Status difference

The pros and cons of working under an agency agreement begin with the status. A person with employee status submits an application for a job and signs an employment contract.

It is compiled in fact according to a standard form. The employer has the right to make additions that do not detract from the rights of the employee.

And from the moment of signing or actually entering work, labor legislation begins to apply.

By providing the services of an agent, a person acquires rights and obligations in accordance with civil law, and his partner has more freedom to establish the rules of cooperation.

A fairly high degree of freedom in determining the terms of cooperation is both a plus and a minus, depending on which point of view is closer.

Regulatory regulation

To find out the pros and cons of working under an agency agreement, let’s consider what acts it is regulated by.

The Civil Code defines what agency relations are and describes the rights and obligations of the parties. The Code is not the only document regulating this area of public relations. When proposing to sign such an agreement, one should not lose sight of tax legislation.

In addition, relations with agents are subject to laws regulating certain areas (for example, tourism). They may establish additional rules.

The application of these norms is discussed in judicial practice, often in arbitration. Also, general explanations on this matter are given in some Resolutions of the Plenum of the RF Armed Forces.

Agreement conditions

The law requires two clauses to be included in the agreement; without them it has no legal force:

- the subject or list of actions that the agent must perform;

- on whose behalf the agent conducts activities (his own or the principal).

The agreement usually includes two more points:

- validity;

- amount of remuneration.

Expert opinion

Volkov Viktor Vladimirovich

Lawyer with 8 years of experience. Specialization: civil law. More than 3 years of experience in developing legal documentation.

When inviting a company for cooperation, it publishes a sample agency contract for work. And the potential employee has an idea of what awaits him. One example is presented in the article.

What is an agency agreement

There are two separate types of mediation - when an intermediary, for a fee from the employer, acts on his behalf, and when an intermediary, for a fee or commission from the employer, acts on his own behalf, but in the interests of the employer. The employer is called the “principal” and the intermediary is called the “agent”.

The agency agreement includes both types of mediation. The agent undertakes an obligation according to which, for an agent's fee from the principal and on his instructions, he will perform legal and other actions on his own behalf or, for a fee and on instructions, perform actions on behalf of the principal.

Step-by-step instructions for drawing up an agency agreement are in this video:

Example of legal relations

The most popular example: A plant producing baby food and drinks posted an advertisement that it was ready to hire energetic, result-oriented people under a contract for high remuneration, but with the following conditions:

- offered to become an agent of the plant;

- attract wholesale buyers and leave your interest on your current account for each purchase of a certain volume, and transfer the rest of the amount to the plant;

- the contract will be concluded only after attracting the first wholesale buyer who actually purchases a batch of children's drinks;

- after that, under the guidance of the chief accountant, step-by-step assistance will be provided in the process of registering an individual entrepreneur, opening a current account and maintaining primary documentation in the accounting department;

- every month the agent had to submit a report on the work done - all contacts with companies, individual entrepreneurs, small wholesalers and, of course, fulfill the minimum plan;

- the lists of buyers should not contain repetitions of the same buyer. But, if this happened, then the head of the plant communicated with him directly.

Along with this, the management proposed another scheme: Become an intermediary who finds buyers by advertising and promoting products.

Both of these schemes are a direct example of an absolutely legal agency agreement.

Types of agency services

In all areas where an organization or individual needs an intermediary, agents can be used who, for a fee, provide intermediary services in the interests of the client. Now there are more than 50 types of agency services for which contracts are concluded.

For example, an agent can work on behalf of principals:

- actors, other creative persons;

- enterprises;

- trade organization;

- collectors;

- an individual;

- financial and credit organizations;

- jewelers;

- lawyers;

- travel agencies;

- universities;

- auto dealers;

- road transport companies;

- brokers;

- computer scientists;

- construction organizations;

- designers, etc.

In a principal-agent interaction, payment is always made by the principal.

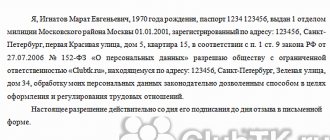

Sample of filling out an agency agreement.

How the work is organized

The agent’s tasks include searching for clients using a database provided by the company or on an independent basis.

