What is the 2-MP innovation form and when does it need to be submitted?

The form is a summary of information about innovations that have been introduced by a small enterprise. In addition, information is provided on the number of employees of such a company and on the patents that the organization has received.

The latest current form of the statistical report was approved by Rosstat in order No. 563 of August 30, 2017. This form was used in 2021 for 2021. The form consists of a title page and three sections.

A special feature of the reporting form is that it is submitted once every two years and is generated only for odd-numbered reporting years.

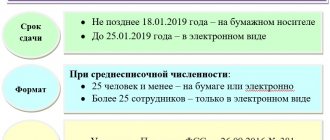

The deadline for submitting the report is April 9.

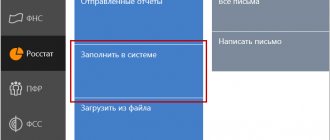

The report can be completed manually, on a computer, or through an electronic reporting service. To fill it out manually, you need to search the Internet and download the current form. You can take the report to the statistics agency in person, send it by mail, or transmit it electronically via telecommunication channels.

Results

Form 2-MP innovation is a source of statistical reporting through which Rosstat monitors the development and implementation of innovations by small businesses. This document is submitted to the department once every 2 years for odd-numbered years in the current version approved by Rosstat.

You can learn more about other forms through which reporting is provided to Rosstat in the articles:

- “Procedure and sample for filling out form P-4 (nuances)”;

- “Procedure and sample for filling out the P-2 quarterly form.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Which taxpayers must submit the form to the statistics office?

Another statistical form that concerns small businesses. However, micro-enterprises are exempt from the obligation to submit a report to the statistical office.

It is necessary to submit a report for small enterprises that operate in such areas as: mining; treatment; production and distribution of electricity, gas, water; water supply, sanitation and waste collection and disposal.

The report is compiled even if the company is in bankruptcy.

Subsidiaries report independently. The parent organization provides information for divisions and branches as part of its report.

Form No. 4-innovation

The list of organizations that must report on . The respondents included companies that deal with:

- any type of construction activity, and not just roofing work and other specialized construction work;

- transportation and storage;

- activities in the field of health and social services.

As before, small businesses are not included in the list of organizations required to submit Form No. 4-innovation.

The deadline for submitting the report has not changed - April 2 of the following reporting year.

The contents of the document have been significantly revised. For example, section 4 “Factors hindering innovation” has been added, which was removed in the previous version of the form. Other departments and the structure of the form have also been adjusted.

General principles for filling out the report form

When filling out the report, there are common principles that must be taken into account:

- Representatives of small businesses, except micro-enterprises, are required to submit a report to the statistics body

- Organizations submit a report if they operate in the following sections of the OKVED2 classifier: sections B, C, D, E

- Information on branches and divisions is included in the report of the parent company

- The report is submitted to the statistics authority at the place of registration of the company or at the address of business

- If the organization does not work for part of the reporting period, then the form is submitted under general conditions, but it indicates from what point the activity is temporarily not carried out

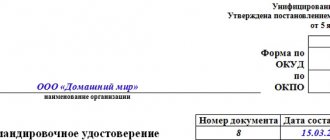

The title page of the report is filled out as standard for a statistical report. Here you must indicate for which year the information is being submitted, the name, address of the organization that is submitting the information, as well as the OKPO code.

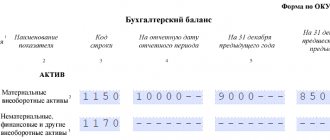

Filling out section 1 of the reporting form

This section is required to be completed by everyone submitting the form.

Since the form reflects information on technological innovations, you should first decide what they are.

Technological innovation is the final product or service that was obtained as a result of innovative activity. That is, this is some kind of new development specifically for the organization. Technological innovation is either a new product or a way of producing new services and products that cannot be produced by conventional conventional methods.

Technological innovations are of two types - innovations that result in the creation of a new, improved product and innovations that result in new methods and methods of production.

Lines 101 and 102 of the report reflect information on marketing and organizational innovations. The lines may indicate code 1, if the innovative activity has been completed or is still ongoing, or code 2, if such activity has not been carried out and the innovative product has not been created.

Line 103 records information about the cost of goods shipped or services provided. Line 104 shows the cost of innovative products that were created in the current year.

