Monetary documents include postage stamps, marked envelopes, state duty stamps, travel documents, fuel and food coupons, certificates and other documents that have been paid for by the enterprise, but services for which have not yet been received. From the moment of purchase until use, such documents are stored at the enterprise's cash desk. In accounting they are reflected in account 50.03 “Cash documents”.

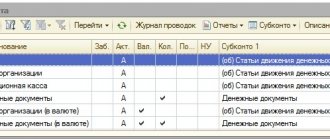

In the “1C: Enterprise Accounting” configuration, the “Cash Documents” group in the “Bank and Cash Office” section is intended for accounting of monetary documents.

What is a monetary document?

Indirectly, the definition of the concept of such an accounting object as monetary documents is given in the Instructions for the use of the chart of accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n (hereinafter referred to as Instruction 94n).

The description of account 50 of Instruction 94n states that subaccount 50-3 “Monetary documents” takes into account stamps (postage, bills, state duties), paid air tickets and other monetary documents that the enterprise has. Thus, monetary documents include those documents that have a certain value and allow you to receive material assets, property rights or services in the future. These can be food coupons, milk, fuel and lubricants (if the fixed cost of fuels and lubricants is indicated); bus, train and other types of tickets, tourist vouchers, and other similar documents. Instruction 94n prescribes keeping analytical records of such documents by type (separately for vouchers, separately for train tickets, etc.).

IMPORTANT! Monetary documents do not include securities (government bonds, bonds of other enterprises, shares and bills), banknotes (checks, coupons, tickets, other forms issued by the enterprise itself).

More information about BSO can be found in the material “What applies to strict reporting forms (requirements)?”

On account 50, monetary documents are taken into account when there is an interval between the moment of their acquisition and the moment of use during which they are stored in the cash register. If, for example, a posted employee purchased a train ticket for his trip using the accountable funds received on his own, then such a document is not processed through the ticket office. And the already used ticket, submitted to the accounting department as confirmation of expenses, will be stored along with the advance report. At the same time, the used ticket is also not a monetary document, since it does not have the property of being exchanged for any benefit in the future.

ConsultantPlus experts explained in detail how to correctly account for monetary documents. If you do not have access to the K+ system, get a trial online access for free.

Let's take a closer look at the procedure for receiving and issuing monetary documents.

Postage stamps and stamped envelopes

Postal services also remain widespread and in demand. The organization of postal shipments is impossible without purchasing stamps and marked envelopes, which, according to Instruction No. 157n, must be taken into account as monetary documents and, as necessary, issued for reporting to the persons responsible for sending correspondence. The supporting document for the advance report may be a register of sent correspondence, and in case of damage, a damaged envelope attached to the report.

- Receipt of stamps and marked envelopes to the institution's cash desk Dt 0 201 35 510 Kt 0 302 21 730; 0 208 21 660

- Issuance of stamps and marked envelopes for reporting Dt 0 208 21 560 Kt 0 201 35 610

The procedure for posting monetary documents

All primary accounting objects, which include monetary documents, must be taken into account in the appropriate registers (Clause 1, Article 10 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, hereinafter referred to as Law No. 402-FZ).

There is no unified register for recording monetary documents. In addition, enterprises have the right to develop the form of the vast majority of primary records and accounting registers independently (Ministry of Finance information No. PZ-10/2012).

More information about how to develop an accounting register can be found in the article “Accounting registers (forms, samples).”

When developing accounting registers for monetary documents, it is necessary to reflect all their essential parameters in separate columns. At the same time, specialized programs for accounting, as a rule, have similar registers in their functionality, and the accountant simply needs to enter into them all the information from monetary documents necessary for accounting.

If for some reason accounting is carried out without the use of a computer program, the register will have to be developed independently. What should be reflected in such a register?

Different documents may have their own nuances. For example, for ticket accounting, the essential information reflected in the register will be:

- date of ticket purchase;

- date of the trip for which the ticket was purchased;

- number of ticket;

- type of vehicle;

- flight number, time, place, ticket class;

- ticket price;

- VAT amount (if any);

- the amount of commissions and insurance payments;

- other data of significant importance (name of the employee for whom the ticket was purchased; number of miles accrued by the carrier; accumulated discount amount, etc.).

