Transferring money to an employee's card against a report is much more convenient compared to cash payments: there is no need to prepare cash documents or go to the bank to withdraw cash. However, as practice shows, these conveniences are canceled out by writing off the money received to pay off the employee’s debts (for example, loans), or blocking the employee’s card.

AUDIT AND ACCOUNTING SERVICES

The company can transfer the accountable money to the employee’s salary or personal bank card.

The list of accountable expenses includes entertainment, travel expenses, expenses for administrative and business needs (purchase of office supplies, household equipment, maintenance of office equipment and similar expenses). The basis for payment of the accountable amount is an order (instruction, decision) signed by the head of the company. There is no need for the employee to fill out an application for the release of funds against the report.

At the same time, the issuance (transfer to a bank card) of accountable amounts can be carried out even if the accountable person has a debt.

The legislation does not establish a specific period during which the employee must report on the accountable amounts spent. According to clause 6.3 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, the employee is obliged to provide the accounting department with a report on the amounts received no later than three working days after the expiration of the period for which these amounts were issued. If the company does not have such an order, we can assume that the deadline for issuing accountable amounts has not been established, which means that settlements on accountable amounts must be made within one business day (Letter of the Federal Tax Service of the Russian Federation dated January 24, 2005 No. 04-1-02/ 704).

Funds issued on account to employees can be transferred to employees’ bank cards to carry out transactions related to:

- with payment of expenses of organizations for the supply of goods, performance of work, provision of services;

- with travel expenses;

- with compensation to employees for documented expenses (Letter of the Ministry of Finance of the Russian Federation dated July 21, 2017 No. 09-01-07/46781).

As a rule, accountable money is transferred to the bank card to which the company transfers the employee’s salary.

To transfer accountable money to an employee’s bank card, the company issues an order, a sample of which is given below:

JSC "Lutik"

ORDER No. 2/1 on the transfer of accountable amounts to the employee’s bank card

January 9, 2021 Moscow

For the purpose of purchasing household goods

I ORDER:

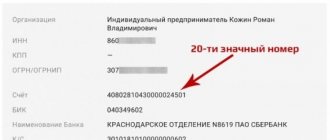

1. Transfer to the bank card of employee T.E. Tsvetochkin. 50,000 (fifty thousand) rubles for the purchase of household goods using the following details:

card number 845044442000008882, account number 40817425550000567044 in Bank PJSC OTP, bank BIC 044573474.

2. Appoint the head of the financial department P.G. as responsible for the execution of the order. Romashkin.

General Director D.I. Lyutikov

As financiers note, “...taking into account the provisions of Article 8 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, when transferring funds to the personal bank cards of employees to pay for business needs (goods, materials) in the regulatory act ", defining the accounting policy of the organization, it is necessary to provide provisions defining the procedure for settlements with accountable persons (Letter of the Ministry of Finance of the Russian Federation dated August 25, 2014 No. 03-11-11/42288)."

TAX LAWYER CONSULTATION

In the Accounting Policy, you can make a reference to the Regulations on Settlements with Accountable Persons approved by the company.

A fragment of the Regulation is presented below:

| Appendix No. 1 to Order No. 48 dated 01.01.2019 REGULATIONS on settlements with accountable persons This Regulation has been developed in accordance with: — with the Decree of the Central Bank of the Russian Federation “On the procedure for conducting cash transactions” dated March 11, 2014 No. 3210-U; — Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ; — Order of the Ministry of Finance of Russia “On approval of the Chart of Accounts” dated October 31, 2000 No. 94n; — Labor Code of the Russian Federation. The purpose of the Regulations is to ensure the correctness of accounting and control in settlements with accountable persons of Buttercup JSC. The procedure for issuing funds for reporting Funds under the report are transferred either for business and operating expenses or for expenses associated with business trips. The list of employees who have the right to receive funds on account is established by the Company Order. Funds are transferred on account regardless of whether the accountable person is indebted for previous accountable amounts. Individuals who have signed a civil contract with JSC Buttercup to perform work or provide services during the validity period of this agreement also have the right to receive funds on account from the cash desk of JSC Buttercup. Basis for issuing funds on account Funds for the report are transferred on the basis of an order from Buttercup JSC, signed by the manager. The administrative and economic department is responsible for preparing the order. The order must contain the following information: -date of; - last name, first name and patronymic (full name) of the accountable person; - advance amount; - the period for which the advance is transferred; -signature of the manager or authorized person by power of attorney. Methods for issuing accountable amounts The report is issued to the employee by non-cash transfer from the current account of Buttercup JSC to the employee’s salary card (Letter of the Ministry of Finance of the Russian Federation dated July 21, 2017 No. 09-01-07/46781). HR SERVICES |

