The plaintiff's claim was granted; the defendant did not file an objection or appeal. Afterwards, the Defendant makes a second appeal to the court with a claim on the same grounds, presenting his arguments. He asks to recover from the Plaintiff the amount that it was decided to recover from him in the previous case.

Can the court reconsider the same case, the same circumstances, but with the participation of the defendant, who is now the plaintiff himself?

USEFUL : re-submitting a claim if you are rejected in the first court; at the acceptance stage, the court may even return the application, watch the video.

Read further what to do if a repeated claim has been accepted for proceedings and a hearing has been scheduled.

What documents are needed to re-refund the tax after purchasing an apartment?

At any time of the year following the emergence of the right to compensation, you can submit the 3-NDFL declaration and its annexes.

provided that a complete list is provided, delivery should proceed quickly and without difficulty. The peculiarity of the deduction for pensioners is that he may not have income subject to personal income tax and, accordingly, no tax paid to the budget. However, since the beginning of 2014, amendments to the legislation came into force, thanks to which the deduction procedure is established not by housing, but by a specific taxpayer. Moreover, the new provision looks most advantageous, first of all, for buyers purchasing real estate valued at less than 2 million rubles. But it is worth considering that if the cost of housing during the first transaction was equal to or exceeded the amount of 2 million, this will mean that the maximum benefit of 260 thousand has already been paid.

Filing process

Documentation can be submitted to the fiscal authority at the place of registration of the taxpayer or to the employer. It is preferable to send the 3-NDFL declaration to the Federal Tax Service, since the employee will check it for errors that will need to be corrected. To submit a package of documents you will need:

- fill out an application form to receive a tax deduction;

- enter information with the 3-NDFL declaration;

- hand over to the employee of the fiscal authority copies of documents confirming the right of ownership of the object.

The application form can be obtained directly from the Federal Tax Service or on the department’s website. Over the course of 3 months, the documentation package can be reviewed by government agency employees. If the decision is positive, an amount not exceeding the employer’s contributions for the previous year will be credited to the applicant’s account.

Tax deductions can be obtained from the employer. This can be done after the transaction for the purchase of housing has been completed and a notification addressed to the new owner has been received from the Federal Tax Service. In this case, there is no need to wait until the end of the current year. Within 30 days, the application for a deduction is considered by the employer.

If the documents are completed correctly, then the withholding of personal income tax from the taxpayer’s earnings ceases. That is, the employee’s salary will increase by 13% for the period until he receives the full amount of the due deduction.

What documents are needed to re-obtain a tax deduction for the purchase of an apartment?

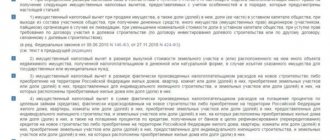

In accordance with paragraph. 27 paragraph 2. paragraph 1 of Article 220 of the Tax Code of the Russian Federation For housing purchased before January 1, 2014, you can use the property deduction only once in your life. In this case, the purchase price does not matter. Even if you took advantage of a deduction of 10 thousand rubles, you will never be able to receive a larger property deduction when purchasing a home.

If you officially work and pay income tax and have purchased an apartment or house, then you can get back the income tax paid in the amount of up to 13% of the cost of the apartment/house (in addition, you can also get back 13% of mortgage interest and some other expenses).

Re-payment of the state fee in case of refusal of registration

You should know that if you were denied registration due to an error, the state fee is not refundable and upon re-application, it is paid again in full. Expert recommendation Best wishes. Grounds and procedure for return or offset of state.

duties are determined by Art. 333.40 Tax Code of the Russian Federation. In relation to this case, when registration was refused due to circumstances depending on the applicant, in particular due to an error made by the applicant, a refund or offset of the state fee paid. There are no duties provided by law.

If the refusal to register the Federal Tax Service was lawful (the grounds for refusal are provided for in Article 23 of the Federal Law of 08.08.2001 N 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”) and is not disputed, upon re-applying it is necessary to pay the state tax again.

duty. Hello! Letter from the Federal Tax Service of the Russian Federation.

An error was made in the application to open an LLC, and therefore registration was denied. When resubmitting the application, they told me to pay the state fee again, what should I do? The question relates to the city.

Krasnoyarsk Hello! According to the Tax Code of the Russian Federation, if state registration of a legal entity is refused, the state duty paid is not refundable. A comprehensive list of state duty refunds is given in Art. 333.

