Let us remind you that the 6-NDFL report must be submitted by all organizations and individual entrepreneurs - employers with employees and tax agents who pay income to individuals.

The 6-NDFL calculation form and the procedure for filling it out were approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] The calculation is made on an accrual basis for the first quarter, for six months, for nine months and for the year. Data is taken from tax registers.

In 6-NDFL, the tax agent provides general information on all individuals who received income from him. These are the amounts of paid income, provided tax deductions, calculated and withheld personal income tax and the timing of its transfer to the budget (clause 1 of Article 80 of the Tax Code of the Russian Federation).

Transfer and dismissal of personnel

Before liquidation is carried out, you will have to decide what to do with the staff: transfer or dismiss. While employees are registered, it is necessary to calculate wages and submit reports.

- If the OP is located in the same area as the company, then it is necessary to offer employees similar and other vacancies available in this area. You need to offer work in another locality only when it is provided for in a labor contract, collective agreement or agreement. Nothing suitable was found, the employee refused the vacancies offered to him - we dismissed him under clause 7 of part 1 of Article 77 of the Labor Code. In this case, the employee receives severance pay in the amount of two weeks’ average earnings (Article 178 of the Labor Code of the Russian Federation).

- An OP located in another locality carries out a dismissal procedure similar to liquidation:

- warning staff at least two months before the event;

- upon dismissal, severance pay is paid;

- before employment (for the period while workers are registered with the employment center) financial support - maintaining average earnings (no more than three months and taking into account severance pay).

Important! Check the employment contract to see what place of work is indicated. The algorithm for dismissal or transfer depends on this.

Of course, with the consent of the employees, you can transfer them to another branch, dismiss them at your own request (for example, the employee was offered a position in another company) or by agreement of the parties. The Labor Code does not prohibit doing this; the main thing is not to exert pressure or mislead employees. When all formalities are completed, the activity ceases.

Message to the tax office

The procedure for notifying the inspectorate of cessation of activity depends on the type of unit.

Branch or representative office:

- We check whether the information is included in the charter. No - go to point 2, yes - we make changes to the constituent documents, fill out and submit form P13001 to update the Unified State Register of Legal Entities, do not forget to pay the fee if the documents are not submitted electronically through a personal account with an electronic signature.

- We fill out the message form S-09-3-2. You can send it via personal account, mail, TKS (operator) or hand it over in person.

- After making a decision on liquidation (issuing an order), you must submit a message and make adjustments to the register within 3 days.

Note! When an on-site tax audit is carried out or initiated against a taxpayer, the OP is not deregistered until its completion.

When an ordinary OP is liquidated, it is enough to issue an order and submit a message. The period is similar.

It is recommended that you submit all reports before completing the procedure. After liquidation, the transfer will become impossible; the tax authority will refuse to accept documents based on deregistration of the taxpayer.

How and where to submit reports

Let us examine this issue in relation to the type of tax or taxation system; in each case the rules are different.

UTII

I wrote above that it is recommended to submit reports in advance - before liquidation. The reason is the technical impossibility of the inspection to accept documents after.

This does not mean that if you did not have time (forgot) to submit the report, then the train has left. In the case of a UTII declaration, it is necessary to report to the Federal Tax Service of the “head”, and indicate the OKTMO of the closed OP.

By the way! It is also advisable to pay taxes, penalties and other payments to the budget before liquidation.

Do not forget to submit an application to the Federal Tax Service to deregister the payer of the imputed tax UTII-3. Specify the reason - code 4 “other”. Term – within 5 days from the date of termination of activity.

If there were several divisions in one city, they were registered with one tax office of their choice, and one of them closed, only this point is deregistered. The application indicates code 4, the application indicates a specific address, the rest continue to work and report as before.

USN and Unified Agricultural Tax

Declarations for the single tax (UST) and the unified agricultural tax (UST) are submitted in general throughout the organization.

