Information on income tax is reflected by tax agents in 2-NDFL certificates and 6-NDFL calculations. These two forms are related. For verification, control relationships are used - intra-document and inter-document. What to do if discrepancies are found between 6-NDFL and 2-NDFL? In what cases is this considered an error, and in what cases is it considered normal? Let's look into the issue.

Read: Control ratios 2-NDFL and 6-NDFL

Consultant Plus

Try it for free

Get access

Is a discrepancy acceptable in line 040 of the 6-NDFL calculation?

Hello! This deviation is acceptable. According to the Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ-7-11/ [email protected] “On approval of the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL), the procedure for filling it out and submitting it, and also the format for presenting the calculation of the amounts of personal income tax calculated and withheld by the tax agent in electronic form”, form 6-NDFL is filled out on the basis of tax registers for personal income tax, filled out for each individual.

Quote:1.1. The Calculation form is filled out on the basis of accounting data for income accrued and paid to individuals by a tax agent, tax deductions provided to individuals, calculated and withheld personal income tax (hereinafter referred to as tax) contained in tax accounting registers. In each tax register you round up personal income tax up to a whole number (Article 52 of the Tax Code). When you summarize the tax register data for all individuals, there is a deviation of the actually calculated tax (line 040) from the number calculated by the formula (line 020 - line 030) * 13%. Nothing wrong with that. In the Letter of the Federal Tax Service of Russia dated March 10, 2016 N BS-4-11 / [email protected] “On the direction of Control ratios”) it is written: Quote: if line 020 - line 030 / 100 * line 010 <, > line 040 (taking into account the ratio 1.2), then the amount of accrued tax is over/underestimated. At the same time, taking into account paragraph 6 of Article 52 of the Code of the Russian Federation, an error is allowed in both directions, determined as follows: line 060 * 1 rub. * number of lines 100 I have no doubt that you fall within such a significant range of error.

Rounding of 3NDFL tax.

Tax rounding 3NDFL - these are the rules and requirements for rounding tax amounts received to the full ruble. In the tax return in form 3-NDFL, all indicators must be left in the form in which they were received, i.e. with kopecks, however, there is an exception - the total amount of tax and advance payments are made in rounded form.

It should also be noted that the income of an individual that was received from non-Russian sources, and the tax that is paid on this income in a foreign country, is submitted to the declaration first in foreign currency, and then translated into rubles and kopecks (clause 1.6 of the Procedure for filling Form 3-NDFL, approved by Order of the Federal Tax Service dated December 24, 2014 No. ММВ-7-11/).

Purpose of form 6-NDFL

To improve control over the timely receipt of income tax into the budget, form 6-NDFL was developed.

This form is submitted by entrepreneurs and organizations that have employees or are tax agents for other individuals. The task of those submitting the report is to provide reliable information on all calculated income, deductions, and tax payments. The task of the inspectors is to verify that the tax is calculated correctly and paid on time.

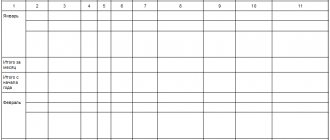

Data from tax registers must be used to complete the report. This is a requirement of Art. 80 Tax Code of the Russian Federation. The absence of such a register will be considered a violation and will be fined by controllers. This register can be developed independently by approving its form in the accounting policy. Every month you need to keep records of salary accruals and other income, tax calculation and withholding, and the dates of tax transfer to the budget.

You can see how to correctly compile such a register in our article “Sample of filling out a tax register for 6-NDFL.”

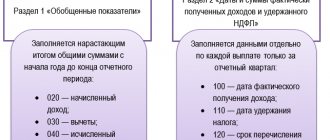

The data in section 1 of the calculation is indicated on an accrual basis from the beginning of the year, in section 2 - only for the last 3 months. Unlike the 2-NDFL reporting form, in this calculation all information is summarized without detailing by name, but broken down by date of transactions.

How to fill out the remaining lines of the report is discussed step by step in ConsultantPlus. See the authoritative opinion of K+ experts in the Ready-made solution by receiving free trial access to the legal reference system.

