What it is

The liquidation balance sheet is a balance sheet that is compiled during the liquidation of an LLC in order to determine the actual property state of affairs of the liquidated enterprise.

The liquidation balance is intermediate

and final.

The interim liquidation balance sheet is drawn up after 2 months from the date of publication in the State Registration Bulletin

notices of liquidation (unless the liquidation commission has established a longer period for filing claims by creditors).

Due to its specific nature, preliminary preparation of data and the preparation of the interim balance sheet usually fall on the shoulders of accounting workers. Although formally, by law, this procedure must be carried out by the liquidation commission.

Entrust reporting to specialists

Liquidation balance: “zero” or with numbers

Anyone who has ever encountered liquidation in practice may have wondered which balance sheet to submit at the final stage: the liquidation balance sheet. There are two possible answers to the question: purely practical or legislative-oriented.

The answer comes from practice

Each registration authority (FTS) can provide advice on the liquidation process. In particular, in Moscow the registration authority (MIFNS No. 46) suggests it is better to submit a “zero” balance. In this case, the “better” position is justified by the fact that the registration authority will have fewer questions. It is unlikely that such a position is consistent with the law.

It is worth noting that the issue is of particular relevance in relation to commercial organizations that have an authorized capital. In the case of non-profit organizations, the issue of “zeroing” the liquidation balance sheet does not present any difficulties. The situation with commercial organizations is complicated by the legal requirement for the mandatory presence of an authorized capital.

The answer stems from legislation

The answer to the question posed can be found by assessing the requirements of the Civil Code of the Russian Federation in terms of the liquidation balance sheet and federal laws on business companies (Federal Law on LLC and Federal Law on Joint-Stock Companies).

The only provision regarding the liquidation balance sheet is contained in Art. 63 of the Civil Code of the Russian Federation, according to which the balance sheet is drawn up after the completion of settlements with creditors. There are no more requirements. Moreover, there is no approved form of the liquidation balance sheet.

Consequently, there is no legally established requirement for a “zero” balance. Which refutes the position of the registration authority that it is better to present a “zero” balance.

Confirmation that the balance sheet must contain figures is the requirement of the Civil Code of the Russian Federation and the laws on business companies that companies have authorized capital. The very fact of the existence of an LLC or JSC indicates the presence of authorized capital.

The Civil Code of the Russian Federation, which regulates the liquidation procedure, does not indicate that the authorized capital “disappears” during the liquidation process.

These considerations lead to the conclusion that the authorized capital disappears at the moment of “disappearance” of the company, which can be considered the entry into the register (Unified State Register of Legal Entities) about the termination of the organization’s activities (liquidation).

Then a logical question arises: how can an entry be made in the register about the termination of an organization’s activities if, according to the balance sheet (it is worth noting the liquidation balance sheet, not the accounting balance sheet), the organization has financial indicators in the form of authorized capital and some kind of asset.

This question can be easily answered.

Firstly, the law does not connect liquidation with zero balance sheet figures.

Secondly, the law allows the termination of the activities of an organization with digital indicators. According to the law on registration of legal entities, the registering authority, in the presence of a number of circumstances, may decide to exclude an organization from the register (Article 21.1). In this case, the registration authority is not at all interested in digital indicators. He makes a decision upon the termination of the activities of a legal entity that, at a minimum, has an authorized capital.

Thirdly, according to Art. 17 Federal Law “On Accounting”, the liquidation balance sheet is the basis for drawing up the latest accounting (financial) statements. This article allows the organization to carry out its activities after drawing up the liquidation balance sheet.

The final conclusion can be stated as follows.

From the point of view of the law, the liquidation balance cannot be “zero”. In practice, it is compiled both “zero” and with numbers. The registering authority will “pass” both balances. The main thing is that there is no debt on the balance sheet to counterparties who are not members of the organization (in relation to the authorized capital). That is why the participants receive property upon liquidation of the company only after satisfying the creditors’ claims, and the amount claimed by each participant is equal to its share in the authorized capital.

