Discussions have not yet subsided about information that has appeared on the Internet that the Russian government can now “freeze” or even confiscate citizens’ funds if their origin seems dubious, the authorities announced another innovation. Russians will be required to pay a 13% tax on foreign currency purchase and sale transactions.

The Central Bank is actively preparing the ground for the introduction of new sanctions aimed at expropriating money from the population by any possible means. Wholesale checks have begun on the market of currency exchange offices.

Why do people invest money in currencies?

In a significant number of cases, individuals want to save their money or increase capital by investing for subsequent income.

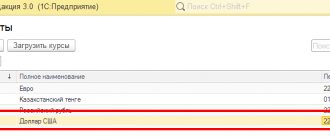

Purchasing currency on the exchange is many times more profitable than at exchange offices. This is due to the fact that there are no resellers on the exchange, which means the exchange rate is higher. In addition, you can view all transactions here and now. And this is a significant time saving.

So why do you need to pay tax on the sale of currency on the exchange? Let's look at the answer to this question next.

In what cases do you need to pay personal income tax when trading currency?

Currency, according to Art. 141 of the Civil Code of the Russian Federation is an asset. And income from the sale of any assets on the territory of the Russian Federation is subject to taxation. Individual taxpayers must independently report their income.

If there was no income, there is no need to pay tax. But you still have to report on Form 3-NDFL.

The deadline for filing the declaration is April 30 of the following year. That is, all transactions in 2021 must be reported by 04/30/2021.

Read more about report submission deadlines here.

If you simply invested money in currency and 3 years have passed since its acquisition, you do not need to declare income from its sale. Submit a declaration too.

IMPORTANT! There is no need to pay tax when purchasing currency on the exchange. Property acquisition transactions are not subject to personal income tax.

What is taxed?

Only interest that exceeds the established limit is subject to tax on deposits made in 2021. To calculate the limit, use the following formula:

1,000,000 rubles * Key rate of the Central Bank of the Russian Federation as of January 1 of the current year

At the beginning of December 2021, the key rate was set at 4.25. So far there are no prerequisites for its sharp growth by the beginning of 2021. At the same time, no one can even guess what it will be like by January 1, 2022. Therefore, for the convenience of calculations, we assume that on January 1, 2021 it will remain at the level of 4.25. This means the limit will be set at the level:

1,000,000 rubles * 4.25 = 42,500 rubles

If income from deposits does not exceed 42,500 rubles, you will not have to pay tax. Anything that exceeds the established limit is subject to taxation.

If the amount of interest received exceeds 42,500 rubles, both residents and non-residents will pay 13% personal income tax on the entire excess amount. The interest rate will increase to 15% if the total income exceeds 5 million rubles. Until 2021, tax percentages on deposit income for residents and non-residents were different.

To figure out how much tax you will need to pay, let’s assume that the investor received 50,000 rubles in interest:

50,000 – 42,500 = 7,500 * 13% = 975 rubles tax on income from deposits

The tax does not apply to money stored on cards, accounts or deposits without interest. The Federal Tax Service will issue notifications only about payment of tax on interest received. That is, when calculating the tax base, interest on all ruble accounts and deposits with a yield below 1% per annum and escrow accounts are not taken into account. And income from all other deposit accounts and savings cards in the name of one individual, the rate for which exceeds 1%, is subject to taxation.

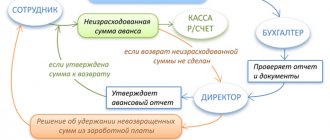

Who should transfer personal income tax - an individual or a tax agent

A tax agent is an intermediary between an individual and the Federal Tax Service, who, when paying income to an individual, is obliged to calculate, withhold and transfer the withheld tax to the budget (Article 226 of the Tax Code of the Russian Federation). At the end of the reporting periods, the tax agent reports on taxes withheld and transferred. On the stock exchange, the tax agent is the broker.

Read about the duties of a tax agent in the material “Tax agent for personal income tax: who is, responsibilities and BCC.”

IMPORTANT! When conducting transactions on foreign exchanges or with foreign currency, the broker is not a tax agent. This means that you are required to report your income yourself by filing a return.

Let's look at how to properly report to the Federal Tax Service.

Who will withhold tax from the deposit and when?

