A fiscal drive is a device for recording, storing, encrypting and transmitting fiscal data. It is a hardware and software cryptographic tool that records and protects information about standard and trading operations carried out on KKM, and also redirects it online to the fiscal data operator. Different FN models support their own format.

Fiscal Data Format (FFD) is the established composition of the check details.

There are three main types of FFD:

- 1.0 is the very first format used after the introduction of online KKT. Out of circulation since 01/01/2019. From this date, fiscal data operators do not accept it.

- 1.05 – is an intermediate version, its purpose is to ensure a smooth transition from version 1.0 to version 1.1. Available with a key for 13 months and 3 years.

- 1.1 – a new fiscal data format, contains the properties of the two previous versions. Available with keys for 13/15 months and 3 years. Records more detailed information about the data being performed.

Only certified devices registered in the register of Fiscal Storage Devices on the website of the Federal Tax Service of Russia are allowed to operate. To select a suitable device, it is necessary to proceed from the size of the customer flow, the type of activity of the enterprise and the taxation system.

What is a fiscal drive

Cash register technology uses a storage device that stores information about financial transactions carried out in encrypted form, and it is impossible to change it. This unit is installed in a cash register (fiscal register, push-button cash register or smart terminal). It is called a fiscal accumulator.

The FN acts as a link between the online cash register and the Tax Service. The essence of the action is that from the cash register, through the fiscal data operator, the necessary information is transmitted online directly to the Federal Tax Service.

Accounting for cash registers in accounting

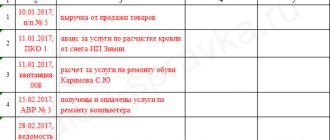

As mentioned above, business owners have the right to take equipment into account as part of the inventory or classify it as an operating system. But how do you figure out which group your equipment belongs to? First, let's look at a diagram that shows the threshold cost of purchased equipment established by law.

Now let's look at each of these price groups.

In accordance with PBU 6/01, any cash register can be registered as a fixed asset, since it meets all the criteria specified in clause 4, art. 1:

- used to perform work or provide services, and can also be used for management activities in enterprises;

- the period of use of such devices exceeds 12 months;

- equipment is not purchased for the purpose of further resale (the cash register is not purchased for profit);

- the device in the future can bring economic benefits to the enterprise (if necessary, the equipment can be resold or leased).

The ability to classify a cash register as an inventory item is established by enterprise policy. Each company independently determines the lower limit of the cost of the operating system (this value should be in the range of 0 - 40,000 rubles). Unless otherwise specified in your organization, then everything that costs less than forty thousand is MPZ.

But if accounting for cash registers in tax and accounting differs, a temporary difference arises, that is, in the first case, the entire amount is written off at a time, and in the second, monthly depreciation is charged.

Article 254 of the Tax Code of the Russian Federation allows you to avoid temporary differences, which states that you can independently choose (based on the operational life or other economic indicators) the method of writing off funds for property that is not related to fixed assets.

That is, you need to add in advance to the company’s tax policy the ability to extend the costs of inventories over time, indicating that this amendment applies to the group of products whose price in accounting relates to fixed assets.

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

Some nuances

If everything is crystal clear with expensive equipment, then inexpensive devices raise questions. It seems that they can be treated as low-value property, but in all respects they are much closer to fixed assets.

Accounting for fiscal registrars, POS terminals, stand-alone devices and other cash registers, the price of which does not exceed 40,000 rubles, depends solely on the internal policy of the company. If, according to this policy, you cannot accept on your balance sheet as fixed assets any property whose value is below the established forty thousand, then even equipment that requires special control (cash registers, personal computers, laptops, etc.) can only be classified as tangible assets .

If the company's policy allows any devices to be taken into account as part of fixed assets, regardless of their cost, then feel free to include them in the operating system account. At the same time, accounting for cash register machines for 30,000 rubles will be no different from accepting equipment for 60,000 rubles or 120,000 rubles onto the balance sheet.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

Reasons for replacing the fiscal drive

Expiration of service life

The fiscal drive has a certain validity period; it is indicated in the accompanying documents for the product.

Which FN to use depends on the specifics of the company’s activities and the chosen taxation regime.

Possible options:

BASIC Duration 13/15 months.

STS, UTII, patent taxation system, Unified Agricultural Tax

Term 36 months.

