The article will discuss issues regarding personal income tax rates on dividends in 2021 for residents and non-residents, as well as the availability of tax deductions when paying dividends and how dividends are reflected in the 2-personal income tax certificate.

Dividends are part of the profit received by a joint stock company or other organization, distributed among shareholders in proportion to the number of shares. The meeting of shareholders and the company's Charter determine the amount of dividends and the procedure for its payment.

Who pays and when

According to Art. 143 of the Tax Code of the Russian Federation, taxpayers for this type of fee are legal entities and individual entrepreneurs, but it is believed that ultimately it is paid by the buyer. The fact is that value added tax is indirect. With its help, the state seeks to receive part of the premium that the manufacturer or seller sets on the price of the product at each stage of production or sales. The tax is calculated by the manufacturer and the seller, but it is included in the cost of the product; in addition, the entrepreneur deducts the input VAT already paid when purchasing goods for production. Thus, the buyer is the source of the collection, but in the legislative act - in the Tax Code - individuals are not mentioned as VAT payers; they do not calculate or transfer it.

This financial commitment is of great importance for the budget and not only in terms of revenue. The state, by introducing a value added tax, ensures the contribution of funds to the budget earlier than the final sale of products, which increases the efficiency of the obligation and its collection.

IMPORTANT!

From 01/01/2019, VAT has been increased from 18% to 20%.

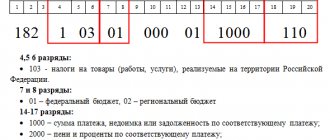

The value of BCC for the main VAT liability

Budget classification codes are established uniformly for legal entities and individual entrepreneurs; the values do not depend on the status of the taxpayer and the legal form.

In 2021, the BCC values for this tax are the same as in 2021. The data for the main obligation is given below.

| Purpose of payment | KBK indicator |

| Value added tax on goods, as well as works and services sold on the territory of the Russian Federation | 182 1 0300 110 |

| Tax on goods, works, services from Belarus and Kazakhstan | 182 1 0400 110 |

| Tax on goods, works, services from abroad | 153 1 0400 110 |

Personal income tax on dividends in 2021 rate for residents and non-residents

According to Article 224 of the Tax Code of the Russian Federation, the following tax rates are established for dividend income:

- 13% – for individuals who are residents of the Russian Federation.

- 15% – for individuals who are non-residents of the Russian Federation.

It is important to monitor the status of an individual.

Let us remind you that if an individual actually stays on the territory of the Russian Federation for at least 183 calendar days for 12 consecutive months, then this individual. the person is a resident of the Russian Federation .

For penalties and fines

The CBC “VAT Penalties” in 2021 are also similar to those used in 2021. The table shows the current indicators of BCC when paying VAT.

| Type of collection | KBK VAT, penalties | Fines |

| Value added tax on goods, as well as works and services sold on the territory of the Russian Federation | 182 1 0300 110 | 182 1 0300 110 |

| Value added tax on goods imported into the Russian Federation from Belarus and Kazakhstan | 182 1 0400 110 | 182 1 0400 110 |

| Value added tax on goods imported into the territory of the Russian Federation (the payment administrator in this case is the Federal Customs Service of Russia) | 153 1 0400 110 | 153 1 0400 110 |

If the payment deadline is missed, VAT penalties will apply; BCC 2021 will be required when filling out a payment order for the transfer of penalties on your own initiative or at the request of the tax authority.

KBK "VAT fine" 2021 for legal entities is required when drawing up a payment document for payment of a fine, which is assigned for untimely or improper fulfillment of a financial obligation (for example, in case of incomplete payment of the established fee).

Budget classification code for 2014

Home / Directory / Budget classification code / Budget classification code for 2014

Budget classification codes are digital designations of various groups of income and expenses. The full list of current KBK 2014 is given below.

