array(49) { ["ID"]=> string(5) "25359" ["~ID"]=> string(5) "25359" ["NAME"]=> string(127) "How to fill out a declaration income tax upon assignment of the right to claim a debt to a third party after the due date for payment?” [“~NAME”]=> string(127) “How to fill out an income tax return when assigning the right to claim a debt to a third party after the payment is due?” ["IBLOCK_ID"]=> string(2) "36" ["~IBLOCK_ID"]=> string(2) "36" ["IBLOCK_SECTION_ID"]=> NULL ["~IBLOCK_SECTION_ID"]=> NULL ["DETAIL_TEXT" ]=> string(6768) » From January 1, 2015, the procedure for recognizing for profit tax purposes a loss received by a taxpayer-seller of goods (works, services) when assigning the right to claim a debt to a third party after the payment deadline has changed. Corresponding amendments have been made to paragraph 2 of Art. 279 Tax Code of the Russian Federation. According to this clause, the negative difference between the income from the sale of the right to claim the debt and the cost of the goods (work, services) sold is recognized as a loss under the transaction of assignment of the right to claim on the date of assignment of the right to claim (that is, at a time). Before the changes were made, such a loss was included in non-operating expenses in equal shares (50 percent on the date of assignment of the right of claim and 50 percent after 45 calendar days from the date of assignment of the right of claim).

In the previously valid form of income tax return (approved by order of the Federal Tax Service of Russia dated March 22, 2012 No. ММВ-7-3 / [email protected] ), the loss from the exercise of the right to claim a debt, recognized in equal shares, was reflected on lines 110, 130, 160 and 170 in Appendix No. 3 to sheet 02 of the declaration.

In the current form of the declaration (approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3 / [email protected] ) to recognize a loss from the exercise of the right to claim a debt after the payment deadline, lines 110, 130, 160 and 170 are also provided in the appendix No. 3 to sheet 02 of the declaration. At the same time, the declaration form and the procedure for filling it out indicate that from January 1, 2015, these lines do not apply.

In this regard, the question arose of how to reflect in the declaration the loss that an organization incurred when assigning the right to claim a debt after the payment deadline.

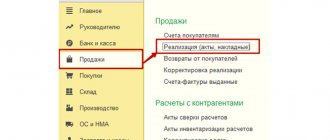

The Federal Tax Service of Russia provided clarification on this issue in letter dated June 25, 2015 No. GD-4-3/ [email protected] The Tax Department indicated that starting from the first reporting period of 2015, such transactions are reflected as follows. Proceeds from the sale of the right to claim a debt after the due date for payment are indicated on line 013 of Appendix No. 1 to sheet 02, and the cost of goods (work, services) sold - on line 059 of Appendix No. 2 to sheet 02 of the declaration. Thus, income and expenses from the assignment of the right to claim a debt after the due date of payment are taken into account for tax purposes, regardless of the financial result obtained.

The Federal Tax Service of Russia also noted in the letter that when filling out the declaration, it is not necessary to reflect the loss (the negative difference between the income from the sale of the right to claim the debt and the cost of goods, works, services sold) separately on line 300 of Appendix No. 2 to sheet 02.

For more information on filling out an income tax return, see the “Organizational Income Tax” reference book.

Assignment agreement: briefly

The seller may assign the buyer's debt to a third party under an assignment agreement.

The seller himself, who is called the assignor, is removed from the obligation. The rights belonging to him are transferred to the new creditor - the assignee. In turn, the new creditor can either demand payment from the buyer-debtor, or assign his right further to another new creditor.

The claim passes to the assignee at the moment of concluding an agreement for the assignment of the right of claim, unless otherwise provided by law or agreement (clause 2 of Article 389.1 of the Civil Code of the Russian Federation).

If you, as the assignee, intend to seek repayment of the debt from the debtor, make sure that the assignor gives you the original documents on the transaction. They will be needed for further assignment or for presentation to court in the event of a dispute with the debtor.

How to get a tax benefit when assigning a future claim

WITH

On July 1, 2014, a new version of paragraph 1 of Chapter 24 of the Civil Code of the Russian Federation came into force. In particular, it is supplemented by Article 388.1 of the Civil Code of the Russian Federation, which regulates the assignment of a claim that has not yet arisen at the moment. This new civil law mechanism, under certain conditions, may well be used in tax planning.

The new norm of the Civil Code of the Russian Federation clarified the fundamental issues regarding the assignment

Let us note that even before the amendments, the assignment of rights that the company would have in the future was possible. But when committing it, it was necessary to be guided by paragraph 4 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated October 30, 2007 No. 120. The judges in this letter noted that the legislation in force at that time not only did not contain a ban on the circulation of future rights, but, on the contrary, in a number of cases directly regulated such transactions (clause 6 of article 340, clause 2 of article 454, clause 4 of article 455 of the Civil Code of the Russian Federation).