Difference in meanings by shape

The difficulty of reconciliation is that it can only be carried out at the end of the year, since the certificate is not generated for quarters. Therefore, you have one report prepared every 3 months, and another once a year. The values will not match.

Thus, line 020 of Form 6 of personal income tax reflects the income received. If the form is submitted, for example, for the 3rd quarter, then the first section will contain the amount for all 9 months, and the second - for the 3rd quarter. You will need to take this difference into account and add the values from previous Section 2 reports and make sure that they match the value of line 020 in the last form.

For reference! The accounting department can also make statements by quarter in order to compare them with 6 personal income tax reports.

General rules for the 1st section of the report

The first section is a summary table of personal income tax data for the period of provision - the tax base and indicators calculated by the agent.

As we can see, there are two peculiar parts of the report. The top one is intended for income and tax calculated at different rates, the bottom one is for summing up information on all rates and indicating details (tax not withheld, returned).

The upper part must be completed for each tax rate applied by the agent. If, in addition to your regular wages, you paid winnings to an individual or you employ a non-resident whose income is taxed at a different rate than a resident, you will have to fill out several upper parts, one for each rate.

You will indicate the amount of income in field 020, the amount of deductions in field 030, and on page 040 you will need to indicate the amount of calculated tax. Separately, here you need to highlight the amount of tax calculated on dividends (on line 045) and indicate the advance payment (if you employ foreigners).

That's it, you've already filled out the top part of the section.

See also “How to fill out section 1 in the 6-NDFL report.”

How does the progressive personal income tax scale work?

We are all accustomed to the standard personal income tax rate for residents of 13%. There are also special tariffs of 9, 30 and 35%, and for non-residents - 15 and 30%. All these rates are still in effect, but another tariff has been added to them, increased - 15%. Amendments to Chapter 23 of the Tax Code of the Russian Federation were introduced by Federal Law No. 372-FZ dated November 23, 2020.

The new rate works according to the following principle:

- We charge 13% on income that is within 5 million rubles. We take the indicator per year;

- 15% - for that part of income that exceeds the permissible limit of 5 million rubles. in a year.

Data to be reflected on line 040 6-NDFL

According to Art. 210 of the Tax Code of the Russian Federation, tax is calculated as a percentage of the tax base. In this case, the tax base is the total income of the taxpayer, reduced by the amount of deductions provided in accordance with the Tax Code of the Russian Federation.

The main interest tax rates for residents currently in effect are as follows:

- 13% - this may be salary, remuneration under civil partnership agreements, income from the sale of real estate or some other income;

- 35% - from the amount of savings on interest when receiving borrowed funds in terms of exceeding the established amounts.

Our “Personal Income Tax Rate” section will help you understand the general picture of personal income tax rates.

The calculation formula for calculating tax by a tax agent is simple:

(Individual's income - Deductions provided) × Tax rate for this type of income.

It is this amount that will appear in line 040 of the 6-NDFL calculation. That is, in relation to the report it will look like this:

(Page 020 – Page 030) × Page 010 / 100.

If the calculated indicator does not coincide with the specified amount, this will not always be an error. The tax is calculated in full rubles. According to rounding rules, the tax amount is less than 50 kopecks. is discarded, and 50 kopecks. and more is rounded to the nearest ruble (rounding error). A discrepancy in any direction of up to 1 ruble is acceptable. for each individual. The published control ratios for checking Form 6-NDFL provide the following formula for calculating the permissible error:

Page 060 × 1 rub. × Number of lines 100.

For example, if on line 060 “Number of people” you have 54 people indicated and during the reporting period income was paid 3 times (that is, line 100 “Date of actual receipt of income” is filled in three times), then the amount on line 040 for the 1st quarter may be 162 rub. differ from that calculated by the formula (54 × 1 × 3). The number of 100 lines will depend on the number of income dates in the reporting period.

IMPORTANT! But if the discrepancy exceeds the maximum error, then the tax authorities will consider that the amount of accrued personal income tax is underestimated or overestimated. This will result in a letter asking for clarification and an adjustment calculation.

How to do this, see our article “How to correctly fill out the clarification on form 6-NDFL?”.