Simplified taxation system (STS)

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Tax levied on taxpayers who have chosen income as an object of taxation | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax levied on taxpayers who have chosen income as the object of taxation (for tax periods expiring before January 1, 2011) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| A tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (for tax periods expiring before January 1, 2011) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Minimum tax credited to the budgets of state extra-budgetary funds (paid (collected) for tax periods expired before January 1, 2011) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Minimum tax credited to the budgets of the constituent entities of the Russian Federation | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of urban districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of municipal districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

VAT

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| VAT on goods (work, services) sold in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| VAT on goods imported into Russia (payment administrator – Federal Tax Service of Russia) | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| VAT on goods imported into Russia (payment administrator - Federal Customs Service of Russia) | 153 1 0400 110 | 153 1 0400 110 | 153 1 0400 110 |

Patent tax system

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of urban districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of municipal districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Personal income tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax on income received by citizens registered as: – entrepreneurs; – private notaries; – other persons engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax on income received by citizens in accordance with Article 228 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Personal income tax in the form of fixed advance payments on income received by non-residents employed by citizens on the basis of a patent in accordance with Article 227.1 of the Tax Code of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

Income tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Income tax credited to the federal budget | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Profit tax credited to the budgets of constituent entities of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Tax on the profits of organizations when implementing production sharing agreements concluded before the entry into force of the Federal Law “On Production Sharing Agreements” and not providing for special tax rates for crediting the specified tax to the federal budget and the budgets of the constituent entities of the Russian Federation | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Corporate income tax on the income of foreign organizations not related to activities in the Russian Federation through a permanent establishment, with the exception of income received in the form of dividends and interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Corporate income tax on income received in the form of dividends from Russian organizations by Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Corporate income tax on income received in the form of dividends from Russian organizations by foreign organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Corporate income tax on income received in the form of dividends from foreign organizations by Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| Corporate income tax on income received in the form of interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

UTII

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Single tax on imputed income for certain types of activities | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Single tax on imputed income for certain types of activities (for tax periods expired before January 1, 2011) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Organizational property tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Property tax of organizations on property not included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Tax on property of organizations included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Property tax for individuals

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Property tax for individuals, levied at the rates applied to taxable objects located within the boundaries of intra-city municipalities of the federal cities of Moscow and St. Petersburg | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Property tax for individuals, levied at rates applicable to taxable objects located within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Property tax for individuals, levied at rates applied to taxable objects located within the boundaries of inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Property tax for individuals, levied at the rates applied to taxable objects located within the boundaries of settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Pension contributions

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in the Russian Federation, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Additional insurance contributions for the funded part of the labor pension and employer contributions in favor of insured persons paying additional insurance contributions for the funded part of the labor pension, credited to the Pension Fund of the Russian Federation | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation to pay the insurance part of the labor pension | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2013) | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Contributions paid by coal industry organizations to the budget of the Pension Fund of the Russian Federation for the payment of additional payments to pensions | 392 1 0200 160 | 392 1 0200 160 | 392 1 0200 160 |

| Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of the insurance part of the labor pension (for billing periods expired before January 1, 2010) | 392 1 0900 160 | 392 1 0900 160 | 392 1 0900 160 |

| Insurance contributions in the form of a fixed payment credited to the budget of the Pension Fund of the Russian Federation for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2010) | 392 1 0900 160 | 392 1 0900 160 | 392 1 0900 160 |

Contributions to compulsory social insurance

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Insurance contributions for compulsory social insurance against industrial accidents and occupational diseases | 393 1 0200 160 | 393 1 0200 160 | 393 1 0200 160 |

| Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity | 393 1 0200 160 | 393 1 0200 160 | 393 1 0200 160 |

Contributions for compulsory health insurance

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Insurance premiums for compulsory health insurance of the working population, credited to the Federal Compulsory Medical Insurance Fund | 392 1 0211 160 | 392 1 0211 160 | 392 1 0211 160 |

| Insurance premiums for compulsory health insurance of the working population, previously enrolled in the TFOMS (for billing periods before 2012) | 392 1 0212 160 | 392 1 0212 160 | 392 1 0212 160 |

