Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

In the life of enterprises, something happens every day: purchasing materials, selling goods, organizing advertising or paying taxes. Accounting requires recording every transaction and doing it correctly - using entries, otherwise the tax office will impose fines. In this article we will tell you what accounting entries are, how to prepare them and show you the most popular options.

What is an accounting entry

An accounting entry is a way of recording information about a company's activities in the accounting accounts. Each transaction involves two accounts and one amount.

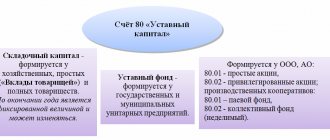

Accounting accounts are fixed in the Chart of Accounts - it contains 99 balance sheet and 11 off-balance sheet accounts. This plan is required for all commercial organizations, but each of them has its own working chart of accounts that it applies. It is not necessary to include all the accounts listed in the Order of the Ministry of Finance; you can choose those that you yourself will use.

Accounting accounts are linked to each other by debit and credit, each transaction is accounted for by the debit of one account and the credit of another. This is called the double entry principle.

Prosecution in the form of fines

The fine is calculated in addition to the penalties. But the grounds for imposing penalties are different. The state does not fine you for violating the payment deadline. Tax fines are imposed for an incorrectly calculated amount of liabilities (unintentionally or deliberately underestimated).

Thus, if you pay the correct amount of the obligation, but after the due date, you will only pay a penalty. And if the tax amount in the documents turns out to be lower and is repaid in this amount, you will pay the arrears, penalties and fines.

The fine has a fixed level and does not depend on the number of days of delay. It amounts to:

- 20% of the debt amount, if it was unintentionally underestimated;

- 40% - if intentional.

Tax fines in accounting entries, just like penalties, are reflected in the debit of the account. 99 and credit account. 68 or 69. For a more detailed picture, open subaccounts to the account. 68 based on the type of tax. Such accounting entries help to track for which taxes fines have already been paid.

Possible accounting entries:

Debit 99 Credit 68 - accrual of a tax penalty.

Debit 68 Credit 51 - transfer of the fine amount to the Federal Tax Service.

Debit 99 Credit 69 - accrual of a fine on insurance premiums.

How to prepare accounting entries

To draw up accounting entries that will correctly reflect events occurring in the organization, you need to follow the rules:

- Chronological order . Postings must be made clearly in the sequence of their execution.

- Systematization . All similar transactions must be reflected in the same accounts.

- Documentary validity . Accounting entries can only be made on the basis of primary documents.

- Monetary expression . Postings are made only in monetary terms.

Beginner accountants often get confused about postings. But they are quite simple to compose if you understand the meaning of the operation. We'll tell you how to do it.

Step 1 . Determine which accounts you are using for the transaction. To do this, refer to the working chart of accounts. Selecting the right account is not difficult - their names clearly explain what transactions they are intended to account for. For example, account 60 “Settlements with suppliers” or account 10 “Materials”.

Step 2 . Organize accounts into debits and credits. To do this, you need to clearly remember that all accounts are divided into active, passive and active-passive. Active accounts increase by debit, and passive accounts by credit. Active-passive accounts are the most complex - they grow by debit or credit, depending on the transaction being reflected.

Step 3 . Make entries using the double entry principle.

Now let's look at this process using an example

Example: Rozetka LLC purchased a set of wires worth 42,000 rubles. How to make a wiring?

Let's analyze the operation: we received materials from the supplier, which means there are more of them in the warehouse, and we now have to pay the supplier money for the purchase.

Step 1 . Wires are the materials that we need to complete the work, which means we take them into account under account 10 “Materials”. All transactions with suppliers are accounted for in account 60 “Settlements with suppliers”.

For posting we need accounts 10 and 60.

Step 2 . Materials are our assets, which means the receipt of materials increases the number of our assets. Account 10 is active, so it increases by debit.

Debt to the supplier forms accounts payable. Its appearance means that the liability has increased. Account 60 is active-passive, but in this case it will increase in credit.

Step 3 . We will make entries using the double entry principle

| Debit | Credit | Sum |

| 10 | 60 | 42 000 |

Calculation of penalties

The Federal Tax Service independently calculates them; organizations do not need to waste their time determining the value. But you need to know why you were given a punishment, how it was calculated and what accounting entries they were made out of. Thus, the correctness of the submitted claim is monitored and additional expenses are determined if the payment period is missed. Tax penalties may also be imposed. We'll talk about this below.

