What is meant by “exemption” from the use of cash register equipment?

Indeed, “exemption” from the use of CCT may in this case involve several interpretations. Namely:

- “Exemption” - as a legal requirement not to use online cash registers.

That is, we are talking about the fact that a business entity should not use cash register systems. Even if he is, in principle, ready to use it, he cannot, the “liberation” is “compulsory” in nature.

- “Exemption” - as a legislative permission not to use online cash registers.

At the same time, such a permit can be established for one or another type of business entity:

- on an ongoing basis;

- on a temporary basis.

At the same time, “voluntary” exemption from online cash registers may be characterized by the presence or absence of an obligation for a business entity to issue documents to its customers that replace a cash receipt. Such documents could be, for example, a sales receipt or a strict reporting form.

- The “exemption” from the “full use” of online cash registers is, in fact, a partial exemption in which cash registers are used according to one or another “simplified scheme.”

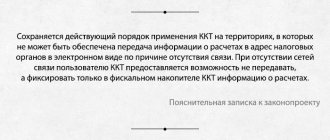

A striking example of such a “simplified scheme” is when an online cash register can be used in a mode without transferring data to the OFD (and, as a result, save on the services of the Fiscal Data Operator) in the manner prescribed by paragraph 7 of Article 2 of Law No. 54-FZ. There are other “simplified” options for using cash registers - related, in particular, to the possibility of not issuing a cash receipt to the buyer or client.

But in essence, all these options and others like them reflect the fact that it is necessary to use an online cash register in principle, and they can hardly be called a full-fledged “exemption” from cash registers.

Let us consider in more detail how Russian entrepreneurs can use one or another scheme for exemption from the use of cash registers in the context of the above interpretations - having agreed that we will talk about the possibility not to apply in principle (without adjusting for the need for their use in a “preferential” regime - as in the case with the option not to enter into an agreement with the OFD).

Connecting to the OFD and registering the cash register

When can you not connect to the OFD?

As a general rule, everyone who uses an online cash register needs to connect to the fiscal data operator (FDO). You can not connect the cash register to the OFD and not transfer data to the tax office only if you trade in an area remote from communication networks. Data on your sales will be stored in the fiscal drive. The Federal Tax Service may require you to provide this information to the inspectorate.

Do I need an electronic signature to operate the cash register?

A qualified electronic signature (QES) will be required to work with the CRF. If you are allowed to use the cash register offline, then neither OFD services nor an electronic signature will be needed.

CEP is also needed to register a cash register in your personal account on the tax website. If you personally come to the Federal Tax Service to register the cash register, you will not need an electronic signature.

How to properly connect and register a cash register?

First you need to register an online cash register with the tax office and connect it to the fiscal data operator (FDO). To work on the Federal Tax Service website, you will need a qualified electronic signature, for example a signature for reporting or electronic trading.

Get a certificate of enhanced qualified electronic signature

The algorithm of actions looks like this.

- You enter into an agreement with the OFD; your operator’s data will be needed when registering the cash register with the Federal Tax Service.

- Register the cash register on the tax website nalog.ru through the “Taxpayer’s Personal Account”: in the electronic application form you indicate the address of the cash register installation, the cash register model and other characteristics. We recommend making sure that the address of your retail outlet is in the directory of the Federal Information Address System (FIAS, see ifias.ru). If there is no such address, contact the district administration with an application to include the address in FIAS.

- After filling out the registration form, click “Sign and Submit.”

- Monitor the status of your application using the link “Information on documents sent to the tax authority.” When the status “KKT registration number assigned” appears in the “Status” column, enter the registration number and TIN at the checkout. This process is called fiscalization; it must be completed within a working day after the cash register is assigned the status of the number.

- In the cash register settings, specify the OFD parameters that were communicated to you when concluding an agreement with the OFD.

- Your cash register will print a receipt, which will serve as a registration report.

- Return to the “Taxpayer’s Personal Account” on the nalog.ru website, in the “Cashier Registration Number” column, click on the registration number. The cash register card will open, click “Complete registration”.

- In the window that opens, enter the data from the cash register registration report that the cash register printed during fiscalization. Click “Sign and Submit.”

- The tax office will send you a registration card.

- Connect the cash register to the fiscal data operator to begin the transfer of checks to the Federal Tax Service - go to your personal office of the OFD and indicate the cash register details.

