- The government plans to give money to employers to pay salaries. Officials need to check that the company meets the conditions: retaining 90% of the staff.

- The Ministry of Labor needs statistics. It must assess how hard it is for employers and employees so that the government can determine the extent of assistance.

- Employment centers process unemployment benefits remotely. They wonder when the employee quit and whether he was hired again.

- The Pension Fund issues pensions and indexed payments to pensioners who have stopped working. Information about employees is needed now, not in six months.

As a result, employers will still have to submit reports: one new one, the other an old one, within the new deadlines. And some reports are in the old deadlines, without being postponed for 3 months.

Why is SZV-TD needed?

The new report is related to the transition to electronic work books (Draft No. 748684-7 of 07/08/2019).

From January 2021, the “Information on Labor Activities” section will appear in the individual personal account of every citizen who is registered in the pension insurance system. Employers will use SZV-TD reports to transmit this information about employees. Employees and employers will have access to information about the work activities of insured persons, which are included in the PFR information base thanks to SZV-TD.

Who to include in the new SZV-M

Form SZV-M is submitted to insured persons. To the insured persons, Article 7 of the Federal Law of December 15. 2001 No. 167-FZ refers to:

- citizens of the Russian Federation;

- foreign citizens or stateless persons permanently or temporarily residing in the Russian Federation;

- foreign citizens or stateless persons temporarily staying in the Russian Federation. The exception is highly qualified specialists.

In addition, it is listed that insured persons are if they work:

- under an employment contract, including heads of organizations who are the only participants (founders), members of organizations, owners of their property;

- under a civil contract for the performance of work and provision of services;

- under copyright agreements - author's order agreement, on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art.

Let's pay attention!

The SZV-M update will resolve some ambiguities regarding whether it needs to be applied to certain categories of persons. So, the question has always arisen: if neither an employment nor a civil contract has been concluded with the head of the company, then is it necessary to file reports against him.

A similar problem arose if the head of the company was also its sole founder. Therefore, it will now be necessary to include directors—the only founders—in the new SZV-M.

However, having resolved one dispute, in our opinion, the new form of SZV-M may lead to other disputes. This was facilitated by the reference wording, which was made in the Procedure for filling out the SZV-M, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p. For example, to disputes about whether this form needs to be submitted to an individual entrepreneur if the company has entered into a civil contract with him. After all, these persons are insured under compulsory health insurance in accordance with Article 7 of the Federal Law of December 15, 2001 No. 167-FZ.

Quote: insured persons are those who independently provide for themselves with work (individual entrepreneurs, lawyers, arbitration managers, notaries engaged in private practice, and other persons engaged in private practice and who are not individual entrepreneurs) (Article 7 of the Federal Law of December 15, 2001 No. 167-FZ).

Note that individual entrepreneurs are individuals who provide themselves with work and pay insurance premiums for themselves. Taking this into account, we can come to the conclusion that the individual entrepreneur is not an insured person for the organization and there is no need to submit a SZV-M for him. However, to clarify this issue, we recommend contacting the Pension Fund.

Form SZV-TD

The Pension Fund of Russia has prepared a form for a new report, but it has not yet been approved. When officials agree on the report with the Ministry of Labor, the form will be published in official sources.

The minimum information about the employer is included in the header of the report:

- registration number in the Pension Fund;

- name of organization or full name of entrepreneur:

- TIN and checkpoint.

After this, enter the reporting period code: from 1 to 12 in order of months - and the reporting year. Next is a table for information about employees.

A blank form takes up one page; a completed form will be longer, depending on the number of employees.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

What's the new report?

The monthly report is completely new, called “Information on Labor Activities.” It will need to indicate:

- name of the insured, information about his renaming, the basis for the renaming and data on the relevant document on the renaming;

- policyholder registration number;

- information about hiring, indicating (if any) the structural unit of the insured;

- name of the position (work), specialty, profession indicating qualifications (rank, class, category, skill level) (if any);

- information about transfers to another job;

- information about dismissal and grounds for termination of the employment contract;

- data of the order (instruction) of another decision or document of the policyholder, which is the basis for formalizing the labor relationship.

There is no form for the report yet, but its meaning is, in principle, clear. Officials need as much information as possible about seniority. These data are planned to be entered into the individual personal account of the insured person.

