Refusal to receive dividends

The company is not empowered to independently make decisions on payment or non-payment of profits to the founders. Such issues are discussed at general meetings of participants; the results must comply with the requirements of the law and the current version of the company’s charter. Members of the general meeting cannot deprive one or more owners of shares in the authorized capital of dividends - such decisions can be challenged in court.

Refusal of dividends can only be initiated by the recipient of the funds. There are several ways to implement this:

- redirection of funds in favor of the company;

- sending money to third party bank details.

In the first case, difficulties may arise at the stage of taxation of payments. The refusal of dividends in favor of the company raises disputes regarding the need to pay personal income tax on the amount of such income. The obligation to pay income tax on income amounts arises if an individual has the right to dispose of these funds (the inclusion of these amounts in the tax base is stipulated in clause 1 of Article 210 of the Tax Code of the Russian Federation). But tax withholding should occur on the date of payment of income, which in fact does not occur for the founder who refused dividends. As a result, there is a twofold situation:

- there was income, the right to dispose of it was fixed;

- due to voluntary refusal, there was no actual receipt of income.

In paragraphs 1 clause 1 art. 223 of the Tax Code of the Russian Federation focuses on the fact that the date of actual receipt of income by a citizen coincides with the date of transfer of funds to his bank account (or to the account of third parties). Since the founder has formalized a refusal to pay dividends, the money is not credited to him, which means that the tax base has not been formed. The Ministry of Finance in its explanations is of the opinion that it is necessary to withhold and pay personal income tax to the budget when redirecting dividends in favor of the company, and the date of receipt of income will be the day the refusal is issued (justification - Letter dated October 4, 2010 No. 03-04-06/ 2-233). At the same time, the taxpayer has the right to disagree with the Ministry of Finance; letters are not regulatory legal acts, their provisions are advisory in nature.

The founder's refusal to pay dividends may take the form of debt forgiveness. This option is regulated by the provisions of Art. 415 of the Civil Code of the Russian Federation. The participant's decision must be documented in a separate statement. It recommends specifying for what purpose the forgiven debts in the form of dividends should be spent. It would be a more profitable option for an enterprise if the transfer of dividends to the company is justified by the need to increase the company's net assets. This will make it possible not to increase the tax base on profits.

Refusal of dividends in favor of another participant can be made upon a written application from the founder. He can initiate the transfer of funds to third party bank accounts. But this method is possible under one condition - the company’s charter specifies an algorithm for actions in case of refusal of income in favor of third parties. If the charter does not contain any mention of such a non-standard situation in the distribution of company profits, it is impossible to transfer funds to another founder through refusal.

Cancellation of the decision to pay dividends. Contradictions of legal regulation.

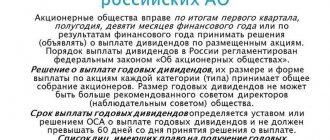

Joint-stock companies and limited liability companies have the right to pay dividends to their shareholders (participants) at the end of the financial year. In this article we will try to understand the problem of paying dividends in relation to joint stock companies that have a more open organizational and legal form compared to LLCs.

The procedure for making decisions on the payment of dividends is regulated by Articles 42 and 43 of the Federal Law “On Joint Stock Companies”. Actually, the procedure for making and executing a decision to pay dividends is not very difficult. However, in practice there are situations when a decision to pay dividends by a joint stock company is made, but is subsequently cancelled. What should a minority shareholder do in such a situation? Let's try to figure it out.

In accordance with Article 153 of the Civil Code of the Russian Federation, transactions are recognized as actions of citizens and legal entities aimed at establishing, changing and terminating civil rights and obligations. In accordance with Part 2 of Article 154 of the Civil Code of the Russian Federation, a unilateral transaction is considered to be a transaction for which, in accordance with the law, other legal acts or agreement of the parties, it is necessary and sufficient to express the will of one party. In accordance with Art. 155 of the Civil Code of the Russian Federation, a unilateral transaction creates obligations for the person who made the transaction. Thus, taking into account the above rules of law, the decision to pay dividends is a unilateral transaction giving rise to rights and obligations.

Article 156 of the Civil Code of the Russian Federation establishes that the general provisions on obligations and contracts are respectively applied to unilateral transactions insofar as this does not contradict the law, the unilateral nature and essence of the transaction.

The most important provision on obligations enshrined in Art. 310 of the Civil Code of the Russian Federation, indicates that unilateral refusal to fulfill an obligation and unilateral change of its conditions are not allowed , except in cases provided for by law.

By deciding to pay dividends to its shareholders, the general meeting of shareholders actually enters into a unilateral transaction, which, in turn, gives rise to an obligation to fulfill it. By issuing a contrary decision to cancel the payment of dividends, the joint-stock company violates Article 310 of the Civil Code of the Russian Federation, which prohibits unilateral refusal to fulfill an obligation.

It should be noted that before the general meeting of shareholders makes a decision on the payment of dividends, the shareholders have the right to dividends in the form of the opportunity to receive an abstract part of the profit of the joint-stock company, that is, in the form of the right to demand payment of all dividends that will ever be declared by the company, and after making this decision - in the form of the right to demand payment of a certain amount of dividend. In other words, the decision to pay dividends is a legal fact, the presence of which is associated with the specification of the content of the right to participate in the distribution of profits in the amount specified in this decision.