After entering the document into the accounting register, an account is selected in which this document must be recorded - subaccount 50-3 “Cash documents” to account 50 “Cash”. Its debit reflects the full cost of the monetary document - the amount that its acquisition cost the enterprise.

Payment and receipt of monetary documents can be reflected by the following transactions:

| Dt | CT | Operation description |

| 60 | 50-1 | Payment has been made for monetary documents purchased from suppliers or other contractors |

| 71 | 51,50-1 | Funds were issued to an accountable person for the purchase of monetary documents |

| 50-3 | 60,71 | Cash documents were capitalized at the cash desk in subaccount 50-3 |

IMPORTANT! Payment for monetary documents can be made either by bank transfer or in cash, but they are taken into account in subaccount 50-3.

Exchange and return of travel documents

In practice, there are situations when a ticket has to be returned or exchanged. In this case, for the return or exchange of a travel document (including an electronic one), the carrier withholds a commission (fine). The transport agency may also charge an additional fee for its services.

If the exchange or return of a ticket is due to operational necessity, then the organization can include as expenses for profit tax purposes both the cost of the originally purchased (minus the amount returned by the airline) and the new ticket (letter of the Ministry of Finance of Russia dated May 2, 2007 No. 03-03-06/ 1/252). Expenses in the form of a fine for reissuing and returning tickets reduce the tax base for corporate income tax (letter of the Ministry of Finance of Russia dated September 8, 2017 No. 03-03-06/1/57890).

Example 3

Let's change the conditions of Example 2. Due to production needs, an organization, through a transport agency, exchanges an electronic air ticket on the route Moscow - Ufa - Moscow (let's say the departure time from Ufa changes). The organization pays an additional RUB 3,880 to the trans agency, including:

|

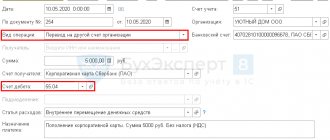

After posting the document Write-off from current account with the transaction type Payment to supplier, an accounting entry will be generated:

Debit 76.05 Credit 51 - for the cost of air tickets, taking into account commission and additional services (3,880 rubles).

The exchange of an air ticket through a transagency is reflected in the following documents:

- Receipt of monetary documents with the transaction type Receipt from an accountable person (if the accounting reflected the issue of a ticket to an accountable person);

- Issuance of monetary documents with the transaction type: Return to supplier;

- Receipt of cash documents with the transaction type Receipt from supplier.

Additionally, you should create a document Receipt (act, invoice) with the transaction type Services to reflect additional expenses for the services of the transagency (590 rubles). When filling out the document Receipt of monetary documents with the transaction type Receipt from an accountable person on the From tab, fill in the details Accountable person and Received from (full name of the employee for the printed form).

On the Cash Documents tab, the name of the cash document, quantity (1 pc.) are indicated, and its value is filled in automatically. After posting the document, the following posting is generated:

Debit 50.03 Credit 71.01 - for the amount of the ticket received (RUB 10,574) in the amount of 1 piece.

In the document Issuance of monetary documents with the transaction type Return to supplier, on the Cash documents tab, not only the name of the monetary document, its quantity (1 piece) and cost (RUB 10,574), but also the return amount (RUB 9,374) is indicated, since the carrier withholds a commission of RUB 1,200. (10,574 rubles - 1,200 rubles = 9,374 rubles) (Fig. 6).

Rice. 6. Return of the monetary document to the supplier

Additionally, you need to fill in the details on the Income and Expense Accounts tab to reflect the differences between the accounting value of monetary documents and the refund amount:

- Item of income and expenses - selected from the directory Other income and expenses;

- Income account - an account for income that arises when the return amount exceeds the accounting value of monetary documents;

- Expense account - an account for expenses that arise when the book value of monetary documents exceeds the return amount.

After posting the document, the following transactions will be generated:

Debit 76.05 Credit 50.03 - for the cost of a refundable air ticket (RUB 10,574); Debit 91.02 Credit 76.05 - for the amount of the withheld commission for the return (RUB 1,200).

Then you should create a new document Receipt of monetary documents with the transaction type Receipt from supplier, where the receipt of a new air ticket should be reflected. After posting the document, the following transactions will be generated:

Debit 50.03 Credit 76.05 - for the amount of the ticket received (RUB 12,664) in the amount of 1 piece.

