Author: Ivan Ivanov

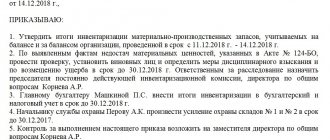

Form INV-17 is used when conducting a mandatory inventory of settlements with suppliers and counterparties in accordance with the Federal Law “On Accounting”. Responsibility for the correct implementation of this procedure lies with the inventory commission, which is selected by the general director.

The difficulty is that many people involved in the process do not know what information should be contained in the INV-17. This document must indicate the following:

- Name of the company of the debtor and/or creditor, as well as contacts of the legal and actual address.

- Information about when and for what the debt was received, that is, how it was formed.

- The exact amount of debt to be written off.

- Documentary proof of availability.

Help for INV-17 (filling sample)

Update: February 9, 2021

Every domestic enterprise that is a legal entity must conduct an inventory. This check is subject to not only inventory, inventories and assets, but also settlements with buyers and sellers, accounts payable and receivable. When taking inventory of obligations, it is necessary to fill out an act in the prescribed form. The basis for such registration is a certificate for INV-17, a sample for filling which has not been officially developed.

Inventory

According to Article 11 of the Federal Law “On Accounting”, enterprises must identify the correspondence of the actual state of assets and liabilities in comparison with accounting data. Such reconciliation is carried out in cases directly listed in domestic legislative acts. The head of the enterprise has the right to increase the number of inventories.

Clause 1.3 of the Methodological Instructions, put into effect by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 N 49, stipulates that absolutely all property and liabilities of the enterprise are subject to inventory.

Individual entrepreneurs are exempt from the need to conduct the above verification.

It should be emphasized that relationships with creditors and debtors, sellers and buyers are subject to inventory along with the material assets of the enterprise. This rule directly follows from the content of paragraph 3.44 of the Guidelines.

The Ministry of Finance of the Russian Federation has provided for the need to conduct an inventory in relation to the correctness and sufficient validity of the enterprise's receivables and payables.

To properly document the results of such an audit, the Ministry of Finance of the Russian Federation has developed a form of act No. INV-17, which is an appendix to the Methodological Instructions. The State Statistics Committee of the Russian Federation, by its Resolution No. 88 dated August 18, 1998, introduced the form and certificate for the INV-17 act. These documents are currently used for inventory purposes.

When filling out documents related to checking the actual state of assets and liabilities, you should remember that the acts must be signed by all members of the inventory commission. Violation of this rule will result in the invalidity of the results of the activities carried out.

Inventory report of receivables and payables (sample)

Sample of filling out form INV-17

Each domestic enterprise must conduct an inventory of its fixed assets, inventory, accounts receivable and payable at varying frequencies. This obligation is provided for by the Law “On Accounting”. The procedure for such reconciliation is spelled out in detail in the instructions of Russian government agencies. One of the documents drawn up based on the results of the audit is form No. INV-17. The sample for filling it out is not approved by law.

Debt inventory

The Russian Ministry of Finance issued Order No. 49 dated June 13, 1995, which not only approved the Methodological Instructions for conducting an inventory, but also developed forms and forms of official documents.

It should be especially emphasized that the provisions of paragraph 1.1 of this regulatory act directly indicate the need to reconcile not only property, but also all financial obligations of organizations. For this purpose, an inventory list of settlements with customers, suppliers, as well as debt amounts is compiled.

In the process of checking such amounts, the inventory commission should establish the correctness of registration and occurrence of obligations to creditors and debtors.

Among other documents, the Ministry of Finance of the Russian Federation, in its Order, approved the INV-17 form. This form is used in cases of inventory calculations:

- with buyers;

- with sellers;

- accounts receivable and accounts payable.

However, we must remember that at present, by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88, the INV-17 form, which is still in use today, has been developed and put into effect.

forms INV-17

When filling out any documents related to the reconciliation of the actual status and information reflected in the accounting records, all members of the inventory commission must certify with their signatures the information contained in the forms used. Ignoring this instruction may result in the corresponding form being declared invalid.

Sample act of inventory of receivables and payables

The State Statistics Committee of the Russian Federation, in Resolution No. 88 dated August 18, 1998, developed not only the form of the act itself used when reconciling obligations, but also approved the annex to it. However, neither the State Statistics Committee of Russia nor the Ministry of Finance of the Russian Federation have developed an official sample for filling out INV-17 in their Methodological Recommendations.