The new norms of the Civil Code specified these rules. In particular, they introduced the requirement that the subject of the assignment can only be an obligation arising from the entrepreneurial activities of the parties (clause 1 of Article 388.1 of the Civil Code of the Russian Federation). A literal reading allows us to conclude that if at least one of the parties does not pursue entrepreneurial goals, then the assignment of a future claim may be challenged and found not to comply with the law. Thus, at least until positive arbitration practice emerges, it is worth avoiding the assignment of claims that may arise from contracts for retail purchase and sale or the provision of household services, or the performance of work under a household contract. Naturally, if the party to such a transaction is a citizen.

The new article quite succinctly spells out the condition for determining the assigned claim by the parties to the assignment. It is sufficient that at the time of its creation or transfer to the assignee it can be identified. This allows for the assignment of any future claim, for example to receive royalties under licensing agreements for the use of any intellectual property. Or to receive rent from the rental of a specific property. International practice allows this option (comments to clause 9.1.5 of the UNIDROIT Principles of International Commercial Agreements 2010). Let's consider whether it is worth rushing to conclude such transactions.

Money received for the assignment of a future claim is not income

One of the most interesting tax implications that can be drawn from the new rule is the fact that as a result of the assignment of a future claim, the company does not receive any taxable income until the claim actually arises. This allows this instrument to be used in schemes for tax-free refinancing of a group of companies and for deferring the payment of income taxes. Let me explain my point.

The Tax Code does not yet have separate provisions that would regulate the taxation of the assignment of a future claim. Therefore, when determining tax consequences, it is worth following the general rules. In the usual case, income from the assignment is taken into account on the basis of Article 249, paragraph 5 of Article 271 of the Tax Code of the Russian Federation. In the case of assignment of a future claim, the claim does not yet exist on the date of concluding the assignment agreement. It passes to the assignee only from the moment of its creation. The agreement of the parties may also provide for a later date of transition (clause 2 of Article 388.1 of the Civil Code of the Russian Federation).

Based on these norms, income will be recognized after transfer to the assignee under the act of claim. Until this moment, the payment received is an advance, which is not taken into account as part of income (subclause 1, clause 1, article 251 of the NKRF). Consequently, taxable income will not appear to the assignor until the claim arises or a later moment, if determined by the contract.

on the numbers

The company built a shopping complex, which it intends to rent out, and in 2015 ceded to a third-party company its right to receive rent from tenants (who do not exist yet) with a conditional discount of 10 percent for 100 million rubles (excluding VAT, we will talk about it later) . At the same time, the parties agreed that the moment of transfer of the right of claim is the date of conclusion of the agreement with each specific tenant. It turns out that the owner of the shopping complex, having ceded the future claim, received an advance payment in the amount specified in the contract. No income tax is paid on this amount yet. The tax base will be formed gradually as contracts are concluded with tenants.

For example, a tenant appears who must pay the landlord 10 million rubles for the year. The lessor (also known as the assignor) recognizes rental income for the year (10 million rubles), income from the assignment of the right to claim rent with a 10 percent discount (9 million rubles), and expenses in the form of the nominal value of the assigned right (10 million rubles). And the assignee, for its part, recognizes income from the repayment of the right of claim (10 million rubles) and the cost of acquiring this right (9 million rubles).

Naturally, at the end of the year, the assignor and assignee may have deviations. Indeed, during the year, when calculating the tax consequences, they used the conditional (planned) discount value. In fact, the right to claim may arise for a larger or smaller amount than originally expected.

in numbers If we use the same numbers, we will assume that the assignor received 100 million rubles from the assignee (excluding VAT), but in reality contracts with tenants were concluded for only 70 million rubles. Accordingly, for tax purposes, it turns out that the lessor’s income includes rent (70 million rubles) and income from the assignment of the right of claim with a conditional discount of 10 percent (63 million rubles). The expenses include the nominal value of the assigned right (70 million rubles). At the same time, it is not clear how to interpret for tax purposes the balance of funds received from the assignee (37 million rubles). After all, this 37 million rubles is an advance payment only for tax purposes. In civil law relations, this is payment for the acquisition of a future claim. It turns out that the assignee incorrectly assessed the real value of the future rights he acquired and overpaid for them. The assignor will not return this overpayment to him, unless, of course, this is expressly stated in the agreement of the parties.

