Home / Real estate / Purchasing real estate / Buying an apartment / Deduction

Back

Published: December 28, 2017

Reading time: 5 min

4

990

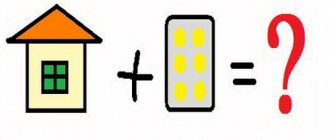

Buying a home is the biggest expense in life for most people. Therefore, the opportunity to save is extremely important

- Deduction and purchase of housing

- Limitations and features of payments for deductions Tax refund on mortgage interest on housing purchased before 2014

- Tax refund on mortgage interest on housing purchased after 2014.

- Income tax refund until 01/01/01.

What is a tax deduction?

If you are officially employed, you do not receive all the money you earn every month. Part goes to the budget of the Russian Federation. This is the 13% that is called personal income tax. Personal income tax is spent on a variety of needs of the country: education, housing and communal services, social programs, sports, transport, medicine and much more. The employer withholds personal income tax from your salary and then transfers it to the state.

So, a tax deduction is a real opportunity not to pay personal income tax for some time, or to return part of what has already been paid. If you spent the money on something recognized by the government as beneficial, such as an apartment, your expenses will not be fully tax deductible.

Agree, a very nice bonus.

How to get a property deduction

There are two ways to get a deduction. The first provides that the amount of tax that was withheld from you, for example, at work, is returned to you from the budget. The second provides that no tax is withheld from you at work.

The first method is the simplest. To use it at the end of the calendar year in which the apartment was purchased (or subsequent years), you need to submit to the tax office:

- Personal income tax return (form 3-NDFL) for the corresponding year. You can download the 3-NDFL declaration for 2011, the 3-NDFL declaration for 2012 and the 3-NDFL declaration for 2013 using the links. For more information on how the 3-NDFL declaration should be submitted, see the link.;

- copies of documents that confirm your expenses for purchasing real estate and paying interest on a bank loan (we wrote about these documents above) - that is, the amount of property deduction;

- application for property deduction and tax refund. You can download the deduction application in a convenient format, recommended by tax authorities, from our website (see link);

The second method requires that you receive a special notification from the tax office. It confirms the fact that you purchased the property and are entitled to the deduction. The notification also indicates its amount. You submit this notification to the accounting department of the company where you work. Based on this document, income taxes are simply stopped being withheld from you. You can apply for notification after purchasing an apartment. To do this, you need to provide the inspection:

- copies of documents that confirm your expenses for purchasing real estate and paying interest on a bank loan (we wrote about these documents above) - that is, the amount of property deduction;

- an application to issue you a notice to receive a property deduction at your place of work.

Portal "Your taxes" 2021

Conditions for receiving a deduction

If you previously, when purchasing a previous apartment, already received a deduction and exhausted the limit, it is no longer possible to receive a deduction again.

To receive a property deduction, you must not only buy an apartment in Russia (in other countries they will not give a deduction), but also pay taxes regularly, and therefore be officially employed. You need to be a tax resident, for which you need to spend at least 183 days a year in your homeland (Article 207 of the Tax Code of the Russian Federation).

Also, you and the seller of the apartment should not be interdependent persons. This means that buying an apartment from your mother or sister and getting a deduction will not work. The tax authorities may also consider a boss and a subordinate to be interdependent - Article 105.1 of the Tax Code of the Russian Federation.

Well, to receive it, of course, you will need documents that will prove to the tax authorities that you actually purchased the apartment and paid for it.

Restrictions on property deduction

There are few such restrictions. But they exist.

First , a property deduction is not provided if the property was purchased from a related party. Those persons listed in Article 105.1 of the Tax Code are recognized as interdependent. For example, these are your close relatives. Therefore, if you bought an apartment from your wife/husband (parents, brother, sister), then you will be denied the deduction.

Secondly , property deductions are not provided if the property was paid for by other persons for you and you have no obligations to them. For example, you were so liked at work that your employer bought you an apartment. There is an apartment - there are no obligations. Your deduction will be denied. However, if the same employer gave you money to buy an apartment on credit, then you will receive a deduction. You will also retain the right to it if you buy an apartment using a bank loan. After all, you still have the obligation to return the money in both the first and second cases.

Third , the property deduction cannot include expenses for the purchase of an apartment (other real estate) that were paid from maternal (family) capital or through payments from the federal, regional or local budget. Accordingly, if, for example, an apartment costs 1,800,000 rubles. and an amount of 250,000 rubles. paid from maternity capital, the deduction will be only 1,550,000 rubles. (1,800,000 - 250,000).

Deduction limit

The deduction will not always be equal to your actual expenses for the apartment. There is a limitation: the state is ready to refund the tax only for a certain amount, and no more.

Now the deduction limit when purchasing an apartment, according to Article 220 of the Tax Code of the Russian Federation, is 2 million rubles.