Having found a client, the agent formalizes the purchase of a service or product by signing an agreement or drawing up other documents confirming the fact of the transaction. The list of supporting documents is agreed upon in advance.

Determining its structure and form is the prerogative of the company. The report is the basis for payment of remuneration. Claims must be made no later than 30 days (or other period prescribed by law or contract) after receipt of the documents, otherwise the report is considered accepted.

Actual employment relationships are sometimes hidden behind the performance of work under an agency agreement. This happens in shopping centers. The employee is subject to labor regulations and has a place of work. However, payments are calculated and made as an agent.

Nuances with payments

The remuneration is calculated based on the amount of sales secured by the agent. He is entitled to a share of the income. The amount of payments depends on the conditions of the company. Successful agents are offered bonuses in various forms and increased payments.

The law requires payment to be made no later than a week after the report is considered accepted, unless otherwise provided by laws and company rules.

If the amount of payments is not clear from the contract, the court has the right to recover the amount that is paid in the same area under similar circumstances.

If the agent is a citizen who does not have the status of an individual entrepreneur, contributions to the budget are made by the company paying the remuneration. If the employee is an entrepreneur, payments become his responsibility.

Termination of an agency agreement with an individual entrepreneur

Agency contractual relations between individual entrepreneurs can be terminated by mutual consent of both parties, or if one of the individual entrepreneurs refuses to fulfill his duties (in this case, penalties are imposed on him).

Termination also occurs under the following conditions:

- if the agent has died;

- recognition of an agent by the court as completely incompetent or partially capable

- the agent is declared missing by the court;

- declaring the agent bankrupt.

What types of activities are covered?

Work under an agency agreement may include the same actions that are required of an employee. But in a number of cases, the law directly refers to the agency services agreement as the basis of the relationship between the parties in the following cases:

- insurance;

- legal services;

- investment activities;

- organization of sea transportation;

- payments industry;

- sales field.

In the latter case, there are several options:

- with the right of exclusive sale (no one else offers similar goods or services);

- the manufacturer still has the right to sell;

- Agents are also involved in sales; their number is not limited.

Structure and content of a standard agency agreement with an individual entrepreneur.

- Date and place of conclusion of the agreement.

- Name of the parties. In this case, the parties are individual entrepreneurs (IP) - individuals registered in accordance with the procedure established by law and carrying out entrepreneurial activities without forming a legal entity.

- Subject of the agreement. It is necessary to define the actions that the agent must perform. These can be legal services, services for the purchase and sale of goods, real estate transactions, etc.

- Contract time. The document can be concluded for a specific period or without specifying a validity period.

- Rights and obligations of the parties. Contractual relations may limit the rights of both one and the other party (for example, non-disclosure, prohibition on concluding similar documents for a given transaction).

- Deadlines for executing agency orders.

- Submission of the Agent's report. The agent is responsible for his actions. It should be specified in what form and within what time frame the agency report will be provided.

- Agent's remuneration and payment procedure. The remuneration can be paid after the agent performs certain actions or after the entire agreement is fulfilled.

- Responsibility of the parties.

- Grounds and procedure for termination of the contract. Termination is regulated by the Civil Code of the Russian Federation.

- Dispute resolution.

- Force Majeure.

- Other conditions.

- List of applications.

- Addresses and details of the parties.

- Signatures of the parties.

What are the disadvantages of being an agent?

- No guaranteed salary.

- No right to leave.

- Lack of payment due to temporary disability (in other words, you have to get sick solely at your own expense).

- The risk of the principal not recognizing the transaction.

- In the event of termination of the contract, payments are made only for work actually performed; compensation for reduction is not provided.

- Contributions to the Social Insurance Fund for subsequent payments in connection with unemployment, accidents, and parental leave are mandatory if provided for by agreement of the parties.

Employers' opinions

Many employers believe that specialists do not need any special training. A sales agent learns all the necessary skills in the process of performing assigned tasks independently.

There is, however, another opinion. Employers, in particular, note that all the tasks that a sales agent performs, the responsibilities, capabilities of a specialist, as well as the intricacies of communicating with clients and establishing interaction between them require careful explanation.

Employee training, according to these employers, is a rather serious process. They believe that every sales agent should undergo training.

