The deadline for submitting an advance report by an accountable person will change from November 30, 2020. Before this date, they were strictly stipulated by law and tied to the last day of the time period for which money is issued on account. A correctly compiled, verified and approved report serves as the basis for accepting the costs incurred by the accountant and generating accounting entries. What and how an accountant should check in order to prevent errors in accounting and what innovations have affected expense reports, you will learn from this article.

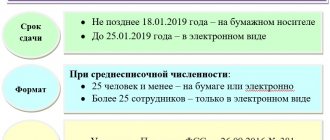

Deadlines for submitting an advance report to the accounting department by the accountable person

One of the innovations in the procedure for conducting cash transactions is that from November 30, 2020, the 3-day period for an advance report by an accountable person was canceled.

Let us recall that for the funds received for expenses necessary for the economic activities of the enterprise or individual entrepreneur, the employee - the accountable person had to report in accordance with clause 6.3. instructions “On the procedure for conducting cash transactions...” dated March 11, 2014 No. 3210-U within 3 working days:

- after the end of the period for which the funds were received;

- after returning to work, if the period expired during his excused absence - illness, vacation, etc.

Also, in accordance with paragraph 26 of the resolution “On the peculiarities of sending employees on business trips” dated October 13, 2008 No. 749, it was necessary to report to the accounting department within 3 days after arriving from a business trip.

But as of November 30, 2020, by order of the Bank of Russia dated October 5, 2020 No. 5587-U, this requirement was changed. Now the organization has the right to independently set the period for which funds are issued for reporting.

By signing the application, the employer approves the amount to be accounted for and the deadline for submitting the advance report.

In the application, it is advisable for the employee to indicate the purpose for which the money is needed. This will make it easier for the manager to decide on the deadline, and for the accountant to make the appropriate entries.

In order for the employee to reasonably indicate in his application the period for which he will need funds, it is recommended to develop an internal document that will define the deadlines for the typical needs of the company. From November 30, 2020, money on account can be issued to several individuals under one administrative document. This document must also indicate the amount and period for which it is issued to the employee.

Who fills out the advance report in 2021

In the advance report, the accountable person reflects how and for what purposes the advance received was spent. The obligation to report on Form 0504505 arises for an employee who has received money from the employer for the following expenses:

- travel allowances including daily allowance;

- representative;

- procurement of goods, works or services;

- settlements with counterparties;

- and other targeted expenses from advances issued.

The expense report is double-sided - that is, it is printed on one sheet on both sides. The reporting person and the accountant can fill out the form together, but often accountants prefer to prepare the documents themselves - this is acceptable.

Checking advance reports of accountable persons

In order to report for funds received and spent, the accountant needs to draw up an advance report and attach to it documents that will serve as the basis for accepting the expenses incurred - checks, BSO, invoices, travel tickets, slips (for payments by bank card), etc. .

If the advance was issued by transfer to the employee’s salary or accountable card, then the payment order must indicate that the money transferred is accountable. To receive accountable amounts on a bank card, the employee is recommended to write an application requesting the issuance of money for a certain time and indicating the card details - this is stated in the letter of the Ministry of Finance dated August 25, 2014 No. 03-11-11/42288. In the same letter, officials report that it is advisable to develop and consolidate the procedure for issuing an advance for household needs by non-cash means and drawing up an advance report and establishing it in the accounting policy of the enterprise.

The form for the advance report can be form AO-1, approved by the State Statistics Committee of Russia dated August 1, 2001 No. 55. It is not mandatory, therefore it is allowed to develop your own report form for the advance received, taking into account the specifics of the enterprise and compliance with all the requirements for filling out the necessary details in accordance with paragraph. 2 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

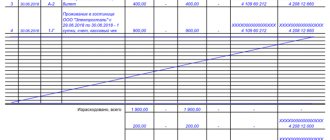

The report form must have space reserved for completion by the employee and the accountant. The document has a front and back side. First, the employee fills out the part intended for him on the front side, in which he indicates information about himself and the purpose of the advance received. Then, on the reverse side, he lists all supporting documents indicating their names, numbers, dates, amounts (for each separately). The total is calculated and indicated. Documents are attached to the report. For ease of use, they can be numbered in accordance with the serial number assigned in the expense report.