The above arguments are also confirmed by judicial practice (Resolution of the Federal Antimonopoly Service of the East Siberian District dated September 22, 2005 No. F02-4683/05-S2 in case No. A33-25557/04-S1; Resolution of the Federal Antimonopoly Service of the Far Eastern District dated March 20, 2012 No. F03- 707/2012 in case No. N Ф03-707/2012).

Thus, a shareholder who is “not satisfied” with the cancellation of the decision of the general meeting of shareholders on the payment of declared dividends has the right to apply to the arbitration court with a statement of claim to apply the consequences of the invalidity of a void transaction, since a transaction adopted in violation of the law (Article 310 of the Civil Code of the Russian Federation) is void in by virtue of Article 168 of the Civil Code of the Russian Federation.

Waiver of dividends: sample

The legislation on the functioning of LLCs and JSCs does not contain any clauses on the possibility of refusing dividends in favor of legal entities or individuals. The procedure for documenting such an operation is not prescribed in legal acts. In order for the refusal of income to be legal, such a possibility must be spelled out in the charter of the company. If this norm is not specified in the charter:

- before the date of registration of the application for refusal to pay dividends, a sample of such a document must be entered into the document flow by local acts;

- Before the application is drawn up, changes must be made to the charter to introduce a clause on the procedure for the founders to refuse income.

Structure of the application form:

- introductory header with information about the applicant and business entity;

- the main part, which contains the essence of the petition - a refusal to receive payments from the company or a desire to transfer funds to the bank accounts of third parties;

- conclusion – date of execution of the document, signature.

Disproportional distribution of profits between LLC participants

Dear Colleagues,

as is known Art. 28 of the Federal Law on LLC provides that part of the company’s profit intended for distribution among its participants is distributed in proportion to their shares in the authorized capital of the company. The charter of the company upon its establishment or by introducing amendments to the charter of the company by decision of the general meeting of the company's participants, adopted unanimously by all the company's participants, may establish a different procedure for the distribution of profit between the company's participants. Amendments and exclusions of the provisions of the company's charter establishing such a procedure are carried out by decision of the general meeting of the company's participants, adopted unanimously by all the company's participants.

Accordingly, the imperative norm establishes that the procedure for distributing profits between participants disproportionate to the size of their share in the authorized capital of the company can be determined exclusively at the level of the charter by adopting such a provision of a local regulatory act unanimously.

Thus, the corporate agreement cannot contain the provisions that interest us on the disproportionate distribution of profits. Can such judgments apply to a unanimous corporate agreement? It seems that the answer should be positive due to the same imperative nature of the requirements of Art. 28 Federal Law on LLC. What is noteworthy in this case is the case involving Verniy Znak LLC.

I also believe that the charter cannot contain blanket (referential) provisions on the possibility of determining the disproportionate distribution of profits within the framework of a corporate agreement. For example, the charter stipulates that profits between participants are subject to disproportionate distribution, and exactly how (specific figures and reasons for such distribution) is specified in the corporate agreement.

The reasons are as follows: firstly, not everyone can enter into a corporate agreement (the matter, as they say, is voluntary, freedom of contract). Secondly, the participants of an LLC can change and the provisions of such a corporate agreement do not automatically apply to new arrivals.

Thus, any manipulations with the proportionality prescribed by law in terms of profit distribution are possible only at the level of the charter. The essence of this imperative rule, in my opinion, is the need to maintain a balance of interests of LLC participants; it is for this reason that the law also imperatively enshrines unanimity regarding the adoption of a decision at a general meeting of company participants to change the procedure for distributing profits.

In the charter, in order to establish a disproportionate distribution of profits, it can be stated that a participant owning a 51% share is entitled to 90% of the distributed profit of the company, and a participant owning 49% is entitled to 10% of the distributed profit. This provision may not contain the motives for the proposed mechanism for departing from the proportion.

I am wondering whether it is necessary to duplicate and determine the “validity period” of the mechanism for indentation from the proportion in the corporate agreement? By “validity period” I mean, for example, provisions in a corporate agreement establishing the conditions and procedure for voting by participants on amendments to the charter, repealing the rules on disproportionate distribution of profits, as well as liability if a participant votes differently.

Colleagues, how did you resolve the issue of disproportionate distribution of profits between LLC participants? What other mechanisms are applicable? What thoughts do my research evoke in you?

Corporate agreement: features and opportunities. Part 2

Acceptable terms of a corporate agreement in JSC and LLC. Legality of the terms of a corporate agreement limiting the rights of individual company participants

A corporate agreement, especially if all participants (shareholders) of the company do not participate in it, by its legal nature is closest to an obligatory transaction, i.e. creates rights and obligations only for those parties who participate in it. As mentioned earlier, it does not give rise to any legal consequences for persons not participating in its signing. If the participants (shareholders) did not inform the company about the agreement they signed in the manner prescribed by law, then the participants (shareholders) who did not sign the agreement have the right to protect their legal rights and interests by appealing against actions and the consequences of these actions relating to the management of the company, participants (shareholders) who signed the agreement.

The obligatory concept makes it possible to successfully justify the admissibility of the terms of corporate agreements that are not directly specified in the law. Thus, the possibility of including in a corporate agreement obligations not listed in paragraph 1 of Article 67.2 of the Civil Code was directly confirmed in the case of the LeOl company (No. A45-12229/2015) on the basis of the principle of freedom of contract (Article 421 of the Civil Code of the Russian Federation).

