Reflection of VAT on advances in financial statements

Advances are an integral part of the life of any business entity. Each fact of economic life is subject to registration as a primary accounting document (clause 1 of Article 9 of Federal Law 402-FZ “On Accounting” dated December 6, 2011) and must be reflected in the accounting registers (clause 3 of Article 9 of Federal Law 402-FZ “On Accounting” accounting" dated December 6, 2011).

For settlements with suppliers and contractors, the Instructions for the application of the Chart of Accounts (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n, hereinafter referred to as the Instructions) provides for account 60 “Settlements with suppliers and contractors”. When reflecting advances received, account 60 “Settlements with suppliers and contractors” is debited in correspondence with cash accounts.

For settlements with buyers and customers, the Instructions provide for account 62 “Settlements with buyers and customers”, which, when reflecting advances issued, is credited in correspondence with cash accounts.

In practice, as a rule, accounting for advances received is kept on account 62.02 “Settlements on advances received”, advances issued on account 60.02 “Settlements on advances issued”.

If an organization is a payer of value added tax (hereinafter referred to as VAT), then accounting for advances is inextricably linked with accounting for VAT. The instructions do not provide for separate accounts for accounting for VAT on advances. Let's consider the case when an organization uses account 76AB “VAT on advances and prepayments” to account for VAT on advances received, and 76 VA “VAT on advances and prepayments issued” on advances issued. The settlements with the budget for VAT are taken into account in account 68 “Settlements with the budget”.

As a general rule (under the general taxation system), an organization must calculate VAT on advances received (subparagraph 2 of paragraph 1, paragraph 14 of Article 167 of the Tax Code of the Russian Federation, hereinafter referred to as the Tax Code of the Russian Federation). An accounting entry is drawn up: Dt 76AB Kt 68 “VAT”.

If an organization uses the right to deduct VAT in accordance with paragraph 12 of Article 171 and paragraph 9 of Article 172 of the Tax Code of the Russian Federation, then when transferring an advance in accounting, VAT on the advance is taken into account separately. In this case, there may be an accounting entry: Dt 68 “VAT” Kt 76 VA “VAT on advances and prepayments issued.”

Thus, at the end of the reporting period, an organization that receives and pays advances may have a balance in its accounting records on the following accounts: 62.02 “Calculations for advances received”, 60.02 “Calculations for advances issued”, 76 AB “VAT on advances and prepayments” , 76 VA “VAT on advances and prepayments issued.”

Balances on all accounts must be reflected in the balance sheet. All that remains is to decide which line.

In practice, there are several options for reflecting advances and VAT amounts on them:

1. including VAT.

That is, advances issued (account 60.02) together with VAT are reflected in line 1230 “Accounts receivable”, advances received (62.02) in line 1520 “Accounts payable”. In turn, VAT on account 76 AB “VAT on advances and prepayments” is reflected in line 1260 “Other current assets”, VAT on account 76 VA “VAT on advances and prepayments issued” is reflected on line 1550 “Other liabilities”.

2. minus VAT.

That is, advances issued (account 60.02) are reflected in line 1230 “Accounts receivable” of the balance sheet minus VAT on account 76.VA (if any), advances received (62.02) are reflected in line 1520 “Accounts payable” of the balance sheet minus VAT on account 76.AB “VAT on advances and prepayments”.

Using the “minus VAT” method, some organizations, reflecting the amount of advances paid in the balance sheet line 1230 “Accounts receivable”, allocate VAT by calculation (Amount of advances on the account 60.02 * 20/120), that is, regardless of the actual application of the deductions provided for Tax Code of the Russian Federation.

