Form

It should be noted right away that there is no specific form for drawing up a power of attorney for the chief accountant.

In this regard, it can be drawn up in any form, but with all the necessary information indicated. Thus, according to the Civil Code of the Russian Federation, when writing a trust document for the chief accountant, you should be guided by the following rules:

- the document must only be in written form, but it is permitted to compose it either in one’s own hand or using printing equipment;

- presence of confirming signatures;

- mandatory indication of the date, as well as, if necessary, the validity period of this document.

Remember that without the specified date, the power of attorney will be invalid!

You can also take note of the fact that many organizations use letterhead to draw up such trust papers.

( Video : “Everything about drawing up a power of attorney”)

In what cases is it necessary to draw up a power of attorney?

You are probably wondering whether there are certain situations when a power of attorney for the chief accountant may be useful. Yes, such a document may be requested during many legal processes, namely:

- manipulation of documents with the bank, as well as receiving receipts for the current account;

- transfer of tax documentation to the Federal Tax Service;

- trust document with the right to sign the chief accountant;

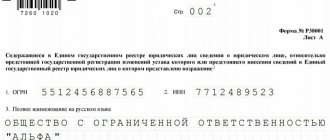

- change of state registration in the constituent documents of the organization;

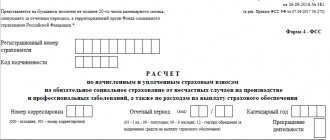

- transfer of a package of documentation to the pension fund and social insurance of the Russian Federation;

- familiarization with the results of inspections, as well as with the requirements for the provision of papers.

Do I need to have a power of attorney certified by a notary?

According to the current legislation of the Russian Federation, a power of attorney for the chief accountant does not require notarization. For the document to gain legal force, it is enough to affix the signature of the head and the seal of the organization.

However, there are still exceptions in the following circumstances:

- the trust document is issued from an individual entrepreneur;

- a power of attorney involves the implementation of transactions for which the intervention of a notary is required by law;

- filing applications for state registration;

- the document is drawn up without the right to cancel it.

What is an accounting power of attorney?

Power of attorney, in accordance with paragraph 1 of Art. 185 of the Civil Code of the Russian Federation is a written authority that can be issued by one person to another for representation before a third party.

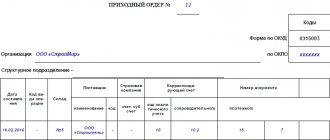

An accounting power of attorney can delegate to another employee of the enterprise the authority to accept inventory, accept and sign documents.

In what situations may it be necessary to draw up this power of attorney?

An employee handling the finances of an enterprise bears great responsibility, therefore strict requirements are imposed on persons who can maintain accounting records in accordance with Art. 7 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”: in particular, they are required to have a higher education, at least three years of experience in the accounting field and no criminal record related to crimes in the economic sphere.

However, in the activities of an enterprise, situations occur whose resolution does not require deep knowledge in the field of accounting: for example, it is necessary to pick up a copy of the company’s financial documents from a counterparty or to receive delivered goods for the enterprise.

This may coincide with the accountant's vacation or going on sick leave, and if these operations are not completed, the work of the enterprise may be slowed down.

The head of the enterprise has the authority to carry out these operations (his signature is valid on any documents of the organization), but in practice, directors usually entrust this to their employees. It is in such cases that a power of attorney for accounting documents is drawn up.

We recommend material: What to do if the insurance company refuses to pay under compulsory motor liability insurance.

How to correctly draw up a power of attorney for the chief accountant in 2021?

As we wrote earlier, the power of attorney for the chief accountant is strict documentation. Therefore, such a document must be drawn up as correctly as possible. In general, there are no specific rules for writing a power of attorney. However, to avoid any disputes with third parties, all necessary information must be clearly indicated here.

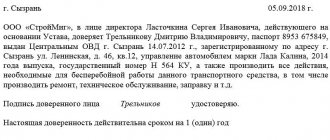

- The first thing any trust document begins with is the name, date and place in which it is issued.

- This is followed by the name of the organization, as well as its legal form.

- Next, you need to enter all the data of the head of the company, namely: full name, passport details and documents on the basis of which he holds his position.

- After this, information about the proposed representative is usually written down. In our case, this is the chief accountant (full name and passport details).

- The following is a paragraph with a list of powers that the manager gives to his subordinate. Special attention should be paid here, since the operations that the chief accountant can perform depend on the entered powers.

- The following entry assumes the validity period of this power of attorney and the right to “reassignment”. It should be noted that the term is not a mandatory entry. If it is not specified, the document will retain its legal force for 12 months, after which it will be automatically canceled.

- At the end of the trust document, autographs of both parties must be left, including the organization's seal (if there is one).

Remember that even such a power of attorney can be revoked at the request of the principal. In this case, you should notify your subordinate. As a rule, this procedure is resorted to in cases where an existing accountant resigns or takes another position in this company.

What rights are given to an attorney?

Whatever the company, the chief accountant usually performs many operations. Consequently, a power of attorney is issued in his name to carry out certain specific procedures.

We have previously clarified exactly what processes the chief accountant can perform under this power of attorney. All powers delegated to him must be clearly stated in the document. The manager independently determines the rights that should be given to the attorney.

It should also be noted that the list of powers can be quite broad. Therefore, it is recommended to enter each as a separate item.

Right to delegate powers

From the point of view of the Tax Code of the Russian Federation, the taxpayer must personally participate in tax legal relations, but this is not always convenient. A full-time employee, a visiting accountant, a courier, or another person can submit reports and other documents to the inspection. To do this, you need to issue a power of attorney with the Federal Tax Service to represent the interests of an organization or individual entrepreneur.