Quite positive judicial practice on disputes arising from corporate agreements of both JSC and LLC has developed in relation to the following conditions:

- Exercising the preferential rights of company participants, the procedure for holding general meetings and making decisions at them, including the obligation to vote unanimously and restrictions on the disposal of shares (for example, case “ImDi-Test” No. A45-1845/2013, determination of the Supreme Court of the Russian Federation dated 10/03/16 No. 304-ES16-11978 in case No. A45-12277/2015).

- Conditions for transactions with shares, for example, the inclusion of put options in the shareholder agreement (case No. A63-9751/2014).

- The procedure for paying the actual value of the share (shares).

Here the practice is quite contradictory, especially if the conditions specified in the company's charter differ from the conditions agreed upon in the corporate agreement. But there is an opportunity to defend your position by pointing out that the terms of the corporate agreement are considered agreed upon if there is a unanimous expression of will, including within the framework of the agreement. And the formal contradiction of the agreement with the charter can be justified by reference to paragraph 7 of Article 67.2. Civil Code, which prohibits the parties to a corporate agreement from referring to its invalidity in the presence of such a contradiction.

- Financing of the company by participants, submission of reports, order of meetings. For all these conditions, there is currently established positive judicial practice.

- The procedure for the distribution of property during the liquidation of a company.

For example, cases No. A34-666/2014, No. A40-87381/2013. As a general rule, property after liquidation is distributed proportionally. However, in these decisions, the courts did not see any obstacles to establishing a different order in the corporate agreement, since the refusal of proportional distribution affects the rights only of the corporation participants themselves who voluntarily entered into the agreement.

Clause 2 of Art. 67.2 of the Civil Code of the Russian Federation establishes restrictions on the content of the Code. Thus, the specified document cannot contain the following provisions:

- obligations of participants to vote in accordance with the instructions of the legal entity’s bodies;

- determination of the structure of the legal entity’s bodies;

- determination of the competence of the legal entity’s bodies.

It is also better not to include the following conditions in a corporate agreement, since they are always controversial, with judicial practice not yet established:

- A procedure for distributing profits between participants other than in the law or charter, except in cases where a corporate agreement is signed by all participants in the company and is justified by a change in shares (shares) or an increase in the authorized capital at the expense of the property of one of the participants.

- The right of a participant to leave the company. The provisions of Article 26 of Law No. 14-FZ, dedicated to the withdrawal of a participant from the company, are mandatory. Therefore, the right to withdraw can only be provided for by the articles of association. Also, in these cases, in accordance with the law, when a participant leaves, the company is obliged to buy out his share. Thus, the inclusion in a corporate agreement of a condition on the right to exit creates obligations for the company, which is not a party to such an agreement (clause 5 of Article 67.2 of the Civil Code of the Russian Federation).

However, participants can achieve the same goal through a corporate agreement. For example, establish the obligation of other participants to buy out the participant’s share at his request (call option). To do this, the agreement must specify the procedure for presenting demands and buying out shares by all or some participants:

- Unconditional restriction of the right to dispose of shares. In some cases, courts proceed from the fact that a corporate agreement cannot establish a ban on the alienation of shares without the consent of other participants (resolution of the Far Eastern District Court of August 14, 2015 in case No. A24-4503/2014). According to the courts, such restrictions must remain in effect until certain circumstances occur or cease. Otherwise, it significantly limits the rights of participants. The position is controversial, but at the moment there is no clear positive practice of the courts. Therefore, it is better to avoid including such a condition in the contract.

As for limiting the rights of individual participants by concluding a corporate agreement, only those participants who have signed the agreement can be limited and only within the framework of the conditions specified in it. For example, a penalty may be charged for violating the obligation to vote in a certain way (determination of the Supreme Court of the Russian Federation of October 3, 2016 No. 304-ES16-11978 in case No. A45-12277/2015).

Possibility of including in a corporate agreement a condition on disproportionate distribution of dividends to JSCs and LLCs

In accordance with paragraph 1 of Art. 67 of the Civil Code of the Russian Federation, a participant in a business company has the right to take part in the distribution of profits of the company of which he is a participant. As a general rule, in an LLC, profits are distributed in proportion to the shares of participants in the authorized capital of the company (clause 2, article 28 of the LLC Law), and in a JSC, each ordinary share of the company provides the shareholder, its owner, with the same amount of rights (clause 1, article 31 of the Law about JSC).

According to paragraph 1 of Art. 66 of the Civil Code of the Russian Federation, a volume of powers of participants in a non-public business company that is disproportionate to the shares of participants in the authorized capital may be provided for by the charter of the company, as well as a corporate agreement, provided that information about the existence of such an agreement and the scope of powers of participants of the company provided for by it is entered into the Unified State Register of Legal Entities. Thus, in an LLC and a non-public JSC, the amount of profit (dividends) due to a participant may be disproportionate to his share in the authorized capital, but more or less relative to this share.