The method of reflecting advances minus VAT complies with Recommendations R-29/2013-KpR “VAT on advances issued and received” of the Accounting Development Fund “National non-state accounting regulator “Accounting Methodological Center”, Recommendations for audit organizations, individual auditors, auditors for auditing annual financial statements of organizations for 2012 (appendix to the letter of the Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01) – section “Evaluation of debt on advances paid (received) (prepayment).” But at the same time, the balance sheet currency is understated and information about the organization’s liabilities in the balance sheet is reflected distortedly. For example:

The organization has account balances:

| Check | Name | Balance | |

| Debit | Credit | ||

| 76 AB | “VAT on advances and prepayments” | 21 600 | |

| 76VA | “VAT on advances and prepayments issued” | 9 000 | |

| 60.02 | “Calculations for advances issued” | 59 000 | |

| 62.02 | “Calculations for advances received” | 141 600 | |

The balance sheet amounts may include:

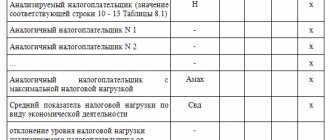

| line | Line name | Method of reflecting advances | |

| including VAT | Less VAT | ||

| 1230 | "Accounts receivable" | 59 000 | 50000 (59000-9000) |

| 1260 | "Other current assets" | 21600 | 0 |

| Total current assets | 80600 | 50000 | |

| 1520 | "Accounts payable" | 141600 | 120000 |

| 1550 | "Other liabilities" | 9000 | 0 |

| Total current liabilities | 150600 | 120000 | |

No matter how we reflect VAT on advances in the balance sheet, according to the Civil Code, the organization’s debt is considered in full, and upon termination of the contract, the refund will also be in full, including VAT. VAT amounts do not fall out of sight of the tax authorities.

Since the above Recommendations do not relate to documents in the field of accounting regulation (in accordance with part one of Article 21 of Law N 402-FZ), an organization can apply such Recommendations at its own discretion. And, based on the fact that the current accounting standards do not set out the procedure for reflecting deferred VAT, and there are no clear recommendations in IFRS, the organization has the right to use clause 7.1 of PBU 1/2008 “Accounting policies of the organization.”

In accordance with paragraph 7.1 of PBU 1/2008 “Accounting Policies of an Organization,” if there are controversial issues that do not have a clear solution in regulations, organizations must independently develop appropriate solutions and consolidate them in their accounting policies. It can be taken into account that in accordance with clause 7.4 of PBU 1/2008 “to the extent that the application of the accounting policy formed in accordance with clauses 7 and 7.1 of these Regulations leads to the generation of information, depending on the presence, absence or method of reflection which in the accounting (financial) statements of the organization do not depend on the economic decisions of the users of these statements (hereinafter referred to as immaterial information)”, the organization has the right to choose the method of accounting, guided solely by the requirement of rationality (without applying clauses 7, 7.1 of these Regulations). The organization carries out classification of information as non-essential independently based on both the size and nature of this information (clause 7.4 was introduced by Order of the Ministry of Finance of Russia dated April 28, 2017 N 69n).

Thus, the organization has the right in its accounting policy to approve its procedure for reflecting in the financial statements the amounts of advances received and issued. At the same time, the legislation does not prohibit entering additional lines into the “Balance Sheet” form for disclosing information. So, if an organization has excluded VAT from turnover, then the VAT amount itself may be reflected in an additionally entered line in the balance sheet. Otherwise, users receive false information about actual accounts receivable and payable related to settlements with the budget for VAT on advances received.

You also need to take into account that you cannot use the calculation method (Amount of advances on account 60.02 * 20/120) when reflecting indicators in the balance sheet, since this form reflects only accounting data generated on the basis of the rules established by regulatory acts on accounting (Order of the Ministry of Finance RF dated 07/06/1999 N 43n (as amended on 01/08/2010, as amended on 01/29/2018) “On approval of the Accounting Regulations “Accounting Statements of an Organization” (PBU 4/99)”).

Thus, each organization has the right to choose its own method of reflecting advances and prepayments in the balance sheet, without forgetting paragraph 1 of Article 13 of Federal Law 402-FZ “On Accounting” dated December 6, 2011, which reads: “Accounting (financial) statements must give a reliable picture of the financial position of an economic entity as of the reporting date, the financial result of its activities and cash flows for the reporting period, necessary for users of these statements to make economic decisions.

