When financial problems arise in the activities of an enterprise, it is very difficult to find external creditors. Investors do not trust organizations with a negative balance and in most cases refuse to provide a loan. In this case, only the founders themselves can save the company from bankruptcy.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Interest-free loan from the LLC founder

According to legislative standards, a citizen who is the founder of an organization is obliged to replenish its current account with an amount equal to the authorized capital of the LLC within 4 months. Its value is determined by the company’s constituent documentation.

If the activity of a business entity has recently begun, then the funds in the account may be needed for settlement transactions. For example, transferring earnings to employees, fulfilling financial obligations to contractors, paying obligatory payments, purchasing raw materials and equipment, and so on. A business entity may not have enough available money to cover all expenses. In this case, the founder can provide a loan to his company without charging interest.

The founders can deposit the required amount of money into the company's current account. To do this, you will need to draw up an agreement for an interest-free loan and provide it to the employees of the banking organization where the account is opened. There is also the possibility of depositing the required amount into the cash desk of a business entity. In the future, when the financial situation improves, the loan amount can be repaid.

How to register correctly

First of all, you need to correctly draw up the contract, taking into account all the requirements for its preparation:

General requirements for the contract:

- Written form is required;

- The text of the document must include:

- validity periods,

- interest rate or lack thereof,

- amount (loan is issued only in national currency),

- conditions after the occurrence of which the contract begins to take effect (usually this is the receipt of a sum of money to the company’s account),

- in the case of a material or other non-monetary loan - the total cost of materials at prices valid on the day of signing the contract.

- The document must be signed in two copies having equal legal force.

Issuing money at interest is preferable for the founders and causes less suspicion among tax officials.

The interest rate and term are determined individually for each individual case. The legislation does not provide any restrictions in this regard. If the company does not have the required amount to repay the debt at the end of the term, the contract can be extended by agreement of the parties.

Legal basis

The fundamental parameters of the operation of an LLC are determined by the provisions of the country’s civil legislation and the Federal Law of the Russian Federation “On LLC”.

Issues related to the opening and constituent documentation are regulated by federal legislation on state registration of legal entities and individuals.

The rules of civil law define the concept of a loan agreement, the rules for its execution, the powers and obligations of the parties. The rules, goals, and methods of accounting are determined by the Federal Law of the Russian Federation “On Accounting”.

Loan taxes

When determining the amount of tax, a loan without interest is not considered either in income or in expenses. Such a loan is considered a benefit in accordance with Art. 41 tax legislation. A benefit of this nature cannot be considered income according to Art. 25 Tax Code of the Russian Federation.

If the founder does not claim to repay the loan, then it is classified as non-operating income. In this case, income tax will have to be transferred to the state treasury. But if the founder who provided the loan owns more than half of the authorized capital, then you will not have to pay income tax. Such receipt of funds will not be considered income.

Results

A loan from the founder is an operation not prohibited by current legislation. Its provision must be accompanied by the execution of an agreement, a number of conditions of which should be treated with special attention. The interest stipulated by the agreement will be the lender's income and the borrower's expense. With an interest-free loan, there are no tax consequences. A loan forgiven by the lender will become non-operating income of the borrower if the share of the founder in its authorized capital is less than 50%.

Sources: civil code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Loan accounting

Legislative standards require mandatory recording of the movement of funds within a business entity. To do this, the accountant must create the appropriate entries.

Registration of a loan also requires recording in accounting, and it does not matter who the creditor is: the founder or the financial structure. It is necessary to record accounting entries for any loan, both with and without interest.

To fix a loan for a period of up to 1 year, account 66 “Short-term loans” is used. If funds are provided for a period of more than a year, then account 67 “Long-term loan” is used.

If the founder provides money to his company, this will be accompanied by an increase in accounts payable in the legal entity’s liability. Forgiveness or return of funds is accompanied by a decrease in accounts payable by a certain amount.

