Analysis of the situation step by step:

- Step 1. Prepare your application and required documents

- Step 2. Submit documents to the tax authority

- Step 3. Wait for the result of reviewing the application and documents

The need to obtain a certificate in the form of KND 1160077 (hereinafter referred to as the certificate) arises when terminating contracts of voluntary life insurance, voluntary pension insurance, non-state pension provision and the return (payment) of a monetary (redemption) amount to an individual. The exception is cases of termination of contracts for reasons beyond the will of the parties, as well as in relation to a non-state pension agreement - its termination due to the transfer of a monetary (redemption) amount to another NPF.

When returning (paying) the specified amount, the insurance organization or non-state pension fund must withhold personal income tax. At the same time, for the purpose of calculating tax, they will reduce the payment due to you by the amount of contributions you made under these agreements, if you did not take advantage of the social tax deduction for these contributions, which must be confirmed by a certificate issued by the tax authority at your place of residence. That is, on the basis of this certificate, it is possible to pay personal income tax in a smaller amount (clauses 2, 4 clause 1 of Article 213, clause 2 of Article 213.1, clause 4 of clause 1 of Article 219 of the Tax Code of the Russian Federation).

The stated rules also apply when changing the validity period of a non-state pension agreement. Therefore, what is said below also applies to such cases (clause 2 of article 213.1 of the Tax Code of the Russian Federation).

Categories of contracts, upon termination of which a certificate is required

Reducing the monetary (redemption) amount by the amount of contributions under contracts of voluntary life insurance, voluntary pension insurance, non-state pension provision on the basis of a certificate is possible subject to the following conditions (clauses 2, 4, clause 1 of Article 213, clause 2 of Article 213.1, paragraph 4, paragraph 1, article 219 of the Tax Code of the Russian Federation; paragraph “b”, paragraph 9, article 2, paragraph “a”, paragraph 12, article 2, part 1, article 4 of the Law of November 29, 2014 N 382- Federal Law; clause “a” clause 4, clause 5, clause “a” clause 10 article 1, part 1, 5 article 4 of the Law of July 24, 2007 N 216-FZ; Letter of the Ministry of Finance of Russia dated June 25 .2015 N 03-04-07/36707):

a) a voluntary life insurance contract must be concluded by an individual for a period of at least five years in his own favor and (or) in favor of his spouse, parents (adoptive parents), children (including adopted children under guardianship or trusteeship). In this case, insurance premiums paid under such contracts starting from 01/01/2015 are accepted for deduction;

b) a voluntary pension insurance agreement must be concluded by an individual in his own favor and (or) in favor of his spouse, parents (adoptive parents), disabled children (including adopted children or those under guardianship (trusteeship)). In this case, insurance premiums paid under such contracts starting from 01/01/2008 are accepted for deduction;

c) a non-state pension agreement must be concluded by an individual with a licensed Russian NPF in his own favor and (or) in favor of his spouse, parents (adoptive parents), children (including adopted children), grandparents, grandchildren, brothers and sisters, and also disabled children under guardianship (trusteeship). In this case, insurance premiums paid under such contracts starting from 01/01/2008 are accepted for deduction.

Procedure for obtaining a certificate

To get help, we recommend following the following algorithm.

What is a certificate in the KND form 1160077

This is a document confirming the fact that the taxpayer did not receive a tax deduction. The full name of the certificate is in the sample below.

This form of certificate has been ratified by orders of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 07/13/2016. You can read the order and download the form on the consultant’s website: https://www.consultant.ru/document/cons_doc_LAW_202843/9be78cf9c1b0221a71000deef128e58f1ad32778/

The abbreviation “KND”, according to the code compliance directory, means “tax documentation classifier”.

The document is prepared within 30 days.

In what cases is it necessary

Changes have been made to the Tax Code of Russia regarding voluntary insurance. If a number of conditions are met, the taxpayer can return 13% of insurance premiums (social tax deduction for personal income tax).

In case of early termination of the contract, the insurer is obliged to withhold a tax deduction from the citizen. The certificate allows you to reduce the amount of the deduction.