Payment by employee’s bank card for organization

If an employee paid with his card, he has the right to count on compensation for expenses if the expenses were agreed upon by the manager and the employee has all the supporting documents confirming the expenses. The law does not prohibit the use of a personal bank card by an employee to make payments on behalf of the company. Since, if an employee pays for goods and services at his own expense without first receiving funds to make the payment against a cash register report, then it doesn’t matter whether he did it in cash or using a bank card. In this case, a bank card only means that the payment was made by bank transfer, but also from the employee and in the interests of the company. An advance report is not issued because the employee did not receive the money in advance. If an employee who did not receive funds on the report paid for the goods with his credit card, how to report to the financial department? The employee submits to the accounting department an application for reimbursement of the funds spent and attaches all documents confirming these expenses to document the expenses. In the application, the employee has the right to indicate how he wishes to receive reimbursement for expenses incurred: to a bank card belonging to the employee, or in cash at the cash desk. If this is an option with funds credited to the employee’s personal or salary bank card, then the employee indicates the details of his bank card in the application.

How to close accountable funds?

Let's consider a classic case. Funds were withdrawn from the organization's current account under the director's report.

Withdrawing funds on a report is one of the easiest and most ancient ways to cash out. But it's dangerous. During an on-site tax audit, these amounts may be subject to personal income tax (NDFL) and insurance premiums. Therefore, the mandatory conditions for using accountable funds are:

- return of unspent funds to the organization’s cash desk and bank;

- mandatory documentary evidence of expenses incurred - in the form of a universal transfer document (UDD), delivery note, sales receipt and online cash register receipt.

Payment by bank card of a person who is not an employee of the company

The law also allows for the option when an employee makes a payment for a product or service using the card of a person who does not work for the organization. In this case, the employee’s application for reimbursement of expenses is accompanied by a notice from the person in whose name the card from which the payment was made was issued. In this notice, the cardholder explains that he did not object to payment for the goods or services with his card. If the payment was made from the bank card of a spouse working at the company of the employee who made the payment, an application confirming consent will not be required.

Cash in organization

All funds received are the property of the legal entity. This applies to both cash and bank accounts. The use of money must be justified. Therefore, cash withdrawals must be justified.

Spending of funds received from the account must be justified. Violation of this rule may result in fines. Cash discipline inspection is carried out by decision of the Federal Tax Service; the control period is limited to 2 months. The type of liability in case of detection of violations by the company is administrative. But if the mistake was actually made more than 2 months before the inspection, there will be no fines. But there will still be reason for closer attention in relation to the taxpayer.

Cash on hand

Payment of expenses by bank card. Advance report

If an employee received funds on account at the enterprise’s cash desk, but paid for services or goods, acting in the interests of the company and in agreement with the organization’s management, then this is also not prohibited by law. In this case, the tax authorities will require the presentation of an advance report for the amount issued and supporting checks, forms, and receipts. Another option permitted by law is for the company accountant to deposit the accountable amount onto the employee’s bank card, with which the employee pays, for example, fuel and lubricant expenses. If an employee pays with a credit card rather than a debit card, then this does not change the algorithm of actions for payment and collection of documentation either on the part of the employee or from the position of the company, and it is also allowed by law. Tax authorities also do not object to an employee making payments for an organization with his credit card, that is, you can pay for the goods with the employee’s credit card. If the funds for the report were issued in the accounting department to one employee, and the payment was made with the bank card of another employee of the same company, then the employee who received the amount for the report provides an advance report to the financial department. Payment by a bank card of another employee is reflected in a statement attached to the advance report of the accountable person, which indicates that the payment was made with the consent of the card owner. It is also recommended that such advance report be accompanied by a receipt from the card owner stating that he received compensation for expenses on his bank card from the accountable person in full.

