Is this information required?

According to paragraph 5 of Article 169 of the Tax Code of the Russian Federation, one of the points that must be indicated in the invoice of goods is the country of origin. Moreover, if a purchase was made abroad, then in the next column indicate the number of the customs declaration (clause 5 of article 169 of the Tax Code, clause 2 of the Rules, approved by Government Decree No. 1137 of December 26, 2011).

An exception to this requirement is specified in the letter of the Ministry of Finance dated November 27, 2017 No. 03-07-09/78220. If you purchase goods abroad and sell individual parts of them in the Russian Federation, you do not need to indicate the country of origin on the invoice. It is required to put a dash in both column No. 10 “Country of origin of the goods” and in column No. 11 “Registration number of the customs declaration.”

In addition, it is not required to indicate it for goods produced on the territory of the Russian Federation for sale within its borders. This is confirmed by the information in subparagraphs K and L of clause 2 of the Rules for filling out an invoice, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

Changes to invoices from January 1, 2021

Although the general issuance procedure has not changed, changes to invoices from January 1, 2021 affected the form of the document. New details have appeared, the contents and design of some columns have changed. You can see what the new invoice looks like and a sample on this page. We will also tell you in detail how to fill out the document.

New invoices from January 1, 2021: sample filling >>

There are several changes in the document.

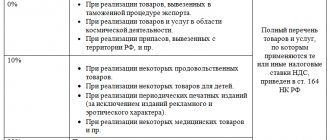

- In column 7 “Tax rate” you need to indicate new values: instead of the usual rate of 18%, indicate 20% - when selling goods, works or services,

- instead of the estimated rate of 18/118, indicate 20/120, for example, when receiving an advance payment for upcoming deliveries.

We will describe in detail below what to write in the fields of the document.

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Instructions for filling out an invoice 2019

Filling the string part

Line 1 Number and date of the invoice. Documents are numbered in order, ascending.

Please note that as of October 1, 2021, new rules for storing invoices have been established. Now they should be stored in chronological order - by date of issue or date of receipt.

The storage period for invoices and delivery notes has not changed - it is still at least four years from the date of the last entry.

Lines 2, 2a and 2b Name, address, tax identification number and checkpoint of the seller. Be careful! The address from October 1, 2021 is indicated in the invoice according to the Unified State Register of Legal Entities, in detail, without abbreviations (which are acceptable in the constituent documents). Violation of this rule may be grounds for deduction.

Line 3 Information about the sender of the cargo. Indicated only when selling goods. When selling services or performing work, put a dash. If the seller is the sender of the goods, write “He” in this line.

Line 4 Information about the recipient of the cargo. The consignee and his address are indicated in the invoice only when selling goods. If you are submitting a document for services, work, property rights, put a dash.

Line 5 Payment order number - if there was an advance payment (that is, the invoice is drawn up for an advance payment). If not, put a dash. A dash is also placed if prepayment was made on the day of shipment.

Line 6 Name, address (from October 1 - strictly according to the Unified State Register of Legal Entities, without abbreviations), INN and KPP of the buyer.

Line 7 Currency and its code. The invoice is issued in the monetary unit in which prices and payments under the contract are expressed.

Line 8 Government contract number. The government contract identifier has been indicated in invoices since July 1, 2021, and everyone has managed to get used to the innovation. But be careful! Since October 1, 2017, line 8 of the invoice itself has a different name: a clarification has appeared that it is filled out only if data is available. This is what it looks like:

Let us remind you that companies that work with contracts with treasury support are required to indicate in the invoice the number of the government contract (or agreement or agreement on the provision of subsidies, investments, contributions to the authorized capital from the federal budget). They receive a 20-digit code.

It is indicated in all contracts drawn up under government orders. You can find this code in the contract or in the Unified Information System.

If you do not need to write the IGK on the invoice (that is, you are not working with a contract to which an identifier is assigned), then do not leave the line empty - put a dash in it.