The duties of a specialist require not only creative, innovative thinking, but also certain knowledge. In particular, employees must understand many of the psychological subtleties of human nature, technical characteristics of products, requirements for drawing up contracts, and so on.

Job description for the specialty "Trading Agent"

Job description of a trading agentzip

_____________________________ (Last name, initials)

(name of organization, its ________________________________

organizational and legal form) (director; other person authorized

approve job description)

JOB DESCRIPTION

TRADING AGENT

I. General provisions

Expert opinion

Volkov Viktor Vladimirovich

Lawyer with 8 years of experience. Specialization: civil law. More than 3 years of experience in developing legal documentation.

1.1. This job description establishes the rights, responsibilities and job responsibilities of a trading agent _____________________ (hereinafter referred to as the “enterprise”). Name of institution

1.2. A trading agent belongs to the category of technical performers.

1.3. A person appointed to the position of a trading agent must have a secondary vocational (economic) education, without presenting requirements for work experience, or secondary vocational education and special training according to an established program, without presenting requirements for work experience.

1.4. Appointment to the position of trading agent and dismissal from it is carried out on the basis of an order from the director of the enterprise.

1.5. The sales agent reports directly to ___________________________.

1.6. If a trading agent is absent, then his duties are temporarily performed by a person appointed in accordance with the established procedure, who is responsible for the proper performance of his official duties.

1.7. In his activities, a trading agent is guided by:

— methodological materials on relevant issues;

— the charter of the enterprise and this job description;

— labor regulations;

— legislative and regulatory acts on the work performed;

- orders and instructions from the director of the enterprise and the immediate supervisor.

1.8. A sales agent must know:

— progressive forms and methods of trade and sales;

— development prospects and needs of the industry, enterprises, institutions that are potential buyers (customers) of manufactured products and services provided;

— the procedure for concluding sales and purchase agreements and preparing the necessary documents;

— conditions for concluding commercial transactions and methods of bringing goods (services) to consumers;

— current price tags and price lists;

— conditions of the domestic and foreign markets;

— assortment, nomenclature and standard size of goods, rules for deciphering codes, articles and labeling;

— requirements of standards and technical conditions for the quality of goods (services), their main properties, quality and consumer characteristics;

— regulatory legal acts, regulations, instructions, other guidance materials and normative documents regulating the organization of marketing and sale of goods, provision of services;

— basics of financial, economic, tax and labor legislation;

— addresses of potential buyers (customers);

— fundamentals of psychology, economics and labor organization;

— internal labor regulations;

— rules and regulations of labor protection;

— advanced domestic and foreign experience in organizing the sale of goods and servicing the population;

II. Functions

The trading agent is assigned the following functions:

2.1. Identification and accounting of potential buyers (customers) for manufactured products and services provided.

2.2. Registration, recording and ensuring the safety of documentation.

2.3. Concluding purchase and sale transactions.

2.4. Consultation on technical and consumer characteristics of goods (services), their advertising.

2.5. Organization of delivery of purchased products.

III. Job responsibilities

The sales agent performs the following duties:

3.1. Carry out the purchase and sale of goods (services) on his own behalf and at his own expense, being the owner of the goods being sold at the time of conclusion of transactions.

3.2. Negotiates purchase and sale transactions.

3.3. Concludes purchase and sale transactions on his own behalf or on another person represented by him on the basis of an agreement governing the relationship between them.

3.4. Analyzes the state and trends in population demand, studies the needs of buyers (customers), advises on the technical and consumer characteristics of goods (services) that help meet the needs of buyers (customers).

3.5. Keeps records of buyers' (customers') claims regarding the execution of sales contracts.

3.6. Ensures the safety of completed documentation under sales and purchase agreements.

3.7. Controls the payment by buyers (customers) of invoices to manufacturers of products or services.

3.8. Draws up purchase and sale agreements and monitors their implementation.

3.9. Identifies the causes of violation of contract terms and takes measures to eliminate and prevent them.

3.10. Conducts purchase and sale transactions as a trading agent with simple rights or a trading agent with exclusive rights.

3.11. Performs the functions of a guarantor for the fulfillment of obligations arising from transactions concluded by him, compensating for possible losses in the event of failure to fulfill his obligations, due to insolvency or other circumstances depending on him.