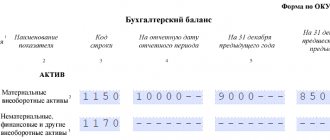

To fill this gap, it is necessary to indicate that the form of the main form consists of two parts:

The first page of the document contains general information about the enterprise, its division, and also indicates the start and end of the reconciliation, its basis, the number and date of the act itself. To follow the procedure for filling out INV-17, the code of the type of activity of the enterprise should be reflected on the title page.

Filling out the form is done on a computer or with a black or blue pen.

After reflecting the specified data, information on receivables is entered into the act form.

The reverse side of the document form is intended to reflect information on relationships with creditors.

The data included in the act of inventory of settlements with buyers, sellers, debtors and creditors is certified by members of the commission.

The basis for drawing up the initial form is a certificate, which is an appendix to form No. INV-17, without which the inventory act cannot be considered issued in accordance with Russian legislation.

Information in the specified application is entered in accordance with the data of the synthetic accounting accounts of the enterprise.

filling out the INV-17 form and its attachments

Help for INV-17

The State Statistics Committee of the Russian Federation, in Resolution No. 88 dated August 18, 1998, indicated the use of act No. INV-17 for proper registration of inventory results:

- accounts payable and receivable;

- settlements with buyers and sellers;

- other obligations.

The specified form is filled out in two copies. After they are signed by all members of the commission:

- one of the acts remains with the inspection workers;

- the second form is transferred to the accounting department of the enterprise.

The basis for drawing up the act is a certificate for INV-17, the attachment of which to the form is a necessary condition for the correct registration of the results of the inventory of receivables and payables.

When filling out this certificate, you should indicate:

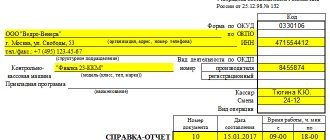

- name of the enterprise and its structural division;

- details of the act to which it is attached;

- date of debt reconciliation with creditors and debtors;

- Fill out the table according to the column names.

The accuracy of the information is confirmed by the signature of the accountant who compiled the corresponding application.

Correctly filling out this certificate on a computer or by hand (using blue or black ink) is a prerequisite for the proper verification and registration of inventory results. Ignoring this document will inevitably lead to the invalidity of the reconciliation of accounts payable and receivable with the accounting data of the enterprise.

sample of filling out a certificate for form INV-17

Purpose of the INV-17 form

Before preparing financial statements, organizations need to take an inventory of their assets and liabilities. This facilitates not only the correct completion of the balance sheet, but also the timely identification of inconsistencies between accounting data and information available to counterparties.

To learn about what accounting data needs to be inventoried before starting to compile annual reporting, read the material “How to conduct an inventory before annual reporting.”

The need for an inventory also arises in the following cases:

- when changing materially responsible persons;

- theft at an enterprise and other unusual situations;

- liquidation of the organization.

The unified form INV-17 is used to document the results of the inventory of receivables and payables. It was put into effect by Decree of the State Statistics Committee of Russia “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results” dated August 18, 1998 No. 88. But it is not mandatory for use since 2013. It is possible to use a self-developed form of similar content instead. However, the INV-17 form contains fields for filling in all the information that must be reflected in such a form, and therefore continues to be actively used.

Results

To document the results of the inventory of receivables and payables, you can use a self-developed form, or you can use the unified form INV-17. Filling it out is not difficult, as we showed in our article.

In connection with the transition of budgetary institutions in 2005 to a new accounting procedure (Order of the Ministry of Finance of Russia dated August 26, 2004 No. 70n), it is recommended to carry out a number of activities, including an inventory of payments, already in 2004. In this article, methodologists tell how to conduct an inventory of calculations in the “Accounting for Budgetary Organizations” configuration (rev. 4).

In “Accounting for budgetary organizations”, starting with release 7.70.426, it is possible to carry out an inventory of settlements with counterparties and register the inventory results using standardized forms No. INV-17 “Act of inventory of settlements with buyers, suppliers and other debtors and creditors” and certificates ( appendix to form No. INV-17), approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88 “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results.”

To draw up an inventory report of settlements with customers, suppliers and other debtors and creditors and a reference to it using unified forms, the reports “Inventory of settlements with counterparties” and “Reference to the INV-17 form” are used. Reports are called up from the “Reports - Inventory” menu of the main menu of the program.

These reports can also be used to promptly identify receivables (payables) with a view to liquidating them.

Where to download INV-17

The INV-17 form is available for download on our website.

