Accounting software under the simplified tax system: postings

Accounting for the company's software is regulated by the basic accounting standards - the Law “On Accounting” dated December 6, 2011 No. 402-FZ and PBU 14/2007. When purchasing exclusive rights to software, the company becomes the owner of the program. If the software meets the criteria for an intangible asset specified in clause 3 of PBU 14/2007 (the object is separated from other assets, is used in the company’s activities for more than a year, is capable of bringing benefits to the company, its value is reliably determined, and its sale is not expected within a year), then it is accounted for at actual cost as part of intangible assets on account 04. Costs incurred will be written off by monthly depreciation over the useful life period established by the company. The service life of the software is determined based on the period of time when the operation of the asset is most profitable for the company, and can be reviewed annually.

Initially, the costs of purchasing software are accumulated in accounting on the account. 08 (D/t 08 - K/t 60, 76), and upon commissioning they go to the debit of the account. 04 (D/t 04 - K/t 08). Write-off of the cost of software is fixed by depreciation every month during the useful life - D/t 20.26, 44 - K/t 05.

If the program was purchased under a simple (non-exclusive) license, this means that the company received the right to use the software for a certain time, and the right to dispose of it remains with the developer. Since the program will not be the property of the company, it cannot be recognized as an intangible asset. In this case, the costs of its purchase are reflected as follows:

- deferred expenses (FBP) (D/t 97 – K/t 60, 76) and are written off evenly every month if the purchase is paid for in a one-time payment (D/t 20,26,44 – K/t 97);

- current expenses, if the company makes periodic payments for using the program (D/t 20.26.44 – K/t 60.76).

The estimated cost of the purchased license is taken into account on the company's balance sheet, for example, in the debit of account 012. Software costs are written off in the manner prescribed by the company, after commissioning and documentation of the installation of the program. Expenses for installing, configuring, and maintaining software are recognized in accounting as current costs and are written off in the reporting period when they were incurred (D/t 20.26.44 – K/t 60.76).

How are deferred expenses taken into account in 1C 8.3

Step 1. The non-exclusive right to use the software has been registered

You are recording the non-exclusive right to use the software with posting Dt 97.21 Kt 60, the document “Receipt (act, invoice)”, type of operation “Services”. At the same time, in 1C 8.3 an entry is made in the register “Expenses of the simplified tax system” and the rights accepted for use Dt 012 are reflected in off-balance sheet accounting.

Let's enter the software receipt document:

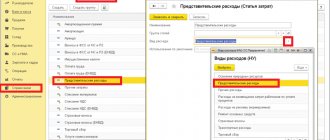

Next, it is important to correctly fill out the cost account - Other deferred expenses, cost division and Expenses (OU) are accepted:

You also fill out the costs in the BPR directory, where you indicate the total amount, how they are written off and where they are written off, the cost account and the cost item, this is for accounting:

How to reflect deferred expenses in 1C 8.3 is discussed in more detail in our article.

Step 2. Funds are transferred to the supplier

Payment to the supplier is formalized by posting Dt 60.01 Kt 51 with the document “Write-off from the current account.” Select the type of transaction “Other”, indicate account 60.01, counterparty and agreement:

If you indicate “Other write-off” and not “Payment to supplier”, then you can include these expenses in the KUDiR at a time and indicate the amount that will be included in the KUDiR:

If it is necessary that every month expenses be included evenly in KUDiR, as in accounting, then in this case a document “Write-off from the current account” with the type “Payment to supplier” is generated. Then in 1C 8.3 everything will be automatically written off evenly. But under the simplified tax system we have the right to immediately write it off as expenses.

Thus, the amount of costs fell into the expenses of KUDiR:

How to reflect the purchase of a 1C program in the 1C 8.3 Accounting database using an example, read our article.

Step 3. Software costs are evenly included in expenses (accounting)

If you set the transaction type to “Payment to supplier”, then when closing the month, the 1C 8.3 program will, as in accounting, evenly write off account 97, and postings for expenses in KUDiR will be added here according to the same even write-off.