Property tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Real estate tax levied on real estate located within the boundaries of the cities of Veliky Novgorod and Tver | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Excise taxes

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Excise taxes on ethyl alcohol from food raw materials (with the exception of distillates of wine, grape, fruit, cognac, Calvados, whiskey), produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on ethyl alcohol from non-food raw materials produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on ethyl alcohol from food raw materials (wine, grape, fruit, cognac, calvados, whiskey distillates) produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcohol-containing products produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on tobacco products produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on motor gasoline produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on straight-run gasoline produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on motor gasoline, diesel fuel, motor oils for diesel and (or) carburetor (injection) engines produced in Russia (in terms of repayment of debt from previous years accrued before January 1, 2003) | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on passenger cars and motorcycles produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on diesel fuel produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on motor oils for diesel and (or) carburetor (injection) engines produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on wines, fruit wines, sparkling wines (champagnes), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on beer produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent (except for beer, wines, fruit wines, sparkling wines (champagnes), wine drinks produced without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate) produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol up to 9 percent inclusive (except for beer, wines, fruit wines, sparkling wines (champagne), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate) produced in Russia | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent (except for wines) when sold by producers, with the exception of sales to excise warehouses, in terms of amounts calculated for 2003 | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent (except for wines) when sold by producers to excise warehouses in terms of amounts calculated for 2003 | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent (except for wines) when sold from excise warehouses in terms of amounts calculated for 2003 | 182 1 0300 110 | 182 1 0300 110 | 182 1 0300 110 |

| Excise taxes on natural gas | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

| Excise taxes on oil and stable gas condensate | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

| Excise taxes on jewelry | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

Excise taxes (imported)

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Excise taxes on ethyl alcohol from food raw materials (with the exception of distillates of wine, grape, fruit, cognac, Calvados, whiskey), imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on ethyl alcohol from food raw materials (wine, grape, fruit, cognac, calvados, whiskey distillates) imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on ethyl alcohol from non-food raw materials imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on alcohol-containing products imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on tobacco products imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on motor gasoline imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on passenger cars and motorcycles imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on diesel fuel imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on motor oils for diesel and (or) carburetor (injection) engines imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on wines, fruit wines, sparkling wines (champagnes), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on beer imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent, including drinks made on the basis of beer, produced with the addition of ethyl alcohol (except for beer, natural wines, including champagne, sparkling, carbonated, fizzy, natural drinks with volume fraction of ethyl alcohol no more than 6 percent of the volume of finished products made from wine materials produced without the addition of ethyl alcohol) imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol up to 9 percent inclusive (except for beer, wines, fruit wines, sparkling wines (champagne), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate), imported into the territory of Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on straight-run gasoline imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

| Excise taxes on household heating fuel produced from diesel fractions of direct distillation and (or) secondary origin, boiling in the temperature range from 280 to 360 degrees Celsius, imported into Russia | 182 1 0400 110 | 182 1 0400 110 | 182 1 0400 110 |

Land tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Land tax levied at a rate of 0.3 percent and applied to taxable objects located within the boundaries of intra-city municipalities of the federal cities of Moscow and St. Petersburg | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 0.3 percent and applied to taxable objects located within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 0.3 percent and applied to tax objects located within the boundaries of inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 0.3 percent and applied to taxable objects located within the boundaries of settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 1.5 percent and applied to taxable objects located within the boundaries of intra-city municipalities of the federal cities of Moscow and St. Petersburg | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 1.5 percent and applied to taxable objects located within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 1.5 percent and applied to tax objects located within the boundaries of inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax levied at a rate of 1.5 percent and applied to taxable objects located within the boundaries of settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Land tax (for obligations arising before January 1, 2006), mobilized in the territories of intra-city municipalities of federal cities of Moscow and St. Petersburg | 182 1 0900 110 | 182 1 09 04051 03 2000 110 | 182 1 0900 110 |

| Land tax (for obligations arising before January 1, 2006), mobilized in the territories of urban districts | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

| Land tax (for obligations arising before January 1, 2006), mobilized in inter-settlement territories | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

| Land tax (for obligations arising before January 1, 2006), mobilized in the territories of settlements | 182 1 0900 110 | 182 1 0900 110 | 182 1 0900 110 |