The inventory report in form INV-17 is accompanied by a certificate (appendix to form INV-17), detailing (by counterparties) the data on existing debt and reflecting information on the availability of documents confirming its amount. In the INV-17 form itself, if there is a significant number of counterparties, consolidated total data on accounting accounts can be entered without breakdown by counterparties. And if there are few counterparties, then INV-17 may also contain their names.

A sample of filling out an act in form INV-17 is available for download on our website.

How is debt inventory carried out?

The beginning of the inventory process is preceded by the presentation of reconciliation reports to counterparties, and these documents serve as the main (although not the only) source of data for conducting a debt inventory. Then management issues an order and appoints an inventory commission. This body, based on documentary checks, must verify the accuracy of the following information:

- settlements with suppliers and customers;

- settlements with regulatory authorities, including the Federal Tax Service, Social Insurance Fund;

- calculations for wages;

- settlements with accountants;

- other calculations of the organization.

The INV-17 form report reflects data confirmed and unconfirmed by counterparties, as well as amounts with an expired statute of limitations.

The purpose of the inventory is to identify possible inconsistencies and confirm the accuracy of accounting information. The latter is one of the most important conditions for the preparation of reliable accounting reports.

About the deadlines established for submitting the main form of accounting to the Federal Tax Service, read the article “When is the balance sheet submitted (deadlines, nuances)?”

Example

The INV-17 form consists of two parts, each of which is filled out when conducting an inventory of debts with suppliers and counterparties: the front part of the form and the back.

The first page of the act contains basic information about the enterprise, as well as the date, time and basis for the reconciliation; in addition, it is necessary to indicate the number of the act and the date of its preparation. In order for the form to be considered legal, the title page must indicate the company's activity code.

You can fill out the form by hand or with a pen with blue or black ink. After this, information about accounts receivable is recorded on the front side of the form, and data on relationships with creditors is recorded on the back side.

The data in the INV-17 act is entered by members of the inventory commission, which is appointed by order of the director of the company. Those responsible for carrying out the inventory enter into INV-17 information about the balances of accounts that record the relationship between suppliers and consumers (suppliers, buyers and other counterparties).

All members of the commission sign the form of the completed act, after which one copy is necessarily transferred to the accounting department, where the correctness of filling out the data in the INV-17 form will be checked.

After filling out the inventory report form, it must be stored in the archive for at least 5 years. Since INV-17 has not been mandatory for 4 years, filling it out for the first time may be fraught with certain difficulties.

As a rule, an inventory of payments by suppliers and counterparties is carried out so that the organization can have an idea of who owes it and how much, as well as to whom and what amount it owes, and after that it can develop measures aimed at both repaying its own loans and and for collection of accounts receivable.

There can be a variety of ways to do this: a peaceful settlement, going to court, or transferring the debt to a collection agency. But there are also cases when debt collection is impossible, that is, bad receivables are formed.

Accounts receivable become uncollectible when a business realizes that there is no likelihood of collection from the debtor. Accounts receivable may arise under the following circumstances:

- the borrower has not repaid the loan issued to him by the organization and does not take any action to repay it;

- a company employee misused funds that were given to him on account for the needs of the enterprise;

- the supplier received an advance, but the products were not shipped;

- the buyer did not pay for the goods that he received, the work performed by the supplier or the services previously provided.

Accounts receivable are subject to write-off under the following circumstances:

- expiration of the debt limitation period;

- impossibility of collecting a debt due to the fact that the statute of limitations has passed or the company has been liquidated.

Help supplement to the unified form INV-17: sample filling

The certificate attached to the INV-17 form is the basis for preparing an inventory act, which is drawn up using the normatively regulated INV-17 form. This inventory act is used to reflect data on the company’s mutual settlements with buyers, sellers, and other partners falling into the category of debtors or creditors. The certificate form is a sample regulated by the State Statistics Committee (Resolution No. 88 dated August 18, 1998). In the article we will tell you about the application to the INV-17 form and provide a sample for filling it out.

Report “Inventory of settlements with counterparties”

The report is intended for:

- reflection as of a given date of receivables (payables) in accounts accounting for settlements with counterparties;

- tracking obligations under the contract.

The report can be generated either according to the unified form INV-17 “Act of Inventory of Settlements with Buyers, Suppliers and Other Debtors and Creditors”, or in a free form.

The report “Inventory of settlements with counterparties” should be generated using the unified form INV-17 to document the results of the inventory of settlements. To quickly identify debt, you should generate a report “Inventory of settlements with counterparties” in a free form.

