What does vacation pay consist of?

There are 3 types of holidays:

- annual paid - basic and additional;

- unpaid (at your own expense, without pay); there are varieties - for example, training or with subsequent dismissal; in some cases, such leave may be paid;

- in connection with the birth of a child - for pregnancy and childbirth, for child care.

In this article we talk only about basic paid leave for a year-round job. Its standard annual duration is 28 calendar days. In the first year of work in the company, you can use it only after six months, but by agreement, the employee can receive paid leave earlier.

Vacation pay is the average daily earnings multiplied by the number of days of rest. Non-working holidays that are included in vacation are not paid.

Legal leave

The Labor Code says: every officially working citizen has the right to request leave provided by his superiors every year. It often lasts 28 days, although many bosses ask their subordinates to take vacation in “pieces” of a week or a week and a half. All vacation days are paid by the company. This is stated in Article 115 of the Labor Code of the Russian Federation.

Article 115 of the Labor Code of the Russian Federation

A person should be allowed to rest every year from the moment he has worked for at least six months (Article 122 of the Labor Code of the Russian Federation). However, you can agree with your employer and ask for a break a little earlier, but there must be good reasons for this. For minor citizens, leave can be issued earlier, and management is obliged to satisfy the request (Article 267 of the Labor Code of the Russian Federation).

Important ! If an employer refuses to let an employee go, then he is violating his rights.

Article 122 of the Labor Code of the Russian Federation

Calculating the amount of money for an incomplete calculation period is not an easy task, and this issue is very acute for all participants in the employment contract.

Why vacation pay is always less than salary

Average daily earnings (ADW) - the vacation pay base - is calculated by calendar days, so it is usually less than the cost of one working day.

For example, the salary is 100,000 rubles. If there are 22 working days in a month, for each of them the employee receives approximately 4,545 rubles. When calculating the ADD, the average monthly number of days per year is taken, which is equal to 29.3 days. When dividing 100,000 rubles by 29.3 days, the amount comes out less - 3,412 rubles.

So, if there are 22 working days in September and 20 in June, then one working day in June costs more than in September.

Rules for calculating average daily earnings

To clarify the question you are interested in, you must:

- First, find out information about the calculation period.

- Determine the amount of payments issued to the citizen during this time period.

The calculation includes the calendar year until the start of the vacation.

Accounting for months in the calendar is done like this:

- January: from 1st to 30th inclusive.

- February: from 1st to 28th inclusive.

- March: from 1st to 31st inclusive.

- The remaining months are calculated similarly.

When calculating vacation pay, the days worked by the employee before the vacation are taken into account.

Example one . How to find out the calculation period?

A citizen wants to go on vacation from 07/10/19.

How then is the calculation period calculated:

- time from July to December '18;

- time from January to June '19.

How to calculate the amount to be paid

To calculate vacation pay, use the following formula:

average daily earnings (ADE) = income for the billing period ÷ hours worked in calendar days

The amount of income for the billing period (the last 12 months or less in the case of an incomplete year of work) includes allowances and bonuses for the last year, but does not include other payments: sick leave, vacation pay, financial assistance, travel allowances and everything that is not provided for by the payment system labor.

Let's say your income for the last 12 months is 390,000 rubles. Of these, 20,000 are business trips and sick leave.

The sick leave period is nine days in August. It turns out that 11 months out of 12 are considered fully worked, that is, 322.3 calendar days (29.3 × 11).

We count the number of calendar days that fell on the worked period in August: (31 − 9) ÷ 31 × 29.3 = 20.79.

Vacation pay will be accrued based on the following number of days: 322.3 + 20.79 = 343.09.

Let's calculate SDZ:

(390,000-20,000) rub. / 343.09 days = 1078.43423 rubles.

This means that the amount of vacation pay for two weeks is 15,098.0792 rubles.

Part 3–4 art. 139 Labor Code of the Russian Federation

How are vacation pay calculated?