Exemption as a ban on the use of CCP

“Forcibly exempt” from the use of cash registers (clauses 1, 9, 10, 11 of Article 2 of Law No. 54-FZ - LINK):

- Banks.

In addition, online cash desks are not used by authorized representatives of banks who carry out payment transactions in accordance with orders from a financial institution.

- Individual entrepreneurs and legal entities selling through automatic devices that do not consume electricity in any way (through an outlet, battery, battery).

For example, through candy vending machines equipped with a scrolling lever, which you can start turning after placing a 5-ruble or 10-ruble coin in a special slot.

- Individual entrepreneurs and legal entities that make non-cash payments to each other.

However, if a representative of an individual entrepreneur or a legal entity (employee, authorized representative) came to pay the counterparty in cash, he must issue them a cash receipt upon receipt of funds to pay for goods or services.

- Business entities that exercise the powers of state or municipal authorities as part of the provision of paid parking for use to citizens and organizations on public roads and on land plots owned by the authorities.

Actually, for now this is all a case of “forced” exemption from the use of online cash registers. Next, we will consider a “softer” version of the exemption, in which a business entity is given the right to choose whether to use an online cash register or not.

Let's start with those users for whom the law has established an indefinite (valid until the law establishes otherwise) right to refuse to use cash register systems.

Trading on the market

Some traders operating at markets, fairs or exhibitions do not require an online cash register. But for this you need to meet several conditions. Spontaneous markets with stalls right on the street are almost never found; their place is taken by shopping complexes - in fact, this is no longer a market in the classical sense of the word, but a bunch of shops in one place. Where is the seller lurking in this pile, who by law does not need an online cash register? Yes, here it is:

- Open counters located inside the trade pavilion. Simply put, if you have your goods laid out on the table, you won't need a cash register. However, there is one condition - you need to trade only non-food products. When selling food, drinks or groceries, you must use the online checkout.

- Trade from unfurnished retail outlets. What does unsettled mean? It’s simple - these are points that do not ensure the safety of goods and equipment. I lay down right on the asphalt, put up a small awning from the rain and wind, and work in peace without any online cash desks.

- Trade from vehicles. If you load a gazelle with potatoes, place a stool next to it for scales and start trading, you won’t need an online cash register. But equipped auto shops and vans with heating, air conditioning and other pleasures of life are required to use online cash registers. After all, conditions for the safety of goods and equipment have been created inside, which means this category does not fall under the exemption from the law.

The conclusion is simple - the simpler the better. If you want to trade without using a cash register, make sure that the outlet can be closed in a couple of minutes and moved to another location. When registering a cash register with the tax office, you must indicate the installation address, and in your case this will be almost impossible. That is why the law exempts such trade from the use of online cash register systems.

True, here, as always, there are some nuances. The fact is that the wording used in the law “a retail outlet must ensure the safety of goods and equipment” raises many complaints. It is not clear who will determine whether it provides these conditions or not? Where is this fine line, after which this item is considered completed, and before it - not? The law should not allow for discrepancies, and we have a problem with this.

Who and what types of activities are exempt from online cash registers indefinitely

They can decide at their own discretion whether to use an online cash register or not (clauses 2, 2.1, 3, 5, 8, 12 of Article 2 of Law No. 54-FZ):

- Individual entrepreneurs and legal entities that carry out the types of activities named in paragraph 2 of Article 2 of the law.

In particular, these types of activities include:

- sale of newspapers and magazines in paper form (and related products, the list of which is determined by the law of the subject of the Russian Federation);

- sale of tickets in public transport (but only until July 1, 2021, after which you will need to use an online ticket office for this type of activity);

- providing meals to students of educational institutions;

- retail trade in markets (unless it occurs outside a store, kiosk, tent), unless such trade is related to the sale of non-food products according to the list reflected in the order of the Russian government dated April 14, 2017 No. 698-r;

- peddling (in the open air, on trains, on airplanes) trade in goods that are not technically complex and require special conditions for storage and sale, as well as those that are not classified as goods subject to labeling;

- sale of ice cream, soft drinks (including kvass and milk from tanks);

- sale of bottled vegetable oil, live fish, vegetables, fruits;

- sale of kerosene;

- acceptance of glass containers and waste materials (except scrap metal) from individuals;

- provision of various household services;

- renting out your own residential premises (only individual entrepreneurs and legal entities must use cash register systems when carrying out this type of activity).

