The calculation for 9 months of 2021 is provided according to the new form 4-FSS, approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381 as amended by Order of the FSS of the Russian Federation dated June 7, 2017 No. 275. We talk about compiling a report in the program “1C: Salary and Personnel Management 8 (ed. 3)".

Policyholders submit quarterly to the territorial bodies of the FSS of the Russian Federation a calculation in accordance with Form 4-FSS on paper no later than the 20th day

month following the reporting period, and

in the form of an electronic document no later than the 25th day

following the reporting period (Article 24 of the Federal Law of July 24, 1998 No. 125-FZ).

Therefore, the calculation in form 4-FSS for 9 months of 2021 must be submitted no later than:

- October 20, 2021 – on paper;

- October 25, 2021 – in the form of an electronic document.

If the policyholder submits a calculation in Form 4-FSS in violation of the deadline established by law, he may be held accountable by the territorial bodies of the FSS of the Russian Federation in the form of a fine, the amount of which is determined separately for each type of compulsory social insurance (letter of the FSS of the Russian Federation dated March 22, 2010 No. 02-03 -10/08-2328).

Types of reporting

Reporting for 2021 differs from reporting to the Social Insurance Fund for 2021. The main difference is the appearance of a new calculation of contributions. A single calculation combines forms RSV-1 and 4-FSS, and it is submitted to the Federal Tax Service.

However, policyholders will continue to submit 4-FSS. The fact is that contributions for injuries must be reported to the Social Insurance Fund. The report is also submitted in Form 4-FSS, but in a modified form.

The report to the Social Insurance Fund in 2021 included, in addition to data on contributions for injuries, data on contributions to compulsory social insurance. Now in form 4-FSS there is only data on “traumatic” insurance premiums. How to fill out a report to the FSS, the filling procedure will tell you (Order of the FSS of the Russian Federation dated September 26, 2016 No. 381).

Submission of reports to the Social Insurance Fund can be carried out in two ways: in electronic format or on paper. If the number of employees is more than 25 people, 4-FSS must be sent to the Fund’s specialists exclusively in electronic form.

In addition to the listed quarterly reports, once a year you need to submit a certificate to the Social Insurance Fund confirming your main type of activity. Only organizations submit these documents; individual entrepreneurs are exempt from this obligation. This form shows the share of each type of activity performed. Based on the data received, the Social Insurance Fund determines the rate of contributions for insurance against industrial accidents.

Report to the Social Insurance Fund and other regulatory authorities through Kontur.Extern.

Send a request

How to fill out a reporting form if the company is temporarily not operating and does not pay salaries to employees?

Author: Tatyana Sufiyanova (tax and duties consultant)

Reporting time has arrived and all accountants are preparing reports for 9 months. It often happens that one or another form of reporting changes in the middle. In particular, this happened with form 4-FSS. If for the first half of 2021 we submitted data using the old form, then for 9 months of 2021 we should report using the new form.

Let us recall that by order of the Social Insurance Fund of the Russian Federation dated 06/07/2017 No. 275 “On introducing amendments to appendices No. 1 and 2 to the order of the Social Insurance Fund of the Russian Federation dated September 26, 2021 No. 381 “On approval of the form of calculation for accrued and paid insurance premiums for compulsory social insurance against accidents at work and occupational diseases, as well as the costs of paying insurance coverage and the procedure for filling it out,” some amendments were made to the reporting form 4-FSS.

The new form must be applied starting with reporting for the nine months of 2021.

I would like to immediately draw your attention to the following: if a company or entrepreneur wants to submit an adjustment for previous periods, for example, an error was discovered in the first quarter of 2021, then the adjustment should be submitted in the form in which the primary reporting form was submitted.

What changes have been made and what to pay attention to?

1) A new field “Budget organizations” has appeared on the title page of the form on the right. Such employers indicate there the policyholder in accordance with the source of financing;

2) New lines have appeared “1.1” “Debt owed by the reorganized policyholder and (or) a separate division of a legal entity deregistered” and “14.1” “Debt owed by the territorial body of the Fund to the insured and (or) a separate division of a legal entity deregistered” in the table No. 2.