As noted, penalties are accrued for each day the deadline is violated. Accordingly, the longer the principal debt is not repaid, the greater the fine you will be charged.

Formula:

Penalty amount = Central Bank key rate/300 x debt x number of days of delay

The key rate is set by the Central Bank of the Russian Federation and changes depending on the financial and economic situation in the country. We are interested in the delinquency valid at the time of the delay. Today the established level is 8.5%.

The accrual of penalties for unpaid debt begins on the next day after the end of the payment period.

There are two options for ending accrual:

- The penalty is not charged on the day the principal debt is repaid. For example, you are obliged to pay the debt on the 15th, but only did it on the 18th. Thus, penalties will be calculated in two days: 16 and 17. This is the option of the Ministry of Finance, which it voices in its letter dated July 5, 2021.

- The penalty is calculated and paid for the day on which the amount of the obligation was repaid. This is what the tax authorities say in their clarifications dated December 28, 2009.

Let's look at the calculation of tax penalties using an example.

must pay an advance under the simplified taxation system for the 3rd quarter of 2021 by October 25, 2017 in the amount of 30,000 rubles. But she did this only on November 2. Total: 7 days of delay, on the eighth the obligation was repaid. We know that as of September 18, the key rate is 8.5%, and we can calculate two options:

- 8.5%/300 x 30,000 x 7 = 59.5 rubles.

- 8.5%/300 x 30,000 x 8 = 68 rubles.

There are calculators for the calculation, so there is no need to do it manually.

Is it possible to record penalties in accounting entries as expenses? After all, the organization, when paying a penalty, incurs costs. Taking into account Accounting Rules 10/99, they are considered other expenses and are indicated either on the debit of account 99 “Profits and losses”, or account 91 “Other income and expenses” and the credit of 68 and 69 accounts. The regulations do not clearly define the required debit account. The decision is made by the enterprise independently and is recorded in its accounting policies. In tax accounting, these amounts should not reduce the taxable profit of the enterprise.

Types of accounting entries

All wiring can be divided into several types:

1. Changes in the property of the enterprise. This group includes only active and active-passive accounts. It assumes that the company's property is redistributed, but the balance does not change.

For example: Rozetka LLC transferred money from the cash register to a bank account to pay the supplier. This operation will be reflected by the posting: Dt 51 Kt 50, that is, we have less money in the cash register by 42,000, we put it in the current account.

2. Changes in the obligations of the enterprise. This group includes only passive and active-passive accounts. It assumes that the company's liabilities are redistributed without changing the balance sheet.

For example: Rozetka LLC agreed to reclassify the debt into a short-term loan. This operation will be reflected by the posting: Dt 60 Kt 66, that is, the debt to the creditor in the amount of 42,000 rubles turned into short-term liabilities for the same amount.

3. The liabilities and assets of the enterprise change - the balance increases. This group includes all types of accounts: for debit - active and active-passive, and for credit - passive and active-passive. In this case, both the assets and liabilities of the balance sheet increase.

For example: Rozetka LLC bought wires from a supplier for 42,000 rubles. Just in this case, our obligations to the supplier increased by 42,000 rubles and the cost of materials increased by 42,000 rubles.

4. The liabilities and property of the enterprise change - the balance decreases. This group includes passive and active-passive accounts for credit, and for debit - active and active-passive. In this case, the assets and liabilities of the balance sheet decrease.

For example: Rozetka LLC repaid the debt to the supplier from the current account. This operation will be reflected by the posting: Dt 60 Kt 51. In this case, we have less money in the current account and the debt to the supplier has disappeared.

In addition, all wiring can be divided into simple and complex. Simple transactions include only 2 accounts, but complex ones may have more. Moreover, each complex transaction can be reflected in several simple ones. This happens when we record receipts from two or more other accounts into one common account.

For example: Rozetka LLC bought from the supplier not only wires for 42,000 rubles, but also special equipment for 128,000 rubles. Complex wiring would look like this:

Dt 10 “Materials” - 42,000 rubles

Dt 07 “Equipment for installation” - 128,000 rubles

Kt 60 “Settlements with suppliers” - 170,000 rubles.

This complex wiring can be written in two simple ones:

Dt 10 Kt 60 - 42,000 rubles

Dt 07 Kt 60 - 128,000 rubles.

Complex entries, contrary to their name, make accounting easier because they reduce the number of entries. This saves a lot of time.

