When was the BCC for insurance premiums last updated?

The last update of the KBK on insurance premiums takes place from 04/14/2021.

Nothing else has changed yet, and these same BCCs will be in effect in 2021. But let's go in chronological order. Since 2021, the bulk of insurance premiums (except for payments for accident insurance) began to be subject to the provisions of the Tax Code of the Russian Federation and became the object of control by the tax authorities. As a result of these changes, in most aspects, insurance premiums were equated to tax payments and, in particular, received new, budgetary BCCs.

The presence of a situation where, after 2021, contributions accrued according to the old rules can be transferred to the budget, required the introduction of special, additional to the main, transitional BCCs for such payments.

As a result, from 2021, there are 2 BCC options for insurance premiums supervised by the Federal Tax Service: for periods before December 31, 2021 and for periods after January 2021. At the same time, the codes for contributions to accident insurance that remain under the control of the Social Insurance Fund have not changed.

From April 23, 2021, the Ministry of Finance introduced new BCCs for penalties and fines on additional tariffs for insurance premiums paid for employees entitled to early retirement. KBK began to be divided not by periods: before 2017 and after - as before, but according to the results of a special labor assessment.

From January 2021, the BCC values were determined according to the order of the Ministry of Finance dated 06/08/2021 No. 132n. These changes also affected codes for penalties and fines on insurance premiums at additional tariffs. If in 2021 the BCC for penalties and fines depended on whether a special assessment was carried out or not, then at the beginning of 2021 there was no such gradation. All payments were made to the BCC, which is established for the list as a whole.

However, from April 14, 2021, the Ministry of Finance returned penalties and fines for contributions under additional tariffs to the 2021 BCC.

In 2021, the list of BCCs is determined by a new order of the Ministry of Finance dated November 29, 2021 No. 207n, but it has not changed the BCC for contributions.

Which BCCs have changed?

In 2021, apply the new budget classification codes. They have changed for those companies that:

- pay income tax on income received in the form of interest on bonds of Russian organizations in rubles issued during the period from January 1, 2021 to December 31, 2021 (Order of the Ministry of Finance of Russia dated June 9, 2021 No. 87n);

- list excise taxes (Order of the Ministry of Finance of Russia dated June 6, 2021 No. 84n).

See the table below for new BCCs taking into account the changes for 2021.

New BCC 2021 for income tax (bond income)

| Tax | 182 1 0100 110 |

| Penalty | 182 1 0100 110 |

| Fine | 182 1 0100 110 |

In payment orders for the payment of excise taxes, the following codes should be entered in field 104:

- 18210302360010000110 – excise taxes on electronic nicotine delivery systems produced on the territory of the Russian Federation;

- 18210302370010000110 – excise taxes on nicotine-containing liquids produced on the territory of the Russian Federation;

- 18210302380010000110 – excise taxes on tobacco (tobacco products) intended for consumption by heating, produced on the territory of the Russian Federation.

| KBK | Current edition | New order of the Ministry of Finance |

| 000 1 0210 160 | Insurance premiums, including arrears or recalculation, if the tariff does not depend on the results of a special labor assessment | Does not change |

| 000 1 0220 160 | Insurance premiums, including arrears or recalculation, if the tariff depends on the results of a special labor assessment | Does not change |

| 000 1 0200 160 | Penalties for periods until 2021 | Penalties if the additional tariff depends on the results of the special assessment |

| 000 1 0210 160 | Penalties for periods after January 1, 2021 | Penalties if the additional tariff does not depend on the results of the special assessment |

| 000 1 0200 160 | Interest on payments for periods up to 2021 | Interest on payment if the additional tariff depends on the results of the special assessment |

| 000 1 0210 160 | Interest on payments for periods after January 1, 2021 | Interest on payment if the additional tariff does not depend on the results of the special assessment |

| 000 1 0200 160 | Monetary penalties and fines for periods up to 2021 | Monetary penalties and fines if the additional tariff depends on the results of the special assessment |

| 000 1 0210 160 | Monetary penalties and fines for periods after January 1, 2017 | Monetary penalties and fines if the additional tariff does not depend on the results of the special assessment |

| 000 1 0200 160 | Interest on overpaid (collected) amounts, as well as when they are not returned on time for periods before 2021 | Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff depends on the results of the special assessment |

| 000 1 0210 160 | Interest on overpaid (collected) amounts, as well as when they are not returned on time for periods after January 1, 2021 | Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff does not depend on the results of the special assessment |

The codes that currently refer to amounts accrued for the period before January 1, 2021 will continue to be used by policyholders in cases where the tariff depends on the results of a special assessment of working conditions. Codes relating to the period after January 1, 2021 will be applied to payments in cases where the tariff does not depend on the results of the special assessment.