Government Contract ID on Invoices: Sample

Filling out the tabular part of the invoice

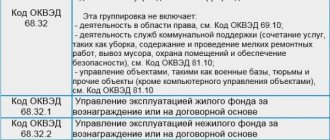

Column 1 Name of the product or description of works, services, transferred rights.

Column 1a Here, in the invoice from 10/01/2017, the code of the type of goods is indicated. This applies only to those products that are exported to the EAEU countries.

If you need to indicate a product type code on the invoice, select it from the HS reference book. If not necessary, put a dash.

Column 2 Unit code. The invoice is indicated in accordance with the all-Russian OKEI classifier. The codes in it are in sections 1 and 2.

Column 2a National symbol of the unit of measurement. For example, "pack". You can also check or find out this designation using OKEI.

Column 3 Quantity or volume of goods, works or services. If they cannot be identified, a dash is added.

Column 4 Price per unit of measurement excluding tax. Indicated in the case where it is possible to indicate it, otherwise a dash is placed.

Column 5 Cost of goods, works, services. Indicated excluding tax.

Column 6 Excise tax amount. If you sell non-excisable goods, you cannot put a dash. In this case, write here “No excise duty”.

Column 7 Tax rate.

Column 8 Tax amount in rubles and kopecks - full, without rounding.

Column 9 The cost of the entire quantity or volume of goods, taking into account the amount of tax.

Columns 10 and 10a Country of origin of the goods (in the invoice, both fields are filled in only for imported products). The digital code and short name are indicated here.

Both values are given in accordance with the All-Russian Classifier of Countries of the World. Do not write the digital code of Russia in the tenth column of the invoice: filling in is not required for domestically produced goods.

In this case, put a dash, as in the next column.

Column 11 Registration number of the customs declaration (indicated in the invoice only for imported goods, in other cases a dash is placed). This column is also new as of October 1, 2021. Previously, the invoice indicated the customs declaration number, but it was serial, but now the registration number is indicated. It looks like this:

Who signs the invoice?

The invoice must be signed by the manager and chief accountant of the organization or individual entrepreneur.

But this can also be done by other employees - those who, in accordance with the power of attorney and the order of the manager, receive such powers.

Since October 1, a new signature field has appeared in the invoice - an authorized person can sign instead of the entrepreneur. And the fields for signatures of representatives of the manager and chief accountant were in the document before.

Invoice 2021: free to fill out

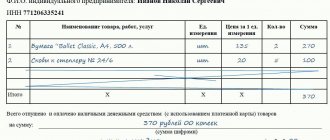

Here's what the completed new invoice form looks like:

Invoice deadline

The procedure for issuing a document has not been affected by changes since January 1, 2021. An invoice is issued within 5 days from the moment of: a) shipment of goods, performance of work, provision of services, transfer of rights, or b) receipt of advance payment. Calendar days are counted.

The period is counted from the day following the day of shipment or receipt of advance payment. If the last day of the term falls on a non-working day, the expiration date of the term is considered to be the nearest next working day.

According to the law, there is no penalty for missing the deadline for submitting an invoice. An organization can be fined only for the absence of a document.

However, a violated procedure for issuing invoices at the junction of tax periods can still lead to a fine. Thus, late provision of a document may be considered as its absence.

For example, when an organization issues an invoice at the beginning of the current tax period that should have been issued at the end of the previous one.

The 20-digit government contract identifier can be found in the contract itself or on the website of the Unified Procurement Information System.

Stamping on the invoice: is it stamped or not?

It is not necessary to put a stamp on the invoice. If you think it necessary, you can install it. Then the seal will serve as an additional prop.

From what date are new invoices valid?

The new invoice form will apply from January 1, 2021.

What is the storage period for invoices and invoices in 2019?

Invoices must be stored for at least five years (according to the rules for storing primary documents). And invoices are stored for four years.

Code 796 on the invoice: what is it?

796 - piece code (as a unit of measurement of a product) according to OKEI. Be careful! It differs from the product code (657) and packaging code (778).

Should the item code be indicated on the invoice if the product is measured in hundreds?

