All articles Replacing a defective fixed asset with a serviceable one: tax and accounting (Vightman E.)

There is no need to restore the depreciation premium. It is important to track depreciation charges so as not to write off excess. How to prove that replacing a defective OS is not a reverse implementation.

If an organization returned a defective fixed asset to the supplier and received a serviceable one in return, this operation is not a separate transaction. After all, the company returns an object whose quality does not meet the terms of the purchase and sale agreement. That is, it operates within the framework of the same agreement (read more in the box on page 26).

Arbitrage practice. The courts do not recognize the return of low-quality goods as a reverse sale. If the buyer has identified irreparable defects in the goods, he has the right, at his choice (clause 2 of Article 475 of the Civil Code of the Russian Federation): - either to refuse to execute the sales contract and demand that the seller return the money paid for the goods ; - or demand from the seller to replace the low-quality product with a product of proper quality. Most courts find that upon initial transfer of a defective product, its sale did not take place. That is, ownership has not passed to the buyer. After all, the supplier did not fulfill its obligations under the contract, since it shipped low-quality goods (Resolutions of the FAS Povolzhsky dated 02/12/2013 N A65-14995/2012, Moscow dated 12/07/2012 N A40-54535/12-116-118, dated 01/28/2010 N KA -A40/14851-09 and dated 07/06/2009 N KA-A40/2935-09 districts). This means that when a low-quality product is returned to the supplier, reverse sales also do not occur.

It doesn’t matter when the buyer discovered the defective equipment - before it was put into operation or after some period of operation. But the Russian Ministry of Finance believes that when returning a fixed asset, VAT must be charged (Letter dated 06/03/2015 N 03-07-11/31971). Let's figure out how replacing a defective OS will affect taxes and how the buyer can reflect it in accounting.

, neither income nor expenses arise in the buyer’s tax accounting

A buyer who discovers a defective fixed asset does not sell it to the supplier. He returns the defective object and receives a good one in return. The Russian Ministry of Finance agrees that in connection with this transfer, no additional income and expenses are generated in the tax accounting of the buyer (Letter dated 06/03/2015 N 03-07-11/31971). This means that when disposing of low-quality fixed assets, the organization does not reflect the proceeds from its sale and does not have the right to write off the residual value of the object. It can be included in tax expenses only in the case of the sale of a fixed asset (clause 1, clause 1, article 268 of the Tax Code of the Russian Federation). If a company discovers a defect after it began to operate and depreciate an object, it is not obliged to restore either the accrued depreciation or the depreciation bonus (Letter of the Ministry of Finance of Russia dated June 3, 2015 N 03-07-11/31971). It is believed that when replacing a defective OS with a serviceable one, the organization’s accounting object does not change. The old fixed asset is replaced with a new one, similar in parameters and useful life. Therefore, the operation to replace the OS is not reflected in the buyer’s tax accounting.

Note. When replacing a defective OS with a serviceable one, the organization's accounting object remains the same.

After receiving a serviceable item, the company will continue to charge depreciation on it at the same rate. It is important not to write off too much. When depreciating a new object, an organization has the right to include in tax expenses only part of its original cost minus the depreciation accrued on the defective asset. She does not have the right to re-apply the depreciation bonus if she accrued it when putting the original OS into operation. But this is done if, instead of a defective OS, the organization received a completely identical object from the supplier. If the supplier replaced the faulty OS with another model with a different useful life (for example, due to the fact that the previous model is no longer produced or is out of stock), it is safer to register this operation as the disposal of a defective item and the receipt of a new item.

Note. If the faulty OS was replaced with something other than an analogue, it is safer to formalize the disposal of the old one and the capitalization of the new object.

In this case, the organization has the right to accrue a depreciation bonus on the new OS (clause 9 of Article 258 of the Tax Code of the Russian Federation). Even if she previously applied it in a defective manner. After all, this is another OS object.

The Ministry of Finance requires buyers to pay VAT when returning defective OS, but the courts do not agree with this

The department selectively interprets the operation of replacing a defective fixed asset with a serviceable one. For tax accounting purposes, the Russian Ministry of Finance does not consider it a reverse sale, but for VAT purposes it recognizes it as such (Letter dated 06/03/2015 N 03-07-11/31971). Therefore, officials believe that when returning a fixed asset that the buyer managed to register, he is obliged to charge VAT. This is explained by the fact that the supplier has the right to deduct VAT on the returned goods. We are talking about the tax that the supplier paid to the budget when selling this product (clause 5 of Article 171 of the Tax Code of the Russian Federation).

If an item of fixed assets is subject to return due to the identification of an irreparable defect

According to the current rules, each individual non-compliance with established requirements is recognized as a defect.

Depending on the cause, defects can be recognized as: structural, manufacturing and operational. Both those, and others, and third ones can be obvious and hidden, removable and irremovable. In particular, such defects are recognized as hidden, the methods and means of identifying which are not provided for in the regulatory and technical documentation required for such control. Fatal – defects, the elimination of which is technically impossible and/or economically impractical. But we will not talk about defects as such, but about how to reflect in accounting the operation of returning an item of fixed assets if a defect is identified, proven and a claim is made to the supplier. There is a question on this topic, and we will answer it.