Prepared by the document “Write-off of deferred expenses”:

Postings are generated for monthly write-offs:

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Tax accounting of software costs under the simplified tax system

In order to recognize exclusive rights to software as an intangible asset in tax accounting, the following conditions must be met (clause 4 of article 346.16, clause 1 of article 256 of the Tax Code of the Russian Federation):

- their cost must exceed 100,000 rubles,

- useful life - more than 12 months,

- the property is depreciated and used for its own needs.

Expenses for this asset are written off quarterly in equal amounts during the tax period (year) after payment and acceptance of the software for accounting.

An asset acquired with periodic payment delineation during the term of the agreement cannot be classified as an intangible asset (clause 8, clause 2, article 256 of the Tax Code of the Russian Federation). The costs for such software are written off upon each subsequent payment.

If a non-exclusive right to use the software has been acquired, then in tax accounting the expenses are written off immediately after payment and acceptance of the asset for accounting as part of the RBP.

General taxation system

The procedure for paying personal income tax for individual entrepreneurs using the general taxation system is regulated by the provisions of Chapter 25 of the Tax Code of the Russian Federation.

In this case, the concept of expense is not used, by which taxable income can be reduced by reducing the tax base. Instead, the concept of deduction is established for individual entrepreneurs on the OSN. There are different categories of personal income tax deductions - investment, property, professional, social, property, standard and social.

Important

How to take into account income when switching from UTII to simplified tax system?

In a situation where an individual entrepreneur purchases computer programs and databases and makes payments under a license agreement, these costs can be taken into account when generating the individual entrepreneur’s professional deduction. They must be supported by documents confirming the fact of purchase.

The composition of expenses that an individual entrepreneur can take into account for a professional deduction for personal income tax is similar to the composition of expenses that are taken into account when determining the income tax base. The Tax Code allows licensing payments for obtaining the non-exclusive right to use computer programs and databases to be classified as other expenses associated with production and sales. Thus, due to these costs, it is possible to reduce the personal income tax base for an individual entrepreneur.

Examples of software accounting (STS)

Example 1

In April 2021, the enterprise acquired the exclusive right to software worth 150,000 rubles, paying in full and installing the software in April. The asset is recognized in the structure of intangible assets, the useful life is set at 3 years (36 months). In accounting, software costs will be written off by depreciation over 3 years. Postings:

| Operations | D/t | K/t | Sum |

| Purchasing software | 08 | 60 | 150 000 |

| Payment | 60 | 51 | 150 000 |

| Putting software into operation as intangible assets | 04 | 08 | 150 000 |

| From May 2021 to April 2021, depreciation is calculated monthly (150,000/36) | 20 | 05 | 4166,67 |

In tax accounting, the accountant will write off the costs of purchasing an asset before the end of the tax year, distributing the costs quarterly - in the 2nd, 3rd and 4th quarters, 50,000 rubles each. (150000/3), and reflecting them in KUDiR.

"1C: Accounting 8": simplified cost accounting

To automate accounting under the simplified taxation system, management chose the software product “1C: Accounting 8”, which allowed us to solve the main problems:

- The ability to maintain a general and simplified taxation system in one program, in case the taxation system changes in the future

- Speeding up the data entry and processing process

- Automatic generation of a book of income and expenses based on entered documents and manual entries

In application solutions (standard configurations) intended for organizations using a simplified taxation system, accounting is fully supported. This is necessary, first of all, for the organization itself to make a decision by the owners on the distribution of net profit and the accrual of dividends and income from participation.

The company chose “Income reduced by expenses” as the object of taxation. In this case, in order to recognize expenses in order to reduce the tax base, it is necessary:

- Monitor the fulfillment of all conditions for their recognition

- Correctly determine the moment of recognition of expenses

- Create an entry in the books of income and expenses when recognizing these expenses

To solve these problems, “1C: Accounting 8” maintains tax accounting of expenses (according to the simplified tax system). Consistent completion of the relevant documents will allow the automatic generation of a book of income and expenses at the end of the reporting (tax) period.

Setting up accounting according to the simplified tax system will be performed in the “Accounting policy (tax accounting)” form (menu “Enterprise” -> “Accounting policy” -> “Accounting policy (tax accounting)”), where on the “Basic” tab the flag “Use of a simplified system” is set Taxation", which makes the "STS" tab available for filling out. On this tab, the object of taxation is determined: “Income” or “Income reduced by the amount of expenses” and the procedure for recognizing expenses (the composition of events, the occurrence of which is a prerequisite for recognizing an expense as reducing the tax base). The fact is that some conditions for recognizing expenses are controversial.

Thus, the Ministry of Finance of Russia, in letter dated August 17, 2006 No. 03-11-02/180, added one more condition necessary for recognizing expenses for the purchase of goods when applying the simplified tax system - the goods must not only be paid to the supplier and sold, but also paid for by the buyer. We note on our own that the last condition does not directly follow from the norms of the Tax Code of the Russian Federation. The financial department made this conclusion based on an analysis of the provisions of Article 346.17 of the Tax Code of the Russian Federation, which regulates the moment of recognition of income.

In “1C: Accounting 8” the user can choose whether to wait for the buyer’s payment to be recognized as an expense or not. In the latter case, you will have to defend your position in court.

The main types of expenses and requirements for the recognition of these expenses are given in Table 1. The list of requirements for some types of expenses is determined in the form “Accounting policy (tax accounting)” on the tab of the simplified tax system (see Fig. 1), some of them are mandatory, and some can be adjusted by the user.

Table 1

| Type of consumption | Requirements (expenses are recognized at the latest) |

| Services | Third party service reflected |

| Paid to supplier | |

| Settlements with employees | Salary accrued |

| Wages paid | |

| Calculations for taxes and contributions | Taxes (contributions) accrued |

| Taxes (contributions) are transferred | |

| Materials | Materials received from supplier |

| Materials paid to supplier | |

| Materials transferred to production | |

| Goods | Goods received from supplier |

| Goods paid to supplier | |

| Goods sold to buyer | |

| Goods paid for by the buyer | |

| Additional costs (based on materials) | Increase the cost of materials and are included in expenses as part of them |

| Future expenses | Deferred expenses reflected |

| Paid to supplier | |

| Part of the expenses is written off (only the written-off part can be accepted as expenses) | |

| Intangible assets | Received NMA |

| Paid to supplier | |

| Fixed assets | Arrival of OS |

| OS commissioning | |

| Paid to supplier | |

| Separation of the principal's revenue from income | When payment is received from the buyer, the payment document is analyzed and if it contains consignment goods, the amount of accepted income is reduced by their sales value. Information about revenue for consignment goods is added to the “Content” field of the KUDiR register entry |

Automatic accounting according to the simplified tax system is provided by several specialized accumulation registers.

Registers are an element of the organization of tax accounting, designed to systematize and accumulate information about the income and expenses of an organization. They record data on the presence and movement of any quantities: material, monetary, etc. The registers used for accounting according to the simplified tax system store information about parties, the state of mutual settlements and balances of unrecognized expenses. Movement through registers is generated automatically when posting documents.

The list of expenses that reduce the tax base for a single tax is determined by Article 346.16 of the Tax Code of the Russian Federation. In accordance with paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, expenses are recognized subject to their actual payment. Therefore, control of the status of mutual settlements for tax accounting purposes is carried out in a separate register “Mutual settlements of the simplified tax system”.

To account for expenses subject to tax accounting, the configuration uses the accumulation register “Expenses under the simplified tax system.” This register stores information about expenses for which all the conditions necessary for their acceptance for tax accounting have not yet been registered (reflected in the “Income and Expense Accounting Book”). To obtain information about what specific conditions are missing, you can use the “List/Cross-tab” report (menu “Reports” -> “List/Cross-tab”), and in the “Accounting section” field you should select the value “ Expenses under the simplified tax system."

To move correctly through the registers, you need to pay attention to filling out documents.

The documents may indicate the procedure for reflecting expenses in tax accounting. To do this, use the “Expenses in NU” attribute, which can take the following values:

- Accepted - expenses comply with the requirements of Article 346.16 of the Tax Code of the Russian Federation

- Not accepted - expenses do not meet the requirements of Art. 346.16 Tax Code of the Russian Federation

- Distributed - for organizations transferred to UTII for one or more types of activities. This is how expenses are reflected that comply with the requirements of Article 346.16 of the Tax Code of the Russian Federation and are accepted, but cannot be attributed to a specific type of activity and are subject to distribution

If, when an expense is received or written off, the document does not contain the “Expenses in NU” attribute, then the procedure for reflecting expenses in tax accounting is determined by the type of transaction (for example, sale of goods), or the operation is not a tax accounting event (for example, transfer of goods to commission).

Thus, in general, in order to recognize expenses in tax accounting, it is necessary that:

- The expense was not not accepted according to the conditions of receipt

- The expense was not unacceptable under the write-off conditions

- All events provided for recognition as expenses by the norms of Chapter 26.2 of the Tax Code of the Russian Federation were reflected

Let's consider how, as a result of the implementation of the 1C:Accounting 8 program, the process of recognizing expenses for purchased goods, expenses for services of third-party organizations and for purchased materials in Absolut-XXI LLC was automated.

Example 1. Recognition of expenses on purchased goods

Goods were received from the supplier LLC “1” for a total amount of 10,000 rubles, according to the advance payment listed earlier.

In accounting, this operation is reflected by the following entries:

- Document “Outgoing payment order” with the “Paid” checkbox: Debit 60.02 Credit 51 - 10,000 rub. (advance payment transferred);

- Document “Receipt of goods and services”: Debit 41.01 Credit 60.01 - 10,000 rubles. (goods arrived); Debit 60.01 Credit 60.02 - 10,000 rub. (advance credited).

We will generate a “List/Cross-Table” report for the accounting section “Expenses under the simplified tax system” to obtain a list of unfulfilled conditions for accepting an expense. For this receipt, the line “Not written off” was created in the amount of 10,000 rubles.

Subsequently, half of the received goods were sold to the buyer LLC “2” for the amount of 15,000 rubles. After posting the document “Sales of goods and services”, the following entries were generated in accounting:

Debit 90.02 Credit 41.01 - 5,000 rub. (Cost written off); Debit 62.01 Credit 90.01 - 15,000 rub. (Revenue received)

In the actual sales report, the second line “Not paid by the buyer” is formed in the amount of 15,000 rubles.

Let us reflect the operation of receiving payment from the buyer in the document “Outgoing Payment Order” with the “Paid” checkbox:

Debit 51 Credit 62.01 - 15,000 rub.

In the report there will be a line for the receipt “not written off” in the amount of 5,000. A line is created in the books of income and expenses for the recognition of expenses for the acquisition of inventory and materials in the amount of 5,000 rubles.

Example 2. Recognition of expenses for third-party services and purchased materials

LLC “3” carried out work to repair the car in the amount of 2,000 rubles, including replacement of spare parts in the amount of 1,000 rubles.

These transactions will be reflected in accounting through the documents “Receipt of goods and services” and will generate the following transactions:

Debit 26 Credit 60.01 - 2,000 rubles; Debit 10.05 Credit 60.01 - 1,000 rub.

In the report on the balances of the register “Expenses under the simplified tax system”, one line is formed for services provided in the amount of 2,000 rubles. and the second line for the receipt of spare parts from about in the amount of 1,000 rubles. (see Fig. 3).

After paying the debt to the supplier, only one line will remain in the report for the receipt of spare parts in the amount of 1,000 rubles. A line is created in the books of income and expenses to recognize expenses for services of third-party organizations in the amount of 2,000 rubles. We will write off materials using the document “Request-invoice”: Debit 26 Credit 10.05

A line is created in the books of income and expenses for the recognition of expenses for the acquisition of inventory and materials in the amount of 1,000 rubles. (see Fig. 4).