Transport tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Transport tax for organizations | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| Transport tax for individuals | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Gambling tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Gambling tax | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Fauna and biological resources

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Fee for the use of fauna objects | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Fee for the use of aquatic biological resources (excluding inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Fee for the use of objects of aquatic biological resources (for inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 11 |

Water tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments)* | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Water tax | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

MET

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Oil | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Combustible natural gas from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Gas condensate from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Extraction tax for common minerals | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Tax on the extraction of other minerals (except for minerals in the form of natural diamonds) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Tax on the extraction of mineral resources on the continental shelf of Russia, in the exclusive economic zone of the Russian Federation, when extracting mineral resources from the subsoil outside the territory of Russia | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mining tax on natural diamonds | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

Unified agricultural tax

| Payment Description | KBK for transfer of tax (fee, other obligatory payment) | KBK for transferring penalties for taxes (fees, other obligatory payments) | KBK for transferring a fine for a tax (fee, other obligatory payment) |

| Unified agricultural tax | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Unified agricultural tax (for tax periods expired before January 1, 2011) | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

Government duty

Income from the provision of paid services and compensation of state costs

| Payment Description | KBK for payment transfer |

| Fee for providing information contained in the Unified State Register of Taxpayers | 182 1 1300 130 |

| Fee for providing information and documents contained in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs | 182 1 1300 130 |

| Fee for providing information on registered rights to real estate and transactions with it, issuing copies of contracts and other documents expressing the content of unilateral transactions made in simple written form | 182 1 1300 130 |

Fines, sanctions, payments for damages

| Payment Description | KBK for payment transfer |

| Monetary penalties (fines) for violation of laws on taxes and fees | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Pension Fund of the Russian Federation) | 392 1 1600 140 |

| Monetary penalties (fines) imposed by the Pension Fund of the Russian Federation and its territorial bodies in accordance with Articles 48 - 51 of the Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical funds insurance" | 392 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on the use of cash register equipment when making cash payments and (or) payments using payment cards | 182 1 1600 140 (to the Federal Tax Service of Russia) 188 1 1600 140 (to the Ministry of Internal Affairs of the Russian Federation) |

| Monetary penalties (fines) for administrative offenses in the field of state regulation of the production and turnover of ethyl alcohol, alcohol, alcohol-containing and tobacco products | 141 1 1600 140 (to Rospotrebnadzor) 160 1 1600 140 (to Rosalkogolregulirovanie) 188 1 1600 140 (to the Ministry of Internal Affairs of the Russian Federation) |

| Monetary penalties (fines) for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | 182 1 1600 140 (to the Federal Tax Service of Russia) |

| Monetary penalties (fines) for violation of the legislation on state registration of legal entities and individual entrepreneurs, provided for in Article 14.25 of the Code of the Russian Federation on Administrative Offenses | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the legislation of the Russian Federation on administrative offenses provided for in Article 20.25 of the Code of the Russian Federation on Administrative Offenses | 182 1 1600 140 |

| Other receipts from monetary penalties (fines) and other amounts for damages, credited to the budgets of the constituent entities of the Russian Federation | 182 1 1600 140 |

| Other receipts from monetary penalties (fines) and other amounts for damages, credited to the budgets of city districts | 182 1 1600 140 |

| Other receipts from monetary penalties (fines) and other amounts for damages, credited to the budgets of municipal districts | 182 1 1600 140 |

| Other receipts from monetary penalties (fines) and other amounts for damages, credited to the budgets of settlements | 182 1 1600 140 |

| Other gratuitous receipts to the federal budget | 182 2 0700 180 |

For tax agents

Tax agents for VAT are, in accordance with Art. 161 Tax Code of the Russian Federation:

- tenants of property from government agencies and local governments;