OKEY provides separate codes for a dozen, a hundred, a thousand, etc. If necessary, you can clarify them in the online version of the directory.

Customs declaration number on the invoice: what is it?

CCD is a cargo customs declaration. Its registration number is a required detail for the invoice. However, it is indicated only in the case of shipment of imported goods or release of domestic consumption products after the end of the free customs zone procedure in the Kaliningrad SEZ from October 1, 2017.

The details are indicated in column 11 of the invoice. From October 1, 2017, it is called “Registration number of the customs declaration”.

Consignee and his address on the invoice: legal or actual?

The law (Article 169 of the Tax Code of the Russian Federation) does not determine which address of the consignee should be indicated in the invoice: legal, actual, warehouse address. You can indicate the name of the recipient of the cargo according to the constituent documents and his postal address, including in cases where the goods are intended for several retail outlets of the buyer - instead of the address of a specific point.

The invoice period is 5 days. Calendar or work?

The invoice is issued within 5 calendar days from the date of shipment or receipt of advance payment.

Will numbering invoices out of order in 2019 result in a fine?

The Tax Code of the Russian Federation in 2021 does not imply responsibility for numbering invoices out of order. A fine is possible only when the document was not issued at all.

What is indicated in columns 10 and 10a?

Column 10 requires the indication of the name of the country of origin of the goods, and subcolumn 10a - the code of this country. If the product was produced in a country belonging to a group of states, then the country of origin is indicated in column 10, and the name of the association in 10a. For example, “United States”, “European Union”.

An exception is goods imported from the countries of the EAEU - the Eurasian Economic Union, since when importing them into Russia, it is not necessary to fill out a customs declaration.

Where can I find out information?

To determine the code, you need to refer to the OKSM table - the All-Russian Classifier of Countries of the World. The information is presented in three sections:

- country name;

- its digital code;

- letter identification.

For an invoice you only need the name of the state and a digital code.

The OKSM table is freely available on the Internet, so it is not always an official document and, as a result, does not exclude the possibility of errors. More reliable information about country of origin codes can be obtained by contacting the Tax Service.

Citizenship country code Armenia 2 personal income tax. Citizenship codes: what are they and where to find them

The main document regulating the filling out of form 2 of personal income tax is the order of the Federal Tax Service dated October 30, 2015 with all changes registered as of the date of compilation of the indicators.

In addition to the Internal Revenue Service, for which information on income is generated at the end of the reporting year, a certificate may be needed from a physical person. face in many situations. Some fields are difficult to fill out, for example, which region code to indicate in the second part.

If there are no questions for a resident of the Russian Federation, what about non-residents? In the review, we will consider all the nuances of the formation of this graph according to the OKSM classifier of countries of the world.

When filling out the second part of the personal income tax declaration 2, the indicators in the cells are entered in relation to data about the individual:

- TIN in Russia - this parameter confirms the employee’s registration with the fiscal authority. If the number is not assigned, you do not need to fill in the information;

- TIN in the country of citizenship - if a TIN or its equivalent was assigned to an individual in the country of citizenship, you must indicate it. This column is not filled out for residents of Russia;

- cells with last name, first name and patronymic are filled out in accordance with the passport data; if the middle name is missing, there is no need to fill out the column. If the foreigner’s document does not have a translation into Russian, the information is transferred in Latin;

- For the taxpayer status field, you must select one of six characteristics:

If during a calendar year an employee working in the Russian Federation changed his status and during a certain period was a resident of Russia, sign 1 should be indicated in the status field;

- information about the date of birth is indicated in the format DD MM YYYY;

- The citizenship field is filled in according to the country classifier. The Russian code is 643, for residents of the Republics of Armenia and Azerbaijan - country codes 051 and 031, respectively.

If the physical persons - foreign employees do not have citizenship, indicate the code of the state that issued the identity document;

- in the “Document Code” column, select the corresponding code from Appendix No. 1 to the order of the tax service. For example, for reference 2 personal income tax: indicator for a residence permit - 12, for a passport indicate 21, for a military ID - 07;

- in the data field about the series and number of the form, fill out information about the identity document without indicating the sign No.