Read more about control ratios for checking the form in our article “Control ratios for checking form 6-NDFL”.

Tax officials also compare the indicators of forms 2-NDFL and 6-NDFL. Find out what the amount of line 040 should be in ConsultantPlus by getting trial access to the system for free.

After filling out lines 010–050 for all tax rates applicable to your company, you can move on to the second part of the first section. There is line 070 here, which will summarize the withheld tax.

IMPORTANT! The amounts of calculated and withheld taxes (lines 040 and 070, respectively) may not coincide. This is possible if some income has already been accrued, the tax on it has been calculated, but the income has not yet been paid. For example, in a situation where salaries are accrued in one quarter and paid in the first month of the next quarter.

Let's compare the tax calculation dates and the withholding dates.

| Income | Tax calculation deadline | Tax withholding period |

| Salary | Last day of the month worked | On the day of payment in cash |

| Payments upon dismissal | Last working day | On the day of payment |

| Sick leave and vacation pay | On the day of payment | On the day of payment |

| Dividends | On the day of payment | On the day of payment |

| Travel expenses (not documented, “extra daily allowance”) | Last day of the month of approval of the advance report | On the day of salary payment for the month in which the advance report is approved |

| Income in kind | On the day of transfer of income | On the day of payment of the next income in cash |

Thus, we see that the dates for tax calculation and withholding do not coincide quite often. This means that inequality between lines 040 and 070 is common.

More information about the dates of receipt of income is described in the article “Date of actual receipt of income in form 6-NDFL”.

To learn how to reflect dividends in 6 personal income tax, read the article “How to correctly reflect dividends in form 6-personal income tax?”

Interpretation of terms and their purpose

Despite the difference, these 2 forms reflect similar information - how much income the employee received, how much tax was withheld and paid from it. Therefore they must match each other.

But first of all, make sure that there are no errors in the reports themselves.

2 personal income tax

What is a certificate: this is a table with detailed information about the employee’s income received from the employer for a certain period. Typically the period is a year. But an employee has the right to request a document for a shorter period - for a quarter or even for the last month.

For reference! There are 2 versions of the form - for submission to the inspection and for issuance to employees. On January 1 of this year, a new certificate form for the Federal Tax Service was approved - machine-oriented.

It consists of 2 parts:

The main part has 3 sections:

employee information;

the total amount of income and tax for the year;

And in the application, the information is already divided by month. Adding the amounts from the application should give the values specified in sections 2 and 3.

6 personal income tax

The difficulty in filling out the report is due to the fact that in the form you fill out:

the first section – information for the entire period from the beginning of the year;

the second section – for amounts for the last 3 months;

taking into account the instructions of the Federal Tax Service of Russia for the report, according to which the dates of accrual of income to personnel, withholding and transfer of taxes to the treasury may differ from the dates according to accounting.

Reconciliation of data according to the form in the first section:

The value of column 020 is greater than or equal to column 030, since tax deductions cannot exceed income. If you have made an error regarding this parameter, the Federal Tax Service will require clarification. But if you yourself discover a mistake and submit a “clarification”, you will avoid sanctions.

Column 040 is equal to: (column 020 – column 030) / 100 × column 010, i.e. Column 040 is equal to the tax base multiplied by the rate. In other words, you check that the income tax calculation is correct. An error due to rounding is allowed.

The value of column 040 is greater than or equal to column 050 (advance payment).

In the second section, only 3 dates and the corresponding amounts are indicated:

transfer to the state budget.

Important! When choosing a date for section 2 of Form 6 of personal income tax, the day of accrual is taken into account, not the actual transaction.

However, there is a difference between different types of income. So, for salary, write the last day of the month, for dismissal payments - the last working day of the person, etc. according to the recommendations of the Federal Tax Service and the Ministry of Finance.

Example of filling line 040

Line 040 is generally not difficult to fill out. But for clarity, let's look at an example.

Example

At Sady LLC, the amount of accrued wages for the 1st quarter was:

- January - 30,000 rubles;

- February - 35,000 rubles;

- March — 49,000 rub.