At the same time, it must be taken into account that with regard to the disproportionate distribution of dividends in a non-public joint stock company, the Civil Code of the Russian Federation has some inconsistency with the norms of the Federal Law of April 22, 1996 No. 39-FZ “On the Securities Market” (hereinafter referred to as the Law on the Securities Market). In particular, by virtue of Art. 2 of the Law on the Securities Market, a share is an issue-grade security, and among the characteristics of an issue-grade security are the equal volume and timing of the exercise of rights within one issue, regardless of the time of acquisition of the security. It follows from this that for all shares within one issue an equal amount of rights must be established, including in terms of the right to dividends, that is, it must be established in the decision on the issue that for one share of the same type dividends are paid to different shareholders in different amounts, according to within the meaning of the Securities Market Law it is not possible.

It seems that within the framework of one issue of shares of a non-public joint-stock company, different dividend rights cannot really be established for one type of shares, since such rights should be provided for shareholders, and not securities. Otherwise, the corporate rights changed (reduced or increased) by the charter or corporate agreement would follow the share during its subsequent alienation to other persons. However, this does not prevent changing the scope of dividend rights in the corporate agreement. Then, regardless of the conditions for issuing shares, a participant in the corporation will have to exercise his rights in accordance with the provisions of the corporate agreement, but when alienating his shares, the volume of dividend rights of the new shareholder will be determined by the decision to issue shares.

It should also be taken into account that in joint stock companies there may be several categories of shares - ordinary and preferred (which, in turn, can be of different types), the rights for which are different. Preferred shares, as a general rule, do not provide the right to participate in the management of the company, but for such shares, the company’s charter must determine the amount of dividend and (or) the value paid upon liquidation of the company (liquidation value), or establish the procedure for their determination. That is, the main feature of preferred shares is the predetermined amount of dividends and (or) liquidation quota, which guarantees shareholders a certain return on shares.

The changes made to Art. 32 of the Law on JSC Federal Law No. 210-FZ dated June 29, 2015, established a new type of preferred shares that can be issued by non-public joint stock companies. Such shares may be provided for by the charter, have one or more types, providing, in addition to or instead of the rights to a fixed dividend and (or) liquidation value, the right to vote on all or some issues within the competence of the general meeting of shareholders, including in the event of the occurrence or termination of certain circumstances.

Regardless of the category of shares (ordinary or preferred) and the proportionality (non-proportionality) of dividend rights, the payment of dividends in a joint-stock company or the distribution of profits in an LLC is a right and not an obligation of a business company and is carried out only by decision of its participants. The legislation also establishes cases when the payment of dividends (distribution of profits) is not allowed in principle. In non-public joint stock companies, the charter may provide that the payment (announcement) of dividends based on the results of the first quarter, six months, nine months of the reporting year falls within the competence of the board of directors (clause 2 1 of article 48 of the JSC Law). Payment of dividends based on the results of the reporting year in a non-public JSC, as well as dividends for any period in a public JSC, can only be within the competence of the general meeting of shareholders.

In an LLC, making a decision on the distribution of the company's net profit is the exclusive competence of the general meeting of company participants. As a general rule, in an LLC, the decision on the distribution of profits is made by a majority vote of the total number of votes of the company's participants, unless the need for a larger number of votes is provided for by the company's charter. In a joint-stock company, the decision to pay dividends on ordinary shares and on preferred shares of a certain type is made by a majority vote of shareholders - owners of voting shares of the company taking part in the meeting. The charter of a non-public JSC may provide for a different number of votes of shareholders - owners of voting shares, necessary for making a decision at the general meeting of shareholders, which cannot be less than the number of votes established by the Law on JSC for the meeting to make relevant decisions.

Thus, the right to dividends is not unconditionally guaranteed to the shareholder and is made dependent on the will of the participants of the business company - their adoption of the appropriate decision. Moreover, as a general rule, to make (not make) such a decision, even the votes of a qualified majority of participants in the general meeting are not required, and in a non-public JSC a decision may even be required not from the participants, but from the board of directors when paying dividends for 3, 6, 9 months of the reporting year, if this is provided for by its charter (clause 2 1 of article 48 of the Law on JSC).

Based on the foregoing, I believe that the corporate agreement may include conditions on the refusal or limitation of the right to distribute profits (payment of dividends) in relation to LLC participants and shareholders - owners of ordinary or preferred shares. However, such an agreement must be signed by all participants/shareholders of the company, since its effect does not apply to persons who have not signed the agreement. In addition, you need to keep in mind that if one of the participants/shareholders sells their share/shares to a third party who refuses to sign a corporate agreement, legal relations with such a person will be regulated by law and the charter of the company.

The ability of participants to transfer dividends to the property of JSCs and LLCs, the regulatory mechanism in the corporate agreement

The distribution of profits in a public joint stock company is carried out in accordance with the provisions of Articles 42 and 43 of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ. According to paragraph 3 of Article 42 of this Federal Law, the shareholders themselves have the right to distribute the income received by the company through a general meeting.

The sources of funds distributed among shareholders are:

- The company's profit remaining after paying all taxes and other obligatory payments and determined on the basis of data in accounting documents. The funds are distributed among ordinary shareholders.

- Special funds in which funds are reserved for payments on preferred shares. In this case, funds are distributed only among shareholders who have such shares.

The profit of a joint stock company is distributed in the following order:

- A decision is made on the distribution of profits.

- Dividends are paid to shareholders.

The period for paying part of the distributed profit of the enterprise should not be more than 60 days from the date of the decision on dividend distribution between shareholders. If the term is not specified in the charter, then by default it is set equal to two months (60 days).

