Do companies and individual entrepreneurs need an online cash register for UTII?

This is the first most popular question we are asked by business owners and individual entrepreneurs working with a single tax on imputed income.

In short, the answer is:

yes, a cash register is needed now for most UTII payers,

and if you don’t have one yet, you will still

need it in the next year or two.

One way or another, the entire business is switching to working with online cash registers, the only question is the timing.

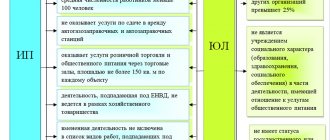

Who should checkout in 2021?

Most of the market has already switched to the new order, in particular, individual entrepreneurs in retail trade and public catering who have hired employees were required to introduce online cash registers by July 1, 2018.

From July 1, 2021, those individual entrepreneurs on UTII who are engaged in:

- Retail sale of goods (not of own production) - without hired employees.

- They operate in the catering industry - without hired employees.

- They provide services/perform work - they have hired employees.

Who is eligible for the deferment until 2021?

Until July 1, 2021, those entrepreneurs who do not have employees and in the course of their commercial activities can work without a cash register:

- They sell products of their own production.

- They provide services independently.

- They do the work themselves.

In the listed cases, you can do without online cash register for some time and not transfer fiscal data to the Tax Inspectorate.

Prohibition of UTII when trading goods subject to mandatory labeling

For several years now, various product categories have been connected to the labeling system. The bottom line is that manufacturers apply unique two-dimensional codes to each product, and wholesale and retail companies, when selling, recognize the codes with a scanner and transmit the data to the state traceability system.

Now the turnover of alcohol, fur products, cigarettes, shoes, and certain medicines is monitored in a similar way; from the end of 2021, bed linen, perfumes, tires, photographic equipment, and some types of clothing will be added.

According to the resolutions of the Ministry of Finance, amendments were made to the Tax Code, so that from January 1, 2021, companies are prohibited from using UTII for the retail sale of medicines, shoes, and clothing made from natural fur.

If your activity falls under this ban, then by December 31, 2019 you need to notify the Tax Inspectorate and switch to OSNO or simplified tax system. Naturally, you will also need an online cash register with the Federal Tax Service, an agreement with the OFD and registration on the Federal Tax Service website.

Requirements 54 of the Federal Law on the use of online cash register systems

The bottom line is this: there is a fiscal drive at the cash register / fiscal registrar, all information about sales in encrypted form is sent online through the Fiscal Data Operator to the Tax Inspectorate, and the buyer receives a receipt with a QR code.

Accordingly, to work according to the new requirements of 54-FZ, you need to have suitable equipment and establish data transmission.

Push-button autonomous cash registers are becoming a thing of the past; they have been replaced by smart terminals. They have a built-in cash register program, allow you to work with a product database, connect a scanner to read barcodes, print items on a receipt, view sales analytics and much more.

They are more expensive than traditional cash registers, but the savings are conditional, because with old models it will not be possible to adapt to new trade requirements. Several years will pass, and the market will gradually move towards electronic document management; companies everywhere will implement at least a minimal automation system, so we strongly advise you to immediately buy modern models. This is an investment in the future development of your business.

Transition deadlines:

- From 07/01/2018 individual entrepreneur on UTII or Patent (for trading activities and catering with hired employees)

- From 07.2018 IP on UTII or Patent when selling excisable goods

- From 07.2019, individual entrepreneur on UTII or Patent when providing services, trading activities and catering, without hired employees, i.e. other.

Important!!! If you didn’t have any employees, but you just hired them, you need to connect an online cash register within 30 days.

How to start working with an online cash register?

Implementation checklist

Buy a new smart terminal or fiscal recorder. Select suitable cash register equipment and pay for the fiscal recorder with the permitted validity period.

Receive a qualified electronic signature recorded on a key medium

You will need it for registration in your personal account of the Federal Tax Service, OFD and other sites.

Conclude an agreement with the fiscal data operator

The standard period is 15 or 36 months, depending on the validity period of the fiscal drive.