Depending on the operations carried out, borrowed funds are recorded using the transactions described in Table 1.

| Operation | Dt | CT |

| If borrowed funds are deposited by the founder into the current account of a legal entity | 51 | 66 (or 67) |

| Money can be processed using other transactions | 52 “Currency account” 10 "Materials" 41 "Products" | 66 (or 67) |

| When depositing borrowed money into the organization's cash desk | 50 | 66 (or 67) |

| Subsequently, borrowed funds are transferred from the cash desk to the current account | 51 | 50 |

| When returning borrowed funds | 66, 67 | 50 (51, 52, 10, 41 and so on) |

How to take into account a loan issued from the founder, watch the video:

How to transfer money from the founder to the company

The material was published in the magazine “Practical Accountants” (No. 1, 2003). The magazine is published by the publishing house “Berator-Press”

V. FEDOROV, expert editor

Very often, newly created companies experience certain financial difficulties. This is due to the fact that the company begins to generate income only after some time, and expenses must be incurred today.

As a rule, the founder helps in this situation and transfers the necessary funds to the company’s account. What is the best way to formalize the receipt of this money so as not to pay additional taxes either to the company or to the founder himself? Let's consider the two most effective ways to solve this problem: using a loan agreement and a gift agreement.

Loan agreement

You can “transfer” money from the founder to the company through an interest-free loan agreement. The advantage of this method is that the funds received by the company will not be subject to income tax (Clause 10, Article 251 of the Tax Code of the Russian Federation). However, there is also a small drawback - the tax inspectorate may consider such a loan as a gratuitous service and force the company to pay additional income tax (clause 8 of Article 250 of the Tax Code of the Russian Federation). It is your right to disagree with this interpretation: then the tax inspectorate will have to prove in court that an interest-free loan is a gratuitous service. To date, there is no arbitration practice on this issue. Note: the option of an interest-bearing loan is obviously worse, since in this case the founder will have to pay taxes on income received in the form of interest. Let us remind you that the amounts of loans received, depending on the terms for which they were issued, are recorded in account 66 or 67. The founder of the company can be either an individual or a legal entity. Let's look at each of these cases in more detail. Loan from a founder - an individual As a rule, the founder is interested in helping the company he created. Therefore, it is possible that he will provide a loan even from his own funds. This case is the most optimal from a tax point of view: neither the company nor the founder - an individual will have to pay any additional taxes. Example 1. On January 8, 2003, Aktiv CJSC concluded with Ivanov I.I. interest-free loan agreement:

When money arrives, the Asset accountant must make the following entry:

Debit 50 (51) Credit 66 - 100,000 rubles. – a loan was received from the founder. The accountant will reflect the loan repayment as follows: Debit 66 Credit 50 (51) – 100,000 rubles.

- the loan is returned. If the founder does not have available funds, he can borrow them from some other organization (for example, from a bank). However, this case is extremely disadvantageous for the founder himself. If he takes out a loan with interest, then he will have to pay it. The company to which he transfers these funds does not have the right to include interest costs in the cost price. If the founder manages to take out an interest-free loan or a loan with a rate less than 3/4 of the refinancing rate, then as a result of savings on interest (material benefits), he will be forced to pay 35 percent of personal income tax. Loan from the founder - a legal entity If the share of the founding company in your capital is more than 20 percent, then the tax inspectorate may regard the provision of an interest-free loan as a transaction between related parties (Article 20 of the Tax Code of the Russian Federation). This means that the tax authorities, based on the market rate, can determine the amount of interest that was not accrued at the time and force the founding company to pay an additional amount of income tax (as well as penalties). If the share of the founder in the capital of the borrowing company is less than 20 percent, then you can “transfer” money using an interest-free loan without fear. However, even in this case you need to be careful. Paragraph 2 of Article 20 of the Tax Code of the Russian Federation gives the court the right to recognize persons as interdependent on grounds not provided for by the Tax Code, if the relationship between these persons may affect the results of transactions for the sale of goods (work, services).

Example 2. On January 15, 2003, Aktiv CJSC received a long-term loan from its founder Passive LLC in the amount of 250,000 rubles. On January 15, 2003, the Asset accountant will make the following entry: Debit 51 Credit 67 - 250,000 rubles. – received a long-term loan. An entry will be made in the Liability accounting: Debit 58 Credit 51 – 250,000 rubles. - loan provided.