An organization using unified agricultural tax purchased a cultivator, paying 400.0 thousand rubles for it. Since the organization did not incur any significant costs for its delivery and commissioning, the same amount constituted the initial cost of the cultivator, and since it itself is not a VAT payer - including the supplier’s VAT1. During operation, a hidden, irreparable defect was discovered, and therefore a claim was filed with the seller. The seller acknowledged the claim and agreed, in accordance with clause 2 of Article 475 of the Civil Code of the Russian Federation, to reimburse the buyer for the entire amount paid by him - 400.0 thousand rubles.

The purchase and return were processed in the same calendar year. Depreciation accumulated by the date of disposal amounted to RUB 20.0 thousand.

How to record settlement transactions for returning the cultivator to the supplier?

From a methodological point of view, there are several options for constructing an accounting scheme for such operations. But, in any case, the scheme involves three stages: 1) acquisition and operation, 2) identification of a defect and filing a claim, 3) satisfaction of the claim.

It would seem that the matter is complicated by the fact that, since this object was already capitalized on the date of return (moreover, put into operation), the fact of its return to the seller, from a fiscal point of view, will be regarded as a return sale. Not without reason, it should be noted. But what else needs to be noted: the complications here are small even for subjects who pay VAT, and in our case, since we are talking about a payer of the Unified Agricultural Tax, there are no difficulties at all. Why this is so - more on this after an example with a detailed analysis of the wiring diagram.

Option 1. Let's call it “expanded”. This scheme involves the use of the sub-account “Retirement of fixed assets” to account 01 (Let’s call them: 01.1 “Fixed assets” and 01.2 “Disposal of fixed assets”), as well as off-balance sheet account 002 “Inventory in custody”.

1. At the stage of acquisition and subsequent operation:

- Dt 08 Kt 60 – costs associated with the purchase of a cultivator are reflected (including VAT);

- Dt 60 Kt 51 – payment for delivery is made;

- Dt 01.1 Kt 08 – the fact of commissioning is recognized;

- Dt 20 Kt 02 - depreciation is calculated during operation.

2. At the stage of settling relations with the supplier, after identifying a hidden irreparable defect and drawing up a report:

- Dt 76 Kt 94 – a claim was made to the supplier;

- Dt 01.2 Kt 01.1 – write-off of the cultivator for disposal;

- Dt 02 Kt 01.2 – write-off of accumulated depreciation as of the date of disposal;

- Dt 94 Kt 91.1 – income is stated in the amount of losses subject to compensation (based on the documented fact of the supplier’s consent to satisfy the claim);

- Dt 94 Kt 01.2 - write-off of a cultivator retired due to an unrecoverable malfunction to the account of losses from shortages and damage to valuables (at residual value);

- Dt 002 – a decommissioned cultivator is transferred to an off-balance sheet account before it is transferred to the supplier under the return certificate.

3. At the calculation stage:

- Dt 51 Kt 76.2 – receipt of monetary compensation from the supplier in order to satisfy the claim;

- Kt 002 – deregistration of the cultivator due to satisfaction of the buyer’s claim and transfer of the object to the seller.

Example for option 1.

| No. | the name of the operation | Debit | Credit | Sum |

| 1. | The costs of purchasing a cultivator are reflected | 08 | 60 | 400000 |

| 2. | Payment is made for delivery | 60 | 51 | 400000 |

| 3. | The fact of commissioning is recognized | 01.1 | 08 | 400000 |

| 4. | Depreciation is calculated during operation | 20 | 02 | 20000 |

| 5. | A claim has been made to the supplier | 76.2 | 94 | 400000 |

| 6. | The cultivator is written off for disposal | 01.2 | 01.1 | 400000 |

| 7. | Write-off of accumulated depreciation | 02 | 01.2 | 20000 |

| 8. | Write-off of the residual value of a retired cultivator to the account of losses from shortages and damage | 94 | 01.2 | 380000 |

| 9. | Income is ascertained (upon the supplier’s consent to satisfy the claim) | 94 | 91.1 | 20000 |

| 10. | Registering the cultivator off-balance sheet | 002 | — | 400000 |

| 11. | Receipt of compensation to the account | 51 | 76.2 | 400000 |

| 12. | Deregistration of a cultivator | — | 002 | 400000 |

Option 2. Let's call it “simplified”. Without applying the “Disposal” subaccount to account 01, since the Instructions for the current Chart of Accounts do not strictly indicate its use. Moreover, it says: “may.” Maybe it means you have the right, but you don’t have to.

Also, in the scheme shown below there will be no off-balance sheet account 002. Firstly, its necessity for such cases has not been proven, and secondly, the fact of transfer of values (whether it is a purchase and sale transaction or another) may be accompanied by different circumstances. Sometimes this is the simplest case: a representative arrived, paid in cash (teared off the check, gave a payment card to write off the funds, etc.), loaded up and drove away.