Procedure for filling out the report

Enter information about the employer in the title book - they are similar to the information in SZV-M, so there will be no difficulties. The same applies to the period code and reporting year.

Next, we enter information about employees into the table; there are 13 columns in the table.

- Sequence Number (Column 1): It does not matter in what order you list employees - alphabetical, chronological, or any other.

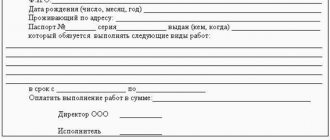

- Full name of the employee (columns 2-4): enter in the nominative case, take the data from the passport or other document that identifies you when applying for a job).

- SNILS (column 5): enter the employee’s individual number in the pension insurance system.

- Date (day, month, year) of admission, transfer, suspension, dismissal (column 6): if there were any personnel events regarding the employee in the reporting month, we enter this data.

- Type of event (column 7): here we enter only the digital code of the event that occurred in the reporting month:

- recruitment;

- transfer to another department;

- dismissal;

- renaming the organization;

- conscription of an employee into the army;

- obtaining education by an employee;

- on-the-job training (e.g. advanced training);

- rewarding;

- obtaining a new rank or profession;

- exclusion from continuous service;

- restoration of continuous service;

- prohibition from holding office.

- Profession, qualification, specialty (column 8): enter data based on documents on education, documents on advanced training or professional training.

- Structural unit (column 9): enter the unit in which the employee works, as it is indicated in the staffing table. If the company has a small staff and there is no schedule, then there will be no name for the structural unit. It is not yet clear whether the field should be left blank or a dash, we are waiting for the official rules for filling out the form.

- Article, paragraph of the Federal Law, reasons for dismissal (column 10): enter the article of the Labor Code of the Russian Federation for which the employee was dismissed.

- Reason for entering information about work activity (column 11–13): here enter the name, date and number of the document that became the basis for dismissal, for example, an order.

New and old SZV-M: what are the differences

The new SZV-M, like the previous one, consists of 4 sections. Let's figure out what their differences are.

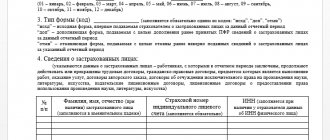

| Name of column or form field | What should have been indicated in the old SZV-M | What needs to be indicated in the new SZV-M | Note |

| Section 1 “Insured details” | |||

| “Registration number in the Pension Fund of Russia” | Registration number of the policyholder assigned to him upon registration as a policyholder under the insurance policy | Registration number of the policyholder assigned to him upon registration as a policyholder under the insurance policy | All fields in section 1 must be completed. Such a reservation was made to the new SZV-M |

| "Name" | Name (short) in accordance with the charter or certificate of registration of an individual | Full or abbreviated name in accordance with the constituent documents. You can indicate the name in Latin transcription or the name of a branch of a foreign organization operating in the Russian Federation, a separate division. | |

| "INN" | TIN | The TIN must be indicated: for a Russian organization - in accordance with the certificate of registration with the Federal Tax Service at the location; for an individual - in accordance with the certificate of registration with the Federal Tax Service of the individual at the place of residence in the territory of the Russian Federation | |

| "Checkpoint" | checkpoint | The checkpoint must be indicated: for an organization - in accordance with the certificate of registration of the organization with the Federal Tax Service at its location on the territory of the Russian Federation; for a separate division - in accordance with the notice of registration of the organization with the Federal Tax Service at the location of the separate division. | The new SZV-M emphasizes that the checkpoint must consist of 9 digits or be absent. |

| Section 2 “Reporting period” | |||

| "Reporting period" | Month code in the format: 01 – January; 02 - February; 03 - March; 04 - April; 05 - May; 06 - June; 07 - July; 08 - August; 09 - September; 10 - October; 11 - November; 12 – December | The month number of the calendar year is indicated in MM format. The year is indicated in YYYY format. | Section 2 must be completed. Such a reservation was made to the new SZV-M |