By order of January 17, 2021, a new form of personal income tax declaration 2 was introduced, where there is no information about the place of residence of individuals. faces. You should not indicate the address in any form.

Filling in the country code can sometimes be confusing. How to find the code? For example, for the Republic of Belarus it may not be difficult - it is 112, for Ukraine - 804, but not all countries are listed in the general classifier. In this case, choose the code of the state that issued the personal identification document. faces.

If a foreign citizen from the Republic of Tajikistan, the Republic of Uzbekistan or the Republic of Kazakhstan works with the registration of a patent agreement and the payment of advance payments, the country code should be indicated 762, 860 and 398, respectively, the status indicator for them is 6. These rules for filling out the country code also apply to residents of the Republic Moldova - code 498.

An example of filling out personal income tax certificate 2 for Russian citizenship, taking into account updates dated January 17, 2021 in sections 2, 4 and 5, is as follows:

Features of filling out personal income tax declaration 2 for a foreign employee

To fill out the report, they are guided by the order of the Federal Tax Service and the Tax Code. Forming a 2nd personal income tax return for a foreign citizen is practically no different from a resident of the Russian Federation, but there are several features for reflecting information in some fields:

- The personal income tax rate depends on the number of days of residence in the country. If the taxpayer’s place of residence is in the Russian Federation for more than 183 days a year, then his status has been changed to “resident”, and for this there is no need to obtain Russian citizenship. Accordingly, in the status cell you can indicate sign 1, the personal income tax rate is 13%;

- if the employee lives for less than the specified period, therefore, when filling out the 2nd personal income tax report, the non-resident is indicated with sign 2 and the personal income tax is calculated at a rate of 30%. For immigrants from EurAsEC states, income tax is calculated at a rate of 13% of total income in Russia, but justification for this status is necessary;

- if there is data on the assignment of a Russian TIN, the corresponding value on foreign information may not be indicated;

- in the “passport” column for a foreign employee, feature 10 should be indicated - a foreign passport for citizens permanently residing abroad and temporarily staying in the territory of the Russian Federation;

- if a foreign citizen works in the territory of the Russian Federation on the basis of a patent, information about advance transfers should be indicated in the fifth part of personal income tax certificate 2. If permission has been issued to reduce their size, you must also indicate the number and date of such a document.

Conclusion

Filling out all the fields is a very simple process. It is important to know where you can clarify the citizenship of an individual.

persons, for example, the code of Russia or the country that issued the document for certificate 2 of personal income tax, and how to fill out the form in its absence.

All indicators are in legislative acts on official websites, on the page of the Office of the Federal Migration Service of the Federal Migration Service, in the event of changes in which the data is promptly updated.

This certificate may be needed in many situations, and questions often arise when filling it out. Such as: where the current country codes are contained or what attribute is included in the document. This text is intended to dispel doubts and help you successfully submit documents, for example, to the tax office.

In general, this document reflects the level of income and taxes of an individual for a certain period. When filling out, the past calendar working year is usually taken and at the end of the year the certificate is submitted by the accounting department to the tax office. In addition, at the request of the employee, the following may be provided to him for the following needs:

- may be useful if he takes out a large bank loan, and in the case of mortgages and car loans, a certificate is required

- sometimes they ask the HR department when applying for a job, but on the other hand, it happens that such a certificate is automatically issued

- at the tax office to process deductions (for example, if the parents have a child studying at a university for a fee, they have the right to a deduction)

- to calculate pension

- adoption

- litigation, especially related to labor relations

The certificate is prepared free of charge within three days and must bear the signature of the manager, sealed (if applicable). At the same time, if an employee has changed several jobs in a year, then the employer has the right to draw up a certificate only for the period of work at his enterprise.

Signs 1 and 2 in the certificate

One of the difficult questions for the filler is which attribute to put.

A certificate with attribute 1 is filled out for each employee to whom the company paid funds and withheld tax from them, as well as for those funds for which it is impossible to withhold. Submitted to the Federal Tax Service no later than April 1.

If it is impossible to collect personal income tax, then a separate certificate with sign 2 is drawn up. For example, if a gift worth more than four thousand was made to a person who is not an employee of the company. The certificate must be submitted before March 1 and indicate the amount of income from which it is impossible to withhold tax and the potential amount of tax.

Thus, if there is income on which it is impossible to pay tax, then you will have to draw up 2 certificates per person with characteristics 1 and 2. In the first, display all the income received by the employee, in the second, only those incomes on which it is impossible to pay tax.

Where can I find out the correct country code?

The OKSM countries were approved by the Decree of the State Standard of December 14, two thousand and one, number 529-ST. This document is constantly updated, so you should look for the latest version. There are several legal information websites that keep their databases up to date. Therefore, you can use them. On the websites this information is absolutely free.

This document is also contained directly on the Gosstandart website, but only in the initial version, and all its editions are separate. That is, the user himself will have to check all changes with the initial version of the resolution, which is extremely inconvenient.

Filling out 2 personal income tax for a Russian citizen

The form consists of several sections.

In this upper part there are 2 sections and the following details must be entered here:

- the name of the tax agent, that is, the organization that issues the certificate

- a sign indicating the possibility or impossibility of paying tax

- certificate number, as well as for what period and on what date it is drawn up

- territorial tax code where the company is registered

- correction number (zero means that no corrections have yet been made to the document)

- company telephone number with area code

- organization details: INN and KPP (for individual entrepreneurs, a dash)

- TIN of the citizen for whom the form is being filled out

- Full name and date of birth of the employee

- taxpayer status (one for a Russian resident)

- RF code or country code where the employee came from

- code of the document used (twenty-one means passport) and its series, number

- the address where the employee lives

The second part of the certificate consists of three sections, which indicate monthly income, deductions and the amount of calculated tax and paid tax.

Section three lists the coded types of income received. So in this example, the salary is displayed using the code 2000, vacation using the code 2012, and in the twelfth month 2720 the gift received. As for code 501, this is a standard maximum deduction of four thousand from the gift received. Everything above is subject to personal income tax.

The fourth section reflects deductions. So, deduction with code 126 is up to eighteen years.

The fifth section for calculating personal income tax. Adding up all income for each month (including gifts), we get 282,000 rubles. Accordingly, according to deductions, it comes out to 23,000 + 4000 = 27,000 rubles. The total base from which the tax is calculated is 282,000 – 27,000 = 255,000 rubles. And the calculated tax is 255,000 * 13% = 33,150 rubles.

But in this example, the employee Vinnik quit her job on December 1 and, accordingly, the accountant in December does not have a basis for receiving tax on the value of the gift exceeding four thousand. After all, the deduction is given only in the amount of four thousand, and the gift costs 12,000, so the difference is 12,000 - 4,000 = 8,000 rubles.

tax must be paid. But since Vinnik no longer works, this is impossible and the accountant writes in a special field the amount that could not be withheld, that is, 8,000 * 13% = 1,040 rubles.

And in those fields where the withheld and transferred tax is indicated, the amount of the calculated tax is written, reduced by this tax, which cannot be collected.

Since a tax has been formed that is impossible to pay, you should additionally draw up 2 personal income taxes indicating sign 2. Where, in general, all the same data is entered, but only the cost of this gift is indicated in the income and the unpaid tax is calculated only on it.

Features of issuing a certificate for a foreign citizen

For foreigners, filling out is not very different, but there are several discrepancies:

Thus, filling out the certificate is not a particularly complicated process. The main thing is not to get confused in a large number of numbers and enter the correct codes. All this information is in government documents.

Write your question in the form below

Source: https://musings.ru/housing/grazhdanstvo-kod-strany-armeniya-2-ndfl-kody-grazhdanstva-chto/

How to present data in a document?

The principles for indicating the name and code on the invoice are identical for all countries. In column 10 it is possible to write both the full and short name, but this information must be exactly consistent with the OKSM data in the country name sections. For example, the full name for the USA is “United States of America”, the short name is “United States”. No other options - America, USA, States, etc. - not indicated.

Below we provide examples of this data for states that most often participate in import-export relations with the Russian Federation.

- Russian Federation. The name can be specified briefly - Russia, code - 643.

- People's Republic of China. Short name – China, code 156.

- Germany. The short and full names are identical. Country code 276.

- USA. Short name - United States, code 840.

- Italian Republic. Short name – Italy. Code 380.

- Japan. The short and full names are identical. Code 392.

How to deal with possible errors when filling out?

Note! Based on the invoice, the taxpayer can reduce the amount of his tax liability. Therefore, this document is carefully analyzed and checked for errors and false facts.

If the latter are detected, the taxpayer will not only be denied a deduction for value added tax, but may also be subject to a fine. In particular, the following errors are most often made when specifying data in sections 10 and 10a:

- Incorrect country of origin. The name of the state is indicated strictly in the same way as in the OKSM table.

- Careless mistakes. Typos in the name, incorrect code indication.

- Incorrect identification of state of origin. According to the Customs Code, the country of origin is the state in which the purchased product was produced or processed.

- Incorrect indication of the customs declaration number. In this case, even the absence of errors when filling out column 10 and subgraphs 10a will not solve the problem.

Can the tax office refuse in case of an error?

According to paragraph 2 of Art. 169 of the Tax Code of the Russian Federation, if all established requirements for filling out an invoice are not met, tax officials have the right to refuse to deduct VAT. One of the reasons for this is the difficulty in identifying the state of origin, which usually arises if the digital code of the state and/or its corresponding name is incorrectly indicated.

On a note. The second paragraph of clause 2 of Article 169 of the Tax Code of the Russian Federation states that if any errors in the invoice do not prevent the identification of the seller, buyer of goods, name of goods, state of origin and other necessary information, then tax officials do not have the right to refuse VAT deductible.

In this article, we looked at how to correctly fill out the “country code” column; we talked earlier about how to fill out other columns, for example, “address”.

Citizenship Armenia country code. Citizenship codes: what are they and where to find them

Manufacturer barcode

is a sequence of black and white stripes that represents some information in a form convenient for reading by technical means. The information contained in the code can be printed in a readable form under the code (decryption).

Bar codes are used in trade, warehouse accounting, librarianship, security systems, postal services, assembly production, and document processing. In global trade practice, it is common to use EAN barcodes to label goods.

In accordance with the accepted procedure, the manufacturer of the product applies a bar code to it, generated using data about the country of location of the manufacturer and the manufacturer’s code. The manufacturer code is assigned by the regional branch of the international organization EAN International.

This registration procedure eliminates the possibility of two different products with the same codes appearing.

There are various ways of encoding information, called (barcode encodings or symbologies). There are linear and two-dimensional barcode symbologies.

Linear (ordinary), in contrast to two-dimensional, are barcodes that are readable in one direction (horizontally).

The most common linear symbols: EAN, UPC, Code39, Code128, Codabar, Interleaved 2 of 5.

Linear symbology allows you to encode a small amount of information (up to 20-30 characters - usually numbers) using simple barcodes that can be read by inexpensive scanners. Example EAN-13 symbology code:

Two-dimensional symbols are those designed to encode large amounts of information (up to several pages of text).

2D barcode

is read using a special two-dimensional code scanner and allows you to quickly and accurately enter a large amount of information.

Deciphering such a code is carried out in two dimensions (horizontally and vertically). Datamatrix, Data Glyph, Aztec.

The bar code can be applied during packaging production (by printing) or using self-adhesive labels that are printed using special printers.

Decoding the manufacturer's barcode

Using a bar code, information about some of the most important parameters of the product is encrypted. The most common are the American Universal Product Barcode UPC and the European EAN coding system.

The most common EAN/UCC product numbers are EAN-13, EAN-8, UPC-A, UPC-E and the 14-digit shipping packaging code ITF-14. There is also a 128-bit UCC/EAN-128 system.

According to one system or another, each type of product is assigned its own number, most often consisting of 13 digits (EAN-13).

Take, for example, the digital code: 4820024700016.

The first two digits (482) mean the country of origin (manufacturer or seller) of the product, the next 4 or 5 depending on the length of the country code (0024) - the manufacturer, another five (70001) - the name of the product, its consumer properties, dimensions, weight , color. The last digit (6) is a control digit used to check whether the scanner is reading strokes correctly.

Barcode EAN-13

For “product code”:

1. number: product name,

2. figure: consumer properties,

3. figure: dimensions, weight,

4. number: ingredients,

5. number: color.

An example of calculating a check digit to determine the authenticity of a product

1. Add the numbers in even places: 8+0+2+7+0+1=18

2. Multiply the resulting amount by 3: 18×3=54

3. Add the numbers in odd places without a check digit: 4+2+0+4+0+0=10

4. Add the numbers indicated in steps 2 and 3: 54+10=64

5. Discard tens: we get 4

6. Subtract from 10 what was obtained in step 5: 10-4=6

If the number obtained after calculation does not match the control number in the barcode, this means that the product was produced illegally.

Manufacturer barcode correspondence table for countries around the world

| Manufacturer barcode | EAN Organization |

| USA and Canada | UCC (USA & Canada) |

| Internal company barcode | |

| GENCOD-EAN France | |

| Bulgaria | |

| Slovenia | |

| Croatia | |

| Bosnia and Herzegovina | EAN-BIH (Bosnia-Herzegovina) |

| Germany | |

| Distribution Code Center – DCC (Japan) | |

| UNISCAN / EAN RUSSIA (Russian Federation) | |

| EAN Estonia (Estonia) | |

| Azerbaijan | |

| Uzbekistan | |

| Sri Lanka | |

| Philippines | PANC (Philippines) |

| Belarus | |

| Kazakhstan | |

| HKANA (Hong Kong) | |

| Great Britain | |

| HELLCAN – EAN HELLAS (Greece) | |

| Macedonia | EAN-MAC (FYR Macedonia) |

| Ireland | |

| Belgium, Luxembourg | ICODIF/EAN Belgium.Luxembourg |

| Portugal | CODIPOR (Portugal) |

| Iceland | |

| South Africa | EAN South Africa |

| Mauritius | |

| EAN Maroc (Morocco) | |

| TUNICODE (Tunisia) | |

| Jordan | |

| Saudi Arabia | EAN Saudi Arabia |

| United Arab Emirates | |

| Finland | |

| Article Numbering Center of China – ANCC (China) | |

| Norway | EAN Norge (Norway) |

| Israeli Bar Code Association – EAN Israel | |

| Guatemala | |

| Salvador | |

| Honduras | |

| Nicaragua | |

| Costa Rica | |

| Dominican Republic | EAN Republica Dominicana |

| Venezuela | |

| Switzerland | EAN (Schweiz, Suisse, Svizzera) |

| Colombia | |

| Argentina | CODIGO – EAN Argentina |

| Paraguay | |

| Brazil | |

| Camera de Comercio de la Republica de Cuba (Cuba) | |

| Slovakia | |

| Yugoslavia | EAN YU (Yugoslavia) |

| North Korea | EAN DPR Korea (North Korea) |

| Union of Chambers of Commerce of Turkey (Turkey) | |

| Netherlands | EAN Nederland (Netherlands) |

| South Korea | EAN Korea (South Korea) |

| Singapore | SANC (Singapore) |

| Indonesia | |

| Australia | |

| New Zealand | |

| Malaysia | Malaysian Article Numbering Council (MANC). |

| 960-969 | UK (for EAN-8) |

| Periodicals ISSN | |

| Book editions ISBN | |

| ISMN music publications | |

| Return receipts | |

| Currency coupons |

When preparing individual tax returns, you may be required to complete a Country Code line. We will tell you where to get this indicator and what country code you need to indicate for Russia in our consultation.