Let’s start the example from the second stage – by filing a claim with the supplier. The first one is not of interest in this context.

Example for option 2.

| No. | the name of the operation | Debit | Credit | Sum |

| 1. | A claim has been made to the supplier | 76.2 | 94 | 400000 |

| 2. | Write-off of accumulated depreciation | 02 | 01 | 20000 |

| 3. | Write-off of the residual value of a retired cultivator to the account of losses from shortages and damage | 94 | 01 | 380000 |

| 4. | Income is ascertained (upon the supplier’s consent to satisfy the claim) | 94 | 91.1 | 20000 |

| 5. | Receipt of monetary compensation to the account in order to satisfy the claim | 51 | 76.2 | 400000 |

So what is the difference between the transaction pattern that reflects a return transaction and the pattern that would reflect a regular purchase and sale transaction? It is appropriate to recall the latter here:

| 62 | 91.1 | An invoice is presented to the buyer |

| 01.2 | 01.1 | The object is written off for disposal (at original cost) |

| 02 | 01.2 | Accumulated depreciation is written off |

| 91.2 | 01.2 | The object is written off for sale (at residual value) |

| 51 | 62 | Payment is credited to the account |

And compare with how the return is reflected:

| 76.2 | 94 | A claim is made to the supplier |

| 01.2 | 01.1 | The object is written off for disposal (at original cost) |

| 02 | 01.2 | Accumulated depreciation is written off |

| 94 | 01.2 | Write-off of the residual value of the disposed object to the account of losses from shortages and damage |

| 94 | 91.1 | Income is stated |

| 51 | 76.2 | Payment is credited to the account |

We play “find 10 differences”. There are two of them, and both are formal, since in neither case is the sale hidden - the proceeds from the disposal of an item of fixed assets are reflected in full. The only difference is that in the scheme for reflecting a purchase and sale transaction it is registered on a single account - 91.1, and in another case, before the final result reaches account 91.1, the entire amount first goes through “transit” through account 94, which in this case The diagram, in fact, indicates the fact of filing a claim, and we simply do not have the right not to reflect this.

As for the score 76.2, which in this case replaced the score 62, there is no difference at all. For even in a diagram reflecting a purchase and sale transaction of an item of fixed assets, account 76.2 is quite appropriate. Account 62 is, strictly speaking, an account intended to reflect settlements within the framework of current (operating) activities, and such random transactions as the sale of fixed assets do not apply to this.

Official position

- In the first quarter of 2009, an enterprise that works for the Unified Agricultural Service purchased a cultivator. During the operation of the asset, it became clear that it was defective. The seller was presented with a claim, he took the goods and returned the money (in the second quarter of 2009). However, the costs of purchasing the asset were partially recognized in tax accounting. What should I do?

Yu.V. Podporin, Deputy Head of the Department of Special Tax Regimes of the Ministry of Finance of Russia

- In accordance with Article 346.7 of the Tax Code of the Russian Federation, the tax period under the Unified Agricultural Tax is a calendar year, and the reporting period is a half-year. Therefore, in tax accounting for the first half of 2009, the amount of recorded expenses for the purchase of a cultivator should be reversed. At the same time, the cost of the cultivator returned by the seller on the basis of a claim presented to him is not included in the income taken into account when determining the tax base under the Unified Agricultural Tax. The basis is paragraph 3 of Article 250 of the Tax Code of the Russian Federation. According to this clause, taxation takes into account fines, penalties and (or) other sanctions for violation of contractual obligations, as well as amounts of compensation for losses or damage recognized by the debtor or payable by the debtor on the basis of a court decision that has entered into legal force. The cost of the cultivator returned by the seller is not the amount of damages to be compensated.

1 See clause 3 of Article 346.1 and clause 3 of clause 2 of Article 170 of the Tax Code of the Russian Federation.

Identification of deficiencies during equipment acceptance

Let us remind you: if an industrial enterprise refuses the equipment transferred by the supplier, it must be accepted for safekeeping and do not forget to notify the supplier about this. In accounting, such equipment is reflected in off-balance sheet account 002 “Inventory assets accepted for safekeeping.” According to the Instructions for using the Chart of Accounts, purchasing organizations take into account in account 002 the values accepted for storage in the event of:

— receipt from suppliers of inventory items for which the organization legally refused to accept invoices of payment requests and their payment;

— receiving from suppliers unpaid inventory items that are prohibited from being spent under the terms of the contract until they are paid for;

— acceptance of inventory items for safekeeping for other reasons.

Example 1. An industrial enterprise entered into an agreement for the supply of equipment worth 295,000 rubles, including VAT - 45,000 rubles. In accordance with the terms of the contract, payment for the equipment is made within five days after its delivery to the buyer. At the time of acceptance of the equipment, fatal deficiencies were identified, and therefore the company refused to accept the goods and notified the supplier of the acceptance of this equipment for safekeeping and refusal to fulfill the supply agreement.