Trade in excisable goods, for example, cigarettes, alcohol (in any form of BUT)

Usually for 15 months. Replacement required after 410 days.

Seasonal work for specialists modes

Both 15 and 36 months are suitable. However, in the case of trading in excisable goods, from the moment of sale begins, the service life will be no more than 410 days (even if you select a Federal Tax Code with a maximum validity period).

When the online cash register operates autonomously (when information is not sent to the OFD)

It is allowed to use FN with any service life. It should be taken into account that a 36-month drive can operate for no more than 560 days, and when trading excisable goods, a maximum of 410 days.

The firmware of modern cash registers provides the ability to notify the user about the expiration of the term of use of the FN. The corresponding notification appears two months before it is time to replace the drive.

Memory exhausted

The drive uses a microchip with a specific amount of memory that cannot be expanded or cleared.

The cash register controls the filling level of the FN memory. When the volume approaches a critical level, a corresponding alert will appear. Sometimes it is enough just to pay attention to the check number to assess the state of memory.

The number of documents depends on the period of the fiscal storage:

- A financial fund for 15 months is designed to store 200-220 thousand documents.

- FN for 36 months has a memory capacity capable of storing up to 500 thousand checks.

Cash register blocking

Equipment can be blocked in the following cases:

- there is no access to the Internet;

- no shifts were closed within 24 hours;

- payments were made, but information about them was not received in the OFD (for a long time);

- The set time in the device does not coincide with the real one.

In these situations, there is no fiscal detail on the check, which makes sending data to the Tax Service impossible.

Typically, such problems are solved by checking the connection and cash register settings, and directly replacing the unit is extremely rarely necessary.

Equipment breakdown

Technical problems may occur caused by a failure of the cash register, the fiscal memory unit itself, or a software failure. Usually the cash register issues a certain error code.

Most likely, you will need a full repair, replacement of spare parts, and sometimes you have to replace the fiscal drive if the problem was in it. In case of a manufacturing defect, a new FN is issued by the manufacturer free of charge.

It should be remembered that using a cash register with a faulty physical function may result in a fine.

The fastest way to figure out what exactly is broken and how to fix it will be the engineers of the service center where you bought the cash register or where you entered into a maintenance contract.

The technicians will decipher the error, conduct an inspection and diagnostics, after which they will tell you exactly what the cause of the breakdown is and how much it will cost to fix it.

Change of owner

The fiscal drive can only be used by one taxpayer - the one whose TIN is specified in the cash register settings.

If the cash register is transferred to another owner, you must provide information about the current user. The information entered into memory cannot be changed, so the FN will need to be replaced so that information about the taxpayer can be updated.

Note that when transferring a cash register to a separate division of the organization, you will not have to set a new tax identification number, since the branches and the head office have the same tax identification number.

Incorrectly specified details

When entering details when registering an online cash register, you should be extremely careful, since if there is the slightest mistake, the drive will not be able to work, even if the unit you just purchased has not been used at all.

You will have to pay another FN and fiscalize the cash register in a new way.

FN suitable for a simplified taxation system

Article 4.1, clause 6 of Federal Law No. 54 states that individual entrepreneurs and LLCs using the simplified taxation system must install fiscal drives with a key on KKT for 3 years.

The fiscal accumulator is selected depending on the type of organization and the type of taxation applied in it.

Thus, for small retail outlets and organizations that sell seasonal goods or services, devices with a key for 13 or 15 months are suitable. In case of sale of excise goods, the device will be valid for no more than 400 days.

For organizations using a simplified tax regime, fiscal drives with a key for 3 years are suitable. In the case of regular sale of excisable goods, the validity period of the key will be reduced to 400 days, in offline mode to 550.

Frequency of replacement of FN for organizations with simplified tax system

The frequency of changing the fiscal drive, first of all, depends on the memory reserve determined by the cryptographic key, since the device cannot be rewritten or edited the stored information. For the same reason, the FN is subject to replacement in the event of a change in the taxation system.

If the device's memory is exhausted, the cash register generates an error and blocks access to the KKT, so the cash register notifies in advance that a replacement memory device will soon be required.

For example, if a three-year validity period of a cryptographic key is indicated, this means that the FN is designed for a number of 200,000 to 250,000 encrypted and stored fiscal documents. If this number of operations is completed before the specified period, the device will still be blocked.

