Note! tax regime has been abolished since 2021 in all regions . Payers of UTII need to choose another taxation option.

Will the UTII regime be abolished in 2021? This issue is still the subject of debate, although the Ministry of Finance assures that there is no longer any chance of imputation. But the fact is that the law of June 29, 2012 No. 97-FZ, which terminates this regime, has already been amended. And thanks to them, the abolition of UTII was previously postponed - from 2021 to 2021.

It is unclear what will happen this time. The situation with the coronavirus pandemic has had a very negative impact on small businesses, which mainly worked on imputation. Is it worth further worsening the conditions for business activity, forcing small retail and household services to switch to other modes?

The latest news encouraging UTII payers came only for Crimea, where this taxation system was extended until 2024. In addition, back in mid-February of this year, deputies of the Legislative Assembly of the Jewish Autonomous Region introduced a bill to the State Duma to extend imputation for 3 years.

However, the Federal Tax Service proceeds from the fact that the abolition of UTII from 2021 is a finally resolved issue. Therefore, there is now an active campaign to notify payers of this regime.

In accordance with letter dated March 11, 2021 N AB-4-19 / [email protected], the tax service uses different sources for this:

- information posters and brochures in tax offices;

- messages through personal accounts of organizations and individual entrepreneurs, through electronic document management and TCS operators;

- service for choosing a suitable taxation regime instead of UTII, posted on the Federal Tax Service website;

- publications and explanations in the media;

- outdoor street advertising.

Let us remind you that the partial abolition of UTII occurred in 2021, because this regime can no longer be used for the sale of certain labeled goods: shoes, clothing and fur products, medicines.

Will UTII be canceled in 2021? Last news

Special bills are not needed to abolish UTII. The duration of the special regime is limited by law. On January 1, 2021, UTII will cease to operate automatically: Part 8 of Art. 5 97-FZ dated June 29, 2012. This is not news: this has been known for 3 years.

UTII approached a similar deadline twice. It was supposed to disappear in 2014, then in 2021. Each time the cancellation was postponed. Entrepreneurs were expecting another transfer, but it seems that it will not happen.

In July, Finance Minister Anton Siluanov made a report at the Federation Council. He stated that the ministry does not plan to renew the UTII. Business Ombudsman Boris Titov proposed postponing the cancellation until 2024. Here is a report from the Stolypin Institute, which he heads.

The proposal was answered negatively. The head of the Federal Tax Service, Mikhail Mishustin, said that UTII is an outdated form of taxation. He was supported by the head of the State Duma Committee on Budget and Tax Policy Andrei Makarov.

Positive aspects of canceling UTII

Entrepreneurs do not see anything good in the latest news about the abolition of UTII from 2021. Instead of this tax regime, businessmen are offered a patent system, which, firstly, is more expensive, and secondly, it is structured differently.

For example, if an entrepreneur could hire up to one hundred employees under imputation, a patent allows him to hire only 15 people.

It seems that there are no advantages for taxpayers in these legislative changes. One thing is certain: there are advantages for the State in the fact that UTII is being abolished.

Now the Tax Service will be able to more strictly control the turnover of small businesses. It is too early to talk about increasing the treasury: some analysts predict that the end of UTII will most likely lead to small enterprises closing.

Why is UTII being cancelled? Officials' arguments

— UTII is a tax that was introduced in 1998 on the principle of “better than nothing.” Times have changed: tax programs have become smarter, businesses have switched to online cash registers. The tax office knows the real income and will demand a percentage of it.

— UTII is an unfair tax. Companies using the simplified tax system pay much more. Imputed income is on average 27 times less than real income.

— UTII is suitable for gray schemes. Firms reduce VAT when they send goods through a chain of one-day products. If the end buyer uses UTII, there will be savings on income tax.

Governmental support"

Due to the epidemiological situation, in the latest news you can read about the extension of UTII until 2024. Although these are rumors, they have one source: the State Duma is considering several bills at once:

- on extension until 2025 (No. 1013197-7);

- on extension until 2024 (No. 1003319-7);

- on extension until 2024 (No. 1033331-7).

Entrepreneurs are happy that the possible entry into force of these projects is just a delay: sooner or later the imputation will cease to be applied, and the transition to another regime will remain only a matter of time.

Cancellation of UTII in 2021: labeled goods

UTII cannot be used in 2021 if you sell medicines, shoes or clothes made from natural fur. The Ministry of Finance has allowed to separate accounting: you can pay for fur coats using the simplified tax system, and for down jackets - UTII.

Medicines and clothing are already marked, so selling them on UTII is prohibited. Trade in unmarked shoes is allowed until March 1.

All other marked products allow you to apply UTII until 2021.

What to do?

If you do nothing, from January 1, 2021 you will find yourself on the general tax system (OSNO). OSNO has high taxes and complex accounting. If you combine UTII with the simplified tax system, you will remain on the simplified tax system. In any case, think about the transition in advance and calculate how much taxes you will pay.

Please note: you cannot switch to a patent, even if it is suitable for your type of activity. Labeled goods do not allow it to be used in the same way as UTII.