The law assumes that money is either given to the employee in person or transferred to a bank card. This happens three days before the vacation (this is specified in Article 136 of the Labor Code of the Russian Federation). Sometimes money is given out earlier, but if they do it later, they are breaking the law.

When a citizen has worked for the required period, the procedure for calculating vacation pay is as follows:

- the person must submit an application requesting leave;

- then an order for the enterprise is formed;

- in the settlement department the amount of money is calculated.

Example of a vacation application

You can take annual paid leave.

What taxes do you need to pay?

According to the Labor Code of the Russian Federation, if the vacation is paid for by the employer, the amount of vacation pay is subject to taxes. Personal income tax - 13% for residents of the Russian Federation and 30% for non-residents - is withheld on the day of payment of vacation pay. The deadline for tax remittance is set for the last day of the month in which the employee’s vacation was paid.

Personal income tax

In addition, insurance premiums must be paid from vacation pay. They are accrued for the same reporting period as vacation pay and transferred to the budget no later than the 15th day of the next month.

Letter of the Ministry of Labor dated August 12, 2015 No. 17-4/OOG-1158

What to do with non-working days?

Everyone knows that in the periods from 03/30/2020 to 04/30/2020 and from 05/06/2020 to 05/08/2020. non-working days have been established (Presidential Decrees No. 206 of 03/25/2020, No. 239 of 04/02/2020, No. 294 of 04/28/2020). Despite the fact that employees did not fulfill their labor duties, during these periods, according to the Decrees, their wages are retained and must be paid by the employer.

But should it be taken into account in the future when calculating vacation pay?

Rostrud and the Ministry of Labor of the Russian Federation answered this question. Moreover, at first their opinions were completely opposite.

Thus, Rostrud on its information portal “Onlineinspektsiya.rf”, responding to incoming questions from users, adhered to the point of view that the retained salary for the period of non-working days should be included in the future in the calculation of average earnings. Since labor legislation does not provide for the concept of non-working days as a period of release of an employee from work.

In addition, the retained cash payment to employees has the status of wages - therefore, this payment must be included in the calculation of average earnings.

The Ministry of Labor, in letter No. 14-1-B-585 dated May 18, 2020, refers to subparagraph “e” of paragraph 5 “Regulations on the specifics of the procedure for calculating average wages” (approved by Russian Government Decree No. 922 dated December 24, 2007). This paragraph lists the periods and amounts accrued during this time that must be excluded when calculating average earnings.

According to the Ministry of Labor, the introduction of non-working days with retained earnings corresponds to paragraphs. “e” clause 5 of the Regulations, which means that this period and payment must be excluded when calculating average earnings.

However, at the moment, Rostrud agrees with the opinion of the Ministry of Labor, as evidenced by the answers to questions No. 131994 dated June 14, 2020 and No. 131953 dated June 12, 2020 on the portal.

Although letters and official responses from the Ministry of Labor and Rostrud are not normative acts and are only advisory in nature, they should nevertheless be followed, because the opinions of these departments are widely used in practice by labor inspectors during inspections.

Important:

1. If the organization had the right to continue working on declared non-working days, or employees, under an additional agreement to the employment contract, worked remotely (that is, the timesheet reflects working days), then this earnings and days do not need to be excluded when further calculating average earnings.

2. If the organization did not work during the period of self-isolation and employees were paid a retained cash payment (that is, the timesheet shows days as non-working days with pay), then in this case, in accordance with the position of Rostrud and the Ministry of Labor, non-working days and payments for them should be excluded from the calculation average earnings (that is, in situations where the employee did not actually work).

3. If the employer has already paid the employee vacation pay and, when calculating average earnings, mistakenly took into account payments on non-working days, then the vacation pay must be recalculated. And if recalculation results in an additional payment, then it must be paid to the employee and compensation must be calculated for each late payment day in the amount of 1/150 of the refinancing rate. When withholding recalculated vacation, you must obtain a withholding application from the employee.