| Section 3 “Form type (code)” | |||

| "Form type (code)" | It must be filled in with one of the codes: “outcome”, “additional”, “o - the original form submitted for the first time for a given reporting period; “additional” – a supplementary form submitted to supplement the information previously accepted by the Pension Fund for the reporting period; “cancel” - a cancellation form submitted to cancel previously incorrectly submitted information for the reporting period | One of the types of the represented form is indicated: original. The SZV-M form with the “Initial” type is submitted for the first time for this reporting period; complementary. Form SZV-M with the “Additional” type is submitted to supplement the information previously accepted by the Pension Fund for the reporting period; canceling. Form SZV-M with the “Cancelling” type is submitted to cancel previously incorrectly submitted information for the reporting period. | Section 3 must be completed. Such a reservation was made to the new SZV-M |

| Section 4 “Information about insured persons” | |||

| Indicate data on insured persons - employees with whom the following were concluded, continue to be valid or terminated during the reporting period: employment contracts; civil contracts, the subject of which is the performance of work, provision of services; copyright contracts; agreements on the alienation of exclusive rights to works of science, literature, and art; publishing licensing agreements; licensing agreements granting the right to use works of science, literature, art | Provide information about the insured persons who are subject to compulsory health insurance in accordance with Article 7 of the Federal Law of December 15, 2001 No. 167-FZ (*) | ||

| column "N p/p" | Filled with continuous numbering. The number is assigned to the record for a specific insured person. Numbers must be indicated in ascending order without omissions or repetitions | ||

| column “Last name, first name, patronymic (if any) of the insured person” | Last name, first name, patronymic (if any) of the insured person in the nominative case | The information must be filled out in Russian in the nominative case in full, without abbreviations or replacing the name and patronymic with initials | Must be filled in. Such a reservation was made to the new SZV-M |

| column “Insurance number of individual personal account” | SNILS | SNILS SNILS must consist of 11 digits in the format XXX-XXX-XXX-CC or XXX-XXX-XXX CC | Must be filled in. Such a reservation was made to the new SZV-M |

| column "TIN" | TIN (to be filled in if available) | Filled out if the policyholder has data on the individual’s TIN | |

(*) In the new SZV-M form, reference is made to the fact that in section 4 “Information about insured persons” it is necessary to indicate information about insured persons who are subject to compulsory health insurance in accordance with Article 7 of the Federal Law of 15.12. 2001 No. 167-FZ.

When do you need to take the SZV-TD?

The report is submitted monthly within the same time frame as SZV-M: within 15 days after the end of the reporting month. Taking into account postponements of dates that fell on weekends and holidays, the reporting schedule in 2021 looks like this:

| January | February 17 |

| February | March 16 |

| March | April 15 |

| April | May 15 |

| May | June 15 |

| June | July 15 |

| July | August 17 |

| August | September 15th |

| September | October 15 |

| October | November 16 |

| November | December 15 |

| December | January 15, 2021 |

Why is the report likely to be entered?

The first reason is that the bill was developed by the Government of the Russian Federation. The likelihood of approval of such laws is very high. Moreover, the law has already received an opinion from the Russian Ministry of Economic Development. The department is not against the law. The officials only asked to clarify some of the wording in the text.

Thus, it is very likely that all employers without exception will expect a new report to the Pension Fund from 2021. You can familiarize yourself with the new law and the conclusion of the Ministry of Economic Development on the official website of the draft regulatory legal acts at this link .

Fines for violations under SZV-TD

Officials plan to issue a warning to an official in 2021 for a single violation of deadlines or data in a report.

For a double violation there will be fines of up to 50,000 rubles for companies and up to 5,000 for individual entrepreneurs.

If a dismissed employee is not hired for a new job due to incorrect data that the company reported to SZV-TD, then the previous employer will have to compensate him for lost earnings.

Submit a new report in the Kontur.Accounting web service. Our system includes simple accounting, salaries, personnel, reporting via the Internet and round-the-clock support from specialists. The first two weeks of working in the service are free for all newcomers.

Report on the website “Work in Russia”

This is a new report to the employment service. In it, the employer reports how many employees he has in total, how many are idle, how many are working remotely, and how many have been laid off since the introduction of self-isolation in the region. When indicators change, the report is immediately resubmitted. It’s good that the report is electronic, and you just need to fill out the form on the “Work in Russia” website. To do this, you will need a State Services account. And Elba’s electronic signature on the media is suitable for her.

For the first time, the report must be submitted as soon as possible.

Art. 25 Law 1032-1

Order of the Ministry of Labor 1207

Order of the Ministry of Labor dated March 24, 2021 No. 15