How to fill out form 4-FSS correctly?

Calculation form 4 - FSS is filled out using computer technology or by hand with a ballpoint (fountain) pen in black or blue in block letters.

When filling out the form, only one indicator is entered in each line and the corresponding columns. If there are no indicators provided for in the Calculation form, a dash is placed in the line and the corresponding column.

The title page, table No. 1, table No. 2, table No. 5 of the Calculation form are mandatory for submission by all policyholders. If the company had no accruals and did not conduct any activity, then the specified “mandatory” tables and title page are presented as zero.

Tables such as No. 1.1, No. 3 and No. 4 are filled out as necessary. If there are no indicators for filling out table No. 1.1, table No. 3, table No. 4 of the Calculation form, the specified tables are not filled out and are not submitted.

After filling out the Calculation form, sequential numbering of the completed pages is entered in the “page” field. At the top of each completed page of the Calculation, the fields “Registration number of the policyholder” and “Subordination code” are filled in in accordance with the notice (notification) of the policyholder issued during registration (registration) with the territorial body of the Fund.

At the end of each page of the Calculation, the signature of the policyholder (successor) or his representative and the date of signing of the Calculation are affixed.

In what form should the 4-FSS Calculation form be submitted?

If a company or entrepreneur has more than 25 employees, then the report should be submitted electronically. In other cases, it can be done on paper. But the deadline for submitting the Calculation will depend on the chosen method of submitting the report.

1) For the electronic form of submission of the Calculation - the deadline is October 25, 2017 for nine months of 2021;

2) For the “paper” form of submission of the Calculation - the deadline is October 20, 2017 for nine months of 2021.

Where is Calculation 4-FSS submitted?

Let us remind you that the report must be submitted to the Social Insurance Fund, and not to the tax office, which, from January 1, 2021, administers other mandatory insurance contributions (except for injuries). If the company does not have separate divisions, then 4-FSS must be sent to the territorial social insurance office at the location of the organization.

What should you pay attention to when filling out the report?

1) Correct filling of the organization’s TIN.

When an organization fills out a TIN, which consists of ten characters, in the area of twelve cells reserved for recording the TIN indicator, zeros (00) should be entered in the first two cells.

2) Correct filling of the OGRN.

When filling out the OGRN of a legal entity, which consists of thirteen characters, in the area of fifteen cells reserved for recording the OGRN indicator, zeros (00) should be entered in the first two cells.

3) The phone number is entered correctly.

In the “Contact phone number” field, indicate the city or mobile phone number of the policyholder/successor or representative of the policyholder with the city code or cellular operator, respectively. The numbers are filled in in each cell without using the dash and parenthesis signs. Look how this is done in the figure:

Deadlines for submitting reports to the Social Insurance Fund

The main report to the Social Insurance Fund is submitted once a quarter. We are talking about form 4-FSS.

- for the first quarter of 2021 - until 04/20/2017 (paper version) or until 04/25/2017 (electronic);

- for the first half of 2021 - until July 20, 2017 (paper version) or until July 25, 2017 (electronically);

- for 9 months of 2021 - until 10/20/2017 (paper version) or until 10/25/2017 (electronic);

- for 2021 - until 01/20/2018 (paper version) or until 01/25/2018 (electronic).

A certificate confirming the main type of activity for 2021 must be brought to the Social Insurance Fund before April 15, 2017. If this is not done, there will be no fine, but the Social Insurance Fund will independently determine the contribution rate, based on the OKVEDs specified when registering the company.

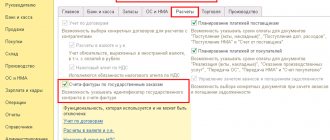

Preparation for drawing up calculations according to Form 4-FSS

When preparing a calculation using Form 4-FSS in programs, most indicators in all sections of the calculation are filled in automatically.

But before generating the calculation, it is recommended to check the completeness and correctness of accounting in your 1C program.