Lines 105-124 reflect information about technological innovation. Moreover, lines 105-115 take into account all costs of research, design, software, capital investments, that is, everything that ultimately produces an innovative product. Lines 116-124 contain information about funding sources.

Legislative framework of the Russian Federation

not valid Edition from 06.09.2010

detailed information

| Name of document | ORDER of Rosstat dated October 30, 2009 N 237 (as amended on September 6, 2010) “ON APPROVAL OF STATISTICAL INSTRUMENTS FOR ORGANIZING FEDERAL STATISTICAL MONITORING OF ACTIVITIES CARRIED OUT IN THE FIELD OF SCIENCE AND INNOVATION” |

| Document type | order |

| Receiving authority | Rosstat |

| Document Number | 237 |

| Acceptance date | 30.10.2009 |

| Revision date | 06.09.2010 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | It does not work |

| Publication |

|

| Navigator | Notes |

ORDER of Rosstat dated October 30, 2009 N 237 (as amended on September 6, 2010) “ON APPROVAL OF STATISTICAL INSTRUMENTS FOR ORGANIZING FEDERAL STATISTICAL MONITORING OF ACTIVITIES CARRIED OUT IN THE FIELD OF SCIENCE AND INNOVATION”

Instructions for filling out form N 2-MP innovation

General provisions

1. Federal statistical observation form N 2MP-innovation “Information on technological innovations of a small enterprise” is provided by enterprises that are small enterprises in accordance with Article 4 of the Federal Law of July 24, 2007 N 209-FZ “On the development of small and medium-sized businesses in the Russian Federation” .

2. Individuals carrying out entrepreneurial activities without forming a legal entity, as well as micro-enterprises, do not provide the federal statistical observation form N 2MP-innovation.

3. Federal statistical observation form N 2MP-innovation serves only to obtain summary statistical information and cannot be provided to third parties.

4. Federal statistical observation form N 2MP-innovation includes information for the legal entity as a whole, i.e. for all branches and structural divisions of a given small enterprise, regardless of their location.

A legal entity fills out this form and submits it to the territorial body of Rosstat at its location.

In the event that a legal entity does not carry out activities at its location, the form is provided at the place of actual activity.

The head of a legal entity appoints officials authorized to provide statistical information on behalf of the legal entity.

5. Temporarily non-operating small enterprises, which produced goods, works (services) during part of the reporting period, provide form N 2MP-innovation on a general basis, indicating how long they have not been working.

6. The address part indicates the full name of the reporting small enterprise, in accordance with the constituent documents registered in the prescribed manner, and then in brackets - the short name.

The line “Postal address” indicates the name of the subject of the Russian Federation, legal address with postal code; if the actual address does not coincide with the legal address, then the actual postal address is also indicated.

The legal entity enters in column 2 of the code part of the form the code of the All-Russian Classifier of Enterprises and Organizations (OKPO) on the basis of the Notification of assignment of the OKPO code sent (issued) to small enterprises by the territorial bodies of Rosstat, and in column 3 - the OKVED code according to the All-Russian Classifier of Economic Activities ( OK 029-2007 (NACE Rev.1.1)). In this case, the OKVED code is entered for the type of economic activity that, based on the results of the previous year, has the largest share in the total turnover or profit.

7. For small enterprises using a simplified taxation system, the current procedure for providing statistical reporting is maintained (Tax Code, Article 346.11, paragraph 4). These enterprises provide form N 2 MP-innovation on a general basis.

Section 1. Volume of innovative goods, works, services; expenses for technological innovations for the reporting year

The section is filled out by all enterprises, regardless of whether they carried out innovative activities in the reporting period or not.

Innovation is the final result of innovative activity, embodied in the form of a new or improved product (product, work, service), production process, new marketing method or organizational method in doing business, organizing workplaces or organizing external relations.

Innovation activity is a type of activity associated with the transformation of ideas (results of scientific research and development, other scientific and technical achievements) into new or improved products or services introduced on the market, into new or improved technological processes or methods of production (transfer) of services used in practical activities. Innovation activity involves a whole range of scientific, technological, organizational, financial and commercial activities, which together lead to innovation.