What remains is the simplified tax system. Compare the conditions on “Income” and “Income minus expenses”. During 2021, submit an application to switch to the simplified tax system. If you switch from “Income” to “Income minus expenses” or vice versa, submit an application too.

At the same time, do not forget to deregister under UTII.

Example 1: transition to simplified tax system

Podkabluchnik LLC sells boots and shoes. The company combines simplified taxation system and UTII. The owner is aware of tax news. He is ready to apply only the simplified tax system from 2021.

Example 2: refusal to sell labeled goods

Olya sells clothes on UTII. There aren't many shoes in her store. She decided to give it up completely and stay on the lucrative special regime. At the same time, I avoided fussing with labeling.

Example 3: Selling other branded products

Alexey owns a grocery store on UTII. He also sells labeled cigarettes. This does not deprive him of the right to apply UTII: the store will continue to pay taxes as before.

When switching to the simplified tax system “Income minus expenses”, take into account an important feature. It will not be possible to reduce the tax on expenses if goods were purchased while working on UTII.

Letter of the Ministry of Finance No. 03-11-11/27126 dated 04/23/2018.

Results

If UTII is indeed abolished in 2021, it is necessary to switch to a new preferential regime in time. Organizations and individual entrepreneurs that do not inform about the choice of another taxation system instead of UTII will automatically end up on the common system. OSNO has the highest tax rates and complex reporting.

For your convenience, we have compiled in a table the main features of each preferential regime and the transition period.

| Mode | Peculiarities | Transition date |

| PSN | Available only for individual entrepreneurs. Limited types of activities, the main of which are household services, retail on an area of up to 50 sq. meters (they promise to increase the limit to 150 sq. meters) One patent is valid in one municipality. | 10 working days before the patent expires |

| NAP | Only individuals – self-employed and individual entrepreneurs – have the right to apply. The lowest income limit, a ban on hired workers, types of activities - services, works and the sale of goods of their own making. | Anytime |

| simplified tax system | Available to almost all organizations and individual entrepreneurs, high limits on income and employees, almost all types of activities are permitted. You can select the object of taxation. | No later than December 31 of the current year |

| Unified agricultural tax | Allowed only for organizations and individual entrepreneurs working in agriculture and fishing. There are additional regional benefits and subsidies; the rate can be reduced to 0%. You can get a VAT exemption, there is no income limit. | No later than December 31 of the current year |

General Tips

For some types of activities there are, one might say, typical tax systems , let's talk a little about them. The simplest example is trading. If you are engaged in trade and purchase all goods officially, then with a high degree of probability the simplified tax system (income minus expenses) will suit you. The same goes for catering services. If you have a serious cost component, then you need to look in the direction of the simplified tax system of 15%.

If you do not incur any costs other than your time and effort, then your choice is the simplified tax system (income). These are primarily those who provide household services to the population, rent out premises, and provide transport services. And if you mainly work with individuals, then you can think about becoming self-employed, this will save 2% of your income (the rate for working with individuals is 4%, not 6%). But this option should only be considered if you are subject to the restrictions associated with working as a self-employed person.

We didn’t say anything about a patent here, because... a patent should be considered as a possible replacement for UTII in any case. No matter what you do, the first thing to do is look at how much a patent will cost you.

We hope you learned something useful from our article. If you still have any questions, ask them in the comments, we will try to help with advice. And we will be very glad if you subscribe to our blog. Thank you for your attention and have a nice day!

Patent

So. The first candidate to replace UTII is a patent. We decided to start with it, because... it is as similar as possible to UTII, and it seems to us that under certain conditions, the majority of UTII payers will switch to a patent. The most basic thing you need to know about a patent is that it acts similarly to UTII, i.e. When calculating tax, real income does not play a role.

A few words about the differences between UTII and a patent. A patent can only be used by individual entrepreneurs. You do not need to submit any declarations for a patent, you only need to buy a new patent once a year. And the most unpleasant thing is that insurance premiums cannot be deducted from the cost of the patent. But there is a chance that this will be fixed by the end of 2021; we recently released a short video on this topic. Below is a table with a more detailed comparison of UTII and patent.

simplified tax system (income)

Now let's take a look at the simplified tax system (income). In this taxation system, tax is paid on the income actually received without taking into account expenses. The standard rate is 6%, but regions can set it lower (the current rate for your region can be found in your tax office or by calling the Federal Tax Service hotline). The declaration under the simplified tax system is submitted once a year, and the tax is paid every quarter. Insurance premiums can be deducted from the simplified tax system in the same way as UTII, i.e. Individual entrepreneurs without employees can reduce their simplified tax system even to zero. Let's calculate how much an entrepreneur without employees needs to earn in order for his tax to be greater than zero.

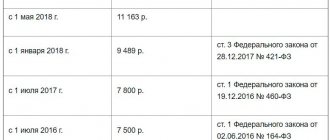

In 2021, fixed insurance premiums for individual entrepreneurs will be in the amount of 40,874 rubles. Those. an entrepreneur without employees can reduce the simplified tax system of 6% by 40,874 rubles. Let's remember the school curriculum and solve a simple equation:

INCOME * 0.06 - 40874 = 0

INCOME * 0.06 = 40874

INCOME = 40874 / 0.06

INCOME = 681,233

It turns out that if your annual income is 680 thousand rubles, then you do not pay the simplified tax system at all. This is approximately 56.5 thousand per month. Below is a table with a more detailed comparison.

Is the product labeled? This is not retail!

Having complicated the use of UTII for retail trade, legislators have simultaneously expanded the list of goods the sale of which is not considered retail.

Thus, from 01/01/2020, retail sales of goods subject to mandatory labeling are not considered. This is an innovation in Art. 346.27 of the Tax Code of the Russian Federation was also introduced by the Law “On Amendments to the Tax Code of the Russian Federation” No. 325-FZ.

Therefore, when analyzing the possibility of remaining on UTII for retail trade in 2021, check whether your goods are subject to mandatory labeling.

You can find out which products are subject to labeling from our publication.

And you can read about innovations in the labeling of shoes and tobacco products from 07/01/2020 in the Review from ConsultantPlus. Trial access to the legal system is free.

Deadline for payment of UTII for the 4th quarter of 2021

Taking into account non-working days, the payment date for the last, fourth, quarter of 2021 is no later than January 25, 2021, when UTII will no longer be valid. In case of delay, penalties will be charged for each day of delay:

- based on 1/300 of the refinancing rate of the debt amount (delay up to 30 days);

- based on 1/150 of the refinancing rate of the debt amount (delay more than 31 days).

In addition, if the debt was discovered as a result of an inspection by the Federal Tax Service, the entrepreneur will be fined at least 20 percent of the debt amount.

Pros and cons of PSN

| PSN | |

| Advantages | Flaws |

| Possibility of purchasing for any number of months within a calendar year: for a month, three, five months, etc. | A patent is valid only in the territory where it was issued |

| Possibility of early termination of activities | The patent applies only to those types of activities for which it was issued |

| The cost of a patent does not depend on the amount of revenue - a fixed tax rate | The need to keep a book of income for each patent; you don’t need to hand it in, but it will be required if an audit comes |

| Installment payment of tax | You cannot work with marked goods |

| No tax return | |

Professional Income Tax (PIT)

And the last contender to replace UTII is the Professional Income Tax. We are all used to calling it the self-employed tax. The first thing worth saying about NAP is that it is not a taxation system. It's more of a form of doing business. Only a person can become self-employed; it is impossible to transfer a company to pay NAP. Moreover, a person cannot pay taxes as an individual entrepreneur and as a self-employed person at the same time.

Self-employed people have many restrictions. Firstly, the NAP payer cannot earn more than 2.4 million rubles per year. This is 200 thousand per month. In addition, when working as an self-employed person, a wide range of activities will be prohibited for you. If we reduce all the restrictions to one sentence, we can say that the self-employed are allowed to provide services and sell goods of their own production. Below is a complete list of restrictions on activities.

The tax is calculated on the income actually received without taking into account expenses (similar to the simplified tax system 6%). The tax rate when working with legal entities is 6%, and when working with individuals - 4%. Self-employed people do not submit any declarations, but only register all their sales in a special mobile application. The tax amount is calculated every month by the Federal Tax Service and offers to pay through the same application. A table with a more detailed comparison is below.

Application criteria

At the end of November this year, significant changes were made to the rules for applying PSN. Russian President Vladimir Putin signed Federal Law No. 373-FZ of November 23, 2020, according to which adjustments are made to Chapters 26-2 and 26-5 of Part Two of the Tax Code of the Russian Federation and Article 2 of the Federal Law on the application of CCP.

One of the main changes is an increase in the list of activities for which PSN can be applied, by clarifying the application criteria. Under what criteria can PSN be used now?

—

Only individual entrepreneurs can use PSN. Organizations cannot.

—

The use of PSN is possible only in those constituent entities of the Russian Federation where this tax regime is established by regional legislation (clause 1 of Article 346.43 of the Tax Code of the Russian Federation).

—

The number of employees should be no more than 15 people.

—

Income should be no more than 60 million rubles. in year.

—

No more than 150 km. m. – area of the trading floor.

—

The patent validity period is from 1 to 12 months.

The cost of a patent can also be clarified using the formula found in the above-mentioned Federal Law. At the same time, an individual entrepreneur without employees will be able to reduce the cost of a patent by the amount of contributions that he paid for himself, and individual entrepreneurs will be able to reduce the tax on contributions by no more than 50%.

Application of a patent in different territories

Another interesting topic for discussion concerned the use of PSN in different territories (in different regions). A patent is applied for one type of activity in a specific territory, explained Sergei Anisimov. A patent must be purchased for activities within one municipality; if activities are carried out in different regions, then a separate patent must be purchased for each region.

Moreover, if an entrepreneur is engaged in cargo transportation between regions, then he can purchase one patent (letter of the Ministry of Finance dated October 11, 2019 No. 03-11-11/78446). But the place where the contract is concluded must be the “home” region where the individual entrepreneur is registered.