The employee passes the completed form with attached originals about expenses to the accountant, who checks the received document:

- according to the form - the correctness of filling out all the necessary lines, the presence of the specified documents, the usefulness of their execution, the correct transfer of data from the originals to the report, the correspondence of the amounts, the presence of signatures;

- in terms of content - the intended purpose of the expenses incurred, the reliability of the documents, the correspondence of the specified dates to the time for which the advance was issued;

- by arithmetic calculation - the total amount in the report is checked, which must be repaid in this sub-report.

After receiving the advance report from the accountant, the accountant must give him a receipt stating that he accepted the report with the attached documents for verification.

The report, verified and signed by the accountant and chief accountant, is submitted to the manager or authorized person for approval. By signing, the director agrees to consider the costs incurred to be justified.

The deadline for submitting the advance report to the accounting department for verification and approval of the report for the advance for the needs of business activities is established by the manager at his discretion. It is recommended to consolidate them in the accounting policies. Based on the approved report in the accounting department, accountable amounts are written off in accordance with the procedure established by law.

How to fill out form 0504505

Before filling out the report, familiarize yourself with the rules that the tax office controls compliance with when checking the report:

- The report must be issued by a company employee on an employment or civil contract. Money cannot be given to other persons on account.

- The manager must approve the expense report. Expenses are recognized on the date on which the report is approved. If the manager or his authorized employee does not approve the document, the accepted expenses may be challenged.

- The employee attaches documents confirming expenses to the advance report: travel tickets, checks, receipts, etc. They are numbered in the order they are recorded in the report.

- The documents must indicate the name of the product. If only the amount is indicated on the receipt, then the employee must ask for a sales receipt. Otherwise, it will not be possible to determine the purpose of the expense and justify it.

- The documents must indicate the dates of the expenses, otherwise the period of their occurrence cannot be confirmed. Accordingly, it will not be possible to take these expenses into account for income tax purposes.

Accountable person's advance report approved: posting

If, according to the advance report, more than the advance received has been spent, the employee is given an overspend. If not all accountable money has been spent, the remainder must be returned to the enterprise's cash desk (the accountant will issue a receipt order for it, the counterfoil will be given to the accountant).

An employee can also spend personal money to purchase something necessary for the company, for example, fuel and lubricants for a company car. In this case, a report is first submitted, and then the funds are reimbursed. Such an action must also be permitted by internal regulations.

If the accountable person does not meet the deadline established by the enterprise for submitting the advance report and does not return the balance of the accountable amounts, the employer has the right to reimburse the debt from his salary (Article 137 of the Labor Code of the Russian Federation).

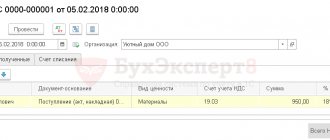

At the time of checking the advance report, the money issued is reflected in Dt 71 “Settlements with accountable persons”. After approval by his manager, the accountant needs to make entries according to Kt 71 in correspondence with the accounts of expenses incurred:

| Debit | Credit | Contents of operation |

| 71 | 50, 51 | Accountable money issued |

| 20 (23, 25, 26, 29, 44) | 71 | Expenses reflected in the advance report |

| 08, 10, 41 | 71 | Reflects the costs of purchasing fixed assets, materials, goods recorded in the advance report |

| 19 | 71 | VAT allocated according to the received invoice |

| 68 | 19 | VAT credited |

| 60 | 71 | Payment made to supplier |

| 50 | 71 | The balance of accountable amounts was handed over to the cashier |

| 70 | 71 | Debt withheld from wages |

| 71 | 50 | Overspending issued from cash register |

What changes affected the reporting in 2016-2017

In 2021, the main transformations in terms of accounting for accountable funds affected budgetary institutions. In connection with the adoption of amendments to the instruction on budget classification, approved by Order of the Ministry of Finance dated July 1, 2013 No. 65n, some KOSGU codes have changed, as a result of which the analytical accounts for accounting for accountable amounts have also changed.