General information about the organization

To correctly fill out the calculation for the organization, the following must be indicated: full name, in accordance with the constituent documents, TIN, KPP, OGRN, OKVED codes, registration number of the policyholder, subordination code, registration address and information about the head of the organization.

The necessary information is indicated in the Organization

(section

Settings - Enterprise - Organizations

) (Fig. 1).

Rice. 1

Information about the tariff of insurance premiums

The rate of contribution for compulsory social insurance against accidents and occupational diseases is established for the policyholder for each year by the territorial body of the Federal Social Insurance Fund of the Russian Federation, depending on the class of professional risk of the type of activity carried out by the policyholder. The established tariff rate for calculating insurance contributions for compulsory social insurance against accidents and occupational diseases is entered in the field Contribution rate to the Social Insurance Fund for NS and PZ

indicating the start date of its use.

Moreover, the rate is indicated taking into account the discount/surcharge (if it is established for the policyholder), i.e. the resulting rate at which insurance premiums for insurance against accidents and occupational diseases should be calculated.

Rice. 2

Accounting for income for the purposes of calculating insurance premiums

For the correct accounting of income received by individuals for the purposes of calculating insurance premiums and for further filling out the indicators for calculating the base for calculating insurance premiums in the calculation, it is also recommended to check and, if necessary, clarify the settings of the types of accruals with which the program makes accruals to employees for worked and unworked time.

All payments and other rewards in favor of individuals in the program are calculated using accrual types (section Settings - Accruals

).

For each type of accrual, on the Taxes, contributions, accounting tab,

in the

Insurance premiums

, the type of income must be indicated for the purposes of calculating insurance premiums (Fig. 3).

When carrying out documents with the help of which accruals are made in favor of individuals (for example, documents Calculation of salaries and contributions

,

Premiums

,

Financial assistance

), the corresponding type of income is recorded for the purposes of calculating insurance premiums. This data is used to determine the basis for calculating insurance premiums and filling out Table 1 of the calculation.

You can obtain data on the formation of the base for calculating insurance premiums using the Analysis of Fund Contributions

(section

Taxes and contributions

-

Reports on taxes and contributions

-

Analysis of contributions to funds

- version of the

FSS_TS

).

Rice. 3

When registering payments under GPC agreements, the need to charge insurance premiums for insurance against accidents and occupational diseases is indicated in the Contract (work, services)

.

In addition, the program can register other income received by individuals from the organization. For such income, the following is indicated for calculating insurance premiums:

- when registering payments to former employees - in the directory Types of payments to former employees

; - when registering other income of individuals - in the directory Types of other income of individuals

; - when registering copyright agreements with individuals - in the directory Types of copyright agreements

; - when registering prizes, gifts from employees - if insurance premiums need to be charged on the cost of the gift, then in the Prize, gift

check the box

Gift (prize) is provided for by the collective agreement of the organization

, in this case the income is registered as income entirely subject to insurance premiums.

Calculation of insurance premiums

During the billing (reporting) period, at the end of each calendar month, policyholders are required to calculate monthly mandatory payments for insurance premiums based on the amount of payments and other remunerations accrued from the beginning of the billing period until the end of the corresponding calendar month, and the tariffs of insurance premiums, as well as discounts ( premiums) to the insurance tariff minus the amounts of monthly mandatory payments calculated from the beginning of the billing period to the previous calendar month inclusive (Article 22.1 of Federal Law No. 125-FZ). Insurance premiums are calculated separately for each individual.

Insurance premiums are calculated from employee income in the program using the document Calculation of salaries and contributions

when completing the procedure for filling out a document or other document by which contributions were calculated (

Dismissal

,

Parental Leave

).

The amounts of accrued insurance premiums for each individual are reflected on the Contributions

of the document. When posting the document, the amounts of accrued contributions are recorded.

Based on these data, the calculation fills in information about the amounts of accrued insurance premiums in Table 2. You can obtain data for analyzing the amounts of accrued insurance premiums using the report Analysis of contributions to funds

.