Since the supplier took the equipment back a month later, the industrial enterprise demanded compensation for storage costs in the amount of 3,000 rubles. The supplier paid this amount.

The following entries will be made in the accounting of an industrial enterprise:

All articles Replacing a defective fixed asset with a serviceable one: tax and accounting (Vightman E.)

There is no need to restore the depreciation premium. It is important to track depreciation charges so as not to write off excess. How to prove that replacing a defective OS is not a reverse implementation.

If an organization returned a defective fixed asset to the supplier and received a serviceable one in return, this operation is not a separate transaction. After all, the company returns an object whose quality does not meet the terms of the purchase and sale agreement. That is, it operates within the framework of the same agreement (read more in the box on page 26).

Arbitrage practice. The courts do not recognize the return of low-quality goods as a reverse sale. If the buyer has identified irreparable defects in the goods, he has the right, at his choice (clause 2 of Article 475 of the Civil Code of the Russian Federation): - either to refuse to execute the sales contract and demand that the seller return the money paid for the goods ; - or demand from the seller to replace the low-quality product with a product of proper quality. Most courts find that upon initial transfer of a defective product, its sale did not take place. That is, ownership has not passed to the buyer. After all, the supplier did not fulfill its obligations under the contract, since it shipped low-quality goods (Resolutions of the FAS Povolzhsky dated 02/12/2013 N A65-14995/2012, Moscow dated 12/07/2012 N A40-54535/12-116-118, dated 01/28/2010 N KA -A40/14851-09 and dated 07/06/2009 N KA-A40/2935-09 districts). This means that when a low-quality product is returned to the supplier, reverse sales also do not occur.

It doesn’t matter when the buyer discovered the defective equipment - before it was put into operation or after some period of operation. But the Russian Ministry of Finance believes that when returning a fixed asset, VAT must be charged (Letter dated 06/03/2015 N 03-07-11/31971). Let's figure out how replacing a defective OS will affect taxes and how the buyer can reflect it in accounting.

When replacing a defective OS with a serviceable one, neither income nor expenses arise in the buyer’s tax accounting

A buyer who discovers a defective fixed asset does not sell it to the supplier. He returns the defective object and receives a good one in return. The Russian Ministry of Finance agrees that in connection with this transfer, no additional income and expenses are generated in the tax accounting of the buyer (Letter dated 06/03/2015 N 03-07-11/31971). This means that when disposing of low-quality fixed assets, the organization does not reflect the proceeds from its sale and does not have the right to write off the residual value of the object. It can be included in tax expenses only in the case of the sale of a fixed asset (clause 1, clause 1, article 268 of the Tax Code of the Russian Federation). If a company discovers a defect after it began to operate and depreciate an object, it is not obliged to restore either the accrued depreciation or the depreciation bonus (Letter of the Ministry of Finance of Russia dated June 3, 2015 N 03-07-11/31971). It is believed that when replacing a defective OS with a serviceable one, the organization’s accounting object does not change. The old fixed asset is replaced with a new one, similar in parameters and useful life. Therefore, the operation to replace the OS is not reflected in the buyer’s tax accounting.

Note. When replacing a defective OS with a serviceable one, the organization's accounting object remains the same.

After receiving a serviceable item, the company will continue to charge depreciation on it at the same rate. It is important not to write off too much. When depreciating a new object, an organization has the right to include in tax expenses only part of its original cost minus the depreciation accrued on the defective asset. She does not have the right to re-apply the depreciation bonus if she accrued it when putting the original OS into operation. But this is done if, instead of a defective OS, the organization received a completely identical object from the supplier. If the supplier replaced the faulty OS with another model with a different useful life (for example, due to the fact that the previous model is no longer produced or is out of stock), it is safer to register this operation as the disposal of a defective item and the receipt of a new item.

Note. If the faulty OS was replaced with something other than an analogue, it is safer to formalize the disposal of the old one and the capitalization of the new object.

In this case, the organization has the right to accrue a depreciation bonus on the new OS (clause 9 of Article 258 of the Tax Code of the Russian Federation). Even if she previously applied it in a defective manner. After all, this is another OS object.

The Ministry of Finance requires buyers to pay VAT when returning defective OS, but the courts do not agree with this

The department selectively interprets the operation of replacing a defective fixed asset with a serviceable one. For tax accounting purposes, the Russian Ministry of Finance does not consider it a reverse sale, but for VAT purposes it recognizes it as such (Letter dated 06/03/2015 N 03-07-11/31971). Therefore, officials believe that when returning a fixed asset that the buyer managed to register, he is obliged to charge VAT. This is explained by the fact that the supplier has the right to deduct VAT on the returned goods. We are talking about the tax that the supplier paid to the budget when selling this product (clause 5 of Article 171 of the Tax Code of the Russian Federation).

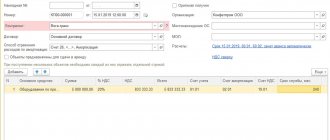

Registration of transactions for returns to the supplier in PP “1C: Accounting 8” edition 2.0

Let's consider the situation with returns. These operations always raise many questions. Return is the transfer of goods from the buyer to the seller if facts of improper fulfillment by the seller of their obligations under the purchase and sale agreement listed in the Civil Code of the Russian Federation are revealed.