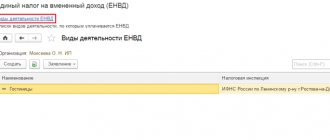

Register on the IFTS website

Fill in the company information.

Carry out fiscalization of cash registers

Enter the details of the purchased cash register in your personal account of the Federal Tax Service. After some time, the equipment will be assigned a registration number. It is important to quickly add information received from the Tax Inspectorate and the OFD to the cash register settings.

The owner of a cash register can do all these steps independently. Now it is not necessary to conclude a maintenance contract and call an engineer.

But many businessmen prefer to get rid of routine and save their time, so they order a package of services for registering cash registers at the Authorized Service Center where they purchased the equipment.

Which fiscal drive is suitable?

Typically, enterprises and entrepreneurs using UTII are suitable for a 36-month tax period.

FN is set for 15 months by those who combine the tax regime with OSNO and/or trade in excisable goods.

It is necessary to replace the fiscal drive when the stated period has expired or when the memory is full.

How to choose a fiscal drive

Individual entrepreneurs need to buy a fiscal accumulator for 36 months. Only entrepreneurs who:

- use OSNO, with the exception of the service sector

- sell excise goods

- have a seasonal business

- use the cash register in offline mode, without transmitting information to the Federal Tax Service

- are payment agents

In what case will an individual entrepreneur receive a fine for a fiscal accumulator?

The individual entrepreneur will be fined 1,500–3,000 rubles. in case he should use FN for 36 months, but uses it for 13 or 15.

Which online cash register to choose for organizations and individual entrepreneurs on UTII

Tips for choosing: what to look for

Cash register or fiscal recorder

The first option is self-sufficient, it is a kind of tablet with a built-in receipt printer: there is a screen, a touch or push-button keyboard, a cash register program based on a familiar operating system and connectors for connecting peripherals. The second type of equipment is a check printing device with a fiscal drive and a connector for other equipment such as a scanner: that is, the device itself only prints checks, so for full-fledged trading it needs to be connected to a POS terminal or computer.

Print speed

For small and medium-sized customer flows, 70-100 mm/s is sufficient; for large stores, it is better to look at models with characteristics of 150-200 mm/s.

Print Width

The classic for trade and services is 57 mm; for supermarkets and some industries, a wide tape of 80 mm is more suitable.

Print yield

Determined by potential customer flow. The standard value of 50 km of receipt tape is suitable for most shops, coffee shops and service enterprises, but for heavy loads, for example, in supermarkets, gas stations and large public catering establishments, a value of 100 km will be optimal.

Auto cutter

Separates checks independently, thereby significantly speeding up customer service.

Powered by mains or battery

The second is relevant for the market, outdoor trade at exhibitions, fairs and festivals, as well as for places where power outages occur.

Display size

A small screen of 5-7 inches is sufficient for small departments, coffee shops, car washes; the golden mean of 8-10 inches is universal for many retail outlets, and for food establishments with an extensive menu, a diagonal of 13-15 inches should be considered.

Internet connection

Data transfer can occur over a local network, wirelessly via Wi-Fi or using a SIM card with 3G Internet. The choice depends on the installation location of the cash register and the stability of data transmission.

Number and type of connectors

Most often, a barcode scanner, a cash drawer, sometimes scales, a buyer’s display are connected to an online cash register; in the case of a fiscal registrar, a POS computer and a monitor are required. Decide in advance what peripherals you will connect, what type of connectors (USB / RS232) and how many you will need.

What is better: do everything yourself or seek help from specialists

Imagine this: an aspiring individual entrepreneur opens the first store in his life. He independently makes repairs there, negotiates with suppliers of goods, goes to banks in search of a loan and does a million other things. Among other things, he also needs to deal with cash register equipment - do everything that we wrote about above.

Often there is simply not enough time for all this. It is almost impossible to sit down at the computer and understand the intricacies of registration while the first coat of paint dries before applying the next.

Therefore, many businessmen are ready to give a certain amount of money to have the work done for them . There are plenty of offers of this service on the market - you just need to find and choose a reliable company.