40 of the Tax Code of the Russian Federation, where your case does not fall, accordingly you will have to pay a new state duty. 1.

The paid state duty is subject to partial or full refund in the event of: 1) payment of a state duty in a larger amount than provided for by this chapter; 2) return of an application, complaint or other appeal or refusal to accept them by the courts or refusal to perform notarial acts by authorized bodies and (or) officials.

They are forced to pay the state fee again for registering the company

Attention

If the state duty is not returned, its amount is counted towards the payment of the state duty when a claim or administrative claim is filed again, unless the three-year period has expired from the date of the previous decision and the original document on payment of the state duty is attached to the repeated claim or administrative claim; 3) termination of proceedings in the case (administrative case) or leaving the application (administrative claim) without consideration by the Supreme Court of the Russian Federation, courts of general jurisdiction or arbitration courts. When concluding a settlement agreement before a decision is made by the Supreme Court of the Russian Federation or arbitration courts, 50 percent of the amount of the state duty paid by him shall be returned to the plaintiff. This provision does not apply if the settlement agreement is concluded during the execution of a judicial act.

The state fee in case of refusal of state registration is not refundable

Paperwork We have already noted that the most popular reason for refusals is the provision of an incomplete package of documents. The state fee in case of refusal of state registration is not refunded. Non-compliance with requirements List of basic requirements that must be met:

- a complete set of documents in accordance with the instructions of Federal Law No. 129;

- Copies of receipts for payment of state duties are submitted to the tax service;

- the applicant is a member of the company or has a power of attorney;

- LLC participants must have a good business reputation, otherwise this may be a reason for refusal.

Because of the legal address Many beginning businessmen are faced with this problem - refusal to register because of the legal address. This is usually due to the fact that they purchase it from some companies or owners.

Do I need to pay the state fee again when resubmitting documents?

- Do I need to pay the state fee again?

- If registration of an individual entrepreneur is refused, do I need to pay the state fee again?

- They are forced to pay the state fee again for registering the company

- If state registration is refused, you will be allowed not to pay the state fee again

- The state fee in case of refusal of state registration is not refundable

- Possible reasons for refusal to register an LLC

- Forum burmistr.ru - forum about housing and communal services (management of apartment buildings)

Do I need to pay the state duty again? Important The tax service can refuse to register an LLC only under certain circumstances. Their list is approved by law. Notification of refusal must be submitted no later than 3 business days from the date of submission of the application for registration.

If registration is refused, you will not have to pay the repeated fee.

Question: Is it possible to refund the state duty paid for the state registration of a legal entity if the registering (tax) authority makes a negative decision? Answer: Let us recall that based on the documents submitted for state registration, a decision on state registration or a decision on refusal of state registration is made (Article 3 of Law No. 129-FZ). For state registration, a state fee is paid in the amounts determined by the Tax Code of the Russian Federation. At the same time, Law No. 129-FZ does not provide for the return of documents submitted for state registration, based on which a decision was made to refuse state registration, and the Tax Code of the Russian Federation does not provide for the procedure for returning the state duty if the registration authority makes the specified decision.

If registration of an individual entrepreneur is refused, do I need to pay the state fee again?

Important

When checking the documents, the tax inspector discovered several errors. He sent me to correct it. The lawyer corrected these errors without requiring additional payment. But there was no luck with the state duty; they say you have to pay it again.

They are forced to pay the state fee again for registering the company Pryuvet)) As a general rule, the company must independently fulfill the obligation to pay the tax, unless otherwise provided by the legislation on taxes and fees (clause 1 of Article 45 of the Tax Code of the Russian Federation). State duty is a federal tax (Clause 10, Article 13 of the Tax Code of the Russian Federation). The Tax Code states that it must be paid by the person applying for legally significant actions (Article 333.17 of the Tax Code of the Russian Federation). At the same time, the company can participate in relations regulated by the legislation on taxes and fees through a legal or authorized representative (unless otherwise provided by the Tax Code) (clause 1 of Art.

Do I need to pay the state fee again?

Payers of the state duty are organizations and individuals if they apply for legally significant actions (Article 333.17 of the Tax Code of the Russian Federation).

The state duty is paid before submitting applications and (or) documents to perform legally significant actions (clause 6, clause 1, article 333.18 of the Tax Code of the Russian Federation).