Typical tax transactions on OSNO

The essence of business, as a rule, is to sell something and make a profit. This entire cycle consists of events that must be reflected in accounting. Let's look at typical postings that organizations use.

Fixed assets and intangible assets

For normal activities, each organization must have fixed assets - equipment for the production of goods, performance of work and provision of services, this also includes buildings. Postings for intangible assets are almost similar to fixed assets, only they are accounted for on account 04.

| Dt | CT | The essence of the operation |

| 08 | 60 | Rozetka LLC purchased a soldering machine. |

| 01 | 08 | The machine is put into operation |

| 20 | 02 | Depreciation has been charged on the machine |

Inventories

We've already figured out how to reflect the purchase of materials, but they won't stay in the warehouse forever. To use wires, you need to write them off for production.

| Dt | CT | The essence of the operation |

| 20 | 10 | Wires are decommissioned |

Production costs

The costs of producing goods, performing work and providing services also need to be taken into account. This includes materials sent to production, depreciation, and workers' wages. In this case, general production and general business expenses must be written off to the main production. And the company can also identify a defect.

| Dt | CT | The essence of the operation |

| 20 | 23 (25,26) | The costs of auxiliary production, general economic and general production are allocated to the main production |

| 20 | 70, 69 | Salaries and contributions to employees of main production were accrued |

| 28 | 20 | A defect was found in production |

Finished products and goods

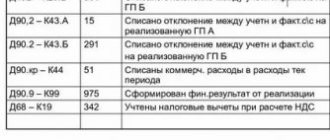

To make money, you need to sell something. Organizations on OSNO pay VAT on sales.

| Dt | CT | The essence of the operation |

| 62 | 90 | Sales revenue taken into account |

| 90 | 68 | VAT accrued on sales |

| 90 | 41 | Products written off |

| 41 | 42 | Trade margin |

Cash

Organizations constantly carry out settlements with suppliers, customers, creditors, founders, employees and others. Let's highlight the main wiring:

| Dt | CT | The essence of the operation |

| 50 (51) | 62 | Settlements with customers |

| 60 | 50 (51) | Payment to the supplier |

| 70 | 50 | Salary payment |

| 68 | 51 | Paying taxes |

| 50 | 75 | Contribution to the authorized capital |

Financial results

Financial result is the result of the company’s work for the period - profit or loss. It also needs to be reflected in accounting.

| Dt | CT | The essence of the operation |

| 90 | 99 | Revenue from sales |

| 99 | 90 | Sales loss |

| 91 | 99 | Income from other activities |

| 99 | 91 | Expenses from other activities |

| 84 | 99 | Uncovered loss |

| 99 | 84 | Profit made |

The most difficult thing is to maintain accounting for organizations under the general tax regime. In addition to all the standard postings, they have to prepare many transactions for paying taxes. Let's look at the tax entries that are most often used by organizations on OSNO.

VAT payment

VAT is calculated and paid every quarter. VAT is charged on sales and non-operating income, and it can also be restored.

| Dt | CT | The essence of the operation |

| 90.3 | 68 | VAT accrued on sales |

| 91.2 | 68 | VAT accrued on income from other activities |

| 76 | 68 | VAT restored |

| 68 | 51 | The tax is transferred to the budget |

Payment of income tax

Income tax is calculated quarterly and is formed on an accrual basis. All profit of the organization is accumulated in account 99.

| Dt | CT | The essence of the operation |

| 99 | 68 | Profit tax accrued |

| 68 | 51 | The tax is transferred to the budget |

Reflection of tax audit results in accounting and reporting

When reflecting additional taxes, fines and penalties in accounting, the date of discovery of the error will be considered the date of entry into force of the tax authority's audit decision , on which all corrective entries must be made. This document will serve as the basis for making corrections to the accounting (Article 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”).

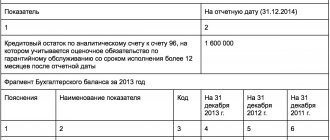

In accounting, accrued interest and penalties for income tax on the date of entry into force of the inspection decision are reflected by an entry in the debit of account 99 “Profits and losses” and the credit of account 68 “Calculations for taxes and duties” (Instructions for using the Chart of Accounts, Appendix to Letter of the Ministry of Finance of Russia dated December 28, 2016 No. 07-04-09/78875).