Accounting (financial) statements must be prepared on the basis of data contained in accounting registers, as well as information determined by federal and industry standards.” Anna Kutilova, Director of Business-Audit LLC

GLAVBUKH-INFO

First of all, we note that within the framework of this consultation we do not consider issues relating to advances issued and received during the construction of fixed assets, the repayment of the cost of which is carried out within a period exceeding 12 months. The amounts of the advance received (advance issued) and the amount of VAT calculated on it (accepted for VAT deduction) are reflected separately in the balance sheet. Rationale for the conclusion: The procedure for drawing up and presenting financial statements is regulated by: - Federal Law dated December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law N 402-FZ); — Regulations on maintaining accounting and financial statements in the Russian Federation (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n, hereinafter referred to as Regulation N 34n); — PBU 4/99 “Accounting statements of an organization” (hereinafter referred to as PBU 4/99). Starting with the annual financial statements for 2011, organizations prepare financial statements according to the forms approved by Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n “On the forms of financial statements of organizations” (hereinafter referred to as Order N 66n). The balance sheet (as an integral part of the financial statements) must give a reliable and complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position (clause 6 of PBU 4/99 and clause 32 of Regulation No. 34n). The elements of information generated in accounting about the financial position of an organization, which are reflected in the balance sheet, are assets, liabilities and capital (clause 7.1 of the Concept of Accounting in a Market Economy of Russia (approved by the Methodological Council on Accounting under the Ministry of Finance of Russia and the Presidential Council of the Institute of Professional Accountants 12/29/1997) (hereinafter referred to as the Concept)). Based on clause 20 of PBU 4/99, information on assets and liabilities is reflected separately in the balance sheet (assets - in the assets of the balance sheet, liabilities - in the liabilities of the balance sheet). That is, assets and liabilities are subject to separate reflection in the balance sheet. At the same time, an offset between items of assets and liabilities is not allowed in the balance sheet, except in cases where such an offset is provided for by the relevant accounting provisions (clause 40 of Regulation No. 34n, clause 34 of PBU 4/99). The concepts of “assets” and “liabilities” are deciphered in the Concept: - assets are considered to be economic assets over which the organization received control as a result of fait accompli of its economic activities and which should bring it economic benefits in the future (clause 7.2 of the Concept). The definition of “future economic benefits” is given in paragraph 7.2.1. Concepts. This is the potential of assets to directly or indirectly contribute to the flow of cash into the organization; — a liability is considered to be the organization’s debt existing at the reporting date, which is a consequence of completed projects of its economic activity and settlements for which should lead to an outflow of assets. An obligation may arise due to a contract or legal norm, as well as business customs. The settlement of a liability usually involves the organization depriving itself of the relevant assets to satisfy the other party's claims. This can occur through the payment of funds or the transfer of other assets (provision of services) (clause 7.3 of the Concept). Based on the above definitions, receiving an advance from the buyer for an upcoming delivery entails the emergence of an obligation (to ship goods, provide services, etc.). Accordingly, the amount of such an advance should be reflected in the liability side of the balance sheet on line 1520 “Accounts payable”. By virtue of paragraphs. 2 p. 1 art. 167 of the Tax Code of the Russian Federation, the taxpayer must calculate VAT on the amount of such an obligation, which, on the basis of clause 5 of Art. 172 of the Tax Code of the Russian Federation is subject to deduction when repaying this obligation. That is, the accrual of VAT on the amount of the advance received entails the possibility of obtaining economic benefits (in the form of the right to deduction) in the future. Accordingly, the accrual of this VAT leads to the formation of an asset, therefore the amount of such VAT should be reflected in the balance sheet asset on line 1260 “Other current assets”. Transferring an advance to the supplier against an upcoming delivery entails the creation of an asset (receipt of economic benefit in the form of a product, service, etc.). Accordingly, the amount of such an advance should be reflected in the balance sheet asset on line 1230 “Accounts receivable”. Based on clause 12 of Art. 171 of the Tax Code of the Russian Federation, a taxpayer who has transferred an advance payment to a supplier has the right to claim VAT for deduction. However, by virtue of paragraphs. 3 p. 3 art. 170 of the Tax Code of the Russian Federation, the amount of tax on prepayment previously claimed by the buyer for deduction is subject to restoration in the tax period of receipt of goods and invoices for shipment from the supplier. That is, deducting VAT on the amount of the advance payment transferred to the supplier entails the emergence of a liability (an outflow of the asset by restoring the VAT previously accepted for deduction), therefore the amount of such VAT should be reflected in the liability side of the balance sheet on line 1550 “Other liabilities”. Thus, due to the fact that offsetting between items of assets and liabilities is not allowed, the amount of the advance received (advance issued) and the amount of VAT calculated on it (accepted for VAT deduction) are reflected separately in the balance sheet. The Ministry of Finance of Russia also agrees with this conclusion that the amounts of the advance received (advance issued) and the amount of VAT calculated from it (accepted for VAT deduction) are reflected separately in the balance sheet (see Recommendations for audit organizations, individual auditors, auditors for conducting an audit of annual financial statements organizations for 2012 (attachment to letter dated 01/09/2013 N 07-02-18/01)). At the same time, we note that in this letter, specialists from the financial department, based on economic logic, propose that receivables be reflected in the balance sheet as assessed minus the amount of value added tax subject to deduction (accepted for deduction) in accordance with tax legislation. Similarly, when an organization receives payment, partial payment for upcoming deliveries of goods by this organization (performance of work, provision of services, transfer of property rights), accounts payable should be reflected in the balance sheet as an estimate minus the amount of value added tax payable (paid) to the budget in compliance with tax laws. For your information: Let us note that the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Instructions for the Chart of Accounts) do not disclose the procedure for recording VAT amounts calculated by the organization from advance payment (received advances) and VAT amounts on prepayments received (advances received). In practice, these amounts are usually reflected in account 76 “Settlements with various debtors and creditors”, in separate sub-accounts: “VAT on advances received” and “VAT on advances issued”. This accounting procedure is fully consistent with the conclusions made above.Answer prepared by: professional accountant Lazukova Ekaterina Response quality control: auditor, member of the Moscow Administrative Offenses Association Vyacheslav Gornostaev February 27, 2013

