In what cases will you receive a deduction?

The conditions are the same as when buying an apartment:

- You are a tax resident of the Russian Federation.

- Officially employed, and the employer pays 13% income tax (NDFL) for you.

- You have on hand documents confirming the costs of purchase and construction.

- The property was not purchased from a dependent person (spouse, parents (including adoptive parents), children (including adopted children), full and half siblings, guardian (trustee) and ward - Article 105.1 of the Tax Code of the Russian Federation).

- You did not use the right to receive a deduction or its balance.

If there are no problems with these conditions, then we analyze the property. You will receive a deduction if:

- We bought or built a house. At the same time, it does not matter at all how they built it: on their own or resorted to the help of hired workers. The main thing is to keep documents confirming expenses.

- We bought a plot of land for the construction of a residential or garden house. What is the difference between a residential house and a garden house, and whether a garden house can become residential, we will look into it below.

When is a tax deduction issued?

The legislation of the Russian Federation does not establish time limits for applying for a tax refund. That is, a citizen has the right to receive such compensation even several years after purchasing residential real estate.

Mandatory conditions for personal income tax refund:

- residential property is fully paid, for example, a mortgage;

- the buyer has registered ownership of the property and has an act of acceptance/transfer of housing (for apartments in new buildings).

You can immediately receive tax compensation upon fulfilling these requirements and registering real estate (receiving a transfer deed) through the employing company. And if the payment is planned to be received through a tax organization, then the application can be submitted only the next year after the execution of the transfer deed and registration of the property.

How much tax can be returned from the budget?

The maximum deduction amount for the purchase or construction of a house is 2 million rubles (clause 1, clause 3, article 220 of the Tax Code of the Russian Federation). This means that only 13% of this amount – 260 thousand rubles – will be returned to your account.

If a house is purchased with a mortgage, then a deduction is allowed for the interest paid. Thus, the limit amount increases to 3 million rubles, and the amount of tax refund will be 390 thousand rubles.

Remember that the purchase or construction deduction can be used once in a lifetime, but for several real estate properties. This innovation has been in effect since January 1, 2014. And you can also receive a deduction for interest paid once, but strictly for one piece of real estate (clause 1, clause 3 and clause 8 of Article 220 of the Tax Code of the Russian Federation).

If you are legally married, then be prepared for pleasant bonuses. Each spouse has the right to a deduction (Letters of the Federal Tax Service dated November 14, 2017 No. GD-4-11/ [email protected] , GD-4-11/ [email protected] ). By this it should be understood that instead of 260 thousand rubles, spouses can return 520 thousand rubles. At the same time, it does not matter to whom the title and payment documents are issued. The property is jointly acquired, everyone will receive the money. It is logical that in this case, the cost of purchase and construction will be 4 million rubles.

Important point. Amounts received as maternity capital or other government subsidies cannot be taken into account as deductible expenses.

What is a tax deduction

A mortgage is a credit agreement between a borrower and a financial institution, according to which borrowed funds can only be used to purchase residential real estate.

Refund of tax deduction (NDFL) is a government benefit that allows the buyer of real estate with a mortgage to save their own money. The state compensates the borrower 13% of the cost of the mortgage housing.

The maximum payment is taken from 2 million rubles.

For example:

- if a citizen purchased a private house for 4.5 million rubles, the state will return only 13% of the taxation of 2 million rubles. This is 260 thousand rubles;

- if the value of real estate is less than 2 million rubles, the deduction can be obtained from other real estate.

The compensation applies only to targeted housing lending programs for which a private house, apartment or room was purchased.

Deduction when buying or building a house

You can receive a deduction when buying a house using the same algorithm as when buying an apartment. You read about this in the previous article. What if you bought a house under construction and you plan to finish it?

In this case, you are buying an unfinished construction project. Please note that this clarification must be reflected in the purchase and sale agreement. Otherwise, you will not receive a deduction for construction work.

Example.

You bought a plot of land with an unfinished house. The purchase and sale agreement states that the house is an unfinished construction project.

Only after construction is completed and you have an extract from the Unified State Register of Property Rights in your hands, contact the tax office for a deduction. The deduction will include the costs of purchasing the house and the costs of completing it.

Features of obtaining a deduction when purchasing a land plot

You cannot receive a deduction for the purchase of land. A land plot has two purposes: a plot for individual housing construction (IHC) or a personal subsidiary plot (LPH). The second relates to garden plots.

The right to deduction will appear if you buy land for the construction of a residential building, that is, with the intended purpose of individual housing construction. It is not enough to buy land and build a house, which according to documents is listed as an unfinished construction project. Such a house has the status of non-residential premises. Previously, for the tax authorities, having the status of “residential building” was a fundamental condition. For residential buildings the deduction was denied.