| KBK | Current edition | Order of the Ministry of Finance |

| 000 1 0200 160 | Penalties for periods until 2021 | Penalties if the additional tariff depends on the results of the special assessment |

| 000 1 0210 160 | Penalties for periods after January 1, 2021 | Penalties if the additional tariff does not depend on the results of the special assessment |

| 000 1 0200 160 | Interest on payments for periods up to 2021 | Interest on payment if the additional tariff depends on the results of the special assessment |

| 000 1 0210 160 | Interest on payments for periods after January 1, 2021 | Interest on payment if the additional tariff does not depend on the results of the special assessment |

| 000 1 0200 160 | Monetary penalties and fines for periods up to 2021 | Monetary penalties and fines if the additional tariff depends on the results of the special assessment |

| 000 1 0210 160 | Monetary penalties and fines for periods after January 1, 2017 | Monetary penalties and fines if the additional tariff does not depend on the results of the special assessment |

| 000 1 0200 160 | Interest on overpaid (collected) amounts, as well as when they are not returned on time for periods before 2021 | Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff depends on the results of the special assessment |

| 000 1 0210 160 | Interest on overpaid (collected) amounts, as well as when they are not returned on time for periods after January 1, 2021 | Interest on overpaid (collected) amounts, as well as when they are not returned on time, if the additional tariff does not depend on the results of the special assessment |

Also, innovations in the KBK affected individual entrepreneurs who do not pay salaries or other remuneration to individuals. Until now, to transfer pension contributions to individual entrepreneurs for themselves, two different KBKs have been used:

- Fixed contributions on income not exceeding 300 thousand rubles per year.

- Additional contributions of 1% on the amount of income exceeding 300 thousand rubles per year.

The second BCC has been abolished, and from April 23, 2021, individual entrepreneurs should not use it.

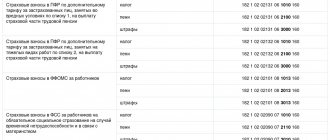

KBC for payment of insurance premiums for employees from 01/01/2017

| TAX | KBK |

| Insurance contributions for pension insurance to the Pension Fund for employees for the payment of the insurance and funded part of the labor pension | 182 1 02 02010 06 1010 160 |

| Insurance contributions to the Pension Fund at an additional rate for insured persons employed in hazardous conditions according to List 1, for the payment of the insurance part of the labor pension | 182 1 02 02131 06 1010 160 |

| Insurance contributions to the Pension Fund at an additional rate for insured persons engaged in heavy types of work on list 2, for payment of the insurance part of the labor pension | 182 1 02 02132 06 1010 160 |

| Insurance contributions to the FFOMS for employees | 182 1 02 02101 08 1013 160 |

| Insurance contributions to the Social Insurance Fund for employees for compulsory social insurance in case of temporary disability and in connection with maternity | 182 1 02 02090 07 1010 160 |

BCC for insurance premiums in 2021 for the Pension Fund of Russia

Payment of insurance premiums to the Pension Fund is carried out by:

- Individual entrepreneurs working without hired employees (for themselves);

- Individual entrepreneurs and legal entities hiring workers (from the income of these workers).

At the same time, payment of a contribution by an individual entrepreneur for himself does not exempt him from transferring the established amount of payments to the Pension Fund for employees and vice versa.

Individual entrepreneurs who do not have staff pay 2 types of contributions to the Pension Fund:

- In a fixed amount - if the individual entrepreneur earns no more than 300,000 rubles. in year. For such payment obligations in 2021-2021, KBK 18210202140061110160 (if the period is paid from 2017) and KBK 18210202140061100160 (if the period until 2017 is paid) are established.

IMPORTANT! The income of an individual entrepreneur on UTII for the purpose of calculating fixed insurance premiums is imputed income, not revenue (letter of the Ministry of Finance of the Russian Federation dated July 18, 2014 No. 03-11-11/35499).

- In the amount of 1% of revenue that exceeds RUB 300,000. in year. For the corresponding payment obligations accrued before 2021, KBK 18210202140061200160 has been established. But contributions accrued in 2017–2021 should be transferred to KBK 18210202140061110160. That is, the code is the same as for the fixed part (letter from the Ministry of Finance of Russia dated 04/07/201 7 No. 02-05-10/21007).

Individual entrepreneurs and legal entities that hire employees pay pension contributions for them, accrued from their salaries (and other labor payments), according to KBK 18210202110061010160 (if accruals relate to the period from 2017) and KBK 18210202110061000160 (if accruals are made for the period before 2021) .

How to read the KBK of insurance contributions for pension insurance?