What is the application to form INV-17 used for?

In accordance with the requirements of the legislative framework governing accounting, the enterprise is obliged to organize and conduct internal audit activities related to the need to compare the actual position of assets with similar data displayed through accounting statements. Order of the Ministry of Finance No. 49, issued on June 12, 1995, regulated the obligation to carry out an inventory of not only the property complex, but also the financial obligations of the organization, in particular mutual settlements with various debtors and creditors of the company.

In the process of inventorying mutual settlements, an appendix to the INV-17 act is filled out, which shows information about existing accounts payable or receivable with disclosure of information about the source of its formation. Based on the data in the application certificate, an inventory report for settlements with debtors and creditors INV-17 is filled out.

Uncollectible accounts receivable

Accounts receivable may arise under the following circumstances:

- the borrower did not repay the loan that the organization issued to him;

- the company employee did not report on the amounts he received for reporting;

- the supplier has already received an advance payment, but has shipped the products to the buyer;

- the buyer did not pay for the goods supplied to him, services provided or work performed.

Accounts receivable in accounting must be written off in the following cases:

- after the statute of limitations has expired;

- in other cases when the debt becomes impossible to collect, for example, upon liquidation of the company.

Who fills out the application to INV-17

When filling out the document form, you should pay attention to the reliability of the information recorded in it. Entering data in the appendix to the INV-17 act is assigned to the accountant of the enterprise in which inventory activities are planned for implementation. You can fill out the certificate in one of the following ways:

- handwritten text using strictly blue or black ink;

- using electronic printing means to publish the text of documents.

If the certificate is prepared correctly, the process of subsequent registration of the results of audit activities in the inventory report INV-17 will be completed correctly.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

How to fill out the attachment to form INV-17

The structure of the document is constructed in such a way as to display the main points that ensure the functionality of the certificate and its ability to act as the basis for the preparation of the INV-17 act. The form includes a title part, a tabular part and a place for the signature of the responsible person.

The upper part of the application form implies the location of information regarding the full name of the business entity within which the need for the work of the inventory commission was initiated in terms of the control check of settlements with counterparties. Next, the structural unit of the enterprise where the implementation of the monitoring mission will take place must be specified. It is possible to leave the field blank and not indicate the structural unit.

The central field of the form contains the name of the document itself. The name is followed by the designation of the details of the act, the affiliation to which is included in the certificate in question (the date of preparation of the corresponding INV-17 act and its registration number are recorded). The purpose of the certificate, the effect of which is addressed to the above monitoring act, is also deciphered here.

Below is the date as of which this document was compiled. As a rule, an inventory is carried out without fail at the end of the year before filling out the annual accounting documentation, and also as necessary during the year.

Generating inventory results in any form

To quickly track debt and generate a custom form, you must uncheck the “Use the unified form INV-17” (Fig. 4).

Rice. 4. Free form details

In this case, on the “Parameters” tab, in addition to the date as of which the debt should be reflected, you can set the following parameters:

- The “Debt Type” detail indicates the type of debt of the counterparties that should be reflected in the report:

- accounts receivable and accounts payable;

- accounts receivable;

- creditor.

- In the “Counterparty” detail, you can specify a specific counterparty for which the debt reflected in the report will be selected. The report can also be generated for all counterparties.

- In the “Accounts for which inventory is carried out” window, a list of accounts for which inventory should be carried out is specified. The list contains subaccounts of settlements for which accounting is kept under the subaccount “Counterparties”. In order for a subaccount to participate in report generation, it must be marked in the list of accounts.

- In the “Options for possible information groupings” window, the order and types of data grouping in the report are specified. The following types of grouping are possible:

- "Account"

- "Counterparty".

Changing the grouping order is done using the arrow buttons.

To generate a report, click the “Generate” button (Fig. 5).

Rice. 5. Generating a free-form report

The report “Inventory of settlements with counterparties” displays the following information: in the “Counterparty” column - the name of the counterparty indicated in the counterparty card; in the column “Agreement” - the name and expiration date of the agreement specified in the subordinate directory “Grounds”; in the “Account” column - an accounting sub-account for which, as of the date the report is generated, there is a debt under the counterparty (agreement); in the columns “Accounts receivable”, “Accounts payable” - receivables and payables, respectively. The amounts of receivables (payables) for counterparties are given for each basis of calculation - in the context of elements of the subordinate directory “Bases” for which there is a debit (credit) balance as of the reporting date.

When specifying grouping by accounts, the data in the report is grouped by subaccounts with summing up for each subaccount.