The opposite situation is also possible: lease agreements will be concluded for an amount of, for example, 140 million rubles. Then it turns out that the parties overestimated the amount of expenses.

The parties to the contract will definitely have to somehow recognize the resulting positive and negative differences in tax income and expenses for 2015. Since the amount of the assignment agreement applies to all transactions, the obvious option seems to be an upward and downward recalculation of the financial result for each transferred claim. In fact, by changing the size of the discount in the calculations (replacing the planned one with the real one). This is labor-intensive, but the tax authorities most likely will not allow you to recognize income at a time at the end of the year, pointing out the requirement to comply with the principle of uniformity (clause 2 of Article 271 of the NKRF).

The situation with a loss is simpler in terms of the time of recognition: inspectors are unlikely to object to its shift to the end of the tax period. However, difficulties of a different order are possible.

The assignor's loss is justified by the fact of lending. But it is worth remembering that in this case the assignor calculates the loss on the assignment of the claim before the payment deadline (clause 1 of Article 279 of the NKRF). The amount of loss is determined in accordance with the provisions of Article 269 of the Tax Code of the Russian Federation. Its value cannot exceed the amount of interest on the debt obligation equal to the income received, which could be taken into account as expenses for the period from the date of assignment to the date of fulfillment of the obligation.

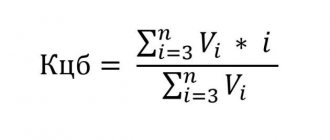

In 2014, this amount is calculated as 1.8 of the refinancing rate established by the Central Bank of the Russian Federation on the date of assignment (paragraph 3, clause 1.1, article 269 of the NKRF). From January 1, 2015, when assigning a claim, the assignor will be able to take into account the entire loss if the transaction is not recognized as controlled (clause 1 of Article 269 of the Tax Code of the Russian Federation as amended, in force since 2015).

As for the assignee, he applies the provisions of paragraph 3 of Article 279 and paragraph 2 of Article 268 of the Tax Code of the Russian Federation, and has the right to take into account the loss in full. However, the tax authorities in this case may not like the loss on the transaction itself. The assignee may be subject to claims due to overpayment for the acquisition of the claim in excess of the face value. And it may be difficult to defend yourself. Despite the fact that initially these costs seem to be economically justified and aimed at generating income. All that remains is to remind the inspectors about business risk.

There is a risk that the entire amount of the assignment of a future claim will be subject to VAT

For a creditor, both initial and subsequent, the VAT tax base arises only for the amount of excess income received from the new creditor over the amount of the claim (clauses 1, 2, 4 of Article 155 of the Tax Code of the Russian Federation). As a rule, at least at the first stage, the debt is ceded at a discount, and in this case VAT is not charged. In this case, the following concessions are not subject to VAT at all:

- rights (claims) for obligations arising on the basis of financial instruments of forward transactions, with the exception of their underlying asset, subject to VAT (subclause 30, clause 2, article 149 of the NKRF);

- rights (claims) of the lender for obligations arising from agreements for the provision of loans in cash or credit agreements, as well as for the fulfillment by the borrower of obligations (subclause 26, clause 3, article 149 of the NKRF).

We have already mentioned above that for tax purposes, payment for the assignment of a future claim is an advance payment, because based on paragraph 2 of Article 388.1 of the Civil Code of the Russian Federation, in the event of an assignment of a future claim, it is considered transferred on the date of its occurrence or later. Clause 8 of Article 167 of the Tax Code of the Russian Federation does not apply to the primary assignment. And according to paragraph 1 of Article 167 of the Tax Code of the Russian Federation, in the general case, the tax base is determined at the earliest of the following dates:

- day of shipment (transfer) of goods, works, services, property rights;

- day of payment, partial payment for upcoming deliveries of goods, performance of work, provision of services, transfer of property rights.

At the time of assignment of a future claim, it is not yet possible to determine the tax base (it is not always clear whether the actual value of the assignment will exceed the nominal value of the claim). But it is obvious that the tax authorities will not agree to wait for the transaction to be executed in full. Moreover, the advance has already been received in a very certain amount. And formally, if VAT is in principle possible on a transaction, then the advance payment should be subject to this tax. The Code does not provide for any exceptions here.

It is still difficult to say how the practice of calculating VAT on such transactions will develop. But for now we can assume that since the tax base cannot be determined, then the entire advance amount will be recognized as it.