All types of research and development (R&D) financed or carried out by an enterprise are counted as innovation activities in accordance with the Oslo Manual Innovation Data Collection and Analysis Guidelines (third edition, a joint publication of OECD and Eurostat).

Internal IR includes all IR performed within the enterprise, as defined in the Frascati Manual (OECD, 1993) and as reported in IR surveys. This includes both IR intended to facilitate the development and implementation of product, process, marketing or organizational innovations, as well as fundamental research that is not directly related to the development of a specific innovation. In accordance with the Frascati Guidelines, internal IR includes acts of acquisition of capital goods directly related to the implementation of IR.

Innovative goods, works, services - goods, works, services that have undergone technological changes to varying degrees over the past three years. Based on the level of novelty, two types of innovative goods, works, and services are distinguished: newly introduced (including fundamentally new ones), or those that have undergone significant technological changes, and those that have been improved.

Technological innovation is the activity of an enterprise related to the development and implementation of technologically new products and processes, as well as significant technological improvements in products and processes; technologically new or significantly improved services, new or significantly improved methods of production (transfer) of services.

Product innovation is the development and introduction into production of technologically new and significantly technologically improved products.

Process innovation is the development and implementation of technologically new or technologically significantly improved production methods, including product transfer methods.

When filling out data on the volume of shipped goods of own production, work and services performed, it is necessary to be guided by the Instructions for filling out the federal statistical observation form N PM “Information on the main indicators of the activities of a small enterprise”, approved by Rosstat Resolution No. 3 of January 14, 2008 (with amendments and additions, introduced by Order of Rosstat dated December 29, 2008 N 330).

Zakonbase: Due to the loss of force of Rosstat Resolution No. 3 of January 14, 2008, one should be guided by Rosstat Order No. 335 of December 31, 2009 adopted in its place

Goods of own production were shipped, works and services were performed with one’s own resources for the corresponding type of economic activity (line 101) - the cost of goods shipped or released by way of sale, as well as direct exchange (under an exchange agreement) of goods of one’s own production, works performed and services rendered with one’s own resources in actual selling prices without value added tax, excise taxes and other similar mandatory payments, including: innovative goods, works, services (line 102) - includes products produced in the reporting year based on various types of technological innovations.

Lines 103 - 122 are filled in by enterprises that carried out technological innovations during the reporting period.

Line 103 shows the costs of technological innovations carried out during the reporting year. The costs of technological innovation include general (current and capital) costs associated with the development and implementation of technologically new or significantly improved goods, works, services or methods of their production (transfer), technologically new or significantly improved production methods, both carried out by the enterprise's own resources, as well as the costs of paying for work and services of third-party organizations.

Current costs, carried out mainly at the expense of the cost of goods, works, services, include the cost of remuneration of workers involved in the development and implementation of innovations, contributions for social needs, as well as other expenses not related to capital costs, such as costs for acquisition of raw materials, materials, equipment, etc., necessary to ensure the innovative activities carried out by the enterprise during the year.

Capital investments (long-term investments) represent annual costs for the creation, increase in size, as well as the acquisition of non-current durable assets (over one year), not intended for sale, carried out in connection with the development and implementation of innovations. They consist of costs for the acquisition of machinery, equipment, and other fixed assets necessary for use in innovative activities, for the acquisition of buildings, land plots and environmental management facilities for carrying out innovative activities.

When filling out column 3, you should be guided by analytical accounting of costs, carried out in accordance with regulatory legislative acts on accounting and standard industry methodological recommendations for planning, accounting and calculating the cost of goods, works, services of relevant types of economic activity.

The data in line 103 must equal the sum of the data in lines 104 - 107 and 109 - 113.

Line 104 reflects the enterprise's expenses for research and development, carried out both in-house and commissioned by third parties.