| Next > |

Advances issued and received: procedure for registering accounting entries

Is a company obligated to make accounting changes based only on one recommendation from auditors?

11/27/2017 Author: Expert of the Legal Consulting Service GARANT Natalya Vakhromova

Due to the large balance sheet currency, the LLC was subject to a mandatory audit. The auditors checked the balance sheet and decided that it needed to be redone, since the data on lines 1230 and 1520 was reflected incorrectly. At the same time, they offered their own version of filling out these lines, in which they minus the balance on accounts 76.AB and 76.BA.

Accounts receivable in the form of advances issued are reflected by the organization, taking into account the amounts of VAT accepted for deduction, on line 1230 of the balance sheet. The VAT amounts recorded in account 76, subaccount “VAT on advances issued,” are reflected by the organization in the liability side of the balance sheet on line 1550.

Accounts payable in the form of advances received are reflected in the balance sheet liability on line 1520, taking into account the amounts of VAT calculated for payment. The amounts of VAT calculated on advances received are indicated by the organization in the asset balance sheet on line 1260. The amounts of VAT on advances issued and received are significant.

How should these lines be filled out? Is there a strictly defined algorithm for passing an audit?

On this issue we take the following position:

In the case under consideration, the organization did not make mistakes when reflecting in the balance sheet debts for advances issued and received. Therefore, no corrections to the balance sheet are required.

Justification for the position:

In accordance with part 1 of Art. 14 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law N 402-FZ), annual accounting (financial) statements generally consist of a balance sheet, a statement of financial results and appendices thereto.

Applications mentioned include:

— statement of changes in capital;

— cash flow statement;

— report on the intended use of funds (clause 2 of Order of the Ministry of Finance of Russia dated 07/02/2010 N 66n “On forms of financial statements of organizations”, hereinafter referred to as Order N 66n);

— other appendices to the balance sheet and financial performance report (explanations) in tabular and (or) text form (clause 4 of Order No. 66n).

The auditor's report is not included in the financial statements. Moreover, if the statements are subject to mandatory audit, then the organization must submit an audit report on the annual accounting (financial) statements to the state statistics body at the place of its state registration, either together with these statements (no later than three months after the end of the reporting period), or no later than 10 working days from the day following the date of the audit report, but no later than December 31 of the year following the reporting year (parts 1, 2 of Article 18 of Law No. 402-FZ).

It is not necessary to include an audit report in the annual accounting (financial) statements submitted to the tax authorities (letters of the Ministry of Finance of Russia dated January 30, 2013 N 03-02-07/1/1724, Federal Tax Service of Russia for Moscow dated March 31, 2014 N 13- 11/030545).