For the procedure for accounting for accountable amounts in budgetary institutions, see the article “Settlements with accountable persons in budgetary institutions .

Also in 2021, amendments were made to the Tax Code of the Russian Federation. Now the date for personal income tax assessment of excess daily allowance paid is the last day of the month in which the employee submitted an advance report (subclause 6, clause 1, article 223 of the Tax Code of the Russian Federation). Previously, officials considered the date of receipt of income subject to taxation to be the moment of payment of excess funds to an employee (letter of the Ministry of Finance dated June 25, 2010 No. 03-04-06/6-135).

If excess daily allowances were paid in foreign currency, then they should be recalculated into rubles to determine income at the rate of the Central Bank of the Russian Federation valid on the last day of the month in which the advance report was approved (letter of the Ministry of Finance of the Russian Federation dated June 5, 2017 No. 03-04-06 /35510).

Let us recall that in tax accounting the daily allowance norms are approved by clause 3 of Art. 217 of the Tax Code of the Russian Federation and amount to 700 rubles. per day for business trips in Russia and 2,500 rubles. - for trips abroad. Amounts of daily allowance paid to employees in excess of the specified norms are subject to personal income tax and insurance contributions.

In 2021, 2 important changes were made to settlements with accountables, and more specifically, to clause 6.3 of the instructions of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U:

- Now, to issue funds, an employee’s application is not necessary - it is enough to issue an administrative document on behalf of the director of the enterprise or individual entrepreneur.

- Accountable amounts can be issued even if there are previously unreturned accountable funds.

The changes are based on the instructions of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U and came into force on August 19, 2017.

Otherwise, the procedure for settlements with accountants in 2021 remains the same. Let's look at it in more detail.

How long are advance reports of accountable persons kept?

After the expense report has been checked, approved, postings have been made on it and the remaining amounts have been closed (overspending has been issued or the balance has been received), the document is sent for storage. Organizations ensure the storage of documents within the periods established by federal laws and other regulatory legal acts (Clause 1, Article 17 of the Law “On Archiving in the Russian Federation” dated October 22, 2004 No. 125-FZ).

The storage periods for documents are given in several regulatory documents:

- According to sub. 1 clause 8 art. 23 of the Tax Code of the Russian Federation, documents related to accounting or tax accounting, on the basis of which the tax base for calculating taxes to the budget is formed, must be stored for 4 years. These documents also include advance reports.

- In accordance with paragraph 4 of Art. 283 of the Tax Code of the Russian Federation, documents confirming the loss incurred are stored for the entire period during which the resulting loss is carried forward to future periods and reduces the tax base of the current tax period.

- In Art. 29 of Law No. 402-FZ for primary accounting documentation, which includes, in particular, advance reports, a storage period established by the rules of state archiving is provided, but not less than 5 years.

- In paragraph 277 of the List of standard management archival documents indicating storage periods, approved. Rosarkhiv sets a storage period of 5 years for advance reports.

Thus, the minimum storage period for advance reports is 5 years, the maximum is determined by the duration of the transfer of the loss (if received) to the future.

Advance report form in 2021

The advance report in the unified form 0504505 has been put into effect since 2015 by Order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n (hereinafter referred to as Order No. 52n). This form of the primary document is required for all state and municipal institutions.

An institution may include additional data and details in form 0504505 if they contribute to a more complete reflection of information and comply with the requirements of regulatory documents (Appendix 5 to Order No. 52).