The document will be required if the following contracts are terminated:

- voluntary pension insurance

- non-state provision of pensions

- voluntary life insurance

Concluded on yourself, your spouse, parents or children with disabilities (natural and adopted).

Step-by-step instructions for registration

The procedure for issuing a certificate is clearly stated in the appendix to the letter of the Federal Tax Service No. ШС-6-3 / [email protected] dated 05/19/2008. The application consists of 5 sections, which describe:

- procedure for receiving and registering documents

- procedure for consideration of the issue by tax officials

- registration of results

Let's consider a step-by-step algorithm of actions.

Step 1

Collect documents. The required documentation is indicated in the letter (section 2):

- copy of the passport

- copy of the contract (insurance policy)

- payment receipts for payment of contributions under the agreement

If insurance was taken out for a relative, then additional documents (copies of passport or birth certificate) must be submitted. And also confirmation of relationship with him.

Step 2

To write an application. The following information is indicated (as stated there):

- contract details

- tax agent details (to whom the certificate will be provided)

- whether a tax deduction was provided or not

- list of attached documents

A sample application is provided below.

This application must be filled out independently or with the help of a tax authority employee.

Step 3

Submit documents to the tax authority. According to clause 2.2, section 2 of the Federal Tax Service letter, this can be done:

- visiting the tax office in person

- transfer a package of documents through an authorized representative

- send documentation by registered mail

The Federal Tax Service office must be located at your place of residence.

If all documents are presented personally by the citizen or through a representative, then the registration of the application is dated no later than the next day. In the case of mail, the date of receipt of the letter.

Step 4

Wait for the results. The review period is 1 month. If, in the process of studying the submitted documents, an employee identifies inaccuracies, the citizen will be informed in writing. Having received a refusal to issue the certificate itself. This is stated in section 4, clause 4.3 of the letter from the Federal Tax Service.

A positive outcome will be the taxpayer receiving a certificate by registered mail (clause 4.4, section 4).

The letter and all recommendations can be found on the consultant’s website: https://www.consultant.ru/document/cons_doc_LAW_77470/

Possible difficulties

On social forums, Russians complain about some difficulties in obtaining and obtaining a certificate.

One of the difficulties is a personal visit to the Federal Tax Service and possible queues

All difficulties can be summarized into two large groups:

- filling out an application yourself. Since not all citizens can get an appointment with the tax authority

- turn to the Federal Tax Service specialist. Since it is not possible to make an appointment using the State Services portal

A solution to these difficulties would be to add to the services of the state reference website an additional option for obtaining KND certificate 1160077.

So, according to the letter of the Federal Tax Service No. ShS-6-3/ [email protected] , obtaining a certificate through State Services is not provided. This is only possible in person, by mail, or through a representative with a power of attorney.

How to obtain a certificate (knd 1160077) of social tax deduction?

The need to obtain a certificate in the form of KND 1160077 (hereinafter referred to as the certificate) arises when terminating contracts of voluntary life insurance, voluntary pension insurance, non-state pension provision and the return (payment) of a monetary (redemption) amount to an individual. The exception is cases of termination of contracts for reasons beyond the will of the parties, as well as in relation to a non-state pension agreement - its termination due to the transfer of a monetary (redemption) amount to another NPF.

When returning (paying) the specified amount, the insurance organization or non-state pension fund must withhold personal income tax. At the same time, for the purpose of calculating tax, they will reduce the payment due to you by the amount of contributions you made under these agreements, if you did not take advantage of the social tax deduction for these contributions, which must be confirmed by a certificate issued by the tax authority at your place of residence. That is, on the basis of this certificate, it is possible to pay personal income tax in a smaller amount (clauses 2, 4 clause 1 of Article 213, clause 2 of Article 213.1, clause 4 of clause 1 of Article 219 of the Tax Code of the Russian Federation).

The stated rules also apply when changing the validity period of a non-state pension agreement. Therefore, what is said below also applies to such cases (clause 2 of article 213.1 of the Tax Code of the Russian Federation).

