An employment contract between an individual entrepreneur and an employee is the same necessity as a similar agreement between any legal entity and a citizen. An individual entrepreneur is a full-fledged business unit; to conduct his commercial activities, he has the right to attract workers and employ them in accordance with the legislation of the Russian Federation.

Many businessmen need a small number of hired specialists, so they try not to enter into an employment contract, since they are required to pay contributions to the Social Insurance Fund and the Pension Fund, and these are additional costs for an individual entrepreneur. But it should be remembered that a correctly concluded employment contract for an individual entrepreneur allows him to avoid problems with unscrupulous employees.

The main feature of an employment contract between an individual entrepreneur and an employee is that the contract is drawn up and signed between two individuals. Otherwise, the document contains the same provisions as the agreement between a citizen and a legal entity. It must comply with the standards prescribed in the Labor Code of Russia, and can be urgent or regular (without specifying the end date of work).

Moreover, any agreement between an individual entrepreneur and an individual entrepreneur is not a labor agreement, but a civil law one. An individual can apply for a vacant position with another businessman, but then the contract does not need to indicate that he is also an individual entrepreneur.

How can an individual entrepreneur correctly conclude an employment contract with a seller?

In accordance with the regulations of the Labor Code of the Russian Federation, not only legal entities, but also individual entrepreneurs can use the labor of hired workers. If an individual entrepreneur enters into an employment contract with an individual, he is obliged to correctly maintain the relevant documentation, calculate and pay wages within the time limits established by law, and submit reports to regulatory authorities. The Labor Code describes how vacation pay is calculated, wages are calculated and all contributions to extra-budgetary funds are made.

Advice : if an employer plans to use a simplified tax regime, he needs to find out from the Federal Tax Service whether the individual entrepreneur pays income tax under the simplified tax system for himself and full-time employees. The Tax Service will tell you which strict reporting forms for individual entrepreneurs are provided for by the Federal legislation of Russia.

When registering an employee for a store, an individual entrepreneur employment contract must be concluded with the seller. Labor legislation provides for several types of agreements that can be drawn up between individual entrepreneurs - employers and individuals - employees:

- Indefinite. This type of agreement is drawn up when an individual entrepreneur plans to constantly cooperate with an employee (a sample can be downloaded on the Internet).

- Urgent. This type of agreement is drawn up when an individual entrepreneur plans temporary cooperation with an employee.

Hiring procedure

The selection and recruitment of personnel at enterprises and firms is usually handled by the human resources department. Individual entrepreneurs do not have such a service, so they do this work independently or enter into an agreement with a specialized organization that maintains accounting and personnel records for small businesses.

When hiring an employee yourself, you must:

- conduct interviews and request all necessary documents for applying for a vacant position;

- draw up and sign an employment contract between an individual entrepreneur and an employee, drawn up in accordance with the Labor Code of the Russian Federation;

- prepare citizen personnel records documents;

- register with the Pension Fund and the Social Insurance Fund of the Russian Federation;

- pay taxes and contributions to extra-budgetary funds on time.

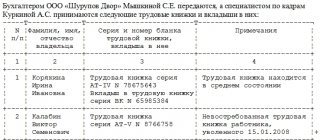

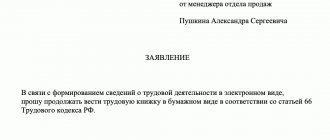

When concluding an employment contract between an individual entrepreneur and an employee, you must provide a passport, education document, work record book, insurance certificate, military ID, and other documents, if required. For example, the driver will need a driver's license. Photocopies must be made of all documents. A citizen must write an application asking to be accepted for a vacant position.

Employment contract with individual entrepreneur with employee

A typical employment contract for an individual entrepreneur and a citizen must contain the following information: information about the employee and the employer, the date the agreement was drawn up, the title of the position, the amount and procedure for calculating wages, the work schedule, the date of entry to the workplace, the obligations and rights of the parties to the contract, the procedure for calculating and payment of compensation for hard work or work that threatens life and health, social guarantees.

When the agreement between the employee and the individual entrepreneur is drawn up and signed, the employer is obliged to make an entry in the employee’s work book and create a personal card of the T-2 form for him. Due to the small number of employees, businessmen do not open personal files for them, but they are required to keep copies of personal documents, T-2 cards and employment agreements for each person. For employed individuals, it is necessary to pay personal income tax and contributions to extra-budgetary funds.

What clauses should be present in an employment contract?

The employment contract concluded between the individual entrepreneur and the seller must contain the details, conditions and information provided for by law:

- Employer information: full name of the individual entrepreneur, his tax identification number.

- Information about the employee: full name, passport details, TIN, home address.

- Date of preparation and place of signing of the contract.

- It is mandatory to indicate the position for which the employee is hired, as well as the date when he must begin performing his professional duties. His workplace is described.

- If the seller is hired for a probationary period, then this point must be reflected in the contract.

- Information regarding the rights, duties and responsibilities of the seller and the employer. This paragraph should be written in great detail so that if conflict situations arise, problems can be resolved pre-trial.

- Work and rest schedule.

- Information regarding the procedure for paying compensation for overtime, working a shift at odd hours, etc.

- The procedure for calculating wages, bonuses, social benefits. The terms of settlements are agreed upon.

How to fill out a job contract

A single form of agreement between a citizen and an individual entrepreneur employer has not been approved at the legislative level; the document is formed in any form.

