General principles for organizing archival business in Russia and storage periods for documents

Work with archival documents is regulated by Federal Law No. 125 dated 10/22/04. According to it, archives are created by:

- government agencies, local governments;

- companies.

The Federal Law obliges them to ensure the safety of documentation, incl. regarding the payroll, throughout the entire storage period (Article 17-1 of Federal Law No. 125). Storage periods are also established by Federal Law No. 125 and a number of its articles. The lists mentioned in the text of the Federal Law indicating the storage periods for documentation are published by the Federal Archive, government agencies, and the Bank of the Russian Federation. Example: order of the Ministry of Culture of the Russian Federation No. 558 dated 08/25/10, containing summary information on shelf life. Regarding JSC, there is a “Regulation”, which specifically regulates the procedure and duration of storage of the Company’s documents. This regulatory act was approved by Resolution No. 03-33/ps. FCSM of the Russian Federation dated 16-07-03

What are the advantages of storing electronic documents in specialized electronic archive software for an organization ?

The storage periods for BU documentation are subject to Federal Law No. 402 dated 06-12-11, NU - Tax Code of the Russian Federation.

When determining the retention period for an organization’s documents, several key points are taken into account:

- Documents relating to the payroll (done before 2003) are retained for a minimum of 75 years.

- Documents relating to the payroll (issued after 2003) are retained for a minimum of 50 years.

- Personnel documentation, namely time sheets, travel certificates, lists of employees, etc. – 5 years.

- Documents on health and safety, i.e. statements of issuance of personal protective equipment, instruction logs, documented industrial accidents, lists of workers in hazardous production conditions - from 12 months. up to 75 years old.

- Annual accounting and similar reporting to the Social Insurance Fund - constantly. Quarterly reporting to the Social Insurance Fund – 6 years.

- Reporting to the Pension Fund - from 6 years to 75 years according to the Persian language. accounting

- Primary documentation on accounting, accounting policies, reporting and registers of NU, information on income of individuals. persons – 5 years.

- Invoices are valid for 4 years.

What documents and for what period are stored in the archives of the Federal Property Management Agency ?

The requirements for storage and the procedure for providing documents to participants in JSCs and LLCs have changed

Federal Law No. 233-FZ dated July 29, 2017 has significantly changed the corporate rules of the game in joint-stock companies and LLCs.

The amendments can be assessed as aimed primarily at protecting majority business owners

and, strange as it may sound,

the administrative staff of large public joint stock companies

. Among the positive aspects for organizations and, accordingly, not always positive for minority shareholders (participants), the following can be noted:

- regulation of the possibility of repeated requests for information. In essence, the presumption has been established that documents can be provided once every 3 years. More often - only at the request of the organization’s management personnel. This is how, most likely, the rule established in subparagraph will be read and implemented in practice. 2 clause 8 art. 91 of the Law on JSC and sub. 2 clause 4 art. 50 of the LLC Law. On the one hand, this provision is aimed at protecting against greenmail3, and on the other, it is essentially a restriction of the rights of shareholders and participants to access information;

- The practice formulated by the Supreme Arbitration Court of the Russian Federation in 20114, stating that a company may (as a general rule) not provide a participant with documents from past periods, as not being valuable for analysis, was elevated to the rank of law and concretized. Now the period for providing documents is limited to the “current” 3-year period (subclause 3, clause 8, article 91 of the JSC Law and subclause 3, clause 4, article 50 of the LLC Law);

- it became possible to refuse to provide information to minority shareholders (less than 25% of the company’s shares) if the shareholder does not have a business purpose in obtaining it (subclause 4, clause 8, article 91 of the Federal Law on JSC). Moreover, this criterion is evaluative. We are likely to face quite a lot of litigation before reasonable criteria for assessing business interests are developed. Please note that this basis is not available in an LLC;

- it became possible to refuse to provide information related to the competitive sphere to a minority shareholder (less than 25% of the company’s shares) associated with competitors (if desired, almost any information, except for publicly available information, can be included under this criterion) - sub-clause. 3 paragraph 7 art. 91 of the Law on JSC.