Like any other, the BCC of contributions to a pension fund includes twenty numbers, which are usually displayed as follows: XXX X XX XXXXX XX XXXX XXX. The code is divided into four groups, each of which has its own specific meaning:

- The first group is “Administrator”. It consists of 3 digits and indicates the department to which the payment is sent (the first three digits in the BCC of pension contributions are always 392, since its addressee is the Pension Fund)

- the second part of the code is “Variety of Income”. It consists of 10 numbers. The first digit of them shows the “Group” itself, so, for example, 1 means income, 2 means income on a non-refundable basis, 3 means income from business, and so on. The remaining numbers indicate “Subgroup”, “Article”, “Subarticle” and “Element”.

“Subgroup” is the two numbers following the group. “Article” is the seventh and eighth numbers, and sub-article is the signs from the ninth to the eleventh. “Element” shows the budget level, for example, federal or municipal. Or, for example, the budget of the Pension Fund.

KBK for payment of insurance contributions to the Pension Fund for employees

| TAX | KBK |

| Insurance contributions for pension insurance to the Pension Fund for employees for the payment of the insurance and funded part of the labor pension | 392 1 02 02010 06 1000 160 |

| Insurance contributions for pension insurance to the Pension Fund for employees for payment of the insurance part of the labor pension within the limit | 392 1 02 02140 06 1100 160 |

| Insurance contributions for pension insurance to the Pension Fund of the Russian Federation for employees to pay the insurance part of the labor pension in excess of the limit | 392 1 02 02140 06 1200 160 |

| Insurance contributions to the Pension Fund at an additional rate for insured persons employed in hazardous conditions according to List 1, for the payment of the insurance part of the labor pension | 392 1 02 02131 06 1000 160 |

| Insurance contributions to the Pension Fund at an additional rate for insured persons engaged in heavy types of work on list 2, for payment of the insurance part of the labor pension | 392 1 02 02132 06 1000 160 |

KBK for payment of penalties on insurance contributions to the Pension Fund for employees

| PENES, FINES | KBK | |

| Penalties, fines on insurance contributions for pension insurance to the Pension Fund for employees for the payment of the insurance and funded part of the labor pension | penalties | 392 1 02 02010 06 2100 160 |

| fines | 392 1 02 02010 06 3000 160 | |

| Penalties and fines on insurance contributions for pension insurance to the Pension Fund of the Russian Federation for employees to pay the insurance part of their labor pension within the limit | penalties | 392 1 02 02140 06 2100 160 |

| fines | 392 1 02 02140 06 3000 160 | |

| Penalties and fines on insurance contributions for pension insurance to the Pension Fund of the Russian Federation for employees to pay the insurance part of their labor pension in excess of the limit | penalties | 392 1 02 02140 06 2100 160 |

| fines | 392 1 02 02140 06 3000 160 | |

| Penalties and fines for insurance contributions to the Pension Fund of the Russian Federation at an additional rate for insured persons employed in hazardous conditions according to List 1, for the payment of the insurance part of the labor pension | penalties | 392 1 02 02131 06 2000 160 |

| fines | 392 1 02 02131 06 3000 160 | |

| Penalties and fines for insurance contributions to the Pension Fund of the Russian Federation at an additional rate for insured persons engaged in heavy types of work on list 2, for the payment of the insurance part of the labor pension | penalties | 392 1 02 02132 06 2000 160 |

| fines | 392 1 02 02132 06 3000 160 | |

How to understand the structure of codes

Any BCC has a certain structure, to determine which there are specially developed rules. The code has 20 bits. Before 2021, the official document reflecting these rules is Order of the Ministry of Finance No. 65n . The new order (No. 132n) preserves the principle of forming any code. The first three digits refer to the chief administrator of budget revenues.

Next, indicate the code for the type of income (10 digits). The last seven digits reflect the subtype of income. All codes inform about the budget level (can be federal or regional) and the type of payment itself (this can be a tax payment, payment of a penalty or a fine).

What BCCs for FFOMS contributions are established in 2021

Contributions to the FFOMS, as well as contributions to the Pension Fund, are paid by:

- IP - for yourself;

- Individual entrepreneurs and legal entities - for hired employees.

Contributions for individual entrepreneurs to the FFOMS are paid for themselves using BCC 18210202103081013160 (if related to the period from 2021) and BCC 18210202103081011160 (if related to the period until 2021).

For hired employees, individual entrepreneurs and legal entities must pay contributions to the Federal Compulsory Medical Insurance Fund using KBK 18210202101081013160 (for payments accrued from 2021) and KBK 18210202101081011160 (for accruals made before 2021).