Banks will not withhold tax on the profits the depositor receives. The bank’s task is to transmit information about interest received to the tax service before February 1 of the next year. After this, the Federal Tax Service will collect all information about each depositor, control whether the limit is exceeded and send the citizen a notice of personal income tax payment.

Payment of tax on interest received on the deposit occurs in the next reporting period. That is, 13% tax if the limit is exceeded in 2021, the investor is required to pay before December 1, 2022.

Since all banks are required to transmit information on depositors to the Federal Tax Service, there is no point in opening several small deposits in different banks. An attempt to evade taxes will fail. Even if you open accounts in different regions, all amounts for one individual are summed up. Tax will be charged if the non-taxable limit is exhausted.

How to submit 3-NDFL

As we noted above, before April 30 you need to submit a declaration in form 3-NDFL. For reporting for 2021, use the form from the Federal Tax Service order No. ED-7-11 dated August 28, 2020/ [email protected] Download it by clicking on the link below:

The declaration consists of several sections and appendices, but when preparing a report on income from the sale of currency on the stock exchange, fill out the sheets shown in the diagram below. It will be more convenient to arrange them in this order:

You can submit a report:

- In person or through a representative at the tax office;

- Send by mail with a description of the attachment;

- Form it electronically and send it via telecommunication channels, for example, in the taxpayer’s personal account or through the government services website.

Let's consider who can claim a tax deduction when filling out Appendix 6.

All legal ways to avoid paying tax on deposit income

To avoid paying tax on interest accrued on a deposit, you can use one of the options:

- receive interest immediately upon issuance of the deposit, if you manage to arrange it before 2021;

- open deposits for children or other close relatives;

- close deposits and not receive profit from bank accounts.

All three methods can be combined, or you can choose one strategy.

The most logical option is to leave only the money on deposits that is intended for the airbag. Transfer the remaining savings to other assets. However, such advice is not suitable for all citizens. The decision is especially difficult for those new to financial planning and developing a wealth accumulation strategy.

Interest in advance

At the end of 2021, deposits with interest payment at the time of deposit are gaining particular popularity. New tax rules force Russians to look for options on how to achieve two goals simultaneously:

- Keep money on deposit to protect it from inflation and additional threats that affect the bank’s activities. According to Russian law, money in accounts and deposits up to an amount of 1.4 million rubles is protected. The depositor can receive them under any circumstances, even if the bank goes bankrupt.

- Receive a percentage from the bank for making a deposit. The goal of any investor is not only to preserve, but also to increase savings. The more a bank is willing to pay for placing a deposit, the higher the demand for its supply.

When choosing a deposit with advance payment of interest, several points are important:

- For such programs the rate is lower. Banks thus insure their risks if the key rate suddenly falls and the deposit becomes unprofitable.

- Restrictions may be set on replenishment or partial withdrawal of amounts. Although there may be restrictions for other types of deposits. Most often, this rule works: the more freedom the investor has, the lower the interest rate.

- If the contract is terminated early, you will have to compensate the bank for all interest that was paid upon its conclusion.

Making a deposit before December 31, 2020 will allow you to save on tax. But at the same time, all the described points will reduce its benefits for the investor. Therefore, it is important to compare in advance:

- How different is the rate on a deposit with advance payment of interest from the most advantageous offers on the market;

- calculate the possible difference on deposits taking into account the amount of tax;

- what amount will be placed on deposits, if it does not exceed 500-800 thousand rubles, it is better to choose programs with monthly or annual interest payments and even taking into account capitalization.

If deposits have already been opened and interest is being accrued on them, the calculations should compare and take into account the conditions of existing agreements and those that will only be opened.

Deposits for family members

The most logical way to diversify is to open deposits for each family member or close relative. In this case, banks will submit tax reports on income received by different citizens. Therefore, the tax base for each investor will be less than if the agreement is concluded for one person.

Currently in the Russian Federation there is no law obliging to take into account household income, so the strategy may be an alternative for investors with large capitals.