3.12. Based on a study of market conditions for goods (services), it carries out work to identify and record potential buyers (customers) for manufactured products and services provided, and organizes their advertising.

3.13. They set prices for goods (services) and determine the conditions for their marketing (sale) and provision of services.

3.14. Organizes delivery of purchased products and provision of services.

3.15. Carries out work to introduce progressive trading methods.

IV. Rights

A trading agent has the right:

4.1. Contact the company management:

— with the requirement to provide assistance in the performance of their official duties and rights;

— with proposals for improving work related to the responsibilities provided for in these instructions.

4.2. Get acquainted with draft decisions of the enterprise management on issues of its activities.

4.3. Receive information and documents from heads of structural divisions, specialists on issues within his competence.

V. Responsibility

The trading agent is responsible for:

5.1. In case of causing material damage, within the limits determined by the criminal, civil, and labor legislation of the Russian Federation.

5.2. If an offense is committed in the course of carrying out its activities, within the limits determined by the criminal, civil, administrative legislation of the Russian Federation.

5.3. In case of failure to perform or improper performance of their official duties, which are provided for in this job description, within the limits determined by the labor legislation of the Russian Federation.

Head of structural unit: _____________ __________________

(signature) (surname, initials)

I have read the instructions,

one copy received: _____________ __________________

Agency agreement in cases of artificial division of business

An agency agreement in conjunction with special tax regimes is perhaps one of the most common tools for tax optimization. It owes its popularity not only to its apparent simplicity, but also to the regular marketing efforts of tax wizards. Be that as it may, the term “agency scheme” and its variety “reverse agency scheme” have firmly taken a place not only in the minds of entrepreneurs, consultants and accountants, but also in arbitration practice.

We analyzed 450 cases of artificial fragmentation for 2017-2020 (analysis coverage was 95% throughout Russia). The agency agreement is mentioned in them as an element of “building a scheme” in more than 10% of cases.

Let us recall that an agency agreement can mediate two models of interaction: a commission model and an assignment model; we wrote in more detail about the features of their use in this article.

According to the commission model, an interested party (principal, principal) gives instructions to another party (agent, commission agent) to carry out transactions on behalf of the commission agent, but in the interests and at the expense of the interested party. That is, the interested party is, as it were, hiding behind the commission agent’s “back.” Although the principal may be mentioned in the agreement concluded by the commission agent, the rights, obligations and responsibilities to third parties arise with the latter.

In the mandate model, the agent acts on behalf of the principal, in his interests and at his expense. In essence, the agent acts on the basis of a power of attorney and all transactions are concluded on behalf of the interested party. Consequently, all rights and obligations under concluded transactions arise with the principal.

The listed features, when used correctly, can provide obvious advantages of an agency agreement both in relation to the sales function (especially geographically isolated) and in relation to the purchasing function:

- distribution of zones (territories) of responsibility when organizing sales and/or purchasing;

- optimization of management processes of interaction with suppliers and/or buyers;

- the maximum possible coverage of the market (territories) by business through the development of a network of partner agents.

And as a nice “side effect”:

- a decrease in the agent’s revenue and, as a consequence, the possibility of applying a special tax regime.

The widespread and apparent simplicity of the agency agreement through the mediation of “tax copperfields” and the disregard for the obvious taboo - concluding a transaction solely for the purpose of tax savings - leads taxpayers into a tax dispute.

According to the Federal Tax Service (See Letter of the Federal Tax Service of the Russian Federation dated July 13, 2021 No. ED-4-2 / [email protected] “On sending methodological recommendations for establishing, during tax and procedural audits, circumstances indicating intent in the actions of officials taxpayer aimed at non-payment of taxes (fees)."), the artificiality of the agency agreement is evidenced by:

- facts of transfer of funds by the commission agent who accepted the goods for sale before the actual sale of the goods (the agent acts at the expense of the principal and cannot finance it);

- inclusion in the contract of the agent’s obligation to pay for the goods no later than a certain date or a condition on the transfer of payment for the goods in installments, regardless of its sale. The agent cannot be sure when he will sell the goods, so he cannot take on the risks of the principal and transfer his funds to him. Such conditions are typical for a supply agreement, but not an agency agreement;

- lack of agent reports or their non-compliance with the requirements of the law and/or the terms of the contract;

- the use of agency agreements in the actual absence of the agent or principal of labor, material and other resources for the actual execution of the agreement, that is, the absence of any real financial and economic activity of one of the parties to the agreement.

