What does Form 1-IP include?

Form 1-IP was approved in Appendix 11 to Rosstat Order No. 419 dated July 22, 2019. Detailed instructions for filling out are also given there.

Since January 1, 2021, changes have appeared in the order; take them into account when drawing up the report. Using this form, entrepreneurs report on their work during the year - revenue, types of activities, number of employees.

The form itself is small. It includes a title page and a short five-item questionnaire. Let's look at the filling rules.

Filling rules

Instructions for completing Form No. 1-IP are set out in Appendix No. 14 to Rosstat Order No. 541 dated August 21, 2017. You can read them in detail by following the link. Fill out the form manually or using a printing device.

The information is entered in the appropriate fields of the form. Corrections, additions, and deletions are prohibited. It can only be filled out on the prescribed form.

Forms are available free of charge at Rosstat departments.

Filling out the first part:

- In the “Postal address of an individual entrepreneur” field, indicate the original place of residence, even if it does not coincide with the place of registration.

- In the corresponding columns of the table with which the first part ends, enter the code according to OKPO and TIN.

- In the “Individual Entrepreneur” field, enter the last name, first name and patronymic of the individual entrepreneur and sign.

Filling out the second part:

- When answering the first and second questions, you need to put an “x” in the appropriate boxes.

- In the second question, if the main activity (bringing the largest share of income) is carried out not at the place of registration, the entity in which it was carried out is entered in a special field.

- When answering the third question, the amount of revenue from all types of income in thousands of rubles is indicated on the line.

Payments actually received in the reporting year are taken into account.If there was no revenue, they put zero.

Determining the amount of revenue depends on various factors.

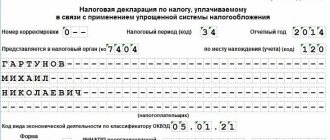

Title page

The title page of form 1-IP is standard for all business reports.

It is necessary to indicate the detailed address of the individual entrepreneur: subject of the Russian Federation, street, house, apartment and zip code. It happens that the actual and registration addresses differ, then you need to enter the details of the actual address.

Next, indicate the full name of the entrepreneur and sign.

A standard part with codes is also provided. It must indicate the TIN from the certificate and OKPO based on the notification of assignment of statistics codes.

Survey part

The text portion of the form contains five questions and several subquestions that must be answered. Let's consider them sequentially.

Question 1. The answer must be “YES” or “NO”. The choice depends on whether you were engaged in business in the reporting year. If yes, then check the appropriate box and move on to the third question.

If you did not conduct business or worked for the entire year for hire from other individual entrepreneurs or organizations, then move on to the second question.

Note! If you are running a business and at the same time working under an employment contract in another company or individual entrepreneur, then you need to answer “YES” to the first question and completely fill out the form in accordance with your business activity.

Question 2. This question is relevant only for entrepreneurs who did not engage in business at all in the reporting year. Here you need to indicate whether you were employed or did not do anything during the entire reporting year.

Question 3. In the answer to this question you need to indicate all your earnings from the business during the year, which you received for the sale of goods, work or services. The amount must include taxes and other mandatory fees.

If you were settled not with money, but in the form of property or the provision of barter services, then the amount of proceeds is calculated based on the transaction price. If it is not determined, then calculate the revenue at the market value of the products received.

If you carried out activities but did not earn anything, put “0” in the line.

Question 4. In your answer, list in as much detail as possible all types of products, works and services that you sold in the reporting year. This needs to be done by type of activity. For example, shoe production and wholesale footwear trade.

Important! If an individual entrepreneur, through his own distribution network or other establishments, sells goods of his own production to the public, then the proceeds from their sale should be classified as production activities. Trade in this case does not stand out.

Subquestion 4.1 assumes that next to each type of activity you indicate the share of revenue that it generated. This must be done as a percentage, in whole numbers. The sum of all lines under clause 4.1 must be equal to 100%.

If you fill out the report electronically, additionally indicate the type of activity code according to OKVED2.

Question 5: This question requires you to indicate the average number of people who worked for your business in the reporting year.

The average number is calculated as follows:

number of persons working in each month (including sick and vacation pay) / number of months of activity in the reporting period.

Round the result to a whole number.

All employees are usually divided into partners, family members and employees.

Partners are those who have contributed to the assets of the business and do some of the work. Ordinary investors who gave money but are not involved in any way in the activity are not included here.

Helping family members include those who work as an assistant in a business owned by a relative or household member.

Employees include persons who work for remuneration under a written or oral contract. Individual entrepreneurs who pay taxes for themselves are not included here.

Form 1-IP Sample filling

Form 1-IP - filling out

Under the general information about the form, the entrepreneur must indicate the postal address (zip code, registration address), in the line “Individual entrepreneur” indicate the full name and put a personal signature. A sample form 1-IP will be provided at the end of the article.

The following contains general information about the report: the year for which the information is submitted, the name of the form, an indication of who must submit it, the deadline for submission, as well as the OKPO code and the entrepreneur’s TIN.

The main part of the form consists of five questions (sections). We will provide a sample of filling out Form 1-IP at the end of the article. The first question that an entrepreneur must answer is whether the activity was carried out in the current year? There are two answer boxes to choose from: “Yes” or “No”. If no activity was carried out, the entrepreneur is o, and in this case the remaining columns of the form do not need to be filled out.

In the second question, the entrepreneur must answer whether he carries out his main activities in the same subject of the Russian Federation in which he was registered. If the address is different, you must indicate the place of main activity in a separate field.

Next, the entrepreneur needs to indicate the amount of revenue he received in the reporting year in all areas of activity (indicated in thousands of rubles). If payment was received in kind (for example, in the form of goods), then the amount of revenue will be determined based on the transaction price. If the transaction price cannot be determined, revenue will be determined based on market prices.

The fourth question of the Rosstat study, which an entrepreneur needs to answer, contains information about the types of activities that were actually carried out in the reporting year. All types of services (or manufactured products) that were produced by the individual entrepreneur in the reporting year should be listed. The answers to this question are recorded in each space provided in as much detail as possible. It is also necessary to indicate the share of revenue received from each type of activity (in percentage). To indicate this information in the 1-IP form, the form has several separate fields.

Next, the entrepreneur reflects how many people worked in his business - not only employees and partners are indicated, but also helping family members. The average number must be calculated separately for each category as follows: add the number of persons who worked in each calendar month and divide by the number of months the individual entrepreneur worked (if the individual entrepreneur worked for a full year, then divide by 12). Data obtained in this way must be rounded to the nearest whole number.

When filling out this item, it is very important to correctly divide employees into categories. Thus, individual entrepreneurs who have entered into a civil law agreement with an entrepreneur and pay their own taxes cannot be considered employees. In general, employees are considered to be citizens who perform work for a certain fee on the basis of both a written contract and an oral agreement.

Who submits Form 1-IP

Individual entrepreneurs report on their activities using Form 1-IP. It is taken by all businessmen who have duly registered and received individual entrepreneur status.

The exception is entrepreneurs in retail trade. Another form is provided for them - 1-IP (trade). But entrepreneurs who retail cars, motorcycles and other vehicles must also submit information using the usual 1-IP form.

Written research on the work of entrepreneurs is carried out selectively. Not all individual entrepreneurs are included in it, but only a part - that is, you do not have to report annually.

If you are included in the sample, the statistical authorities will send you a letter in which they will tell you about the need to report. But it happens that it is not sent. This circumstance does not exempt you from the obligation and penalties for late reports, so check the need to report yourself in the Rosstat service. Another option is to call your statistical office and ask if you are on the list.

Once every five years, Rosstat arranges a comprehensive survey and requires all individual entrepreneurs to report on the form. The last time it was held was in 2021. If nothing changes, the next full business study will begin in 2021.

Form 1-IP auto cargo transportation activity - Bryanskstat

Form 1-IP for 2021, standard for filling out instructions for filling out the annual form 1-IP in 2021, approved by Rosstat order 541. - download form n 1-IP (truck cargo) - survey questionnaire for personal businessmen. If you need legal advice, we recommend that you obtain it by calling the numbers listed above, or see our newest article for the 2021 tax calendar. N 195-FZ, as well as Article 3 of the Law of the Russian Federation dated 13.

Okud 0609045 form 1-ip (month) main information about personal activities.

On questions of filling out and submitting federal statistical forms. Form 1-IP for 2021 free of charge (in excel).

All small enterprises, with the exception of micro-businesses, carrying out road freight transportation on a commercial basis, must submit the designated form to the territorial offices of Rosstat. The 2021 production calendar with holidays and weekends has been approved. With its help, you can quickly find known documents.

So when citizens submit reports to this office, ask for a paper from their nickname with a seal that they accepted them.

The 1-IP auto cargo questionnaire is quite simple in its content. But the Federal Tax Service Inspectorate establishes its own rules for the preparation of documents, approved by legislation.

When and where to submit form 1-IP

Only those included in the sample will submit the 1-IP report for 2021 to Rosstat. This must be done once - before March 2, 2021. This day falls on Monday, so the deadline will not be postponed.

If by this time you have not appeared on the list of those required to submit a report, then you can relax. This year the examination will not affect you.

The form can be submitted in paper or electronic form. The place of delivery is the territorial body of Rosstat for the subject, which is attached to the address of the individual entrepreneur.

Who submits form 1-IP (motor cargo) and when?

Form 1-IP (truck), along with instructions for filling it out, was approved by Rosstat order No. 527 dated August 19, 2014 as a quarterly report.

It must be filled out by individual entrepreneurs who carry out cargo transportation by road as a commercial activity. This form is distinguished from most other statistical reports by:

- the need to enter data into it not for the entire quarter, but only for 1 week of it;

- lack of indication of the deadline for delivery of 1-IP (truck cargo) in days and linking it to any specific event.

Both parameters are determined by the territorial body of Rosstat, which sends a form to the individual entrepreneur with information about the start and end dates of the survey period. And the same body must indicate what exactly the deadline for submitting 1-IP (vehicle cargo) in 2021 will be in relation to the survey quarter.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Penalties

Rosstat treats its reporting as strictly as tax reporting. For violation of the delivery procedure, late deadlines or provision of incorrect information, you will have to bear responsibility under the Code of Administrative Offenses of the Russian Federation.

Article 13.19 of the Code of Administrative Offenses provides for a fine for officials of 10-20 thousand rubles. If you commit a violation again, the fine will increase significantly and amount to 30-50 thousand rubles.

Law of the Russian Federation dated May 13, 1992 No. 2761-I provides that the violator is obliged to compensate the statistical authorities for the damage caused if he was late with the report or submitted incorrect data. In this case, Rosstat will have to make corrections to the final consolidated statements, and they will be required to compensate for this.

Zero report 1-IP

It happens that an entrepreneur has just registered and has not started working, but is already included in Rosstat’s sample. In this case, you will still have to report - fill out a zero report.

If you did not conduct business, you must fill out the title page and answer the question about conducting business in the reporting year.

Next, check the box that corresponds to the answer to the question “Did you work for hire?” If not, then the survey is completed - sign the form and submit it to Rosstat.

Entrepreneurs who do not work temporarily or have stopped working for a certain period of the reporting year report in accordance with the general procedure. Questions must be answered in accordance with the period in which the activity was carried out.