When specifying a grouping by counterparties, the data in the report is grouped by counterparties, indicating the full name of the counterparty, and summing up the results for each counterparty.

In the report lines, it is possible to detail the data: when deciphering the columns “Counterparty”, “Agreement”, “Account”, elements of the directories are opened for viewing; When deciphering the columns “Accounts receivable” and “Accounts payable”, the “Account balance sheet” report is generated with the possibility of further detailing the data.

We also recommend using this report to identify accounting errors. For example, when grouping “by counterparties”, it is possible to identify for the same counterparty the same amounts of receivables and payables for different calculation bases or subaccounts. This indicates possible errors in entering information into the system or incorrect use of the subconto, for example, when entering transactions for debiting funds, one basis of calculation is indicated (Invoice, Agreement), and when posting goods, works, services, another (Invoice, Invoice). This error is illustrated in Figure 6.

Rice. 6. Identifying accounting errors using a free-form report.

If such errors are detected, corrections should be made to the information base. Corrections are made according to the general rules:

- if for the period in which the error was discovered, reporting has not yet been submitted, corrections are made to the documents that recorded settlements with the counterparty;

- if for the period in which the error was discovered, reporting has already been submitted, corrective entries are entered.

Filling out the tabular part of the application form

The main part of the help is presented in a table with nine columns:

| Column number | Explanations for filling out the column |

| 1 | Line numbering is sequential, starting from one. |

| 2 | The full correct name of the third party organization acting as a debtor or creditor (the column is supplemented by the requirement to record the contact number and registration address of each of the partners acting in the role designated in one of the above categories). |

| 3 | The reason that caused the debt to arise (for example, for the provision of a specific list of services or the sale of commercial products). |

| 4 | The date from which the debt factor began to exist. |

| 5 | Decoding of the amounts of accumulated debt of debtors, expressed in monetary terms. |

| 6 | Monetary debt relating to obligations to creditors. |

| 7-9 | A type of document that regulates the existence of debt for each partnership. For each reflected debt, documentary evidence must be provided, indicating the following details:

|

The process of issuing a certificate is completed by indicating the personal signature of an employee of the accounting department of the enterprise with certain powers, with the presence of a decoding of the position and initials.

Features of preparing an application for form INV-17

The tabular form of this certificate provides for the display of general information related to the criteria and circumstances of the occurrence of debt facts for each of the partnership entities separately. This nature of the reflection of information is also contained in the designation of supporting documentation (column No. 7).

It is possible to ensure that reliable information is included in the certificate if there is appropriate primary documentation confirming the specific nature of the debt (creditor or debtor).

Errors in filling out the application to form INV-17

In order to eliminate as much as possible the possibility of making an error when preparing a certificate for the INV-17 act, you should carefully check the primary documentation and correctly rewrite the debt amounts. You only need to enter reliable, documented information. It is not permissible to enter information about debt if there are no documents that can confirm its existence.

To enter the debt amount in the appendix to the INV-17 form, you must have a primary document.

The person responsible for filling out the certificate is an accountant who is entrusted with the functions of implementing and monitoring mutual settlements with counterparties. By signing the form, the accountant confirms that he has indicated all the data correctly, and there is documentary evidence for each amount.

Help and Application

In addition to the act itself, when reconciling settlements with suppliers and counterparties, a certificate is attached, on the basis of which the INV-17 act is subsequently drawn up.

In turn, the basis for drawing up the certificate is the data from the financial statements, which must contain all information about the debt and the amount.

After this, the debt is divided into three groups: confirmed by the debtor, unconfirmed by the debtor and expired debt. After filling out the certificate, the received accounting data is detailed in the INV-17 form.

However, there are no special legal requirements for filling out the INV-17 certificate. Those who are faced with the need to carry out this procedure for the first time will find the instructions for filling out the certificate for the INV-17 act useful.

Column 3 contains information about what the debt was received for. It may indicate a loan, products, services or other reasons for the debt.

Column 4 contains information about the exact date when the debt arose. This column must be filled out especially carefully due to the fact that the statute of limitations is calculated on the basis of this date, and when going to court, it may be impossible to collect the debt from the debtor.

In column 7, you must write down a document that confirms the existence of the debt. As such a document you can use:

- waybill;

- act on the provision of services or performance of work;

- an agreement that specifies the deadline for the counterparty to fulfill its obligations under the agreement;

- the amount of debt for the reporting period.