These are the following cases:

- approval of the order, the seller’s obligation to transfer the goods free from the rights of third parties was violated (Article 460 of the Civil Code of the Russian Federation);

- the seller’s obligation to transfer accessories or documents related to the goods within the period established by the contract has been violated (Article 464 of the Civil Code of the Russian Federation);

- the conditions regarding the quantity of goods were violated (Article 466 of the Civil Code of the Russian Federation);

- the conditions regarding the assortment of goods were violated (clauses 1 and 2 of Article 468 of the Civil Code of the Russian Federation);

- goods of inadequate quality were transferred (clause 2 of Article 475 of the Civil Code of the Russian Federation);

- the packaging of the goods has been violated (clause 2 of Article 480 of the Civil Code of the Russian Federation);

- the conditions for containers and/or packaging of goods were violated (Article 482 of the Civil Code of the Russian Federation).

If the buyer, when returning, does not make any claims to the seller (for quality, suitability, etc.), in accordance with the above-mentioned violations, then this return should be considered a normal sale. And in this case, the buyer needs to issue an invoice for the shipment of goods received from him in the TORG-12 form.

Accounting for the return of defective fixed assets

But for this he needs an invoice (clause 1 of Article 172 of the Tax Code of the Russian Federation). Having issued an invoice for the supplier, the buyer is forced to register it in the sales book and pay to the budget the amount of VAT indicated in it (clause 3 of the Rules for maintaining the sales book used in VAT calculations, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137) . The Russian Ministry of Finance explained that in the invoice the buyer indicates the original cost of the returned fixed asset (Letter dated 02/09/2015 N 03-07-11/5176). It doesn’t matter whether he started charging depreciation on it or not. Most courts hold that returning a defective OS is not a reverse sale. Neither for income tax purposes, nor for VAT purposes (Resolutions of the FAS Povolzhsky dated 02/12/2013 N A65-14995/2012 and dated 05/14/2008 N A55-15140/2007, Moscow dated 12/07/2012 N A40-54535/12-116 -118 and dated 07/06/2009 N KA-A40/2935-09, North-Western district dated 06/01/2009 N A66-7216/2008). Therefore, the supplier does not need an invoice from the buyer to deduct VAT on the returned item. This means that the buyer does not have the obligation to draw up this document and charge VAT for payment to the budget.

Note. Courts have held that when returning a defective OS, the buyer is not required to issue an invoice.

If an organization is ready to defend its interests in court, its chances of winning the dispute are high (read more about possible arguments in the box on page 29).

Note! Arguments in favor of the fact that there is no need to pay VAT To prove that when returning a defective OS, the buyer is not obliged to charge and pay VAT, organizations cite the following arguments: - we are not just talking about returning a defective OS to the supplier, but about replacing it with a similar serviceable object ; — upon receipt of an OS item of inadequate quality, the buyer has the right to demand from the supplier that he replace it with a serviceable one (clause

2 tbsp. 475 of the Civil Code of the Russian Federation). This replacement does not entail any additional obligations for the buyer and supplier. It occurs as part of the original purchase and sale agreement; — tax legislation does not provide for the buyer’s obligation to charge VAT when returning defective goods to the supplier or exchanging them. There is no obligation to draw up an invoice in this case; — the buyer returns the defective OS to the supplier because it does not meet the declared quality. It is believed that the supplier did not properly fulfill the terms of the purchase and sale agreement. In this case, ownership of the object did not pass to the buyer. The item must be returned to the supplier. This means that when returning a defective OS, ownership of it does not transfer back to the supplier. Consequently, there are no grounds for charging VAT (clause 1, article 39 and clause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

If the company does not intend to sue the tax authorities or if the amount of tax is insignificant, it is safer to charge it. Then, upon receipt of a serviceable OS from the supplier, the buyer has the right to deduct VAT a second time. Naturally, if there is a supplier invoice and after the object has been accepted for accounting (clause 1 of article 172 of the Tax Code of the Russian Federation).

“Input” VAT accepted for deduction on the original fixed asset does not need to be restored

The Russian Ministry of Finance has confirmed that when returning goods that the buyer has managed to capitalize, the VAT accepted for deduction on them is not restored. But only on the condition that on the date of return of the goods to the seller, the buyer accrued this tax for payment and issued an invoice (Letter dated November 29, 2013 N 03-07-11/51923). The same approach can be applied when returning a defective fixed asset. This means that if an organization decided not to argue with the tax authorities and charged VAT on the cost of the returned fixed asset, it is not obliged to restore the tax that it accepted for deduction when registering this object. There is no need to restore VAT even if the company did not charge this tax when returning low-quality OS. After all, in return she received a serviceable fixed asset from the supplier. That is, her accounting object has not changed. It continues to be used in activities subject to VAT. This means that there are no grounds for reinstating VAT (clause 3 of Article 170 of the Tax Code of the Russian Federation).