An exhaustive list has been established, according to which the paid state duty is subject to partial or full refund (clause 1 of Article 333.40 of the Tax Code of the Russian Federation).

Based on this list, a refund of the paid state duty for state registration of a legal entity (individual entrepreneur) is possible in the case of: - payment of a state duty in a larger amount than provided; — refusal of persons who have paid the state duty to perform a legally significant action before contacting the authorized body.

How can I avoid paying the state fee when submitting the same application again?

S.V.Gladilin Advisor to the State Civil Service of the Russian Federation Password is someone else's computer Forgot your password? © 1997 - 2021 PPT.

RUFull or partial copying of materials is prohibited; in case of agreed copying, a link to the resource is required. Your personal data is processed on the site for the purpose of its functioning within the framework of the Policy regarding the processing of personal data. If you do not agree, please leave the site.

Question to a lawyer Contact the editor here and now Personal question from a private person (labor disputes, social issues, etc.) Professional question from a lawyer / accountant / individual entrepreneur about the activities of a legal entity. Payers of the state duty are organizations and individuals if they apply for legally significant actions (Article 333.

17 of the Tax Code of the Russian Federation). The state duty is paid before submitting applications and (or) documents to perform legally significant actions (clause 6, clause 1, article 333.18 of the Tax Code of the Russian Federation).

An exhaustive list has been established, according to which the paid state duty is subject to partial or full refund (clause 1 of Article 333.40 of the Tax Code of the Russian Federation). Based on this list, a refund of the paid state duty for state registration of a legal entity (individual entrepreneur) is possible in the case of: - payment of a state duty in a larger amount than provided; — refusal of persons who have paid the state duty to perform a legally significant action before contacting the authorized body.

If a negative verdict is issued, the registration service notifies the applicant of the reasons that served as the basis for it. If the founders of the LLC do not agree with the refusal, then they have the right to appeal it in court. The notice of refusal to register must indicate the reason for such a verdict with reference to the relevant article of Federal Law No. 129.

- Categories

- Tax law

- We are registering a company. We specifically contacted a lawyer so that he would draw up all the documents correctly, since we are still new people in this matter.

Source: https://kodeks-alania.ru/povtornaya-oplata-gosposhliny-pri-otkaze-v-registratsii/

Receive the carryover balance of the property deduction

According to Article 93 of the Tax Code of the Russian Federation, tax authorities are prohibited from demanding from the person being inspected documents previously submitted during desk or field tax audits. It follows from this that if the taxpayer, in order to receive the remainder of the property tax deduction, submitted a tax return with copies of documents confirming the right to deduct, and this tax deduction was not fully used by the taxpayer, then in order to receive its balance in subsequent years, re-submission of copies of these documents is not required.

To receive the remainder of the deduction, copies of these documents are submitted to the tax authorities along with the 3-NDFL tax return and payment documents to confirm the fact of payment of funds (receipts for receipt orders, bank statements about the transfer of funds, sales and cash receipts, etc.).

Do I need to go to court?

To go to court again, you need to have procedural grounds. You can resubmit your application in the following cases:

- If previously the court refused to accept the application due to its incorrect execution. In this case, the plaintiff can correct the shortcomings and re-submit the application;

- New circumstances have emerged that may change the decision made.

Is it possible to get a repeated tax deduction when buying an apartment?

- an application requesting a refund of part of the tax already paid;

- a declaration in form 3-NDFL completed in accordance with all the rules;

- income certificate in form 2-NDFL;

- a copy of an identity card, a certificate of registration of marriage and birth of children (if any);

- documents for the purchased property;

- agreement for the purchase of an object on credit (if any);

- an extract confirming the registration of ownership of the acquired property;

- Bank details for transferring tax deductions.

For greater clarity, let's look at an example. Citizen Sidorov bought an apartment with a mortgage in 2015 for the price of 3 million rubles. Half of this money is overpayment on the loan for ten years. A year later, he acquired another property worth 6 million and a period of 15 years. The overpayment amounted to 3 million.

We recommend reading: Duration of vacation, labor code

Re-filing for alimony and re-collection of alimony

A repeated claim for alimony is considered a completely legal process. Only this can be done in several ways: going to court or resolving the case with the help of bailiffs.