The situation is strange: the tax base for the assignment is calculated in a special manner, and for the prepayment for this assignment - in general. If the entire payment amount is taken as the assignor’s income reduced by expenses (0 rubles), then as the transaction is executed, this amount will decrease, and accordingly, the tax base will decrease. Which will lead to constant overpayment of VAT by the assignor. Moreover, since the claim was assigned at a discount, VAT is not charged upon the actual transfer of the claim, because the tax base is zero. If, based on the results of the execution of the contract, the payment received does not exceed the amount of the claim, then it turns out that the entire amount of VAT must be returned. But a different situation is also possible.

in numbers Let's use the data from the previous example. The assignor, having assigned a future rental claim to the assignee, must pay VAT. The amount of 100 million rubles is defined as the income of the assignee excluding VAT; the assignee transferred tax in the amount of 18 million rubles. In 2015, contracts were concluded in the amount of 70 million rubles. The amount of excess payment (excluding VAT) actually amounted to 30 million rubles, which means that 5.4 million rubles are due to the budget for the year. Of the VAT paid upon receipt of the advance, a portion in the amount of 12.6 million rubles is over-calculated, claimed from the assignee and paid to the budget. It must first be returned to the assignee, and then returned from the budget (clause 21 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 30.05.14 No. 33). And 5.4 million rubles are subject to recovery as VAT paid on the advance payment.

Even in the final calculation, this order is obviously inconvenient and clearly requires explanation. And, without a doubt, the tax authorities will have questions about the calculation and claims. Therefore, it is still advisable, at least until clarifications appear, to avoid concluding agreements for the assignment of a future claim if its amount cannot immediately be determined more accurately.

In what cases can cession of a future claim help optimize taxes?

Let us remind you that if the agreement does not directly stipulate the conditions for the provision of a commercial loan, then interest for the use of funds is not accrued (clause 13 of the resolution of the Plenum of the All-Russian Socialist Republic of Russia and the Plenum of the Supreme Arbitration Court of the Russian Federation from 10/8/98 No. 13/14, determination of the Supreme Arbitration Court of the Russian Federation dated 02/25/09 No. 1511/09, dated 01/28/13 No. VAS-18386/12). Thus, the assignment of a future claim allows you to provide credit to a friendly company without fear of applying transfer pricing rules. The main thing is that the price of the assigned right does not raise doubts.

In this case, it is possible that the requirement will not arise. For example, the seller has assigned the right to receive payment under the concluded agreement. But the buyer subsequently backed out of the deal. In this case, the assignor will return the amount of payment received to the assignee. Thus, in a group of friendly individuals, such transactions can be used for tax-free and free lending. But, of course, this method should not be considered as a permanent practice.

Naturally, the tax authorities will look for signs of fictitious transactions in such cases. In particular, an insufficiently precisely defined requirement, which is the subject of the assignment, will give grounds to challenge the transaction. The contract from which this requirement is determined will also be closely examined. If its conditions are spelled out too generally, tax authorities will suspect fictitiousness. It will be especially difficult for a company to defend itself if the parties entered into this agreement specifically for the purpose of such optimization without the intention of fulfilling it.

But for a fairly common scheme for transferring a loss through a double assignment to a friendly entity - a loss-making company - the assignment of a future claim in 2014 is much less suitable. The reason for this is the difficulty of taking into account the costs of the original lender. As stated above, the amount of loss is normalized. This limits the size of the discount. In 2015, based on the letter of the law, problems with taking into account even a significant discount will not arise if the transaction does not fall under the definition of controlled.

But this scheme can be used if there is more than one participant. The first creditor then assigns the claim with a small discount, and for subsequent creditors the loss is taken into account on the basis of paragraph 3 of Article 279 of the Tax Code of the Russian Federation, which does not contain special requirements. In addition, when recognizing expenses, the Code prescribes that one should also be guided by the general requirements for them. In particular, according to paragraph 1 of Article 252 of the Tax Code of the Russian Federation, expenses or losses should not be indicated in Article 270 of the Tax Code of the Russian Federation. In this case, the named article does not establish restrictions for accounting for such losses. The Federal Tax Service of Russia drew attention to this in a letter dated November 11, 2011 No. ED-4-3/ [email protected]

Income tax

As a result of the transaction for the assignment of the right of claim, the receivables, which are sold under the assignment agreement, are repaid from the assignor. As a result of the transaction, he may experience both income and losses. Just like you too. as the assignee, hereinafter.

If the costs of acquiring the right of claim exceeded the income from its sale, such a loss can be taken into account when taxing profits (clause 2 of Article 268 of the Tax Code of the Russian Federation).

You will have to reflect the receipt of income on the date of the subsequent assignment or on the date of fulfillment of the demand by the debtor (clause 5 of Article 271 of the Tax Code of the Russian Federation).

Next, we will analyze the situation when you, as the assignee, nevertheless received income.

In this case, all attention is paid to VAT.