To the definitely positive aspects

The following points can be noted:

- the issue of requests for information for periods when the shareholder has not yet become a shareholder was finally resolved. Now the JSC may not provide information on those transactions that were completed before the shareholder took possession of the shares (subclause 6, clause 8, article 91 of the JSC Law). This decision of the legislator, although not ideal, due to its unambiguity, reduces the number of controversial situations;

- The issue of providing public documents to the organization has been resolved. It is possible not to provide shareholders/participants with documents communicated to an unlimited number of persons by publishing them on the company’s website (subclause 1, clause 8, article 91 of the JSC Law and subclause 1, clause 4, article 50 of the LLC Law).

In connection with the adoption of this law, the importance of paperwork support for the provision of information has increased significantly. So, now journals for familiarization of shareholders / participants with company documents

gained additional weight (see Examples 1-2 for JSC; similar journals can be kept in LLC).

After all, on their basis it is determined who, when and with what documents was familiarized, and therefore, they make it possible to determine whether it is possible to refuse to re-provide documents (subparagraph 2, paragraph 8, article 91 of the JSC Law and subparagraph 2, paragraph 4, art. 50 of the LLC Law - on a second request for the same documents within a 3-year period). Example 1

“Head” of the Journal for recording incoming requests from shareholders

CollapseShow

Example 2 “Head” of the Journal for sending copies of requested documents to shareholders

CollapseShow

Example 3 “Head” of the Journal for familiarization of shareholders with documents on the territory of the joint-stock company

CollapseShow

Now let's look at what the JSC, LLC and their officials face for violating the procedure for providing information and documents

to its shareholders/participants.

In case of failure to provide, as well as violation of the procedure and (or) deadlines for providing information, administrative liability is possible on the basis of Part 1 of Art. 15.19 Code of Administrative Offenses of the Russian Federation, as well as parts 2 and 11 of Art. 15.23.1 Code of Administrative Offenses (clause 7 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 18, 2011 No. 144 “On some issues of the practice of arbitration courts considering disputes regarding the provision of information to participants in business companies”):

Document fragment

CollapseShow

Article 15.19 “Violation of legal requirements relating to the presentation and disclosure of information on financial markets” of the Code of Administrative Offenses of the Russian Federation

1. Failure to provide or violation

by the issuer

... of the procedure and deadlines for the provision of information (notifications) ... as well as the provision of information not in full, and (or) unreliable information, and (or) misleading information ... if these actions (inaction) do not contain criminal offenses punishable act -

entails the imposition of an administrative fine on officials in the amount of 20,000 to 30,000 rubles or disqualification for up to 1 year; for legal entities - from 500,000 to 700,000 rubles.

Document fragment

CollapseShow

Article 15.23.1 “Violation of legal requirements on the procedure for preparing and holding general meetings of shareholders, participants in limited (additional) liability companies and owners of investment shares of closed mutual investment funds” of the Code of Administrative Offenses of the Russian Federation

2. Violation of the procedure or deadline for sending (delivery, publication) of a notice of a

general meeting of shareholders (general meeting of owners of investment shares of a closed-end mutual investment fund)

, as well as failure to provide or violation of the deadline for providing information (materials) subject to provision in accordance with federal laws and other regulatory legal acts adopted in accordance with them, in preparation for holding a general meeting of shareholders (general meeting of owners of investment shares of a closed-end mutual investment fund) -

entails the imposition of an administrative fine on citizens in the amount of 2,000 to 4,000 rubles; for officials - from 20,000 to 30,000 rubles or disqualification for up to 1 year; for legal entities - from 500,000 to 700,000 rubles.

…eleven. Illegal refusal to convene or evasion of convening a general meeting of participants of a limited (additional) liability company

, as well as violation of the requirements of federal “laws” for the procedure for convening, preparing and holding general meetings of participants in limited (additional) liability companies -

entails the imposition of an administrative fine on citizens in the amount of 2,000 to 4,000 rubles; for officials - from 20,000 to 30,000 rubles; for legal entities - from 500,000 to 700,000 rubles.

