Transferring unused property to conservation

Conservation is the transfer of assets to a state that will allow them to remain serviceable after a specified period of time. Can be preserved:

- objects of unfinished construction - if there are no funds to continue construction or it is not practical to invest them at the moment;

- both technological complexes and parts of the whole;

- ready-made fixed assets – if they are not planned to be used for at least 3 months.

IMPORTANT! This procedure can be performed on the basis of clause 23 of PBU 6/01 “Accounting for fixed assets” and p.

3 tbsp. 256 Tax Code of the Russian Federation.

Preservation procedure

Transfer to conservation is done in accordance with the decision of the management of the enterprise or, if the property is state-owned, by the relevant decree of the ministry.

The procedure for conservation and re-preservation is adopted by an internal decision of the management of a particular organization and is fixed by local regulations. An act on the transfer of a fixed asset object to conservation must be drawn up and signed (there is no standard form, it needs to be approved). The act is signed by a commission that management established by order. The act must necessarily reflect:

- name of the unused asset;

- its inventory number;

- the initial cost at which the fixed assets were accepted onto the balance sheet;

- the amount of depreciation that has already been accrued on it;

- reasons for conservation;

- term of future re-opening;

- signatures of the commission members.

Accounting for mothballed OS

Expenses for the maintenance of unused fixed assets, including those transferred to conservation, are classified as other, they should be reflected in account 91 “Other expenses”.

When depreciation is lost

There is no need to temporarily charge depreciation on unused property if one of the following conditions is met:

- if conservation is for more than 3 months;

- repair (restoration) lasts longer than a year;

- modernization (reconstruction) will take longer than 12 months;

- the property was transferred under a contract for free use (this is no longer conservation).

If the temporary downtime is shorter, is not economically justified, or is not registered as conservation, depreciation is accrued in the usual manner.

During conservation, the useful life of a fixed asset increases for the period until it was used.

NOTE! If not all the fixed assets were mothballed, but only part of it, while the remaining parts continue to take part in the activities of the enterprise, depreciation is not charged on the entire fixed assets, although it is listed on the balance sheet as a single whole. For example, in a building that is in use, one floor is closed for renovation, while the rest continue to function

Tax accounting for conservation

Taxes are paid on the funds used to generate income. On the one hand, fixed assets continue to be on the balance sheet and are the property of the enterprise. On the other hand, due to downtime, they are not directly used to extract economic benefits.

If depreciation continues to accrue on an unused fixed asset, it can be taken into account to reduce the tax base for income tax (clause 1 of Article 252 of the Tax Code of the Russian Federation), since these expenses:

- economically justified;

- documented;

- aimed at future income generation (after all, the asset will later be reactivated).

Once decommissioning has occurred, depreciation should be calculated as it was before, before the outage began.

Temporary roofing

Construction may stop during the construction of walls and interfloor ceilings. In this case, it is necessary to protect horizontal sections of the structure from precipitation. This is especially true in cases where the walls are made of slotted bricks or are multi-layered (for example, stone and concrete blocks are combined). It is necessary to put together a lattice of boards over the unfinished building. It is covered with roofing felt on top. This is a temporary roof. You can also build a rafter structure with a sheathing of uncut boards and cover it with roofing felt on top. There is no need to cover the outside walls with anything. Nothing will happen to facing or rough brickwork in winter. Water will drain from vertical surfaces. And the moisture that the pores do absorb has an insignificant volume. Therefore, it will not cause destruction.

Decision on conservation of an object

Letter of the Federal Tax Service No. SD-4-3/ [email protected] dated 08/27/2018

The Federal Tax Service reviewed the letter of the Federal Tax Service of Russia (hereinafter referred to as the letter of the Office) on the methodological issue planned to be reflected in the on-site tax audit report, and reports the following.

From the letter of the Department it follows that the taxpayer, in violation of subparagraph 8 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), took into account as part of non-operating expenses the cost of costs associated with the creation of an unfinished construction project, which, by decision of the taxpayer (minutes of the meeting on financial economic activity of the company) is subject to partial dismantling with the subsequent construction of a new purpose facility.

Article 252 of the Code provides that the taxpayer reduces income received by the amount of expenses incurred (except for expenses specified in Article 270 of the Code).

Expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Code, losses) incurred (incurred) by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were made, and (or) documents indirectly confirming expenses incurred (including customs declaration, business trip order, travel documents, report on work performed in accordance with the contract). Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

In accordance with subparagraph 8 of paragraph 1 of Article 265 of the Code, non-operating expenses not related to production and sales include reasonable costs for carrying out activities not directly related to production and (or) sales, in particular the costs of liquidating fixed assets being decommissioned , for write-off of intangible assets, including amounts of depreciation underaccrued in accordance with the established useful life, as well as expenses for the liquidation of unfinished construction projects and other property whose installation has not been completed (costs of dismantling, disassembly, removal of disassembled property), subsoil protection and others similar work, unless otherwise established by Article 267.4 of the Code.

Paragraph 5 of Article 270 of the Code establishes that when determining the tax base, expenses for the acquisition and (or) creation of depreciable property, as well as expenses incurred in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment of fixed assets, are not taken into account, with the exception of expenses in in the form of a depreciation bonus provided for in paragraph 9 of Article 258 of the Code.

Thus, on the basis of subparagraph 8 of paragraph 1 of Article 265 of the Code, the taxpayer has the right to take into account as non-operating expenses only the costs of liquidating these unfinished construction projects and other property, the installation of which has not been completed.

The expenses listed in the letter of the Department (construction and installation works, design and estimate documentation, project management services, research, insurance, construction and installation works, electricity supply) are the costs of forming the initial cost of the disputed object, and are not related to the actual liquidation of this object (dismantling, dismantling, removal of disassembled property).

Taking into account the above, if the liquidation (partial liquidation) of an unfinished construction object is carried out in the process of creating a new object of depreciable property, then for profit tax purposes the amount of costs that form the cost of the liquidated object of unfinished construction is subject to inclusion in the initial cost of the created object, in that part in which this unfinished construction facility will be used to create a new facility (this position is confirmed by the Resolution of the Arbitration Court of the East Siberian District dated September 29, 2017 No. F02-5060/2017 in case No. A19-22028/2016).

Acting State Advisor of the Russian Federation, 3rd class D.S. Satin

Expert commentary

Why do you need to preserve your house?

Conservation of a structure is a set of measures aimed at preventing damage, future destruction or deterioration of the parameters of communications, equipment and the building itself. In addition, conservation can ensure the safety of people and the environment. This means that the construction site and the unfinished building must be in a condition that guarantees their stability, strength characteristics and safety (for materials, structures, equipment). This requirement is stated in the Rules, which are approved by decree of the Russian government (approved by order No. 802).

Conservation is a necessary measure that is implemented in the absence of funds to continue work, as well as during the rainy or winter season, when materials deteriorate due to low temperatures and other negative factors.

Only fixed assets can be preserved

The concept of conservation in accounting and tax accounting is applicable only to fixed assets. If an object does not meet all the requirements of clause 4 of PBU 6/01, then there is no need to talk about its conservation. For example, objects that cannot be used in the provision of services (are in disrepair, subject to demolition, purchased for reconstruction, etc.) cannot be reflected on account 01. Until they are brought into a condition suitable for use, the cost such property remains on account 08.

This is confirmed by clause 5.2.3 of the Regulations on accounting for long-term investments, approved by Letter of the Ministry of Finance of Russia dated December 30, 1993 N 160, according to which acquired buildings and structures are included in fixed assets upon their receipt by the enterprise and completion of work to bring them to the condition in which they are suitable for use for the intended purposes, on the basis of the acceptance certificate of fixed assets. Financiers came to similar conclusions in Letter dated 09/04/2007 N 03-05-06-01/98: if the acquired building is not in use and requires capital investments, which must be confirmed by administrative documents for the organization, a contract agreement for construction work to bring it to condition , in which the building is suitable for use for the planned purposes, then this real estate object is not subject to taxation until it is transferred to fixed assets, since it does not simultaneously meet the requirements of paragraph 4 of PBU 6/01 (see also Letter of the Ministry of Finance of Russia dated May 29, 2006 N 03-06-01-04/107).

This is exactly the situation that arose in one of the enterprises in the health sector, which in 1998 received property as a contribution to the authorized capital and did not use it until 2006 (the property was subject to reconstruction). The arbitrators decided that if the acquired real estate requires reconstruction or is subject to demolition, then they cannot be taken into account as fixed assets, therefore they recognized the additional assessment of property tax for the entire past period as unlawful (Resolution of the Federal Antimonopoly Service of the Moscow Region dated October 1, 2009 N KA-A41 /10020-09).

It must be taken into account that if the property is in principle ready for operation (even if not for the intended purpose) and was actually operated by the previous owners, then even with the intention to reconstruct the object and change its purpose, the organization is obliged to register such an object as part of fixed assets (Resolutions of the Presidium Supreme Arbitration Court of the Russian Federation dated 04/08/2008 N 16078/07, FAS SKO dated 07/21/2009 N A32-20402/2008-58/368, FAS BBO dated 01/22/2008 N A12-11490/07-C51). Before reconstruction, it is advisable to transfer it to conservation (if the property is not used in the organization’s activities).

S.N. Kozyreva

Journal expert

"Tourist and hotel services:

accounting and taxation"

Protection of buildings and structures during downtime

The court, agreeing with the position of the prosecutor, assigned the obligation to the educational institution to repair the school, and the municipality to finance the said work.

DEBIT 20 “Main production” CREDIT 10 “Materials”, 70 “Calculations with personnel for wages”, 69 “Calculations for social security and insurance”, etc.

Accounting for the costs of construction in progress is carried out on the account “Investments in non-current assets” (sub-account “Construction of fixed assets”) and is carried out for objects from the start of work until the buildings are put into operation. After this, they are included in fixed assets as separate inventory buildings, structures and equipment. List of unused and subject to conservation (storage) equipment, materials and structures. The standard form of the Statement is given in Appendix 2.

What a tenant needs to check in a draft real estate lease agreement

Subject of the agreement

Before concluding a contract, you need to check:

1. description of real estate;

2. area of transferred property;

3. legal title of the lessor (whether the leased object belongs to him);

4. purpose of use of the real estate;

5. possible encumbrances of the leased object.

Description of the rental object

state registration of rights to real estate;

technical accounting of real estate (BTI documents).

Documents of state registration of rights to real estate include an extract from the Unified State Register of Real Estate (USRN) and a certificate of state registration of rights. Until July 15, 2021, Rosreestr issued paper certificates. But from this date, Rosreestr stopped issuing certificates of state registration of rights.

Rights and obligations of the parties

2

The tenant should pay attention to four conditions. Method 2: obtain the landlord’s consent for each sublease of property

This method is less convenient for the tenant. But landlords most often agree to this. It is better to stipulate in the agreement the procedure for the landlord to consider the tenant’s request for the possibility of subletting the premises or part of it. In this case, the procedure for giving consent to sublease will not be indefinite in time.

Method 2

: obtain the consent of the lessor for each transfer of property for sublease. This method is less convenient for the tenant. But landlords most often agree to this. It is better to stipulate in the agreement the procedure for the landlord to consider the tenant’s request for the possibility of subletting the premises or part of it. In this case, the procedure for giving consent to sublease will not be indefinite in time.

An example of the terms of a lease agreement on the procedure for the lessor to give consent to the transfer of property for sublease

“When the Tenant requests to sublease the Premises or part thereof, the Landlord is obliged to notify the Tenant of his decision within 5 (five) working days.”

Landlords often indicate in the agreement that the tenant does not have the right to reimburse the cost of inseparable improvements: “Upon termination of the Agreement, the Tenant undertakes to transfer the premises to the Landlord along with all inseparable improvements made in the premises without reimbursement of their cost.” Such conditions are contrary to the interests of the tenant. Therefore, they must be excluded from the text of the draft agreement.

the tenant properly fulfilled his obligations under the contract;

otherwise is not provided by law or contract.

Thus, the tenant needs to ensure that in the contract:

there was no clause stating that the tenant does not have a pre-emptive right to enter into an agreement for a new term, and

a period was specified during which the tenant could exercise his pre-emptive right to conclude a new contract (for example, no later than 30 calendar days before the end of the lease term).

Alexander Sorokin answers,

Deputy Head of the Operational Control Department of the Federal Tax Service of Russia

What documents should the organization have?

In order to organize operational control of buildings and structures, the employer appoints responsible persons and commission members.

In the regulations on the procedure for technical operation and inspection of buildings and structures, the employer distributes in detail the responsibilities and main functions of those responsible, and also determines the procedure for carrying out inspections and inspections. Also, the organization that operates buildings and structures maintains a technical journal and issues inspection reports.

The technical journal for the operation of buildings and structures records identified faults and damage, as well as the technical condition of the elements. The inspection report is drawn up in any form and reflects the results of general checks of the condition of buildings and structures.

Single inventory object

As representatives of the Ministry of Finance of Russia indicated in Letter No. 03-03-06/1/8 dated January 16, 2008, if in accounting a building is accounted for as a single object of fixed assets, then in tax accounting it is an object of depreciable property as a whole. And in this situation, from the moment the order is issued to begin partial reconstruction of the building, depreciation on it is not accrued as a whole until the completion of the relevant work. Consequently, we can conclude that similar consequences occur when part of such a building is conserved.

According to clause 6 of PBU 6/01, the accounting unit of fixed assets is an inventory item. This is recognized as:

- object with all fixtures and fittings;

- a separate structurally isolated object designed to perform certain independent functions;

- a separate complex of structurally articulated objects, representing a single whole, which is intended to perform a specific job. A complex of structurally articulated objects is understood as one or more objects of the same or different purposes, which have common devices and accessories, common control and are mounted on the same foundation. As a result, each item included in the complex is capable of performing its functions only as part of this complex, and not independently.

Moreover, only if one object has several parts, the useful lives of which differ significantly, each such part is taken into account as an independent inventory object.

Based on this, the Ministry of Finance, in its explanations regarding real estate objects, to which the building belongs, indicates that their components can be taken into account as independent inventory objects if:

- such property does not require installation;

- it can be used separately from the property complex;

- its purpose does not coincide with the functional purpose of the entire complex;

- its dismantling will not affect their purpose.

These criteria, in particular, include elevators, built-in ventilation systems, local networks, and other building communications (Letters of the Ministry of Finance of Russia dated October 23, 2009 N 03-03-06/2/203, dated September 23, 2008 N 03- 05-05-01/57).

In addition, for tax accounting purposes, financiers appeal to the Classification of fixed assets, approved by Decree of the Government of the Russian Federation of January 1, 2002 N 1. The presence in it of different useful life periods of parts of the operating system, such as, for example, an elevator and a building, they indicate, may indicate about the possibility of independent accounting of these objects. It is this approach that the judges support (Resolutions of the FAS Moscow District dated September 16, 2011 in case No. A40-130812/10-127-755, dated January 21, 2011 N KA-A40/16849-10, FAS Ural District dated February 17 2010 N Ф09-564/10-С3; FAS Volga District dated January 26, 2010 in case N A65-8600/2009; FAS Central District dated September 10, 2009 in case N A08-8752/2008-16) . However, such parts of the OS as individual premises of the building (levels, floors) are not named in the Classification.

In this sense, the building for which a single certificate of ownership has been issued (is being issued), which is a single object according to technical documentation, with a single cadastral number, by and large, should be taken into account as a single object in both accounting and tax accounting. And the company has no right to divide it only on the basis of conservation of its individual premises. This means that in this case, depreciation should be suspended for the building as a whole.

On the other hand, nothing prevents the organization from dividing the building, including in accounting, by re-registering the ownership rights to it as separate premises.

O. Kutko

..

.., …

thirty ( - ). , ( – ) , (. 4 . 52 ). (). (.,: 05.08.2010 N 55-3166/2010; 05.05.2010 N -40/4207-10 N 40-144904/09-17-1143). ( , , ) .

, . , .

, , . , . , () , , , .

() . :

- (. 9 ) ;

- , ;

- ;

- , . ().

() , :

- , . , , ;

- . , , , (. 7 ).

10 () , , . , .

, , , . , (. 752 ). , , , . . . . (.,: 08/18/2011 N -10809/11 N 40-50133/09-19-361, 05/04/2010 N 17-3321/2010- N 60-53406/2009).

, , (). , . . , ( ).

, , ( ).

Accompanying documents

In addition to the inventory, to formalize the conservation of a building, an act of suspension of construction is required, which is drawn up according to form No. KS-17, approved by Resolution of the State Statistics Committee of the Russian Federation dated November 11, 1999 No. 100 “On approval of unified forms of primary accounting documentation for accounting of work in capital construction and repair- construction work." It reflects:

- Name and purpose of the building/structure whose construction is suspended;

- Construction start date;

- Estimated cost of work under the contract;

- The actual cost of work at the time of closure of the facility;

- Customer expenses;

- Expenses for conservation and security measures.

Based on the act, an estimate of the upcoming work is drawn up.

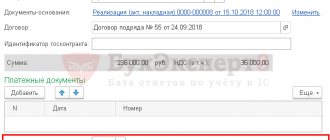

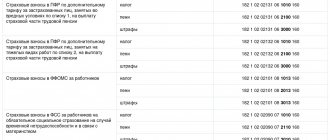

Based on the results of the calculations, the customer’s accounting department makes payments to the contractor. Specialists work with company accounts and submit reports to supervisory authorities.

Main goal pursued

The highest priority should be protection from moisture. Why? As you know, water, when it turns into ice, increases in volume. If you do not protect the joints and seams from moisture, then the structural elements will begin to collapse and deform after the onset of frost. To protect against precipitation, temporary simple structures made of inexpensive and accessible materials are erected over unfinished objects. Window and door openings must be closed using roofing felt or glassine. You can use plywood panels and, in very rare cases, polyethylene film (it is convenient to seal non-standard shaped holes). In order not to resolve issues during the process, it is necessary to create an adequate and detailed project for the conservation of the building.

What is unused property

Unused property is considered to be property that is temporarily not involved in the main activities of the organization. The reasons why this may be the case are various:

- change in production volumes;

- transition of the organization to another type of activity;

- property being repaired;

- seasonal activities of the organization;

- obsolescence of fixed assets (obsolescence), etc.

REFERENCE! Such fixed assets can be equipment or (more often) real estate.

If it is planned to use this asset again after a certain time, this means that from an accounting point of view it is “mothballed”. You can rent out an unused OS or sell it - that is, one way or another, bring it back into economic circulation.

About the foundation with a basement

In this case, quite serious problems arise. Preservation of a building requires that the temporary shelter be secure. After all, if water leaks, it can tear the entire structure. In this case, there is one popular method: you need to throw plastic bottles, one-third filled with water, into the basement. Then, when the water freezes, most of the expansion forces will be taken on by bottles immersed in the volume of ice and more susceptible to compression, and the basement will not be damaged. This method allows you to ensure the safety of the structure, but it is desirable to have 3-4 large containers per square meter.

Sequence of operations

The conservation procedure occurs in a certain sequence.

First of all, a decision is made to carry out this procedure by the body of the enterprise that has all the necessary powers for this. After a decision is made, an order is issued that it is necessary to create a commission that deals with conservation issues. The head of this commission should be the head of the enterprise. After the order is issued, it is necessary to create a report stating that the use of fixed assets is impossible. The creation of a report must be approached from a technical and economic perspective.

At the end, an act is created indicating that fixed assets are temporarily removed from the circulation and it is advisable to mothball them. The creation of a commission and the preparation of all documents are optional procedures. In this case, it will be sufficient to provide a decision on conservation.

Fixed assets that have undergone conservation cannot be used by the enterprise. Compliance with this rule is mandatory. It is not recommended to violate it, because the funds that have been preserved are not ready for use. If you ignore this rule, then there is a risk of causing damage to these products by subjecting them to breakage.

If an enterprise has decided to sell or transfer objects that have been mothballed, then in this case it is not necessary to re-mothball them. That is, they can be sold or transferred in the form in which they are located.

About the foundation

Let's start with the very basics. It is better to leave the foundation and ground floor of a stone house (as well as concrete and brick) for a year without load. This is necessary so that it settles and settles. Wooden buildings do not need such a period of time. After all, they are lighter and create less load on the base. Considering that in our latitudes the snow cover regularly exceeds 0.5, the foundation must be prepared in the most careful manner. The first step is to carefully inspect the base. If you find cracks and leaks into which water can seep, they must be sealed. If weather conditions no longer allow working with cement mortar, then the foundation walls must be closed. For this, as a rule, roofing material is used. If waterproofing is already provided, then you just need to close its upper part so that precipitation does not fall on it. You also need to take care that melt water does not accumulate near the foundation strip. To do this, grooves are laid around the perimeter. If the terrain does not allow this, then it is necessary to take care of waterproofing.

How to preserve an object

What should be done? Here are step-by-step instructions.

Step 1. Make a decision on conservation of the object. It is accepted by the developer or technical customer. The decision is formalized by order or directive of the head of the organization. It states:

- a list of works on conservation of the object and the timing of their implementation;

- timing for the development of technical documentation necessary for the conservation of the facility (its preparation is provided by the developer or technical customer);

- who is responsible for the safety and security of the facility and construction site (official or organization);

- the amount of funds required. It is determined on the basis of an act prepared by the contractor and approved by the developer or technical customer.

Stages of preparing production for conservation

When organizing the storage of equipment, machines and production equipment in workshop buildings and shutdown areas, as well as in large and unheated warehouses, measures are taken to protect each unit. At the same time, it is necessary to preserve the building itself intact if it will not be used for a long time and will be disconnected from engineering systems.

Preparation should be carried out in several stages, during which you will have to:

- turn off, vent and preserve the indoor heating system;

- carry out work to disconnect from the power supply, possibly dismantle supply cables and switchboard equipment to prevent accidental connection;

- carry out thorough cleaning, since any accumulation of debris and dust are sources of two dangers - fire and active accumulation of moisture;

- create a strong and reliable shelter at the entrances to the premises, organize natural ventilation through limited openings.

If most of the work can be carried out by our own personnel, and the equipment can be prepared for storage according to existing specifications, then the covering and creation of protective layers of packaging should be organized separately. For this purpose, specialized materials are used, which enterprises often do not have at their disposal, and the level of knowledge of specialists is insufficient to create reliable preservative packaging.

What if you don't preserve it? Tax depreciation

In accounting, the rule is identical to the tax rule: depreciation is not charged on objects mothballed for a period of more than three months. This is the requirement of PBU 6/01, approved by Order of the Ministry of Finance dated March 30, 2001 No. 26n.

The act is drawn up on the basis of the data from the Logbook of work performed (Form N KS-6a) in the required number of copies.

It has over 30 settlements. When the new manager came here last year, he could not immediately deal with all the empty objects. Therefore, the farm decided to temporarily mothball the feed mill. And when it became clear that it could not be restored, much less sold, the company applied for the demolition of the unsafe building.

The company was found guilty and was subject to penalties in the amount of 30,000 rubles. But the sanctions could have been harsher. Such a violation entails a warning or the imposition of an administrative fine on citizens in the amount of one thousand to two thousand rubles; for officials - from twenty thousand to thirty thousand rubles; for legal entities - from one hundred thousand to three hundred thousand rubles.

Therefore, it is better to foresee such a situation in advance - when you enter into an agreement with the contractor. Namely: to stipulate the procedure for terminating or suspending the contract during conservation. And indicate for this case the rights and obligations of the parties in accordance with the norms of the Civil Code of the Russian Federation.

There is something to think about. Either bury hundreds of millions in the ground, or try to restore outdated buildings for the same money. The decision, perhaps, would have been easier if this money had been available in principle. However, funds will not help if there is no clear vision of the future fate of such walls. There are still many empty buildings in our cities and towns. Some are in relatively good shape. Others are on the verge of half-life. What do they have in common? Conservation. Most of these buildings are waiting in the wings in this status. But is he always justified?

Particular attention should be paid to the correct execution of the depreservation act. Since the form of the act is not unified, it should be approved in the regulations on accounting policies. The depreservation act must provide an assessment of the technical condition of the fixed assets subject to reactivation.

The act is drawn up in the required number of copies for each construction site, indicating separately the work suspended by construction. One copy is transferred to the contractor, the second to the customer (developer). The third is presented at the request of the investor.

The development of a conservation project is a complex, multi-step process consisting of several stages.

At the same time, compliance with fire safety requirements is not carried out in relation to these objects due to the absence of the subject of inspection.

Development of a project for the conservation of buildings and structures in the industrial safety center of Tsvetmeremont Holding LLC means high standards of engineering surveys, supervision of the conservation process and implementation of the project in the shortest possible time.

State fire inspection authorities must provide documents confirming the official fact of conservation of objects.

An act of suspension of construction should be drawn up. You can use form No. KS-17 or develop the form yourself.

In accordance with the Chart of Accounts for accounting the financial and economic activities of organizations, the equipment intended for installation is recorded by the customer on account 07 “Equipment for installation”, and the contracting construction organization - on the corresponding subaccount to account 10 “Materials”.

The customer is obliged to fully pay the contractor for all the work that he performed at the time when the object was decided to be mothballed. And also to reimburse expenses incurred due to the fact that he is forced to stop work ahead of schedule. Including lost benefits (Article 752 of the Civil Code of the Russian Federation).

During the inspection, it was established that construction work at the site has not been carried out for more than 6 months - since 2013.

This definition is given in the Sectoral Features of Budget Accounting in the Healthcare System of the Russian Federation, approved by the Ministry of Health and Social Development. According to the document, environmental conservation is a set of necessary measures aimed at ensuring the safety of objects during their temporary inactivity.

This is directly provided for in paragraph 3 of Article 256 of the Code. Resumption of depreciation accrual occurs from the 1st day of the month following the month of re-putting the OS into operation (clause 2 of Article 322 of the Tax Code).

Construction, reconstruction, conservation and liquidation of enterprises, buildings, structures and other facilities, the operation of which is related to waste management, are permitted subject to a positive conclusion from the state environmental assessment.

First of all, a formal approach to conservation. In some areas there are neither specific plans for the use of such buildings in the future, nor effective measures to protect them from destruction and theft. If you decide to preserve, then you need to do everything to ensure that the object is preserved efficiently. If you let it go for demolition, it means approaching this...

Thus, in the Resolution of the Federal Antimonopoly Service ZSO dated May 2, 2007 N F04-2507/2007 (33689-A27-40), the court concluded that the conservation documents submitted by the enterprise can serve as documentary evidence of conservation costs.

Conservation projects

The court revealed the customer’s failure to carry out measures to preserve the capital construction project, the customer’s absence of complaints regarding the quality of work during the work, and his consent to the contractor performing additional work.

It is also necessary to draw up a document that clearly indicates that ownership of the result of the work performed by the contractor has passed to the customer. Conservation of a capital construction project can be carried out at varying degrees of completion of construction.

Protection of equipment from temperature changes

Conservation is an unprofitable measure for an organization that pays income and property taxes. Thus, for a period of mothballing lasting more than three months, the enterprise is deprived of the right to take into account the amount of depreciation accrued on mothballed objects in the tax base.

The Kurgan City Court found justified and satisfied the claims of the prosecutor's office, filed in the interests of students against the Administration of the city of Kurgan, MBOU of the city of Kurgan "Secondary school No. 29" to impose the obligation to organize repairs.

It will also be possible to arrange a break in the payment of transport tax on temporarily unused cars. The fact is that the obligation to pay this tax depends on the registration of the vehicle, and not on its actual use. This opinion is shared by the Ministry of Finance in its letters dated February 18, 2009 No. 03-05-05-04/01 and dated September 23, 2008 No. 03-05-05-04/23.