Land tax: national norms

At the federal level, the basic rules for paying land tax are established: who is the taxpayer, general benefits for the country and a list of non-taxable plots, tax and reporting periods, tax base, maximum tax rates, reporting deadlines, tax payment deadlines for citizens and the earliest tax payment deadline for organizations .

IMPORTANT! From 01/01/2021, a number of innovations have been introduced in relation to land tax:

- its declaration has been cancelled;

- The Federal Tax Service will independently calculate the tax amount and send a notification;

- The tax payment deadlines have been changed: advances on tax payments must be transferred no later than the last day of the month following the reporting period, the annual payment must be transferred no later than March 1.

The tax must be paid by citizens and organizations that own land plots, as well as those who own them by the right of perpetual or lifelong inheritable ownership. No tax is paid for leased and freely used plots.

To calculate land tax, you need to know the cadastral value of the plot as of January 1 of the paid year. For plots formed during the year, the cadastral value as of the date of their inclusion in the Unified State Register is taken into account.

The Tax Code sets the maximum possible tax rates (Article 394 of the Tax Code of the Russian Federation). The following lands are taxed at a rate of 0.3%:

- agricultural purposes;

- occupied by engineering objects of housing and communal services and residential buildings, as well as intended for their construction;

- intended for personal subsidiary plots, summer cottages, gardening and farms;

- provided for defense, security and customs needs.

All other lands are taxed at a rate of 1.5%.

The reporting periods are the first, second and third quarters. The tax period is one year.

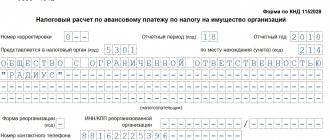

Starting with land tax for 2021, the submission of the declaration is cancelled. In this case, the legal entity will receive a tax message with the calculated amount. However, this does not mean that they will no longer need to calculate the tax themselves. This responsibility will remain with organizations in the future. After all, they must know the amount in order to make advance payments throughout the year (if such are established by local authorities). And the message from the tax office is more of an informational nature, so that the company can compare its accruals with those made according to the tax authorities. And she will receive it after the deadline for paying advances (see, for example, letter of the Ministry of Finance dated June 19, 2019 No. 03-05-05-02/44672).

Important! Recommendations from ConsultantPlus Compare the amount of tax calculated by the inspectorate with the amount you calculated and paid. If they are equal, then the tax was calculated and paid correctly. If the amounts differ, check... See K+ for more details with a free trial.

Tax on agricultural land in 2016

Land tax rates for legal entities are the same as for citizens. The possibility of benefits for organizations under this tax is provided for by regional legislation. At the federal level, benefits are established only for companies resident in special economic zones.

Current legislation is based on the principle of recognizing the special value of land plots involved in agricultural production. The legislation also provides for state support for persons using this land for agricultural production. Therefore, reduced tax rates apply to land plots classified as agricultural land. The base rate is defined as 0.3% of the cadastral value. Local authorities can reduce this rate to 0%. This may take into account the nature of the use of the land plot, its location, agrochemical, geodetic or geographical parameters.

Non-taxable lands and state benefits

Certain types of land plots are not subject to tax (clause 2 of Article 389 of the Tax Code of the Russian Federation). These include areas:

- occupied by federal facilities listed in paragraph 4 of Art. 27 Land Code of the Russian Federation;

- on which cultural heritage sites, water bodies and forests listed in sub-clause are located. 2, 3, 4 p. 5 art. 27 Land Code of the Russian Federation;

- plots of common ownership on which multi-apartment residential buildings are located.

The Tax Code exempts certain categories of organizations and citizens from taxation (religious organizations, societies for the disabled - the full list is given in Article 395 of the Tax Code of the Russian Federation).

In addition, there are preferential categories of citizens (WWII veterans, pensioners, disabled people, Chernobyl victims) who have the right not to pay tax on 600 square meters. m of one of the plots belonging to them (clause 5 of Article 391 of the Tax Code of the Russian Federation).

Features of calculating tax on land plots intended for housing construction

To speed up housing construction, as well as to eliminate abuse of the right to a reduced tax rate, the state provides increasing coefficients when calculating land tax on plots intended for housing construction (clauses 15, 16 of Article 396 of the Tax Code of the Russian Federation).

The tax on such plots, except for those intended for individual housing construction carried out by individuals, is paid with a coefficient of 2 in the first 3 years from the date of registration of the right to the plot.

If within 3 years the house is built and registered, the tax is recalculated with a coefficient of 1. The tax overpaid during the construction period is returned to the taxpayer.