No deductions are provided to employees. The report will be filled out like this:

What can a tax agent be fined for?

| Violation | Fine | Base |

| The 6-NDFL calculation was submitted at the wrong time | 1000 rubles for each full and partial month | clause 1.2 art. 126 Tax Code of the Russian Federation |

| You indicated inaccurate data in the 6-NDFL calculation or in the 2-NDFL certificate | 500 rubles for each erroneous document | Art. 126.1 Tax Code of the Russian Federation |

| We were required to submit the 6-NDFL calculation electronically, but we submitted it on paper | 200 rubles | Art. 119.1 Tax Code of the Russian Federation |

| Did not submit information on form 2-NDFL on time | 200 rubles for each document not submitted | clause 1 art. 126 Tax Code of the Russian Federation |

A fine for submitting false information can be avoided if two conditions are met:

- errors in calculations do not affect the amount of personal income tax;

- you submitted an updated calculation before the tax authorities discovered the error.

How to submit a corrective or canceling 2-NDFL certificate is described in the article “Procedure for submitting clarifications on 2-NDFL and 6-NDFL”.

Fill out, check and send 6-NDFL through Extern for free with your certificate

Join for free

Don't miss new publications

Subscribe to our newsletter and we will help you understand the legal requirements, tell you what to do in controversial situations, and teach you how to earn more.

Results

Reflection of the calculated personal income tax in the 6-NDFL report is a process that requires knowledge of the nuances of the legislation. At the same time, the existing basic formulas for calculating report indicators will help you independently check the correctness of your accounting data, without waiting for a request from the tax office.

This article will help you check if you are making the most common mistakes when filling out 6 personal income taxes.

You can find more complete information on the topic in ConsultantPlus.

Full and free access to the system for 2 days.

Reporting Differences

The forms for submitting a report on the income of individuals working in an organization or a private entrepreneur and reports on the income of citizens have a number of fundamental differences:

- the frequency of submitting a new 6-NDFL document is quarterly , and 2-NDFL forms are submitted once a year;

- the new form reflects summary indicators for the organization , and in the usual 2-NDFL information is submitted individually for each specific employee separately.

Title page

Tax legislation explains the features of each of the reports and the nuances of possible discrepancies, coordinating the rules for filling out and calculating several regulations. For example, a separate letter from the fiscal authority, issued in 2021, establishes where 2-personal income tax and 6-personal income tax should converge and indicates the ratios that make it possible to check the indicators for tax deductions of two types of statements.

In 6-NDFL, an error in the tax amount was allowed, taking into account rounding to the whole ruble

By letter dated March 10, 2021 N BS-4-11/ [email protected] the Federal Tax Service sent control ratios to verify the correctness of filling out the 6-NDFL calculation. This is already the third version of the relations for this calculation. The first appeared at the end of December, the second was sent out in a January letter.

The new letter changes ratio 1.3, which checks the calculation of the tax amount. If income is reduced by deductions, divided by 100 and multiplied by the rate, then now the resulting number should be equal to the amount of tax (according to the previous ratios, the amount of tax should not have been less, that is, it was assumed that the tax could be more than what was calculated). At the same time, it is now stipulated that, taking into account paragraph 6 of Article 52 of the Tax Code (that is, rounding to the nearest whole ruble), an error is allowed in both directions, defined as line 060 * 1 ruble. * number of lines 100 (that is, taking into account the number of individuals).

The ratio 1.5 “line 070 = sum of lines 140” has been abolished - checking the resulting withheld tax for equality to the sum of its components calculated on different dates and terms.

Relationships between reports

The Federal Tax Service of Russia provides control ratios of 6 personal income tax and 2 personal income tax, according to which the inspector will check your reporting. If he discovers a deviation from the established ratios, he will send you a notice requiring you to provide written explanations within 5 days.

If, after studying the explanations, the inspector reveals a violation of the Tax Code of the Russian Federation and tax legislation, then an inspection report will be drawn up with a decision on prosecution.

Note! There are penalties for filing reports with errors.

If it is revealed that you deliberately underestimated the tax base or hid the income of some employees, the fine will be greater.