The average cost of the service is around 3-4 thousand rubles. This includes concluding an agreement with the OFD and registering the cash register with the tax office. If you pay about the same amount, they will connect and set up your equipment and provide staff training. In general, the best solution is to order all the work on a turnkey basis.

This method allows you to do nothing at all - you just need to call and agree on the service. You will receive a commercial offer by email, which will indicate the prices for all work performed by the technician. Typically, the package offer includes the cash register itself , all work on connecting equipment and settings, registration and conclusion of contracts and obtaining an electronic signature, and staff training.

If things go well and there are no deadlines, you can get the job done in one working day . A specialist will come to your location, bring equipment with him, set everything up and connect it. Additionally, you can order technical support for a certain period of time - a very useful thing. At first, when working with equipment, questions will arise that need to be resolved promptly. In addition, the equipment tends to break down: either the cash register does not see the barcode scanner, or does not recognize the terminal for accepting bank cards.

Selection from retail experts PORT

Self-sufficient smart terminal

You can turn it on and start working. The receipt printer is built into the case, there is a touch screen, and there is a convenient and easy-to-learn program. If you need to read barcodes from goods, just connect a scanner.

Optimal for small departments with groceries, shoes and clothing, car washes, beauty salons, coffee shops and fast food restaurants. It is considered one of the most budget-friendly options for automating microbusinesses and small businesses.

Here, the Sigma 7/8/10 series of cash desks from ATOL and the Evotor line of terminals are becoming popular and universal solutions.

Smart terminal ATOL Sigma 10

Touch POS terminal ATOL Strike

Smart terminal ATOL Sigma 7

Smart terminal ATOL Sigma 8

Fiscal registrar for the cash register area

Connects to a candy bar or POS computer. The checks are printed, and the cashier performs all actions with the program on the candy bar screen or using a keyboard and monitor.

Most often, a fiscal recorder working together with a computer, monitor and scanner is installed in stores with medium and high traffic. The equipment is integrated with the commodity accounting program. The advantage is that you can independently select a set of equipment for specific tasks and budget.

Online fiscal registrar SHTRIH-ON-LINE

Online fiscal registrar ATOL 30F

Online fiscal registrar ATOL 50F

Online fiscal registrar RETAIL-02F RS/USB

Ready POS system

Convenient kits assembled by the manufacturer taking into account the specifics of the business, for example, there are options for a liquor store, restaurant, small retail outlets, etc. The configuration depends on the model, usually it is a fiscal recorder + a computer with a keyboard and monitor or a candy bar + scanner + software.

POS system ForPOSt supermarket 8″

POS system ATOL Retail 54 Pro

POS system ATOL Boutique 15″

POS system ATOL Optima Core

How to get an electronic signature

An electronic signature is an encrypted file with which you can sign electronic documents. In some cases, it has the same legal force as a handwritten signature. This is reflected in the legislation of the Russian Federation.

The main purpose of an electronic signature is to maintain electronic document management. It allows you to sign documents without leaving your computer. The point is that the digital signature confirms the fact that the document was signed by a specific person who knows the key.

So, an electronic signature is needed both when registering a cash register with the tax office and when concluding an agreement with the OFD. All documents are signed remotely through the appropriate accounts. Therefore, without an electronic digital signature you can’t go anywhere.

EDS will also be needed in the following cases:

- to remove cash register equipment from tax registration;

- to re-register a cash register;

- for maintaining accounting records and transferring them to the tax authorities;

- when replacing a fiscal drive with a new one;

- when changing the fiscal data operator. When concluding an agreement with a new OFD, you need to certify the documents with an electronic signature.

An electronic signature of this format can only be obtained from specialized organizations - certification centers. There you need to take the necessary documents, fill out an application and pay the cost of the service. The production time depends on the workload and promotion of the center, the region of its presence and other factors. Usually it is 1-5 business days. There are services for urgent production of digital signatures, but they are more expensive.