An important nuance: if an individual entrepreneur or legal entity sells excisable goods (for example, alcohol or tobacco products), then you will not be able to take advantage of the preference in question. The same applies if payments are made automatically (for example, through a vending machine, which in this case should have an automatic online cash register built into it).

Business entities carrying out the above types of activities have the right not to issue the buyer or client with any documents confirming the purchase, instead of a cash receipt. But it’s still useful to do this - consumer confidence will increase. An alternative document to a cash receipt can be the same sales receipt, BSO - as an option, printed using a receipt printer.

- Individual entrepreneurs on PSN, carrying out activities that do not relate to those named in subparagraphs 3, 6, 9 - 11, 18, 28, 32, 33, 37, 38, 40, 45 - 48, 53, 56, 63 of paragraph 2 Article 346.43 of the Tax Code of the Russian Federation - LINK.

Please note that the types of activities that are subject to an indefinite exemption from CCP do not include such large segments as retail trade and public catering. There, in general, you need to use an online cash register.

Individual entrepreneurs on PSN, who may refuse to use online cash registers, in turn, need to issue clients with a document alternative to a cash register receipt. This document must have the details named in paragraphs 4-12 of paragraph 1 of Article 4.7 of Law No. 54-FZ.

Namely:

- name of the document, its serial number from the beginning of the cashier’s shift;

- date, time, place of receipt of funds from the buyer or client;

- name of the business entity (or full name of the individual entrepreneur), TIN;

- the tax regime that the company applies;

- information about the content of the payment transaction (receipt, expense);

- a list of goods or services for which the buyer or client pays;

- price for selected goods or services including VAT (or highlighting those goods sold without VAT) - final, taking into account discounts and markups;

- information about the method of accepting payment - in cash or through acquiring (with a division of the amounts accepted by each method);

- Full name and position of the person who accepted the payment.

The document replacing the cash receipt must be signed by the seller.

From a technical point of view, the document in question can be generated in any way convenient for the seller - on a receipt printer, on a computer, or even manually.

The IP document in question on the PSN must be issued to the client or buyer without waiting for a request from him.

- Individual entrepreneurs and legal entities that operate in hard-to-reach areas.

In each region, the authorities themselves determine which localities these are and publish the relevant regulations (more details about this can be found in THIS ARTICLE). Such areas cannot include:

- cities;

- regional centers (unless they are the only settlements in their municipality);

- PGT.

At the same time, you need to take into account the same rule as in the case of “exceptional” types of activities above - preference is not available when selling excisable goods or using automatic devices.

As in the case of the exemption from the use of cash registers for entrepreneurs on a “patent,” those firms that operate in hard-to-reach areas are required to issue clients and customers with a document alternative to an online cash register receipt.

In the scenario under consideration, a number of special requirements are established for this document in terms of the procedure for issuance and accounting. These requirements are determined by Decree of the Government of Russia dated March 15, 2017 No. 296.

The company has the right to issue a document alternative to a cash register receipt only if the client or buyer themselves requests it.

- Pharmacies operating as legal entities located in paramedic and obstetric centers in rural areas (and separate divisions of medical institutions located in rural areas).

Note that in the scenario under consideration, it is necessary to use an online cash register when using vending machines or selling excisable goods.

There are no requirements for the use of documents alternative to cash receipts for pharmacists and rural hospitals.

- Religious organizations.

There are no requirements for the use of alternatives to cash receipts for such organizations.

- State, municipal libraries belonging to the Russian Academy of Sciences (and other academies, institutes, educational institutions) - when providing paid services within the framework of the main type of activity.

At the same time, the list of such services should be established by the Russian Government.

The list of cases when you can not use the online cash register is listed in the table (the table does not indicate situations when a temporary exemption applies):

The State Duma, in the third and final reading, adopted a bill with new rules for online cash registers on May 23. One of the main changes is a deferment until July 2021 for individual entrepreneurs without employees. But 23 more amendments were submitted for the second reading, of which the deputies accepted 14. Here is how the original version of the document was changed:

- The period for generating a check for offset of advances has been increased to 10 days. In the original text of the project, the period was five days. This applies to those organizations and individual entrepreneurs who can make offsets with one check per billing period.

- We have added to the list of those who are exempt from cash registers. Distributors of tickets, calculations for individual entrepreneurs for renting out apartments and parking spaces, sales of shoe covers, etc. are exempt from the use of online cash register systems.