The traditional tax scheme for unfair use of a structure looks simplified like this:

The principal on the simplified tax system sells goods through an agent controlled by him on the simplified tax system, thus withdrawing part of the profit received in the form of payment of agency fees at a lower tax rate.

However, a cross-sectional analysis of court cases again revealed several unexpected findings:

Firstly, the taxpayer himself is increasingly acting as a pseudo-agent. Most likely, out of a desire to control the entire “incoming” revenue flow (sales agent) or key relationships with suppliers (if he is a purchasing agent).

Second, the vast majority of cases involve the use of the much-publicized “reverse agent” model.

To bring a little clarity to the minds of domestic entrepreneurs, we will cite several situations that were lost in court, noting what served as evidence of artificial fragmentation:

1. A wholesale company for OSN (taxpayer) supplied products to municipal kindergartens for two and a half years. Since the buyers, due to their status, did not need input VAT, the taxpayer signed agency agreements with two controlled companies using the simplified tax system and re-signed contracts with kindergartens for them. Now they supply products to municipalities, and the Wholesale Company only purchases these products from its suppliers. Here he is a “reverse agent” - a taxpayer. The savings are obvious: the entire final delivery is now free of VAT. This tax arises only from the remuneration of a newly minted agent, and the main income is taxed at the simplified rate.

The tax authority, of course, did not appreciate such creativity

(Resolution of the Volga District Court dated 10/04/2018 in case No. A12-34781/2017)

Evidence of the scheme was:

- registration of principals at the taxpayer's address;

- historical interdependence by participants and leaders;

- presence of part-time workers for the agent and principals;

- testimony of the actual delivery of products by the same persons, by the same vehicles, on behalf of all companies

- Most of the principals' revenue eventually "settled" with the agent in the form of transfers for the purchase of goods.

2. In addition to her own sales of products, the individual entrepreneur on the simplified tax system also acted as a purchasing agent for several individual entrepreneurs on the simplified tax system, including her spouse. Similarly, in this situation, revenue from final sales through controlled entities was subject to taxation at the lower rate of the principals. The tax authorities established that the principals issued powers of attorney to the taxpayer to represent their interests in the bank, as well as a single IP address from which the bank accounts of all entities were managed. In addition, one of the principals directly stated that he receives 5,000 rubles for registering an individual entrepreneur. per month from a “pseudo-agent”. (Resolution of the Volga District Court of the Volga District dated January 24, 2019 in case No. A12-1656/2018)

3. The taxpayer company manufactured and sold canned meat and fish using the simplified tax system. However, over a long period of time, it did all this not in its own interests, but as an agent of a number of companies. The agent's functions included: purchasing raw materials, manufacturing products and shipping them to end customers. Moreover, even the trademarks of the products sold were also registered to the agent. The tax office identified the classic signs of one-day companies among the principals (founding a person in 596 organizations, exclusion from the Unified State Register of Legal Entities as an inactive person, termination of activities by merger, signing by an unidentified person, etc.) and imputed to the agent all the group’s revenue (Resolution of the AS of the North-Western District dated 02/06/2019 in case No. A21-8557/2017).

More “classic” examples of unreasonable use of an agent identified by the tax authority:

4. The purchase of household goods was carried out on behalf of three companies, which then shipped products wholesale through Agent LLC on the simplified tax system, and at retail through the supply of individual entrepreneurs on the simplified tax system and UTII.

The tax authorities blamed all the activities of one of the purchasing companies, proving:

- interdependence of all subjects;

- purchasing goods from the same suppliers and selling them through one agent;

- coincidence of the legal addresses of the group entities with the actual address of the taxpayer’s activities;

- migration of employees between group companies;

- matching phone numbers and email addresses;

- unified management of current accounts;

- the presence of outstanding accounts payable in a significant amount to the agent, which he did not even try to collect, which “is not typical for organizations that conduct independent business activities and do not influence each other’s business decisions,” etc.