However, when choosing this way to reduce the tax on income from deposits, several nuances arise:

- when registering a deposit for a spouse, children, son-in-law or father-in-law, the money becomes their property;

- in the event of the death of the investor, you can receive money only by inheritance, and it is not a fact that the aunt does not have her own children, who are primarily heirs, or that the spouse will not write a will or testamentary disposition for another person;

- The interest rate on deposits with larger amounts is higher, so it may be more profitable to open such a deposit and pay tax than to split the amount into several small ones.

The method works. If you manage to avoid all the pitfalls, you can open several deposits for your relatives and not pay anything to the state from your savings, which are stored in bank deposits.

Close deposits

The most radical way to avoid taxes is to close all bank deposits. However, in most cases this will lead to financial losses if the deposit agreement has not expired. Banks will recalculate the accrued interest at the lowest possible rate of about 0.01% per annum.

You don’t have to act so radically; you can simply control the amounts that are stored on savings cards and accounts. The most reasonable option is to keep from 6 to 12 average monthly amounts on them, which is enough for the needs of the whole family.

Go to the stock market

Often, after closing their deposits, investors move their money to the stock markets. However, they may not take into account the serious differences between these two types of investments:

| Contribution | Investment |

| If the conditions under the deposit agreement are met, the bank is guaranteed to pay the interest specified in the agreement | No investor has the right to give any guarantee of profitability. If an advertisement or contract specifies a guaranteed income, then it is most likely a scam. |

| The deposit amount up to 1.4 million rubles is insured by the state. In the event of bank bankruptcy, the depositor can return amounts within the insured limit. To save amounts greater than 1.4 million rubles, you can open several deposits in different banks that cooperate with DIA | No assets in the stock market are insured by the government. Also, money in brokerage accounts or IIS is not insured. Therefore, in the event of bankruptcy or any other unforeseen circumstances, the state is not obliged to return the amounts that were in the assets |

| There is no need to study or recalculate anything. It’s enough to figure out in what form the bank will charge interest and you won’t have to control anything | To start investing, you need to carefully study the topic. But those who find this difficult can use the services of the Management Company. Most brokers provide this service to owners of brokerage accounts and individual investment accounts. |

| You don’t need to calculate the amount of tax on interest on the deposit yourself; a notification from the tax office will be sent by mail | If a profit is made from an investment, you will need to pay personal income tax. Basically, personal income tax is withheld by the broker, so few people will need to independently calculate and pay taxes |

Not all former investors will be able to become successful investors, even if they invest only in bonds. Moreover, there is also a tax on income from bonds.

Tax benefits when selling currency

As we noted above, currency is property. This means that when selling it, you can apply property deductions for personal income tax.

Article 220 of the Tax Code of the Russian Federation provides for the following types of property deductions:

- A fixed amount of 250 thousand rubles;

- In the amount of expenses incurred for the purchase of foreign currency.

ATTENTION! The first deduction applies to all types of income from the sale of various property for the year. For example, if you sold currency and a car, you can reduce the income from both transactions by 250 thousand rubles.

Let's look at examples of how to calculate tax when withdrawing currency from a brokerage account.

Examples of calculating personal income tax payable

Example 1.

You bought currency worth 10 thousand dollars in 2021 at a price of 70 rubles. They also sold it in 2021 for 75 rubles. You have the right to claim one of the property deductions:

- 250 thousand rubles. Then the tax amount will be equal to 65 thousand rubles. ((750 thousand rubles – 250 thousand rubles) × 13%).

- The cost of purchasing foreign currency is 6.5 thousand rubles. ((750 thousand rubles – 700 thousand rubles) × 13%).

IMPORTANT! The cost of purchasing currency can also include other expenses, for example, a broker's commission.

Example 2.

You bought 1000 dollars at a price of 76 rubles, and sold them for 77 rubles. There will be no tax due, because transaction amount is 77 thousand rubles. (1000 dollars × 77 rubles). less than the property deduction of 250 thousand rubles.

Example 3.

Let's take the conditions of the previous example and assume that in addition to income from the sale of foreign currency, income was received from the sale of a car in the amount of 500 thousand rubles, which was owned for less than 3 years. Then the tax amount will be: 42,510 rubles. (500 thousand rubles + 77 thousand rubles – 250 thousand rubles) × 13%).

If you still have documents confirming the purchase of the car, you can claim a deduction in the amount of the costs.

ATTENTION! You cannot claim 2 deductions at the same time.

Example 4.

During the year you made several currency purchase and sale transactions:

In this case, it is more profitable to claim a deduction in the amount of the cost of purchasing currency. That is, the tax amount will be 4,420 rubles. ((1,015 thousand rubles – 981 thousand rubles) × 13%).

You have the right to decide for yourself which deduction to claim. But do not confuse the property deductions we discussed above with investment deductions when trading currencies in an individual investment account.

Let's look at what investment deductions are.

Deductions when selling currency on IIS

First of all, let’s find out what an IIS is.

IIS is:

You can deposit and withdraw money to IIS only in rubles. And you can invest your money in different assets, including currency. The state has provided the following deductions for IIS:

IMPORTANT! If you close your IIS before 3 years, you are required to return all deductions received.

The nuances of obtaining an investment deduction for personal income tax are described in detail in ConsultantPlus. To do everything right, get a trial demo access in the K+ system and go to the material. It's free.

Currency trading offenses and sanctions

For late payment of tax, the Federal Tax Service will charge a penalty in the amount of 1/300 of the Central Bank refinancing rate for each day of delay.

For late submission of the 3-NDFL declaration, a fine will be imposed, the amount of which will range from 5% to 30% of the amount of the arrears. If the declaration is zero, but submitted at the wrong time, the fine will be 1,000 rubles.

Can tax authorities verify that there was income from the sale of currency? We can answer if:

- The transaction amount exceeded 600 thousand rubles. This information is transmitted automatically via internal communication channels.

- The inspector will request information on transactions on current accounts.

But not all cards are requested, and they are not automatically transferred to the Federal Tax Service if the transaction amount does not exceed the above limit. Consequently, income may remain undeclared.

IMPORTANT! If you have opened an account with a foreign broker, you are required to independently report on the movement of funds in the account, as well as notify the Federal Tax Service about the opening and closing of such accounts. The deadline for submitting information is June 1 of the following reporting year. For the first time, such information must be submitted no later than 06/01/2021. The notification form was approved by order of the Federal Tax Service dated April 24, 2020 No. ED-7-14/ [email protected]

you can follow the link below:

Explanations from ConsultantPlus will help you understand the nuances of filling out the notification. To do everything right, get a trial demo access to the K+ system. It's free.

If you do not submit a report, you will be fined under Article 15.25 of the Administrative Code:

- from 1 thousand rub. up to 1.5 thousand rubles. for filing a notification in an unspecified form;

- from 4 thousand rubles. up to 5 thousand rubles for failure to submit a document.

Will Russians pay 13% tax when purchasing foreign currency?

Important

Against this background, speculation began to arise that the government was going to introduce a tax on currency exchange. But the head of the Ministry of Finance, Anton Siluanov, denied these rumors. “No one was going to introduce any taxes on foreign exchange transactions of citizens,” Siluanov said. — The point is that companies that operate in the foreign exchange market, on Forex, and have income from foreign exchange transactions, they simply take this income into account as part of the total income from the company’s operations. No one has ever intended to introduce any additional taxes on citizens and never will.”

Let us recall that the practice of a currency exchange tax existed in Russia from 1997 to 2003. At that time there was a commission of 1% on the amount purchased. But this measure was abandoned because it did not bring the expected budget revenues.

Results

Purchasing currency through a brokerage account is not subject to taxes. When selling currency, be sure to calculate and pay personal income tax and report the income received in Form 3-NDFL. You can apply a property deduction in the amount of 250 thousand rubles to the income received. or in the amount of actual costs incurred for the purchase of currency.

Sources:

- Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

- Tax Code of the Russian Federation

- Code of Administrative Offenses

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What deposit interest is subject to taxation?

The amount of taxable profit on deposits depends primarily on the options for calculating interest:

- once a day, month, quarter or year;

- at the beginning or end of the term;

- with capitalization or not.

The annual profit on the deposit directly depends on the interest payment options. If a large long-term deposit becomes due in 2021 and the amount of interest exceeds the established limit, tax is required. The depositor is obliged to pay personal income tax on the entire excess amount, even if he extends the deposit.

To simplify the calculation, you can use an online deposit calculator. But if significant amounts are stored on bank deposits, it is inconvenient to track whether the amount of interest exceeds the established limit or not.