One of the first partners with which any enterprise enters into a relationship is a bank. Opening a current account, making payments, registering currency transactions, buying or selling currency - all this is possible only if you have an agreement with a banking organization. The bank, like any partner providing services, issues invoices for payment or debits amounts from the organization’s current account for the bank’s services provided. How to correctly reflect such business transactions in the 1C: Accounting program, edition 3.0 will be discussed in this article.

Bank services can be combined into two large groups:

- Services not subject to VAT;

- Services subject to VAT.

Each group of services has its own peculiarities of generating accounting entries.

Services not subject to VAT are reflected in accounting accounts in the following order:

- D 91.02 (Other expenses) – D 51 (Current account) – bank commission amounts are written off as other expenses.

Services subject to VAT are reflected in accounting accounts in the following order:

- D 76 (Settlements with various debtors, creditors) – D 51 (Current account) – funds were transferred from the current account as a reflection of the bank’s commission;

- D 91.02 (Other expenses) - D 76 (Settlements with various debtors and creditors) - accounts receivable are written off as other expenses as expenses for bank services;

- D 19 (VAT on purchased services) – K 76 (Settlements with various debtors and creditors) – VAT on purchased bank services is reflected.

Let's consider the reflection of each group of bank services in 1C 8.3.

Admission

The money was transferred to the organization's account. Now the data needs to be entered into the program. Open the "Bank and Cash" tab, then "fail" into "Bank Statements".

The document will have to be entered manually through the “Receipt” button.

The next step is to select the required type of operation. Then the organization and counterparty (the directory will suggest).

You must enter your organization's bank account information.

We make the correct payment amount.

Next we work with the tabular part. Here you need to add data about the counterparty agreement.

Then enter the VAT rate and check the accounts for settlements and advances. It is not necessary to indicate the cash flow item here.

“1C: Accounting 8” (rev. 3.0): how to create a bank account (+ video)?

How to create a bank account for an organization or counterparty in 1C:Accounting 8 (rev. 3.0), including in foreign currency?

The video was made in the program “1C: Accounting 8” version 3.0.71.63.

To record funds in accounts opened in credit institutions (banks), accounting accounts are intended (Chart of accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n):

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 55 “Special bank accounts.”

Analytical accounting is maintained for each bank account.

To store information about Russian and foreign bank accounts of all legal entities and individuals (including own organizations and third-party counterparties), the program uses the Bank Accounts

.

The list of bank accounts of your own organization or counterparty is determined by those bank accounts that are subordinate to the Organization

,

Contractors

and

Individuals

.

You can go to the list of bank accounts by following the link Bank accounts

from the organization’s (counterparty’s or individual’s) card.

For each counterparty or own organization, you can select a main bank account. This account will be inserted by default into payment documents.

A new bank account, including a foreign one, is created by clicking the Create button.

In the bank account card that opens, you should fill in the basic details: the bank in which the account is opened; Account number; currency of funds, correspondent bank for indirect settlements, as well as other additional information.

Selecting the bank where the account is opened

It is recommended to start filling out a bank account with the Bank

, since the specified bank affects the display of details in the bank account card and the composition of the input checks.

To select a bank, simply enter the BIC or the first letters of the bank's name. When entering a value, the bank is searched in the Banks

and the values are substituted into the remaining fields. If there is no bank with such a BIC, you need to enter a new bank in the bank directory.

Information about a new Russian bank can be filled in automatically using the all-Russian bank classifier. Classifier of Russian banks

is a separate program directory that contains detailed information about all Russian banks and is kept up to date.

Banks whose activities have been discontinued are hidden by default. In order to see these banks in the list, you should run the command More - Show inactive banks

.

You can update information about banks using the Load classifier

. Using the switch you can select the boot option:

- From Portal 1C:ITS

; - From the 1C:ITS disk

- loading will be performed from the “All-Russian Classifier of Banks” supplied on the 1C:ITS disk);

- From file

- you will need to specify the path to the file on disk. Download the file with the bank classifier here; access will require an ITS login and password.

Updating the classifier from the 1C website can be configured automatically on a schedule using the scheduled task Loading a bank classifier

. To download the bank classifier from the 1C website, the program must have online user support enabled.

To enter Banks

a new record about a Russian bank should use the command

Create - By classifier

.

In the selection form that opens, Classifier of Russian Banks

You should highlight the required bank with the cursor and press the

Select

.

You can also double-click. to the Banks

, where the following information is stored:

- Name

- name of the bank; - SWIFT

- code for banks connected to the SWIFT international payment system; - Country

Russia

; _ - BIC

- bank identification code of the bank in the banking system of the Russian Federation; - Corr.

account - the bank's correspondent account with the Central Bank of the Russian Federation; - Group

is the region in which the bank is located. - City, address, phone numbers

- bank contact information.

To enter Banks

new record about a foreign bank, you should use the

Create – New

, refusing the program’s offer to select a bank from the classifier.

The foreign bank card stores the following information:

- Name

- the name of the bank (mandatory details), which is recommended to be filled out in English; - SWIFT

- code for banks connected to the SWIFT international payment system; - Country

—the country where the bank is located. When the SWIFT field is filled in, the country is filled in automatically; - National code

is a code assigned to a bank in the banking system of the country of its registration. This field is only available for foreign banks; - Corr.

account - correspondent account of the bank; - City, address, telephone numbers

- bank contact information, which is recommended to be filled out in English.

Indication of bank account number

If a Russian bank is selected, the program allows you to enter only a Russian account number, consisting of 20 digits. In this case, a check will be performed using the account check digit. If the verification fails, a message will appear: the account number or bank was entered incorrectly.

