Disability codes on a sick leave certificate are two-digit numbers that encrypt the reasons why an officially employed employee went on paid sick leave. The sick leave certificate itself (hereinafter referred to as SL) is a very important document: it confirms the status of the sick employee, and on its basis the accounting department calculates the amount of insurance premiums due to the sick person. Code 09 in a medical document implies “family ties”, that is, an employee of the organization went on sick leave as a result of providing care for a minor child or another family member who needs it. This article describes the nuances of deciphering BL codes, in particular code 09, and how the employer should compensate sick leave in 2021.

What does the reason for disability code mean?

It shows in encrypted form on what basis the person was given a ballot. This code is entered on the sick leave certificate in the “Cause of disability” field. It consists of three blocks:

- Two cells labeled “code”. They indicate the code of the reason why the employee went to the doctor on the first visit and received a certificate of incapacity for work.

- Three cells with the signature “additional code”. They are filled out only in certain cases (see table).

- Two cells labeled “change code.” They are filled out in a situation where the cause of disability has changed (for example, when the original diagnosis is corrected).

All values with explanations are given in the order in which certificates of incapacity are issued (approved by order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n) and on the reverse side of the ballot form.

Work with electronic sick leave and submit all related reporting through Kontur.Extern

Table with decoding of disability codes on sick leave

| First block (initial reason for visiting a doctor) | |

| Code | Decoding |

| 01 | Disease |

| 02 | Injury |

| 03 | Quarantine |

| 04 | Accident at work or its consequences |

| 05 | Maternity leave |

| 06 | Prosthetics in hospital |

| 07 | Occupational disease or its exacerbation |

| 08 | Aftercare in a sanatorium |

| 09 | Caring for a sick family member |

| 10 | Other condition (poisoning, manipulation, etc.) |

| 11 | The disease specified in paragraph 1 of the List of Socially Significant Diseases (approved by Decree of the Government of the Russian Federation dated December 1, 2004 No. 715). For example, tuberculosis, hepatitis B, C, diabetes, etc. |

| 12 | Care for a child under 7 years of age, if his illness is included in a special list (approved by order of the Ministry of Health and Social Development dated February 20, 2008 No. 84n) |

| 13 | Caring for a disabled child |

| 14 | Caring for a child whose illness is associated with a post-vaccination complication or malignant neoplasm (indicated with the consent of the employee) |

| 15 | Caring for an HIV-infected child (indicated with the consent of the employee) |

| Second block (additional three-digit codifiers) | |

| Code | In what case is it indicated? |

| 017 | During treatment in a specialized sanatorium |

| 018 | During sanatorium-resort treatment in connection with an industrial accident during a period of temporary incapacity for work (before referral to medical examination) |

| 019 | When treated in a clinic of a research institution (institute) of balneology, physiotherapy and rehabilitation |

| 020 | With additional maternity leave |

| 021 | In case of illness or injury resulting from alcohol, drug, toxic intoxication or actions related to such intoxication |

Create electronic registers and submit them to the Social Insurance Fund via the Internet

When and for how long is sick leave extended?

There is no specific minimum period of sick leave established by law. In fact, the doctor has the right to prescribe him for one day, but in practice this rarely happens. Typically, the doctor will prescribe an initial bulletin for a period of 3 to 15 days, unless the illness is severe. Paramedics and dentists can issue it for up to 10 days.

The doctor alone decides whether to issue a bulletin or not, whether to extend it or close it, based on the patient’s health status, disease, and the presence of complications.

| When the doctor opens the bulletin | When a ballot is issued in the absence of illness |

| The grounds for registration of sick leave are: 1. Illness of the employee himself. 2. Operation. 3. Injury. 4. Pregnancy and childbirth. | If a sick relative needs constant care or when a child gets sick |

So, for example, a standard bulletin is issued: (click to expand)

for ARVI: for 5-15 days; for chickenpox: from 10 to 21 days; in case of tooth extraction (with general anesthesia) - from 3 to 10 days, etc. d.

The required period is determined by the attending physician, guided by the current legislation. If, at the end of the 15-day period of illness, the patient who was treated on an outpatient basis has not recovered, then the hospital certificate is further extended with the participation of a medical commission.