The advance report should be drawn up as an electronic document and certified with a qualified electronic signature. If it is not possible to generate and store electronic documents or a paper form is required, draw up a report on paper.

Results

A report for an advance received by an employee for expenses for the company's business is an important document for both accounting and tax accounting, since based on the documents attached to it and approved by the manager, the expenses incurred can be taken into account (or not taken into account) when forming tax base. Therefore, company employees must comply with the deadlines for submitting advance reports, which, from November 30, 2020, companies have the right to determine independently, and accounting employees must carefully approach the timely reflection of accountable amounts in accounting.

To whom can money be given on account?

The issuance of accountable amounts is possible only to employees of the enterprise. According to the norms of labor legislation, only that employee with whom the employer has concluded an employment contract is recognized as an employee (Article 15 of the Labor Code of the Russian Federation). However, clause 5 of Directive No. 3210-U also includes other individuals with whom the company has entered into civil law agreements (hereinafter referred to as the civil law agreements) in the concept of “employee”. Such explanations were given by the Central Bank of the Russian Federation in its letter dated October 2, 2014 No. 29-R-R-6/7859.

Thus, the accountable can be either a full-time employee of the enterprise or a contractor operating under a GPC agreement. However, a person who is not a full-time employee is not required to provide an advance report, and the customer does not have the opportunity to withhold the advance from his salary, as is the case with a full-time employee (Article 37 of the Labor Code of the Russian Federation). To avoid troubles with non-return of accountable amounts, when concluding a GPC agreement, appropriate penalties should be prescribed.

Is an application for issuance of a report required?

Until August 19, 2017, the application was a mandatory document on the basis of which funds were issued on account. The inspectors could consider the absence of such a statement a violation of cash regulations and impose a fine of up to 50 thousand rubles. (Article 15.1 of the Administrative Code). However, judges often decided that no penalties were provided for such violations (resolution of the 7th Arbitration Court of Appeal dated March 18, 2014 No. A03-14372/2013).

On June 19, 2017, the Central Bank of the Russian Federation issued instruction No. 4416-U, which came into force 2 months later. Currently, clause 6.3 of Directive No. 3210-U stipulates the following: an expense cash order is issued either on the basis of an administrative document of a legal entity/individual entrepreneur, or according to a written application of an accountable person, drawn up in any form and containing a record of the amount of cash and the period for which is issued in cash. In this case, the application is endorsed by the manager and indicates the date.

Thus, the company has an alternative: either the employee writes an application for reporting, and the manager signs it, thereby giving consent to the release of money from the cash register, or the manager himself issues an order, which the accountant reads under his signature.

NOTE! We recommend that you clearly inform the employee that he is receiving accountable amounts - either by receiving an application from the employee, or by reading the manager’s order on accountability. Otherwise, a situation is possible when, for example, when transferring a sub-account to a card, an employee will regard such a payment as income and spend it for other purposes.

You can download a sample director's order on accountable persons here.

The employee spent his money - is this accountable?

An application must also be obtained from the employee who spent his own funds on the needs of the company. However, it will have a slightly different wording since this case does not relate to reporting. Since the employer reimburses the employee’s expenses, the latter needs to write a statement requesting reimbursement of the funds spent. This application must be approved by the head of the company and also sign the corresponding order.

The procedure for reimbursing employees should be set out in the company’s local regulations. It must be accompanied by a sample of the corresponding report, which will confirm the expenses incurred by the employee.

IMPORTANT! In order to accept expenses reimbursed to an employee for tax accounting, you should carefully check the primary documents provided by him. Ideally, they should be registered to a company. If the primary document is registered in the name of an employee, inspectors may consider the actions of the employee and the enterprise to be a sales transaction and charge him additional personal income tax. But, according to the Ministry of Finance, such actions by tax officials are unlawful, since the employee does not receive economic benefits, which means there is no basis for taxation (letter of the Ministry of Finance dated 04/08/2010 No. 03-04-06/3-65).