An incorrect Russian account number cannot be saved in the program.

Selecting a foreign bank allows you to enter a bank account in the formats provided for foreign banks. For foreign banks, it is supported to enter an account in IBAN format (for banks with SWIFT and located in countries registered in the IBAN Registry) or in national format.

When entering an invoice, the program checks the correctness of the following parameters:

- correctness of the entered characters (letters of the Latin alphabet AZ and numbers are allowed);

- checksum of the account number (only for accounts in IBAN format);

- correspondence between the country of the bank and the country of the account number (only for accounts in IBAN format).

Specifying the bank account currency

For Russian bank accounts, the currency of funds is filled in automatically based on the correct account number being entered.

For foreign bank accounts, you must specify the currency by selecting a value from the Currencies

.

Access to the Currency

is carried out using the hyperlink of the same name from

the Directories

, regardless of the enabled functional options.

The currencies required for work can be selected from the All-Russian Currency Classifier - or added to the directory manually.

The program provides a routine task: Loading exchange rates

for automatic downloading of exchange rates from the 1C website.

Specifying additional bank account details

For Russian bank accounts, the bank account card allows you to fill in the bank for settlements, which are required if settlements are made through a correspondent account of this bank in another bank. The correspondent bank is substituted as the sending bank or the receiving bank in payment orders.

One or more corporate employee cards can be linked to an organization's account. They can be indicated directly on the bank account card.

Write-off

Now in the form of a bank statement you need to reflect the debit from the current account. This is done by clicking the corresponding “Write-off” button.

We indicate the type of operation and organization. To reflect the prepayment made, select the counterparty. If it is not on the list, then we add it manually. Then you need to enter the payment amount and the organization’s bank account.

Let's move on to the table.

When there are several contracts, each of them will require a separate line. In the cash flow item we specify the VAT rate. Check that the settlement accounts and amounts are correct.

In the tab you see the line “Purpose of payment”, it will be filled in automatically. However, if necessary, you can make edits manually.

All that remains is to post the document so that movements on the accounts are formed.

Bank services not subject to VAT - registration method in 1C 8.3

The formation of posting D91.02-K51 in 1C is carried out using the standard document “Write-off from the current account”. As a rule, the bank withholds the commission directly, using a payment order. Withholding information is provided in the form of a bank statement. The line in the bank statement about the write-off of the commission is actually the document “Write-off of non-cash funds”.

Most often, these documents are uploaded into the accounting system from the client bank - a special banking program, but we propose to understand in detail the features of manual generation of write-off documents, then editing the uploaded documents will not be difficult.

From the “Bank and Cash Office” section of the main interface of the system, let’s go to the document journal “Bank Statements”.

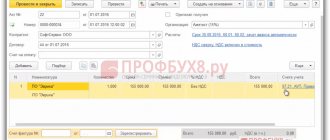

Fig.1 Bank statements

You can create two types of documents in the journal – receipt (+) and write-off (-) on the organization’s current account. Documents are created by clicking on the appropriate button.

Fig.2 Two types of documents

Let's create a write-off document and fill it out. First, select the desired type of operation. By default, Payment to Supplier will be offered. Select Bank Commission from the drop-down list (in 1C 8.3).

Fig.3 Bank commission

Next, fill in the necessary document details:

- Let's adjust the date;

- We indicate the incoming order number and date;

- We will select a recipient and organization;

- Fill in the required amount and cash flow item;

- The payment purpose is filled in automatically. Let's leave it unchanged for reference.

Let us pay special attention to the “Confirmed by bank statement” detail, which is set by default. Only its installation will allow you to generate transactions after posting the document.

Fig.4 Confirmed by bank statement

Let's go through the document and look at the postings for accounting for bank commissions.

Fig.5 Let's check the document

Fig.6 Posting for bank commission accounting

Postings in 1C exactly correspond to the required accounting records to reflect the bank commission.

Setting up downloading statements from a client bank

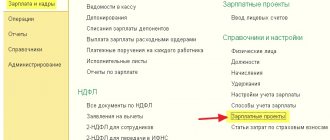

Again, go to “Bank statements” through the “Bank and cash desk” tab.

Select “Download”, then the desired organization, bank account - “Settings”.

The system can offer exchange settings with the client-bank. This needs to be done, so select “Open Settings”.

Select the name of the client bank. Then specify the download file where information about the flow of funds in the account is located. To create it, you need to go to the client bank and find the unloading point in 1C.

When you upload a file, you will need to indicate its location. Then in 1C register the path to this folder. To do this, use the “Download File” field.

You will see another field “Upload File”. But if you make all payments in the client bank, you don’t have to change it. The “upload file” will be needed when outgoing payments are made in 1C and then uploaded to the client bank.

When all the settings have been completed, the data file has been downloaded from the client bank, you need to “Update from statement”. We check the list of payment orders, especially the “Type of transaction” column. If necessary, we make changes. Then click “Download”.

The uploaded documents will be reflected in the bank statement in 1C.

Exchange with bank

To save time, you can easily set up automatic data exchange with the bank. All settlement transactions will be taken into account, there is no need to worry about this. For this purpose, the system provides special processing “Exchange with the bank”.

In 1C 8.3 there are several options for working with the client bank:

- from the “Exchange with the bank” form;

- from the magazine "Bank Statements";

- from the magazine.

Standard settings do not always take into account all the features of a company’s business processes. If you need individual customization, you can order 1C modification and maintenance services from us.