Categories of contracts, upon termination of which a certificate is required

Reducing the monetary (redemption) amount by the amount of contributions under contracts of voluntary life insurance, voluntary pension insurance, non-state pension provision on the basis of a certificate is possible subject to the following conditions (clauses 2, 4, clause 1 of Article 213, clause 2 of Article 213.1, paragraph 4, paragraph 1, article 219 of the Tax Code of the Russian Federation; paragraph “b”, paragraph 9, article 2, paragraph “a”, paragraph 12, article 2, part 1, article 4 of the Law of November 29, 2014 N 382- Federal Law; clause “a” clause 4, clause 5, clause “a” clause 10 article 1, part 1, 5 article 4 of the Law of July 24, 2007 N 216-FZ; Letter of the Ministry of Finance of Russia dated June 25 .2015 N 03-04-07/36707):

a) a voluntary life insurance contract must be concluded by an individual for a period of at least five years in his own favor and (or) in favor of his spouse, parents (adoptive parents), children (including adopted children under guardianship or trusteeship). In this case, insurance premiums paid under such contracts starting from 01/01/2015 are accepted for deduction;

b) a voluntary pension insurance agreement must be concluded by an individual in his own favor and (or) in favor of his spouse, parents (adoptive parents), disabled children (including adopted children or those under guardianship (trusteeship)). In this case, insurance premiums paid under such contracts starting from 01/01/2008 are accepted for deduction;

c) a non-state pension agreement must be concluded by an individual with a licensed Russian NPF in his own favor and (or) in favor of his spouse, parents (adoptive parents), children (including adopted children), grandparents, grandchildren, brothers and sisters, and also disabled children under guardianship (trusteeship). In this case, insurance premiums paid under such contracts starting from 01/01/2008 are accepted for deduction.

Procedure for obtaining a certificate

To get help, we recommend following the following algorithm.

Step 1. Prepare your application and required documents

To obtain a certificate, you need to prepare an application for its issuance. You will also need the following documents (clause 4, clause 1, article 219 of the Tax Code of the Russian Federation; clause 2.1 of the Recommendations to the Letter of the Federal Tax Service of Russia dated May 19, 2008 N ShS-6-3 / [email protected] ):

- a copy of the agreement (insurance policy) with an insurance organization or non-state pension fund;

- copies of payment documents confirming your payment of contributions under the relevant agreements (in particular, payment orders, receipts for cash receipts, bank statements);

- copies of documents confirming the degree of your relationship with the person for whom you made contributions (marriage certificates, birth certificates (adoption documents) of a child, etc.).

Step 2. Submit documents to the tax authority

You can submit an application and supporting documents to the tax authority at your place of residence (clause 2 of article 11.2 of the Tax Code of the Russian Federation; clause 2.2 of the Recommendations; clause 5 of the List to the Order of the Federal Tax Service of Russia dated March 17, 2017 N CA-7-6 / [email protected ] ):

- personally or through your representative directly to the inspectorate;

- by mail. It is advisable to send documents by registered mail with acknowledgment of receipt and an inventory of the contents in order to have confirmation of their receipt by the tax authority;

- in electronic form, in particular through your personal account on the website of the Federal Tax Service of Russia. In this case, scanned images of the required documents must be attached to the electronic application.

Step 3. Wait for the result of reviewing the application and documents

If, when considering your application and documents, the tax authority determines that you did not indicate the necessary information or did not submit the necessary documents, or you do not have the right to receive a social tax deduction, they will refuse to issue you a certificate and will notify you about this in writing (clause 4.3 recommendations).

If the review of your documents is positive, you will receive a certificate that should be presented to the insurance organization or non-state pension fund when contacting them in the event of termination of the relevant contracts.

Related situations

How to get a social deduction for personal income tax for voluntary life insurance? Find out →

How to take advantage of the social tax deduction for contributions to non-state pension provision and additional contributions to a funded pension? Find out →

Useful information on the issue

Official website of the Federal Tax Service - www.nalog.ru

A certificate in the form of KND 1160077 is a document confirming the fact that a citizen has received or not received a social tax deduction in the amount of paid pension (insurance) contributions under a non-state pension provision (voluntary pension insurance) agreement with a non-state pension fund (insurance organization).

You can obtain this certificate from the tax office after submitting an application and submitting the necessary documents.

You will find more information about obtaining a certificate in the KND form 1160077 in the article.