KBK for payment of insurance premiums to the FFOMS for employees

| TAX | KBK |

| Insurance contributions to the FFOMS for employees | 392 1 02 02101 08 1011 160 |

KBK for payment of penalties on insurance premiums to the Federal Compulsory Compulsory Medical Insurance Fund for employees

| PENES, FINES | KBK | |

| Penalties and fines on insurance contributions to the Federal Compulsory Compulsory Medical Insurance Fund for employees | penalties | 392 1 02 02101 08 2011 160 |

| fines | 392 1 02 02101 08 3011 160 | |

What BCCs for insurance premiums are established for the Social Insurance Fund in 2021

Payments to the Social Insurance Fund are classified into 2 types:

- paid towards insurance for sick leave and maternity leave;

- paid towards insurance for accidents and occupational diseases.

Individual entrepreneurs working without hired employees do not list anything in the Social Insurance Fund.

Individual entrepreneurs and legal entities working with hired personnel make payments for them:

- for sick leave and maternity insurance - using KBK 18210202190071010160 (if we are talking about accruals made since 2017) and KBK 18210202190071000160 (if accruals were made before 2017) - contributions are administered by the Federal Tax Service;

- for insurance against accidents and occupational diseases - in the amount determined taking into account the class of professional risk by type of economic activity, using BCC 393 1 0200 160 - contributions are transferred directly to the Social Insurance Fund.

Individual entrepreneurs and legal entities concluding civil contract agreements with individuals pay only the second type of contributions, provided that this obligation is specified in the relevant agreements.

KBK for payment of insurance contributions to the Social Insurance Fund for employees

| TAX | KBK |

| Insurance contributions to the Social Insurance Fund for employees for compulsory social insurance in case of temporary disability and in connection with maternity | 393 1 02 02090 07 1000 160 |

| Insurance contributions to the Social Insurance Fund for employees against industrial accidents and occupational diseases | 393 1 02 02050 07 1000 160 |

KBK for payment of penalties on insurance contributions to the Social Insurance Fund for employees

| PENES, FINES | KBK | |

| Penalties and fines on insurance contributions to the Social Insurance Fund for employees for compulsory social insurance in case of temporary disability and in connection with maternity | penalties | 393 1 02 02090 07 2100 160 |

| fines | 393 1 02 02090 07 3000 160 | |

| Penalties and fines for insurance contributions to the Social Insurance Fund for workers from industrial accidents and occupational diseases | penalties | 393 1 02 02050 07 2100 160 |

| fines | 393 1 02 02050 07 3000 160 | |

FILES

KBK for individual entrepreneurs in special modes in 2020

For each special regime tax, its own BCC has been approved:

| Tax | KBK |

| Tax under simplified tax system: | |

| 182 1 0500 110 |

| 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

Self-employed citizens participating in the experiment must transfer professional income tax to KBK 182 1 05 06000 01 1000 110. This code is provided for by Order of the Ministry of Finance dated November 30, 2018 No. 245n.

KBC for insurance premiums for individual entrepreneurs “for themselves” in 2021

The Ministry of Finance, in its new order No. 132n, also updated the BCC for entrepreneurs. We are talking about fixed contributions for yourself.

KBC on contributions for individual entrepreneurs for themselves in 2021

| Payment Description | KBK contribution | KBK penalties | KBK fine |

| Contributions in a fixed amount to an insurance pension (from income within 300,000 rubles) | 182 1 0210 160 | 182 1 0210 160 | 182 1 0210 160 |

| Contributions to the FFOMS in a fixed amount | 182 1 0213 160 | 182 1 0213 160 | 182 1 0213 160 |

BCC of property tax in 2021 for legal entities

If you indicate the wrong KBK or completely forgot to write down the code, inspectors will receive a notification of refusal to accept the declaration. It will say: there was an error in filling out the data for the “Budget Classification Code” indicator. The error code is 300300027.

If you do not solve the problem and are late in submitting the report, then a fine cannot be avoided. Delay the report for more than 10 days and tax inspectors will suspend transactions on bank accounts. To avoid such troubles, check

KBK of income tax to the federal and regional budgets - 2018

| Purpose of payment | Mandatory payment | Penalty | Fine |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| from the profits of controlled foreign companies | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

In 2021, pay corporate property tax to the budget according to the BCCs that we have given in the table below. Enter the budget classification code in field 104 of the payment order.

BCC of property tax for legal entities in 2021 (table)

| Purpose of payment | Mandatory payment | Penalty | Fine |

| for property not included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| for property included in the Unified Gas Supply System | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

In field 104 of the payment order, provide special budget classification codes when you transfer the transport tax. All BCCs for transport tax in 2021 are in the table below.

KBK – transport tax 2021 for individuals and legal entities

| Purpose of payment | Mandatory payment | Penalty | Fine |

| from organizations | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| from individuals | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

Below we present the BCC for all other taxes, fees, and obligatory payments. Check the codes on your payment slips with the tables to avoid errors.