This is how it was installed in 2008. Before this, the limit was 1 million rubles. This means that if you bought a home after 2008 for 1.7 million rubles, the deduction amount will be equal to your expenses, i.e. it will be 1.7 million rubles.

If you paid 2, 6 or 10 million rubles for an apartment, the deduction in each case will be 2 million rubles. According to the limit, it is clear what the maximum amount can be returned: 13% of 2 million is 260 thousand rubles.

A nuance: if you purchased an apartment before 2014, then the limit is tied specifically to this apartment; it cannot be “reached” by another purchased apartment. If you bought an apartment later than 2014, the situation is better. You can use the remainder of the limit when purchasing your next apartment, if you have not exhausted it immediately.

News

Tax innovations provided for by Federal Law 212-FZ of July 23, 2013 come into force on January 1, 2014. For all transactions for 2013 and earlier, the old procedure and old restrictions are retained - both on the distribution of shares, and on amounts, and on percentages.

The main thing is that the property tax deduction loses the one-time principle; now the limit principle prevails. Which is, of course, fair and puts all taxpayers on an equal footing in terms of reimbursement. If previously the deduction could be obtained once, that is, only for one object or share in it (and at the same time the “unused balance” was burned), now the right to deduction can be claimed multiple times until the limit is exhausted, which is currently 2 million rubles. Let us remind you that this is the taxable base, and 13%, or 260 thousand rubles, will be due for compensation. This change is relevant if the documentary value of the property does not reach 2 million rubles.

Previously, the property deduction was tied not only to a person, but also to a share in a jointly acquired property. That is, 2 million rubles for a joint purchase became the limit for the entire apartment. For example, an object worth 5 million rubles was purchased by two spouses for ½ share - each spouse could receive a deduction in the amount of 1 million rubles, and not 2 million. From January 1, 2014, the link to the object disappears, and in the example given, each of the owners can claim a deduction in the amount of 2 million rubles.

A negative innovation for recipients of mortgage loans: the maximum deduction for interest, previously not limited (the entire amount of interest paid to the bank could be claimed as a deduction, even if it amounted to, say, 10 million rubles), will be limited to 3 million rubles, that is, the borrower will return in “real money” no more than 3 million * 13% = 390 thousand rubles. Moreover, the deduction for interest is deprived of the principle of multiplicity, that is, it is possible to deduct from taxation interest paid up to 3 million rubles on only one object, or more precisely, only on one mortgage loan. In this case, the unused remainder is burned. Thus, if the interest for the entire loan term, say, in case of early repayment or due to the insignificant loan amount, is 2 million rubles, then the “available in reserve” 1 million rubles cannot subsequently be claimed for the next mortgage loan. And this norm goes against the principle of the supremacy of the limit, approved directly for real estate.

Another provision enshrined in the tax code concerns the possibility of taxpayers who are parents receiving a deduction for objects or shares in real estate purchased in the name of their minor children. The same rule applies to adoptive parents, guardians, and trustees. Previously, the right to receive a deduction for real estate acquired in the name of children was determined by court decisions, clarifications of authorities, etc.

So, firstly, all changes will take effect from legal relations that arose after January 1, 2014. That is, for all transactions for 2013 and earlier, the old procedure and old restrictions are retained - both on the distribution of shares, and on amounts, and on percentages. And also, alas, only once. Positive point: a deduction in the amount of expenses actually incurred by the taxpayer to repay interest on targeted loans (credits) received by the taxpayer before January 1, 2014, as well as to repay interest on loans received from banks for the purpose of refinancing such loans, is provided without taking into account such restrictions. Alas, it will be impossible to “get” anything from previous transactions. The law does not have retroactive effect. Thus, the Ministry of Finance explained that if a person previously purchased housing worth less than 2 million rubles, then the next purchase of real estate after 2014 cannot claim the right to the balance (Letters dated 08/09/2013 No. 03-04-05/32362, No. 03-04 -05/32333).

Source: “Our Money” magazine

Carrying forward the balance of the deduction to the next year

Only those whose annual income is more than 2,000,000 rubles will be able to receive the maximum amount of the deduction immediately. In this case, for the year you pay the state personal income tax in the amount of 260,000 (or more). This means that the tax office has something to return to you.

Everyone else will be refunded for the year only that part that they actually transferred to the budget in the form of taxes for this year. The rest can be obtained in subsequent years. Moreover, this can take as many years as is needed in your case - there are no limits, the main thing is that the entire allocated amount ends up with you.

Let's say your salary is 50 thousand rubles a month, and you should get 260 thousand back, since the deduction amount was 2 million. You receive 600,000 rubles a year and pay 78,000 rubles as tax to the state. It turns out that the tax will be returned to you within 4 years.