You can check the correctness of the calculation of insurance premiums for a certain period using the report Checking the calculation of premiums

(section

Taxes and contributions - Reports on taxes and contributions - Checking the calculation of contributions

- version of the

FSS_TS

).

Rice. 4

Calculation of contributions from payments in favor of disabled people

If the organization employs disabled people of groups I, II or III, in respect of whose payments insurance premiums for insurance against accidents and occupational diseases are paid in the amount of 60% of the insurance rate (clause 2 of article 2 of the Federal Law of December 22, 2005 No. 179- Federal Law), then it is necessary to fill out information about disability (Fig. 5).

In calculations using Form 4-FSS, the amount of accruals in favor of disabled individuals is shown separately in column 4 of Table 1.

Rice. 5

Insurance Cost Data

Expenses for compulsory social insurance against accidents and occupational diseases made by the employer are counted towards the payment of insurance premiums for insurance against accidents and occupational diseases. Benefits for temporary disability due to an accident at work and occupational disease are fully reimbursed from the funds of the Federal Social Insurance Fund of the Russian Federation.

In the program, the accrual of such benefits is registered using the Sick Leave

(section

Salary

-

Sick leave

-

Create

or section

Salary - Create - Sick leave

). Based on data on the amounts assigned in the current month for temporary disability benefits in connection with an industrial accident and occupational disease, the program records the costs of paying benefits, which are subject to financing from the Federal Social Insurance Fund of the Russian Federation.

You can obtain data on accrued benefits using the report Register of benefits at the expense of the Social Insurance Fund

(section

Taxes and contributions

-

Reports on taxes and contributions - Register of benefits at the expense of the Social Insurance Fund

). Data on benefits is used when filling out table 3 of the calculation.

Information about paid insurance premiums

Policyholders are required to pay mandatory payments for insurance premiums no later than the 15th day of the calendar month following the calendar month for which the monthly mandatory payment for insurance premiums is calculated. If the specified deadline for payment of the monthly obligatory payment falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the expiration date of the deadline is considered to be the next working day following it (Clause 4 of Article 22 of Federal Law No. 125-FZ ).

The amount of insurance premiums to be transferred to the Social Insurance Fund of the Russian Federation is determined in rubles and kopecks (without rounding) (Clause 5, Article 22 of Federal Law No. 125-FZ).

The fact of payment of insurance premiums in the program is reflected using the document Payment of insurance contributions to funds

(section

Taxes and contributions

-

Payment of insurance contributions to funds

) (Fig. 6).

Indicators of paid contributions are reflected in table 2 of the calculation. Payment of contributions accrued according to inspection reports is also recorded in the document Payment of insurance contributions to funds

.

Rice. 6

Punishment for violating reporting deadlines to the Social Insurance Fund

You need to take 4-FSS on time. If you are late even by a day, the Foundation may issue a fine.

5% of the amount of contributions for each month of delay (full and incomplete) - this is how the amount of the fine is determined. The fine has a minimum limit of 1,000 rubles. At the same time, the fine cannot exceed 30% of the amount of contributions.

The company will also be fined for violating the delivery method. Do not submit a report on paper if there are more than 25 people. Otherwise, the organization will be fined 200 rubles.

Submission of calculations in form 4-FSS to the FSS authorities of the Russian Federation

All insurers are required to

represent the title page, tables 1, table 2, table 5 of the calculation in form 4-FSS.

If there are no indicators to fill out other calculation tables (tables 1.1, 3, 4), the corresponding tables are not filled out or submitted.

Insurers whose average number of individuals in whose favor payments and other remunerations are made exceeds 25 people

, as well as newly created (including during reorganization) organizations whose number of specified individuals exceeds this limit, submit calculations in form 4-FSS in the formats and in the manner established by the body for control over the payment of insurance premiums, in the

form of electronic documents

, signed with an enhanced qualified electronic signature.

Insurers and newly created organizations (including during reorganization), for which the average number of individuals in whose favor payments and other remunerations are made, for the previous billing period is 25 people or less, submit calculations on paper. However, such policyholders have the right to submit calculations in the form of electronic documents.