KBK on UTII (single tax on imputed income) 2018

| Tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

KBK for 2021 for individual entrepreneurs (patent)

| Purpose of payment | Mandatory payment | Penalty | Fine |

| tax to the budgets of city districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

BCC for Unified Agricultural Tax for 2021

| Tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

KBK for water tax for 2021

| Tax | 182 1 0700 110 |

| Penalty | 182 1 0700 110 |

| Fines | 182 1 0700 110 |

BCC for land tax (table)

| Payment Description | KBK tax | KBK penalties | KBC fines |

| For plots within the boundaries of intra-city municipalities of Moscow and St. Petersburg | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of inter-settlement territories | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of rural settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban settlements | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of urban districts with intra-city division | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

| For plots within the boundaries of intracity districts | 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

KBC for mineral extraction tax 2018

| Payment Description | KBK tax | KBK penalties | KBC fines |

| Oil | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Combustible natural gas from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Gas condensate from all types of hydrocarbon deposits | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Extraction tax for common minerals | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Tax on the extraction of other minerals (except for minerals in the form of natural diamonds) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation, when extracting minerals from the subsoil outside the territory of the Russian Federation | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax in the form of natural diamonds | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Mineral extraction tax in the form of coal | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

Payments for the use of subsoil (KBK 2018)

| Payment Description | KBK |

| Regular payments for the use of subsoil for the use of subsoil (rentals) on the territory of the Russian Federation | 182 1 1200 120 |

| Regular payments for the use of subsoil (rentals) for the use of subsoil on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 182 1 1200 120 |

Payments for the use of natural resources - KBK for 2018

| Payment Description | KBK for payment |

| Payment for negative impact on the environment Payment for emissions of pollutants into the air by stationary facilities | 048 1 1200 120 |

| Payment for emissions of pollutants into the atmospheric air by mobile objects | 048 1 1200 120 |

| Payment for discharges of pollutants into water bodies | 048 1 1200 120 |

| Payment for disposal of production and consumption waste | 048 1 1200 120 |

| Payment for other types of negative impact on the environment | 048 1 1200 120 |

| Payment for the use of aquatic biological resources under intergovernmental agreements | 076 1 1200 120 |

| Payment for the use of federally owned water bodies | 052 1 1200 120 |

| Income in the form of payment for the provision of a fishing area, received from the winner of the competition for the right to conclude an agreement on the provision of a fishing area | 076 1 1200 120 |

| Income received from the sale at auction of the right to conclude an agreement on fixing shares of quotas for the production (catch) of aquatic biological resources or an agreement for the use of aquatic biological resources that are in federal ownership | 076 1 1200 120 |

KBK for fees for the use of wildlife objects (2018)

| KBK for fees | BCC for penalties | KBC for fines |

| 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

BCC 2021 for fees for the use of aquatic biological resources

| Payment Description | Codes | ||

| Tax | Penalty | Fines | |

| Fee for the use of aquatic biological resources (excluding inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

| Fee for the use of objects of aquatic biological resources (for inland water bodies) | 182 1 0700 110 | 182 1 0700 110 | 182 1 0700 110 |

KBK 2021 for trading fee

| Payment Description | KBK for payment |

| Trade tax in federal cities | 182 1 0500 110 |

| Penalty trading fee | 182 1 0500 110 |

| Interest trading fee | 182 1 0500 110 |

| Fines trade fee | 182 1 0500 110 |

KBK 2021: tax on gambling business

| BCC for tax | BCC for penalties | KBC for fines |

| 182 1 0600 110 | 182 1 0600 110 | 182 1 0600 110 |

State duty: BCC for 2021 (table)

| Payment Description | KBK |

| State duty on cases considered in arbitration courts | 182 1 0800 110 |

| State duty on cases considered by the Constitutional Court of the Russian Federation | 182 1 0800 110 |

| State duty on cases considered by constitutional (statutory) courts of constituent entities of the Russian Federation | 182 1 0800 110 |

| State duty on cases considered by the Supreme Court of the Russian Federation | 182 1 0800 110 |

| State duty for state registration: – organizations; – individuals as entrepreneurs; – changes made to the constituent documents of the organization; – liquidation of the organization and other legally significant actions | 182 1 0800 110 |

| State duty for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities | 182 1 0800 110 |

| State duty for carrying out actions related to licensing, with certification in cases where such certification is provided for by the legislation of the Russian Federation, credited to the federal budget | 182 1 0800 110 |

| Other state fees for state registration, as well as performance of other legally significant actions | 182 1 0839 110 |

| State duty for re-issuance of a certificate of registration with the tax authority | 182 1 0800 110 |

Income from the provision of paid services and compensation of state costs: KBK 2018

| Payment Description | KBK for payment |

| Fee for providing information contained in the Unified State Register of Taxpayers | 182 1 1300 130 |

| Fee for providing information and documents contained in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs | 182 1 1300 130 |

| Fee for providing information from the register of disqualified persons | 182 1 1300 130 |