Research and development costs include:

labor costs for payroll employees who carried out research and development, taking into account bonuses for production performance, incentives and compensation payments (including compensation for wages in connection with price increases and income indexation within the limits prescribed by law), as well as costs for remuneration of unpaid employees engaged in core activities. Labor costs do not include bonuses paid from special-purpose funds and targeted revenues, financial assistance, interest-free loans for employees of the enterprise, payment for additional vacations provided under a collective agreement, pension supplements and other types of payments not directly related to wages. ;

mandatory deductions according to the norms established by law from the wage fund of the above categories of employees (except for those types of payment for which insurance contributions are not charged): unified social tax (amounts of accrued payments for pensions, social insurance and compulsory medical insurance of employees), as well as insurance contributions for compulsory social insurance against accidents at work and occupational diseases. Contributions to non-state pension funds, voluntary medical insurance and other types of voluntary insurance for employees are not taken into account;

costs for the acquisition and production of special tools, fixtures, devices, stands, apparatus, mechanisms, devices and other special equipment necessary to perform a specific topic, including the costs of its design, transportation and installation. Such costs are incurred at the expense of the cost of work performed under contracts, and the special equipment remaining after their completion or termination, as well as prototypes, mock-ups and other products purchased or manufactured in the process of work on the topic, must be transferred to the customer. If the specified equipment and products are not returned to the customer, then upon completion of the topic they are inventoried and, depending on the cost, are included in fixed or working capital from the authorized capital as received free of charge;

the cost of purchased raw materials and materials, components, semi-finished products, fuel, energy of all types of natural raw materials, works and services of a production nature performed by third parties, losses from the shortage of received material resources within the limits of natural loss. Material costs for the production of goods, works, and services are shown in the report at the cost of their acquisition (including value added tax), including markups (surcharges), commissions paid to supply and foreign economic organizations, the cost of commodity exchange services, customs duties, expenses for transportation, storage and delivery carried out by third parties;

capital costs for research and development, including the acquisition of land, construction or purchase of buildings, the purchase of equipment included in fixed assets, and other capital costs associated with research and development. Capital investments made by the reporting enterprise for the construction of housing, cultural and community facilities, etc., not related to scientific research and development, are not taken into account;

other costs associated with research and development and not included in any of the listed types of costs.

Research and development costs also include the cost of research and development performed by third parties under contracts with the reporting enterprise.

Line 105 indicates the costs of production engineering, design and other developments (not related to scientific research and development) of new goods, works, services and methods of their production (transfer), new production processes. Industrial design work is associated with technological equipment, organization of production and the initial stage of production of new goods, works, and services. In industry, their content may be the design of an industrial facility (sample) associated with the preparation of the production of new goods, works, services, other design work aimed at certain production processes and methods, technical specifications, operational features (properties) necessary for production technologically new goods, works, services and the implementation of new processes. These works should not be taken into account on line 104, which provides information about design and construction work taken into account as part of research and development (on line 104) and, as a rule, relating to the initial concept of the project to create new goods, works, services or technological processes .

These costs also include costs for technological preparation of production, trial production and testing associated with the introduction of technological innovations (not shown in line 104). They include costs for:

means of technological equipment that complements technological equipment for performing a certain part of the technological process. Examples of technological equipment are cutting tools, dies, fixtures, gauges, molds, models, casting molds, core boxes, etc.;

trial production or testing necessary at the initial stage of production of goods and in cases where further stages of development and design are intended (these costs are not related to pilot work included in research and development on line 104).

Line 106 indicates capital investments aimed at purchasing machinery, equipment, installations, including integrated software, and other fixed assets in connection with the introduction of technological innovations. This takes into account capital investments for the acquisition and installation of progressive types (on a new technological basis) of machines and equipment necessary for the introduction of new or improved technological processes, or machines and equipment that do not improve production capacity, but are necessary for the production of new goods (for example, additional molding and packaging machines), works, provision of new services. Other cases of acquisition of machinery and equipment are not considered as technological innovations and are not indicated in line 106.

Line 106 shows all capital investments in machinery, equipment, and other fixed assets associated with the introduction of technological innovations, including the cost of acquiring know-how and other non-patent licenses provided along with technological innovations (the latter is not shown in line 107).

Line 107 shows the costs of acquiring new technologies used to implement technological innovations, including the costs of acquiring both patent licenses (rights to patents, licenses to use inventions, industrial designs, utility models) and non-patent licenses, “know-how” , new technologies in disassembled form, as well as trademarks, other engineering, consulting services (excluding research and development) acquired from third-party organizations and individuals related to the implementation of technological innovations.