Replacement is also required in cases where the cryptographic key expires, even if there is actually space left to record the information. In this case, the cash desk issues a message about an early replacement one month before the due date. If the FN is not replaced and re-registered by the expiration date, any transactions at the cash desk will be blocked. And to remove information from the chip you will need to contact the Federal Tax Service.

The used fiscal drive is stored in the organization for 5 years and is provided during scheduled inspections by regulatory tax authorities.

Almost all organizations falling under the simplified taxation system must equip KKM with fiscal drives with a key for at least 3 years, but there are exceptions, these include:

- companies providing seasonal goods and services;

- sellers of excise products;

- enterprises with a combined tax regime;

- paying agents or subagents.

They all use memory devices with a key of 13 to 15 months.

Replacement period and penalties

30 days are allotted for replacement, during which the cash register can operate offline. In this case, there are no fiscal details on the checks. The data is not transferred to the OFD, but is, as it were, accumulated in the cash register itself.

If the taxpayer does not install a new fiscal storage device within the specified period, then according to Art. 14.5 of the Code of Administrative Offenses of the Russian Federation, a fine is imposed on him:

- for individual entrepreneurs - 1500-3000 rubles;

- for LLC - 5000-10000 rubles.

Thus, it is advisable to replace the FN before its expiration date, so that there is time in reserve for all related procedures and settings.

Deadlines for filing an application with the tax authority

As a rule, this issue is left to the discretion of the entrepreneur himself. However, in a number of cases, 54-FZ obliges you to meet the deadline:

— upon transfer of the device — 1 business day;

- in case of theft or loss - 1 business day from the moment of discovery of the relevant fact;

— in case of breakdown of the FN — 5 working days.

If an examination of a faulty FN reveals the possibility of reading its data, it will be necessary to additionally send it no later than 60 days from the date of filing the application. The easiest way to do this is to personally contact any tax authority. The inspection must have special USB adapters that allow you to retrieve fiscal documents.

An individual entrepreneur can also copy fiscal documents from the FN to an electronic medium independently. To do this, you need a cash register and the “FN reader” program or similar. You can send the archive to the tax office through the individual entrepreneur’s personal account on the tax office’s website in the “Cash Accounting” section.

Simple online accounting for entrepreneurs

The service will replace your accountant and help you save money. Elba will prepare the reports herself and send them via the Internet. It will calculate taxes, help prepare documents for transactions and will not require special knowledge.

Try 30 days free Gift for new entrepreneurs The promotion is valid for individual entrepreneurs under 3 months old

Procedure for replacing the fiscal drive

Here we will tell you in more detail about the individual steps, which will be most relevant when replacing it yourself.

Closing the archive

— You must first wait until all the checks have been generated and transferred to the OFD. To do this, you need to close the shift and make sure that the amount of transmitted fiscal data is zero.

— Only after this they proceed to closing the archive (there is a corresponding item in the online cash register menu).

The CCP will generate a report, and its electronic version will be sent to the OFD.

The drive can be removed only after confirmation that the report has been sent to the operator about closing the archive. Information about receipt is reflected on the screen.

Installation of a new FN

CCP designs differ from each other, so before installing the fiscal module, you should determine the location of the compartment.

— The device is disconnected from the network, the lid is opened and the old FN is removed.

— After which a new unit is installed, and then the cash register is reconnected to the power supply.

Re-registration of cash register

To activate a new FN, you must re-register.

— Go to the corresponding cash register menu item. It is important to synchronize the time with the computer.

— Next, choose the reason for re-registration (in this case it is called: “Replacement of FN”).

Remember that it is extremely important to immediately enter all the CCP data correctly.

— After this, you need to save the changes and wait for the fiscalization report to be generated.

If the procedure is completed correctly, a notification will appear in the program window that the operation was completed successfully.

Re-registration of an online cash register with the Federal Tax Service

After replacing the FN, re-registration of the online cash register with the Tax Service is required. This is done during a face-to-face visit to a Federal Tax Service department or remotely in your personal account on the website nalog.ru.

It is important not to delay in completing the necessary actions, since the deadline for re-registration is 1 day after replacing the fiscal module.

For the online procedure on the Federal Tax Service portal there is the following algorithm:

— After logging into your personal account, go to the “Cashier” section and find the registration number of the cash register. Then you need to re-register it by selecting the appropriate command.

— In the window that appears, indicate the basis for re-registration of the CCP and OFD.

— At the final stage, they confirm the action with an electronic signature and send the application online to the Federal Tax Service for consideration.

If there are no errors in the registration number of the cash register, and complete information on details and reports is provided, the new card will be ready within 5 working days.

Ending the process

— After updating the online cash register, you should make sure that you have an electronic cash register card in your personal account, since the Tax Service may have reasons for refusing re-registration (Clause 17, Article 4.2 of 54-FZ).

Typical errors that prevent the completion of the process include typos in the entered data and incomplete information provided.

— If the electronic card has been received, then click “Registration card received”, and then click the “Complete re-registration” field.

This point is important, since otherwise the OFD will not receive reports on the operation of the cash register with the new FN, which threatens with a fine - as if the entrepreneur had not replaced the storage device in a timely manner.

Extension of the agreement with the fiscal data operator - OFD

What is a fiscal data operator

OFD is an organization that transmits fiscal data to the Federal Tax Service . They use cloud storage technologies for this. All information is accumulated on the operator’s servers and is provided at the request of the tax inspector when checking the activities of a company or individual entrepreneur.

The operator works under a contract for the provision of services. The annual subscription cost for all operators is standard and amounts to 3 thousand rubles per year. After the current contract expires, it must be renewed. This is done remotely, through your personal account on the operator’s website.

Operating principle of OFD

How to find out when an agreement with an OFD is expiring

Here the principle is the same as when replacing a fiscal drive. Notification of the end of the current contract will be sent to the email specified when registering your personal account. Usually this also happens 30 days before the end of the agreement.

There is also a small nuance here. The fact is that you can pay for the operator’s services for any period of time: a day, a week or a month. Tariffing provides for daily debiting of funds for services. If you paid not for a year, but, say, 246 days, then you will have to renew the agreement after this time. The operator will also warn you about this in advance.

Extending service from a fiscal data operator - step-by-step instructions

Independent contract extension consists of the following steps:

Step 1. Log in to your personal account on the OFD website using your login and password.

A simple form of entry into your OFD personal account

Step 2. If there are several cash registers, you need to select the one whose service will soon be discontinued. To search, you can use the “Information” section in the account menu.

Step 3. Next, everything depends on whether there are enough funds in your personal account and whether the online cash register service has been discontinued or not yet:

- if the balance allows you to continue the operation, find the “Extend service” menu item. After this, a window will open in which you need to enter data about the periods for which you are going to extend the service. We enter the deadlines (any), after which we confirm the correctness of the data entry. Funds will be debited from the account automatically, after which the agreement will be extended;

- If the balance does not allow you to extend the service, you need to top it up. All invoices issued by the system are located in the “Messages” section. You can pay for the service in two ways: bank transfer or bank card. After replenishing your balance, follow the steps described in the previous paragraph;

- If the cash register service has already been stopped by the operator, you first need to top up your personal account balance. After that, do what is written in the first paragraph.

If everything is done correctly, servicing the cash register will continue automatically , and you will receive a notification by email.

Do it yourself or contact a specialist

As you can see, there is nothing complicated about extending the service of the OFD and replacing the fiscal drive. However, if you have a large fleet of cash register equipment, it is difficult to keep track of everything alone. Therefore, the best solution is to enter into a service with a specialized organization involved in trade automation, for example, the ECAM company.

Specialists will develop a maintenance schedule for the CCP and will carry out all the necessary work themselves. The only thing that is required of you is to pay your bills on time.

We hope the article was useful. Do not delay the deadlines - make all replacements according to the regulations. Good luck in business!

How to change: yourself or at a service center

According to the current requirements of 54-FZ, the owner himself can change the fiscal drive

by purchasing a unit from an authorized center.

Neither contacting the service center nor concluding a contract for cash register maintenance is no longer a mandatory requirement when registering a cash register (as was the case before 2016-2017).

However, for most companies there is no reason to refuse to contact the ASC, and here’s why:

- You need to activate the FN the first time without errors.

- To maintain the factory warranty, it is important that only employees of the official service center of a particular brand open the case and carry out manipulations.

Directly replacing the FN unit takes no more than 15 minutes, but there are many related procedures that will require time and concentration on technical issues.

Even with several cash registers, and even more so with a large fleet of cash register equipment, the owner probably has things to do that are more important for business development.

Therefore, retail experts recommend entrusting all work to your service center, where you purchased and/or serviced the cash register.