Insurers participating in the implementation of the pilot project do not fill out Table 3 and do not submit it (Order of the Federal Insurance Service of the Russian Federation dated March 28, 2017 No. 114).

Setting up the composition of the calculation

By default, all sections and tables are shown in the report form. If individual tables are not filled out and presented in accordance with the Procedure, then you can set a mode for them in which they will not be displayed in the form of a regulated report and will not be printed.

To prevent tables from being displayed in the report form and not printed, click the More

located in the top command bar of the report form, and select

Settings

.

In the Report Settings

on the

Section Properties

, you must uncheck

the Show

and

Print

for these tables (Fig. 9).

Rice. 9

Checking the calculation

After preparing the 4-FSS

it should be written down.

Before transferring it to the FSS of the Russian Federation, it is recommended to check the calculation for errors. To do this, use the Check

—

Check control ratios

.

After pressing the button, the result of checking the control ratios of the indicators is displayed. In this case, you can see either those control ratios of indicators that are erroneous, or all the control ratios of indicators that were checked in the 4-FSS

(by unchecking the

Display only erroneous ratios

) (Fig. 10).

When you click on the required ratio of indicators, in the column Explanation of ratios of indicators

, a transcript is displayed that shows where these numbers came from, how they came together, etc. And when you click on a certain indicator in the transcript itself, the program automatically shows this indicator in the report form itself.

In addition, you can check control ratios when printing and uploading, if in the report settings (the More button - Settings

-

General

) check the

Check the ratio of indicators when printing and uploading

.

Rice. 10

Print calculation

If necessary, you can generate a printed calculation form by clicking the Print

located in the top command bar of the report form.

When you click on the button, the report form will immediately be displayed on the screen for preview and additional editing, generated for printing sheets (if necessary). Next, to print, click on the Print

.

In addition, from this form (preview), you can save the report as a file to the specified directory in PDF document format (PDF), Microsoft Excel (XLS) or in spreadsheet document format (MXL) by clicking on the Save button

(Fig. 11). The program assigns a name to the file automatically.

Rice. eleven

Uploading calculations electronically

In the regulated report 4-FSS

There is also the possibility of downloading the calculation in electronic form, in a format approved by the Federal Tax Service of the Russian Federation.

If the report must be uploaded to an external file, then the report form supports the upload function, and it is recommended to first check the upload to ensure that the report is formatted correctly using the Check button - Check upload

.

After clicking this button, an electronic report will be generated. If errors are detected in the report data that prevent the upload from being completed, the upload will be stopped. In this case, you should correct the detected errors and repeat the upload. To navigate through errors, it is convenient to use the error navigation service window, which is automatically brought up on the screen.

To upload a calculation for subsequent transfer through an authorized operator, you must enter the Upload

and indicate in the window that appears the directory where the calculation file should be saved (Fig. 12). The program assigns file names automatically.

Rice. 12

Sending calculations to the portal of the Federal Social Insurance Fund of the Russian Federation

In 1C

containing a subsystem of regulated reporting, a mechanism has been implemented that allows directly from the program, without intermediate uploading to an electronic presentation file and using third-party programs, to perform all actions for submitting calculations in form 4-FSS in electronic form with an electronic digital signature (if the 1C-Reporting service is connected ").

Before sending, it is recommended to perform format and logical control of filling out the report. To do this, click on the Check button - Check on the Internet

.

To send the calculation, you must click on the Send

(Fig. 13).

Rice. 13

Table 4

Submit Table 4 as part of the 4-FSS report for the 2nd quarter of 2017, if from January to June there were industrial accidents or occupational diseases were identified.

| Rows of table 4: decoding | |

| Line | What needs to be shown |

| 1 | The number of employees who were injured at work in the first half of 2021. |

| 2 | How many died due to accidents? |

| 3 | The number of workers who were diagnosed with occupational diseases from January to June. |

| 4 | The sum of rows 1 and 3 of table 4. |

| 5 | The number of cases at work or occupational diseases that resulted in temporary disability. |

We fill out the lines of form 4-FSS for the third quarter of 2021.