Note. A member of the board of directors (supervisory board), audit commission, counting commission or liquidation commission of a joint-stock company (limited (additional) liability company), who voted against a decision that led to a violation of the requirements of federal laws and other regulatory legal acts adopted in accordance with them, to liability provided for in this article is not incurred.

Part 1 of Art. cited here. 15.19 and part 2 of Art. 15.23.1 of the Code of Administrative Offenses of the Russian Federation with impressive fines for organizations from 500,000 to 700,000 rubles are intended for joint-stock companies!

Applicable to LLC

(with similar penalties):

- Part 11 Art. 15.23.1 of the Code of Administrative Offenses of the Russian Federation - if the refusal to provide information / documents is related to the holding of general meetings of LLC participants (on this basis, the punishment for JSC and LLC is the same);

- according to Part 1 of Art. 15.19 of the Code of Administrative Offenses of the Russian Federation, LLCs are very rarely liable - only if they issue bond issues on open markets. Let's take the following case as an example:

Arbitrage practice. Resolution of the Federal Antimonopoly Service of the Moscow District dated August 21, 2013 in case No. A40-50317/12-120-487

CollapseShow

A. demanded that the Federal Service for Financial Markets hold Lanega-Stroy LLC and its general director liable under Part 1 of Article 15.19 of the Administrative Code of the Russian Federation, and having received a refusal, she challenged it in court. But all the courts that considered this case considered that this norm does not provide for liability for failure to provide copies of documents for the LLC. This part of the article directly indicates the list of entities to which it applies (it is long, includes issuers, professional participants in the securities market, etc.), but there are no limited liability companies there!

Such an imbalance of responsibility between JSC and LLC may not seem entirely fair, but in this case it is necessary to take into account the legal nature of the organizational forms (JSC and LLC). In most cases, an LLC is an association of people based on special trust relationships, and the legislator moves the emphasis in resolving disputes that arise between them out of the scope of public regulation. Whereas a violation of the right to information in a joint-stock company usually affects a significant number of persons whose participation in the company’s business is limited to purely financial interests.

If an organization is found guilty under any of the rules mentioned above, then not only the organization itself, but also its officials

(usually this is the sole executive body of the company). Punishments for officials must be considered in the same standard chosen by the court - this could be a fine, which in some cases is replaced by disqualification for a period of 1 year. But in fact, such a “stigma” can interfere much longer, especially when trying to get a government position or a leadership position in a company with significant government participation. However, in most cases, personal liability begins to apply in case of repeated or multiple violations.

The fines in the above-mentioned articles of the Code of Administrative Offenses of the Russian Federation for officials are significantly lower than for the organizations they manage (20,000 - 30,000 rubles versus 500,000 - 700,000 rubles). Although for the management bodies of the company (the sole executive, for example, the general director, or members of the collegial body) there is another danger - Articles 53.1 and 15 of the Civil Code of the Russian Federation allow the entire fine paid by the organization due to their fault to be transferred to them - see the news about this in our magazine.

Company archive and third-party archive

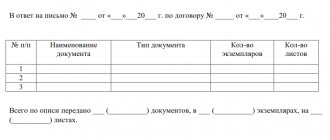

Documents that have a permanent storage period and temporary ones, but more than 10 years, are transferred to the company archive. Completed cases are transferred according to their inventory. When sending cases to a third-party archive (most often a state or municipal institution), they are accompanied by the following:

- a letter of relationship with a request addressed to his supervisor, which indicates the number of cases and their last dates;

- inventory in 3 copies;

- historical information about the company (only for the first application);

- a certificate documenting the incomplete preservation of files or individual documents in them, if necessary.

Cases are handed over according to the act according to the inventories. After passing the examination, the cases are accepted by the archive for storage.

Agreement with the archive

The third-party archive, as well as the organization, are legal entities. Their relationship is formalized by a contract (agreement). Documents of public, historical significance, handed over “outside”, are stored at the expense of government funds, and documents of the company that it does not want or does not have the opportunity to store on its territory are stored for a fee.