In a situation where payments are not made during the specified period, the shareholder has the right to appeal to the JSC within three years (from the date of expiration of this period) to make a payment. Otherwise, the unclaimed portion of the income will be restored to the organization's retained earnings. The 3-year period begins at the end of the 60-day period established by the company, and not from the day when dividends are reflected in the books.

The law does not provide for waiver of dividend requirements. On the other hand, the Civil Code (Article 415) stipulates the possibility of removing obligations if this does not conflict with the rights of other persons.

As a result, the shareholder has the right to refuse due dividend payments. Such a decision is usually formalized by drawing up a special document. In this case, the purposes for which unpaid payments will be spent can be specified at the request of the shareholder (based on his personal judgment and opinion). If we proceed from the position of tax benefits, then if dividend payments are waived, it is still better to specify the direction of the funds (for example, “to increase the volume of net assets of the issuing party”).

In essence, a waiver of a dividend requirement is a forgiveness of debt to a joint stock company in relation to mandatory cash payments. Therefore, it does not in any way affect the amount of further dividend payments to the shareholder who refused to receive, nor the amount of payments to other shareholders.

Issues of profit distribution are assigned by law to the competence of the general meeting of LLC participants. The general meeting of the company's participants makes a decision on non-payment of dividends and at the same time on the use of the company's net profit to replenish working capital. A corresponding written statement is received from the participant who refused payment.

In accordance with the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies” (hereinafter referred to as the Law of 02/08/1998 No. 14-FZ), the founders of the company enter into an agreement on the establishment of the company, which determines the size and nominal value of the share of each of founders of the company, as well as the size and procedure for payment of such shares in the authorized capital of the company.

- The size of the share in the LLC can be changed when the authorized capital is increased due to additional contributions of its participants and third parties accepted into the company.

- Most often, changes and redistribution of shares in an LLC are carried out on the basis of transactions. These can be both paid (purchase and sale) and gratuitous (donation) transactions; such transactions are not necessarily aimed directly at the alienation of a share, but only imply the possibility of such (pledge). Parties to transactions can be both participants and third parties, but in any case the legislation and the requirements of the company’s charter must be observed.

- Another reason for changing shares in an LLC is legal succession, that is, the transfer of rights and obligations from one subject of legal relations to another. Succession is possible as a result of inheritance of shares in an LLC and reorganization of the company.

According to paragraph 1 of Art. 12 (charter of the company) of Law No. 14-FZ dated 02/08/1998, the charter of the company is the constituent document of the company.

In accordance with paragraph 1 of Art. 90 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), paragraph 1 of Article 14 of Law No. 14-FZ dated 02/08/1998, the authorized capital of a company is made up of the nominal value of the shares of its participants.

The size of the share of a company participant in the authorized capital of the company is determined as a percentage or as a fraction. The size of the share of a company participant must correspond to the ratio of the nominal value of his share and the authorized capital of the company.

According to clause 4 of Article 12 of Law No. 14-FZ dated 02/08/1998, changes to the company’s charter are made by decision of the general meeting of the company’s participants.

In accordance with paragraph 2 of Art. 33 of Law No. 14-FZ dated 02/08/1998, the competence of the general meeting of company participants includes changing the company’s charter, including changing the size of the company’s authorized capital.

Thus, making a decision to change the size of the authorized capital of an LLC is the exclusive power of the general meeting of company participants (clause 2, paragraph 2, article 33 of the LLC Law). This decision is made by a majority vote of at least 2/3 of the total number of votes of the company's participants, unless the need for a larger number of votes is provided for by the LLC Law or the company's charter (Clause 8, Article 37 of the LLC Law).

From the above, it follows that refusal to receive dividends and directing them to the development of the company does not give rise to grounds for the refused LLC participant to change his share in terms of increasing it.

The corporate agreement can provide for a written application form and the procedure for the participant/shareholder’s refusal of the dividends due to him, as well as fix how such funds will be spent by the company in the event of the participant/shareholder’s refusal. However, since the issue concerns profit, such an agreement must be signed by all participants/shareholders of the company.

Risks of parties to a corporate agreement in JSC and LLC

The parties to a corporate agreement bear standard liability for its violation, as provided for by the Civil Code of the Russian Federation. When concluding such an agreement, it is necessary to understand that its terms, which meet the requirements of the legislation of the Russian Federation, are binding on the parties and their violation will entail the need to compensate for losses caused by the violation of law.

The risk of violating a corporate agreement is manifested in the intended use of corporate rights by one of the parties to the agreement in a manner different from that agreed upon.

In paragraph 7 of Art. 32.1 of the Law on Joint Stock Companies states that a shareholder agreement may provide for methods of ensuring the fulfillment of obligations arising from it, and measures of civil liability for non-fulfillment or improper fulfillment of such obligations. There is no such rule in the LLC Law, but here, when going to court, you can talk about an analogy of law regulating similar legal relations and refer to the JSC Law.

The methods of ensuring the fulfillment of obligations provided for by the Civil Code of the Russian Federation and which may be specified in a corporate agreement are as follows:

- Penalty. You can write down a fixed amount, or some kind of formula that allows you to determine the size. Its disadvantage is the possibility of a serious reduction through the use of Art. 333 of the Civil Code of the Russian Federation, as well as the position of the Constitutional Court, for example, set out in the ruling of October 24, 2013 N 1664-O “the court must establish a balance between the measure of responsibility applied to the violator and the amount of actual damage.”