If construction lasts longer than 3 years, then from the fourth year until the end of construction, a coefficient of 4 is applied.

Citizens who received land for individual housing construction and did not build housing within 10 years from the date of registration of the right to the site, starting from the eleventh year until the end of construction will have to pay double tax.

Land tax: local legislation

At the local level, deadlines for payment of taxes and advance payments by enterprises are established. The Tax Code does not regulate these issues, only not allowing the payment date to be set earlier than February 1.

In addition, municipalities have the right:

- introduce all kinds of additional benefits and tax deductions;

- set lower compared to Art. 394 of the Tax Code of the Russian Federation, rates, which can be differentiated by categories of land and the nature of their use;

- cancel reporting periods and advance payments for organizations.

Thus, to find out how to calculate land tax, you need to carefully study the legislation of the municipality where the site is located. Let's consider the formula for calculating land tax for legal entities.

The procedure for calculating land tax for legal entities

Enterprises calculate taxes themselves. In general, the formula for calculating land tax for legal entities looks like this:

N = KS1 × CH1 × KV1 + … + KSn × CHn × KVn,

Where:

N - land tax for the year;

KS1 ... KSn - cadastral value of each plot;

Сн1...Снn is the tax rate for each plot;

Kv1 ... Kvn is the coefficient of ownership of each plot.

The easiest and fastest way to find out the cadastral value is on the State Register of Real Estate website. In addition, you can contact the State Register in person and receive an official statement of the cost of the plot.

If the enterprise owned the land for a whole year, then the coefficient will be equal to 1. Otherwise, to determine it, the number of months of ownership should be divided by 12. Moreover, if the ownership right arose after the 15th day or was lost before the 15th day, then the month of occurrence ( loss) of rights is not taken into account.

The tax on plots located on the territory of several municipalities is calculated in proportion to the share of each municipality.

If local law requires quarterly advance payments, then their amount is 1/4 of the annual tax amount. That is, the procedure for calculating land tax is as follows:

Nav = N × ¼,

Where:

Nav - advance tax on land,

N - tax for the year

The final payment for the year is reduced by the amount of advances paid.

Organizations entitled to benefits adjust the formula given to take them into account. Local legislation may provide for tax exemptions for certain objects, tax deductions and other preferences, so it is impossible to develop a single formula suitable for everyone.

ConsultantPlus experts spoke about the nuances of calculating land tax in special cases. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Let's look at how to calculate land tax using an example.

How is the tax calculated for a one-, two- and three-story house?

The total amount to be paid depends entirely on the tax base. For a private house, this will be the cost of the property. It is the price of the home , which was established by the state cadastral authority, that determines the final amount of the tax. No other parameters (height, number of floors, presence of an attic, etc.) affect it.

However, the specific calculation will depend on the region in which the house is located. This is not just about a specific rate. The calculation algorithm is determined by the calculation system used in a specific constituent entity of the Russian Federation - based on the cadastral or inventory value.

By 2021, all regions of the country must switch to a cadastral tax calculation system. However, at the moment, 11 constituent entities of the Russian Federation continue to calculate property duties on the basis of inventory value.

Tax calculation based on cadastral value

It happens according to the formula:

N = (Kst - Nv) x St x Pkf , where

- N - tax.

- Nv - tax deduction.

- Cst - cadastral value.

- St - rate.

- Pkf - reduction factor (set for the transition period from the calculation system based on inventory value to cadastral value, ranges from 0.2 to 0.6 depending on the region).

Tax calculation based on inventory value

When calculating tax according to the old system, the tax base will be the inventory value of the apartment (you can find it out in the BTI, on the Federal Tax Service website, on the Rosreestr website).

We recommend: Privatization of a private house and land: how, why and who benefits from it?

Calculation formula:

H = East x St x Kfd , where

- N - tax.

- East - inventory value.

- St - rate.

- KFD - Deflator coefficient (For 2021, set at 1.518) (Order of the Ministry of Economic Development dated October 30, 2018 No. 595).

Calculation of tax using the “transitional” formula

In accordance with paragraph 8 of Article 408 of the Tax Code of the Russian Federation, during the transition to new rules, in addition to the reduction coefficient, regions may apply a special formula for real estate tax. Its essence is to pay a tax rate on the difference between the cadastral and inventory values .

The formula looks like this:

H = (Hk - Ni) x K + Ni , where

- N - tax payable.

- NK – tax calculated from the cadastral value.

- Neither – tax calculated according to the previous system (inventory value).

- K – reduction factor.

An example of accounting for land tax calculations by organizations

LLC "Rus" owns a plot, the cadastral value of which as of January 1, 2021 is equal to 1,525,000 rubles. The tax rate in the municipality is 0.75%.