There are two points of view on how the buyer should reflect in accounting the replacement of a defective OS with a serviceable one

The first point of view is that replacing a low-quality OS is not reflected in accounting

This approach is based on terminology used in accounting. Since 2013, in accounting, instead of the concept of “property”, the term “asset” has been used (Article 5 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”). In the previous Law on Accounting, property was considered the object of accounting (clause 2 of Article 1 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting”). When replacing a defective OS with a quality one, the asset does not change. Both before and after replacement, the organization has a fixed asset at its disposal. Only specific property is replaced. If a company received a completely identical operating system from a supplier, it is not obliged to reflect this transaction in accounting. After all, the main parameters of this object (its useful life, initial cost, etc.) have not changed. Therefore, the organization does not draw up either an act on the write-off of a defective fixed asset, or an act on the acceptance and transfer of a new one. It is enough to correct the information about it in the inventory card of the object (if it has changed). That is, indicate the new serial number or passport number, year of manufacture. It is advisable to leave the inventory number the same. The organization makes accounting entries only if replacing a defective OS entails additional costs. For example, to dismantle a faulty asset, transport it to the supplier’s warehouse, or install a new facility. These expenses do not increase the initial cost of the fixed asset, since they arose after its commissioning (clause 14 of PBU 6/01 and clause 41 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n). The company reflects them with the following entries: Debit 91-2 Credit 60 or 76 - the costs of dismantling or transporting a defective fixed asset are taken into account; Debit 19 Credit 60 or 76 - reflects the amount of VAT presented by the contractor; Debit 68 Credit 19 - accepted for deduction of “input” VAT on the services of the contractor; Debit 60 or 76 Credit 50 or 51 - settlement with the contractor has been made.

The second point of view is that the replacement is reflected in accounting as the disposal of a defective OS and the acquisition of a new one

There is no difference between the terms “property” and “asset”. The replacement of a faulty fixed asset is reflected in accounting as a reverse sale. That is, the return of a defective OS to the supplier is carried out as the sale of a used object, and the receipt of a serviceable one is carried out as the acquisition of a new fixed asset. On the date of return of the faulty OS to the supplier, the buyer makes the following entries in accounting: Debit 62 Credit 91-1 - income from the sale of the defective OS is recognized (in the amount of the original cost of the serviceable item); Debit 01, subaccount “Retirement of fixed assets”, Credit 01, subaccount “Fixed assets in operation” - the initial cost of the defective fixed assets is written off; Debit 02 Credit 01, subaccount “Disposal of fixed assets” - depreciation accrued during the operation of the defective OS is written off; Debit 91-2 Credit 01, subaccount “Disposal of fixed assets” - the residual value of the faulty fixed assets is included in other expenses. The buyer reflects the receipt of a high-quality OS in exchange for a defective one in accounting as follows: Debit 08 Credit 60 or 76 - a serviceable OS was capitalized; Debit 60 or 76 Credit 62 - mutual obligations of the parties are offset. On the date of putting a new fixed asset into operation, the organization makes the following posting: Debit 01, subaccount “Fixed assets in operation”, Credit 08 - fixed asset put into operation. But with this approach, the question arises about the calculation of VAT when returning a defective OS and about “input” VAT when purchasing a serviceable object. If the organization does not intend to charge this tax, it is safer not to replace the OS as a reverse implementation in accounting. Otherwise, tax authorities may cling to accounting and demand the same approach for tax purposes. If the company agrees with the requirements of the tax authorities, it additionally makes the following entries in accounting: on the date of return of the defective OS to the supplier Debit 91-2 Credit 68 - VAT is charged on the original cost of the returned OS; on the date of receipt of a serviceable OS from the supplier Debit 19 Credit 60 or 76 - VAT presented by the supplier upon transfer of a high-quality OS is taken into account; Debit 68 Credit 19 - accepted for deduction of VAT on a working operating system. The buyer reflects the costs of dismantling the defective fixed asset and transporting it to the supplier’s warehouse in accounting in the same way as in the first point of view. That is, it includes them in other expenses (clause 11 of PBU 10/99). If a new fixed asset requires installation, expenses for these purposes increase its initial cost (clause 8 of PBU 6/01 and clause 24 of the Guidelines for accounting of fixed assets). The organization re-determines the useful life of a working OS. This period is counted from the date of commissioning of the new facility. The actual period of use of the defective OS is not taken into account.

If you do not find the information you need on this page, try using the site search:

The purchase price of equipment is reflected without VAT

VAT charged on purchased equipment

The equipment was put into operation as part of its own fixed assets

Accepted for deduction of VAT on equipment put into operation

Payment for equipment reflected

Return to supplier in 1C 8.3 - regulatory regulation and registration scheme

When returning goods, either defective or high-quality, the supplier issues an adjustment invoice (CFS) (Letter of the Ministry of Finance of the Russian Federation dated 02/04/2019 N 03-07-11/6171). An exception is the reverse sale, when the return is carried out as a regular sale: the buyer acts as a seller of goods, and the former seller acts as a buyer. With this scheme, a separate agreement is concluded and a regular invoice (SF) is issued by the new seller (former buyer).