Cases when accounting (financial) statements are subject to mandatory audit are established in Art. 5 of the Federal Law of December 30, 2008 N 307-FZ “On Auditing Activities”, hereinafter referred to as the Law on Auditing Activities), as well as in other federal laws.

Information on the cases in which a mandatory audit of accounting (financial) statements should be carried out is published annually by the Russian Ministry of Finance. The list of cases of mandatory audit of accounting (financial) statements for 2016 is given in the information of the Ministry of Finance of Russia dated January 10, 2017.

In particular, a mandatory audit is carried out if the volume of revenue from the sale of products (sale of goods, performance of work, provision of services) of the organization for the previous reporting year exceeds 400 million rubles or the amount of assets of the organization’s balance sheet as of the end of the previous reporting year exceeds 60 million rubles ( clause 4 of part 1 of article 5 of the Law on Auditing).

As we understand from the question, it is on this basis that the organization’s annual reporting for 2021 is subject to mandatory audit. Accordingly, the organization must submit an audit report on these reports to the state statistics body within the time limits specified in Part 2 of Art. 18 of Law No. 402-FZ.

In addition, in accordance with paragraph 3 of Art. 36 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies” (hereinafter referred to as the LLC Law), information and materials to be provided to the participants of the limited liability company when preparing the general meeting of the company’s participants include, among other things, the conclusions of the audit the commission (auditor) of the company and the auditor based on the results of checking the annual reports and annual balance sheets of the company. Such information and materials within thirty days before the general meeting of the company’s participants must be provided to all company participants for review in the premises of the company’s executive body.

Let us remind you that the next general meeting of company participants must be held no earlier than two months and no later than four months after the end of the financial year (Article 34 of the LLC Law).

Thus, in the situation under consideration, the company is obliged to provide its participants with the opportunity to familiarize themselves with the auditor’s report on the company’s annual financial statements for 2021 in connection with the holding of the next general meeting of participants in 2017, which, as follows from the above norm, should have been held on time until 04/30/2017. However, administrative liability for failure to comply with this requirement is not established by law.

In the situation under consideration, when conducting an audit, the auditors found that in the balance sheet asset on line 1230, information about receivables in the form of advances issued was reflected by the organization, taking into account the amounts of VAT accepted for deduction on the basis of clause 12 of Art. 171, paragraph 9 of Art. 172 of the Tax Code of the Russian Federation, which subsequently, by virtue of paragraphs. 3 p. 3 art. 170 of the Tax Code of the Russian Federation are subject to restoration in the tax period of receipt of goods (provision of services, performance of work). The VAT amounts recorded on account 76, subaccount “VAT on advances issued”, are reflected by the organization in the balance sheet liability on line 1550 “Other liabilities”.

Let us recall that in accounting, transactions involving the transfer of advance payments to suppliers (contractors, performers) and the deduction of VAT amounts calculated and presented by the recipients of the advance payment are reflected in the accounting records as follows:

Debit 60, subaccount “Advances issued” Credit 51

— the transfer of advance payment to the seller is reflected;

Debit 68, subaccount “VAT” Credit 76, subaccount “VAT on advances issued”

— VAT presented by the seller is accepted for deduction.

In the situation under consideration, in the liability side of the balance sheet on line 1520, information about accounts payable in the form of advances received is also reflected by the organization, taking into account the amounts of VAT calculated for payment in accordance with paragraphs. 2 p. 1 art. 167, paragraph 1, art. 154, paragraph 4 of Art. 164 of the Tax Code of the Russian Federation, which, as goods are shipped (services are provided, work is performed), are accepted for deduction due to the provisions of clause 8 of Art. 171 Tax Code of the Russian Federation. The amounts of VAT calculated on advances received are reflected by the organization in the balance sheet asset on line 1260 “Other current assets”.

Transactions to receive an advance payment and calculate VAT on these amounts are reflected in accounting by the following entries:

Debit 51 Credit 62, subaccount “Advances received”

— advance payment has been received from the buyer;

Debit 76, subaccount “VAT on advances received” Credit 68, subaccount “Calculations for VAT”

— VAT is charged on advance payment amounts.