Income code in the payment slip for the issuance of accountable funds

The obligation for employers to enter payment purpose codes when making transfers to employees began on June 1, 2021. This norm is enshrined in the amendments to the law on enforcement proceedings No. 229-FZ dated 10/02/2007 and in the letter of the Bank of Russia No. 45-1-2-OE/8224 dated 06/08/2020. We will figure out which code to indicate in the payment order when transferring accountable amounts in 2021 according to the new rules.

The Central Bank issued instruction No. 5286-U dated October 14, 2019, which explains the new rules for filling out bank documents for transfers to individuals. The Bank provides for the use of three values.

| Meaning | When to use |

| 1 | It is placed on payment slips when transferring payments to an employee that are recognized as income. There is a limitation on collection on these amounts. These include wages, bonuses, additional payments, payments under GPC agreements, severance pay, and so on. The full list is given in the Central Bank instruction No. 5286-U dated 10/14/19. |

| 2 | Used in payments for payments to which debt collections are not applied. Their list is in Article 101 of Federal Law-229 dated 10/02/07. Such payments include payment of travel expenses, various employee compensation, alimony, and maternity benefits. |

| 3 | Indicated for compensation for damage to health. Also when transferring compensation to victims of man-made accidents. Adjustable pp. 1 and 4 tbsp. 101 FZ-229 dated 10/02/07. |

Often there is a situation when it is necessary to make a payment when transferring funds according to an advance report to an employee or to issue an advance for upcoming expenses, for example, for the purchase of material assets, payment for services on behalf of the company (communications, notary, delivery, etc.). There is no clear answer to the question of whether it is necessary to fill in a payment purpose code when making a transfer for reporting to an employee; there are two opposing points of view:

- According to the Central Bank, such payments are not the employee’s income and the income code for accountable amounts does not need to be indicated in the payment slip. The argument in favor of this position is that such receipts are not recognized as the employee’s income and they are not specified in the law on enforcement proceedings.

- There is another expert opinion, according to which it is safer to indicate this value and it is similar to the travel income code in the payment order, that is, 2. This value is entered in field 20 “Name. pl."

ConsultantPlus experts examined the latest changes in working with accountants. Use these instructions free of charge to check and correct your work and documentation.

to read.

An employee paid for services using his bank card: how to report

Using, for example, a rental car or ordering the transportation of furniture from an office to a warehouse, and acting in the interests of the company, the employee paid for the services with his credit card, how to report to the accounting department in order to receive a refund? The service is no different in terms of the reimbursement algorithm in this case from the product. The employee only needs to submit an application for reimbursement of expenses to the financial department or accounting department and attach to it all checks and receipts confirming payments. The requirement for providing a report on spent funds is the timeliness of reporting. The law defines a period of three days after the employee makes a payment or arrives from a business trip and returns to work. If the deadline for submitting supporting documentation to the organization's accounting department is violated, the expenses are recognized by the manager as unfounded, and the employee will be denied reimbursement of expenses, and if the amount was issued earlier for reporting, it will be deducted from the employee's salary. Tax and accounting services do not differ from product accounting.

Fill out a payment order for reporting

Step-by-step instructions for filling out a payment order are clearly presented in the article “Sample of filling out a payment order in 2021.” Let's look at how to fill out a payment slip in a sub-report using a specific example.

Secretary of State Budgetary Educational Establishment of Children's and Youth Children's Institution "ALLUR" Pechatina I.A. wrote an application for the issuance of accountable money for the purchase of office supplies (5000.0 rubles) and payment for Internet services (1500.0 rubles). Based on the manager’s order, the accountant drew up payment orders.

Please note that when generating a payment in a public sector institution, the procedure for filling out field 24 “Purpose of payment” is somewhat different from the generally accepted rules. That is, state employees are required to indicate the budget classification expense code in the field.