Features of leave after 6 months for minors

The Labor Code of the Russian Federation allows for the possibility of employing minors. However, this category of workers has certain additional rights, consisting of a special regime for carrying out labor activities.

Thus, the number of days a minor can count on is 31. The employer is also obliged to allow him to go on unpaid leave, related, for example, to undergo training.

In addition, there are additional preferences related to the procedure for going on vacation. A minor does not need to work for 6 months for a specific employer. He can leave at any time without taking into account the established vacation schedule. The employer does not have the right to refuse such an employee to exercise his rights.

Important! The Labor Code does not allow the replacement of vacation days for a minor with monetary compensation.

Vacation experience

The vacation period of employees with part-time work and (or) part-time work week is calculated in exactly the same way as for ordinary employees <1>.

That is, it must include all the same periods as other employees. In this case, working days, including part-time ones, and all weekend days in case of a part-time work week are counted towards the time of actual work <2>. For example, if an employee works 4 hours 3 days a week - Tuesday, Wednesday, Thursday, then he must include in his vacation experience:

- days worked - Tuesday, Wednesday, Thursday - as full days;

- Weekends are Monday, Friday, Saturday and Sunday.

And if the working year of such an employee began on 06/01/2013 and he did not have periods not taken into account in the vacation record (for example, vacation at his own expense for more than 14 calendar days), then this year will end on 05/31/2014.

And the establishment of part-time work may affect the length of service required for leave “for harm”. After all, this length of service includes only the time actually worked by the employee in harmful conditions <3>. Moreover, <4> are counted towards such length of service:

- <if> in the List of hazardous industries <5> in relation to the position (profession) of the employee there is an entry “permanently employed” or “permanently working” - days on which the employee was actually employed in hazardous conditions full time;

- <if> there is no such entry in the List - days on which the employee was employed in hazardous conditions for at least half of the working day.

This means that if an employee worked in hazardous conditions for less than the established time, then such a day does not need to be taken into account in the length of service for leave for hazardous work.

Is vacation pay calculated if you have worked for 5 months?

The legislator has established that an employee has the opportunity to exercise his right to rest only if he has worked in a particular organization for less than six months. However, in this case there are exceptions.

The following employees can take leave earlier:

- women before going on maternity leave;

- persons who have adopted a young child;

- minors.

In addition, current labor legislation allows for the possibility of going on vacation before the end of six months upon reaching an agreement with the employer. However, it should be noted that business managers rarely meet their employees halfway in this case.

This is due not only to the need to ensure the workflow, but also to difficulties in making final payments if the employee decides to quit immediately after the vacation.

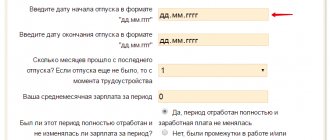

Calculation of vacation pay in 2021

Once we have found out what the calculation period includes, we can determine the money spent for a specific period of time.

All money received during the period when a person performed duties is taken into account, and it is necessary to take into account bonuses, additional payments, allowances, incentives, and the like.

Important ! The payments taken into account can be viewed in Decree of the Government of the Russian Federation dated December 24, 2007 No. 922.

More specifically, this includes payments in various forms, allowances, additional payments of various kinds, compensation paid for working conditions and working conditions.

They take into account all the money received by an employee for a certain period

Example two . Calculation of the average salary taking into account the necessary payments

The person plans to go on vacation from 07/05/19.

The calculation involves taking into account the calendar year before the start of the holiday.

We take into account the following time periods:

- from July to December '18;

- from January to June '19.

Every month a person earns 20 thousand rubles.

In addition to salary, a person can be rewarded for fulfilling or exceeding work plans. More information is provided in the Regulations on Bonuses.

That is, if in March a person coped with the work plan and exceeded it, he was given a bonus of 8 thousand rubles.

In April, the situation repeated itself, but the overfulfillment was slightly different, so he was paid an incentive of 5 thousand rubles.