Please note that the changes affected not only the form, but also the rules and procedures for filling it out. Let's take a closer look at the rules that apply to filling out:

- fill out the form on a computer or on paper with a pen with black or blue ink and in block letters only;

- Only one value is entered in one column; if there is no data, a dash is entered;

- when filling out a report by a budgetary institution, the “Budgetary organization” field is filled in with the attribute of the organization according to the source of funding;

- if there is no data to indicate in tables 1.1, 3 and 4, the table data does not need to be provided to the relevant authority;

- Incorrect data can be crossed out by replacing them with correct ones; however, the signature of the policyholder or his representative with the current date must be left under them. Corrections must be certified with the seal of the organization or the signature of an individual entrepreneur. Correctors and similar products are prohibited from being used;

- in the form we use continuous numbering of sheets;

- at the top of each page on which data is entered, we indicate the registration number of the enterprise and the code of subordination based on the notification issued upon registration at the foundation institution;

- At the bottom of each sheet we put the signature of the manager and the date of signing the calculation;

- when submitting reports for 9 months of 2021, we fill in only the first two cells of the reporting period column (that is, you must indicate the code “09” - 9 months);

- in the OGRN column we write down the main registration code from the state registration certificate of the legal entity; private entrepreneurs indicate the code from the state registration certificate of an individual;

- in the process of filling out the OGRN of an enterprise from 13 digits in a line of 15 cells, enter 00 in the first two cells;

- if an enterprise has several OKVED codes, then we indicate the code of the company’s key area of activity.

How to submit a report

The reporting form changes from time to time and corrections are made to it, but the main design rules always remain the same.

The report contains a title page, which contains mandatory information about the policyholder. It is through them that his identification will be made in the FSS. The main details are: the name of the company and the registration number that was assigned by the fund. In addition to this information, on the title page you need to indicate: OGRN, location of the company, SSCH, etc.

You only need to take those sections that contain digital data. In certain cases, the FSS will require additional documentation to confirm the expenses incurred.

Where to send the report

If the organization does not have separate divisions, then 4-FSS for the 2nd quarter of 2021 must be submitted to the territorial branch of the FSS of Russia at the place of registration of the company (Clause 1, Article 24 of the Federal Law of July 24, 1998 No. 125-FZ).

If there are separate divisions, then Form 4-FSS for the 2nd quarter of 2021 must be submitted to the location of the separate division. But only on the condition that the “isolation” has its own current (personal) account in the bank and it independently pays salaries to employees.

Completion rules and required sections

The rules for filling out the 4-FSS calculation are contained in the Procedure approved by Order of the FSS of Russia dated September 26, 2016 No. 381. This document (in paragraph 2) stipulates that the calculation (including for the 2nd quarter of 2021) must include:

- title page;

- tables 1, 2 and 5.

The remaining tables are filled in only if there is information that needs to be recorded in these tables.

Even if the organization did not operate during the reporting period, the “zero” 4-FSS for the 2nd quarter of 2021 still needs to be submitted. You only need to fill out the required sections:

- title page;

- Table 1 “Calculation of the base”;

- table 2 “Calculations for social fear.";

- Table 5 “Information on the assessment of working conditions.”

Next, we provide samples of filling out 4-FSS for the 2nd quarter of 2021, which was formed using a specific example (with line-by-line explanations).

Title page

If you are submitting the first payment in form 4-FSS for the 2nd quarter of 2021, then enter “000” in the “Adjustment number” field. If you are clarifying the semi-annual report, then indicate the adjustment number (for example, “001”, “002”, etc.)

When you fill out the calculation for the 2nd quarter of 2021, indicate “06” in the “Reporting period” field, and put dashes in the next two cells.

Indicate the name of the organization. For individual entrepreneurs, you must indicate your last name, first name and patronymic. Also indicate the TIN and KPP, postal code and registration address.

In the “OKVED Code” field, show the main code of the type of economic activity of the policyholder according to the OKVED2 classifier OK 029-2014.

