Along with the proud title of “entrepreneur”, you have new responsibilities in terms of paying taxes, filing reports and complying with other legal requirements. How not to get confused in the legislation and not make mistakes? This instruction, I hope, will help a “young” entrepreneur not to get confused and self-organize at the initial stage. Consider a situation where:

- An individual entrepreneur works independently without the involvement of employees;

- Payment for the individual entrepreneur's services is transferred to the individual entrepreneur's account (the individual entrepreneur does not accept cash and does not need to use cash register systems);

- The turnover of an individual entrepreneur is far from the limit, exceeding which deprives the individual entrepreneur of the right to apply the simplified tax system.

If, at the end of the reporting (tax) period, the “simplified” person exceeds the income limit of 150 million rubles, he will lose the right to apply the simplified tax system (clause 4 of article 346.13 of the Tax Code of the Russian Federation).

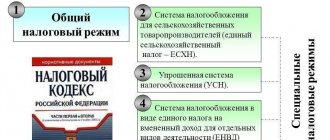

What taxes does an individual entrepreneur pay?

In fact, the simplified tax system (tax base - income) seems to be one of the simplest taxation systems. The individual entrepreneur requires a minimum of effort in keeping records and calculating taxes.

An individual entrepreneur who has chosen the simplified tax system (tax base is income) pays the simplified tax system at a rate of 6% (a subject of the Russian Federation may reduce it for some types of activities). At the same time, individual entrepreneurs are exempt from paying personal income tax in terms of income from business activities, VAT and property tax (with the exception of real estate that is subject to property tax in a special manner, based on their cadastral value). The individual entrepreneur does not keep accounting records.

In order to calculate the taxable amount of income, individual entrepreneurs are required to keep records of income in the book of income and expenses of organizations and individual entrepreneurs using the simplified taxation system (Article 346.24 of the Tax Code of the Russian Federation). The form of such a Book is approved by Order of the Ministry of Finance of Russia dated October 22, 2012 N 135n. The book is a register of documents on the basis of which the amount of income is determined. The book also records the payment of insurance premiums, which reduces the amount of tax. The main source of data for filling out the Book of our young entrepreneur is the current account statement for the corresponding period.

BCC according to the simplified tax system “income” 6% - 18210501011011000110.

A template for filling out a payment order can be generated using the service on the nalog.ru website: https://service.nalog.ru/payment/payment.html. The payer needs to select the type of payment and the service will offer KBK.

In addition, the individual entrepreneur must pay for himself the amounts of insurance contributions to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund of the Russian Federation:

1) insurance contributions for compulsory pension insurance in the amount determined in the following order:

- if the payer’s income for the billing period does not exceed 300,000 rubles, - in a fixed amount of 26,545 rubles for the billing period of 2021 , 29,354 rubles for the billing period of 2021, 32,448 rubles for the billing period of 2020;

- if the payer’s income for the billing period exceeds 300,000 rubles, - in a fixed amount of 26,545 rubles for the billing period of 2021 (29,354 rubles for the billing period of 2019, 32,448 rubles for the billing period of 2021) plus 1, 0 percent of the payer’s income exceeding 300,000 rubles for the billing period . In this case, the amount of insurance contributions for compulsory pension insurance for the billing period cannot be more than eight times the fixed amount of insurance contributions for compulsory pension insurance established by paragraph two of this subclause (26,545 * 8 = 212,360 rubles);

2) insurance premiums for compulsory medical insurance in a fixed amount of 5,840 rubles for the billing period of 2018, 6,884 rubles for the billing period of 2021 and 8,426 rubles for the billing period of 2021.

The entire amount is recognized as a fixed payment: 26,545 + 1% of the excess amount of 300,000 + 5,840.

The amounts of insurance premiums for the billing period are paid by individual entrepreneurs no later than December 31 of the current calendar year. Insurance premiums calculated on the amount of the payer's income exceeding 300,000 rubles for the billing period are paid by the payer no later than July 1 of the year following the expired billing period.

The amount that must be paid by the end of the year can be paid in full at once or transferred in installments. For example, once a quarter in an amount related to the current quarter.

The amount of income (in order to calculate the amount - 1% of the amount exceeding 300,000 rubles) is determined according to the declaration data - line 113 of section 2.1.1 of the declaration according to the simplified tax system (tax base - income).

If our individual entrepreneur was not registered from the beginning of the year, then he needs to pay insurance premiums in a smaller amount, namely, in proportion to the days from the date of registration of the individual entrepreneur until the end of the year.