On January 1, 2021, a new law was issued - No. 217-FZ “On the conduct of gardening and vegetable gardening by citizens for their own needs and on amendments to certain legislative acts of the Russian Federation.” It states that buildings on garden and dacha plots registered before January 1, 2021 with the designation “residential” or “residential building” are considered residential buildings from that date. The tax will be returned only if the house was built with the right of registration (registration) and is registered with Rosreestr.

Who can receive compensation?

Not everyone can count on a partial refund of the cost of housing. If you bought real estate and want to apply for tax compensation, then you need to know about the following conditions:

- You must be a citizen of the Russian Federation (the system of property deductions is aimed at helping Russians purchase housing);

- Your employment must be official (for fired, unemployed and those who work unofficially, the right to compensation does not apply);

- Your employer monthly transfers personal income tax amounts to the budget from your salary at a rate of 13% (in this case you are the taxpayer).

Deduction when buying a garden house

Don’t be confused, people live in a residential building all year round, while in a garden house they live when it’s time to plant potatoes. If you bought a summer cottage with a garden house that is not recognized as residential, the deduction will be denied. But if you have patience and transfer it to residential status, you will receive a deduction not only for the house, but also for the purchased land (Letter of the Federal Tax Service of Russia No. ED-4-3 / [email protected] dated 12/10/12).

From January 1, 2021 to March 1, 2021, summer residents and gardeners can re-register their real estate according to a simplified procedure (Federal Law dated August 2, 2019 No. 267-FZ).

The main thing is that the garden house meets the requirements of a residential one (clause 4 of the Government of the Russian Federation of January 28, 2006 No. 47 “On approval of the Regulations on the recognition of premises as residential premises...” (as amended on December 24, 2018). Namely, it is built from a solid foundation and is provided with the necessary communications: sewerage, heating, electricity.

Example 1.

In 2021, you built a house on a garden plot. In the Unified State Register of Real Estate the house is registered as “non-residential”. In summer you will enjoy spending time there with your family. From January 1, 2021, this house is officially considered a garden house. And if you want a deduction for it, then you need to re-register the purpose of the house as “residential”.

Example 2.

In 2009, you bought a plot of land with the purpose of individual housing construction. The house was built only in 2021, and then we received title documents. And we learned about the possibility of receiving a deduction in 2021. In 2021, you submit a declaration and claim a deduction for both the construction of a house and the acquired land.

What expenses are included in the deduction?

Do not think that absolutely all costs of building a house are included in the deduction. The tax code only specifies expenses:

- for the development of design and estimate documentation;

- for the purchase of construction and finishing materials;

- for construction and finishing works;

- for connection to electricity, water supply, gas supply and sewerage networks.

Remember that if you bought a built house and remodeled it, you will not be able to claim a deduction for construction costs. For this purpose, the house must have the status of an unfinished construction project.

Documents for registration of deduction

As soon as your home has become residential, you have every right to submit a 3-NDFL declaration to the tax office for a tax refund. As with the deduction for an apartment, the declaration is submitted after the end of the tax period (clause 7 of Article 220 of the Tax Code of the Russian Federation).

If the title documents for the house are received in 2021, then the right to deduction will appear in 2021. But you will be able to file a declaration only in 2021.

To apply for a deduction, prepare the following copies of documents:

- documents on ownership of the house and land (certificate or extract from the Unified State Register of Real Estate);

- contract for the sale and purchase of a house and land plot (if you are applying for a deduction for the plot);

- payment documents for the purchase of a house and land;

- payment documents for the purchase of a house, land, construction and finishing materials (bank statements, checks, receipts, acts on the purchase of materials, etc.);

- mortgage agreement and a certificate from the bank about the interest paid (if you are buying a house with a mortgage).

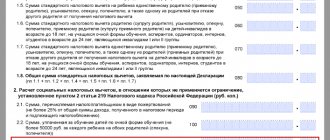

Of the originals, you will need a passport, a 2-NDFL certificate for the year the deduction was issued (given by the employer, or uploaded on the website nalog.ru) and a completed 3-NDFL declaration.

Reimbursement of mortgage interest

According to the current legislation (TC Art. No. 220/1/4), in addition to the tax deduction, which is calculated on the market value of the real estate purchased with a mortgage, the borrower can return part of the interest paid to the credit institution for the use of borrowed funds.

Procedure for reimbursement of credit interest:

- First, the borrower must issue a tax refund on the cost of the housing itself - 13% of the value of the real estate, but no more than 2 million rubles.

- Only after receiving the main payment can you apply for reimbursement of bank interest accrued for using the loan.

Unlike the return of payment for real estate, you can receive interest compensation only for one object.

For housing in a new building

Citizens who bought mortgaged housing in a new building have the right to receive state compensation after drawing up a transfer deed for the property, and not after its registration.

There are also features regarding the reimbursement of interest paid to the lender for the use of borrowed funds. With shared participation, borrowers receive a loan before the acceptance/transfer of housing in a new building is issued. But, the borrower has the right to apply for a personal income tax refund on interest for the entire loan period, i.e. regardless of when the act of acceptance/transfer of the residential property was signed.