Before going to the certification center, you need to collect a package of necessary documents. They will differ for legal entities and individual entrepreneurs. For IP you will need:

- personal passport (original and copies of the main page and registration);

- taxpayer identification number (TIN) (original and copy);

- extract from the Unified State Register of Individual Entrepreneurs (for no more than six months);

- SNILS pension certificate (original and copy);

- certificate of state registration as an individual entrepreneur (original and copy).

In addition, you need to write an application for an electronic signature and pay a receipt . After checking the documents, the center specialist will write the key and key certificate onto an electronic medium and hand it over to you.

List of documents for legal entities:

- personal passport of the future owner of the digital signature (original, copies of the main page and registration);

- certificate of state registration of a legal entity (original and copy);

- an extract from the register of registration of legal entities (for a period of no more than six months from the date of issue);

- TIN;

- pension certificate of the future owner of the electronic signature - SNILS.

To receive it, you also need to fill out an application and pay the invoice for the work.

If you contact the certification center not personally, but through your legal representative, a notarized power of attorney will be added to the list of documents . You can get it from any notary. The price starts at 1800 rubles.

Individual entrepreneurs can submit documents and receive an electronic signature not only at certification centers, but also at the Russian Post, at the Federal Tax Service, as well as at multifunctional public service centers - MFCs. For legal entities, only registration at certification centers is available.

Documents can be brought in person or through a legal representative, or you can make scans and send them to the certification center via the Internet. After paying the invoice, you must personally obtain a signature from the organization.

Let's sum it up

So, most business owners in 2018-2019 have already installed and are using online cash registers, transmitting data to the Tax Service through the Fiscal Data Operator.

For some entrepreneurs and enterprises, there is a deferment on UTII until 2021, so they can work without changes. This applies to those individual entrepreneurs without employees who are engaged in the sale of goods of their own production, provision of services and performance of work.

However, we recommend that even these categories adapt their business in advance to the new requirements of the law in order to debug all processes, train staff, calmly implement minimal commodity accounting, purchase cash register equipment with a fiscal drive without any fuss, and register everything without haste.

—

The review was prepared by PORT specialists.

We will answer questions in the PORT VKontakte group or in the ASC in Krasnoyarsk. If you found the article useful, share the material on social networks.

conclusions

- OSNO and simplified tax system have already been using cash registers since 2021

- Catering enterprises, retail trade and vending that employ hired workers can use CCP in 2021.

- UTII, patent, vending and service industries are required to connect online cash registers from July 1, 2021

- If you sell beer, you should clarify the timing of the transition to CCP in 54-FZ

- The simplified tax system, UTII and PSN are not required to indicate the name and quantity of goods on the receipt until January 1, 2021

- Individual entrepreneurs on PSN and UTII will receive a tax deduction in the amount of 18,000 rubles. for one online checkout

- If you use a fiscal drive with a shorter operating life than necessary, you will be fined 1,500–3,000 rubles

You can buy an online cash register for individual entrepreneurs from Multikas at any time convenient for you. Our competent specialists will solve all technical problems and tell you how not to make a mistake and make the right choice.

Who has the right not to connect the cash register after 2021

LLCs and individual entrepreneurs providing services can conduct payments without a cash register at all:

- shoe repair and painting

- for the production and repair of metal haberdashery and keys

- for the supervision and care of children and the sick

- for the production and sale of folk arts and crafts

- for plowing gardens and sawing firewood

- porters at railway stations, bus stations, air terminals, airports, sea and river ports

- ceremonial and ritual services

A complete list of persons is contained in Art. 2 of Law No. 54-FZ.

In this case, the seller does not have the right:

- use automatic devices to carry out calculations

- trade in excisable goods

Federal Tax Service and Ministry of Finance: postponement until 2021

The tax office commented on Anton Siluanov’s speech about the deferment for online cash registers for individual entrepreneurs. According to the Federal Tax Service, about 1 million businessmen are projected to switch to online cash registers in 2021. Of these, several tens of thousands are without hired workers. This number of service sector entrepreneurs is expected in June. Siluanov proposed considering a deferment for online cash registers until 2021 for this category, given the introduction of a special tax rate for the self-employed. Many of them will re-register and will no longer need a cash register. As for the category of service sector entrepreneurs with employees, the transition of labor will not be difficult for them. The market is already ready. All necessary assistance is provided. Many people are already purchasing cash register equipment in advance. The point here is not only mandatory; purchasing a cash register of this kind carries a number of advantages. This concerns automation of a large part of the work, simplification of interaction with tax authorities and reduction of reporting.