- We have prescribed a method for fulfilling the obligation to hand over a receipt for drivers who sell tickets on public transport. When issuing a ticket, it will be enough to indicate a unique link or code to the electronic receipt. The driver himself must punch the check on the day of payment, when he returns “to base”.

- We clarified the conditions based on information about lottery winners. From July 1, 2019, when paying out winnings, information about the client must be indicated on the cash receipt. The amendments clarify that this information is required if the winning amount is 15 thousand rubles or more.

- We have simplified the procedure for transferring a check for paying utility bills by bank transfer. The check can be sent by e-mail or phone number of the buyer.

These and other norms will come into force from the moment the bill is officially published. Now the document has been sent to the Federation Council, and the President of Russia must also approve it.

WHAT ALL CHANGES LOOK LOOK LIKE

Individual entrepreneurs without employees will receive a one-year deferment

Entrepreneurs without hired personnel are planned to be exempt from CCP until July 1, 2021. Checks may not be punched when making payments:

- for sold goods of own production. For individual entrepreneurs who are engaged in the resale of purchased goods, a deferment is not provided (letter of the Federal Tax Service dated April 17, 2019 No. ED-4-20/7260);

- for work performed;

- for services rendered.

Please note that individual entrepreneurs who exercise the right to deferment will not be able to apply a tax deduction when calculating UTII or PSN tax (letter of the Federal Tax Service dated April 17, 2019 No. ED-4-20/7260).

When selling remotely, it will be allowed not to issue a receipt.

They will simplify the procedure for using cash register systems for distance and retail trade, as well as when performing work or providing services that are performed or provided outside a retail facility, retail location, building, or structure. For example, trade through couriers, passenger transportation services on public transport. For such cases, it was allowed to use one cash register, which is located remotely from the place of payment.

An organization or individual entrepreneur can fulfill the obligation to issue a cash receipt in one of the following ways:

- issue a check or BSO at the time of settlement or send it to the buyer’s email address or phone number;

- send information to the email address or subscriber number that allows you to identify the cash receipt;

- provide the buyer with the ability to read a QR code from the display of a mobile phone, smartphone or computer, including a tablet computer.

When offset or refunding advances for housing and communal services, there will be one check

We adjusted the procedure for generating cash receipts when crediting and returning advances. There are three new rules.

Firstly, we have added to the list of cases when it is possible to issue one check for offset or refund of an advance payment for a billing period. Now organizations and individual entrepreneurs that provide services have received this right:

- Housing and communal services, including services of resource supply organizations;

- security and safety systems;

- in the field of education.

Secondly, we adjusted the duration of the billing period for which a check can be processed. It should not exceed one month.

Thirdly, the time for generating a check has been changed. Now the law requires a check to be punched no later than one business day following the end of the billing period. According to the new rules, the check generation period will be no later than 10 calendar days.

When paying for housing and communal services, it will be possible to issue a receipt at the client’s request

The bill proposes to simplify the procedure for issuing checks when paying for housing and communal services. Thus, organizations that accept payment for housing and communal services can fulfill the obligation to send a cash receipt to the buyer in one of the following ways:

- send a check to the buyer’s email address or phone number;

- issue a cash receipt at the client's request. This must be done within five working days from the date of receipt of the request. In this case, the client must send a request for the issuance of a check no later than three months from the date of its generation. The text adopted in the first reading offered the opportunity to submit a request within a year.

The initial version of the project offered another way: print individual check details on a payment document for the next month and send this document to the client. However, this option was ruled out.

More organizations and individual entrepreneurs will be able to refuse cash registers

| Who may not use CCT | Condition |

| Individual entrepreneurs when renting out apartments owned by him with parking spaces located in apartment buildings; Previously, Law 54-FZ only exempted the lease of residential premises. The amendments clarified the wording | For any payment method |

| Organizations and individual entrepreneurs in the retail sale of shoe covers | For any payment method, including sales through vending machines |

| — Partnerships of real estate owners, including HOAs, horticultural and gardening non-profit partnerships — Housing, housing-construction cooperatives and other specialized consumer cooperatives | The cash desk is not needed for payments for the provision of services to its members within the framework of statutory activities, as well as when accepting payments for residential premises and utilities. Cash register systems may not be used for non-cash payments, with the exception of card payments in the presence of the client. Checks must be punched when paying in cash or by card in the presence of the client |