The order of recording entries in accounting accounts, in terms of reflecting the amount of income tax, will also be influenced by how significant the error is.

An error is considered significant if it, individually or in combination with other errors for the same reporting period, can affect the economic decisions of users made on the basis of the financial statements compiled for this reporting period.

The organization determines the materiality of the error independently, based on both the size and the nature of the relevant article (articles) of the financial statements (clause 3 of PBU 22/2010 “Correction of errors in accounting and reporting”, approved by Order of the Ministry of Finance of the Russian Federation dated June 28, 2010 No. 63n ).

The criteria by which the level of materiality are fixed by the economic entity in its accounting policies .

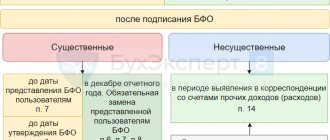

If the error is insignificant , then the corrective entries will be as follows (clause 14 of PBU 22/2010):

Debit 99 Credit 68 sub-account for income tax - the amount of income tax for 2015, recognized as insignificant, was additionally accrued.

When additionally accruing income tax, the amount of which is significant, account 84 “Retained earnings (uncovered loss)” is used (clause 9 of PBU 22/2010).

The corrective accounting entries will be as follows:

Debit 84 Credit 68 subaccount for income tax - the amount of income tax for 2015, recognized as significant, has been additionally accrued.

In addition, a retrospective recalculation of erroneous financial statements for previous years is also necessary (clause 9 of PBU 22/2010).

Restatement of comparative financial statements is carried out by correcting the financial statements as if the error of the previous reporting period had never been made (retrospective restatement).

If a significant error was made before the beginning of the earliest previous reporting period presented in the financial statements for the current reporting year, the opening balances for the corresponding items of assets, liabilities and capital at the beginning of the earliest reporting period presented are subject to adjustment.

Since the error relates to 2015 , in the annual reporting for 2018 the net profit figure for 2021 should be given taking into account the identified error in the income tax for 2015.

If an organization has justification for including repair costs actually incurred in 2015 as expenses taken into account for profit tax purposes in 2021, then the organization must submit an updated income tax return for 2021 (Article 81 of the Tax Code of the Russian Federation) .

Corrections in accounting will also be carried out in 2018 on the date the error was discovered. Reflection of corrections in accounting will depend on the significance of the error made.

If the error is insignificant, then the reduced profit tax for 2016 is reflected in the accounting record: D68 subaccount for profit tax K99 subaccount for profit tax (reduced profit tax due to overstatement of tax in 2021).

If the error is significant, then the decrease in income tax for 2016 will be reflected in entry D68, subaccount income tax K84 (income tax has been reduced due to an overstatement of tax in 2016).

Based on the above, it follows that if an organization reflects corrections to the profit tax for 2015 (increase the amount of profit tax) and at the same time reflects corrections to the profit tax for 2021 (reduce the amount of profit tax), then the corresponding reporting indicators for 2021, these corrective entries will not affect, nor will they affect the net profit indicator and the amount of receivables/payables for 2016, reflected in the 2021 reporting.

If an organization will charge additional income tax only for 2015, without adjusting for 2021, and the amount of income tax is considered significant, then in the balance sheet for 2021 it is necessary to retrospectively correct the balance of net profit for 2021 and the accounts receivable/payable indicator for 2021, as well as the net profit indicator for 2021 in the statement of capital flows for 2021.

In the income statement for 2021, the amounts of accrued penalties and fines for income tax are reflected in line 2460 “Other” (clause 83 of the Regulations on accounting and financial reporting, approved by Order of the Ministry of Finance of the Pension Fund dated July 29, 1998 No. 34n, Instructions for application of the Chart of Accounts) If the error is recognized as not significant (additional tax accrual for 2015 is reflected in the entry D 99 K 68 subaccount for income tax) and corrections are not made to the declaration for 2021, then in the statement of financial results for 2021 the amount of additional tax accrued is as follows: will be included in the indicator of line 2460 “Other”. (Clause 22 PBU 18/02 “Accounting for income tax calculations”, approved by Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n).

If an organization reflects corrections for the profit tax for 2015 (the amount of profit tax is increased) and at the same time reflects corrections for the profit tax for 2021 (the amount of profit tax is reduced), then in the income statement as part of the indicator of line 2460 “Other” » only interest and penalties for income tax are reflected.

Get expert advice

according to your situation and get expert advice.

Ask a Question

Ask a Question