In the “Average number of employees” field, indicate the average number of employees. In the fields “Number of working disabled people”, “Number of employees engaged in work with harmful and (or) dangerous production factors” - indicate the list number of working disabled people and employees employed in hazardous working conditions. Form all indicators as of the reporting date - June 30, 2021 (clause 7 5.14 of the Procedure, approved by Order of the Federal Tax Service of Russia dated September 26, 2016 No. 381).

Table 1

In Table 1 of the 4-FSS report for the 2nd quarter of 2021 you need to show:

- payments subject to insurance premiums for half a year and separately for April, May and June;

- payments from which contributions “for injuries” are not accrued;

- basis for calculation;

- tariff rate;

- discount and surcharge to the insurance rate;

- tariff including discount/surcharge.

Let's decipher the content of the rows of table 1:

| Table 1 rows | |

| Line | What needs to be shown |

| 1 | The calculation base for calculating insurance premiums (that is, the amount of payments subject to insurance premiums). |

| 2 | Payments that are not subject to insurance premiums. |

| 3 | The basis for calculating contributions (this is the difference between lines 1 and 2). |

| 4 | The amount of payments in favor of disabled people. |

| 5 | Insurance rate. |

| 6 | The percentage of discount on the tariff (if you are eligible for a discount). |

| 7 | The percentage of the premium to the insurance rate (if established). |

| 8 | The date of the order of the Social Insurance Fund authority to establish the premium. |

| 9 | The final rate of insurance premiums. |

Table 1.1 should be compiled exclusively by those insured employers who temporarily transfer their employees to other organizations or entrepreneurs. If so, then the table needs to reflect:

- number of assigned workers;

- payments from which insurance premiums are calculated for half a year, for April, May and June;

- payments in favor of disabled people;

- the insurance premium rate of the receiving party.

table 2

Table 2 should contain the following information:

- on arrears of insurance premiums at the beginning of 2021 and as of June 30, 2021;

- about insurance premiums “for injuries” accrued and paid in April, May and June and for the entire six months;

- amounts accrued based on the results of inspections;

- expenses that were not accepted by the Social Insurance Fund for offset in the first half of the year;

- returns from the Social Insurance Fund;

- expenses reimbursed by the Social Insurance Fund.

As for row-by-row filling, show the following information in the main rows of this table:

- in line 1 - debt on accident insurance contributions at the beginning of 2021;

- in lines 2 and 16 - accrued and paid amounts of accident insurance premiums since the beginning of 2021;

- in line 12 - the debt of the FSS body of the Russian Federation to the policyholder at the beginning of 2021;

- in line 15 – accident insurance expenses incurred since the beginning of 2021;

- in line 19 – arrears in accident insurance contributions as of June 30, 2021, including arrears in line 20;

- in other lines - the remaining available information.

Table 3

Please fill out Table 3 as part of Form 4-FSS for the 2nd quarter of 2021 if in the first half of the year you paid hospital benefits in connection with work-related injuries and occupational diseases, financed injury prevention measures, and incurred other expenses for insurance against accidents and occupational diseases. An exhaustive list of such expenses is given in paragraph 1 of Article 8 of the Federal Law of July 24, 1998 No. 125-FZ. The table is formed on a cumulative basis from the beginning of 2021.

| Table rows 3 | |

| Line | What needs to be shown |

| 1 | Paid temporary disability benefits due to industrial accidents. |

| 2 | Information about benefits for external part-time workers. |

| 3 | Information about benefits for citizens who suffered in other organizations. |

| 4 | Information on benefits related to occupational diseases. |

| 5 | Information about benefits for external part-time workers. |

| 6 | Information about benefits for citizens who suffered in other organizations. |

| 7 | Data on payment of vacations for sanatorium-resort treatment of employees. |

| 8 | Amounts of payments and other remuneration accrued in favor of foreign citizens and stateless persons temporarily staying in the Russian Federation, except for persons who are citizens of the EAEU member states. |

| 9 | Data on preventive measures to reduce industrial injuries and occupational diseases (if any). |

| 10 | Summarizing data as a result of adding rows 1 + 4 + 7 + 9. The sum must coincide with row 15 of table 2. |