Further actions with the electronic ticket are similar to those described in Example 2.

How are monetary documents issued to an accountable person?

The fact of issuing cash documents from the cash register to accountants is formalized using a cash expense order (RKO). In this case, the accounting entry looks like:

Dt 71 Kt 50-3 - issuance of monetary documents from the cash desk of the enterprise to the accountable person.

ATTENTION! As of November 30, 2020, the rules for issuing reports have been simplified. Now, in the application for the issuance of accountable money, it is not necessary to indicate the amount of the advance and the period for which the accountable amounts are issued. The organization sets the deadline independently. The requirement to submit an advance report within three days has been removed. Employers were also allowed to issue one order for several cash payments to one or more employees. In this case, you need to indicate the name, amount and period for which the money is issued for each employee.

ConsultantPlus experts told us what other innovations in the procedure for recording cash transactions came into effect on November 30, 2020. Get trial access to the K+ system and go to the review material for free.

Example

An employee of a trading enterprise Savelyev A.I. was assigned to go on a business trip on 05/12/2021 for 9 days, with a return date of 05/20/2021. The enterprise purchased train tickets (round trip) for him through an accountable person. The cost of a ticket there, including commission and insurance, was 6,950 rubles. (including RUB 631.82 VAT allocated on the ticket). The cost of a return ticket for 05/19/2021 with arrival on 05/20/2021 was 5,750 rubles. (including the VAT allocated on the ticket of 522.73 rubles). 05/23/2021 Savelyev A.I. reported to the accounting department on the use of monetary documents.

Let's look at how all these operations were formalized:

| date | Dt | CT | Sum | Operation description | Primary document |

| 29.04.2021 | 71 | 50-1 | 15 000 | Ivanov A.A. was given money on account to purchase train tickets for Savelyev A.I. | Order or instruction, RKO |

| 04.05.2021 | 50-1 | 71 | 2 300 | Ivanov A.A. returned the rest of the money to the cash desk of the enterprise | PKO, advance report by Ivanov A.A. |

| 04.05.2021 | 50-3 | 71 | 6 950 | Ticket No. 08935992 for train No. 018, date: 05.12.2021, in the name of Savelyev A.I. was registered for a trip there | PKO for monetary documents, ticket form, registration entry made in the journal of accounting of monetary documents |

| 04.05.2021 | 50-3 | 71 | 5 750 | Ticket No. 03565978 for train No. 017, date: 05.19.2021, in the name of Savelyev A.I. was registered for the return trip | PKO for monetary documents, ticket form, registration entry made in the journal of accounting of monetary documents |

| 12.05.2021 | 71 | 50-3 | 12 700 | Travel documents for a round trip were issued to A.I. Savelyev for reporting | RKO for monetary documents, ticket forms, entry in the journal for issuing monetary documents |

| 23.05.2021 | 44 | 71 | 11 545,45 | An advance report was received from Savelyev A.I. on the use of monetary documents - railway travel tickets. The cost of train tickets (excluding VAT) was written off for business expenses of the enterprise | Advance report, forms of used tickets, business trip report |

| 23.05.2021 | 19 | 71 | 1 154,55 | Accepted for deduction of VAT on railway tickets No. 03565978 and No. 08935992 | Ticket forms |

IMPORTANT! According to Art. 164 of the Tax Code of the Russian Federation, the VAT rate on the ticket fare is 10% (Law “On the establishment of a deflator coefficient...” dated December 29, 2015 No. 386-FZ). Other services included in the full price of tickets are taxed at a rate of 20%. In this case, there is no need to calculate VAT yourself.

Nuances of accounting for cash documents for fuel and lubricants

Enterprises today purchase fuels and lubricants in 2 main ways:

- by coupons;

- on fuel cards.

Monetary documents are only coupons for fuel and lubricants and only of a certain type. Fuel cards, for which payments for gasoline are carried out in monetary terms, are classified as low-value and are taken into account off the balance sheet at a conditional cost. To do this, you can open a special off-balance account or keep records of their movement in a special journal, where you should reflect data on who and when fuel cards were issued. Regular replenishment of fuel card balances is carried out with advance payments, which at the end of the month are closed with documents from the fuel supplier:

- invoice,

- fuel invoice;

- register-report on car refueling by card number.