Of course, you need to imagine whether the trustee will be able to provide explanations on the composition of the statements, if such a need arises. To do this, it is worth indicating only those actions for which the principal has authorized him. Otherwise, it may turn out that the tax inspectorate’s report on behalf of the taxpayer will include explanations from a courier who has nothing to do with the business.

The powers of a representative can be described as follows:

- submit reports, applications, complaints and other documents to the tax office;

- receive documents addressed to the company (or individual entrepreneur);

- provide explanations on issues of calculation and payment of taxes;

- participate in tax control activities, submit objections and explanations to the acts of the Federal Tax Service;

- certify with your signature on behalf of the company (or individual entrepreneur) acts, decisions, notifications, letters, protocols, notices, certificates, explanations.

How to issue a power of attorney to submit reports to the tax office?

According to the Civil Code of the Russian Federation, absolutely all subordinates of a particular company can submit statistical, accounting and tax reports. The only requirement is the presence of an appropriate power of attorney, on the basis of which they will be able to perform these actions. Therefore, a chief accountant is a reliable option for such transactions.

In order for an accountant to submit reports, the head of the organization must draw up a special trust document and write down the appropriate authority in it. Of course, there are also companies in which chief accountants can carry out these procedures without a power of attorney - this must be enshrined in the company’s charter. But first, the tax service must provide information about such an employee. Here it should also be taken into account that employees of the federal tax service have grounds to refuse to accept such information. This in turn means that they will need a trust document.

There are other nuances for submitting reports to the tax service. So, in addition to the chief accountant, a completely different company engaged in accounting affairs has the right to submit such reports on behalf of a specific organization. In this case, the power of attorney must be issued in the name of the director of this organization. As a rule, this is where a mark with the right to delegate is placed - this will allow the head of the organization involved in accounting reports to delegate the trust document to a specific person to conduct business with the tax service.

Strict reporting documents: purpose and list

As such, the concept of “strict reporting documents” does not have a legal definition. Therefore, it is more correct to talk about strict reporting forms - a special type of documents mentioned in several legal acts.

In particular, strict reporting forms are discussed in the order of the Ministry of Finance of the Russian Federation “On approval of the Chart of Accounts…” dated October 31, 2000 No. 94n. This regulatory act (in the description of off-balance sheet account 006) includes the following types of documents:

- certificates;

- receipt books;

- season tickets;

- diplomas;

- tickets;

- coupons;

- commodity accompanying forms.

The concept of “strict reporting forms” is used by another important accounting legal act - the Decree of the Government of the Russian Federation “On the procedure for making cash payments...” dated 05/06/2008 No. 359. According to clause 2 of this resolution, the purpose of strict reporting cash forms is to perform the function of cash receipts in case of non-use of cash register equipment by business entities for one reason or another when providing services to the population.

In this case, the list of documents is as follows:

- receipts;

- travel documents;

- tickets;

- vouchers;

- coupons;

- season tickets;

- other documents performing the functions of cash receipts.

Moreover, if we analyze the list of mandatory details of such documents (clause 3 of Resolution No. 359), we will see that an important feature of the form is the presence of a unique number and series on it.

Details are in the article “What applies to strict reporting forms (requirements)?”

In addition, the following requirements apply to strict reporting forms:

- Manufacturing method - printing or using automated systems.

- The form must be prepared in at least 2 copies.

- An incorrectly completed form will not be destroyed and must be retained.

- The forms are kept in a special book, numbered and laced, endorsed by the signatures of the director and chief accountant of the company (or the entrepreneur).

- The forms are stored in a place inaccessible to unauthorized persons.

- Forms are subject to periodic inventory.

For information on how to store and account for such forms, read the article “Procedure for accounting and storage of strict reporting forms.”

Thus, we can give the following general definition of strict reporting forms: these are documents of a monetary and non-monetary nature that have unique registration numbers and are subject to special accounting.

The legislative framework

| Legislative act | Content |

| Article 29 of the Tax Code of the Russian Federation | "Authorized representative of the taxpayer" |

| Article 186 of the Civil Code of the Russian Federation | "Term of power of attorney" |

| Letter of the Federal Tax Service of Russia No. OA-4-17/ [email protected] dated 09/06/2016 | “On the submission of a power of attorney on paper, previously sent to the tax authority in electronic form; on the presence of the seal of LLC and JSC on documents submitted to the tax authorities" |

| Article 119 of the Tax Code of the Russian Federation | "Failure to submit a tax return" |

Results

A power of attorney can be drawn up in ordinary written form, and also in cases specified by law, certified by a notary. The powers of the attorney in the power of attorney should be specified as precisely as possible in order to avoid disagreements with the employees of the Federal Tax Service.

Sources

- https://www.buhgalteria.ru/article/nalogovaya-otchetnost-cherez-predstavitelya

- https://assistentus.ru/forma/doverennost-na-sdachu-otchetnosti-v-nalogovuyu/

- https://online-buhuchet.ru/doverennost-dlya-sdachi-otchetnosti/

- https://infportal.ru/doc/doverennost-v-nalogovuyu-inspektsiyu.html

- https://www.regberry.ru/registraciya-ooo/doverennost-v-nalogovuyu-na-predstavlenie-interesov-yuridicheskogo-lica

- https://nalog-nalog.ru/nalogovaya_proverka/doverennost-v-nalogovuyu-obrazec/