What is the difference

A repeated appeal to the court occurs if the last time the application was not considered, the claim was withdrawn. The re-feed is the same as the initial one.

If the court has already made a final decision, then it will no longer be possible to file a second lawsuit with the same request.

It is worth contacting bailiffs when you already have a writ of execution in your hands, but the enforcement proceedings have been withdrawn. The reason for this may be the impossibility of collecting alimony from the defendant or the applicant simply changed his mind. Now that the payer needs to be held accountable again, you need to submit an application to the FSSP.

What documents are needed for a tax deduction for an apartment for the second time?

- The property tax deduction has become multi-use since 2014. This means that you can apply for it not only from one purchased apartment, but also from the acquisition or renovation of other real estate properties, provided that you meet the limit established by law.

- The tax deduction limit is calculated per person, not per property. The limit is 2 million rubles.

This certificate is provided in the accounting department at work, and on its basis, income tax will not be withheld for a long time, therefore, wages will increase.

- However, not all working citizens can receive a deduction, but only those who are:

- residents of the Russian Federation;

- capable, working citizens;

- have reached the age of majority.

Why do you need to re-submit 3-NDFL?

In some cases, the taxpayer will need to contact the tax authorities several times in order to receive the required deduction amount. According to the law, a citizen can return a lump sum amount of personal income tax, no more than what the employer pays for him throughout the year. That is, the amount of personal income tax depends on the amount of official earnings. If it is not enough to receive a deduction at once, then several visits to the fiscal authority will be required. You can apply for a deduction no more than once per year.

Tax deduction for an apartment: complete instructions

For example, if an apartment costs 2 million rubles, and income is 1 million rubles per year, then the deduction will stretch for two years. And if, at the same price of an apartment, the annual income is 500 thousand rubles, then the personal income tax will have to be returned within four years. You can stretch the deduction for any period until the state returns 13% of the entire amount of expenses for the apartment.

Until 2014. The property deduction limit was tied not only to the taxpayer, but also to the object. It was given once in a lifetime and only for one apartment. If the apartment cost less than 2 million rubles, the remainder of the deduction could not be transferred to another property - this money was “burned out” and 13% of the unused amount could never be received.

Is it possible to apply for alimony a second time after refusal and how many times can I apply?

You can reapply for alimony in the following cases:

- identification of another biological father;

- evidence of the defendant’s financial solvency was found;

- change of condition: the plaintiff decided to reduce or increase the amount of alimony, change fixed payments to shared payments, and vice versa.

If the judicial authorities have made a decision, re-filing the claim is impossible. The decision can only be subject to challenge.

How many times you can apply for alimony is an equally important question. You can file a claim in court an unlimited number of times.

Documents for tax deduction when purchasing an apartment

The actual application + tax notice is submitted to the accounting department. All other forms and papers. The following are papers for the tax service. On their basis, a notification is issued. This is the main document for the employer, which confirms the employee’s right to an increase in salary in the amount of a monthly personal income tax deduction.

- Loan agreement. We need copies of all pages with a visa on each page that confirms the authenticity of the copy. They will be needed both when processing the principal amount of the deduction, as well as when returning interest.

- Certificate of interest paid for the reporting period.

- Payment papers that confirm the return of money to a banking institution. These are checks and discharge forms, receipts and orders.

Do I need to pay the state fee again if I submitted incorrect documents?

- Do I need to pay the state fee again?

- If registration of an individual entrepreneur is refused, do I need to pay the state fee again?

- They are forced to pay the state fee again for registering the company

- If state registration is refused, you will be allowed not to pay the state fee again

- The state fee in case of refusal of state registration is not refundable

- Possible reasons for refusal to register an LLC

- Forum burmistr.ru - forum about housing and communal services (management of apartment buildings)

Do I need to pay the state duty again? Important The tax service can refuse to register an LLC only under certain circumstances. Their list is approved by law. Notification of refusal must be submitted no later than 3 business days from the date of submission of the application for registration.

If state registration is refused, you will be allowed not to pay the state fee again

When checking the documents, the tax inspector discovered several errors. He sent me to correct it. The lawyer corrected these errors without requiring additional payment.

But there was no luck with the state duty; they say you have to pay it again.