If the borrowing company cannot return the money received within the prescribed period, then the founder has the right to create a reserve for doubtful debt, thereby reducing the income tax base. The requirements for reserves for doubtful debts are contained in Article 266 of the Tax Code. If the loan is recognized as unrealistic to collect, the debt on it must be written off by the founder as non-operating expenses. However, they will not be taken into account when taxing profits. For the borrowing company, the amounts of the unrepaid loan are written off as non-operating income and are subject to income tax.

Free transfer of money

Another way to “transfer” money from the founder to the company is a gratuitous transfer. Property is considered received free of charge if its recipient is not obliged to transfer any other property or perform work (provide services) in exchange. Please note: gratuitous transfer of property between commercial organizations is prohibited (clause 4 of article 575 of the Civil Code of the Russian Federation). The only exceptions are gifts worth no more than 5 minimum wages (5,000 rubles). Therefore, only an individual can donate funds to a company (we do not consider non-profit organizations in this case). The founder can deposit money both into the current account and into the company's cash desk. Evidence of their receipt will be, respectively, a bank statement or a cash receipt order. If the founder deposited money into the cash register, the accountant should remember that the cash balance in the cash register should not exceed the established limit. Before transferring money, you must draw up a gift agreement.

Example 3. January 20, 2003 Ivanov I.I. transferred 122,800 rubles free of charge to the current account of ZAO Aktiv. A preliminary donation agreement was drawn up:

On January 20, 2003, the Asset accountant must make an entry:

Debit 51 Credit 98-2 – 122,800 rubles.

– received funds free of charge from Ivanov I.I. The gratuitous transfer of money has one advantage: if the authorized capital of the recipient company consists of 50 percent or more of the contribution of the founder who transfers the money gratuitously, then the funds received are not subject to income tax (clause 11 of Article 251 of the Tax Code of the Russian Federation). In all other cases, the recipient company will have to pay income tax. In conclusion, we note that the choice of one or another method of transferring funds depends not only on the amount of taxes paid, but also on a number of other factors (for example, on how trusting the relationship is between the founder and the management of the company). One way or another, the final decision on the choice of transfer method remains with the founder.

Postings of an issued interest-free loan from the founder and to the founder

If the founders of a business entity do not have the opportunity to draw up a loan agreement at a banking institution, you can borrow money from your own company. To do this, one of the founders will need to draw up an agreement for the provision of borrowed funds.

If the other founders at the meeting determined that the lender should make a profit from the funds issued, then its amount may increase monthly.

The decision on the procedure for repaying the debt by one of the founders is determined at the meeting. Borrowed funds can be provided at a certain percentage or without it. In this case, the amount of money received from one of the founders is not income and is not subject to taxation.

To avoid difficulties with the fiscal authority, the loan agreement must include the following provisions:

- provision of borrowed funds without paying interest

- if interest is accrued, then its amount must be reflected

- if a business entity has only 1 founder, then the agreement is drawn up individually

- the currency of the agreement must be the ruble

If a business entity lacks its own funds to develop a business, then one of the solutions is to receive borrowed funds from its founder. This loan has a number of positive aspects:

- no interest, fines or penalties

- the founder's interest in the successful activities of the organization

The founder can deposit the required amount of money to the current account or to the cash desk of the business entity. In the future, the creditor may refuse to demand the return of the loaned funds. But such a clause cannot be indicated in the agreement, since the loan provides for the return of money.

If the funds do not need to be returned, then one of the following procedures must be carried out:

- execution of the corresponding agreement between the lender and the borrower

- the lender can send the recipient of the funds a notice of loan forgiveness

In each document, the lender will need to indicate:

- fact of termination of the borrower's obligations

- details of the parties to the agreement

- details of the agreement itself

- amount of debt and interest accrued on it (if any)

But if the debt is forgiven, then the business entity must transfer a tax to the state treasury, since the amount received will be considered profit. The amount of the fee will depend on the tax regime used by the enterprise.

Obligations to pay tax do not arise if the founder’s share in the authorized capital exceeds half.

