Filling out personal data

An example of filling out form 3-NDFL in the “Taxpayer’s Personal Account”

An example of filling out form 3-NDFL in the “Taxpayer’s Personal Account”

Select the year for which the tax return is being prepared. (In your personal account, you can fill out a declaration only for yourself).

If you indicate the TIN, then information about the date and place of birth, citizenship, and identity document do not need to be entered. If you do not have a TIN, these sections are required to be completed.

An example of filling out form 3-NDFL in the “Taxpayer’s Personal Account”

How to restore a personal income tax return from an xml file?

I made a declaration in Taxpayer 2011 - saved it as xml and in the native format - but the original file was lost - how, in what program, can I convert the remaining xml into completed declaration forms?

I made a declaration in Taxpayer 2011 - saved it as xml and in the native format - but the original file was lost - how, in what program can I convert the remaining xml into completed declaration forms? Is there no Load from xml function in the Service?

No If you try to open it, it gives an error. A sign of a program's weakness. QuckPatent, but haven’t you tried it in the Taxpayer Legal Entity? documents-documents on personal income tax-2-personal income tax-download (red arrow) Not all, but many users of modern computer systems often encounter incomprehensible files in the XML format. Even fewer users know what kind of data this is and why it is needed.

Well, only a few understand which program to open an XML file.

Although everything in this matter is quite simple, nevertheless, sometimes problems arise. Let's see what's what.

Selecting deductions

A tax deduction is an amount that reduces the amount of income on which tax is levied, or allows you to return part of the tax previously paid to the budget.

Select the deductions that need to be included in the return and click the “NEXT” button.

If you need to enter other income, select the appropriate interest tab.

4.1 According to the 2-NDFL certificate, enter the following data:

4.2 When filling out a declaration in connection with the sale of property (apartment, land, etc.) owned for less than 3 years:

Enter the amount of income received from the sale of the property.

5.1 To receive property tax deductions, in the “Property Tax Deduction” tab, enter data on expenses for purchasing housing and repaying interest on targeted loans.

5.2 If you additionally want to receive a social tax deduction, select the appropriate tab in the deductions menu.

To receive social tax deductions, check the appropriate box.

Enter the amount of expenses in the appropriate line.

How to open xml through browser

When you double-click on a file, in most cases it opens through a browser, and through the one that is designated as the default browser on a given computer (mostly Microsoft Edge for Windows 10).

But this setting is changeable:

- Confirm the action with the “OK” button.

- On the “General” tab, click “Edit” and select the desired browser or other application through which you want to open the file.

- Right-click on the file, calling up the context menu, find the “Properties” item (located at the bottom).

Example of information from invoices issued by persons specified in clause 5 of Article 173 of the Tax Code of the Russian Federation (Section 12)

Section 12 of the VAT return (also approved by order of the Federal Tax Service) is filled out only if an invoice is issued with the allocation of the tax amount by the following persons:

- persons who are not taxpayers of value added tax.

- taxpayers upon shipment of goods (work, services), sales operations of which are not subject to value added tax;

- taxpayers exempt from fulfilling taxpayer obligations related to the calculation and payment of value added tax;

Example information in xml format

Filling out a tax refund application

Return Application

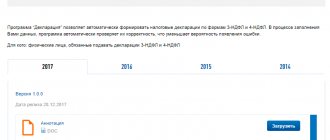

An example of filling out Form 3-NDFL in the “Taxpayer’s Personal Account”

Select the year of the declaration and the file. Attach supporting documents, sign with an electronic signature and send the declaration to the inspectorate. If you submit a return to obtain a tax deduction, do not forget to submit a refund application.

Obtaining a tax deduction from an employer

Samples, explanations, instructions - you can find all this in our article. We will show you how easy and free you can fill out the 3-NDFL declaration in your Taxpayer Personal Account.

Taxpayer’s personal account - if you don’t have one yet, then you can come to any tax office (which is closer to home) with a passport and ask to register your Personal Account. The inspector will take your passport and register you. You will be assigned a temporary password, which you can then change to a permanent one. And your login is already your TIN.

Let’s say that this citizen’s home cost was 1,800,000 rubles; he bought it on the secondary market and registered ownership of it on May 16, 2021.

We enter the taxpayer’s Personal Account (as shown in the figure).

1 log into the taxpayer’s Personal Account

2 Life situations

3 Submit a 3-NDFL declaration

4 Choose the method of filing the declaration - online

5 Select the desired year and mark the required answers

6 Press the Next button

7 Select the type of income (in Russia or not) and click Next

8 Select the type of deduction and mark it (you can select several types of deduction)

9 To enter work data, you need to select a source

10 From the 2-NDFL certificate, we rewrite the information about the employer and click Add income

11 We rewrite the data from the 2-NDFL certificate

12 We continue to enter data from the 2-NDFL certificate

13 We make a deduction for training

14 Fill in the information on property deductions

15 After we have entered the data on the apartment, attach supporting documents and then press the Next button

16 We can download the declaration and visually check all the data

17 Sending 3-NDFL

That's it, your documents have been sent to the tax authority.

Of course, as you fill out, questions and difficult situations may arise that were not covered in this article. Write to us - we will immediately help you figure it out.

And for those who find it difficult to create a package of documents on their own, we offer a service for filling out the 3-NDFL declaration.

Transformations

As discussed above, XML also allows for efficient use and reuse of data. The mechanism for reusing data is called an XSLT transformation (or simply transformation).

You (or your IT department) can also use transformations to exchange data between back-end systems, such as databases. Let's assume that database A stores sales data in a table that is useful to the sales department.

Database B stores income and expense data in a table specifically designed for accounting.

Database B can use a transformation to take data from Database A and put it into the appropriate tables.

The combination of the data file, schema, and transformation forms the basic XML system.

The following figure shows the operation of such systems. The data file is checked against the schema rules and then passed in any suitable way for transformation. In this case, the transformation places the data in a table on a web page. The following example shows a transformation that loads data into a table on a web page.

The following example shows a transformation that loads data into a table on a web page.

The point of the example is not to explain how to create transforms, but to show one of the forms they can take. Name Breed Age Altered Declawed License Owner This example shows what the text of one type of transformation might look like, but remember that you may be limited to a clear description of what you need from the data, and that description can be done in your native language. For example, you might go to the IT department and say that they need to print sales data for specific regions for the last two years, and that the information should look like this and that.

The department can then write (or modify) a transformation to fulfill your request. Microsoft and a growing number of other companies are creating transforms for a variety of purposes, making XML even more convenient to use.

In the future, it will likely be possible to download a conversion that suits your needs with little or no additional customization. This means that over time, using XML will become less and less expensive.