How to take into account payment from a card in tax accounting

The money that the accountant transfers to employees’ subaccount cards or to a corporate card remains the company’s money. Upon receipt of supporting documentation confirming the legality of accounting for such expenses, the accountant takes into account the costs to reduce the tax base. In this case, personal income tax is not charged, since the employee does not receive economic benefits; such amounts, when credited to the employee’s card, are represented as the employee’s debt to the company. After submitting checks, forms, receipts confirming expenses in favor of the company, the expenses are distributed among the company's expenses by the accountant in accordance with the expense item. If the employee has not provided the necessary evidence that the money was spent in the interests of the company, the accountable amount is deducted by the accountant from the employee’s salary, subject to personal income tax of 13 percent. Since such amounts are accepted as the economic benefit of the employee. For example, with the company’s accepted practice of paying employees for mobile communications at the company’s expense, the employee topped up the connection from his bank card (accounting entries reflect expenses for the company’s needs and reimbursement of expenses to the employee). The accountant considers such payments as company expenses. If an employee tops up his personal phone account, and the company policy does not provide for compensation for mobile communications, then these expenses will not be taken into account as company expenses.

Four possible options for closing the accountable amount:

Option 1. Using sales receipts, cash register receipts and online cash register receipts

There are still many operating individual entrepreneurs on the patent tax system, from whom you can ask for a sales receipt or even a cash receipt if an online cash register is used. This will not affect the taxes of entrepreneurs on a patent. The annual revenue limit for such entrepreneurs is RUB 60,000,000.

Many businessmen are savvy, because online cash registers are used both in the simplified taxation system and in the general one. I recommend reading the articles - about online cash register receipts, part 1 and online cash register receipts, part 2

From the life hacks used today, I note that entrepreneurs who use the PSN, simplified tax system, unified agricultural tax and UTII, and at the same time do not trade in excisable goods, may not indicate on the cash receipt and strict reporting form the names of the goods (work, services) and their quantity until February 1 2021 (Letter of the Ministry of Finance 03-01-15/37032 dated 07/14/17).

Option 2. Draw up an interest-bearing loan agreement

You can, for example, draw up a loan agreement. This option is only suitable for organizations . This operation will allow you to close the debt on accountable amounts of the head of the company. An interest-bearing loan must be issued (the interest rate is specified in the contract). The director must sometimes return this loan to the organization and pay accrued interest.

With an interest-free loan, there is a material benefit in the form of savings on interest. And this is subject to personal income tax at an increased rate - 35%. To avoid financial gain, you will need to set interest on the loan. In this case, the company will have taxable income.

Option 3. Purchasing equipment from the manager

An organization can buy from the director some equipment that is actually used and is already in your business. For example, this could be furniture, computers or office equipment - not listed on the organization’s balance sheet. In other words, you are buying some equipment from an individual that you actually have. The price accordingly must be market price in order to avoid additional attention from the tax authority for this transaction. After all, this operation can be classified as a transaction between related parties.

Clarifications from the Bank of Russia

The issuance of advances to employees in connection with a business trip or transfer to another job in another locality, as well as in other cases - for expenses associated with the activities of the employer - is provided for by the Labor Code of the Russian Federation (paragraph 4 of article 137).

The specifics of sending employees on business trips are established by the Regulations approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749. Paragraph 10 of these Regulations states: when sent on a business trip, an employee is given a cash advance to pay expenses for travel and rental accommodation and daily allowances.

Is it possible to issue such advances in non-cash form - by transferring to the employee’s bank card? Labor legislation does not provide an answer.

One thing is unclear - why the ministry insists that transfers be made to employee cards issued as part of “salary” projects...

Meanwhile, cash can be issued not only by a cashier (clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014), but also by an ATM (clause 1.3 of the Regulations on the issuance of payment cards and on transactions performed with their use, approved by the Bank Russia 12/24/2004 No. 266-P). In addition, an employee can use not only cash, but also his bank card to pay for goods (work, services, results of intellectual activity) (clause 2.3 of Regulation No. 266-P).

Explaining the application of Regulation No. 266-P, the Bank of Russia, in letter No. 14-27/513 dated December 24, 2008, reported: the question of the admissibility of reimbursement of expenses associated with business trips by transferring them to the bank accounts of employees - individuals opened for transactions with the use of bank cards is within the scope of the application of labor legislation. It does not fall within the competence of the Bank of Russia. Subsequently, this position was supported by the Russian Ministry of Finance - in letter dated December 29, 2011 No. 14-01-07/1396-1966. But it can be extended to any advances issued to employees on account.

Unfortunately, the commented letter does not contain a link to the mentioned clarification of the Bank of Russia. But the Russian Ministry of Finance is not authorized to give explanations related to the sphere of labor or monetary circulation.