Highlights

Information for an application for a certificate of social deductions is provided in the manner prescribed by law. It is important to know the main points of the procedure that the taxpayer goes through.

Legitimate references

The rules for providing a certificate of non-receipt or receipt of a tax deduction are reflected in subparagraph 4 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation. According to the norm, citizens who have made contributions to a non-state pension fund can receive a deduction. Paid personal income tax can be returned to the tax authorities upon submission of an application.

Article 219. Social tax deductions

When determining the amount, all actual expenses of the taxpayer are taken into account. Each of the contracts is taken into account.

Taxpayers who contact the tax office at their place of residence can receive a deduction. You can confirm your right with certain documents. You must apply at the end of the tax period.

Pension funds must calculate the basis according to which the tax deduction for the payer is determined for the early termination of the agreement. In this case, the citizen may be issued a certificate of non-receipt of a social tax deduction, which is transferred to the tax agent.

The Federal Tax Service has developed recommendations for issuing such documents. The certificate form was also approved. As justification, there is Order of the Federal Tax Service No. MM-3-04/, issued on January 1, 2001.

Order of the Federal Tax Service No. MM-3-04

To issue a certificate, the taxpayer provides the inspectorate with:

- statement;

- copies of agreements with a non-state pension fund;

- payment documents.

The details of the agreements and the data of the tax agent who will be the recipient of the documents must be reflected. The complete package is provided in person by the taxpayer or by mail. An authorized person can also transfer documents if there is an official permit.

Standard provisions

A tax deduction refers to a certain amount by which a person’s contributions can be reduced. It is determined from the taxpayer’s income, including wages. Refunds are made legally.

There are two ways to receive a deduction. In the first case, the taxpayer submits documents directly to the tax service. This option is used by citizens when a large sum of money is being reimbursed. But the verification will take three months.

The second option is faster. Payments are made by the employer based on the employee’s application. Refunds are made monthly and in smaller amounts. But the option has one important advantage: the taxpayer does not have to worry about inflation, since the funds will be returned immediately.

These two methods do not apply to all types of deductions. Tax legislation provides for the right to a refund in various areas. The most popular is the social deduction, which can only be provided at the end of the tax period by contacting the tax service.

Social deductions are provided when a citizen has spent certain funds on:

- treatment;

- education;

- pension contributions to non-state pension funds;

- charity.

You can only receive them at the end of the year in which the payment was made. The appeal is not difficult. It is only important to provide the tax office with documents, the list of which is approved by law. Most often, taxpayers need to fill out a 3-NDFL (declaration) and attach receipts for expenses incurred.

Form 3-NDFL for 2021

What is KND certificate 1160077 and why is it needed?

The full name of the mentioned certificate is: “Certificate confirming that the taxpayer has not received a social tax deduction or confirming that the taxpayer has received the amount of the provided social tax deduction provided for by subparagraph 4 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation for ____ year.”

The abbreviation KND stands for “classifier of tax documentation.”

The need to obtain a certificate in the KND form 1160077 may arise when terminating certain types of certain contracts and returning a sum of money to the citizen. Such agreements include the following agreements:

- voluntary life insurance;

- voluntary pension insurance;

- non-state pension provision.

However, in cases of termination of these contracts for reasons beyond the control of the parties, no refund is made.

A citizen can conclude such agreements both in his own favor and in favor of his spouse (widow, widower), parents (adoptive parents) and disabled children (including adopted children and wards).

When returning the contract amount to a citizen, the insurance organization or non-state pension fund must withhold personal income tax. At the same time, for the purpose of calculating income tax, these organizations reduce the amount of the agreement due to the citizen by the amount of contributions made by him under these agreements, but only on the condition that the citizen has not previously taken advantage of a social tax deduction in relation to these contributions. But the fact that a citizen took advantage (or did not take advantage) of a tax deduction must be confirmed by a certificate issued by the tax office at the citizen’s place of residence. This certificate is a certificate in the form of KND 1160077.

Based on this certificate, a citizen will be able to pay income tax in a smaller amount.

Let us consider in more detail the conditions under which it is possible to reduce the amounts paid as personal income tax for various types of contracts.