The design scheme in Accounting 3.0 is possible in two ways and is presented below.

If an item of fixed assets is subject to return due to the identification of an irreparable defect

The organization’s accounting policy has established a procedure for the disposal of objects without using the subaccount “Disposal of fixed assets”

Revenue from the sale of a fixed asset item to its original owner (supplier) is reflected.

VAT debt to the budget was accrued from the cost of the returned fixed asset item

02 subaccount “Depreciation of fixed assets accounted for on account 01”

The accumulated depreciation on the returned object is reflected. The residual value of the fixed asset is determined

Reflects other expenses from the return of fixed assets

Received funds from the supplier for returned property

Revenue from the sale of equipment is reflected

VAT accrued on turnover on the sale of equipment

The book value of sold equipment is written off

Payment for equipment reflected

Reflects the purchase price of equipment without VAT returned by the buyer

VAT charged on purchased equipment

Accepted for deduction of VAT on capitalized equipment

Money transferred for returned equipment

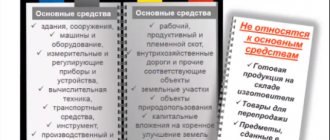

9.1. Capital investments as a method of reproduction of fixed assets.

Capital investments aimed at replacing living labor allow saving the latter. This group includes capital investments for acquisition.

Analysis of the implementation of the capital investment plan for the acquisition of fixed assets.

With a limited amount of investment, it is primarily planned to purchase those machines and mechanisms that play the most important role in the process.

The return to the lessor of fixed assets leased from him at the end of the lease period is reflected on the balance sheet as follows: D-t. 99999 “Account for correspondence with active ones.

During a medium repair, the unit being repaired is partially disassembled and some parts are restored or replaced.

This system provides for the maintenance of fixed assets, current, medium and major repairs.

Method 1. Document “Adjustment of receipts”.

In the receipt document, click the “Create based on” button and select “Adjustment of receipt”.

Attention! If this item is missing from the “Create based on” button, then you need to check the enabled functionality of the program.

Go to Main - Functionality - on the Trade tab, check the box “Correction and adjustment documents”.

Enter the receipt adjustment document:

On the Main tab, select the type of operation “Adjustment by agreement of the parties” to generate an adjustment invoice. The basis field indicates the source document on which the return will be issued. In the “Reflect adjustment” field, select the “In all accounting sections” option - accounting entries for the return of goods and a VAT entry will be generated for formation in the sales book or purchase book.

Because in our example, we are returning the goods, therefore, reducing the cost according to the receipt document, then a sales book entry is generated to restore the VAT previously accepted for deduction on the invoice, to which an adjustment invoice was issued (clause 4, clause 3, art. 170 of the Tax Code of the Russian Federation). To do this, check the Restore VAT in the sales book checkbox.

On the “Products” tab we reflect the return of defective goods. To do this, in the “SHARP” TV position, in the “After change” field in the “Quantity” column, remove the quantity of the product.

If I return the product partially, then in the quantity column in the field after the change, indicate the quantity that the buyer has left, and the program calculates the quantity of the returned product as the difference between the fields Quantity before change minus Quantity after change.

In the field “Corr. Invoice No., indicate the number and date of the adjustment invoice and click the “Register” button.

In the invoice we see the amounts to be reduced, and the transaction type code is 18. The entry in the sales book will go with this code.

From the invoice, using the “Print” button, we can print an invoice for the supplier

Return of fixed assets to the seller

The procedure for returning low-quality goods is regulated by Articles 475, 476 and 477 of the Civil Code of the Russian Federation.

Often, fatal deficiencies of the acquired fixed asset are revealed only during operation. The organization has two ways out of this situation. The organization may return the purchased fixed asset to the seller and receive the money back, or may require the replacement of a low-quality product with a quality product.

Let's look at specific examples of the procedure for reflecting each of the possible options in the accounting accounts.

Example.

In February 2004, the production organization purchased a fixed asset from the manufacturing plant, the contract price of which was 147,500 rubles, including VAT of 22,500 rubles, and put the facility into operation in the same month. The warranty period established by the manufacturer was 2 years.

When accepting an object for accounting, the organization established the useful life of the object as 10 years.

In May 2004, during operation, this fixed asset item failed. The warranty workshop determined that due to an irreparable manufacturing defect, the fixed asset cannot be repaired and must be returned to the manufacturer. The buyer submitted a claim to the manufacturer in the amount of 147,500 rubles, which was accepted.