Income tax

According to the Tax Code, a company that has separate units must provide declarations for the organization as a whole (including details of divisions) and separately for the location of the OP (clause 1 of Article 289 of the Tax Code of the Russian Federation). In this case, the tax is paid to the federal and regional budgets. The federal part is not broken down in any way, but the regional part is paid for each OP. For several divisions located in one subject of the Russian Federation, by assigning one person responsible, you can calculate the tax jointly and submit declarations in the same way. To do this, a notification is sent to the Federal Tax Service by December 31 of the year preceding the reporting year.

If a responsible OP is closed, you need to not only notify the inspectorate about its liquidation, but also inform about the selection of a new representative through whom tax payment and reporting will be submitted. When closing one of several divisions, only report a change in their number (clause 2, Article 288 of the Tax Code).

Note! If a company on OSNO has closed its last representative office (branch) and does not intend to open them in the future, then from January 1 of the next year, subject to filing an application before December 31 of the current year, it has the right to apply a simplified taxation system.

Before the moment of liquidation, reports are submitted at the place of registration of each OP or responsible person (depending on whether there was one), after that - at the location of the organization. For details of filling out the details of the title and other sheets of the declaration when closing, see the Filling Out Procedure approved by Order No. ММВ-7-3 / [email protected] dated September 23, 2019 - clauses 2.7, 2.8, 4.5, 10.1, 10.2 and others.

VAT

As with the single tax on the simplified tax system, the declaration is submitted for the company as a whole. In this case, the checkpoint and addresses of departments are indicated in the invoice or UPD. After the termination of their activities, make sure that there are no errors in the documents issued.

Transport, land, property taxes

Starting from the periods of 2021, calculations for transport and land taxes have been cancelled. For past periods, reports must still be submitted at the place of registration of the property. If the property of the liquidated OP was disposed of later (sold, transferred to pay off obligations to counterparties, etc.), then the organization will have to report, indicating the OKTMO of the former OP.

If the property remains, we continue to pay taxes on it until disposal. The same should be done with property tax calculations. However, this is only true for real estate.

With movable property, the scheme is slightly different: according to Article 384 of the Tax Code of the Russian Federation, for an enterprise that does not have a separate balance sheet, reports are submitted by the parent organization.

For the tax period (year) from 2021, it is possible to provide a single declaration for property located in one constituent entity of the Russian Federation, provided that it meets several requirements: the tax base is determined based on the average annual value, standards for contributions to local budgets have not been established, and the taxpayer has declared about your intention before March 1 of the reporting year to the tax authority of the subject with which you are registered for real estate (clause 1.1, Article 386 of the Tax Code).

RSV

The calculation of insurance premiums is submitted in general for the organization, if its divisions are not allocated to a separate balance sheet and do not have the rights to calculate and pay income to employees.

Important! Granting the authority to calculate and pay remuneration in favor of individuals requires filing a report with the Federal Tax Service on the selected OP within one month from the date of adoption of the relevant decision (clause 7, clause 3.4 of Article 23 of the Tax Code of the Russian Federation).

When granting the right to make such a payment (a bank account is required), the DAM is surrendered at the location of the OP. The last report is submitted indicating code 9 on the title page in the line “Deprivation of authority (closing) of a separate division.” In the future, if it is necessary to submit updated calculations, they are submitted by the organization, but with code 9 and the checkpoint of the inactive OP.

4-FSS

The calculation is submitted to the place of registration of the unit only if all three conditions are met:

- Separate balance.

- Granting powers to calculate and pay income to individuals.

- I have an open bank account.

Note! In order to independently report, the OP must register as an insurer in its FSS branch.

The same rules apply as for the DAM: after closing, reporting is submitted “head on”. In all other cases, the 4-FSS calculation is submitted one for all.