- Pledge of a share in the charter of an LLC and pledge of shares (it is the rights certified by a share or a share that are transferred as a pledge, but the share/share is some external form of their expression, in addition, registration is carried out by encumbering the pledge with a share/share):

- Pledge of shares in the authorized capital of an LLC.

By virtue of para. 2 p. 2 art. 385.15 of the Civil Code of the Russian Federation, the rights of the participant who pledged the share are exercised by the pledgee. The law does not directly speak about the possibility of limiting the use of rights from a share by the pledgee, in contrast to the situation with the pledge of shares. But there are no direct prohibitions preventing the settlement of this issue by contract, i.e. by including this condition in the corporate agreement.

- Pledge of shares.

In order for the rights under the pledged share to be exercised by the pledgee, this must be explicitly stated in the pledge agreement. In this case, it is possible to determine the boundaries of the use of such rights. Having concluded a corporate agreement, the parties additionally enter into pledge agreements for their shares/shares with the most trusted person, who disposes of the rights thereunder in accordance with the terms of the commercial agreement.

When this type of security is provided for the fulfillment of obligations under a concluded corporate agreement, the party that violated it will be held liable either by paying a penalty, or by losing control over its property and using it to pay off losses to the other party to the agreement.

Neither Art. 67.2 of the Civil Code of the Russian Federation, nor the provisions of the Federal Law “On JSC” or the Federal Law “On LLC” do not contain special grounds, as well as special provisions regarding the termination of a corporate agreement. Based on this, a corporate agreement concluded in relation to a Russian business company can be terminated by its parties on the general basis provided for by the Civil Code of the Russian Federation:

- by agreement of the parties;

- in court on the initiative of one of the parties to the corporate agreement;

- through the unilateral refusal of one of the parties to the corporate agreement to execute it;

- in addition, a corporate agreement may provide for circumstances upon the occurrence (non-occurrence) of which it is terminated automatically (cancellable condition).

The consequences of termination of the contract in the event of violation by one of the parties are contained in Part 5 of Art. 453 of the Civil Code of the Russian Federation: If the basis for changing or terminating the contract was a significant violation of its terms by one of the parties, the other party has the right to demand compensation for losses caused by the change or termination of the contract.

Source: Press, Calculation Magazine

You may also be interested in:

- Corporate law

- Legal support for transactions with securities

Consequences of founders refusing dividends

Nothing prohibits a shareholder (participant) from leaving the dividends due to him at the disposal of the organization. However, the income it receives may be less than the amount of dividends distributed to the owners of the company.

Obviously, for a company, a shareholder’s (participant’s) refusal of dividends is an economic benefit—income. However, qualifying such income is challenging.

What happens in the situation under consideration - the company receives property (money) free of charge or its accounts payable are written off? The answer to this question is of particular importance if dividends are left in the company by its major shareholder (founder). Let us recall that on the basis of sub. 11 clause 1 art. 251 of the Tax Code of the Russian Federation, income in the form of property received free of charge from a participant in an organization is exempt from taxation if its authorized (share) capital (fund) consists of more than 50% of the contribution (share) of this participant.

A major shareholder refused dividends

If a large shareholder (participant), whose share in the company exceeds 50%, refuses dividends, can the organization take advantage of the benefit established by subsection. 11 clause 1 art. 251 of the Tax Code of the Russian Federation? Tax legislation does not provide a direct answer to this question.

The regulatory authorities did not provide any explanations on this problem. However, the Russian Ministry of Finance has repeatedly considered similar situations when participants in an organization renounced their monetary claims against it. For example, in letter dated April 17, 2009 No. 03-03-06/1/259, financial department specialists considered this situation. The company took out a loan from its sole participant. He subsequently forgave the company's interest debt. The Russian Ministry of Finance noted that when forgiving the interest payment debt, the company cannot apply the exemption provided for in subsection. 11 clause 1 art. 251 Tax Code of the Russian Federation. Financial department specialists believe that amounts written off through debt forgiveness cannot be considered as property received free of charge, since there is no fact of its transfer to the taxpayer.

At the same time, in paragraph 3 of the information letter dated December 22, 2005 No. 98, the Presidium of the Supreme Arbitration Court of the Russian Federation noted that saving funds as a result of releasing an enterprise from fulfilling obligations is equivalent to receiving them. Federal district courts, when resolving disputes about debt forgiveness, refer to this conclusion of the Supreme Arbitration Court of the Russian Federation. For example, the Federal Antimonopoly Service of the Central District did not support the tax authorities who demanded that the company include the amount of accounts payable in taxable profit (resolution No. A54-125/2007-C13 dated November 15, 2007). A disputed debt arose to a company participant. However, in order to reorganize his company, he did not demand that it repay the debt. The judges equated saving money with receiving it and concluded that in this case the company lawfully applied the benefit under subsection. 11 clause 1 art. 251 Tax Code of the Russian Federation.

Taking into account the point of view of the courts, we believe that if a major shareholder (participant) refuses dividends, the company has the right to take advantage of the benefit established in subsection. 11 clause 1 art. 251 Tax Code of the Russian Federation. The arguments presented above will help you defend your position in the event that tax authorities make claims.

The company does not claim benefits

When the conditions for applying the benefit are not met (dividends are refused by a participant (shareholder) who owns no more than 50% of the company’s authorized capital), the company will have to record income.