For example, an individual entrepreneur registered on February 20. Therefore, the period from the date of registration to the end of the year is 10 months and 9 days. The amount of the insurance premium for the period until December 31 will be:

Amount for 10 months = (26545 5840) *10/12 = 26,987.50 rubles.

Amount for 9 days of February = ((26545 5840)/12) * 9/28 = 867.46 rubles.

Total = RUB 27,854.96

BCC of a fixed contribution to OPS - 182 102 02140 06 1110 160.

BCC of a fixed contribution for compulsory medical insurance - 182 102 02103 08 1013 160.

Individual entrepreneur reporting on the simplified tax system

Maintaining accounting records for individual entrepreneurs using the simplified tax system involves submitting a regulated list of reporting documents for certain periods of commercial activity. At the same time, the taxpayer is not exempt from submitting zero reports if there is no movement of funds in the accounts.

The documents are submitted to the tax office at the place of residence of the entrepreneur. You can submit your annual declaration under the simplified tax system by mail, in person, through a representative using a notarized power of attorney, or electronically via the Internet. The papers must be accepted by the inspector before the end of April 30 of the following reporting year.

Accounting for individual entrepreneurs under the simplified tax system occurs according to 2 options:

- The rate is 6% on income.

- The rate is 5-15% on the difference between income and expenses.

If there are no employees on staff, then individual entrepreneur accounting using the simplified tax system is limited to sending documents to the Federal Tax Service. The presence of employees requires the generation of reporting forms to extra-budgetary funds. Employers report on hired employees by taking:

- Every year (2-personal income tax until April 1, data on the average number of employees until January 20).

- Every 3 months (in the Federal Tax Service - calculation of insurance premiums within 30 days after the end of the quarter, in the Social Insurance Fund - a 4-FSS certificate within 20-25 days after the end of the quarter, in the Pension Fund - the SZV-M report before the 15th, which replaced in 2021 year form RSV-1).

KUDiR is a book of accounting for income and expenses of an individual entrepreneur, which acts as the main reporting document. It records revenues and expenses that were taken into account when calculating tax according to the simplified tax system. Financial information is reflected if the individual entrepreneur uses the “Income minus expenses” option.

If the entrepreneur has chosen the simplified tax system “Income”, he needs to note in the book the income and insurance premiums paid in favor of the individual entrepreneur and his employees. Non-operating income and information about profits received from the sale of goods and services are entered into KUDiR. Registration is made on the day payment is received. Each entry is confirmed by primary documents recording the fact of a financial and business transaction (acts, checks, strict reporting forms, invoices, payment orders).

Private entrepreneurs, in a simplified manner, report to the territorial branches of the Pension Fund. Until 2021, individual entrepreneurs submitted quarterly payments in the RSV-1 form by the 15th day of the second calendar month following the reporting period. When drawing up the SZV-M that replaced it, individual entrepreneurs reflect information only about persons accepted as employees. The form contains information on the number of concluded and terminated employment contracts and civil contracts.

If an individual entrepreneur conducts commercial activities independently, without involving employees, there is no requirement to submit reports to extra-budgetary funds. The necessary information about the activities of the individual entrepreneur is transferred to the pension fund by authorized tax inspectors.

How to determine the amount of income that is included in the tax base

For purposes of calculating “simplified” tax, income is considered received on the date on which you actually received the money (for example, into a bank account). This method of recognizing income is called cash. This means that the amount of the prepayment received by the individual entrepreneur is included in the amount of taxable income. If the contract is terminated and the advance received must be returned, the amount of the refund is reflected in the Income and Expense Book with a “-” sign in the period in which the refund was made.

However, according to the Ministry of Finance of the Russian Federation, if the advance payment (prepayment under the contract) is returned to the buyer (customer) in a tax period in which the “simplified person” had no income, then the tax base by the amount of the advance cannot be reduced (Letters of the Ministry of Finance of Russia dated July 30, 2012 N 03-11-11/224, dated 07/06/2012 N 03-11-11/204). Those. at the end of the year, the amount of income cannot be < 0 as a result of reflecting transactions for the return of advances.

Good news! Not all deposits of funds are subject to reflection in the income book and inclusion in tax calculations. In particular, the following transfers are not included in taxable income:

- Funds received under credit or loan agreements, as well as funds received to repay such borrowings;

- Income taxed at other tax rates (dividends, bond coupons, etc.);

- Income taxed under other tax systems (personal income tax, UTII, patent, etc.);

- Receipts that are not inherently income: funds received upon return of defective goods, funds mistakenly transferred by the counterparty or mistakenly credited by the bank to the taxpayer’s current account, etc.

An example of reflecting income in a book:

| No. | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | 2 | 3 | 4 | 5 |

| 1 | 20.03.2018 № 3 | Prepayment under agreement dated March 20, 2018 No. 1 | 30 000,00 | |

| 2 | 25.03.2018 № 4 | Prepayment under agreement dated March 25, 2018 No. 2 | 40 000,00 | |

| 3 | 26.03.2018 № 5 | Prepayment under agreement dated March 26, 2018 No. 3 | 50 000,00 | |

| Total for the first quarter | 120 000,00 | |||

| No. | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | 2 | 3 | 4 | 5 |

| 4 | 09.04.2018 № 10 | Prepayment under agreement dated 04/09/2018 No. 4 | 40 000,00 | |

| 5 | 22.04.2018 № 6 | Refund of prepayment due to termination of contract dated March 20, 2018 No. 1 | — 30 000,00 | |

| Total for the second quarter | 10 000,00 | |||

| Total for the half year | 130 000,00 |

Purchasing software under the simplified tax system Income - Expenses

An organization using the simplified tax system (Revenue Expenses) purchased software. How to reflect this operation in 1C? When calculating the tax base under the simplified tax system, is it possible to write off the costs of purchasing software as a lump sum?

In accounting (BU), the non-exclusive right to use computer programs relates to deferred expenses (clause 39 of PBU 14/2007). Write-off of deferred expenses (FPR) as expenses for ordinary activities is carried out evenly in accordance with the period of use of the software specified in the license agreement.

If the term is not specified in the agreement, then you can set it yourself, fixing the procedure for determining it in the Accounting Policy (clause 7, 7.1 PBU 1/2008, clause 39 PBU 14/2007, Instructions for the use of the Chart of Accounts approved by Order of the Ministry of Finance of the Russian Federation dated October 31 .2000 N 94n).

At the same time, in the BU you can focus on the following options for establishing the useful life of the software (clause 4 of article 1235 of the Civil Code of the Russian Federation, 1238 of the Civil Code of the Russian Federation, clause 18 of PBU 10/99):

- 5 years;

- the period during which the software will be used in the activity;

- without setting a write-off period (one-time allocation of software costs if this amount is insignificant).

Please note that the procedure for recognizing expenses for the acquisition of a non-exclusive right to use computer programs in the BU and in the simplified NU may not be the same. And that's why.

When calculating the tax base of the simplified tax system, expenses include expenses in the form of one-time payments associated with the acquisition of the right to use computer programs and databases under agreements with the copyright holder (licensing agreements), as well as expenses for updating programs (clause 2, clauses. 19 clause 1 article 346.16 of the Tax Code of the Russian Federation). Such expenses are included in KUDiR at a time under the following conditions (clause 2 of Article 346.17 of the Tax Code of the Russian Federation):

- transfer of the right to use the program;

- payment of remuneration to the seller.

Thus, if accounting uses a method of writing off software costs other than a one-time one, differences will arise between accounting and accounting.

Let's look at purchasing a program using 1C as an example.

The organization (Income - expenses, 15%) entered into an agreement with 1C-Eureka LLC for the purchase of the 1C:UPP 8 program worth 155,000 rubles. (without VAT).

The term of use of the software under the license agreement is 5 years.

On January 30, the software was received from the supplier and accepted for accounting.

On February 2, payment was transferred to the supplier.

Step 1 . Purchasing the program.

The purchase of the program is reflected in the document Receipt (act, invoice) transaction type Services (act) in the section Purchases – Purchases – Receipt (acts, invoices) – Receipt button.

In the Accounts , enter cost accounting analytics:

- Cost account - deferred expense account 97.21 “Other deferred expenses”;

- Future expenses — element of the RBP directory, formatted as follows:

Type for NU - Other ; - Type of asset in the balance sheet - Other current assets ;

- Amount — indicate the cost of the software;

- Recognition of expenses - By month ;

- The write-off period from... to... is the period of use of the software, in our example 5 years from 01/31/2018 to 01/30/2023 ;

- Cost account - an expense account, the debit of which will be uniformly included in the RBP, in our example - 26 “General business expenses”;

- Cost items - indicate the items to which the costs of using the software will be written off: in accounting - Software costs , in tax accounting - Other expenses;

In accounting, software costs will be written off evenly over the period of use of the software as deferred expenses.

See also Deferred expenses

Step 2. Accounting for the program in an off-balance sheet account.

In accordance with clause 38 of PBU 14/2007, it is necessary to organize the accounting of intangible assets provided for use by the copyright holder in an off-balance sheet account:

- Dt 012 “Intangible assets received for use” - for the value of the exclusive right received for use.

The program does not provide an off-balance sheet account for software accounting; you need to create it in the Main section - Settings - Chart of accounts - Create button.

Accounting for software on an off-balance sheet account is reflected in the document Transaction entered manually, transaction type Transaction in the Transactions – Accounting – Transactions entered manually section.

- Debit - account 012 "Non-exclusive rights to software": Subconto 1 - element of the RBP directory, in our example - Software "1C: UPP 8";

- Subconto 2 - the counterparty from whom the software was purchased;

- Subconto 3 is an agreement with a counterparty with the type C supplier for the purchase of software.

Step 3 . Payment to the supplier for the program.

The transfer of payment to the supplier is reflected in the document Write-off from the current account transaction type Payment to the supplier in the Bank and cash desk section – Bank – Bank statements – Write-off.

Postings according to the document

Register of the simplified tax system Book of accounting of income and expenses (section I)

Step 4. Write off the costs of purchasing software in tax accounting.

Recognition of expenses for software for the purposes of the simplified tax system is reflected in the document Entry of the book of income and expenses of the simplified tax system in the section Operations – Simplified Tax System – Entries of the book of income and expenses of the simplified tax system.

Income and expenses tab :

- Date, number of the primary document - date and number of the payment document for payment of the software to the supplier;

- Contents - in our example “ Acquisition of non-exclusive rights to software ”;

- Expenses - cost of software; Accepted ;

The result obtained can be checked through the section Reports - Simplified Taxation System - Book of Income and Expenses under the simplified taxation system.

In tax accounting of the simplified tax system, expenses for the purchase of software are taken into account at a time .

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- VAT when upgrading the PBX network software for a customer from Kazakhstan Good afternoon! Sorry for the intrusiveness, but the contract was changed by the counterparty and it arose again...

- Accounting for OS and software for it Good afternoon. We purchased a device for carrying out the project in situ for...

- Selling software for export Good afternoon! We are considering selling software for digital telephone exchanges...

- LLC on the simplified tax system (income minus expenses), purchase of the 1C ZUP program Good afternoon! LLC on the simplified tax system (income minus expenses) acquired...

When should you pay tax?

The tax at the end of the year must be paid by the entrepreneur to the budget no later than April 30 of the following year (a different deadline is established for organizations).

During the year, the individual entrepreneur must pay advance payments - no later than the 25th day of the month following the reporting period.

| Period | Term |

| 1st quarter | 25th of April |

| half year | July 25 |

| 9 months | the 25th of October |

| year | April 30 next year |

If the last day of the deadline for paying the tax (advance payment) falls on a weekend and (or) a non-working holiday, the tax (advance payment) must be transferred no later than on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

How to calculate the payment amount

Advance payments are calculated on the basis of income received for the corresponding reporting period on an accrual basis.

Advance payment = tax base for the reporting period on an accrual basis * 6%.

The payment amount is then determined as follows:

Payment amount at the end of the reporting period = Advance payment at the end of the reporting period - insurance premiums paid for the reporting period - advance payments paid earlier in the current year.

The tax amount at the end of the year is calculated as follows:

Tax to be paid additionally (refunded) = Tax base for the year * 6% - paid insurance premiums for the tax period - advance payments paid earlier in the current year.

Example

Individual entrepreneurs apply the simplified tax system with the object of taxation “income” with a general tax rate for this object of 6%. Has no hired workers. Over the past year (tax period), the individual entrepreneur received income in the amount of 720,000 rubles.

| Month | Income, rub. | Reporting (tax) period | Income for the reporting (tax) period (cumulative total), rub. |

| January | 0 | I quarter | 72 000 |

| February | 0 | ||

| March | 72 000 | ||

| April | 72 000 | Half year | 288 000 |

| May | 72 000 | ||

| June | 72 000 | ||

| July | 72 000 | 9 months | 504 000 |

| August | 72 000 | ||

| September | 72 000 | ||

| October | 72 000 | Year | 720 000 |

| November | 72 000 | ||

| December | 72 000 |

In the specified tax period, the individual entrepreneur paid insurance premiums for himself in the amount of:

— 4,000 rub. — in the first quarter;

— 12,000 rub. - within six months;

— 20,000 rub. — within 9 months;

— 28,000 rub. - during a year.

Note: the amounts of insurance premiums in the example are indicated in abstract terms!

Solution

Based on the results of the 1st quarter, the advance payment will be:

72,000 rub. x 6% = 4,320 rub.

This amount is reduced by insurance premiums paid in the first quarter.

4,320 - 4,000= 320 rub.

The amount due for tax payment according to the simplified tax system based on the results of the 1st quarter by the deadline of 25.04. will be 320 rubles.

2. Based on the results of the six months, the advance payment will be:

288,000 *6% = 17,280 rub.

This amount is reduced by insurance premiums paid during the six months:

17,280 - 12,000 = 5,280 rubles.

Payment due July 25. will be 5,280-320=4960 rubles.

3. Based on the results of 9 months, the advance payment will be:

504,000×6% = 30,240 rub.

This amount is reduced by insurance premiums paid within 9 months:

30,240 - 20,000 = 10,240 rubles.

Payment for 9 months due October 25. will be 10,240 - 320 - 4960 = 4,960 rubles.

4. Tax calculation at the end of the year:

720,000 rub. x 6% = 43,200 rub.

This amount is reduced by insurance premiums paid during the year:

43,200 - 28,000 = 15,200 rubles.

This result is reduced by advance payments paid at the end of the first quarter, half year and 9 months:

15,200 - 320 - 4960 - 4960 = 4960 rubles.

Thus, at the end of the year (due April 30 of the next year), the tax payable will be 4,960 rubles.

If in the first quarter of 2021 an individual entrepreneur pays additionally to the budget the amount of insurance premiums for 2021, which is calculated as 1% of the amount of income exceeding 300,000 rubles, then such payment of contributions will reduce the amount of the simplified tax system for the 1st quarter of 2021.

The nuances of calculating and recognizing “deductions” in the form of insurance premiums paid for oneself

1) Individual entrepreneurs who do not make payments to individuals who have paid insurance premiums, calculated as 1% of the amount of income exceeding 300 thousand rubles at the end of the billing period (calendar year), have the right to take into account the specified amounts of paid insurance premiums when calculating the tax in that tax period (quarter) in which their payment was made. Letter of the Federal Tax Service of Russia dated October 31, 2014 N GD-4-3/ [email protected]

If the amount of insurance premiums is greater than the amount of tax (advance tax payments) paid in connection with the application of the simplified tax system, then the tax (advance tax payment) is not paid in this case. Transferring to the next tax period part of the amount of the fixed payment not taken into account when calculating (reducing) the amount of tax paid in connection with the application of the simplified tax system due to the insufficiency of the amount of calculated tax is not provided. This means that if, for example, the payment under the simplified tax system was 10,000 rubles, and insurance premiums were paid for 13,000 rubles, then you do not need to pay the simplified tax system, but the difference is 3,000 rubles. is not compensated in any way.

2) According to paragraphs. 1 clause 3.1 art. 346.21 of the Tax Code of the Russian Federation, the amount of tax (advance payment) under the simplified tax system for the tax (reporting) period can be reduced by the amount of insurance premiums that have been paid within the calculated amounts. But we are not talking about calculation in this period. Those. contributions can be calculated for previous periods, but paid in the current one. Based on this, for the amounts of insurance premiums paid in the tax (reporting) period that exceed the calculated ones, the “simplifier” with the object “income” does not have the right to reduce the amount of tax (advance payment) for the corresponding period.

The overpaid amount of insurance premiums can be taken into account as a tax reduction in the tax (reporting) period in which the tax authority decided to offset the overpayment of insurance premiums against future payments (Letter of the Ministry of Finance of the Russian Federation dated 02/20/2015 N 03-11-11/ 8413).

Registers of information on the basis of which KUDiR records are formed

Book of income and expenses (section I)

- Expenses under the simplified tax system

is intended for tax accounting of expenses for the purposes of the simplified tax system. This register contains information about the organization's expenses. - Other calculations

are intended to account for mutual settlements regarding salaries, taxes and accountable persons for the purposes of the simplified tax system. Register entries are used to control payments and determine the amount of expenses.

Book of accounting of income and expenses (section II)

- Registered payments for fixed assets (STS)

, is intended for tax accounting of payments for fixed assets for the purposes of the STS. This register contains information about all payments made for fixed assets put into operation. - Registered payments for intangible assets (STS)

, is intended similarly to the accumulation register “Registered payments for fixed assets (STS)” for tax accounting of payments for intangible assets.