- purchasers of goods, work and services from foreign organizations operating in the Russian market, which themselves are not registered as taxpayers in the Russian Federation;

- buyers of state property, with the exception of individual entrepreneurs;

- bodies, companies and individual entrepreneurs authorized to sell confiscated property, etc.;

- from 01.10.2011 - buyers of property and (or) property rights of debtors declared bankrupt (with the exception of individuals who do not have the status of individual entrepreneurs);

- registered as taxpayers (organizations and individual entrepreneurs) carrying out business activities using agency agreements, commission agreements or agency agreements, and making settlements under them with foreign persons who are not registered with the tax authorities as taxpayers.

The tax agent indicates its status in field 101, which is designated by the code “02”.

| Status | BCF value |

| Tax agent | 182 1 0300 110 |

KBK dividends in 2021 for personal income tax payment

To pay personal income tax to the budget on income in the form of dividends in 2016, the BC code is used:

- 182 1 0100 110.

There is no separate KBK for personal income tax on dividends; the KBK salary personal income tax is used.

It is worth noting that personal income tax on dividends is transferred no later than the day following the day of actual payment of dividends.

We transfer personal income tax to the specified BC Code both for individuals who are residents of the Russian Federation and for individuals who are non-residents of the Russian Federation:

How to fill out a payment form

Budget classification codes are indicated in field 104; they are the same for the entire country. When filling out the payment form, it is necessary to take into account that the details are indicated by the tax office to which the payer is assigned in accordance with his location. The registration rules are specified in the Regulation of the Central Bank of the Russian Federation No. 383-P dated June 19, 2012 and Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013, as amended.

When filling out, you must also correctly indicate:

- payer status (check in the article “What is the payer status in a payment order and how to fill it out”);

- payment amount (integer);

- quarter for which payment is made (in the form “KV.01.2019”).

BCC in 2014 for insurance premium payers changed

From January 1, 2014 in accordance with Article 22.2 of Law No. 167-FZ, payment of insurance premiums for compulsory pension insurance for billing periods since 2014 is carried out by the payer of insurance premiums with a single payment document (one payment order, receipt) without dividing into the insurance and funded parts of the labor pension.

The payment order for the payment of the current insurance premium for 2014 indicates the BCC intended for accounting for insurance premiums for the payment of the insurance part of the labor pension, namely: 392 1 0200 160 for employers , 392 1 0200 160 for payers paying insurance premiums for themselves (individual entrepreneurs, heads of peasant farms, lawyers, notaries, etc.). The Pension Fund of the Russian Federation will independently distribute the amounts of insurance contributions to the insurance and funded parts of the labor pension based on the applications of the insured persons about their choice of pension provision option (deduct 0% or 6% to the funded part).

Please note that when making payments to repay arrears on insurance premiums and arrears on penalties and fines for periods before 2014, payment orders indicate the same BCCs that were used to pay insurance premiums, repay arrears on insurance premiums, arrears on penalties and fines until 2014. The payment procedure for compulsory health insurance has not been changed.

The payment order (receipt) indicates KBK 392 1 02 02101 08 1011 160, used for periods from 2012. Order of the Ministry of Finance dated November 12, 2013 No. 107n “On approval of the rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation” introduced changes in filling out the fields of payment (settlement) documents from 01/01/2014.

Instead of the currently used OKATO codes, from January 1, 2014, the codes of the All-Russian Classifier of Municipal Territories - OKTMO are used . When preparing payment documents in field [105], regardless of the period for which the payment is made, it is necessary to indicate the OKTMO codes of the territories. The OKTMO code, valid since January 1, 2014, takes the value of 8 characters (the OKATO code contained 11 characters). //PFR

Dear visitors! This site is an independent source of information and does not reflect all materials published in the official publication of the Federal Tax Service of Russia - the magazine “Tax Policy and Practice”. If you are interested in the official point of view of the top officials of the Federal Tax Service on various tax issues, you can subscribe to the Tax Policy and Practice magazine from any month, having previously read the announcements of published issues.