaying all debts to the tax office and extra-budgetary funds, in particular to the Pension Fund. All known debts and claims must be settled before the merger is completed.

An example of a notification to creditors about the reorganization of an LLC in the form of a merger.

Stage 5. Submitting a package of necessary documents to the registration authority to begin the reorganization procedure.

Stage 6. Registration of a new enterprise in the Unified State Register of Legal Entities and receipt of documents confirming the merger procedure.

Reorganization in the form of a merger of enterprises is considered completed from the moment information about the newly created enterprise is entered into the state register.

The merger period usually ranges from 2-3 months to six months, depending on the size and specific types of reorganized enterprises.

Reorganization of LLC in the form of merger

A merger involving legal entities from different regions has its own characteristics and advantages.

A merger imposes certain specifics on registration actions: they are carried out at the place of registration of the newly created legal entity. Thus, legal entities always have a real opportunity to transfer registration actions to another locality, and sometimes to another region - a subject of the Russian Federation.

This allows you to significantly optimize and minimize a huge part of the risks, which include the possibility of conducting a tax audit. The procedure for deregistering a taxpayer, preparing and transferring his registration file to another locality or subject of the Russian Federation takes a long time. In addition, during reorganization in the form of a merger, tax authorities rarely initiate inspections, since according to the law, all rights and obligations of the reorganized legal entities must pass to the new legal entity.

In practice, such a significant period of time even makes it possible to carry out an official procedure for liquidation or bankruptcy of a new legal entity, bypassing possible inspections by tax authorities from the previous regions of registration of the organization.

In this case, merger seems to be a more preferable form for the purpose of liquidating the organization. The legal address of the new LLC may be located thousands of kilometers from the previous legal address, which greatly complicates the task of the tax authorities to fully audit the liquidated organization.

As a result, reorganization in the form of a merger leads to a situation where one “liquidated” LLC completely ceases its legal and actual existence, and information about it is completely excluded from the Unified State Register of Legal Entities, and is excluded from the Unified State Register of Legal Entities, but together with that, a successor appears. On the other hand, instead of two LLCs, a new legal entity appears that has assumed all the rights and obligations of the liquidated organizations, which creates a certain likelihood of filing claims for the debts and tax obligations of the previous legal entities.

If reorganization by merger is carried out in strict accordance with the given procedure, the main goal of such an event will be achieved. However, a logical question arises - what to do with the new organization, which was formed in place of the reorganized ones and assumed the entire range of rights and responsibilities?

Even having gotten rid of the hassle with the debts and obligations of their legal entities, the founders (owners) of the reorganized enterprises have lost not only their rights and obligations in relation to their organizations, but also control over the further fate of these obligations, which formally may be the subject of claims from third parties .

In practice, claims are often made against a newly formed legal entity, both by creditors for the obligations of reorganized legal entities, and by tax authorities, which have the right to initiate an investigation into violations of tax legislation. In some cases, the findings of such checks may also be of interest to law enforcement agencies regarding the legality of merger actions.

The main advice that experienced lawyers give in such a situation is to carry out a full-fledged liquidation procedure as soon as possible in relation to the newly formed legal entity. The period of such liquidation, in a successful scenario, will be no more than a year, but it will allow you to forever forget about old debts, claims of creditors and claims of tax authorities.

Any reorganization of an enterprise in the form of a merger consists of a number of actions that must be carried out for its successful implementation. We will try to formulate the main steps that should be taken so that the reorganization of an enterprise in the form of a merger achieves its goal.

The beginning of the procedure for reorganizing an enterprise in the form of a merger.

The general meeting of the founders of the limited liability company or the sole participant in the organization of each of the companies starting the reorganization of the enterprise in the form of a merger makes a decision to begin the reorganization procedure.

One of the companies participating in the reorganization of an enterprise in the form of a merger submits to the registration authority - the Inspectorate of the Federal Tax Service - a notification of the start of the procedure for reorganization of an enterprise in the form of a merger within three working days from the date of the decision.

Each of the companies participating in the reorganization of the enterprise in the form of a merger notifies its territorial Inspectorate of the Federal Tax Service, as well as the territorial divisions of the Pension Fund of the Russian Federation and the Federal Statistics Service, within three working days from the date of the decision on the reorganization of the enterprise in the form of a merger.

Required documents

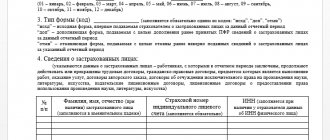

The list of documents required for reorganization by merging can be divided into two groups:

- Documents that enterprises prepare before reorganization. These include: Application form P12001, which must be certified by a notary. This document indicates the form of reorganization, the number of participants in the procedure, as well as the number of enterprises that will be formed after completion of the procedure (in this case, one).

- The charter of the new enterprise, which must be developed and approved at the stage of the meeting of owners. are submitted to the registration authority , one of which is then returned. There are general requirements for the registration of the charter: it must be stitched and numbered.

- The transfer act is a mandatory document during a merger, and all enterprises participating in the reorganization must draw it up. The act must contain information about the amounts of accounts payable and receivable, as well as the amount of property that is transferred from each company to the new company. There is no established form for this document; it can be drawn up in the form of a regular balance sheet or by simply listing all assets.

- Permission from the Antimonopoly Committee. This document is required only if the total assets of the enterprises or proceeds from sales exceed the legally established limit.

- Documents confirming notification of creditors. These may be receipts for payment of letters sent to them, as well as copies of the pages of the Bulletin.