If situations arise where the statute of limitations had to be interrupted because a reconciliation act was being generated, it is necessary to indicate the reconciliation act as a supporting document and indicate the exact date when it was created.

Column 8 contains information about the date of generation of the document confirming the debt.

Documents for download (free)

- Form No. INV-17

- Completed form No. INV-17

Inventory report of settlements with buyers, suppliers and other debtors and creditors INV-17.

The unified form No. INV-17 was approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88 Act of Inventory of Settlements with Buyers, Suppliers and Other Debtors and Creditors (Form No. INV-17) - used to formalize the results of the inventory of settlements with buyers, suppliers and other debtors and creditors. The act is drawn up in two copies and signed by the responsible persons of the inventory commission based on the identification of balances of amounts listed in the relevant accounts from the documents. One copy of the act is transferred to the accounting department, the second remains with the commission. For the specified types of debt, a certificate must be attached to the settlement inventory report (appendix to form N INV-17), which is the basis for drawing up an Act in form N INV-17. The certificate is compiled in the context of synthetic accounting accounts.

form form INV-17 in Word and Excel format:

Download the certificate attached to form No. INV-17 Download other forms on our website:

| Power of attorney for a car | Summary | Help 2-NDFL | Hotel form |

| Advance report JSC-1 | Invoice Torg-12 | Sales receipt | Invoice |

| Receipt cash order KO-1 | Travel certificate | Expense cash order KO-2 | Invoice |

Didn't find what you wanted - use the site map

Drawing up statements of reconciliation of calculations

The debt identified during the inventory of settlements with buyers, suppliers and other debtors and creditors must be confirmed by the relevant counterparty. For this purpose, settlement reconciliation acts are drawn up and certified.

“Accounting for budgetary organizations” provides for obtaining information on the status of mutual settlements with counterparties and for monitoring the completeness of the reflection of settlements in the program information base. Such information can be obtained from the report “Act of reconciliation of mutual settlements”.

The report can be called for generation from the “Settlements with counterparties” group of the “Reports” menu of the main menu of the program. The report can also be generated from the “Third Party Services” journal. In the journal, a report is generated for the counterparty selected in the current document for the quarter of the document date.

In the form for requesting report output parameters, you must specify the period for which you want to receive the report; specify the accounts for which the report should be generated. The “Accounts” window contains a list of accounts that reflect settlements with counterparties. In the field to the left of the account number you can set whether to analyze the account data (the checkbox is checked) or not (empty field). Using special buttons, you can mark all accounts at once or remove all marks at once, as well as remove marks and set them for unmarked accounts (Fig. 9).

Rice. 9. Setting up parameters for generating a reconciliation report.

The report can be generated for all counterparties, for one counterparty, or for a group of counterparties. The selection of counterparties for whom you want to receive a report is made on the “Counterparties” tab. When you click the selection button to the left of the “List of Contractors” window, the “Counterparties” directory opens for multiple selection of values. It should indicate the counterparties for whom the report should be generated. Marking (unchecking) is done by double-clicking the left mouse button on the desired element. Selected elements are marked in the “Check” column. To cancel further selection, click the “OK” button or close the directory window with the standard close window button.

The list can be changed using the buttons “…”, “X”, “XX” to the right of the field with the list of contractors (the “Counterparties” tab).

When you click the “Generate” button, separate acts are generated for each counterparty.

If the report is generated without selecting counterparties, then acts are generated only for those counterparties from the general list with whom settlements were not completed at the beginning of a given period or were made during the reporting period.

The generated report opens in the form of a spreadsheet document (Fig. 10), which can then be printed. The report provides data on the status of mutual settlements with selected counterparties for a given period: the balance of settlements at the start and end dates of the period, as well as all transactions in chronological order for a given period.

Rice. 10

In the “Operation” column, you can decipher the report data by opening the document (operation) that generated the transactions.

Please note that this report is intended for the technical needs of an accountant only. Based on its data, it is possible to draw up an act that has legal force.

In order for the act to have legal force, it must list the names and details of contracts, details of payment documents. Its content must be determined by the terms of the contract. It must be signed by authorized representatives of the organization.

Such an act can be drawn up using the external processing “Act of reconciliation of mutual settlements”, which is located on the ITS disk in the section “Additional reports and processing - For the “Accounting for budget organizations” configuration. It also provides detailed instructions on how to use this treatment.

To use processing, you need to copy the AktSverB.ert and AktSverB.efd files from the ITS disk to the ExtForms folder of the infobase. You can access this processing from the “Tools - Additional Features” menu.