For the year, the company must pay 11,437.50 rubles. (1,525,000 × 0.75%).

The amount of advances for each quarter will be 2,859.38 rubles. (11,437.50/4).

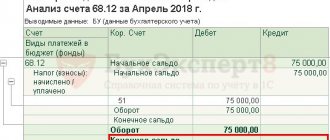

Accounting for land tax calculations is carried out using account 68, subaccount “Land Tax”:

- Dt 20 (23,25,26,44...) Kt 68 “Land tax” - tax accrued.

- Dt 68 “Land tax” Kt 51 - tax paid.

If the land plot is used in related activities, the cost account is changed to other expenses:

- Dt 91 “Other expenses” Kt 68 “Land tax”.

See another example of calculating land tax.

Land tax for individual entrepreneurs in 2016

In practice, situations are common when individual entrepreneurs use their land plot in business, for example, a land plot for private household plots is used for breeding bulls for meat. Since 2015, individual entrepreneurs have been exempted from the obligation to submit a land tax return; currently, the calculation of this tax for individual entrepreneurs is done by the tax authorities themselves, as for individuals; the fact of using land in business activities does not matter. The deadline for paying land tax by an entrepreneur is similar to the deadline for individuals, so you know exactly when to pay taxes on land for individual entrepreneurs.

Land tax cannot be included by an entrepreneur in expenses under the simplified tax system, and it does not reduce the single tax on imputed income in 2021 for individual entrepreneurs.

How to calculate tax when changing cadastral value

The procedure for taking into account changes in the cadastral value of land during the year when calculating tax has its own peculiarities. Let's consider the procedure for calculating land tax in various situations.

In general, changes in cadastral value during the year do not affect the calculation of tax. But there are exceptions to this rule:

- correction of errors made in determining the cost;

- change in value by decision of a court or a special commission for the consideration of disputes;

- change in area, type or category of land.

In the first case, the tax (advance payments) is recalculated for the entire period in which the incorrect value was applied. Adjustments by decision of the commission or court are carried out starting from the year in which the value was disputed.

Please note that as of January 1, 2019, changes to Ch. 31 of the Tax Code of the Russian Federation, according to which tax recalculation in both cases is carried out for the entire period of application of the incorrect cadastral value. The amendments do not have retroactive effect and are applied if changes occurred after 01/01/2019.

In the third situation, the tax (advance payments) is determined taking into account a coefficient calculated similarly to the ownership coefficient (clause 7.1 of Article 396 of the Tax Code of the Russian Federation). Let's look at how to calculate land tax using the ownership and change coefficient formulas.

State cadastral valuation

If land plots are recognized as an object of taxation, then their cadastral value is determined in accordance with clause 2 of Art.

66 of the Land Code of the Russian Federation, according to which, to establish the cadastral value of land plots, a state cadastral valuation of land is carried out, with the exception of cases specified in clause 3 of Art. 66 of the Land Code of the Russian Federation. State cadastral valuation of land is carried out in accordance with the legislation of the Russian Federation on valuation activities. State cadastral valuation is a set of actions, including (Article 24.11 of Federal Law No. 135-FZ):

making a decision to conduct a state cadastral valuation; compilation of a list of real estate objects subject to state cadastral valuation; selection of a contractor to determine the cadastral value and conclusion of an agreement with him to conduct an assessment; determining the cadastral value and drawing up a report on it; approval of the results of determining the cadastral value; entering the results of determining the cadastral value into the state real estate cadastre.

The executive authorities of the constituent entities of the Russian Federation approve the average level of cadastral value for the municipal district (urban district).

In cases where the market value of a land plot is determined, its cadastral value is established equal to the market value of this plot, as defined in clause 3 of Art. 66 of the Land Code of the Russian Federation.

The rules for conducting state cadastral valuation of land are approved in Decree of the Government of the Russian Federation dated April 8, 2000 No. 316 (hereinafter referred to as Rules No. 316).

In accordance with clause 1 of Rules No. 316, the state cadastral valuation of land is carried out by Rosreestr and its territorial bodies, which follows from clauses. 3, 4 Decree of the President of the Russian Federation dated December 25, 2008 No. 1847 “On the Federal Service for State Registration, Cadastre and Cartography.” To carry out the above work, appraisers or legal entities who have the right to enter into an appraisal agreement may also be involved.

Cadastral valuation is carried out to determine the cadastral value of land plots for various purposes at least once every 5 years and is based on the classification of lands by purpose and type of functional use (clauses 2, 3 and 4 of Rules No. 316).