The use of a specific balance (“zero” or with numbers) depends on the company itself. But we must keep in mind that the liquidation balance sheet with numbers is oriented towards legislation.

The procedure for drawing up an interim liquidation balance sheet

In addition to financial indicators, the interim liquidation balance sheet must contain:

Information on the composition of the organization’s property

The interim liquidation balance sheet must include (if available) data on property:

- List of machinery, equipment and other fixed assets indicating:

- object inventory number;

- name of the object and its location;

- brands;

- year of commissioning;

- actual wear and tear;

- their residual value.

- List of buildings and structures indicating:

- object inventory number;

- name of the object and its location;

- year of commissioning;

- actual wear and tear;

- their residual value.

- List of unfinished capital construction projects and uninstalled equipment, indicating:

- name of the object and its location;

- year of construction start;

- volume actually completed;

- their book value.

- List of long-term financial investments indicating:

- names of long-term financial investments;

- their value according to the balance sheet asset.

- List of intangible assets indicating:

- names of intangible assets;

- their value according to the balance sheet asset.

- List of inventories, expenses, cash and other financial assets, expenses, cash and other financial assets indicating:

- industrial stocks;

- animals for growing and fattening;

- work in progress;

- deferred expenses;

- finished products;

- goods;

- VAT on purchased assets;

- other inventories and costs;

- Money;

- calculations;

- other assets (including indication of shipped goods).

- Settlements with debtors:

- for goods, works and services;

- on bills received;

- with subsidiaries;

- with a budget;

- with staff;

- for other transactions;

- with other debtors.

- Advances issued by suppliers and contractors.

- Short-term financial investments.

- Cash:

- cash register;

- current accounts;

- foreign currency accounts.

List of claims presented by creditors and the results of their consideration

When filling out the list of claims presented by creditors, indicate:

- name of the creditor (in order of priority);

- amount of debt;

- satisfaction decision.

The results must be reflected in a separate column

consideration of creditors' claims by the liquidation commission.

Note

, the above information can be included directly in the balance sheet itself, or can be issued in

the form of an appendix

() drawn up in any form (act, protocol, etc.).

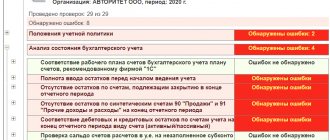

When compiling an interim liquidation balance sheet, data from the last balance sheet prepared before the decision on liquidation was made is usually used.

The interim liquidation balance sheet can be drawn up more than once.

Free accounting services from 1C

Liquidation balance

Liquidation balance is the assets of the liquidated organization remaining at the disposal of the liquidation commission after settlements with budgets of different levels, partners and counterparties under business contracts.

In other words, this is a positive difference between the assets and liabilities of a liquidated business entity.

May include real estate, equipment, cash, intellectual property rights, securities. As a general rule, it is subject to distribution among shareholders/participants in proportion to their share in the authorized capital.

Distribution of the remaining assets of a business structure

The liquidation procedure in relation to a solvent organization is regulated by Art.

63 Civil Code. It is organized by the liquidation commission. Based on the results of its work, a liquidation balance sheet is compiled, approved by shareholders/participants. The property remaining after satisfaction of the legal claims of creditors is transferred to the participants of the organization and persons holding corporate rights (Article 63 of the Civil Code). If several participants/shareholders simultaneously claim the property, it is sold at auction.

Distribution of the remaining assets of a non-profit organization

Non-profit structure according to Art. 50 Civil Code has a purpose other than making a profit. As a general rule, its participants do not have the right to claim a share in the liquidation balance of such an entity. It must be aimed at implementing the activities specified in the charter (Article 63 of the Civil Code).

By virtue of Art. 11 135-FZ “On Charitable Activities and Charitable Organizations”, upon liquidation of such an entity, its property is directed to charity in the manner specified by the charter. If the charter did not regulate this issue - in the manner established by the decision of the liquidation commission.