KBC 2021: fines, sanctions, damages

| Payment Description | KBK for payment |

| Monetary penalties (fines) for violation of legislation on taxes and fees, provided for in Art. 116, 118, paragraph 2 of Art. 119, art. 119.1, paragraphs 1 and 2 of Art. 120, art. 125, 126, 128, 129, 129.1, art. 129.4, 132, 133, 134, 135, 135.1 | 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on taxes and fees provided for in Article 129.2 of the Tax Code of the Russian Federation | 182 1 1600 140 |

| Monetary penalties (fines) for administrative offenses in the field of taxes and fees provided for by the Code of Administrative Offenses of the Russian Federation | 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on the use of cash register equipment when making cash payments and (or) payments using payment cards | 182 1 1600 140 |

| Monetary penalties (fines) for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | 182 1 1600 140 |

New BCCs for fines on insurance premiums for payments in 2021

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0210 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

New KBK 2021

13 new BCCs have been officially approved for 2021. Nine for taxes and excise taxes, two for state duties, one for property taxes of individuals (Federal Law No. 459-FZ dated November 29, 2018, Order of the Ministry of Finance dated September 20, 2018 No. 198n). The complete list is in the table.

| Payment Description | KBK |

| Excise tax on dark marine fuel imported into Russia | 153 1 0400 110 |

| Excise tax on crude oil sent for processing | 182 1 0300 110 |

| Excise tax on dark marine fuel produced in the Russian Federation | 182 1 0300 110 |

| Excise tax on dark marine fuel imported into the Russian Federation | 182 1 0400 110 |

| Income tax on the implementation of agreements on the development of oil and gas fields located in the Far Eastern Federal District, under the terms of production sharing agreements, credited to the budgets of the constituent entities of the Russian Federation | 182 1 0100 110 |

| Tax on additional income from the extraction of hydrocarbons on subsoil plots located wholly or partially in the territories specified in subparagraph 1 of paragraph 1 of Article 333.45 of the Tax Code | 182 1 0700 110 |

| Tax on additional income from the extraction of hydrocarbons on subsoil plots located wholly or partially in the territories specified in subparagraph 2 of paragraph 1 of Article 333.45 of the Tax Code | 182 1 0700 110 |

| Tax on additional income from the extraction of hydrocarbons on subsoil plots located wholly or partially in the territories specified in subparagraph 3 of paragraph 1 of Article 333.45 of the Tax Code | 182 1 0700 110 |

| Tax on additional income from the extraction of hydrocarbons on subsoil plots located wholly or partially in the territories specified in subparagraph 4 of paragraph 1 of Article 333.45 of the Tax Code | 182 1 0700 110 |

| State duty for issuing excise stamps with a two-dimensional bar code containing the EGAIS identifier | 153 1 0800 110 |

| State duty for the issuance of federal special stamps with a two-dimensional bar code containing the EGAIS identifier | 160 1 0800 110 |

| Single tax payment of an individual | 182 1 0600 110 |

Where to pay in 2021

In 2021, the Federal Tax Service will continue to control the calculation and payment of insurance contributions for compulsory pension, medical and social insurance (with the exception of contributions for injuries). The listed types of insurance premiums in 2021 must be paid to the Federal Tax Service, and not to the funds.

Accordingly, the payment order for the payment of contributions in 2021 must be completed as follows:

- in the TIN and KPP field of the recipient of the funds - TIN and KPP of the tax inspectorate;

- in the “Recipient” field - the abbreviated name of the Federal Treasury body and in brackets - the abbreviated name of the Federal Tax Service;

- in the KBK field - budget classification code, consisting of 20 characters (digits). In this case, the first three characters indicating the code of the chief administrator of budget revenues should take the value “182” - Federal Tax Service.

From 2021 a new order with the KBK is in force

From 01/01/2019, Order of the Ministry of Finance dated 01/07/2013 No. 65n, which approved the budget classification codes, became invalid (Part 1 of the Letter of the Ministry of Finance dated 08/10/2018 No. 02-05-11/56735).

And in its place, there is a new order on the BCC for 2021 (Order of the Ministry of Finance dated 06/08/2018 No. 132n. However, all the main BCCs have not changed. Contributions and main taxes are paid according to the same codes as in 2021.

In short, two new codes have been added to the KBK list intended for “physicists”: 182 1 0600 110 – single tax payment of an individual (for property taxes) and 182 1 0500 110 – tax on professional income (tax for registered self-employed citizens).

There are also four new BCCs for legal entities under a new tax on additional income from the production of hydrocarbons.

Actually, that’s all the main taxpayers need to know. However, if you are interested, we will tell you about the innovations for 2021 in more detail.