In general, the lack of financial discipline is one of the frequent signs of the artificiality of relations in a group when implementing any contractual structures.

5. An individual sales commission agent who is interdependent with the taxpayer (again, one of the beneficiaries of the business, since there is no trust in third-party agents, and it’s safer in the moment, the owners think) delays the transfer of proceeds to a number of principals so that they do not exceed the limits under the simplified tax system (Resolution of the AS Zapadno- Siberian District dated 03/06/2018 in case No. A46-16687/2016). Which again is not typical for normal economic relations.

It is interesting that in the vast majority of court cases, the use of an agency agreement has some grotesque features. Whatever the case, it’s a situation taken to the point of absurdity. The court and the tax office don’t even remember about the proper preparation of reports, etc. It is not necessary. There are already enough signs of a “scheme”. However, at the same time, this inspires confidence that cases of reasonable application of the design are absent in judicial practice because in reality they do not raise any special questions. Only extravagant sales reach the courts:

6. The LLC owner of real estate on the simplified tax system leased part of its assets to an interdependent company, while concluding an agency agreement with it to represent its interests with third-party subtenants. I looked for these subtenants, collected rental payments from them into my accounts, etc. Obviously, there is no business purpose in such relations, other than to actually divide the proceeds between several persons according to the simplified tax system.

7. Two LLCs were engaged in the sale of furniture. (Resolution of the Arbitration Court of the Volga District of February 4, 2021 in case No. A12-13680/2019) The explanation for the emergence of the second company was its specialization in the trade of outdated models. According to the idea, LLC-1 sold LLC-2 obsolete or discounted furniture. Companies had to differ both in product range and customer categories, as well as in territory. This idea might work.

However, as a result, LLC-1 began to transfer LLC-2 and current models for sale under a commission agreement. This seriously shook the “legend” of building a group of companies.

The situation was aggravated by: interdependence (one founder and director, lack of real relationships between companies, common management, etc.), identical assortment and pricing policy, common territory of stores. There were also serious complaints about the commission agreement:

- the goods were received by the commission agent not from the consignor, but directly from the manufacturer;

- lack of an agreed upon selling price for consignment goods or the procedure for determining it;

- The commission agent did not transfer the proceeds to the principal for more than a year.

In fact, all claims against the taxpayer come down to the lack of autonomy (independence from him) and self-sufficiency among his counterparties (they can work without him), as well as the absence of a business purpose for the relationship (the presence of any other purpose of the transaction than obtaining tax savings). These are the cornerstones in protecting against any artificial crushing claims. And if they exist, then there is interdependence, intersection with third-party contractors, unified management, etc. not so scary anymore:

The individual entrepreneur transferred the fuel and lubricants for sale to the company, in which he had a 19% share. There was a coincidence of telephone numbers and addresses of contact persons, accounting services were carried out by the same person, and the agent’s remuneration was 1.5-2 times different from the cost of services to other persons. However, the courts supported the taxpayer-agent, to whom the tax authority tried to impute all the proceeds of the principal. The defense arguments were: the presence of third-party independent principals from the taxpayer. Independent purchase of fuel and lubricants by the principal from persons with whom the taxpayer has never had economic relations. (Resolution of the Arbitration Court of the Ural District of November 21, 2021 in case No. A76-34350/2017)

If we take a closer look at the latest statistics , the overall picture looks like this:

- for 3 years, an agency agreement was found in every 10 cases of artificial fragmentation;

- The risk level of applying this agreement is high (84% of cases are won by the Federal Tax Service, which is almost 10% higher than the average - 75%).

At the same time, the riskiness of a “reverse” agency agreement is even higher - 88%.

If you look at the data for years separately, you will find the following trend .

For the entire 2021, groups of companies with agency schemes were encountered more often - 12% of cases. Where the agent was involved in implementation (in half of the cases), the risk level was significantly below average - only 69% of lost cases (while the average for the year was 79%). But when using the “reverse” agent scheme, the riskiness went off scale - 100%. Not a single group of companies was saved from additional charges.