Line 108 identifies the costs of acquiring patent licenses, namely rights to patents, licenses to use inventions, industrial designs, utility models. When filling out this line, you should be guided by the Civil Code of the Russian Federation (Part 4, Chapter 72, Art. 1349, 1350, 1351, 1352).

Rights to patents can be transferred by the patent holder to an organization in accordance with a patent assignment agreement registered with the federal executive body for intellectual property. A contract without registration is considered invalid.

Data on the acquisition of licenses are indicated only based on the results of concluded license agreements registered with the federal executive body for intellectual property. A license agreement without registration is considered invalid.

A patent is a document of protection issued for registered objects of intellectual property and certifying the priority, authorship and exclusive right to use the specified objects during the validity period of the document of protection.

An invention is a technical solution in any field related to a product (in particular, a device, substance, microorganism strain, plant or animal cell culture) or method (the process of performing actions on a material object using material means). An invention is granted legal protection if it is new, has an inventive step and is industrially applicable.

A utility model is a technical solution related to a device. A utility model is granted legal protection (patent) if it is new and industrially applicable. Utility models include the design of means of production and consumer goods, as well as their components.

An industrial design is an artistic and design solution for an industrial or handicraft product that determines its appearance. An industrial design is granted legal protection if its essential features are new or original.

The costs of acquiring licenses represent the license fee paid to the licensor (license seller). It can be either a lump sum payment, i.e. be paid in the form of an agreed upon flat sum, or royalty, i.e. be paid in the form of certain parts from the profit received by the licensee (buyer of licenses) as a result of using the license.

Lines 108 (and 107) take into account only the amount paid for the reporting year.

Line 109 shows the costs of purchasing software related to innovation. Software tools, in addition to computer programs, may include office applications, programming languages and application development tools, publishing systems and graphic editors, image collections, etc.

Line 110 indicates the costs of other types of work related to the preparation of production for the release of new products, the introduction of new services or methods of their production (transfer). These may, in particular, include work to change production and quality control procedures for goods, works, services, methods, standards and related software necessary for the release of a new or improved product or the use of a new or improved technological process.

Line 111 provides data on the costs of education, training and retraining of personnel in connection with the introduction of technological innovations (production of new goods, works, services, work using new technologies and new equipment, introduction of new or significantly improved types of services or methods of their production) . Personnel education and training costs may include the use of third party services and in-house (including on-the-job) education and training costs.

Line 112 indicates costs associated with marketing or market implementation of technological innovations (release of technologically new or improved goods, works, services to the market). They include preliminary research, market probing, adaptation of the product to different markets and initial advertising, but excluding the cost of setting up distribution networks (launching new products or services on the market) for market innovation.

Line 113 shows other costs (not taken into account in lines 104 - 112) associated with the introduction of technological innovations, for example, payment for consultations of attracted qualified specialists, other work, technological maintenance services not listed above.

In lines 114 - 122, costs are distributed according to sources of financing technological innovation:

on line 114 - at the expense of the enterprise’s own funds, including from profit, at the expense of the cost of manufactured goods, works, services;

on lines 115 and 116 - at the expense of funds, respectively, from the federal budget and the budgets of the constituent entities of the Russian Federation and local budgets received by the enterprise directly or under agreements with the customer;

on line 117 - at the expense of extra-budgetary funds (economic stabilization fund, regional development fund, sectoral and inter-industry extra-budgetary funds for research and development, Russian Technological Development Fund, conversion fund, road fund and others);

on line 118 - at the expense of funds received by the enterprise from legal entities and individuals located outside the borders of the Russian Federation, as well as from international organizations;

line 119 shows the costs of innovation carried out from other sources not taken into account in lines 114 - 118.

The data in line 103 must equal the sum of the data in lines 114 - 119.

From other costs (line 119), funds received through borrowings are allocated (line 120).

Line 121 indicates funds received by attracting loans and borrowings on preferential terms.

Line 122 of the total costs (line 103) allocates funds from venture funds. These are long-term risky investments of private capital and the state in innovative projects and newly created small high-tech enterprises focused on the development and production of high-tech products.

Reference. Volume of innovative goods, works, services newly introduced and improved over the past three years

Line 123 reflects the volume of goods shipped, work performed, services newly introduced (including fundamentally new ones) or subjected to significant technological changes over the past three years. For these goods, works, services, the scope (use), operational characteristics, features, design, as well as the composition of the materials and components used are new or significantly different in comparison with previously produced goods, works, services.