Note! According to Art. 24.12 of Federal Law No. 135-FZ, state cadastral valuation is carried out by decision of the executive body of state power of a constituent entity of the Russian Federation or in cases established by the legislation of a constituent entity of the Russian Federation, by decision of a local government body no more than once in three years (in cities of federal significance no more than once within two years) from the date as of which the state cadastral valuation was carried out. Thus, Federal Law No. 135-FZ does not contain requirements for the need to conduct a state cadastral assessment of land at least once every 5 years. It should be recalled that until July 15, 2021 in Art. 24.12 of this Law contained a provision that the state cadastral valuation is carried out at least once every 5 years. However, in accordance with the Federal Law of July 3, 2016 No. 360-FZ “On Amendments to Certain Legislative Acts of the Russian Federation,” this requirement was excluded.

In the process of state cadastral valuation of land, an assessment zoning of the territory is carried out (clause 8 of Rules No. 316).

An assessment zone is recognized as part of land that is similar in purpose, type of functional use and similar in value to the cadastral value of land plots. Depending on the territorial size of the assessment zones, their boundaries are combined with the boundaries of land plots, taking into account the existing development and land use, the location of linear objects (streets, roads, rivers, watercourses, overpasses, railways, etc.), as well as the boundaries of cadastral districts or cadastral quarters .

Based on the results of assessment zoning, a map (scheme) of assessment zones is drawn up and the cadastral value of a unit of area within the boundaries of these zones is established.

Note! The state cadastral assessment of land is carried out taking into account the data of land, urban planning, forestry, water and other cadastres (clause 9 of Rules No. 316).

The executive authorities of the constituent entities of the Russian Federation, on the recommendation of the territorial bodies of Rosreestr, approve the results of the state cadastral valuation of lands (clause 10 of Rules No. 316). Based on these results, information on the cadastral value of land plots is provided to taxpayers in the manner determined by the federal executive body authorized by the Government of the Russian Federation (clause 14 of Article 396 of the Tax Code of the Russian Federation). Currently, this procedure is established by Decree of the Government of the Russian Federation dated February 7, 2008 No. 52 “On the procedure for bringing the cadastral value of land plots to the attention of taxpayers” (hereinafter referred to as Resolution No. 52).

According to paragraph 1 of Resolution No. 52, territorial bodies of Rosreestr are obliged to provide land tax payers with free information about the cadastral value of land plots upon a written application from the taxpayer in the form of the cadastral number of the property and its cadastral value in the manner established by Art. 14 of Federal Law No. 221-FZ of July 24, 2007 “On the State Real Estate Cadastre” (hereinafter referred to as Federal Law No. 221-FZ).

Note! From January 1, 2021, on the basis of the Federal Law of July 3, 2016 No. 361-FZ “On Amendments to Certain Legislative Acts of the Russian Federation and the Revocation of Certain Legislative Acts (Provisions of Legislative Acts) of the Russian Federation” Chapter 2 of the State Real Estate Cadastre , including Art. 14, and Chapter 3 “Procedure for cadastral registration” of Federal Law No. 221-FZ will lose force. From this date, the Federal Law of July 13, 2015 No. 218-FZ “On State Registration of Real Estate” will come into force, which will regulate relations arising in connection with the implementation on the territory of the Russian Federation of state registration of rights to real estate and transactions with it, subject to in accordance with the legislation of the Russian Federation of state registration, state cadastral registration of real estate that is subject to such registration, as well as the maintenance of the Unified State Register of Real Estate and the provision of information contained in this Register.

In accordance with paragraph 2 of Resolution No. 52, information on the cadastral value of land plots for tax purposes must be posted on the official website of Rosreestr on the Internet. As noted in the letter of the Ministry of Finance of Russia dated August 15, 2013 No. 03-05-05-02/33366, information on the cadastral value of a land plot posted on the official website of Rosreestr on the Internet can be used by the organization when calculating land tax.

Consequently, taxpayer organizations are obliged to independently provide themselves with information about the cadastral value of land plots by obtaining such information via the Internet or by submitting a written request to the territorial bodies of Rosreestr for the provision of such information.

According to paragraph 1 of Art. 14 of Federal Law No. 221-FZ, publicly available information included in the state real estate cadastre is provided by the cadastral registration authority upon requests (hereinafter referred to as requests for information) of any persons, including by mail, the use of public information and telecommunication networks, including The Internet, a single portal of state and municipal services, as well as using a unified system of interdepartmental electronic interaction and regional systems of interdepartmental electronic interaction connected to it, using other technical means of communication by providing access to an information resource containing information from the state real estate cadastre.