BCC for insurance premiums for basic deductions in 2021

| Payment Description | KBK |

| Pension contributions at basic and reduced rates | 182 1 0210 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 1) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 1) | 182 1 0220 160 |

| Pension contributions at an additional tariff that does not depend on the special assessment (list 2) | 182 1 0210 160 |

| Pension contributions at an additional tariff depending on the special assessment (list 2) | 182 1 0220 160 |

| Medical fees | 182 1 0213 160 |

| Social contributions | 182 1 0210 160 |

| Contributions for injuries | 393 1 0200 160 |

Tables with all KBK for 2019

The BCC for basic taxes and contributions remained unchanged, that is, the same as in 2021. In this regard, there is simply no point in listing the BCC changes in 2021 in a comparative table. But in the tables below you will find the BCCs that will be in effect in 2021.

KBK for paying taxes for organizations and individual entrepreneurs on OSN

| Name of tax, fee, payment | KBK |

| Corporate income tax (except for corporate tax), including: | |

| — to the federal budget (rate — 3%) | 182 1 0100 110 |

| — to the regional budget (rate from 12.5% to 17%) | 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| - for any property, with the exception of those included in the Unified Gas Supply System (USGS) | 182 1 0600 110 |

| - for property included in the Unified State Social System | 182 1 0600 110 |

| Personal income tax (individual entrepreneur “for yourself”) | 182 1 0100 110 |

KBK for paying taxes for organizations and individual entrepreneurs in special modes

| Name of tax, fee, payment | KBK |

| Tax under the simplified tax system, when the object of taxation is applied: | |

| - “income” | 182 1 0500 110 |

| — “income minus expenses” (tax paid in the general order, as well as the minimum tax) | 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

KBC for insurance premiums

| Type of insurance premium | KBK |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for compulsory health insurance in a fixed amount (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount | 182 1 0213 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| – for those employed in work with hazardous working conditions (clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (the additional tariff does not depend on the results of the special assessment) | 182 1 0210 160 |

| – for those employed in work with hazardous working conditions (clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (additional tariff depends on the results of the special assessment) | 182 1 0220 160 |

| – for those employed in jobs with difficult working conditions (clauses 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (the additional tariff does not depend on the results of the special assessment) | 182 1 0210 160 |

| – for those employed in jobs with difficult working conditions (clauses 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (additional tariff depends on the results of the special assessment) | 182 1 0220 160 |

| Insurance premiums for injuries | 393 1 0200 160 |

KBK for payment of other taxes for all organizations and individual entrepreneurs

| Name of tax, fee, payment | KBK |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| VAT (as tax agent) | 182 1 0300 110 |

| VAT on imports from Belarus and Kazakhstan | 182 1 0400 110 |

| Income tax on dividend payments: | |

| — Russian organizations | 182 1 0100 110 |

| - foreign organizations | 182 1 0100 110 |

| Income tax on the payment of income to foreign organizations (except for dividends and interest on state and municipal securities) | 182 1 0100 110 |

| Income tax on income from state and municipal securities | 182 1 0100 110 |

| Income tax on dividends received from foreign organizations | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax | 182 1 06 0603х хх 1000 110 where xxx depends on the location of the land plot |

| Fee for the use of aquatic biological resources: | |

| — for inland water bodies | 182 1 0700 110 |

| — for other water bodies | 182 1 0700 110 |

| Water tax | 182 1 0700 110 |

| Payment for negative impact on the environment | 048 1 12 010x0 01 6000 120 where x depends on the type of environmental pollution |

| Regular payments for the use of subsoil, which are used: | |

| - on the territory of the Russian Federation | 182 1 1200 120 |

| — on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 182 1 1200 120 |

| MET | 182 1 07 010хх 01 1000 110 where хх depends on the type of mineral being mined |

| Corporate income tax on income in the form of profits of controlled foreign companies | 182 1 0100 110 |

KBK for payment of penalties on contributions

As a general rule, when paying penalties in the 14th-17th categories, the value is “2100”. However, there is an exception to this rule:

| Type of insurance premium | KBK |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for mandatory insurance in a fixed amount, paid by individual entrepreneurs for themselves (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount, paid by individual entrepreneurs for themselves | 182 1 0213 160 |

| Additional insurance contributions for compensatory pension insurance for employees** who work in conditions that give the right to early retirement, including: | |

| – for those employed in jobs with hazardous working conditions (clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) | 182 1 0210 160 |

| – for those employed in jobs with difficult working conditions (clauses 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) ** In 2018, for the payment of penalties on additional contributions for periods starting from 01.01. 2017 there were 4 KBK, now there are only two left | 182 1 0210 160 |