Tax implications in 2021

Tax features of interest-free lending:

- Not taxed

- It is not required to indicate in the company’s expense and income statement,

- The founder can forgive the issued debt at any time, while paying income tax.

If a company has entered into an agreement with an individual who owns more than half of all shares of the company, or all 50% or more of the authorized capital, the creditor will be exempt from paying tax (Article 251 of the Tax Code of the Russian Federation).

Tax features of interest lending:

- Income tax taking into account the interest-bearing loan is recalculated downward

- After returning the money to the founder, he will have to pay personal income tax on the amount earned from interest.

- If the founder and employee of the company are the same person, payment of income tax for an individual can be made by deduction from his salary.

- If the owner is not on the company's payroll, he must independently indicate the fact of receiving remuneration in the declaration and pay the appropriate tax.

- If the company has not repaid the debt within three years after the end of the term and has not asked the creditor to extend the contract:

- the debt is automatically written off,

- the loan is equated to income, and therefore the company must pay income tax to the state in full.

- These rules do not apply to open-ended loans repaid at the request of the lender.

From the founder to the employee

An economic entity has the right to issue loans to its employees. To record the transaction, account 73-1 “Settlements on submitted loans” is used. The issuance of funds affects the debit of the account, the return affects the credit. The accumulated interest is taken into account in the same account.

Accounting records each loan issued to employees of the enterprise. The operation is accompanied by the following transactions:

- transfer of money to the worker: Dt 73.1 – Kt 50 (or 51)

- accrual of interest under the agreement: Dt 73.1 – Kt 91.1

In the absence of interest on the loan, as well as if their value is less than 2/3 of the refinancing rate, the borrower generates a profit. In this case, the business entity must transfer personal income tax to the treasury.

Currently, the refinancing rate is equal to the key rate. The value of the latter is 7.75%. Then we get:

7,75 * 2/3 = 5,17

If the accrued interest is less than the result obtained, then personal income tax will need to be transferred to the state. The amount of profit received is subject to taxation.

When providing a cash loan at 4%, the profit received will be:

5,17 – 4 = 1,17%

From the amount of interest received, the accountant should withhold personal income tax at a rate of 35%.

From the founder of another organization

The details of providing borrowed funds from the founder of another business entity must be specified in the loan agreement. It can be provided with or without interest. If there is interest under the terms of the agreement, it must be reflected in financial investments.

The operation is accompanied by the creation of the following transactions:

- issuance of borrowed funds: Dt 58.3 – Kt 51

- accrual of interest for using a loan: Dt 76 – Kt 91.1

- transfer of interest for using the loan is recorded as: Dt 50 – Kt 76

Postings of the received loan from the founder

The situation when the founder provides funds as a loan with interest is recorded by the following entry: Dt 66 (67) – Kt 50 (51).

The percentages are recorded by posting: Dt 91.2 – Kt 66 (67).

Interest is accounted for in the subaccount for accounts 66 (or 67).

If the founder has drawn up a loan agreement to pay the debt of a legal entity, then the following accounting entries are formed: Dt 60 – Kt 66. This procedure does not contradict legal norms, but contributes to the emergence of problems when paying VAT.

If the money lent is not subject to interest, then the entries in the accounting system remain the same. But the absence of interest is necessarily indicated in the agreement for the provision of borrowed funds.

A business entity can pay off existing debt with money or goods produced. In this case, the proceeds from the sale of goods to pay off the debt are recorded: Dt 76 – Kt 91. The sale of goods is accompanied by the accrual of VAT: Dt 90.3 – Kt 68.02. To offset the debt, a posting is created: Dt 66 – Kt 76.

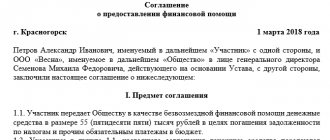

Registration of the contract

If a company needs to raise funds, it turns to its founder.

In this case, the parties must draw up an agreement on the basis of which funds will be transferred between the LLC. The contract must consist of several points:

- subject of the contract;

- obligations of the parties;

- liability of the parties;

- contact details;

- There must be information about the terms of the loan, its amount, and the type of loan (interest-bearing/interest-free).