For profit tax purposes, economic benefit is recognized as income if it is expressly provided for in Chapter 25 “Organizational Profit Tax” of the Tax Code of the Russian Federation. The procedure for its assessment is also established here (Article 41 of the Tax Code of the Russian Federation). If the benefit received by the company when a shareholder (participant) refuses dividends is income, then this is non-operating income. The list of cases when an organization generates such income is given in Art. 250 of the Tax Code of the Russian Federation. It does not directly mention the refusal of shareholders (participants) to pay dividends.

Meanwhile, this list names two situations that are essentially similar to the one under consideration. So, in paragraph 8 of Art. 250 of the Tax Code of the Russian Federation states that non-operating income includes property, work, services or property rights received free of charge (except for the cases provided for in Article 251 of the Tax Code of the Russian Federation). And paragraph 18 of Art. 250 of the Tax Code of the Russian Federation requires increasing non-operating income by the amount of written off accounts payable.

It will be safer for the company to include the amount of dividends in the income tax base. And it doesn’t matter for what reason.

The duties of a tax agent must be fulfilled

Regarding the company’s income, we note that its size will differ from the amount of dividends by the amount of tax that the company must pay as a tax agent. Thus, the letter of the Ministry of Finance of Russia dated October 4, 2010 No. 03-04-06/2-233 considers the situation when the founder, an individual, refuses dividends.

If a company must pay dividends to individuals, then personal income tax is calculated at a rate of 9% (Article 224 of the Tax Code of the Russian Federation). The day of receipt of dividends is considered the day of written registration of their refusal. Experts from the financial department come to this conclusion.

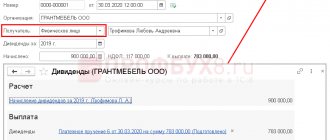

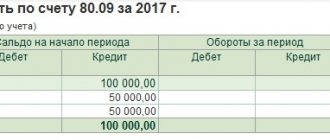

example

An individual participant in an organization (LLC), owning 49% of its authorized capital, was accrued dividends in the amount of 100,000 rubles based on the results of 2009. However, in order to maintain the financial stability of the company, its founder refused his share of the profits. The refusal of dividends was formalized by a receipt.

The company's accounting department included the amount of dividends in the founder's personal income tax base and calculated tax on it. Its value was 9,000 rubles. (RUB 100,000 x 9%).

In order to avoid disputes with tax authorities, the company took into account the remaining amount of dividends after taxation (91,000 rubles) in non-operating income. She will have to pay income tax at a rate of 20%. The tax amount is 18,200 rubles. (RUB 91,000 x x 20%). As a result, the amount of benefit received by the company from the participant’s refusal to receive dividends amounted to 72,800 rubles. (RUB 100,000 – RUB 9,000 – RUB 18,200).

In the company's accounting records, these transactions are reflected by the following entries:

Debit 84 Credit 75, subaccount “Calculations for payment of income”

— 100,000 rub. — the debt to the participant for the payment of dividends is reflected;

Debit 75, subaccount “Calculations for payment of income” Credit 68

— 9000 rub. — personal income tax is withheld from the amount of dividends that the company participant refused (as of the date of drawing up a written document on refusal: receipt, act, protocol, etc.);

Debit 75, subaccount “Expenses for payment of income” Credit 91, subaccount “Other income”

— 91,000 rub. — the amount of dividends refused by the shareholder (participant) is taken into account in income.

We pay dividends: non-standard situations

Disproportional distribution

The charter of an LLC may determine that profits are distributed among participants not in proportion to their shares in the authorized capital, but in a different proportion. This is permitted by paragraph 2 of Article 28 of the Federal Law of 02/08/98 No. 14-FZ “On Limited Liability Companies”. However, not everyone knows the consequences of such a disproportionate distribution of dividends.

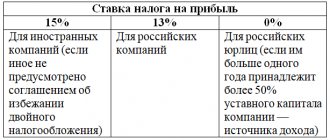

Let us recall that in a normal situation (when profits are distributed in proportion to the shares of participants), when paying dividends to the founders, the company, as a tax agent, must withhold and pay 9 percent of personal income tax to the budget if the founder is an individual. And in the case where the founder is a legal entity, the income tax rate is 0 percent or 9 percent. That is, the tax rate paid on dividends is preferential, be it personal income tax or income tax. Does the same rate apply to dividends in case of disproportionate distribution of profits?

To begin with, let us turn to the definition of dividend, which is given in paragraph 1 of Article 43 of the Tax Code of the Russian Federation. It says that a dividend is any income received by a shareholder (participant) from an organization when distributing profits remaining after taxation on shares (shares) owned by the shareholder (participant) in proportion to the shares of shareholders (participants) in the authorized (joint) capital of this organization.

From this definition, officials conclude: profit received by a participant in excess of his share is not a dividend in the sense of the definition given for tax purposes. This means that this amount forms another income of the founder, to which a general rate is applied: 13 percent when paying income to an individual, 20 percent when paying income to a legal entity (letter of the Ministry of Finance of Russia dated January 30, 2006 No. 03-03-04/1/ 65, dated June 24, 2008 No. 03-03-06/1/366).