KBC for payment of fines on contributions

When paying a fine, as a rule, the 14th-17th digits take the value “3000”. But here we should not forget about exceptional cases:

| Type of insurance premium | KBK |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for mandatory insurance in a fixed amount, paid by individual entrepreneurs for themselves (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance in a fixed amount, paid by individual entrepreneurs for themselves | 182 1 0213 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| – for those employed in work with hazardous working conditions (clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (the additional tariff does not depend on the results of the special assessment) | 182 1 0210 160 |

| – for those employed in jobs with difficult working conditions (clauses 2-18, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ) (the additional tariff does not depend on the results of the special assessment) | 182 1 0210 160 |

Filling out a payment form when paying a fine

The differences between paying the tax amount and the penalty amount lie in filling out several fields of the payment order:

- Field 106 “Basis of payment” when paying penalties acquires the value “ZD” in case of voluntary calculation and repayment of debts and penalties, “TR” - at the written request of the supervisory authority or “AP” - when accruing penalties according to the inspection report.

- Field 107 “Tax period” - you need to put a value other than 0 in it only when paying a penalty on a tax claim. In this case, the field is filled in according to the value specified in such a requirement.

- Fields 108 “Document number” and 109 “Document date” are filled in in accordance with the details of the inspection report or tax requirement.

As for the BCC (field 104), for penalties on contributions paid to the Federal Tax Service in 2021-2021, they are as follows:

| Insurance type | KBK |

| Pension | 182 1 0210 160 |

| Medical | 182 1 0213 160 |

| For disability and maternity | 182 1 0210 160 |

And for contributions for injuries, which remain under the jurisdiction of the FSS, the KBC for penalties is 393 1 0200 160.

Calculation of penalties for insurance premiums in 2021

Since 2021, the rules for determining the amount of penalties are regulated by clause 4 of Art. 75 of the Tax Code of the Russian Federation, containing 2 calculation formulas, in which the amount of debt is multiplied by the number of days of delay and by a rate equal to:

- 1/300 of the refinancing rate - applies to individuals and individual entrepreneurs (regardless of the number of days of delay in payment) and for legal entities that are late in payment by no more than 30 calendar days;

- 1/150 of the refinancing rate - valid only for legal entities and only for a period of delayed payment exceeding 30 calendar days, while for 30 days of delay a rate of 1/300 will be applied.

“Unfortunate” contributions, which continue to be supervised by the FSS, are subject to the procedure described in Art. 26.11 of the Law “On Social Insurance against Accidents and Occupational Injuries” dated July 24, 1998 No. 125-FZ, and are calculated using a formula similar to those described above using a rate of 1/300 of the refinancing rate.

The refinancing rate in each of the above calculations is taken in its actual values during the period of delay. That is, if it changed during the calculation period, then such a calculation will be divided into several formulas using their own refinancing rates.

Consequences of errors when paying penalties

Since the latest changes came into force, the Treasury and the Federal Tax Service have jointly organized work to independently clarify payments that were assigned the status of unclear in the system (letter from the Federal Tax Service dated January 17, 2017 No. ZN-4-1 / [email protected] ). Therefore, if funds are received into the budget account using incorrect details, the treasury will send the payment where it is needed. But this does not apply to all errors. For your convenience, we have prepared a table for determining further actions depending on the type of error made:

| Error in payment order | Consequences |

| TIN, KPP, recipient's name, field 104, 106, 107, 108, 109 | Payment is subject to automatic verification. To speed up the process, you can write a clarifying letter to the tax office. |

| Payment details (account number, BIC, bank name) | Payment will not be credited to your personal account. You need to write a letter to the bank to cancel the payment if it has not yet been executed, or contact the Federal Tax Service to return it. In the second case, it is recommended to duplicate the payment using the correct details to avoid arrears. |

| Amount of payment | If the payment is made for a large amount, then you need to write a letter to offset the overpayment to another cash register company. If you paid less than necessary, then you need to make an additional payment |

Results

The rules for calculating penalties on contributions from 2021 are subject to the requirements of the Tax Code of the Russian Federation. Compliance with the special requirements for payment documents for the transfer of fines is necessary when issuing a payment order for the payment of this payment. In some cases, errors made in the payment document do not prevent the payment from being credited to the correct treasury account.

Sources

- https://nalog-nalog.ru/uplata_nalogov/rekvizity_dlya_uplaty_nalogov_vznosov/kbk_po_strahovym_vznosam_tablica/

- https://assistentus.ru/kbk/strahovye-vznosy-za-rabotnikov/

- https://xn—-btbhxcbx.xn--p1ai/pensionnyie-vznosyi/

- https://buhguru.com/strahovie-vznosy/kbk-strahovye-vznosy-2021-tablitsa.html

- https://nalog-nalog.ru/strahovye_vznosy/uplata_strahovyh_vznosov/kbk_peni_po_strahovym_vznosam/