Next, the parties sign the agreement, and the accountant can safely carry out the posting.

It is important to remember: according to Article 809 of the Civil Code of the Russian Federation, if the contract does not clearly state that the loan is interest-free, then it automatically becomes interest-bearing. This results in the lender having to deal with the tax consequences that will arise if he receives the income.

And in this case, the interest rate will be considered income. If the contract has already been drawn up, a written addition should be made to it, which should include the missing information.

You may be interested in an article about consumer loans. Read this article on how to get an interest-free loan for an employee.

When the return period is due, the company returns the money to its founder's account by making a payment from the LLC, and then writes off accounts payable.

Example of transactions for an interest-free loan

For example, we can consider the case of lending money in the amount of 180 thousand rubles. the sole founder of the company for a period of 9 months at 1.5%.

Postings for an interest-free loan from the founder will have the following form (Table 2).

| Dt | CT | Operation | Transaction amount | Supporting document |

| 51 | 66 | receiving money from the founder | 180,000 rub. | Bank statement |

| 91,1 | 66 (percent) | accrual of interest for the use of borrowed funds | 2,700 rub. | accounting certificate |

| 66 | 51 | funds were returned to the founder | 180,000 rub. | outgoing payment order |

| 66 | 51 | transfer of interest to the founder's account | 2,700 rub. | outgoing payment order |

If funds are lent by a business entity to the founder, then the procedure is formalized with the following entries (Table 3).

| Dt | CT | Operation |

| 76/73 | 50/51 | The borrower must pay personal income tax on the amount received, but due to the lack of interest, the founder will be able to save a certain amount of money. |

| 58/73 | 50/51 | If the terms of the agreement provide for the accrual of interest on the loan. |

| 58/73 | 01/41 and more | If the loan was of a property nature. |

| 76 (or 58, 73) | 91,1 | Calculation of interest on the loan. |

Difference between interest-bearing and interest-free loan

When drawing up an agreement between the company and the founder, an important point is what type of loan is this - interest-bearing or not?

In the first case, the interest rate can be considered your income, therefore, it will be taxed. But again, such a payment can be written off as an expense transaction, since it has certain risks.

If this issue does not concern you at all, then it is easier to draw up an interest-free use agreement. Then the tax consequences will not affect you.

Loan forgiveness: postings

For example, we can consider a situation where the founder in June 2018 loaned his company funds in the amount of 380,000 rubles. Due to financial problems that arose, the lender decided to forgive the debt in January 2021. Such an operation is accompanied by the following accounting entries:

- Upon receipt of funds: Dt 51 – Kt 66. Cash in the amount of 380,000 rubles. received from the founder.

- In January 2021, the fact of debt forgiveness is accompanied by the following entry: Dt 66 – Kt 91. The entire amount provided by the founder as a loan relates to non-operating income of the business entity.

As another example, we can consider a situation where the founder of a business entity purchased its bill of exchange worth 95,000 rubles. After 1 month, the acquirer decided to return the security to the legal entity free of charge. This situation should be accompanied by the formation of the following entry: Dt 66 – Kt 91, transaction amount 95,000 rubles. – the emergence of non-operating income from the return of one’s own security.

But do not forget that the legal entity will have to pay tax to the state treasury on the income received.

List of required documents

The procedure for obtaining a loan between the founder and the business entity must be accompanied by the following documentation:

- agreement for the provision of borrowed funds

- documentation certifying the receipt of the amount of money specified in the agreement from the lender to the borrower

The loan agreement does not require notarization. To formalize the agreement, the following documents are required:

- civil passports of the founders and director

- statutory documentation

- OGRN, INN

- information from the Unified State Register of Legal Entities

- If there is collateral, you will need documentation for it

If an agreement is concluded between an individual and a business entity, then it must contain the following information:

- loan amount in rubles

- purpose of providing funds

- order and parameters of its return

- accrued interest

- presence of penalties

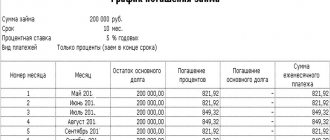

The agreement must indicate the procedure for calculating interest or the fact of its absence. Today the following methods of debt repayment are used:

- One-time deposit of funds before the day specified by the concluded agreement. If there is interest, the borrower must pay the principal amount and interest on it.