| Physical culture and sports organizations when providing services to the population in the field of physical culture and sports | Payments for services rendered in the field of physical education and sports are exempt from cash register payments. Cash register systems may not be used for non-cash payments, with the exception of card payments in the presence of the client. If payment is made in cash or by card in the presence of the client, checks must be punched |

| Houses and palaces of culture Houses of folk art Clubs, centers of cultural development Ethnocultural centers Culture and leisure centers Houses of folklore Houses of crafts Houses of leisure Cultural-leisure and cultural-sports centers | Payments for services to the population in the field of culture are exempt from CCT. Cash register systems may not be used for non-cash payments, with the exception of card payments in the presence of the client. If payment is made in cash or by card in the presence of the client, checks must be punched |

| IP from entrance tickets and subscriptions to visit state and municipal theaters | Sales from hands and (or) tray are exempt from CCT. When selling tickets online, the cash register must be used |

Drivers will be able to issue tickets or coupons to passengers

The amendments simplified the procedure for transferring a check to passengers in cases of selling tickets or coupons on board the bus. The driver can fulfill the obligation to hand over the check if he gives the passenger a ticket or coupon that contains information about how the passenger can receive an electronic check. The electronic check must be punched on the settlement day.

Information about the client in the check when paying out winnings will not always need to be indicated

From July 1, 2021, when paying out winnings, information about the client must be indicated on the cash receipt. The amendments clarified that this information will need to be indicated only if the lottery winnings amount to 15,000 rubles. and more. In other cases, this detail is not needed in the check.

BSO can be transferred to the client on paper with check details

If the law requires the issuance of a form for strict reporting of services to the public, you can write details on it that allow you to identify an online check. In this case, the obligation to the client is considered fulfilled. The rule applies to BSO approved by law, for example, a bail ticket.

Who is exempt from online cash register until 2021

The following business entities are temporarily exempt from using online cash registers until July 1, 2019:

- Individual entrepreneurs on PSN and UTII, legal entities on UTII, which, having employees on staff, carry out activities not related to retail and catering - here sellers and restaurateurs are again “in the wings”).

- Individual entrepreneurs on PSN and UTII, which, without employees, carry out any activities permitted under the relevant tax regimes (including retail and catering - there is a loophole here, but the business owner will have to rely on his own strength).

A complete list of permitted activities for which online cash registers may not be used in both cases is given in paragraph 7.1 of Article 7 of Law No. 290-FZ of July 3, 2016 - LINK.

The specified categories of business entities under special regimes are required to issue a sales receipt instead of an online cash register receipt - at the request of the buyer or client.

- Individual entrepreneurs and legal entities providing services, having employees, in any field of activity, except for public catering (under any taxation system - if not in a special regime, then in the OSN, simplified tax system, unified agricultural tax).

- Individual entrepreneurs and legal entities performing work and providing services to the public without having employees - in any field of activity (and regardless of the applied tax regime).

It is worth keeping in mind that a legal entity without employees will most likely not be able to function in practice, since in order for a business company to enter into legal relations, it must at least have a director appointed. Even if he does not have an employment contract (that is, if the director is the founder himself), then he, nevertheless, can be considered as an employee - since he will be considered an insured person in the pension, social and health insurance system.

The specified categories of business entities providing services are required to issue strict reporting forms to clients instead of online cash register receipts - in the manner prescribed by Decree of the Government of Russia dated May 6, 2008 No. 359.

- Individual entrepreneurs and legal entities that, without employees, conduct sales through vending machines.

There are no requirements for issuing documents alternative to checks.

Features of equipment and number of cash desks

How does an online cash register differ from a cash register calculator, except for the price?

The online cash register (CCT) has a fiscal drive (FN) (a storage medium like a flash drive). It encrypts information about the user's cash transactions. CCP can receive items from the commodity accounting system and print it on the receipt. CCTs are required to be used by all organizations and individual entrepreneurs, unless otherwise provided by Law 54-FZ.

The concept of cash register-calculator is used in two meanings:

- A cash register, which in appearance resembles a calculator: push-button, has no interface, with or without a small screen, has a Federal Law, which means it complies with 54-FZ.

- any cash register that can be used instead of an online cash register provided by Federal Law 54-FZ. Such a cash register may not have a FN. At the same time, it prints checks, which the seller is obliged to issue at the buyer’s request. If the cash register has a FN, then you need to set up a special mode at the cash register so as not to record fiscal data until the deadline for this has come by law.

You can get information about choosing equipment and ask relevant questions at the free webinar “How to choose cash register equipment for business on UTII and PSN?” The webinar will take place on March 28 at 11.00 (Moscow time).

Register to participate in the webinar “How to choose cash register equipment for business on UTII and PSN?”

How many cash registers will you have to buy when combining two taxation systems?

You can install one online cash register, but it must be able to work with two different tax systems. For example, the cash register module "Kontur.Market" successfully works with two taxation systems - the module generates two different receipts for goods sold under different tax regimes.

When fiscalizing cash register systems, indicate both systems, and when selling, generate two receipts.

Example. You sell motor oil on the simplified tax system and windshield washer fluid on UTII. You generate two checks: one for oil indicating the simplified taxation system, the second for liquid - indicating UTII.

A complete set for online cash register: for the price of a cash register you will receive a cash register, OFD and the Kontur.Market product accounting system Send a request

How many cash registers are needed for several types of activities?

The legislation does not prohibit the use of one cash register for several types of activities or for the sale of goods under several taxation systems.

The number of cash registers depends on the number of retail outlets. If the provision of services and the sale of goods occur at one point, you can use one cash register. One check can only indicate one taxation system, which means that the sale of goods and the provision of services must be issued with two different checks. At the same time, the cash register and the installed software (goods accounting system) must be able to work with several taxation systems.

Is a separate cash register needed for the pick-up point for online store orders?

Online stores that receive payment only by electronic means of payment (EPP) must use online checkout from July 1, 2018. The cash register may not have a receipt printing device (receipt printer), but must be able to send an electronic receipt to the buyer and to the tax office.

- If at the point of issue the employee does not accept payment, but only gives orders to the buyer, one cash register is enough for you.

- If the buyer pays for the goods at the point of delivery, there should also be an online cash register here. In addition to electronic checks, it should also generate paper ones.

Thus, it is possible to use one cash register for both electronic means of payment and for payments at the point of issue, if the cash register is capable of printing paper receipts.

Use the same logic to work with couriers:

- If the goods have already been paid for and the courier has just delivered it, the online store only needs a cash register that generates electronic receipts;

- If a courier delivers goods and takes money for it, he is obliged to generate a receipt on a mobile cash register and issue a paper receipt. That is, the courier must have his own cash register.

Let us remind you that electronic means of payment include payment applications for smartphones and websites, electronic wallets, client banks and other systems. (Clause 19 of Article No. 161-FZ “On the National Payment System”).

Postponement of the use of cash register until July 1, 2021 for individual entrepreneurs without employees

Federal Law 129-FZ dated 06.06.2019 On amendments to the Federal Law “On the use of cash register equipment when making payments in the Russian Federation” provides an exemption from the use of online cash registers until July 1, 2021 for individual entrepreneurs without employees when selling goods of their own production. , performance of work, provision of services. Comments on this topic are given in a SEPARATE ARTICLE.

Video - who can be exempt from online checkout until July 1, 2021:

For whom online cash registers are required from July 1, 2018

For many individual entrepreneurs, online cash registers became mandatory a year ago - from July 1, 2021. It was then that the innovation of 2021 affected individual entrepreneurs. However, for some individual entrepreneurs a deferment was introduced for another year, until 2021.

From July 1, such cash registers are required for the following individual entrepreneurs:

- those who are covered by the UTII system (online cash desks for individual entrepreneurs on the simplified tax system in 2021 should already be installed);

- those who work under the patent system;

- those who provide services to the population (except for those for whom there is a deferment until 2021);

- those who trade through machines.

During 2021 and 2021, entrepreneurs who have installed online cash registers will be able to take advantage of a special right to a tax deduction. Thanks to this deduction, they will be able to offset part of the costs of purchasing an expensive cash register. The maximum deduction amount for one cash register is 18 thousand rubles.

Preferential list of the Law on CCP

If the activities of an organization or entrepreneur are listed in Art. 2 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register systems”, then from July 1, the use of cash register equipment is not required. These types of activities include:

- sale of printed materials;

- sale of securities;

- sale of transport tickets;

- fair and market trade, etc.

However, if in carrying out these types of activities vending machines, payment terminals are used, or excisable products are sold, you will have to switch to cash registers.

There are two editions of the list: old and current. And if your activity is not found in the latest edition, although it was indicated in the previous one, from July 1 you are obliged to switch to cash register.