They are forced to pay the state fee again for registering the company Pryuvet)) As a general rule, a company must independently fulfill the obligation to pay taxes, unless otherwise provided by the legislation on taxes and fees (clause

1 tbsp. 45 of the Tax Code of the Russian Federation). State duty is a federal tax (Clause 10, Article 13 of the Tax Code of the Russian Federation). The Tax Code states that it must be paid by the person who applied for the performance of legally significant actions (Art.

333.17 Tax Code of the Russian Federation). At the same time, the company can participate in relations regulated by the legislation on taxes and fees through a legal or authorized representative (unless otherwise provided by the Tax Code) (clause 1 of Art.

Refund of state duty of traffic police

An application for a refund of state duty is submitted to a body or official (for example, the traffic police), which is authorized to perform legally significant actions.

If it is necessary to return money for state fees in cases that are being heard in the courts, an application is submitted to the tax office at the location of the court in which the case is being heard.

How to return an erroneously paid state duty to the traffic police? The application must be accompanied by original payment documents confirming payment of the state duty. How to return overpaid state duty to the traffic police? A partial refund occurs after submitting an application and a copy of documents confirming payment of the state duty.

How to return the state duty

The applicant may have to provide additional documents. The email appeal must include the full name, postal and email addresses, and the essence of the appeal. If the details or the above information are not provided, the request may not be answered. There will also be no response to obscene language or insults.

The letter must contain only reliable information. Appeals are registered within three days and considered within a month.

If the review period is extended, the applicant will be notified. The response is sent to the address indicated in the appeal. The essence of the problem is formulated briefly and clearly. Don't forget to attach the relevant documents.

How to return money erroneously paid to the budget (state duty)?

You cannot delay your application. The application is taken to the traffic police department in the area and handed over personally to the official. The traffic police officer is obliged to issue a notice of acceptance of the document, which must indicate:

- date of acceptance;

- position, full name of the employee;

- signature.

You can also send the application by registered mail with a valuable inventory. The applicant will receive notification of receipt and will be able to prove that he did not forget to enclose the document in the envelope. If the applicant submitted an application and other documents, but the money from the treasury was not returned on time, interest will be added to the total amount.

Interest is calculated using the following formula: Amount of state duty * number of days overdue * 1/300 of the refinancing rate valid at the time the delayed payment appeared = interest on late payment.

Important How long to wait for a duty refund The total period consists of several factors:

- The organization has five days to consider your application;

- Another fifteen is allocated for issuing a certificate for the Tax Service;

- The Federal Tax Service has a month to return your funds.

If an organization transfers money to you bypassing the Federal Tax Service, then it also has a month to do this. The payment comes from the Federal Treasury. Funds will be credited to the same account from which they were withdrawn.

We will determine the procedure for returning the state duty. The document on the basis of which funds can be returned is an application. The application, as a rule, is drawn up in any form, but is submitted to the government agency where the payment was made. Let's look at the text of the statement in more detail.

The fact of payment of the state duty by the payer in cash is confirmed either by a receipt of the established form issued to the payer by the bank, or by a receipt issued to the payer by an official or the cash desk of the body to which the payment was made.

Let's consider individuals. Of course, the person who paid the receipt must sign and submit the application to government agencies, but if it is not possible to carry out these actions, a representative may be present.

A representative can be any person acting under a power of attorney. It is important to know that the power of attorney must be certified by a notary and it must indicate specific powers to collect state fees.

As for a legal entity, the applicant is the payer organization.

Source: https://fundsnet.ru/nuzhno-li-povtorno-oplachivat-gosposhlinu-esli-sdali-ne-vernye-dokumenty/

List of documents for tax deductions in different areas

A tax deduction is a certain amount of money by which the taxable base can be reduced. Sometimes these funds are issued after the tax is paid directly in the form of money, but most often they are applied before calculating its value. It is important to know that a tax deduction can be received by any citizen living on the territory of the Russian Federation and having resident status in our country. At the same time, he must be officially employed and pay 13% of the income received at his place of work to the state treasury. The list of documents for tax deduction may vary depending on the type of return.

The procedure for re-collection of alimony through bailiffs

The job of bailiffs is to take coercive measures against a person who does not pay alimony.

Procedure for resumption of enforcement proceedings

Bailiffs have the right to begin their duties only after receiving a court order. It often happens when the debtor goes to a meeting with the collector and an agreement is concluded between them on the procedure and amount of cash payments. But in the future, the alimony payer may refuse to comply with the conditions. . In this case, the applicant can re-apply to the bailiffs.