- Debt repayment is carried out in accordance with the schedule determined by the terms of the agreement (once a week, month, quarter).

- The debt is returned upon presentation of a claim from the lender.

Due to the fact that funds are used to develop their own business, collateral is usually not issued. For the founders, the order in which the funds lent are spent is of great importance. Each of the participants can exercise control over the use of money without being part of the company's management.

List of documents on video:

If the borrower does not comply with the terms of the agreement, the lender may go to court. In this case, the borrower will have to not only repay the existing debt and interest on it, but also reimburse legal costs and pay fines to the creditor.

Thus, the procedures for providing and receiving borrowed funds require mandatory recording in the accounting system. If there is interest for using the loan, their accrual is recorded in separate transactions.

Top

Write your question in the form below

Interest-bearing loan: tax implications

Quite often, a loan agreement, even one concluded with the founder, provides for the payment of interest on it. What tax consequences will an interest-bearing loan from the founder bring in 2021?

The interest amounts received by the lender will become his taxable income. The founder-individual (both Russian and foreigner) will have to pay personal income tax from them at a rate of 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation) or 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation), respectively, and withholding tax on income will be carried out by the borrower (clause 1 of Article 209 of the Tax Code of the Russian Federation). And the founder - a legal entity of Russian origin, upon receipt of interest, will be the payer of income tax (clause 6 of Article 250 of the Tax Code of the Russian Federation) or the simplified tax system (clause 1 of Article 346.15 of the Tax Code of the Russian Federation) at rates of 20% (clause 1 of Article 284 Tax Code of the Russian Federation) and 15% or 6% (clause 1 of Article 346.20 of the Tax Code of the Russian Federation), respectively. On the income of the founder, who is a foreign organization, when paying interest to him, the borrower will also have to withhold tax himself (clause 1 of Article 310 of the Tax Code of the Russian Federation) at a rate of 20% (subclause 1 of clause 2 of Article 284 of the Tax Code of the Russian Federation). Under certain conditions, part of the interest accrued in favor of a foreign founder is equated to dividends (clause 6 of Article 269 of the Tax Code of the Russian Federation) and is taxed at the corresponding rate of 15% (clause 3 of Article 224 and clause 3 of Article 284 of the Tax Code of the Russian Federation) .

From what base will the tax be calculated: from interest, the amount of which is provided for in the borrowing agreement, or from those that correspond to the real market level of such income? This question arises because the parties to the loan agreement may be mutually dependent. Let us recall that the interdependence between the founder and the legal entity in which he participates is directly related to the share of such participation (both direct and taking into account indirect contribution). For a dependence to arise, it is enough for the share to slightly exceed 25% (subclauses 1, 2, clause 2, article 105.1 of the Tax Code of the Russian Federation).

Thus, in relation to an interest-bearing borrowing agreement, the following situations are possible:

- There is no dependency. Then the prices agreed upon by the parties to the transaction are considered market prices (clause 1 of Article 105.3 of the Tax Code of the Russian Federation), and there is no need to revise them.

- There is a dependence. Its consequences will be different for resident founders and non-resident founders. In the first case, transaction prices will be controlled only when the amount of all transactions between the parties for a calendar year exceeds 1 billion rubles. (Subclause 1, Clause 2, Article 105.14 of the Tax Code of the Russian Federation). In the second case (with a non-resident), the transaction will always be controlled.

The recipient of the loan has the right to accept interest accrued in accordance with the terms of the agreement as a reduction in the profit base (subclause 2, clause 1, article 265 of the Tax Code of the Russian Federation) or the simplified tax system, the base of which is determined taking into account expenses (subclause 9, clause 1, article 346.16 Tax Code of the Russian Federation). However, in relation to a controlled transaction with a foreign founder, the determination of the amount of interest included in expenses occurs in a special order (Article 269 of the Tax Code of the Russian Federation), and it is here that, if the maximum permissible amount is exceeded, the question arises of equating interest to dividends for tax purposes .