Disease Maximum period for extending the bulletin Tuberculosis (some injuries) Up to 12 months Stroke From 3 to 8 months. depending on the severity of the disease and prognosis. Surgical intervention: up to 10 months, and in particularly difficult situations - up to 12 months.

Oncology

The bulletin is extended up to 4 months, and then, if the forecast is favorable, for another 10 months.

In other cases, the patient is sent to MSEC (on the issue of establishing disability)

From the above data it follows that the maximum period for extending a sick leave certificate can be 12 months. The extension is issued until the patient has fully recovered or before he is sent to MSEC to determine his disability. If the patient refuses to undergo MSEC, the sick leave may be closed and he will have to go to work.

As the FSS points out, an electronic bulletin is equivalent to a regular sick leave on paper. Accordingly, it is also subject to general extension.

Website of the FSS of the Russian Federation.

Causes of illness and legal consequences for the employer

Sick leave codes 01, 02

Code 01 on the sick leave means that the employee was absent from work due to illness (flu, pneumonia, sinusitis, etc.).

Code 02 means that the person missed work due to injury.

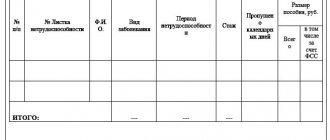

Having received a bulletin with one of these codes, the personnel officer must reflect the information in the work time sheet (usually they use forms No. T-12 or No. T-13, approved by Resolution of the State Statistics Committee dated 01/05/04 No. 1). The corresponding days are marked with the symbols “B” or “19”.

Next, the accountant calculates temporary disability benefits (for more details, see: “Payment of sick leave in 2019”). In this case, the employer pays for the first three days at his own expense. The remaining days, starting from the fourth, are financed by the FSS. This is stated in paragraph 1 of part 2 of article of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

Calculate your salary and benefits for free in the web service

Sick leave code 04

Code 04 on the certificate of incapacity for work means that the person missed work due to an accident at work or its consequences.

In the report card in form No. T-12 or No. T-13, days of absence are marked with the symbols “B” or “19”.

Benefits under such a bulletin must be issued for the entire period up to the date of recovery or until the fact of permanent disability is established. The payment amount is calculated based on 100% of average earnings, regardless of length of service, but for a full calendar month cannot exceed the maximum amount. It is equal to the maximum monthly insurance payment approved by law, multiplied by four (Article 9 of Federal Law No. 125-FZ of July 24, 1998).

IMPORTANT. First, the organization or individual entrepreneur pays the benefit from its own money, and then can reimburse it from the Social Insurance Fund. To do this, it is necessary that the incident be investigated by a special commission, which recognized it as an accident (Article 229 of the Labor Code). Next, the accountant must reflect the costs of the benefit in Table 3 of the calculation in Form 4-FSS (approved by Order of the FSS dated September 26, 2016 No. 381).

Fill out and submit 4‑FSS online for free using the current form

Special cases

Certain ailments fit several codes at once. Therefore, injuries must be differentiated between those sustained at work and those sustained at home. Let’s say we saw the code “02” on the sick leave sheet, which means “injury.” Keep in mind that this is a domestic incident. Another thing is the code “04” on the sick leave, which means the same injury, but here it means an accident during work.

Do not forget that disease codes on sick leave are designated from 01 to 15, and the remaining values are more related to related circumstances, the treatment process, indication of family ties, etc. Codes after the 15th are considered additional. Moreover, they can significantly affect the amount of sick pay. Also see “How sick leave is paid in 2021.”

If you don't know what the codes on a sick note mean , there is a hint on the back of this document.

There is also such a thing as a subordination code on a sick leave certificate . It indicates a specific organization and is necessary, rather, for the FSS.

Mode violation codes 23, 24

Significant information is contained in the field of the sick leave sheet, which is called “Notes on violation of the regime.” A two-digit code and the date of violation are entered here. The following marks are most often used.

Code 23 indicates non-compliance with the prescribed regimen, unauthorized leaving the hospital, traveling for treatment to another administrative region without the permission of the attending physician.

Code 24 indicates late attendance at a doctor's appointment.

If these values are present, then starting from the date specified in this field, the benefit must be calculated in an amount that does not exceed for a full calendar month the minimum wage established for the current year and multiplied by the regional coefficient (if any). This rule applies even if the employee’s actual average earnings exceed the minimum wage.