What has changed in the calculation of 4-FSS for 9 months of 2021

Form 4-FSS for the 3rd quarter of 2021 was put into effect by Order No. 381 of September 26, 2016. For the first time, it was necessary to provide data on injuries using the new form for the 1st quarter of 2021 and the first half of the year. For 9 months it is required to report on an adjusted form (changes are regulated by the Social Insurance Fund in Order No. 275 of 06/07/17). The document was updated primarily due to the transfer of administration of social insurance contributions to the Federal Tax Service of the Russian Federation. Injuries remain under the control of the FSS - such payments must be calculated and paid, as before, in Sostra.

The updated 4-FSS for the 3rd quarter of 2021, which can be filled out below, no longer contains information about insurance premiums for VNIM (temporary disability and maternity). The relevant sections have been excluded as unnecessary. What has changed in the report over the past nine months? Compared to previous documents, the changes are not so significant. The new reporting form contains the following amendments:

- A special field “Budgetary organization” has been added to the list of title page details, where the relevant institutions indicate the funding code - from 1 for subsidies with federal funds to 4 for mixed financing.

- The title page clarifies the algorithm for calculating the average number of employees - the indicator is determined from the beginning of the reporting year.

- In table 2 with data on settlements with the Social Insurance Fund, page 1.1 was added on the amount of debt transferred to the policyholder by way of succession after the procedure of reorganization or deregistration of the SE (separate division) of the company. In connection with the expansion of indicators, the algorithm for calculating the total amount of funds on page 8 has changed.

- In table 2 added p. 14.1, which reflects data on the debts of the Social Insurance Fund to the policyholder, transferred as a result of the completion of the reorganization or closure of the legal entity's subsidiary. The calculation of the total amount on page 18 has changed.

The above changes should be taken into account by policyholders, especially public sector employees and reorganized companies, when filling out the form for the third quarter of 2021. Regulatory additions also affected the Procedure for the formation of 4-FSS for the 3rd quarter of 2021: the document is provided according to the new regulations in accordance with legal requirements. If it is necessary to submit updated calculations for previous periods to Social Insurance, standard forms are used that are relevant for the period of updating the information (clause 1.5 of Article 24 of Law No. 125-FZ of July 24, 1998).

Insurance contributions to the Social Insurance Fund in 2021

Completed sample

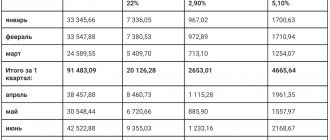

Now let’s look at filling out 4-FSS using a specific example:

Example conditions

The LLC Charodeyka organization has only five employees. Among them is one disabled person. As of the beginning of 2021 (as of January 1), the arrears (debt) on contributions for “injuries” amounted to 290 rubles. For the first half of 2021 (from January to June inclusive), contributory payments and benefits to all employees amounted to 898,000 rubles, in particular:

- for January, February, March, April and June – 150,000 rubles each;

- for May – 148,000 rubles;

- In May, one employee was awarded temporary disability benefits in the amount of 2,000 rubles.

Insurance premiums for “injuries” are determined at an insurance rate of 0.2%. And for a disabled person at a reduced (preferential) rate of 0.12 percent (0.2 × 60%). For the period from January to June 2021, insurance premiums were paid to the Social Insurance Fund: 1,666 rubles. (for December 2021 - May 2017), including April 12 - 276 rubles, May 15 - 276 rubles, June 5 - 272 rubles.

There were no accidents in the organization, and measures to prevent injuries and occupational diseases were not funded. In the second quarter of 2021, the organization conducted a special assessment of working conditions.

We present a completed sample 4-FSS for the 2nd quarter of 2021 based on the above example with indicators for the first half of 2021.

If there is a pilot project in the region, then do not fill out line 15 of Table 2 and Table 3 in Form 4-FSS for the 2nd quarter of 2021. See “Participants in the FSS pilot project in 2021.”