Buyers of housing in new buildings can return their own funds spent on the interior decoration of the apartment. But, for this, the contractual agreement must state that the apartment was sold without finishing. At the same time, it is necessary to understand that only part of the investment in repairs will be returned, since the payment of personal income tax is not provided for all finishing materials.

For a private house

The procedure for completing paperwork for tax reimbursement when purchasing a private house is similar to the process of paying compensation for an apartment, but there are several nuances.

When purchasing unfinished housing, without finishing the premises, it is possible to return part of your own funds invested in repairs. But, this point must be reflected when purchasing real estate in the contractual agreement.

For individual construction, you can also receive a tax refund.

For military mortgage

Military mortgage is a special lending program for military personnel, under which housing is purchased at the expense of the state. In this case, a property deduction is also provided.

Reimbursement of personal income tax for housing purchased using a “Military Mortgage” is only possible if the military personnel invested part of their own financial savings in the purchase.

Example:

- maximum amount of compensation – 13% of 2 million rubles;

- a serviceman purchased under a preferential mortgage program for 6 million rubles. a private house;

- the state subsidized only 2.5 million rubles;

- The serviceman paid an additional 3.5 million rubles for the apartment from his own savings.

- In this case, according to the law, he is entitled to the maximum state compensation from the cost of the residential property - 13% of 2 million rubles. This amounts to 260 thousand rubles.

Any citizen of the Russian Federation who is officially employed has the right to reimburse part of their own funds when purchasing mortgaged housing. The main condition is compliance with the requirements imposed in accordance with current legislation for the preparation of necessary documents and for concluded transactions.

In a few years

There are often situations when the owners of residential property purchased under a mortgage lending program have fully returned the main tax deduction from the market value of the property. But they still have the right to refund part of the money paid towards bank interest.

You can submit an application for a personal income tax refund separately for each year or one general application for several previous years.

When refinancing

Refinancing a home loan is taking out a new loan, through which the debt under the old loan agreement is fully repaid.

According to Russian legislation (TC, Art. No. 220/1/4), a borrower in such a situation has the right to receive a personal income tax refund on both loans. But, the refinancing agreement must necessarily indicate the intended purpose of the borrowed funds, i.e. to pay off the existing mortgage.

It does not matter whether the borrower received a tax deduction for the previous loan or not. When applying for a personal income tax refund, both loan agreements are attached to the package of required documents.

Return of personal income tax to the co-borrower

If the borrower involved co-borrowers when drawing up a mortgage agreement, then all parties to the agreement have the right to receive a personal income tax refund on the value of the property in a shared ratio.

Also, the owners have the right to distribute among themselves the amount of personal income tax refund at the credit rate in any percentage. To do this, it is necessary to submit papers confirming the payment of interest to the lender for the use of borrowed funds.

Only the main borrower on his own behalf can contribute funds towards the mortgage debt. In this case, in order to receive his share of the tax payment, the co-borrower must provide the tax authority with a document confirming his participation in the payment of the loan debt. Such a document is a power of attorney, which fixes the amount of money and also states that the money is provided to the main borrower to pay off the mortgage debt. The power of attorney is drawn up in free form; it is not necessary to have it certified by a notary.

How to quickly and inexpensively issue a deduction

You can submit documents in person to the tax office, remotely through the taxpayer’s personal account, or apply for a deduction through your employer. No one will give you a guarantee that the tax office will accept your documents without problems, and no one will bother you for three months of a desk audit.

Repeatedly you will have to spend time and effort proving to the tax authorities the legality of including certain construction works as deductible expenses. You may have to wait more than three months for your tax refund. These are the harsh realities of the work of tax authorities. But everything is being resolved.

In less than 24 hours, the specialists of the Return.tax company will advise you on deductions, fill out a declaration, prepare and submit documents to the tax office. Minimal participation is required from you. The cost of filing a deduction for one calendar year under the “Standard” package is 1,690 rubles.

The Premium package offers full support for the verification from the moment of submission, resolution of controversial issues and until the receipt of money in your account. The cost of filing a deduction for one calendar year under the Premium package is 3,190 rubles.

Question answer

Question: Morozov N.G. I bought an apartment in March 2014, and in February 2015 I bought a room. The total cost of the property is 1,810,900 rubles. As of 08/01/16, Morozov did not submit documents for deduction? Can Morozov receive compensation, how, in what amount?

Answer: Yes, Morozov can issue a deduction for both objects. The deadline for submitting documents is no later than 3 years after the purchase of each apartment (room). For Morozov’s apartment, this period expires in 2021, for a room – in 2021. In order to receive the payment, Morozov must complete the necessary documents and contact his employer or the Federal Tax Service. The total refund amount that Morozov will receive is 245,817 rubles. (RUB 1,890,900 * 13%).