To reflect transactions on accounting accounts, we will use the following names of subaccounts:

01-1 “Fixed assets in operation”;

01-2 “Disposal of fixed assets”;

08-4 “Acquisition of individual fixed assets”;

76-2 “Calculations for claims.”

| Account correspondence | Amount, rubles | ||

| Debit | Credit | ||

| Accounting entries for February 2004 | |||

| 08-4 | 60 | 125 000 | The acquisition of a fixed asset item is reflected |

| 19 | 60 | 22 500 | The amount of VAT presented by the supplier is reflected |

| 60 | 51 | 147 500 | The debt to the supplier for the purchased fixed asset has been repaid |

| 01-1 | 08-4 | 125 000 | The main asset was put into operation |

| 68 | 19 | 22 500 | The amount of VAT actually paid to the supplier is accepted for deduction |

| Monthly from March to May 2004 | |||

| 20 | 02 | 1041,67 | Depreciation has been calculated on a fixed asset item (125,000 / 120 months) |

| Accounting entries in May 2004 after the failure of a fixed asset | |||

| 01-2 | 01-1 | 125 000 | The original cost of the fixed asset is written off |

| 02 | 01-2 | 3 125 | The amount of depreciation accrued during operation was written off (1041.67 x 3 months) |

| 76-2 | 01-2 | 121 875 | The residual value of the fixed asset returned to the manufacturer is written off (125,000 – 3,125) |

Upon receipt of the fixed asset, the amount of VAT paid to the supplier was accepted for deduction. When returning a fixed asset, it is necessary to restore the amount of VAT only from the residual value of the fixed asset, since in accordance with subparagraph 1 of paragraph 2 of Article 171 of the Tax Code of the Russian Federation, this fixed asset was in operation for three months, used for the manufacture of products subject to VAT, therefore, part of the VAT was offset lawful.

| 76-2 | 68 | 21937,50 | VAT was restored from the residual value of the returned fixed asset and attributed to settlements of claims (121,875 x 18%) |

| 76-2 | 91-1 | 3 687,50 | The difference between the recognized amount of the claim, the residual value of the fixed asset and the restored amount of VAT is reflected (147500 – 121875 – 21937.50) |

| 51 | 76-2 | 147 500 | Cash received in exchange for the returned faulty fixed asset |

If, instead of a low-quality fixed asset, the organization receives a new fixed asset, this operation will be reflected in the accounting records as follows:

| 08-4 | 76-2 | 125 000 | Fixed assets received to replace faulty ones |

| 19 | 76-2 | 22 500 | VAT amount reflected |

| 01-1 | 08-4 | 125 000 | The resulting fixed asset was put into operation |

When receiving a replacement fixed asset for a faulty one, the buyer, on the basis of paragraph 2 of Article 171 of the Tax Code of the Russian Federation, has the right to deduct the amount of VAT presented by the supplier and paid by the buyer. In this case, the amount of VAT presented by the supplier and paid by the buyer is 22,500 rubles, but when returning the faulty fixed asset, the buyer restored the amount of VAT from the residual value of the fixed asset in the amount of 21,937.50 rubles, which means that the buyer has the right to offset the tax on this exact amount .

| 68 | 19 | 21937,50 | VAT amount accepted for deduction |

| 91-2 | 19 | 562,50 | The non-refundable amount of VAT is written off as non-operating expenses (22,500 – 21,937.50) |

You can find out more about the issues of accounting and taxation of transactions with fixed assets in the book of JSC “BKR Intercom-Audit” “Fixed Assets”.

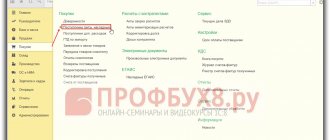

Registration of a return to the supplier

You can find this document in the “Purchases” section. All previously reflected returns are also located there.

In the header of the document, we will first indicate our organization - Store No. 23. It is there that the product is listed for which you need to make a return to the supplier in 1C. You can also indicate a department, but this field is not required.

Next, we will indicate the counterparty, that is, the organization from which we purchased this product and the agreement with it as a supplier. The last thing that remains to be clarified in the header is the receipt document for the goods that we are going to return. If you cannot find it in the selection list, most likely one of the header parameters is not filled in correctly.

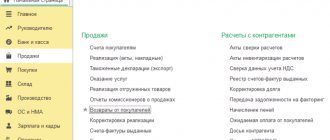

Now you can proceed to directly filling out the table of goods we return. E can be filled in manually or automatically. Automatic filling is much more convenient. It is located in the “Fill” menu and consists of two items.

When you select the “Fill in upon receipt” item, the program will add to the table all the products from the document that you specified in the header. If you selected the “Add from receipt” item, then in this case you will need to indicate in the window that appears from which other receipt from the specified supplier the goods will be returned.

Simply put, the first filling option adds lines from the receipt in the header to the second of any others. In this example, we will fill from the receipt indicated in the header.

A completely filled line with the nomenclature “Candy “Bar”” has been added to the tabular part. All values in the table can be edited. This may be necessary, for example, if we do not return all received goods, but only a part.

In this document, all that remains is to indicate the availability of returnable packaging, for example, if we bought draft drinks in aluminum kegs and they need to be returned along with the goods. On the “Calculations” tab, those accounts that will participate in document movements are indicated. On the “Advanced” tab, if necessary, you can specify the consignee and consignor.