2-NDFL and 6-NDFL

Regardless of the powers of the branch, representative office or any other division, the calculation of 6-NDFL and 2-NDFL certificates are submitted for each separately. More precisely, they surrendered until 2021. Starting from January 1, 2020, you can choose one authorized person from several public organizations if they are located within the boundaries of the same municipality. The Federal Tax Service must be notified of this before January 1 of the year from which the new procedure will be in effect.

It is necessary to notify the inspectorate of the closure of the responsible unit and appoint a new one. If the taxpayer applies a patent or UTII, then he submits certificates and calculations, pays personal income tax at the place of business (clause 7 of Article 226 of the Tax Code).

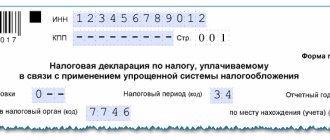

After liquidation, reporting is submitted to the parent organization, and the cover page of the calculation indicates:

- OKTMO closed OP.

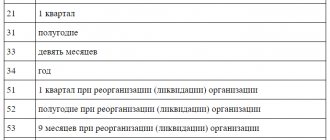

- In the line “Form of reorganization (liquidation)” - 0 (according to Appendix No. 4 to the filling procedure).

- TIN/KPP of the reorganized organization - TIN of the “head” and KPP of the unit that has ceased to operate.

SZV-M and SZV-STAZH

If a division, as in the case of the DAM, is vested with the right to accrue and pay income to individuals and has a separate current account, then it is registered with the Pension Fund of the Russian Federation (clause 3, clause 1, article 11 of Federal Law No. 167-FZ). Registration occurs automatically based on data from the Federal Tax Service register (after entering information into the Unified State Register of Legal Entities).

After liquidation has occurred, all information is provided directly by the organization.

Updated calculation

According to paragraph 6 of Article 81 of the Tax Code of the Russian Federation, the updated calculation must be submitted:

- if the fact of non-reflection or incomplete reflection of information is revealed;

- if errors are identified that lead to an underestimation or overestimation of the amount of tax to be transferred.

On the title page put:

- when submitting the primary calculation – the value “000”;

- when submitting an updated calculation - the adjustment number (value “001”, “002”, etc.).

Thus, an “adjustment” is submitted if the tax agent discovers that he did not reflect any information in the initial calculation or made an error that led to an understatement or overstatement of the tax amount.

Reconciliation of calculations before and after

It is not necessary to carry out a reconciliation, but given the intricate process of work, the peculiarities of submitting reports, paying taxes and contributions, it is much easier to deal with payments.

Why do I recommend duplicating the reconciliation and conducting it before and after liquidation? “Before” there are always some movements, the Federal Tax Service may not have time to enter the submitted reports into the program, and the reconciliation will contain incomplete data.

Important! When transferring taxes, except regional ones, to a closed OP, you need to pay the debt to the “head” inspection, indicating the OKTMO and checkpoint of the inactive unit. With incorrect details, the funds will “freeze” as unknown; you will have to write an application for clarification.

The exchange between inspections is going very badly. Information is lost, transmission is delayed, data is sent with errors. Therefore, having received a claim with arrears, having payment orders in hand and confidence in the accuracy of payments, write a response with supporting documents attached to the Federal Tax Service as quickly as possible.

If there is a repeated demand or, in the worst case, blocking of the account, file a complaint with the head of the inspectorate; if there is no response, file a complaint with the higher-level Department.

Sample of filling out the title page 6-NDFL in 1C 8.2 ZUP 2.5

When filling out the title page of 6-NDFL in the 1C ZUP 2.5 program, you work with the “Separate division” field: the field is either selected or not. If you want to fill out calculation 6 – personal income tax for a separate division, then in the “Separated division” field, select the division directly:

OKTMO of this unit and code 220 are already automatically substituted:

If you do not select a division, it is considered that this is a calculation for the parent organization, which means that OKTMO of the organization itself is established here:

And the code needs to be set to 212 “At the place of registration of the Russian organization”: