OSNO companies pay tax on their profits in installments throughout the year. When the year ends, you need to calculate the annual tax amount and pay the difference. Advance payments for income tax are calculated and transferred in several ways. Let's figure out what this depends on and whether the organization has a choice. We will also look at possible calculation options using examples.

Who pays advance income tax payments and with what frequency?

Advance payments for income tax are paid quarterly or monthly. The payment procedure depends on who pays advance payments for income tax, i.e. what category the taxpayer belongs to. Let's consider the existing tax payment options and categories of taxpayers.

- All organizations, with the exception of those named in paragraph. 7 clause 2, clause 3 art. 286 of the Tax Code of the Russian Federation, must calculate advance payments based on the results of the quarter and pay them both upon its completion and monthly during the next quarter (paragraph 2, clause 2, article 286 of the Tax Code of the Russian Federation).

- Organizations with revenue less than the limits established by clause 3 of Art. 286 of the Tax Code of the Russian Federation (in the amount of 15 million rubles on average for each quarter of the previous 4), they can calculate and pay quarterly advance payments for income tax quarterly without paying monthly payments.

IMPORTANT! In 2021, officials returned the previous revenue limit of 15 million rubles. Let us remind you that for 2021 this limit was increased to 25 million rubles. on average for the quarter (law dated April 22, 2020 No. 121-FZ). See here for details. There you will also find explanations from the Federal Tax Service on how to deal with advances for the 1st quarter of 2021.

- If an organization independently expresses a desire to calculate and pay advance payments of income tax on a monthly basis from the profit actually received, it must notify the tax authority of its decision no later than December 31 of the year preceding the tax period (paragraph 7, paragraph 2, article 286 of the Tax Code of the Russian Federation ).

ConsultantPlus experts explained how to fill out an income tax return for 2021 and subsequent periods when making advance payments based on actual profits. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

A flowchart developed by our specialists will help you find out how often your organization should pay advances on profits.

Responsibility

If the quarterly advance payment for income tax was transferred later than the established deadlines, the tax inspectorate may charge the organization a penalty (Article 75 of the Tax Code of the Russian Federation).

If the organization does not transfer the advance payment within the established time frame, the tax inspectorate may recover the unpaid amount of the advance payment from the current account or at the expense of the organization’s property (Articles 46 and 47 of the Tax Code of the Russian Federation).

Failure to fulfill the obligation to make advance tax payments is the basis for sending an organization a request to pay tax (paragraph 3, paragraph 1, article 45 of the Tax Code of the Russian Federation, paragraph 12 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98). This requirement specifies the amount of debt and the period for its repayment (clause 1 of Article 69 of the Tax Code of the Russian Federation).

The inspectorate may make a request for an advance payment of income tax within three months starting from the day following the day the arrears were discovered (Article 70 of the Tax Code of the Russian Federation).

The decision to collect an advance tax payment is made after the expiration of the deadline for its payment specified in the request, but no later than two months after the expiration of the specified period (Clause 3 of Article 46 of the Tax Code of the Russian Federation).

Organizations cannot assess a fine for the amount of unpaid advance payments (clause 3 of Article 58 of the Tax Code of the Russian Federation).

Income tax quarterly

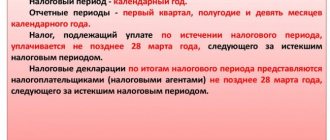

As for the frequency of payment of advance payments on profits, they must be paid by organizations quarterly if the reporting periods for them are the first quarter, half a year and 9 months of the calendar year (paragraph 1, paragraph 2, article 285, paragraph 2, paragraph 2, paragraph 3 Article 286 of the Tax Code of the Russian Federation).

The following organizations are required to make a quarterly advance payment of income tax in accordance with clause 3 of Art. 286 of the Tax Code of the Russian Federation (at the same time, they are exempt from monthly advance payments for income tax):

- organizations whose income, calculated in accordance with Art. 249 of the Tax Code of the Russian Federation for the previous 4 quarters, does not exceed 15 million rubles. on average for each quarter;

- budgetary institutions;

- foreign companies operating in the Russian Federation through a permanent representative office;

- enterprises participating in simple partnerships, in relation to income from participation;

- investors of production sharing agreements in terms of income from the implementation of agreements;

- beneficiaries under trust management agreements.

Advance payments reduce the amount of income tax calculated for the year (paragraph 5, paragraph 1, article 287 of the Tax Code of the Russian Federation).

What happens to the advance if there is a loss in the quarter?

In one quarter of the tax period, a taxpayer may receive less profit than in the previous one, or a loss. But these circumstances do not exempt the taxpayer from paying monthly advance payments in the current quarter. In such cases, the amount or part of the monthly advance payments paid in the current quarter will be recognized as an overpayment of income tax, which, according to clause 14 of Art. 78 of the Tax Code of the Russian Federation is subject to offset against upcoming payments for income tax or other taxes; for repayment of arrears, payment of penalties or refund to the taxpayer.

If the calculated amount of the monthly advance payment turns out to be negative or equal to 0, then monthly advance payments in the corresponding quarter are not paid (paragraph 6, paragraph 2, article 286 of the Tax Code of the Russian Federation). A similar result obtained based on the results of the third quarter leads to the absence of payment of advances in the fourth quarter of the current year and the first quarter of the next.

Accrual of advance payments for income tax quarterly

Let's consider the procedure for calculating the advance payment of income tax for organizations whose revenue does not exceed 15 million rubles. on average for the quarter (paragraph 2, paragraph 2, article 286 of the Tax Code of the Russian Federation).

First, the amount of income tax corresponding to the reporting period is calculated using the formula:

APKotch = NBotch × C,

Where:

APKotch - advance payment for the reporting period;

NBotch - tax base of the reporting period, calculated on an accrual basis;

C is the income tax rate.

The amount of advance income tax payable at the end of the reporting period is determined by the formula (paragraph 1 of Article 287 of the Tax Code of the Russian Federation):

APKadd. = APKotch. – APKpred,

Where:

APKadd. — quarterly advance payment for additional payment, payable at the end of the reporting period (six months, 9 months, year);

APKotch. — the amount of the advance payment calculated on an accrual basis for the reporting period;

APKpred. — payment amount based on the results of the previous reporting period (within the current tax period).

The amount of the additional payment based on the results of the tax period, that is, the amount of the 4th quarterly payment is formed based on the amount of profit actually received, calculated on an accrual basis for the year, minus the quarterly advance payments paid to the budget during this year. The amount of the latter will be equal to the amount of the advance payment calculated on an accrual basis for 9 months.

Thus, the size of the final income tax payment is reduced by the amount of advance payments paid quarterly. If at the end of the year, instead of a profit, a loss is received, then the amount of the 4th quarterly advance payment will be zero (clause 8 of Article 274, paragraph 6 of clause 2 of Article 286 of the Tax Code of the Russian Federation).

If you pay quarterly advances, you can double-check the accuracy of your calculations with the help of explanations from ConsultantPlus experts. Get free trial access to K+ and proceed to visual explanations and calculation examples.

How to reflect advance payments for income tax in accounting - see the entries here.

Option 2: once a month based on actual profit

Beta LLC has been operating for several years, and its income is increasing. In 2021, the company prepared in advance for exceeding the limit and submitted a notification to the Federal Tax Service about the payment of advances on actual profits.

This method is similar to the previous one, with the only difference being that advances are calculated at the end of each month, not the quarter. The base is taken on a cumulative basis from the beginning of the year. That is, in February the tax for January is calculated, in March - for January and February, in April - for the period January-March, and so on. Payment is due by the 28th day of the month following the period.

Table 2. Calculation of advance payments for income tax of Beta LLC for 2021

| Last month of the period | Tax base, thousand rubles | Calculated advance, thousand rubles (base * 20%) | Payable at the end of the period (federal/regional part), thousand rubles | Payment deadline |

| January | 15 000 | 3 000 | 3 000 (450 / 2 550) | 28th of February |

| February | 33 000 | 6 600 | 3 600 (540 / 3 060) | March 28 |

| March | 51 000 | 10 200 | 3 600 (540 / 3 060) | April 29 |

| April | 60 000 | 12 000 | 1 800 (270 / 1 530) | May 28 |

| May | 90 000 | 18 000 | 6 000 (900 / 5 100) | June 28 |

| June | 126 000 | 25 200 | 7 200 (880 / 6 120) | July 29 |

| July | 153 000 | 30 600 | 5 400 (810 / 4 590) | August 28 |

| August | 180 000 | 36 000 | 5 400 (900 / 5 100) | September 30th |

| September | 210 000 | 42 000 | 6 000 (900 / 5 100) | 28 of October |

| October | 237 000 | 47 400 | 5 400 (810 / 4 590) | November 28 |

| november | 264 000 | 52 800 | 5 400 (810 / 4 590) | December 30th |

| December | 291 000 | 58 200 | 5 400 (810 / 4 590) | March 28, 2020 |

This method is simpler and more understandable than the next one. There is no tax overpayment. This is due to the fact that the advance is calculated based on the fact, and not on the basis of estimated income. Another advantage is that part of the actual profit received is used to pay the tax, and not the organization’s money withdrawn from circulation.

How are income tax advances calculated monthly?

If the organization does not meet the criteria established in paragraph 3 of Art. 286 of the Tax Code of the Russian Federation, and the reporting period for it is a quarter, then in addition to quarterly advance payments for income tax, monthly ones must be paid.

Monthly advance payments, as well as quarterly ones, reduce the amount of income tax payable based on the results of the reporting period or year (paragraph 5, clause 1, article 287 of the Tax Code of the Russian Federation).

The procedure for calculating the amount of monthly advances payable in 2020-2021 has not changed. As before, the monthly advance payment for profit in the 1st quarter of the year is equal to the amount of the monthly advance payment in the last quarter of the previous year; in the 2nd quarter - 1/3 of the advance quarterly payment for the 1st quarter; in the 3rd quarter - 1/3 of the difference between the amount of the advance for the first half of the year and the advance due for the 1st quarter; in the 4th quarter - 1/3 of the difference between advances accrued for 9 months and for half a year.

The organization switches to paying monthly advance payments if, based on the results of the past 4 quarters, the amount of income received exceeded 15 million rubles. on average for the quarter (clause 3 of Article 286 of the Tax Code of the Russian Federation).

In order not to make a mistake in the calculation, you need to correctly determine which quarters will be the previous ones. The Tax Code contains a rule according to which the previous quarters are the 4 quarters preceding the current one (clause 3 of Article 286 of the Tax Code of the Russian Federation).

The Ministry of Finance clarifies that previous should be understood as 4 quarters, sequentially preceding the quarter in which the taxpayer submits a declaration (letters of the Ministry of Finance of Russia dated December 24, 2012 No. 03-03-06/1/716, dated September 21, 2012 No. 03-03-06/ 1/493). That is, income from sales in the last quarter of the tax period is also included in the calculation of average income.

Explanations and a practical example from K+ experts will help you correctly calculate monthly advances for income tax. See them in the Ready-made solution with a free trial access.

For more information on the procedure for calculating the monthly tax payment, see the material “How to calculate monthly advance payments for income tax during the reporting period .

Also find out how to report advances on your income tax return:

- on line 210;

- line 220;

- line 290.

Calculation of advance payments during reorganization and when changing the payment procedure

In the event of a reorganization of a taxpayer, during which another legal entity is merged with it, the amount of the monthly advance payment on the date of reorganization is calculated without taking into account the performance indicators of the merging organization (letter of the Ministry of Finance of Russia dated July 28, 2008 No. 03-03-06/1/431).

If a taxpayer changes the procedure for calculating advances, moving from monthly determination of them from actual profit to monthly payments calculated quarterly, then this can only be done from the beginning of the new year (paragraph 8, paragraph 2, article 286 of the Tax Code of the Russian Federation), notifying the Federal Tax Service no later than 31 December of the year preceding the change. The amount of the monthly payment that will have to be paid in the first quarter, in this case, will be determined as 1/3 of the difference between the amount of the advance calculated based on the results of 9 months and the amount of the advance payment received based on the results of the half-year in the previous year (paragraph 10 p. 2 Article 286 of the Tax Code of the Russian Federation).

To learn about the timing of advance payments, read the article “What is the procedure and deadlines for paying income tax (postings)?”.

Changes in the calculation of income tax in 2020–2021

One of the recent innovations in income tax is the introduction of the possibility of applying an investment deduction to the amount of tax transferred to both budgets (Article 286.1 of the Tax Code of the Russian Federation). It can be used in the period 2018–2027. By deducting 90% of the cost of fixed assets, you can reduce the tax charged to the regional budget, and the remaining 10% can be attributed to the reduction of tax charged to the federal budget. The decision to introduce an investment deduction is made by the regions, and they also specify the conditions for its application. Such objects will no longer be depreciated.

Initially, the deduction was provided for fixed assets of 3–7 depreciation groups put into operation. But from January 1, 2020, it also applies to groups 8-10 (law of July 26, 2019 No. 210-FZ). Also, starting from 2021, it will be possible to include infrastructure costs in the investment deduction.

Read more about the application of this deduction in the article “Investment tax deduction for income tax.”

From 2021:

- Organizations have the opportunity not to pay income tax on money received free of charge from an organization of which it is a participant or shareholder, within the limits of the contribution to property made by it previously also in money.

- Income received by a shareholder or participant upon leaving a liquidated company, in the form of an excess over his contribution to the charter capital, is recognized as dividends for income tax purposes at a rate of 13%.

- Payments to the Platon system can be included in expenses in full.

- Employers have the right to reduce income by the cost of vouchers for employees (we talked about the nuances in this material).

In addition to the above innovations with advances also (laws dated 08/02/2019 No. 269-FZ, dated 07/26/2019 No. 210-FZ):

- in non-operating expenses, you can take into account the costs of constructing social infrastructure facilities if they are transferred free of charge into state or municipal ownership;

- regional operators for the management of municipal solid waste, museums, theaters and libraries received the right to a 0% rate;

- There are changes for participants in regional investment contracts and SEZ residents.

How to calculate sales income

The same type of indicator is involved in the calculation of CDQ - quarterly sales income. If you incorrectly calculate its amount, the result of the calculations and conclusions about the possibility/impossibility of quarterly payment of advances may turn out to be erroneous. How to calculate this indicator correctly?

Income from sales must be determined according to the provisions of Art. 249 of the Tax Code of the Russian Federation. What it includes, see the figure below:

The calculation does not include income not subject to income tax. The list of such income is closed (Article 251 of the Tax Code of the Russian Federation). Recently, it was supplemented with one more paragraph (Law “On Amendments to Part 1 and Chapter 25 of the Tax Code of the Russian Federation” dated August 3, 2018 No. 294-FZ). When calculating income tax starting from 2021, the tax base does not take into account the income of an international holding company in the form of profits of controlled foreign companies (for which such a company is recognized as a controlling person).

Sales proceeds are included in calculations without VAT and excise taxes. When calculating the average income from sales (when taking it into account with VAT), income indicators for the accounting quarters of 2021 and 2021 are taken minus VAT equal to 20%.

Non-operating income does not take part in the calculations.

Results

Advances on income tax are paid by all organizations on the general taxation system. There are three options for calculating advances: quarterly with payment or based on the results of the quarter (the possibility of its use is limited by the amount of revenue received); monthly with additional payment for the quarter; monthly based on actual profit. The algorithm for calculating advances in each of the listed cases has its own nuances.

Sources:

- Tax Code of the Russian Federation

- Federal Law of April 22, 2020 No. 121-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Why transfer advances based on profit?

Despite the fact that the tax period for income tax is a calendar year, transferring tax to the budget in one amount at the end of the year is not allowed.

Before the payment deadline (based on the results of the reporting periods), advances are required to be paid, the amount of which is determined by one of the methods established in tax legislation. The purpose of such an advance payment is an even flow of funds into the budget. The procedure for calculating advances and paying them is established in Art. 286, 287 Tax Code of the Russian Federation. They describe the specifics of calculating advance payments for each of the permitted methods.

Advances paid during the year at the end of the year are counted towards the payment of income tax. Advance payments for the 1st quarter and income tax may be the same in size if the payer ceased activity before the end of the 1st quarter (or on the last day of this period).

What to take into account when calculating advances on profit for the 1st quarter, we will tell you further.

Quarterly additional payments to monthly advances (method No. 3): basic algorithm

This method is the most labor-intensive in terms of the volume of calculations and the number of issued payment orders for the transfer of advances. When using it, you are required to pay advances on profits based on the results of the 1st quarter, half a year and 9 months. In addition, monthly advances must be paid within each quarter.

The basic rules for this method are shown in the figure:

Monthly earnings advances for 1Q 2021 are calculated based on 4Q 2021 data. If the calculated advance payment is negative or equal to zero, nothing needs to be transferred to the budget at the end of the current quarter (reporting period).

An example of calculating monthly advance payments for income tax payable in the 2nd quarter from K+ In the 1st quarter, Alpha LLC received a profit of RUB 3,750,000. and calculated the quarterly advance payment: 750,000 rubles. (RUB 3,750,000 x 20%). Accordingly, the monthly advance payment to Alpha LLC, payable in the second quarter, will be 250,000 rubles. (RUB 750,000 / 3). You can view examples for the II, III and IV quarters in full in K+. Trial access is free.