Distribution of liquidation balance in bankruptcy

The final stage of bankruptcy is the competitive procedure. Its essence is that the property of the insolvent debtor is inventoried, assessed and sold through a competitive procedure.

Thus, a liquidation mass is formed that is sufficient to repay part of the creditors' claims. Using the funds received, the arbitration manager pays off with creditors in the order established by law. Unliquidated claims are written off.

Theoretically, in a situation where the bankrupt's liabilities exceed its assets, there should be no liquidation balance. But its formation is possible. The remainder consists of illiquid property, which:

- fails to implement;

- none of the bankruptcy creditors accepted payment of the debt.

According to Art. 148 127-FZ “On Insolvency (Bankruptcy)” the illiquid balance is transferred to the arbitration managers to the authorized local government bodies according to the act. If officials avoid accepting it, the act of acceptance and transfer can be replaced by a ruling of the arbitration court.

Ownership obliges to maintain the property and to be responsible for the harm caused by it (Article 210 of the Civil Code). Provisions of Art. 148 127-FZ are aimed at avoiding cases of ownerlessness of property and protecting public interests.

After drawing up the interim liquidation balance sheet

After the interim liquidation balance sheet has been drawn up, it must be approved by the persons who made the decision on liquidation. To do this, they need to draw up a protocol (decision) on approval or put the appropriate marks directly on the balance sheet.

As soon as the interim balance is approved, the tax office must provide:

- notarized notification in form P15016;

- interim liquidation balance sheet.

In addition, many Federal Tax Service may additionally require:

- protocol (decision) on approval of the interim liquidation balance sheet;

- documents confirming publication in the Vestnik

.

Briefly about the liquidation procedure

Liquidation of a legal entity is a procedure that should lead to the complete cessation of the activities of a commercial entity. Liquidation should not be confused with merger, reorganization, etc. The legislative procedure is regulated by the Civil Code of our country.

In general, the mechanism for liquidating an enterprise can be presented as follows:

- Approval of the decision that the entity needs to be liquidated. Adopted on the basis of the decision of the governing body. This may be the Board of Shareholders, Directors and other management bodies;

- Informing the territorial tax inspectorate that the company is undergoing liquidation proceedings;

- Creation of a functioning liquidation commission;

- Informing the public that the company is going to cease operations. This is done through television or print media;

- Mandatory provision of a complete inventory of both fixed assets and other material assets. An inventory of accounts, reconciliation of mutual settlements, etc. is carried out. Based on the results of the inventory, measures are taken to collect all existing customer receivables;

- An interim liquidation balance sheet is compiled ();

- Whenever possible, settlements with creditors are made. Priority debts are repaid;

- The final liquidation balance sheet is compiled;

- The assets remaining after repayment of all debts and sale are distributed among the co-founders of the enterprise;

- State registration of liquidation of an enterprise.

Based on the presented algorithm of actions, we can conclude that during the entire liquidation, not one, but two, liquidation balance sheet is created: liquidation and final.

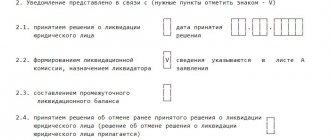

The company informs the tax service about all its actions. There is a strictly approved form - form P15001 (). There is nothing difficult in filling out, but if you have any questions, you can.

Next, we’ll talk about what an interim liquidation balance sheet is, what its form is and how to fill it out.

How and who should correct an error in a company’s liquidation balance sheet during reorganization

Last year there was a reorganization (merger). One organization has submitted a liquidation balance sheet, and the other has an interim balance sheet. When preparing the annual balance sheet, it turned out that errors were made in the liquidation balance sheet (balances changed), accordingly, the interim balance sheet also needs to be corrected. Do I need to take the correction in this case, or since I passed it, should I now show all the corrections in the annual?

Since during a merger the activities of the reorganized organization are terminated, the correction of errors made in the liquidation balance sheet must be made by the successor organization (reflected in a document - an accounting certificate). It is advisable for the successor organization to reflect the correction of the error in its annual balance sheet (accounting entry as of December 31) before its approval.