The reduction in tax payment is a consequence of a reduction in the monetary (redemption) amount by the amount of contributions under the agreements listed below, based on KND certificate 1160077, subject to the following conditions:

- for a voluntary life insurance contract: this contract must be concluded by a citizen for a period of at least five years in his own favor and (or) in favor of his spouse, parents, children (including adopted children, those under guardianship or trusteeship). In this case, insurance premiums paid starting from January 1, 2015 are accepted for deduction to reduce personal income tax;

- for a voluntary pension insurance agreement: this agreement must be concluded by a citizen in his own favor and (or) in favor of his spouse, parents, disabled children (including adopted children or those under guardianship or trusteeship). Please note that insurance premiums paid under such contracts starting from January 1, 2008 are accepted for deduction;

- for a non-state pension agreement: such an agreement must be concluded by a citizen with a licensed Russian non-state pension fund (NPF) in his own favor and (or) in favor of his spouse, parents, children (including adopted children), grandparents, grandchildren, brothers and sisters, as well as disabled children under guardianship (trusteeship). Under such an agreement, insurance premiums paid starting from January 1, 2008 can be deducted.

The stated rules also apply when changing the validity period of a non-state pension agreement.

Description

The certificates must bear the seals and signatures of managers.

General information:

- A tax deduction is a deduction from the amount of taxes paid to the account of parents who have one or more children.

- This benefit is provided only to citizens of the Russian Federation who pay 13 percent contributions to the budget.

- Parents, adoptive parents, and guardians have the right to receive a tax deduction. To do this, as well as to obtain guardianship, it is necessary to collect all documents and certificates.

- You can receive the benefit until the month when your income exceeds 280,000 rubles for the year.

- The deduction is provided for each child in the family.

- A double tax deduction is received only if the second parent refused to receive this payment at work. In order to do this, he should write an application addressed to the employer refusing to receive benefits and obtain from him a certificate confirming this fact.

Double tax deduction does not require confirmation if there is only one parent. This applies to widows and single mothers.

How to get a certificate, procedure for receiving it

To obtain a certificate, you must prepare and submit the following documents to the tax office:

- application for the issuance of a certificate form KND 1160077;

- a copy of the agreement (insurance policy) with an insurance organization or non-state pension fund;

- copies of payment documents confirming the payment of contributions under the relevant agreements (in particular, payment orders, receipts for cash receipt orders, bank statements);

- copies of documents confirming the degree of relationship of the citizen with the person for whom he made contributions (marriage certificates, birth certificates of a child, etc.).

Next, the specified documents must be submitted to the tax office at the place of residence in any of the following ways:

- personally to the tax office (or through a representative);

- by registered mail with acknowledgment of delivery and a list of the contents;

- in electronic form, in particular through your personal account on the website of the Federal Tax Service of Russia. In this case, the application and necessary documents (scanned) are sent electronically.

If the review of the application and documents is positive, the tax office will issue a certificate KND 1160077, which the citizen submits to the insurance organization or non-state pension fund at the same time as contacting them upon termination of contracts concluded with them.

If the tax office refuses to issue a certificate, then it notifies the citizen in writing. The refusal may be due to the lack of necessary information, lack of documents, or the citizen’s lack of right to receive a social tax deduction.

Answers to the question

Share a link to a question

Hello, Natalia. You need to contact the tax office with an application. Next, take the certificate to the NPF.

Thank you, Alexey. Where can I get the application form and what will need to be attached to this application? For me, all payments with the tax and pension fund are carried out through the employer.

- application - copy of the agreement (agreements) of voluntary pension insurance (non-state pension provision) - copy of payment documents confirming the payment of contributions under this agreement To the tax office, take the documents to receive a certificate in person / send by mail / take it by an authorized person (acting on your behalf) (clause 2.2 section 2 Letter of the Federal Tax Service of Russia dated May 19, 2008 No. ШС-6-3/368) I don’t have information regarding the delivery of the received certificate to the Pension Fund, please contact the Pension Fund.

To answer, please log in or register.