In the first year after purchasing an apartment, you will be able to take home 78,000 rubles, in the second and third years - also 78,000 each, and in the fourth year you will receive the remaining 26,000 rubles.

If a pensioner buys an apartment, an exception is provided for him. He will be able to return the tax for 4 years at once. To do this, he needs to submit 4 declarations at the same time: for the year in which the housing was purchased, and 3 years before that.

How does property deduction work?

The amount of property deduction is equal to the cost of the purchased property. However, the maximum deduction amount is limited. Regardless of how much you paid, the deduction when purchasing an apartment (or other real estate) cannot exceed RUB 2,000,000. (excluding mortgage interest, if any). But we won’t stop there for now. Details below.

Let us illustrate the mechanism of how the deduction works. But first of all, you need to remember that income tax is calculated only at the end of the year. That is, at the end of each year you sum up all the income received, reduce them by deductions and calculate the tax amount. Then you compare it with the amount that you personally paid (or your employer paid for you). You either pay the difference to the budget (if you paid less than necessary), or return it from the budget (if you paid more than necessary).

Example Let's assume that your salary is 35,000 rubles. per month. The income tax that will be withheld from her will be: 35,000 rubles. x 13% = 4550 rub.

The company you work for will pay this amount to the budget monthly. Consequently, you will receive your salary in your hands minus tax, that is, only in the amount of 35,000 rubles. — 4550 rub. = 30,450 rub.

Accordingly, for the year you will receive a salary in the amount of: 35,000 rubles. x 12 months = 420,000 rub.

Tax will be withheld from her in the amount of: 420,000 rubles. x 13% = 54,600 rub.

So, the company where you work has withheld a tax from you in the amount of 54,600 rubles for the year. and paid it to the budget.

This year you received the right to a deduction when purchasing an apartment in the amount of 380,000 rubles. At the end of the year, your annual taxable income will be: RUB 420,000. (salary for the year) - 380,000 rubles. (deduction) = 40,000 rub. (taxable income)

Tax must be withheld from him in the amount of: RUB 40,000. (taxable income) x 13% = 5200 rub.

However, you have already been deducted 54,600 rubles. After all, the company that paid the tax for you calculated your income without this deduction. Consequently, you have the right to return part of the overpaid tax for you from the budget in “real” money. This part will be: 54,600 rubles. (tax already withheld) - 5200 rub. (tax to be paid) = RUB 49,400. (tax that the budget will have to return)

Accordingly, you have the right to claim a tax refund on this amount.

Read more about how to apply tax deductions by following the link.

Deduction from the employer

If you declare a deduction at your place of work, you will immediately receive a salary increased by 13% - there is no need to wait for next year, as is the case with the declaration. This happens due to the fact that the employer stops transferring your personal income tax to the budget. All tax you have already paid at the beginning of the year will be refunded to you immediately.

To realize this opportunity, you need to bring a notice from the tax office to work. To do this, you need to fill out a tax application on the website, attach all the required documents to it, and sign with an electronic signature (it will be generated in your personal account). Within one month, the tax office will send you the necessary document.

The tax notice is valid for one year. To receive the balance, you will need to receive the notice again and give it to your employer.

If you are married

Both spouses have the right to a deduction, so when buying an apartment, no matter who you register it for, claim two deductions. Both the wife and the husband can return 260 thousand rubles, since each has a limit of 2 million.

You can get 520 thousand rubles per family if your apartment costs 4 million rubles or more. If the apartment costs less than 4 million rubles, one of the spouses or both does not use the entire limit. Then you can return the balance when purchasing a new home.

There is an exception: if spouses purchased an apartment as shared ownership before 01/01/2014, then their right to deduction arose entirely from the property: the maximum payment will be 260 thousand per family. You cannot use the balance when purchasing a new home after receiving a deduction for such an apartment.

If you live in a common-law, unregistered marriage, you will not be able to get a double deduction.

If you used maternity capital

You can only receive a deduction from funds that you spent personally. The amount that was allocated to you as maternity capital is not your expenses, and therefore will not be taken into account.

If you bought an apartment for 2 million, and 450 thousand of them were paid with maternity capital, then the deduction amount will be equal to 1,550,000 rubles. The refund amount will be 201,500 rubles.

If you bought an apartment for 5 million, and 450 thousand of them were paid by maternity capital, your expenses are equal to 4,550,000 rubles. The deduction amount will be equal to the limit, 2 million, and 260 thousand rubles will be returned to you.

If you were not present at the transaction

It happens that it is not possible to come to a purchase and sale transaction, and then the buyer draws up a power of attorney for a friend or relative so that he transfers the money. In this case, the owner will still have the right to deduct. To prove to the tax authorities that these are your expenses, and not a friend or relative, attach to other documents a copy of the power of attorney, which states that you trust to pay your money for the apartment. Also attach a bank document, from which it is clear that the money was withdrawn from your account.