The recommended version of the contract contains, in addition to the usual details (name, date, names of the parties to the contract), such a clause as “Procedure for the implementation of the contract”, which states in detail:

- how the nomenclature of transferred cases is formed and how it is agreed upon;

- who ensures the selection, preparation and transfer of cases, who brings them to an orderly state (usually this is the responsibility of the company);

- who carries out the examination of the documentation (usually this is the responsibility of the archive);

- what is the composition of the commission that controls the transfer of cases;

- in what form are cases transferred (using containers, in bundles), etc.

State and municipal archival institutions indicate in the contract that the documents are of public or historical value. The wording may be as follows: “This agreement regulates the relations of the parties in the process of transferring to the “Archive” documents generated as a result of the activities of the “Organization”, as well as their subsequent use for scientific, practical and other purposes.” Based on the clause mentioned above, the contract contains the entry “free storage” or something similar in meaning. Thus, participants in relationships in the field of archival affairs comply with the requirements of Federal Law No. 125, Art. 17-1.

If the company is not liquidated or closed, but it is not possible to store documents on its territory, they are rented out “to the outside” for a fee. In order to reduce costs, it is advisable not to specify a specific storage period for files in the agreement with the archive. The wording could be as follows: “Documents are stored in the archive until required by the organization. After the expiration of the period (years), the documents are destroyed.”

Drawing up an order for storing documents, mandatory elements

An entrepreneur must draw up such a document immediately from the moment of opening his business. Using it, you can create a unified system for storing documents of various types, be it the charter of an enterprise or a regular official memo.

The document in question is of an administrative nature and establishes specific tasks for organizing the storage of company documents. In case of any violation and disciplinary action, the original order must be available.

It is worth noting that there is no single form for preparing such a document, and therefore the entrepreneur is allowed to develop his own form. Registration should begin with the “header”, which must contain information about the legal entity, its place of registration, TIN, and so on.

The document must have a date and registration number, in connection with which the corresponding designations are placed in the left corner, and opposite them, on the right side, the locality of the enterprise is indicated.

Then the document needs to be titled and a short preamble drawn up, after which the text of the document is drawn up. The order determines the employees of the enterprise who are charged with the responsibility for proper storage of documents. Typically, this task falls under the competence of the head of the centralized office management department, that is, the office.

Accounting for costs of storing documents and registers

Expenses for storing documents in the company’s own archive are usually collected on account 26 “General business expenses (OCR)”. Such costs may include:

- payment of utilities;

- renovation of premises;

- rental payments if the building is rented by an organization;

- wages with contributions to employees, etc.

Postings:

- Dt 26 Kt 60, 76 – utility payments, rent payments;

- Dt 26 Kt 23, 10, 70, etc. cost accounts (or 60, 76) - depending on whether the repairs are carried out in-house or by a third-party organization;

- Dt 26 K 70, 69, 68 – wages with deductions, if an individual employee is registered in the archive;

- Dt 19 Kt 60, 76 – VAT is recorded on services of third-party organizations;

- Dt 68 Kt 19 – VAT deductible on services of third-party organizations;

- Dt 60 Kt 51, 50 – payment for services of third-party organizations.

Note that the organization can carry out repairs on its own and at the expense of the established repair fund. Then the wiring will be like this:

- Dt 26 Kt 96 – monthly contributions to the fund;

- Dt 96 Kt 23, 10, 70, etc. – actual expenses for repairing the archive.

To account for third-party archive services, use account 97 “Deferred expenses”:

- Dt 97 Kt 60, 76 – the cost of archive services is recorded in accounting;

- Dt 60, 76 Kt 51 – the cost of archive services has been paid;

- Dt 26 Kt 97 - part of the storage costs is included in the costs.

The portion of expenses included in the monthly costs is calculated based on the manager’s order indicating the period for writing off the costs of archive services (for example, 12 months).

In tax accounting, “archival” costs are classified as other expenses directly related to the production and sale of products, as management expenses (Article 264-1 of the Tax Code of the Russian Federation, paragraph 18). Amounts are included in calculations for NU purposes.

It should be borne in mind that according to Art. 149-2 Tax Code of the Russian Federation, paragraphs. 6, archive services are not subject to VAT, therefore, the tax amount will not have to be excluded from costs.