According to the auditors, on lines 1230 and 1520 of the balance sheet, the amounts of receivables and payables in the form of amounts of advances issued and received should be reflected excluding VAT, and the amounts of VAT accepted for deduction and calculated should not be reflected, respectively, in lines 1550 and 1260 of the balance sheet.

We believe that this position of the auditors is based on the position of the Ministry of Finance of Russia, set out in the section “Assessment of debt for paid (received) advances (prepayment)” of the Recommendations for audit organizations, individual auditors, auditors on conducting an audit of the annual financial statements of organizations for 2012 (appendix to letter of the Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01). The financial department, in particular, explained that the repayment of the obligation of the party that received the advance payment (advance payment) in the manner prescribed by the contract consists of the delivery of goods (performance of work, provision of services, transfer of property rights). Based on the requirements of the Tax Code of the Russian Federation regarding the payment and reimbursement of VAT, the amount of obligations subject to repayment does not include the amount of VAT.

Taking this into account, in the case of an organization transferring payment, partial payment for upcoming deliveries of goods (performance of work, provision of services, transfer of property rights), receivables are reflected in the balance sheet in the value minus the amount of VAT subject to deduction (accepted for deduction) in accordance with Tax Code of the Russian Federation.

Similarly, when an organization receives payment, partial payment for the upcoming supply of goods by this organization (performance of work, provision of services, transfer of property rights), accounts payable are reflected in the balance sheet as assessed minus the amount of VAT payable (paid) to the budget in accordance with the Tax Code RF.

A similar position is set out in Recommendation R-29/2013-KpR “VAT on advances issued and received”, adopted by the National Non-State Accounting Regulator “Accounting Methodological Center” foundation on 08/09/2013 (hereinafter referred to as Recommendation R-29/2013-KpR).

At the same time, we note that part 1 of Art. 21 of Law N 402-FZ establishes that documents in the field of accounting regulation include:

1) federal standards;

2) industry standards;

2.1) regulations of the Central Bank, provided for in part 6 of Art. 21 Law No. 402-FZ;

3) recommendations in the field of accounting;

4) standards of an economic entity.

Federal and industry standards are mandatory for use, unless otherwise established by these standards (Part 2 of Article 21 of Law No. 402-FZ).

At the same time, according to Part 1 of Art. 30 of Law N 402-FZ, until regulators approve the federal and industry standards provided for by this Law, the rules for maintaining accounting records and preparing financial statements approved by the Ministry of Finance of Russia before the date of entry into force of Law N 402-FZ (until 01/01/2013).

As stated in Part 7 of Art. 21 of Law N 402-FZ, recommendations in the field of accounting are adopted in order to correctly apply federal and industry standards, reduce the costs of organizing accounting, as well as disseminate best practices in organizing and maintaining accounting, the results of research and development in the field of accounting. Unlike standards, recommendations in the field of accounting are applied on a voluntary basis (Part 8 of Article 21 of Law No. 402-FZ).

From the above provisions of Law N 402-FZ it follows that Recommendations for audit organizations, individual auditors, auditors on conducting an audit of the annual financial statements of organizations for 2012 (appendix to the letter of the Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01) and Recommendation An organization can apply R-29/2013-KpR, but is not obliged to.

At the same time, none of the current rules for maintaining accounting records and preparing financial statements approved by the Ministry of Finance of Russia (Part 2 of Article 21, Part 1 of Article 30 of Law N 402-FZ) specifies the procedure for reflecting debt on advances issued and received in the given recommendations. not installed.

Thus, according to clause 73 of the Regulations on maintaining accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n (hereinafter referred to as Regulation N 34n), settlements with debtors and creditors are reflected by each party to the transaction in their accounting statements in amounts arising from accounting records and recognized by it as correct.

As follows from paragraph 36 of PBU 4/99 “Accounting statements of an organization” (hereinafter referred to as PBU 4/99), the rules for evaluating individual items of financial statements are established by the relevant accounting provisions.

At the moment, there are no special accounting provisions (PBU) for accounting for receivables and payables.

At the same time, according to paragraph 34 of PBU 4/99, offsets between items of assets and liabilities, items of profit and loss are not allowed in the financial statements, except in cases where such offset is provided for by the relevant PBUs. A similar rule is contained in paragraph 40 of Regulation No. 34n.