Coupons for fuels and lubricants are received from the supplier company after making an advance payment on the basis of an agreement for the supply of fuels and lubricants. They can be liter or value. Coupons that indicate the quantity of fuel and lubricants without indicating its cost do not relate to monetary documents and are taken into account off the balance sheet.

A cost coupon for obtaining fuel and lubricants is received at the accounting department on the day the car is checked out. Upon returning to the enterprise, the driver reports on fuel consumption based on the waybill.

The postings for these operations may look like this:

| Dt | CT | Operation description | Source documents |

| 60 | 51 | An advance payment for coupons was transferred to the fuel and lubricants supplier | An agreement for the supply of fuels and lubricants, an application from the head of the garage to pay for fuels and lubricants for a month, monthly consumption rates for fuels and lubricants for the enterprise, a payment document |

| 50-3 | 60 | Received coupons from the supplier | PKO for coupons |

| 71 | 50-3 | Tickets issued to the driver/dispatcher | Logbook of coupons, cash register for coupons, waybill/dispatcher application |

| 25 | 71 | An advance report on the consumption of fuel and lubricants has been received (a waybill is attached). The cost of consumed fuel and lubricants is written off as general production expenses | Waybill/dispatcher report on consumption and balances of fuel and lubricants, accounting certificate - calculation, cash book |

The initial registration of coupons for fuel and lubricants is carried out in the appropriate logbook. At the enterprise, coupons can be issued either directly to the driver or to the dispatcher of the auto workshop (garage). If the enterprise has such an opportunity, then you can entrust the work of accounting for fuels and lubricants to a specialist - an auto shop worker (boss, foreman, dispatcher). This work is very painstaking and time-consuming: you need to take into account the arrival and consumption of fuel and lubricants, carry out write-offs using waybills, and monitor whether write-off standards are met. At transport enterprises, all of the above operations are performed by a separate specialist who has the ability to directly monitor fuel consumption.

More information about the procedure for accounting and writing off fuel and lubricants can be found in the material “Procedure for accounting and writing off fuel and lubricants based on waybills in 2020–2021.”

Accounting for travel tickets for employees engaged in traveling work

Separately, it is necessary to consider the procedure for recording passes for public transport. Very often, an enterprise purchases travel tickets for its employees so that they can work outside the office (traveling work).

Typical wiring in this case may look like this:

| Dt | CT | Operation description | Source documents |

| 60 | 51 | Payment for travel tickets to the transport company has been made | Agreement with a transport company, bank statement, payment order |

| 50-3 | 60 | Received travel tickets from the transport company | Travel ticket forms, invoice, PKO for travel tickets |

| 19 | 60 | VAT reflected on purchased travel tickets | Invoice |

| 71 | 50-3 | Travel tickets were issued to employees for reporting purposes | RKO, entry in the ticket register |

| 25 (26, 44) | 71 | Received advance reports (route sheets attached) from employees. Transportation costs are written off as general production (commercial) expenses | Route sheets, forms of used tickets (at the end of the period for which they were purchased) |

IMPORTANT! If employees who received travel tickets do not provide the accounting department with a route sheet, they must be charged personal income tax on the cost of the travel document. The employee’s route sheet confirms that he used the travel card not for his personal needs, but to perform production tasks.

If travel tickets are purchased for a long period, covering several months or quarters, then the enterprise, based on route sheets, can write off part of the cost of travel tickets as expenses for the corresponding period. Route sheets can be daily, or they can take the form of weekly or monthly forms. The form of route sheets and the period during which they are filled out are established by the enterprise in its accounting policies.

Results

Accounting for monetary documents must be maintained using a special subaccount 50-3. They need to be issued with accountability. This will allow the company to minimize the risks of non-economic use of monetary documents, as well as incorrect calculation of the tax base for income tax or VAT.

Sources:

- Tax Code of the Russian Federation

- Law “On Accounting” dated December 6, 2011 N 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Main

Cash documents are a type of material assets that accompanies the movement of funds. Accounted for in account 50.3 at the cost of acquisition, stored in the cash register, according to the rules for storing cash. The movement of monetary documents is documented using standard cash documents, with the mark “stock” on them. The concepts of “monetary documents” and “strict reporting forms” are different in a broad sense. Strict reporting forms can serve as confirmation of already paid monetary documents, however, not all BSO can be monetary documents.