In 2021, the number of claims against the agency agreement decreased by almost 2 times - to 7% of cases that reached cassation. All cases concerned sales agents. Taxpayers with “reverse” agents, apparently, began to soberly assess their chances of winning by the third instance. But cases involving “ordinary” agents now clearly indicate an increase in the efficiency of the work of tax inspectors and a growing accusatory bias in arbitration courts.

But don't panic. The designated “riskiness” of a contract does not mean the impossibility of its application. The issue is not the contract, but the stupidity and inappropriateness of its use. Firstly, without taking into account the real organizational structure of the business and existing processes, and, secondly, without a separate study of the nuances of ownership of group entities. It is also necessary to clearly define the rights and obligations of the parties to such an agreement and monitor the procedure for its execution. The price of the issue can be significant: 35 million rubles is the average amount of additional charges for groups of companies that used agency agreements in 2021.

When working under the agency model, you must also remember:

- compliance with financial discipline between counterparties: absence of outstanding debts, advances of the principal, unusual forms of payment;

- careful preparation of primary documentation that mediates the relationship (agent’s reports, re-issuance of invoices, etc.);

- economic feasibility and good faith in the relations between the parties: the minimum remuneration of the purchasing agent can be explained by his reciprocal benefit in accumulating additional volumes of supply at a lower price, and the maximum remuneration of the sales agent by ensuring the stable sale of additional volumes of the principal’s products, etc.

Responsibility

The sales agent monitors the fulfillment of the obligations of the parties - the supplier and the buyer. This means that his tasks also include collecting payments.

For example, the goods have been delivered, but the client says that payment can only be made in the evening. The sales agent waits for the allotted time and goes to collect the money.

Thus, his day can end at 6, 8, or even 10 pm. It should be remembered that a sales agent is a financially responsible person.

Expert opinion

Volkov Viktor Vladimirovich

Lawyer with 8 years of experience. Specialization: civil law. More than 3 years of experience in developing legal documentation.

This is mentioned in the contract that he concludes with the employer. The specialist bears property liability for shortages, unpaid deliveries on time, etc.

Strengths of a specialist

The following qualities are important in the work of sales agents:

- Cheerfulness. Specialists, as a rule, perfectly understand the essence of their activities. A positive outlook helps them communicate effectively with clients. In those phenomena where others see only problems, experts notice advantages. This helps to quickly search and find solutions to various problems.

- Energy. This quality is of particular importance for a sales agent. Specialists can take on complex tasks and, by solving them, inspire others. Sales agents can work long hours and very intensely. This distinguishes them from specialists in other fields.

- Non-conflict and stress resistance. The job of a sales agent involves communicating with people. Clients are not always in a good mood. This must be taken into account when building interaction.

- Logical thinking. The ability to analyze a situation and draw the right conclusions allows you to make the right decisions and find an individual approach to different clients. This, in turn, ensures success.

pros

Accounting entries and taxation system

It should be noted right away that principal accountants do not like agency agreements. So many “troubles” and “fussing” with cash transactions that come from several agents are no longer in accounting.

Moreover, this is aggravated by the fact that the responsible person is authorized to carry out training work among unexpectedly materialized beginning entrepreneurs who know what a current account is, but do not understand how to conduct and reflect in their primary documentation the interest on transactions and the amounts intended for transfer.

Not every accountant agrees to become a teacher. The manager can either persuade his accountant or reward him with an additional bonus.

Postings of the agent when selling the principal's goods

| Debit | Credit | |

| 004 | ||

| 50 (51) | 62 | |

| 62 | 76 Sat. | |

| Next, you need to write off the principal’s goods from the off-balance sheet account | ||

| 004 | ||

| 76 | 51 | |

| 76 Sat. | 76 | |

| 76 Sat. | 90 | |

| 90 | 68 | |

| 76 Sat. | 51 | |

Principal postings

| Debit | Credit |

| 45 | 41 |

| 62 | 90 |

| 90 | 68 |

| 90 | 45 |

| 44 | 76 Sat. |

| 19 | 76 Sat. |

| 76 Sat. | 62 |

| 68 | 19 |

| 51 | 76 Sat. |

Note: Account 76, “Settlements with various debtors and creditors,” is used for the subaccount “Settlements with the principal” and, accordingly, “Settlements with the agent.” If the principal has several intermediaries, then they are held in different subaccounts of the 76th account.