When terminating which contracts do you need a KND certificate 1160077

A reduction in the monetary (redemption) amount by the amount of contributions under contracts of voluntary pension insurance, voluntary life insurance, non-state pension provision on the basis of a certificate is allowed if certain conditions are met. They are enshrined at the legislative level in:

- Letter of the Ministry of Finance of Russia dated June 25, 2015 No. 03-04-07/36707;

- Part 1 art. 4 of the Law of November 29, 2014 No. 382-FZ;

- pp. “a” clause 4, clause 5, Clause. “a” clause 10 article 1, part 1.5 art. 4 of the Law of July 24, 2007 No. 216-FZ.

- pp. "b" clause 9 of Art. 2, pp. “a” clause 12 art. 2;

- clause 2.4 clause 1 art. 213, paragraph 2 of Art. 213.1, clause 4 clause 1 art. 219 of the Tax Code of the Russian Federation.

The conditions are as follows:

- A voluntary pension insurance agreement must be concluded by an individual in his own favor and (or) in favor of his parents (adoptive parents), spouse, disabled children (this also includes children who have been adopted or are under guardianship (trusteeship)). In this case, insurance premiums that were paid under these agreements, starting from January 1, 2008, are accepted for deduction.

- A voluntary life insurance contract must be concluded with an individual for a period of at least 5 years in their favor and (or) in favor of their parents (adoptive parents), spouse, disabled children (this also includes children who have been adopted or are under guardianship (trusteeship)). In this case, insurance premiums that were paid under these agreements, starting from January 1, 2015, are accepted for deduction.

- A non-state pension agreement must be concluded by an individual with a domestic non-state pension fund that has the appropriate license in its favor and (or) in favor of parents (adoptive parents), spouse, sisters, brothers, grandfathers, grandchildren, grandmothers, children with disabled status who are under guardianship (trusteeship). In this case, insurance premiums that were paid under these agreements, starting from January 1, 2008, are accepted for deduction.

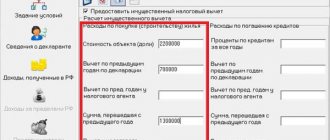

Application for deduction

You can receive a tax deduction (for example, you bought an apartment, for treatment or training, an investment deduction) for personal income tax by submitting a tax return 3-NDFL to the tax office (at your place of registration). What does this procedure look like?

Stage 1. You pay for education or treatment, buy an apartment or deposit money into your individual investment account. For example, this is happening in the current year 2017.

Stage 2. You are waiting for the end of the current year 2021.

Stage 3. In January (or another month) 2021, you collect your documents and, based on them, fill out the 3-NDFL declaration for 2017.

Stage 4. Submit your completed 3-NDFL declaration for 2017.

Stage 5. You receive a deduction .

What do we see? The role of the application for deduction is performed by the 3-NDFL tax return. It is in it that you declare your rights to one or another type of deduction.

There is also a document - an application for issuing a tax notice so that you can be given a tax deduction at work. For example, you bought an apartment in May 2017 and, as the happy owner of square meters, you want to return your personal income tax.

You have the right not to wait for the end of the current year 2021 and return the money now. To be precise, it’s not just “returning the money”, but not paying personal income tax at work.

If you want to do this, then you write to the tax office an application to issue you a tax notice and take the received notice to work.

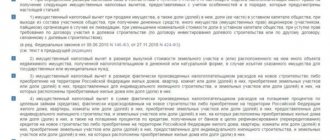

Certificate of non-receipt of tax deduction

And there is another document - a certificate stating that you did not receive a tax deduction . For example, social. How to obtain such a certificate? I would like to draw your attention to the letter of the Federal Tax Service of Russia dated September 1, 2016, “BS-4-11/16272 “On the recommended form of application for the issuance of a certificate.”

The Federal Tax Service, in order to ensure uniformity in the implementation by tax authorities of the provisions of sub-clause. 2, 4 p. 1 art. 213 and paragraph 2 of Art. 213. 1 of the Tax Code of the Russian Federation sends for use in work the recommended form of application for the issuance of a Certificate confirming that the taxpayer has not received a social tax deduction or confirming the fact that the taxpayer has received the amount of the provided social tax deduction provided for in subparagraph. 4 paragraphs 1 art. 219 of the Tax Code of the Russian Federation.

Source: https://moy-nalog.ru/zajavlenie-na-vychet-ili-spravka-o-tom-cht.html