What now. Nuances of the 3rd stage

From July 1, 2021, CCP should be applied in the following cases:

— when making settlements with individuals who are not individual entrepreneurs, non-cash (for example, through a bank cash desk);

— when carrying out offset and return of prepayment and (or) advances;

— when providing loans to pay for goods, works, services;

- when providing or receiving other consideration for goods, works, services.

From July 1, 2021, (client) data must be entered into the cash register receipt

— when making payments between organizations, individual entrepreneurs in cash or by bank card (in this case, the law may also require information about the country of origin of the goods, the amount of excise tax and the registration number of the customs declaration);

- when paying out winnings from gambling, lotteries;

— when accepting an insurance premium or insurance payment.

Users have the right to use a cash register (with the exception of a cash register used in a regime that does not provide for the mandatory transmission of fiscal documents to the tax authorities in electronic form through a fiscal data operator), located outside the place of settlement , in the following cases:

— when making payments (with the exception of non-cash payments on the Internet) for goods sold during peddling trade and during the remote method of selling goods (except for excisable products);

- when making payments at the place of performance of work and (or) provision of services that are performed (provided) by the user outside a retail facility, retail location, building, structure, structure and their parts and (or) land plot used by the user to perform work and ( or) provision of services on the basis of ownership, lease or other legal grounds;

- if, in accordance with the legislation of the Russian Federation, federal executive authorities are vested with the authority to approve the forms of document forms used in the provision of services to the population, and (or) the legislation of the Russian Federation provides for the use of appropriate document forms when providing services to the population;

— when making payments by a driver or conductor in the vehicle when selling travel documents (tickets) and coupons for travel on public transport;

— in cases of making payments (except for payments in cash, as well as settlements with the presentation of an electronic means of payment, subject to direct interaction between the client and the user) when accepting payments for residential premises and utilities.

A cash register may not be used when making payments (except for cash payments, as well as settlements with the presentation of an electronic means of payment, subject to direct interaction between the buyer (client) and the cash register user):

— TSN (HOA, SNT), housing, housing-construction cooperatives and other specialized consumer cooperatives for the provision of services to their members within the framework of the statutory activities of these partnerships and cooperatives, as well as when accepting payments for residential premises and utilities;

— educational organizations when providing services to the population in the field of education;

— physical culture and sports organizations when providing services to the population in the field of physical culture and sports;

- houses and palaces of culture, houses of folk art, clubs, centers of cultural development, ethnocultural centers, centers of culture and leisure, houses of folklore, houses of crafts, leisure houses, cultural and leisure and cultural and sports centers when providing services to the population in the field of culture.

- individual entrepreneurs when selling entrance tickets and subscriptions to theaters that are state or municipal institutions, carried out by hand or by tray, except for cases of selling these entrance tickets and subscriptions using the Internet and communication networks.

At the seminar on December 13, they will talk about new rules for the use of cash registers by certain categories of users, new mandatory check details, and a new format for fiscal data.

Sign up!

Postponement of cash registers in vending until 2021

Entrepreneurs who do not have employees and who trade using vending machines are also entitled to a deferment of online cash register until 2021. But by July 1, they will have to install cash register equipment.

At the same time, owners of vending machines were allowed to use one cash register for several machines, provided that:

excisable, technically complex and subject to mandatory labeling goods are not sold,

The device's serial number is clearly indicated on the device's body.

In addition, from February 1, 2021, it will be possible not to print a receipt if a QR code is displayed on the device screen.

Those who use mechanical machines (for example, selling candy) do not need to install cash registers at all.