Resumption of enforcement proceedings is allowed only if obligations are not fulfilled in relation to minor children. In other cases, the resumption of enforcement proceedings will be impossible.

Required documents

The main document that needs to be presented to the bailiffs is the writ of execution. In addition to this, you must provide:

- Information about the plaintiff and defendant.

- Details of the document that authorizes the use of compulsory measures.

- Details of the bank account where the funds will be received.

Documents for mortgage tax refund

According to the law, for the purchase of real estate using credit funds, monetary compensation is required in the form of a tax deduction. Let's look at what documents you will need for a tax refund for an apartment on a mortgage in order to exercise your legal right. The list of documents is quite large, but collecting it is not as difficult as it might seem at first glance.

- declaration in form 3-NDFL;

- photocopy of the passport of a citizen of the Russian Federation;

- a photocopy of the loan agreement with the payment schedule;

- photocopy of the purchase and sale agreement;

- application for tax refund addressed to the head of the Federal Tax Service;

- application for the return of a deduction for mortgage interest paid;

- a certificate from the financial institution that issued the loan regarding the amount of interest paid under the agreement;

- certificate of ownership (extract from the Unified State Register from 01/02/2017), or an act of acceptance and transfer of property when purchased in a facility under construction;

- photocopies of payment documents (for tax compensation for mortgages) confirming the deposit of funds towards the loan payment;

- photocopies of payment documents confirming the fact of payment for housing for deduction on the mortgage.

- bank statement indicating details and account number (for transferring funds).

certificate from the official place of work (2-NDFL) for each working year;

We recommend reading: What types of apartment ownership are there?

Do I need to pay the state duty again?

You just have to have a Sberbank card. Open the site and enter your username and password. Click on the “Transfers and Payments” tab in the main menu and on the page that opens, click “Staff Police, taxes, duties, budget payments.”

Depending on what service you want to pay a state fee for, select the appropriate item in this category. After this, enter the recipient's details and the amount that will be withdrawn from your account.

Carefully check the correctness of the entered data and confirm the payment.

Do I need to pay the state fee again if registration of changes is refused?

I paid the state fee. Within a month, my husband and I reconciled. All paid government services are subject to state duty, the fact of payment is confirmed by a receipt, which must be attached to the package of documents.

Often, due to confusion, unpleasant situations arise when a citizen pays a larger amount than he should in fact. Don’t rush to worry and look for the culprit of the expenses, because the difference can be returned by writing a corresponding statement. Also, if you were denied the service later, but you have already paid the fee, you also have every right to a refund.

In this article you will find a complete list of reasons, and also find out what you need to do to get the state duty back. 1 In what situations can the state duty be returned? This issue is fully regulated by Article 333.40 of the Tax Code of the Russian Federation.

Do I need to pay the state fee again if I change the appointment time?

The basis on which a driver’s document will be issued to the owner of a vehicle is a medical certificate issued in accordance with the Order dated September 28, 2010.

No. 831n. If an international driver's license This type of document allows a citizen of the Russian Federation to drive a car outside the country. It is a certificate translated into one of the main languages of the world. How much is the right: state duty for a university in 2021 It could be:

- issuance of a new certificate;

- replacement of a document.

- Information about the payer, including his residential address.

- Amount of payment.

We recommend reading: When will the sleep tax be cancelled?

Types of payment You can pay the state fee for issuing a driver’s license in several ways:

- Traffic police terminals. Directly at the traffic police department.

It contains special terminals.

Obtaining rights when registering for receipt, do you need to pay the state fee again?

Please note that changes are periodically made to OKATO codes, so it is worth checking the current data.

To contact a bank representative, you will need a passport.

- State fee for a driver's license

- How much are rights: state duty for a university in 2021

- State duty for rights.

Attention The following will be allowed to take the exam: Age Category B 16 For transport category M, A1 B 17 For transport B and C B 18 A, B1 and C1 B 21 D, Tm, Tb, D1 There are no restrictions on old age, unless there is a medical prohibition. The list of diseases for which a driver’s license will be denied is contained in Order No. 302n of the Ministry of Health and Social Development of Russia dated April 12, 2011.