Please note that the general rate (13 or 20 percent) does not apply to the entire amount of distributed profits, but to the excess amount. Although in practice, tax authorities may try to tax the entire amount at a higher rate. In this case, justice can be restored in court (resolutions of the Federal Antimonopoly Service of the North-Western District dated January 12, 2006 in case No. A44-2409/2005-7, FAS Ural District dated December 12, 2007 No. Ф09-10292/07-С2). But unfortunately, there are no examples in judicial practice where an organization managed to refute the position of the Ministry of Finance and prove that a preferential tax rate can be applied to the entire amount of a “disproportionate” dividend.

Who must pay the excess tax?

It turns out that in the event of a disproportionate distribution of profits, two rates will be applied to the participant receiving an inflated amount of dividends: 9 and 13 percent for personal income tax; 0 (9) percent and 20 percent for income tax. That part of the tax to which the preferential rate applies must be withheld by the company paying the dividends. The question arises: what should society do with the remaining amount of dividends that were not subject to taxation at a preferential rate? Also withhold tax, but at a rate of 13 (20) percent?

It all depends on who exactly is the founder who received an inflated dividend amount. If it is a legal entity, then the company does not need to withhold tax from this amount as a tax agent. The fact is that an organization that pays “dividend” income to its founders, legal entities, is a tax agent only in relation to dividends. And a dividend in the tax sense, as we noted earlier, is the amount of income corresponding to the participant’s share. The excess amount is not, in fact, a dividend; therefore, the company should not withhold tax on this amount.

Consequently, the tax on this income (at a rate of 20 percent) must be paid by the participant himself, including this amount in his non-operating income. True, if a participant owns more than 50 percent of the authorized capital of the company, then he can take advantage of the benefit established by subparagraph 11, paragraph 1 of Article 251 of the Tax Code of the Russian Federation and not be taxed on the excess amount.

If the participant receiving an inflated dividend amount is an individual, then it is the company paying the dividends that must withhold personal income tax on both parts: on dividends - at a rate of 9 percent, on the excess amount - at a rate of 13 percent. We made this conclusion based on Articles 214.1, 227 and 228 of the Tax Code, which describe situations when an individual independently pays tax on his income. The situation in question with disproportionately distributed dividends is not mentioned there. This means that the general rules apply and income tax is withheld from the source of payment of income (tax agent).

Refusal of dividends in favor of the company

The next non-standard situation is that the participant refuses dividends in favor of the company. Officials believe that in this case, despite not receiving dividends, the participant still has taxable income. Experts from the Ministry of Finance explain theirs by saying that “the possibility of a taxpayer refusing to receive dividends is not provided for by current legislation” (letter of the Ministry of Finance of Russia dated October 4, 2010 No. 03-04-06/2-233). The date of actual receipt of income, as noted by the Ministry of Finance, is the day the taxpayer refuses the dividends due to him in favor of the organization that pays them. Does the conclusion of the Ministry of Finance comply with tax legislation?

It is quite difficult to answer this question unambiguously. On the one hand, according to Article 210 of the Tax Code of the Russian Federation, when determining the tax base, all income (including dividends) of the taxpayer is taken into account, both actually received and those over which he has the right to dispose. In this situation, this norm confirms the conclusion made by officials. After all, we can say that the participant, by refusing to receive dividends, actually exercised his right to dispose of the income due to him. However, we must not forget that personal income tax is withheld by the tax agent from the taxpayer’s income upon actual payment. In this situation, the company simply has nothing to withhold tax from, since no payment of funds occurs to the participant.

In addition, the fundamental principle of determining income for tax purposes is enshrined in Article 41 of the Tax Code of the Russian Federation, according to which economic benefits in cash or in kind are recognized as income. In case of refusal of dividends, it is not entirely fair to talk about economic benefits.

In general, the situation is ambiguous, so in order to avoid risks it is better not to allow it. The founder does not have to refuse to receive dividends. It is necessary to distribute the net profit, but “forget” to transfer dividends to him. In such a situation, the company will simply have a debt to the participant, which, after three years from the moment when dividends should have been paid, will be restored as part of the company’s retained earnings.

Now let's change the situation a little. Let's assume that the company's participants decided to distribute the net profit in such a way as to transfer it to only one of the participants, making a corresponding decision at the general meeting and making appropriate changes to the charter. In fact, the remaining participants in this case (as in the situation described above) also refuse dividends, but not in favor of the company, but in favor of another participant. There are no longer any risks that arise when refusing dividends in favor of society. After all, such a distribution is permitted by current legislation, provided that such an order is determined by the charter of the company.

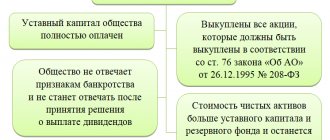

When a joint stock company cannot pay dividends

A JSC cannot pay dividends to shareholders (Article 43 of Law No. 208-FZ):

- in case of incomplete payment of the authorized capital;

- in case of incomplete repurchase of JSC shares from shareholders requesting it;

- if at the time of making such a decision the JSC meets the signs of insolvency (bankruptcy) or if the specified signs appear at the JSC as a result of making such a decision;

- if at the time such a decision is made, the value of the net assets of the JSC is greater than the authorized capital and reserve fund (if any) and will not become less than their size as a result of payment;

- in other cases provided for by federal laws.

In addition, if a JSC has a board of directors, there must be recommendations from the board of directors on the amount of dividends (clause 4 of article 42, clause 1 of article 64 of Law No. 208-FZ).