Example

The specialist's experience is 15 years, his average earnings are more than the minimum wage.

From February 10 to February 17, 2021, he was treated in a hospital. On February 14, the employee violated the regime, and the doctor made a note on the bulletin.

The accountant calculated the allowance:

- for the period from February 10 to February 13 - based on the actual average earnings multiplied by 100%;

- for the period from February 14 to 17 - according to the formula: minimum wage for 2021, divided by 29 (the number of days in February) and multiplied by 4 (the number of days of sick leave, starting from the date when the regime was violated).

Line “Other” (code 31, 36)

It contains additional information in encrypted form. Here are some of them.

Code 31 means that a person needs long-term treatment, and although he was given a certificate of incapacity for work, he continues to be ill. In this case, he submits the primary sheet to the accounting department and receives benefits for the first part of the illness. In this document, the “Get Started” field is not filled in. And in the “Other” field there is code 31, which stands for “continues to hurt.”

Code 36 indicates the following situation. The employee, while on sick leave, missed his next doctor's appointment. And when he showed up (later than the appointed date), he was recognized as able to work. The ballot fields are filled in as follows:

- “Notes on violation of the regime” - worth 24 and the date of the missed appointment;

- “Exemption from work” - the period from the onset of illness to the date of the missed appointment is indicated;

- “Other” - costs 36;

- “Get Started” remains blank.

ATTENTION. The benefit for the ballot, in which code 36 is indicated in the “Other” field, is calculated as follows. From the onset of illness to the date preceding the absence - based on actual average earnings. For a day of failure to appear - in an amount not exceeding for a full calendar month the minimum wage established for the current year and multiplied by the regional coefficient (if any). From the date following the day of failure to appear, benefits are not accrued at all (letter from the Moscow branch of the FSS dated September 01, 2020 No. 14-15/7710-2216l; see “The capital FSS clarified how to calculate benefits if there is a note on the sick leave for violation of the regime ").

Calculate a “complex” salary with coefficients and bonuses for a large number of employees Try for free

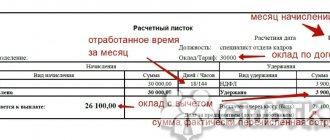

How is sick leave payment calculated by code?

After closing the certificate of incapacity for work, it must be transferred to an accounting employee to calculate temporary disability benefits.

The calculation is done as follows:

- The number of days due for payment is calculated. The main codes are taken into account, since they determine how many days will be paid. So, according to code 01, all sick days are paid, and according to code 09, a specific number of days is paid.

- The average earnings for the two previous calendar years (730 days) are calculated and adjusted taking into account the insurance herd. For example, less than 5 years - 60% of average earnings, 5-8 years - 80%, over 8 years - 100%. If the work experience is less than six months, the calculation is made on the basis of the minimum wage.

- The average daily earnings are determined taking into account length of service and multiplied by the number of days to be paid for sick leave.

Payment must be made within 10 days. The funds are transferred to the employee along with the next salary.

We must remember! The sick leave certificate must be presented to the employer within six months after its closure. If the deadline is missed, payment will not be made.

What codes should an employer provide?

The employer should put the subordination code in the bulletin and fill out the “Calculation conditions” field (the codes are given on the back of the sick leave form).

Doctors indicate all other codes, in particular: reasons for disability, notes on violation of the regime and the corresponding values in the “Other” field.

IMPORTANT. If doctors filled out a sick leave certificate with errors (including incorrect disease codes), and the accounting department paid for it, the Social Insurance Fund will most likely refuse to reimburse the benefit. But the courts support policyholders in such situations.

Why is information encoded?

The old-style sick leave certificate, valid until 2011, had to be filled out manually and included a large amount of information, despite the fact that the document itself was smaller than the one in force in 2018. Another important reason for the introduction of the new model was the huge financial losses of the state due to the fact that sick leave was very easy to fake. With the introduction of the new document, the options for falsifying it have practically exhausted themselves and the problem has actually been solved.

At the same time, the main reason for introducing codes was the need to save space, as well as to hide personal data of patients. That is, when transferring a document from hand to hand, a citizen can be calm, since his illness will not be directly written on the sheet. It will be indicated with a special code. And since since 2011, the document must be filled out only in block letters or by machine, errors due to illegible doctor’s handwriting are minimized, including due to the need to use code values.