The procedure for returning state fees paid through State Services

However, if the refusal was due to the fault of an official, then the money already spent must be returned. The court refused to accept the complaint. You will need to understand each situation separately to understand whether you can return the money or not.

As a rule, an erroneous translation can be redirected to the right person. But this will take a lot of time until the issue is considered and a decision is made. It often happens that a person entered the details incorrectly or made an excessive transfer.

When re-obtaining a license, do I need to pay a state fee?

For some it is more convenient to pay through Sberbank or another bank (with which they, for example, live close), for others it is more convenient to use the postal service or come directly to the traffic police.

It all depends on two factors:

- from the expiration date of the driver’s license (their validity may expire during the deprivation);

- from medical indicators. The driver must provide a certificate of health (if contraindications are identified, adjustments may be made to the driver's license).

If we are talking about issuing new licenses (and this will be the case with an expired driver’s license or making changes to the list of permitted categories), then the answer to the question of whether it is necessary to pay a state fee after deprivation of a license will be positive - you will need to pay 2,000 rubles.

Question #29436 Do I need to pay the state fee again?

After a court decision, the arrest was lifted and the buyer was recognized as the owner of the car. to another house. Having arrived and exited it, I even managed to take a step; traffic police officers drove up to me and began a verbal dialogue about my being drunk and driving.

Since we were previously acquainted with these employees, they did not provide a certificate or a reason and offered to sit in the patrol car in order to show the video recorder that I was driving the car because...

Do I need to pay the state duty a second time if the first payment was 6 months ago?

Regards, Tatiana.

June 13, 2021, 08:47 Was the lawyer’s response helpful? + 0 — 0 All legal services in Moscow Best price guarantee - we negotiate with lawyers in every city on the best price.

Similar questions

- January 17, 2015, 16:14, question No. 689841

- December 19, 2021, 12:34, question No. 1850379

- 15 September 2021, 12:46, question No. 1378326

- March 21, 2021, 15:32, question No. 1189270

- 18 August 2021, 16:05, question No. 1349746

see also

What documents are needed for a tax deduction when buying an apartment in 2018-2019?

Officially employed citizens have the right to receive a property tax deduction after purchasing real estate. Read the article about what documents you will need for a tax deduction when purchasing an apartment in 2018-2019, depending on the registration method.

- tax return in form 3-NDFL;

- a certificate from the employer’s accounting department in form 2-NDFL;

- legal documentation for the apartment - purchase and sale agreement, transfer and acceptance certificate, certificate of ownership or extract from the Unified State Register of Real Estate from 2021;

- mortgage agreement, repayment schedule and interest transfers - if the housing was purchased with a mortgage;

- papers confirming the transfer of funds for the purchase of real estate - receipts, bank statements from personal accounts, checks, certificates from the creditor bank);

- marriage registration certificate, application for distribution of property tax deduction between husband and wife - if the apartment was purchased as joint property.

If an agreement was concluded to pay alimony

According to the Family Code, the ex-husband and wife have the right to draw up an alimony agreement and have it notarized. The parties to the agreement independently determine the amount, terms and method of payment of funds. If the agreement was drawn up after the court made a decision, then you need to draw up an application for termination and annulment of the enforcement proceedings from the FSSP. After this, a new decision is made, which is given to the bailiff. It confirms the termination of enforcement proceedings, and in the future payment of alimony is carried out only under a notarial agreement.

Necessary documents for tax deduction for an apartment

3. Documents for the return of personal income tax, indicating all expenses incurred, including a receipt for receipt of money for property deduction (a sample of filling out the document can be downloaded here), receipts, bank payments. It is also necessary to include expense documents for repairs carried out in the apartment, since these costs can also be used to receive a property deduction;

Documents for property deduction can be submitted only after the transaction has been completed, expenses have been paid and a document on the right to own the property has been received. At the same time, there is no time limit for submitting documents in one year. In other words, documents for a tax refund when purchasing an apartment are submitted before December 31 of the corresponding year.

Terms of consideration

Through the Federal Tax Service

The tax office has 90 calendar days to verify documents. One more month to transfer the money.

Through the employer

The accounting department is required to make a refund upon receipt of the notice from the beginning of the year and stop withholding income taxes until the end of the year. If the amount of the deduction did not cover the amount of two hundred sixty thousand plus the amount of interest on the mortgage loan, you must apply again for a new notification next year.