Newly introduced (new) are goods, works, services that, in their characteristics or areas of use, differ significantly from the goods, works, services produced by the organization previously. Such goods, works, services, as a rule, are based on new (including fundamentally new) technologies or on a combination of new ones with the use of existing technologies. An example of such innovations (radical type) are the first microprocessors and digital cameras, the production of which used new technologies. The first portable MP3 player, which combined existing software standards and miniature hard drives, became a new product that combined existing technologies. In both cases, no finished product had ever been produced before.

Significant technological changes in existing goods, works, and services can be made by changing materials, components and other characteristics that increase efficiency. In automobile manufacturing activities, the introduction of anti-lock braking systems, navigation systems, and other improvements are examples of product innovations consisting of partial changes or additions to some of the many integrated technical subsystems. The use of breathable fabrics in clothing is an example of product innovation involving the use of new materials that improve product performance.

Column 4 from Column 3 provides data on innovative goods, works, services (newly introduced or significantly improved), which are at the same time new to the sales markets of the reporting organization. These can be innovative goods, works, services that are new to the organization in terms of profile, level of complexity or other characteristics, and allow the organization to enter new markets.

Line 124 shows the volume of goods shipped, work performed, services that have been improved over the past three years. Such goods, works, services are based on the introduction of new or significantly improved production methods, involving the use of new production equipment, new methods of organizing production, or a combination of both. Examples of new manufacturing methods are the launch of new automated equipment on a production line or computer-aided design systems for product development. As a rule, this applies to goods, works, and services already produced by the organization.

Section 2. Number of employees of the enterprise for the reporting year

The section is filled out by all small businesses, regardless of whether they carried out innovative activities during the reporting year or not.

Line 201 reflects the average number of employees (without external part-time workers).

Line 204 shows the average number of external part-time workers and employees who performed work under civil contracts.

The average number of part-time workers is calculated in proportion to the time actually worked.

The average number of workers who performed work under civil contracts is calculated based on the accounting of these workers for each calendar day as whole units during the entire term of the contract.

Calculation of the average number of employees and the average number of external part-time workers and workers performing work under civil contracts is carried out in accordance with the methodology set out in the Instructions for filling out the federal statistical observation form N PM “Information on the main indicators of the activities of a small enterprise”, approved by the Resolution of Rosstat dated January 14, 2008 N 3 (with amendments and additions made by Rosstat Order dated December 29, 2008 N 330).

Line 203 (from line 201) takes into account personnel with completed higher professional education.

Lines 202 (from line 201), 205 (from line 204) indicate personnel engaged in research and development. These include mainly researchers and technicians.

Researchers are workers professionally engaged in research and development and directly involved in the creation of new knowledge, products, processes, methods and systems, as well as the management of these activities. Researchers usually have completed higher professional education.

Technicians - workers involved in research and development and performing technical functions, usually under the direction of researchers (operation and maintenance of scientific instruments, laboratory equipment, computer equipment, preparation of materials, drawings, conducting experiments, experiments and analyzes, etc.) . This category usually includes persons with secondary vocational education and (or) the necessary professional experience and knowledge.

Completing section 2 of the statistical form

The section is filled in with information about the number of employees of the company.

The section contains only five lines:

- Line 201 indicates the average number of employees. External part-time workers are not taken into account in this case

- Line 203 (as part of line 201) contains information about those who have a higher education

- Line 204 shows the number of external part-time workers, as well as those who worked in the company under a civil law agreement

- Line 202 (as a special case of line 201) and 205 (as a transcript of line 204) are filled with information about those employees of the organization who are engaged in research and development

Filling out section 3 by column

The section displays information about patent applications . Moreover, such applications can be submitted both in Russia and abroad and must be reflected in the reporting form.

Column 4 contains data on those patents that are already in force at the time of compilation of the report.

Column 5 reflects patents that were received in the current year.

Column 6 shows all those patents that were obtained earlier, but continue to be valid in the reporting year.

After filling out all the necessary information on the form, it must be signed by the responsible person. A contact telephone number, email address and the date of submission of the report are also indicated.