Various premiums are usually taken into account when calculating the SDZ

It was not possible to fulfill the work plans for the next month, but the citizen requested financial support amounting to 4 thousand rubles (due to the birth of a child).

Now let's calculate the average salary of a person:

- Let's calculate how much money he received in a year:

12*20.000=240.000

- We calculate the incentive payments that were given to him in March and April of 1919.

240.000+8.000+5.000=253.000

- Material support is not taken into account.

Material support is not taken into account when calculating SDZ

Can an employee go on vacation 6 months after employment?

It has been established that a working citizen has the right to leave once a year. This raises the question of when exactly it is provided. The Labor Code of the Russian Federation does not give a direct answer to it, however, it establishes that the corresponding right arises for an employee after 6 months after employment, subject to the continuity of performance of job duties.

However, in practice, employers rarely satisfy requests for vacation after six months, since, as a rule, organizations have special vacation schedules, within which the appropriate dates and periods for each employee are already agreed upon in advance.

At the same time, the law allows for the possibility of providing rest time until the expiration of 6 months if there is an agreement between the parties to the employment contract.

In addition, certain categories of workers are particularly highlighted who are granted the right to go on vacation until six months have elapsed from the date of employment.

These include:

- minors;

- women before and after going on holiday according to the BiR.

Reference! Employees whose spouse is on leave under the BiR are granted leave regardless of the previously established schedule. Their expression of will alone is enough.

What to do if the manager refuses leave after 6 months

The Labor Code of the Russian Federation establishes that the right to rest on a general basis arises after six months of work for one employer. In this case, many employees mistakenly believe that management should provide them with days of rest immediately after the expiration of 6 months of continuous performance of a labor function. However, in practice this is absolutely not the case.

The thing is that in every organization where hired employees work, an appropriate schedule is approved, which is approved in advance. When compiling it, both the interests of employees entitled to annual leave and the interests of the employer, who requires a certain number of active staff positions to carry out business activities, are taken into account.

Thus, in practice, it can be provided significantly later than the date on which the six-month period ends.

However, certain categories of employees have the right to go on vacation without taking into account the corresponding schedule. For example, these are minors. They have the right to independently determine the time of vacation at their own discretion.

If an employer denies the right to rest without any reason, this is a violation of labor laws. In this case, the employee has the right to file a complaint with the labor inspectorate, whose specialists will conduct an inspection of this circumstance.

If the illegality of the refusal is confirmed, the employer will be given an order to eliminate the violation, and may also be held accountable. In addition, an employee can go to court to protect his rights.

Responsibility for violations

If an employer violates the regulations for making vacation payments, the state imposes sanctions on him. For a one-time offense:

- you must pay a fine of 30-50 thousand rubles (for organizations);

- For an entrepreneur, the fine is 1-5 thousand rubles.

For repeated violations, the sanctions increase:

- for legal entities – 50-70 thousand rubles;

- private entrepreneurs - 10-20 thousand.

If a manager violates the regulations on vacation pay, he will be punished financially by the state

Important ! Also, violating managers are sometimes banned from holding leadership positions for several years.

Calculating vacation pay for six months is no different from calculating vacation pay for a year worked - only you need to take into account not 12, but 6 months.

Examples of vacation pay calculation

Let us remind you that to calculate vacation pay, a calculation note, form T-60, is used, the form and sample for filling it out can be downloaded here.

Note: all of the above formulas are applicable to employees who are on a part-time basis, without reservations.

Let's consider a standard case: the employee worked for a full year, during which he was not sick or went on leave without pay. Utkin goes on annual paid leave from 10/01/2015 to 10/28/2015, leave is granted for a fully worked year. Every month Utkin received the same salary in the amount of 30,000 rubles. Let's calculate what vacation pay he should be paid. Initial data: Another example is related to the situation when an employee gets a job and, without working for 12 months, goes on vacation.

How to calculate vacation pay if an employee has worked for less than 12 months?

Initial data: