Very often in our work activities we are faced with the need to draw up an application to the accounting department to resolve financial issues. This could be payment for travel in connection with a business trip or study, payment of financial assistance, or an application for deduction from wages. Some applications are made in the name of the employer, as they require management decisions. And only a very small part of the documents can be sent directly to the accounting department. What are these cases and how to correctly draw up an application to the accounting department - you will find answers to these questions in the article.

:

Application to the accounting department

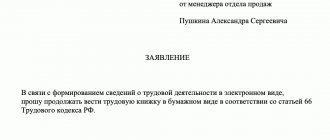

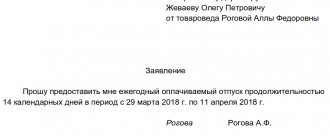

Example of an application to the accounting department

Chief Accountant

of Anaconda LLC

Head of Debt Management Department

Kaganidze Maria Alekseevna

Statement

Based on Art. 218 of the Tax Code of the Russian Federation, I ask you to provide a standard tax deduction for personal income tax for my minor children: Marianna Pavlovna Kaganidze, born in 2012, and Petr Pavlovich Kaganidze, born in 2009.

Application:

- Copy of birth certificate series GE No. 136876 dated 08/20/2012

- Copy of birth certificate series EU No. 687464 dated October 10, 2009.

05/19/2017 M.A. Kaganidze

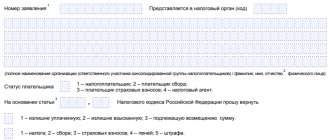

Forms of documents, financial statements, tax returns used in 2015

From January 1, 2013, in accordance with Federal Law dated December 6, 2011 N 402-FZ “On Accounting”, the forms of primary documents used in an organization are approved by its head (Law N 402-FZ does not contain a requirement for the mandatory use of unified forms of primary accounting documentation approved Goskomstat of the Russian Federation). At the same time, you can use familiar standard forms in your work. Just check that they contain all seven required details and approve them in the organization’s accounting policies (you can also issue a separate order from the manager). Cash documents (approved by the Regulations on the procedure for conducting cash transactions (Central Bank of the Russian Federation October 12, 2011 N 373-P)), invoices (approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137), waybill (approved by the Rules) are still mandatory for use. transportation of goods by road (Resolution of the Government of the Russian Federation of April 15, 2011 N 272)). Mandatory details of the primary accounting document

: name and date of preparation of the document; name of the organization on behalf of which the document was drawn up; content of a business transaction; meters of business transactions in physical and (or) monetary terms; the position of the person responsible for the execution of a business transaction and the correctness of its execution; personal signatures of these persons).

On this page of our website you can find and download in MS Excel format the most commonly used forms of primary accounting documents: invoice for payment, invoice, acceptance certificate for work performed or services rendered, delivery note in form TORG-12, approved by the State Statistics Committee Russia dated December 25, 1998 No. 132. As well as a free-form invoice, a goods and transport invoice or abbreviated TTN, a sample invoice for the internal movement of inventory items. Among the submitted document forms you can find a demand invoice (Standard interindustry form No. M-11), approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a, an advance report form, cash documents, for example, cash receipt and expenditure orders, a sample payroll for issuance wages and many other primary documents necessary for any enterprise when conducting business activities. Many accountants who prepare accounting and tax reporting based on the results of the reporting period may need forms of accounting and tax reporting: balance sheet and profit and loss account (since 2013, interim accounting reports are not provided to the Federal Tax Service), tax returns for VAT and income tax , as well as calculations of advance payments for property tax, submitted quarterly to the Federal Tax Service.

1. Invoice for payment 2. Invoice. Valid from 04/01/2012 (see Letter of the Ministry of Finance of the Russian Federation dated 01/31/2012 N 03-07-15/11) 3. Acceptance certificate for work performed (services provided) 4. Consignment note TORG-12, Unified form No. TORG-12 Approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132. 5. Invoice 6. Consignment note (TTN) 7. Invoice for internal movement 8. Requirement-waybill (Standard interindustry form No. M-11), approved by the Decree of the State Statistics Committee of Russia dated 30.10 .97 No. 71a 9. Advance report, Unified form No. AO-1, approved by Resolution of the State Statistics Committee of Russia dated 01.08.2001 No. 55 10. Receipt cash order 11. Expenditure cash order 12. Payroll for salary payments 13. Commissioning certificate object of fixed assets 14. Act on write-off of an object of fixed assets (except for motor vehicles), Unified form No. OS-4, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7

1. Balance sheet 2. Order journal 3. Tax register for accounting of fixed assets 4. Purchase book. For the period from 2012 to 09/30/2014 5. Purchase book. Valid from the 4th quarter of 2014. 6. Sales book. For the period from 2012 to 09/30/2014 7. Sales book. Valid from the 4th quarter of 2014.

1. Form No. 1 “Balance Sheet” and Form No. 2 “Profit and Loss Statement” 2. Cash Flow Statement

1. Tax return for value added tax (VAT). Valid from 2012 to 2014. 2. Tax return for value added tax (VAT). Valid from the 1st quarter of 2015. 3. Tax return for corporate property tax 4. Calculation of advance payments for property tax 5. Calculation of transport tax 6. Tax return for income tax. For the period from 2013 to 2014. 7. Tax return for income tax. Valid from the 1st quarter of 2015. 8. Tax return for land tax

7. Calculation of accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity. Form-4 FSS. The calculation form is applied to reporting to the Federal Social Insurance Fund of the Russian Federation for six months of 2013. Calculation of accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity. Form-4 FSS. The calculation form applies to reporting to the Federal Social Insurance Fund of the Russian Federation for 2014. Calculation of accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity. Form-4 FSS. The calculation form is applied to reporting to the Federal Social Insurance Fund of the Russian Federation for the 1st quarter of 2015. 8. Calculation of accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and for compulsory medical insurance to the Federal Compulsory Medical Insurance Fund. Form RSV-1 PFR. The calculation form is applied to reporting to the Pension Fund of the Russian Federation, starting from the 1st quarter of 2013. Calculation of accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and for compulsory medical insurance to the Federal Compulsory Medical Insurance Fund. Form RSV-1 PFR. The calculation form is applied to reporting to the Pension Fund of the Russian Federation, starting from the 1st quarter of 2014.

1. Order on the organization’s accounting policy for 2012. Example in MS Word format. 2. Order on the organization’s accounting policy for 2013. Example in MS Word format. 3. Inspection log (Federal Law No. 294-FZ dated December 26, 2008)

Up About the project Documentation Download Forms Buy Contacts

Tweet

Phone E-mail Copyright © 2021, nm-a.ru All rights reserved. Copying of materials is permitted only with the written permission of the administration.

When to submit an application to the accounting department

As stated above, most statements on financial matters are addressed to the head of the organization. This is due to the fact that the resolution of such issues directly depends on the employer’s resolution. The issue of payment of vacation pay when applying for another vacation or benefits during parental leave is resolved through the manager.

You can submit statements directly to the accounting department that do not require decision-making. On the provision of tax deductions, on changing account details for transferring wages to a bank card, changes associated with a change of surname. Quite often, an application may be submitted to the accounting department for the transfer of child support as a percentage of accrued wages. You can also send documents to the accounting department about joining a trade union and paying contributions from wages or about leaving such a body and, accordingly, stopping the payment of trade union dues. Or as part of participation in voluntary co-financing of the funded part of a pension.

In such cases, drawing up an application addressed to the employer will not be a mistake. It’s just that specific organizations have adopted their own internal document flow rules. And when the accounting department in an individual case asks you to draw up a statement addressed to them, you can use the suitable example and sample posted on the website.

Contents of the document

The application to the accounting department is drawn up according to the general rules of office work. The document is drawn up in writing by hand or using a computer and includes:

- addressee: “to the accounting department”, “chief accountant”, etc., name of the organization (individual entrepreneur);

- information about the applicant in the genitive case (from whom): full name, position and department in the organization;

- name of the document: application;

- relevant request and basis;

- an application in the form of written documents confirming the basis for the employee’s application to such a document as an application to the accounting department.

The application to the accounting department must be signed by the applicant and dated for signing and filing. The document can be submitted either by the employee himself, or his representative through the office of the organization, or directly to the accounting department.

Mandatory accounting documents of a legal entity

The legal activity of a legal entity, regardless of its organizational and legal form, requires confirmation of each business transaction with relevant documents. The latter form the basis for accounting. Primary documents must be:

- reliable;

- created in parallel with the conduct of a business transaction;

- duly formatted.

According to the requirements of the Federal Tax Service, primary documentation must be created in the order in which financial and business transactions are carried out. Making errors in documents practically eliminates the possibility of accurately assessing the financial situation of the enterprise and does not allow correctly determining the taxable base.

Accounting documents are divided into three categories. In addition to the primary documentation that forms the basis for accounting, the enterprise prepares accounting registers and reporting documents.

Registers are used to accumulate and systematize information contained in primary documentation, documents on company accounts, and accounting reports. The use of registers optimizes the work of specialists involved in the field of accounting.

Accounting reports are combined into a single system of data reflecting the financial and property status of the enterprise and the results of its economic activities. Reporting is prepared according to approved forms. It is based on accounting data.

Documents are also classified according to their composition. They are:

- internal;

- outgoing;

- incoming.

Classification by purpose also takes place. On this basis they distinguish:

- administrative documents (regarding business transactions);

- executive documents (certifying the fact of the transaction);

- combined documents (for example, receipt and expenditure orders);

- accounting papers (statements, certificates, etc.).

All accounting documents of a legal entity are properly drawn up and taken into account. Handwritten documents must be filled out in such a way that guarantees the safety of the record for a long time. It is prohibited by law to fill out handwritten forms using a pencil.

As for the records themselves, they must be clear and legible. Blots and strikethroughs are not allowed. Corrections to accounting documents are made exclusively in accordance with the procedure established by law.

Records of documents are maintained from the moment accounting is organized. Each form is assigned an identifier number. Accounting rules must be strictly observed at the enterprise.

Organizing the storage of documents is no less important than recording them. According to current legislation, accounting documentation is stored from 1 year to an unlimited period. Documents of each category have their own shelf life. Balance sheets and statements with additions, appendices, and special forms can be stored for at least 1 year. It is necessary to permanently store summary and annual documents. Quarterly records are stored for 5 years, monthly records - 1 year.

For accounting accounts (material, analytical), documents confirming audits, contracts with auditors, accounting registers, turnover sheets, loan agreements, agreements, most primary documents, a five-year retention period is provided (in case of disputes with the tax authorities - until a decision is made court). Personal accounts of company employees are kept for the longest time – 75 years.