In this regard, it is not allowed, for example, to set off the debit balance on account 62 “Settlements with buyers and customers” and the credit balance on the subaccount “Advances received”.

Consequently, accounts receivable and payable are reflected in the balance sheet “expanded”. In addition, clause 38 of PBU 4/99 establishes that items in the financial statements prepared for the reporting year must be confirmed by the results of the inventory of assets and liabilities. And as you know, in payment orders and reconciliation acts with counterparties, debts on advances received and issued are indicated in full, including VAT.

Since, according to Part 1 of Art. 13 of Law N 402-FZ, the balance sheet is compiled on the basis of data contained in accounting registers, as well as information determined by federal and industry standards (in this case, based on the current PBU 4/99 and Regulation N 34n), then if available as of December 31 .2016 debit balance on accounts 60, subaccount “Advances issued” and 76, subaccount “VAT on advances received”, it can be reflected in the balance sheet in full amount, respectively, on lines 1230 and 1260 of the balance sheet asset. The credit balance of accounts 62, subaccount “Advances received” and 76, subaccount “VAT on advances issued” can also be reflected in full in lines 1520 and 1550 of the balance sheet liability, respectively.

We believe that this procedure for reflecting in the balance sheet the amounts of receivables and payables for advances issued (received) does not contradict the current regulatory acts on accounting, therefore errors for the purpose of applying the provisions of PBU 22/2010 “Correcting errors in accounting and reporting” (hereinafter - PBU 22/2010) does not arise in this case (clause 2 of PBU 22/2010).

In our opinion, in the situation under consideration, make changes to the balance in the manner established by paragraphs. 7, 8, 9, 10 PBU 22/2010, there are no grounds.

Some auditors adhere to a similar position (see, for example, Question: OJSC XXX reflects in the balance sheet on line 15202 “Advances received” the amount of accounts payable, including VAT. In the conclusion of the audit commission of OJSC XXX based on the results of an audit of financial and economic activities for 2012, recommendations were made that advances in accounts payable should be reflected minus VAT paid, since this led to an overestimation of the amount of receivables and payables by the amounts indicated in line 12601 of the balance sheet. These recommendations were given on the basis of a letter from the Ministry of Finance of the Russian Federation dated 01/09/2013 N 07-02-18/1 “Recommendations for audit organizations, individual auditors, auditors on conducting... (LLC “Audit-new technologies”, June 2013)).

Let us recall that if the regulatory documents do not establish accounting methods for a specific issue, then when forming an accounting policy, the organization develops an appropriate method based on accounting provisions, as well as International Financial Reporting Standards (clause 7 of PBU 1/2008 “Accounting organizational policy").

That is, the company can independently determine the procedure for reflecting VAT amounts calculated on advances issued (received) in the financial statements and consolidate it in the accounting policy. This will eliminate the possibility of disagreements with auditors in the future.

Please note that there is no special algorithm for passing the audit for audited entities. At the same time, when conducting an audit, auditors are guided by the Rules (standards) of auditing activities.

According to Part 1 of Art. 7 of the Law on Auditing, auditing activities are carried out in accordance with international auditing standards, which are mandatory for audit organizations, auditors, self-regulatory organizations of auditors and their employees, as well as with the auditing standards of self-regulatory organizations of auditors.

Moreover, if the agreement to conduct an audit of the accounting (financial) statements of an organization was concluded before January 1, 2017, the auditing organization or individual auditor has the right to conduct an audit of the accounting (financial) statements, including drawing up an audit report, under such agreement in accordance with auditing standards in force before the entry into force of international auditing standards (Part 9.1 of Article 23 of the Law on Auditing, clause 3 of Order of the Ministry of Finance of Russia dated November 9, 2016 N 207n, clause 3 of Order of the Ministry of Finance of Russia dated October 24, 2016 N 192n).

If the audit agreement was concluded in 2021, then when conducting an audit of financial statements and drawing up an audit report, the auditor must be guided by international auditing standards put into effect by orders of the Ministry of Finance of Russia dated November 9, 2016 N 207n and dated October 24, 2016 N 192n.

GUARANTEE

Post: