Perhaps many car enthusiasts have heard the abbreviation GTD mentioned at least once in their lives. Not many people pay attention to this. In addition, there is often a chance of seeing this combination of three letters in some documents. In practice, every car owner can encounter these mysterious three letters, so it would be useful to find out what they are and what they represent.

- 2 How to declare goods transported across the border?

- 3 Features of filling out a cargo customs declaration

- 4 Customs clearance and control

- 5 Cargo customs declaration for the car

- 6 Number of cargo customs declaration

- 7 Is it always necessary to fill out a customs declaration and additional documents?

Introduction

Selecting the type of engine, as well as their number, to drive electric generators at a power plant of any capacity is a complex technical and economic task. Attempts to compare piston and gas turbine engines as drives are most often made using natural gas as fuel. Their fundamental advantages and disadvantages were analyzed in technical literature, in advertising brochures of manufacturers of power plants with piston engines, and even on the Internet.

As a rule, generalized information is provided about the difference in fuel consumption and the cost of engines without any consideration of their power and operating conditions. It is often noted that it is preferable to formulate power plants with a capacity of 10–12 MW on the basis of piston engines, and for larger power plants on the basis of gas turbine engines. These recommendations should not be taken as an axiom. One thing is obvious: each type of engine has its own advantages and disadvantages, and when choosing a drive, some, at least indicative, quantitative criteria for their assessment are needed.

Currently, the Russian energy market offers a fairly wide range of both piston and gas turbine engines. Among piston engines, imported engines predominate, and among gas turbine engines, domestic ones prevail.

Information on the technical characteristics of gas turbine engines and power plants based on them, proposed for operation in Russia, has been regularly published in recent years in the “Gas Turbine Equipment Catalog”.

Similar information about piston engines and the power plants they are part of can only be gleaned from advertising brochures of Russian and foreign companies supplying this equipment. Information on the cost of engines and power plants is most often not published, and the published information is often not true.

How to declare goods transported across the border?

There are two ways to declare goods that a motorist is carrying with him and intends to cross the border with them. Both methods differ in that they are used in different situations.

So, there are two ways to declare goods transported across the border:

- The first method is relatively simple, since the car owner will have to submit a special application to the relevant authorities, which can rather be called semi-official. This written document must be drawn up in any form and contain information about the property that the owner of the vehicle intends to transport across the border. This method is applicable only in cases where the total value of the goods available does not exceed 100 euros. You should also remember that goods should not be subject to taxation or have any restrictions on transportation. What you need to indicate in the application:

- The name of the person who transports the declared property across the border, as well as an indication of its legal address;

- Name of all available products. In this case, it is mandatory to indicate their quantity and codes;

- Customs regime;

- The second method will be discussed in more detail in this article, since this is where the registration of a customs declaration will be required. That is, this method involves submitting a cargo declaration to the customs authorities. More information regarding the gas turbine engine will be provided to the reader further.

GTE for a car

In order for a Russian citizen to register his foreign car with the State Traffic Safety Inspectorate, he first needs to submit a customs declaration for the car, since the cargo customs declaration is the basic document for customs control of all imported and exported goods. The customs declaration for the car is issued by the owner or an authorized person and certified by a customs officer. After the procedure for issuing a customs declaration, this document becomes the only basis for allowing the vehicle to cross the customs border.

If a foreign car is imported into the territory of the Russian Federation by a legal entity (for example, a car dealership), its buyer is given a certified copy of the customs declaration. In this case, the owner of the car must check its VIN with the specified alphanumeric code in the PTS (vehicle passport)

It is important to understand that if such a discrepancy is detected at the traffic police, registration will be guaranteed to be denied. In addition to the PTS, a customs receipt order must also be issued for a car imported from abroad (new or used), confirming the fact of payment of all necessary customs duties

In order to gain an understanding of the customs declaration for a car, you first need to understand what a cargo customs declaration number is. It consists of the following four slash characters, separated by each other:

– the first fragment of the number contains the identification of the customs post (eight characters);

– the second part of the number represents the date of registration of the customs declaration with the customs control authority in the “day/month/year” format;

– the third slash character indicates the serial number of the gas turbine engine (a seven-digit number, where the first digit can be replaced by the letter “P”);

– the fourth part of the number is the product number in the customs declaration (consists exclusively of numbers).

There are features of customs clearance of a car imported from the territory of countries that are members of the customs union (Kazakhstan and the Republic of Belarus). Since the CU (customs union) is a single customs zone in the form of trade and economic integration since January 1, 2010, the import of cars into the Russian Federation from CU member countries is duty-free, but with the obligatory provision of a customs declaration. And after issuing a certificate of conformity, vehicles imported into Russia are entered into the customs database

It is important to understand that from January 1, 2013, cars released by the customs authorities of the CU member countries have the status of CU goods and, according to the terms of the tripartite international agreement, are not subject to the “customs clearance” procedure

It is important to understand that in addition to the main and additional sheets of the customs declaration (CD1 and TD2), a mandatory customs clearance document is the DTS (declaration of customs value), which is an annex to the cargo customs declaration. It is the DTS that contains complete information on the payment of all types of customs duties, including customs duties, excise taxes and VAT

For imported cars, a DTS must be issued, except in cases specifically provided for by the relevant legal regulations.

So, for example, a DTS for an imported car is not needed if the vehicle value (customs value) for it (consignment) does not exceed 5,000 US dollars. In addition, vehicles under multiple deliveries under the same contract or different contracts are not subject to economic regulation measures if the sender and recipient are the same. Also, tariff regulation measures do not apply to individuals importing cars for non-commercial purposes.

Customs clearance of a car engine deserves special attention. Since the engine (new or used) is the basic component of the car, customs control measures apply to it on a full scale. That is, a customs declaration must be issued for automobile engines, which for the traffic police will be indisputable evidence of customs clearance and confirmation of their origin.

This applies to cases of engine replacement (overhaul) when registering a repaired vehicle with the traffic police. The gas turbine declaration for the engine must also be issued during their implementation. Along with the cargo customs declaration, you need to have the following package of documents:

- Registration certificate;

- contract of sale;

– documents on tax registration of the seller of the engine for the car (spare parts).

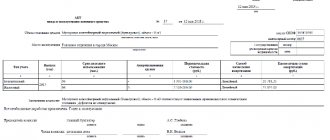

Sample of a completed customs declaration form

After completing all the points, the customs declaration will be accepted for registration, then everything is recorded in a special journal and after the customs declaration becomes a document with legal force. After the full registration of the customs declaration is completed, it is strictly prohibited to issue it to the declaring party or to an outsider who is not a border service employee until the full registration is completed.

Amendments, additional notes or withdrawal of the customs declaration can be made only before the start of the inspection process of cargo and vehicles. A fully completed customs declaration along with the accompanying package of documents is transferred to the border service for control.

CCD for engine and car: what is it? – Car service

Currently, there are the following methods of importing a car under documents: - Cutting - Carpiling - Kostruktor - Cutting for swap. All these schemes have one goal - to avoid huge customs duties on cars. Let's figure out what each of these methods means.

- Sawing

- When importing a car according to the sawing scheme, the car is sawn along the front or back, and the windshield or rear window is removed, respectively.

- technical components and assemblies remain intact, wires and hoses are removed if necessary.

- When you bring a car according to the cut scheme, you receive the following documents: - CCD (cargo customs declaration) for the “front part of the body” indicating the body number and engine number. - CCD for the rear part of the car, naturally without a number

- Purchase and sale agreement for these spare parts.

- Karpil.

- When importing a car using the carpiling scheme, the car is partially disassembled, doors, fenders, bumpers, optics, seats are removed, and the front part behind the TV is sawed off.

This cutting pattern does not affect the integrity of the body and the rigidity of the body, which guarantees the safe operation of such a car. There will be no seams on the car body, which eliminates questions about cutting when inspecting the car.

At the same time, such a delivery scheme is more expensive than a cutting scheme, and is the most profitable from a price-quality point of view.

When importing a car according to the carpil scheme, you receive the following documents - CCD (cargo customs declaration) for the “body frame without engine compartment” indicating the body number. - CCD for the engine.

- — Purchase and sale agreement for these spare parts.

- Constructor.

The designer import scheme is the oldest and most famous among the people. Designers have been tinkering for more than 10 years. With this scheme, the car passes customs with separate spare parts - body (cabin), engine, frame (if any).

All these components are given away (but remain in their places), so that if customs has the desire, each element of the car can be submitted for inspection separately.

It is clear that the consequences of such an import in terms of the integrity of the car, its components and assemblies are practically zero, as if you had removed the engine at a service center for repairs and put it back.

This scheme was basic for all cars until 2009. But after the entry into force of the decree on the minimum duty on the body of passenger cars at 5,000 euros (after accession to the WTO it was reduced to 2,900 euros), the scheme lost its economic feasibility.

Although it is still relevant for expensive cars.

Trucks and buses of category D were not subject to the protective duty, because they do not have a passenger car body (category B). Trucks have a cab, while category D buses have a non-passenger body.

Cut for spare parts. (swap)

It is also popular to import a car cut into tacks, not welded. Such cars are transported as donors for cars that have either been involved in an accident or are in poor condition. A car brought by a donor is bought that is completely identical to an existing car and everything that is needed is transferred from the donor.

In this way, a new life is given to an old car. The car is transported as a whole; when imported into the Russian Federation, the car is sawed at the front or rear, at your choice, then spot welding is carried out for ease of transportation. The car remains on the move as if purchased in Japan, all hoses and wires remain untouched.

All you have to do is remove everything you need or absolutely everything and replace it with your old car.

When you bring a car for spare parts, you receive the following documents: - CCD (cargo customs declaration) for the front part of the body, indicating the body number and engine number. - CCD for the rear of the car, naturally without a number.

— Purchase and sale agreement for these spare parts.

The point is this. I want to buy myself a mark-shaped turbochat while in St. Petersburg. But the problem is, how best to do this? We know the import methods. What options do we have? ——Option one, buy in average mark-shaped condition (m.o.

) at a low price, order a swap kit (cut for spare parts), put the whole thing on the purchased MO, paint it and rejoice! But there is a minus, the car is not tuned, it was not assembled by a Japanese, and perhaps rotten after our salt, time and a lot of money.

— option two, buy a carp and weld the bar. The cheapest option, everything is set up and assembled by the Japanese, you can snatch a wildly charged tourer, but it’s not legal and the face is cut!—option three, buy a ready-made m.o. in St. Petersburg.

Minus the high price, it is not clear what the owner did, how he looked after him, and in general I think with my connections in the Far East it makes no sense to overpay.

We type correctly: customs declaration number, decoding, example of creation

Any declaration, regardless of whether an export or import is drawn up by a participant in foreign economic activity, begins with a number.

This is what it looks like in X format:

xxxxxxxxxx/xxxxxxx/xxxxxxxxxx

All elements of the declaration number are placed through a separator, and spaces between them are not allowed.

An example with numbers: let’s say the customs authority code is 10101020, the release date (import of goods) is December 6, 2012, the serial entry in the journal is 00012503. Then the declaration number for these data will be written like this:

10101020/061212/00012503

The gas customs declaration number and the decoding of its digital elements are determined by the content of information hidden in it and grouped into three blocks:

- The first block is the code of the customs department exercising control over the import of goods.

- The second is the date of registration of the declaration; the day, month, and last two digits of the current year are indicated.

- A serial number assigned according to the register of cargo customs declarations by the customs office that registers the declaration. Every year it starts anew, from one.

Rating of the best UPS for a boiler

The compiled rating is based on the overall functionality of the UPS, which ensures long-term and stable operation of the gas boiler.

1 place

The best option for a gas boiler would be an uninterruptible power supply with continuous operation and an external battery with a capacity of 50Ah or more.

It will ensure round-the-clock stable operation of heating equipment and its autonomous operation for 3-5 hours. Good models in this category are Legrand DAKER DK 1kVA, LogicPower LPY-WPSW-1000VA, CyberPower OLS1000E, Luxeon UPS-1000LE and Delta Amplon N1K.

The LogicPower LPY-WPSW-1000VA uninterruptible power supply is a device with double voltage conversion and will be an ideal solution for boilers with power consumption up to 500 W

2nd place

The middle of the rating is occupied by linear-interactive devices with a wide range of operating voltages, a smooth sine wave at the output and the ability to connect an external battery. The cost of devices that will be sufficient to operate a gas boiler is within $100.

Typically, such UPSs already contain a battery that will provide 5-20 minutes of operation of the heating equipment. For longer operation, you can connect an additional battery to the UPS, the capacity of which is limited only by the size of the wallet.

The best models in this category are REALEL HOME UPS-1000, Luxeon UPS-1000ZY, PowerWalker VI 1000PSW, APC SmartUPS XL 1000VA and LogicPower LPY-BPSW-800.

The Luxeon UPS has a minimalist design and is suitable for most indoor gas boilers. An external battery can be connected to it

3rd place

It housed backup-type devices with minimal power, small capacity of built-in batteries and an approximate sinusoid.

Sudden voltage rises can be transmitted through such UPSs to the heating boiler circuit board and lead to its breakdown. And the battery capacity of such uninterruptible power supplies is only enough for 10-30 minutes of continuous operation of the heating equipment, after which it will still turn off.

Popular models in this category are the FSP DP 450VA, CyberPower Value500EI, Powercom WOW-500U and Mustek PowerMust 424EG SVEN Pro+ 400 devices. You can buy these devices for a gas boiler only if you do not have enough funds to purchase a more suitable device.

A small backup UPS is more suitable for autonomous operation of a computer than a gas boiler. Therefore, such devices are rarely recommended to ensure the operation of the heating system

Requirements for gas customs declaration

The main requirements for filling out a cargo customs declaration are as follows:

- Information in the columns of the customs declaration, decoding of their contents in accordance with the classification and codes is entered in Russian.

- Records must be legible and easy to read.

- Corrections in the declaration are allowed only for numbers. At the same time, they are entered by carefully crossing out and writing the correct (updated) data.

- All adjustments are certified by the signature and seal of the declarant.

- The customs declaration is accepted by customs in printed form. It is possible to fill in cost indicators with a value of more than nine characters by hand.

- It is unacceptable to enter information that is not contained in the fields of the form. On the back indicate information that does not fit into the fields of the declaration. They write on the main form: “see. on the back."

- Codes cannot be duplicated; it is permissible to indicate previously entered data with the link “see. column no.

- The declaration is certified by the signature and seal of the declarant.

How to read the customs declaration for imports?

How to decipher the information contained in it using the customs declaration (customs declaration, declaration of goods)? To do this, you need to know the procedure for filling out a goods declaration.

Instructions on the procedure for filling out were approved by the Decision of the Customs Union Commission dated No. 257.

The instructions contain both general provisions and the procedure for filling out the declaration for various customs procedures.

In general, one goods declaration declares information about goods contained in one consignment that are placed under the same customs procedure. If goods contained in the same consignment are declared for placement under different customs procedures, separate declarations for goods must be submitted for each customs procedure.

One customs declaration can contain information about no more than 999 goods.

The declaration of goods consists of the main (DT1) and additional (DT2) sheets. Additional sheets are filled out if information on two or more types of goods is declared in one declaration.

If the declaration of goods is completed in writing, then it is submitted on A4 sheets.

The main sheet of the customs declaration contains information about one product. And on one additional sheet there can be data on three products.

The declaration of goods is filled out in capital letters using printing devices, legibly, and should not contain erasures, blots or corrections.

Submission of the customs declaration in writing (in 3 copies) is accompanied by the submission of an electronic copy to the customs authority.

The detailed procedure for filling out the customs declaration is given in the Instructions approved by the Decision of the Customs Union Commission dated No. 257.

Cargo customs declaration

Surely every driver of a car in the Russian Federation has heard at least once in his life about such a concept as a gas turbine engine of a car. However, not every car owner knows the meaning of this concept.

A customs declaration for a car transported across the border is a type of documentation that the car owner must provide at customs. This type of customs documentation must contain information about the vehicle being transported through customs and the person directly carrying out this transportation.

How to fill out this type of customs documentation correctly

First, a person transporting a foreign-made car through customs will need to write a corresponding application. Such an application is filled out on forms TD2, as well as on forms TD1.

TD1 is the main component of this type of customs documentation, and the second, as you probably already understood, is additional. TD 1 includes the following:

- sheet submitted to the customs authorities;

- sheet that is provided for statistics;

- sheet that is intended for the declarant.

https://youtube.com/watch?v=_nNj87Rcl5I

How do customs clearance and control of cars transported across the border take place?

With the help of such a type of documentation as the customs declaration of a car, customs officials can exercise control over cars transported across the border. In addition, as mentioned above, this type of documentation contains data about the person who transports the car across the border.

A customs declaration for a car transported across the border is always provided along with the following documentation:

- articles of association;

- constituent agreement of the organization;

- contract for the supply of transported vehicles;

- various types of registration documentation;

- receipt for payment of customs duties;

- various types of shipping documentation;

- documents confirming the implementation of non-tariff regulation measures in relation to the transported vehicle.

For what purposes is a gas customs declaration required?

A customs declaration for a car is required primarily in cases where a citizen wants to register a foreign-made car.

Here it is very important to check the correctness of the car’s VIN code, because if it turns out to be incorrect, then a foreign-made car will not be able to be registered with the State Traffic Safety Inspectorate of the Russian Federation. In cases where a citizen of the Russian Federation purchases a foreign-made car that has just rolled off the production line, in addition to the passport of this car, it is also necessary to provide a customs receipt order

Customs declaration number

This type of customs documentation consists of 4 parts. They are separated by so-called slash characters. The first part of the customs declaration number for a car that is transported across the border indicates the number of a specific customs post.

It consists of 8 characters. The 2nd part of the customs declaration for a car transported across the border means the date. It indicates only the last digits of the year. The 3rd part is directly the number of the gas turbine declaration for the car itself. 4th - product number. It consists only of numbers.

For sawn machines, that is, for machines that need to be assembled in parts, a gas turbine engine is also required. In this case, the gas turbine declaration must be issued for the internal combustion engine, as well as for the body. This scheme for importing foreign-made cars into the Russian Federation is very often used by scammers.

Next, they weld the car and add body parts from a vehicle of another brand. For committing such actions, the current legislation of the Russian Federation provides for appropriate punishment. However, this does not mean that importing sawn-up cars is prohibited.

The main thing is to do this without violating the legal norms established by the current legislation of the Russian Federation. That is, with the preparation of all necessary documentation, as well as with the payment of customs duties. Currently, there are the following methods for importing disassembled vehicles:

Many drivers have encountered gas turbine engines, but few pay attention to this abbreviation. Even fewer drivers are interested in the meaning of this concept

But in vain, because in practice everyone can encounter gas turbine engines and you need to have at least the slightest idea about this phenomenon.

This abbreviation often comes up in professional circles. Even when buying a car, you may suddenly encounter a mysterious set of these letters. What are we dealing with?

Cargo manager tasks

When exporting and importing goods, the main action of a participant in foreign economic activity remains its declaration and execution of the appropriate export (import) document.

The registration of a cargo customs declaration when moving goods is carried out by the following persons:

- Declarant - the manager of the cargo.

- A customs broker who carries out the declaration on behalf of the manager.

- The declarant and (or) broker presents and presents the goods to the customs authority in accordance with the completed customs declaration.

Only Russian legal entities and individual entrepreneurs equated to them under customs legislation who move goods across the border of the Russian Federation for commercial purposes can act as declarants.

The necessary information about the product, its value, sender, recipient and other data is recorded in the declaration. Without this document, customs will not allow the cargo to move across the border.

What it is?

Rose-shrub (from the English shrub) is a flowering shrub that can easily tolerate cold winters. At the same time, some varieties, for example, Canadian scrub rose, can easily withstand 40-degree frosts. Plants of this type are classified as park plants and are widely used by landscape design specialists and gardeners. Today, the number of varieties of scrub roses numbers several dozen. Experts conditionally divide them into three categories, each of which contains plants with similar morphological characteristics. The classification is informal and is used only to structure data when describing varieties.

The first group includes English scrub roses, bred by the famous British breeder David Austin at the end of the last century. Their distinctive feature is the unusual “English” flower shape, for which the plants received the unofficial name “nostalgic roses.” Individuals of Bourbon, Damask and French roses, as well as specimens of modern varieties of hybrid tea rose and “Floribunda” were taken as parental pairs. English shrub roses are distinguished by their unsurpassed aroma, long flowering time and the power of their buds. The group includes a large number of hybrids with different growth rates and shoot heights.

In addition to the obvious differences, there are also a number of features that are characteristic of all plants of this species.

- Scrub roses are characterized by continuous flowering that begins in early June and ends at the first frost. Flowers replace each other throughout the growing season, thereby increasing the decorative properties of the shrub. The only exception is the variety “Fritz Nobis” (lat. Fritz Nobis), which is a single flowering plant.

- The species is distinguished by a wide variety of inflorescences, among which there are both classic shapes and textures, and buds that are completely unusual in color and structure.

- Almost all varieties of scrub roses have a bright and rich aroma, thanks to which the bush literally smells fragrant throughout the entire flowering period.

- Frost resistance is one of the most important qualities of a shrub, which sets it apart from other types of garden and park plants.

- Scrub roses are immune to most diseases characteristic of other types of roses, which, combined with their absolute unpretentiousness, makes them the best option for novice gardeners.

- Bushes of almost all varieties are distinguished by their density, power and volume, with some specimens reaching 2 meters in height and often acting as the main decoration of the garden.

- Scrub roses go well with any other types of roses and can be grown next to them without fear.

Cargo customs declaration

Surely every driver of a car in the Russian Federation has heard at least once in his life about such a concept as a gas turbine engine of a car. However, not every car owner knows the meaning of this concept.

A customs declaration for a car transported across the border is a type of documentation that the car owner must provide at customs. This type of customs documentation must contain information about the vehicle being transported through customs and the person directly carrying out this transportation.

How to fill out this type of customs documentation correctly

First, a person transporting a foreign-made car through customs will need to write a corresponding application. Such an application is filled out on forms TD2, as well as on forms TD1.

TD1 is the main component of this type of customs documentation, and the second, as you probably already understood, is additional. TD 1 includes the following:

- sheet submitted to the customs authorities;

- sheet that is provided for statistics;

- sheet that is intended for the declarant.

https://youtube.com/watch?v=0TRFNJRkm9s

How do customs clearance and control of cars transported across the border take place?

With the help of such a type of documentation as the customs declaration of a car, customs officials can exercise control over cars transported across the border. In addition, as mentioned above, this type of documentation contains data about the person who transports the car across the border.

A customs declaration for a car transported across the border is always provided along with the following documentation:

- articles of association;

- constituent agreement of the organization;

- contract for the supply of transported vehicles;

- various types of registration documentation;

- receipt for payment of customs duties;

- various types of shipping documentation;

- documents confirming the implementation of non-tariff regulation measures in relation to the transported vehicle.

For what purposes is a gas customs declaration required?

A customs declaration for a car is required primarily in cases where a citizen wants to register a foreign-made car.

Here it is very important to check the correctness of the car’s VIN code, because if it turns out to be incorrect, then a foreign-made car will not be able to be registered with the State Traffic Safety Inspectorate of the Russian Federation. In cases where a citizen of the Russian Federation purchases a foreign-made car that has just rolled off the production line, in addition to the passport of this car, it is also necessary to provide a customs receipt order

Customs declaration number

This type of customs documentation consists of 4 parts. They are separated by so-called slash characters. The first part of the customs declaration number for a car that is transported across the border indicates the number of a specific customs post.

It consists of 8 characters. The 2nd part of the customs declaration for a car transported across the border means the date. It indicates only the last digits of the year. The 3rd part is directly the number of the gas turbine declaration for the car itself. 4th - product number. It consists only of numbers.

For sawn machines, that is, for machines that need to be assembled in parts, a gas turbine engine is also required. In this case, the gas turbine declaration must be issued for the internal combustion engine, as well as for the body. This scheme for importing foreign-made cars into the Russian Federation is very often used by scammers.

Next, they weld the car and add body parts from a vehicle of another brand. For committing such actions, the current legislation of the Russian Federation provides for appropriate punishment. However, this does not mean that importing sawn-up cars is prohibited.

The main thing is to do this without violating the legal norms established by the current legislation of the Russian Federation. That is, with the preparation of all necessary documentation, as well as with the payment of customs duties. Currently, there are the following methods for importing disassembled vehicles:

Let's start with the fact that in professional circles you can often hear such an expression as a gas turbine engine for an engine or body, as well as a car with a gas turbine engine. Let us immediately note that in this case you need to understand exactly what we are talking about. In other words, you need to know what a gas turbine engine is and what a gas turbine engine is for an engine, body or car. Let's take a closer look.

Read in this article

Customs clearance and control

Now you should indicate the meaning of the submitted cargo customs declarations directly to the customs authorities. Perhaps among the readers there will be people who are interested in this issue.

The customs declaration is a very important document for control authorities. The fact is that it is thanks to the submitted cargo customs declarations that customs officers can exercise control over all goods transported across the Russian border. This document also contains some information about the person who transports the declared goods.

Along with the customs declaration, other documents must be submitted to the customs authorities:

- Charter of the enterprise and its constituent agreement;

- Existing contracts for the supply of transported goods;

- Registration documents;

- Transaction passport, receipt indicating payment of all customs duties, certificate of availability of ruble and foreign currency accounts. The latest certificate is issued by the bank;

- Shipping documents;

- Depending on the vehicle on which the declared goods are transported, the relevant documents must be provided: CRM, bill of lading, railway or air waybill;

- Documents must also be provided that would confirm the implementation of certain non-tariff regulation measures in relation to transported goods;

- Document on control of goods delivery, TIR Carnet.

Creating a foreign supplier in 1C

When purchasing goods from foreign suppliers, there are some special features when creating a counterparty and an agreement. Let’s create a “Foreign Supplier” supplier in the “Counterparties” directory.

Let's add a counterparty, indicate its name and check the "Supplier" flag. In addition to the “Supplier” flag, it is advisable to also set the “Non-Resident” flag. In this case, the program will automatically prepare documents from the supplier at the VAT rate “Without VAT”:

Let’s save the counterparty using the “Record” button.

At the time of recording, an agreement was automatically created for the counterparty. The contract must specify the currency, for example, Euro. Let’s go to the “Accounts and Agreements” tab, double-click to open the main agreement and change the currency:

Click “OK” to save and close the agreement.

Advantages and disadvantages of gas turbine engines

Gas turbine engines are superior to piston engines in many ways. Thanks to the ability to develop high speeds, the device has high power, but at the same time has a compact size. Kerosene or diesel fuel is used as fuel. The mass of a gas turbine engine is 10 times less than the mass of an internal combustion engine of similar power. Due to the absence of rubbing parts, a gas turbine does not require an extensive cooling system.

Chrysler engineers, who created the only small-scale car with a gas turbine engine, experimentally found out that the best fuel for a gas turbine engine is regular kerosene.

The main disadvantage is increased fuel consumption caused by the need to artificially limit the gas temperature. This limitation is due to the fact that in the case of a car, the engine is installed inside the body, and not under the wing, like in an airplane, for example. Accordingly, the engine temperature should not exceed 700 degrees. Metals that are resistant to such temperatures are very expensive. This problem is often of interest to scientists, and gas turbine engines with good efficiency indicators should appear in the near future. Obviously, this will only happen if the problem of removing a large amount of heat is solved, which will make it possible to install “unstifled” engines in the design of which the problem of efficiency has been solved. Disadvantages also include high requirements for atmospheric air quality and the lack of engine braking.

Placing an order to a foreign supplier

When working with a foreign supplier, you can place an order, or you can work without an order. In this respect, import is no different from purchasing from a Russian supplier. We will place an order for the goods with the supplier.

The document will indicate the supplier, warehouse, ordered goods and their cost.

Please note that the document is drawn up in Euro currency and the VAT rate for all goods is set to “Without VAT”

Example of a completed order:

Important: all imported goods must have the “Keep records by series” flag. Otherwise, it will be impossible to correctly register the receipt of goods at the warehouse in the future.

Customs declaration: decoding and example of the necessary information in the document

The list of information contained in the cargo declaration is divided into the following main blocks:

- Information about the person moving the goods, the sender.

- Name and coordinates of the cargo recipient.

- The name and codes of the country where the contract was concluded - the grounds for moving the cargo (export or import).

- Information about the country of origin and country of destination with codes adopted by the Customs Code of the Russian Federation.

- Delivery conditions, vehicle at the border, contract currency. This information is duplicated from the transaction passport, which is issued by the bank of the sender or recipient of the goods.

- Information about the cargo in accordance with the code classifier of goods (commodity nomenclature of foreign economic activity).

- Information about customs checkpoints, including the place of registration of the declaration and the place of border crossing.

- Data on the received quota for the goods (if they exist for the import or export of goods).

- Information on customs duties and fees calculated depending on the declared value of the cargo being transported.

- Other information required to fill out the customs declaration.

Important! Any discrepancy between the data declared in the declaration and the actual data will lead to a delay in customs procedures and will result in additional costs for a tidy sum.