You can develop a form of an employment contract for an individual entrepreneur yourself, it’s not difficult. A sample of filling out an employment agreement, current for 2021, is presented in Appendix 1. The document requires the following to be indicated:

- name and date of signing;

- Full name of the businessman, registration certificate number;

- Full name of the citizen, passport details, registration address;

- name of the position, actual place of work, functions of the employee;

- for what period is it concluded or unlimited;

- responsibilities and rights of an employee and an entrepreneur;

- conditions for performing job functions (ordinary, difficult, dangerous to life and health);

- work schedule, vacation;

- size and procedure for payment of wages;

- availability of social, medical, pension insurance.

If the employee’s position involves the storage of material assets, then the contract must specify responsibility.

The nuances of a contract with a probationary period

If an employment contract with a probationary period is drawn up between an individual entrepreneur and a seller, then the parties need to take into account various nuances:

- If the agreement does not contain a probationary clause for the seller, then the employer will be deemed to have hired him on normal terms and conditions.

- If the seller began to perform his professional duties before signing the employment agreement, then it will no longer be possible to include a clause on the probationary period.

- If a temporary contract is concluded with the seller for a period of 2 to 6 months, then the duration of the trial period cannot exceed 2 weeks.

- When concluding standard employment agreements, a period for testing the seller is provided - 3 months (for specialists this period is 6 months).

- If a salesperson hired on a probationary period falls ill, the time spent on sick leave will not be included in the period allocated for testing.

Duration of the employment contract

An open-ended employment contract with an individual entrepreneur and a citizen is concluded if a businessman needs a permanent employee. For example, a salesman in a grocery store, a guard in a parking lot, etc. The document does not indicate a validity period.

An individual entrepreneur has the right to draw up a fixed-term employment contract with an employee, then the text of the document must indicate the expiration date of its validity. For example, such agreements are concluded with waiters in outdoor cafes, bicycle or ski rental employees, repair crews to perform certain work, etc. It must be remembered that a fixed-term employment contract will become permanent if, within 3 days before the date of termination of the contract, the employee is not notified in writing of its termination or, upon expiration of the agreement, neither the employer nor the citizen has expressed a desire to terminate it.

However, a fixed-term agreement will not become permanent if it was drawn up before the former employee returned from maternity leave or sick leave. In this case, the permanent employee goes to work, and the temporary employee is automatically considered dismissed and receives a paycheck, work book and other documents.

How is a probationary agreement terminated?

If an employee with whom an individual entrepreneur has entered into an employment contract continues to perform his professional duties at the end of the probationary period, then he will be considered to have passed all the tests. The seller may unilaterally terminate the agreement with the individual entrepreneur. To do this, he must notify the employer of his intentions within three days (an application must be submitted in writing). An individual entrepreneur also has the right to terminate an employment agreement with an employee if he considers that he has not passed the test. The procedure for notifying individuals about early termination of cooperation with them is regulated by the Labor Code of the Russian Federation. It says that the employer is obliged to notify the employee in writing of his decision (three days before issuing the relevant order). He is obliged to give reasons why, in his opinion, the employee failed the test. The seller retains the right to appeal the dismissal in court, but, as practice shows, the chances of proving that the dismissal was unlawful are minimal.

Save the article in 2 clicks:

When registering a seller for a store with a probationary period, the individual entrepreneur must draw up an employment contract with him. An employer can obtain a sample of such an agreement from a law office or download it on the Internet. The parties should take into account all possible nuances regarding the procedure and timing of the tests. If disagreements arise in the process of working together, the seller or individual entrepreneur can terminate the contract unilaterally.

How is hourly payment made and what is it?

Based on legislative sources, announced in Article 285 of the Labor Code of the Russian Federation, certain categories of specialists or employees may receive earned money based on payment for the number of hours worked.

Hourly payment is allowed in situations where, for objective reasons, it is difficult to identify the fact of rationing of work performed. Accordingly, it is not the volume of activity that is paid, but the time spent on it.

Hourly payment is based on the number of hours worked, as well as education, qualifications, incl. specialist level. If certain criteria for the quality of work are taken into account, the method of additional accruals is indicated.

REFERENCE: Such forms of calculation are used quite rarely. The employer does not have the right to demand, on their basis, production standards other than hours worked.

This type of payment is mainly provided for the performance of services of teachers working on the basis of external or internal combination. The number of hours is equal to the number of lessons taught by the teacher. For teachers of universities and colleges, a lesson (lesson) is two hours. If groups are overcrowded, additional payment is allowed.

Types of hourly earnings can be classified. Earnings can be calculated based on the type of accruals:

- based on the tariff adopted for employees on a fixed salary. The cost of one hour of tariff salary is calculated.

- Based on one minimum wage (minimum wage).

In both cases, it is unacceptable for prices to be lower than the minimum wage established in the region. If the tariff does not reach the minimum prices in volume, it must be brought up to the established minimum wages, as indicated by the legislative standards set out in Part 3 of Article 133 of the Labor Code of the Russian Federation.

This method of calculation has its pros and cons. Among them are the positive aspects:

- application is convenient for part-time work;

- Earnings are easy to calculate;

- sometimes helps the employer save money;

- allows you to control the use of working time.

The main disadvantage is the lack of the right to demand the number of actions performed. Such requirements can only be stimulating. For example, if a salesperson is paid a salary for the time worked, then a bonus surcharge is offered based on the number of sales.

But the working day must be paid even when the person is not interested in sales and works in bad faith. The same applies to an employee whose functional responsibilities may involve a large workload with minimal hourly pay. That is, in this case there are no criteria for the fair accrual of earnings to both counterparties.