- The merger agreement signed by the participants at the general meeting. This document defines the conditions and rules for the reorganization, as well as the procedure for exchanging shares of old enterprises for new ones.

- Minutes of the joint meeting of enterprise owners.

- A certificate from the Pension Fund of Russia confirming the absence of debts, which must be received by each participating enterprise.

- Receipt of payment of the state duty (its amount is 4,000 rubles).

- Documents that must be obtained as a result of the reorganization. These papers are issued by the tax office: charter of LLC merger;

- documents on deregistration of enterprises;

- state registration certificate;

- documents on tax registration of a new company;

- extract from the Unified State Register of Legal Entities.

These papers must be issued within five days after submitting the first package of documents.

After this, the new enterprise can begin its work in accordance with the chosen type of activity and available capabilities. Read more about changing the types of LLC activities here.

Reorganization of a legal entity by merger

Merger is a special form of reorganization of legal entities, in which an enterprise is enlarged due to the inclusion of several legal entities. In this case, all responsibilities and rights are transferred from the constituent enterprises to the newly formed one.

Moscow Firms will help you correctly formalize the reorganization of legal entities through their merger.

There are several features of this process that allow for a more flexible approach to the reorganization of a legal entity as a result of a merger.

- "Mixed" reorganization. The term implies a merger of legal entities having different legal forms. There is an important point in this matter. For example, the reorganization of two LLCs into CJSCs is unacceptable. According to current legislation, such a change cannot be made. But a “mixed” reorganization of a legal entity—merger—is possible. For example, the merger of a closed joint stock company with an open joint stock company does not contradict the law.

- Permission from the antimonopoly authority. For commercial organizations, additional permission will be required if the amount of total assets exceeds 20,000,000 rubles. If it is within 100,000 rubles, then you only need to notify this body. For NPOs, only information is required. Financial organizations are limited to certain limits, exceeding which also leads to the need to obtain consent. The size of the limit depends on the type of activity of the financial organization.

- Changing the composition of the organization's participants. The authorized capital, the composition of participants, as well as their shares are added up.

- Creditors. As a result of a merger, the organization is closed and all its responsibilities are transferred to another enterprise. That is why informing creditors about the upcoming transformation is mandatory. Moreover, all those who have the right to make any financial claims can do so within 30 days from the date of the merger decision.

Transfer deed. The document is binding and contains a statement of all the nuances of succession.

Personnel component

With any form of reorganization, the changes that have occurred in the company will affect such an element of the enterprise as personnel. A merger is no exception; some personnel changes will occur in this case as well.

What will happen to employees when organizations merge by joining?

It is worth highlighting several rules for reorganization that directly affect employees:

- None of the forms of enterprise reorganization provide for the dismissal of employees. Therefore, such an event cannot be a basis for termination of the employment contract with them (by the employer).

- Before the reorganization or after completion of the procedure, employees have the right to resign, indicating as a reason such a reason as a change in the owner of the enterprise or its legal form.

- Before the merger, employers are not required to notify staff of upcoming changes, however, after the procedure is completed, it is better to do this (in writing).

- In an organization that is formed as a result of the reorganization of a legal entity by merger, a new staffing table must be adopted. Duplication of responsibilities is also inevitable, so some employees may be transferred to new positions or dismissed due to staff reductions.

- In case of changes in working conditions, additional annexes to the employment contract must be accepted and signed and appropriate entries must be made in the employees’ work books.

Obviously, in most cases, layoffs are inevitable anyway. According to the labor code, it is impossible to dismiss employees due to the reorganization of structural divisions through a merger, however, after completion of the procedure, the management of the new enterprise will be able to legally reduce staff.

General steps for processing and registering changes in passport data

We suggest you read about how to formalize and register a change in the passport data of a director or founder, about the procedure for changing the founder of an enterprise or the name of an LLC, as well as about making changes to the OKVED IP, to the constituent documents. The site also contains materials about the reorganization of a closed joint stock company into an LLC and the division of an LLC into two LLCs.

Mandatory notification procedure for creditors

This stage begins after entering into the Unified State Register of Legal Entities information that the companies participating in the reorganization of the enterprise in the form of a merger have begun reorganization and are currently in a state of reorganization.

One of the organizations participating in the merger twice publishes in the State Registration Bulletin a notice of the reorganization of the enterprise in the form of a merger. Such messages are published on behalf of all companies participating in the reorganization. In addition, each of the merger participants notifies in writing all creditors known to them about the reorganization of the enterprise in the form of a merger.

Both organizations submit reports to the Inspectorate of the Federal Tax Service and territorial divisions of extra-budgetary funds, and receive a certificate from the Pension Fund of the Russian Federation on personalized accounting information.

Debts of participants and final reporting

Before carrying out the procedure, each reorganized company must prepare final financial statements, the date of which will be the day before the merger is recorded in the Unified State Register of Legal Entities. This includes the balance sheet, as well as statements of profit and loss, cash flows and changes in equity.

This reporting should reflect all transactions that have occurred in the company since the date of drawing up the transfer deed.

The “Profit and Loss” account must also be closed, funds from which are distributed according to the decision of the owners.

After the reorganization, all debts of the old companies are completely transferred to the legal successor.

If one of the predecessor enterprises had debts to the tax authorities or funds, they will be transferred to the account of the new organization.

It is advisable to submit tax returns to reorganized companies, but this can also be done by their legal successor after the procedure is completed.

An important point is the fact that reorganization is not a basis for changing the periods for paying taxes or submitting reports.

The new company is obliged to submit all documents within the period established by law.