As for credit and insurance organizations, information included in the state real estate cadastre, necessary for these organizations to carry out banking operations and insurance, they request and receive from the cadastral registration authority only in electronic form through the use of public information and telecommunication networks, including the Internet, or other technical means of communication.

Based on clause 8 of Art. 14 of Federal Law No. 221-FZ information entered into the state real estate cadastre, with the exception of those provided in the form of cadastral plans of territories, must be provided no more than 5 working days from the date the cadastral registration authority receives the corresponding request (maximum period), unless otherwise established by Federal Law No. 221-FZ. The period for providing the requested information in the form of cadastral plans of territories cannot exceed 15 working days from the date the cadastral registration authority receives the corresponding request.

If the provision of the requested information is not permitted in accordance with federal law, or such information is not available in the state real estate cadastre, the cadastral registration authority within the period provided for in paragraph 8 of Art. 14 of Federal Law No. 221-FZ, issues (sends) a reasoned decision to refuse to provide the requested information or a notification about the absence of the requested information in the state real estate cadastre. If the request contains an instruction to receive (issue) information entered in the state real estate cadastre through a multifunctional center, the cadastral registration authority is obliged to transfer to the specified center a document prepared within a specified period of time containing the requested information, or a reasoned decision to refuse to provide such information, or a notification about the absence of the requested information in the state real estate cadastre. The decision to refuse to provide the requested information can be appealed in court (clauses 9, 10, article 14 of Federal Law No. 221-FZ).

The Constitutional Court of the Russian Federation in Determination No. 1555-O dated July 3, 2014, analyzing the issues of cadastral valuation, noted that for tax purposes there is an advantage in using the cadastral value of a land plot equal to the market value over the cadastral value of land plots established based on the results of the state cadastral valuation of land. However, at the same time, the Constitutional Court of the Russian Federation, citing, among other things, the provisions of the Federal Law “On Valuation Activities in the Russian Federation”, indicated that the state cadastral valuation of land is not without economic grounds, and the establishment of a cadastral value equal to the market value does not refute the supposed reliability of previously established cadastral valuation results.

Simultaneous application of ownership and change factors

According to the Federal Tax Service (letter dated May 23, 2018 No. BS-4-21/9823), supported by the Ministry of Finance (letter dated June 6, 2018 No. 03-05-04-02/38570), a tax with the simultaneous application of ownership and change coefficients other than 1, calculated by the formula:

Ni = KS1 × Sn × Kv × Ki1 + KS2 × Sn × Kv × Ki2,

Where:

Neither is the tax on the site, the value of which has changed;

KS1 - initial cadastral value;

Сн - tax rate;

Kv - ownership coefficient;

Ki1 - change coefficient equal to the ratio of the number of months of ownership before the change in value to the total number of months of ownership;

KS2 - new cadastral value;

Ki2 is the change coefficient equal to the ratio of the number of months of ownership after the change in value to the total number of months of ownership.

Calculation of land tax for individuals

The question: how to calculate land tax for the year is not a problem for individuals. The tax office makes the calculations for them. The amount of tax due is communicated to taxpayers by sending a tax notice. The formula for calculating land tax for individuals is similar to the formula for legal entities.

The notification tax must be transferred to the budget no later than December 1 of the year following the one paid. For 2021 you must pay by 12/01/2021.

Citizens receiving benefits should take into account that their right to benefits must be reported to the tax office. To do this, an application is submitted in the form from the order of the Federal Tax Service dated November 14, 2017 No. ММВ-7-21/897. It is recommended to attach supporting documents to the application. There is no need to re-apply for a previously granted permanent benefit.

To take advantage of the tax deduction under clause 5 of Art. 391 of the Tax Code of the Russian Federation, before November 1 of the year from which the deduction will be applied, submit to the Federal Tax Service a notification about the site selected for applying the deduction. The notification form was approved by order of the Federal Tax Service dated March 26, 2018 No. ММВ-7-21/167. If notice is not given, the benefit applies to the highest tax parcel.

This might also be useful:

- simplified tax system for individual entrepreneurs in 2021

- Tax system: what to choose?

- UTII for individual entrepreneurs in 2021

- Calculation of income tax from salary

- General taxation system for individual entrepreneurs

- Unified agricultural tax for individual entrepreneurs and organizations

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Results

To correctly calculate land tax, you must carefully study local legislation. It is this that determines the specific tax rates applicable in the territory of the exemption, and the deadlines for payment by legal entities.

Individuals do not need to calculate taxes on their own. They pay it based on tax notices. However, if there are benefits, they must be reported to the inspectorate.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.